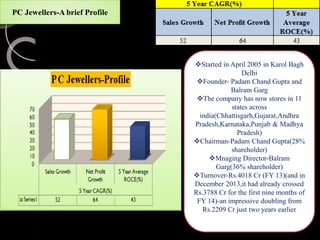

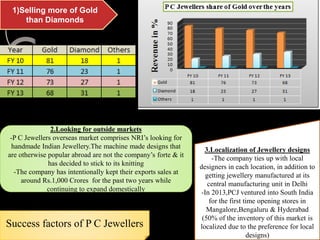

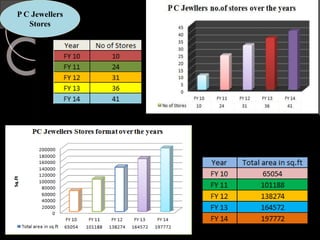

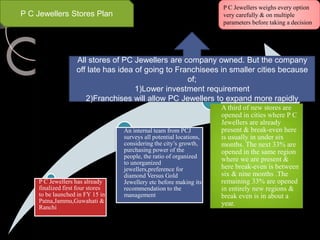

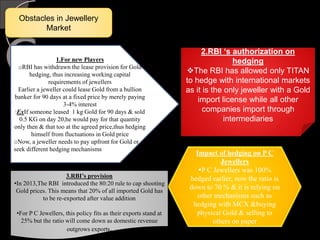

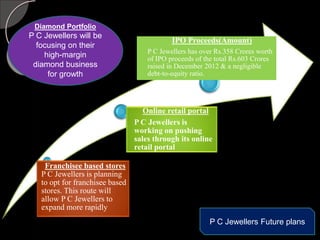

PC Jewellers is one of the fastest growing jewelry companies in India. Founded in 2005 in Delhi, it now has stores in 11 states. PC Jewellers has a lower cost structure than competitors due to in-house manufacturing and inventory management. It focuses on gold jewelry over diamonds. PC Jewellers plans to continue expanding through both company-owned stores and franchises to rapidly enter new markets. It also aims to grow its diamond portfolio and online sales. Regulations around gold hedging present an obstacle for new players in the jewelry market.