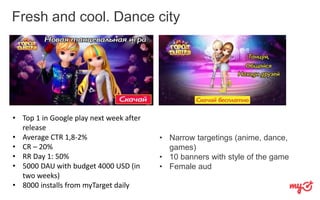

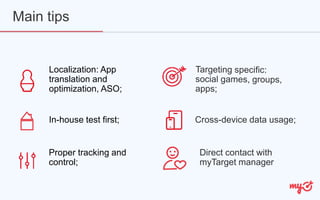

MyTarget is the largest mobile advertising platform in Russia, owned by Mail.Ru Group. It provides targeted mobile and social advertising using data from Russian social networks and services. Case studies showed mobile game developers were able to achieve high installation rates, click-through rates, and returns on investment using myTarget's targeted advertising options and working with myTarget experts to refine campaigns over time through audience segmentation, creative testing, and multi-channel approaches. Key tips included localizing apps for the Russian market, thorough in-house testing, proper tracking and analysis, leveraging cross-device data, and direct communication with myTarget managers.