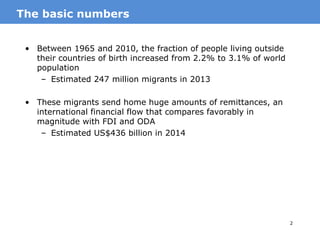

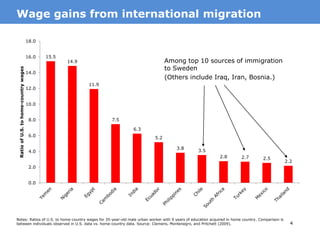

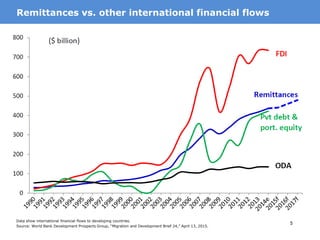

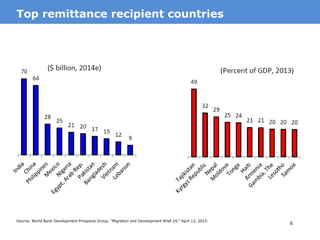

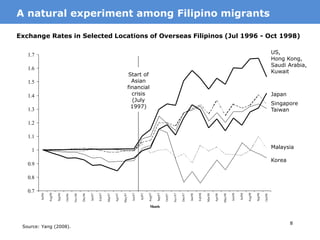

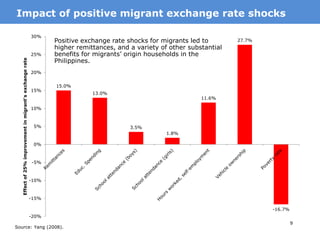

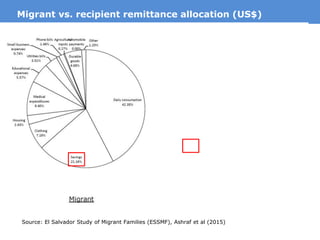

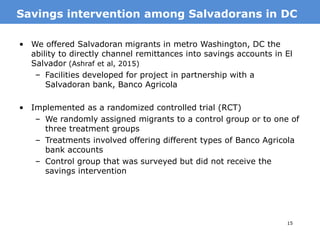

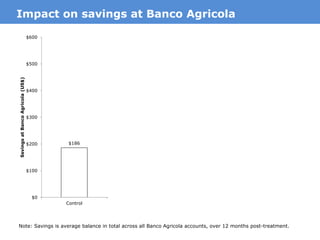

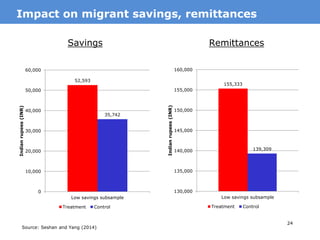

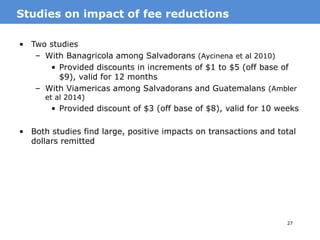

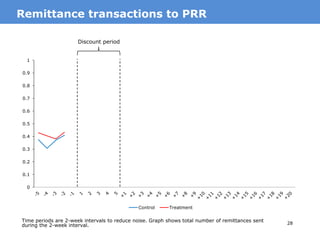

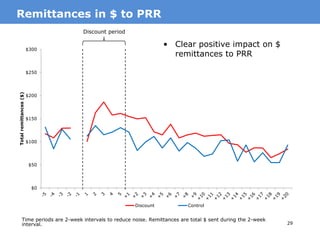

The document discusses the increasing global trend of migration and the significant role of remittances in economic development, highlighting that migrants sent home an estimated $436 billion in 2014. It emphasizes that remittances can improve household consumption, reduce poverty, and serve as insurance during economic shocks, while also addressing the need for policies that enhance migrant control over their financial decisions. The findings suggest that providing financial education and savings options can lead to better remittance outcomes and long-term development impacts.