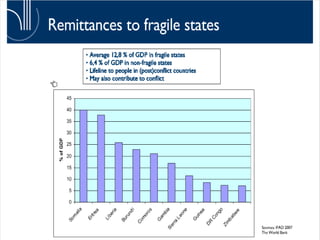

The document discusses the significant impact of remittances, especially from migrant workers in developed countries to their families in developing countries, highlighting the Philippines as a major sender. While remittances boost economies, reduce poverty, and improve welfare, they also create dependency and can exacerbate disparities within societies. Challenges include high costs of remittance transfers, particularly in Africa, and potential negative effects on local economies due to large inflows.