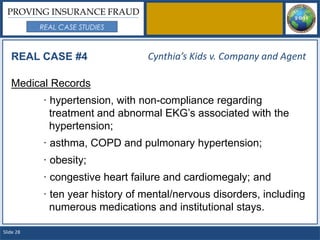

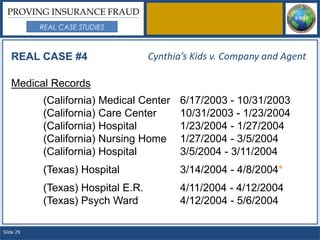

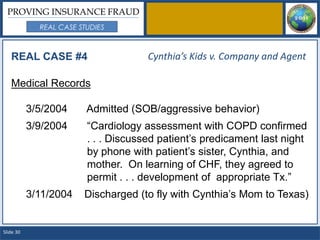

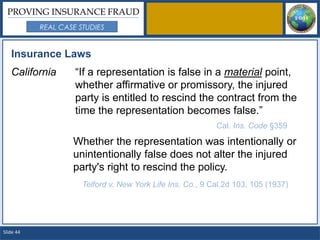

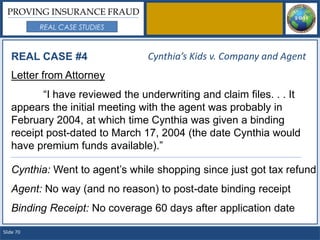

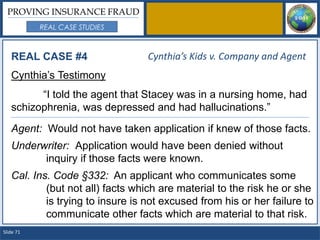

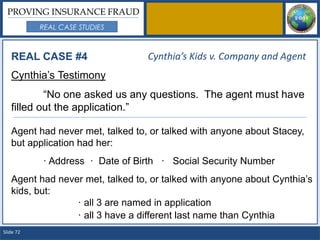

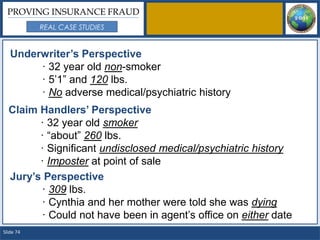

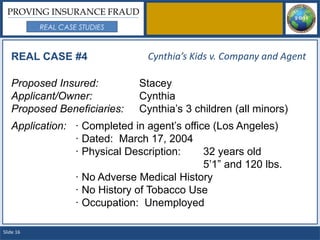

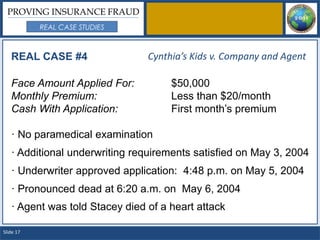

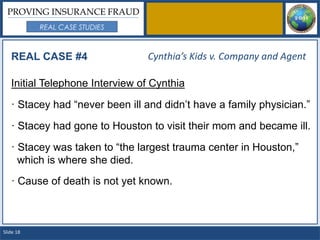

This case involves a $50,000 life insurance policy where the proposed insured, Stacey, died one day after the policy was approved. The insurer investigated and found inconsistencies in the application and interviews. Medical records showed Stacey had significant health issues contradicting the application. The insurer denied the claim, suspecting insurance fraud by the applicant and beneficiary, Cynthia and her children.

![PROVING INSURANCE FRAUD

REAL CASE STUDIES

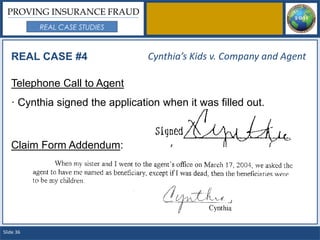

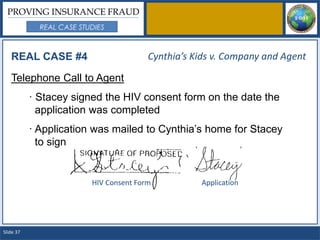

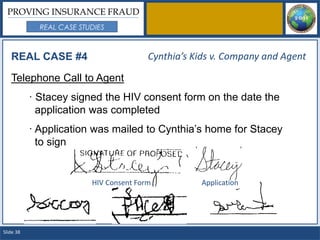

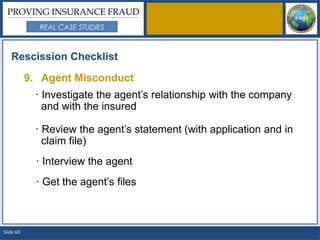

REAL CASE #4 Cynthia’s Kids v. Company and Agent

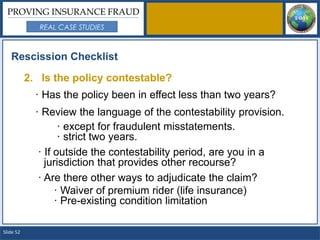

Telephone Interview of Cynthia

· Did not remember any application questions being

read to her.

· Just “signed the application” where “she was told to.”

· Told the agent that “if something happened to her and

her sister, she wanted her [Cynthia’s] kids to be the

beneficiaries.”

Slide 22](https://image.slidesharecdn.com/provinginsurancefraud2011wcc-13385672788201-phpapp01-120601111557-phpapp01/85/Proving-Insurance-Fraud-Real-Case-Studies-22-320.jpg)

![PROVING INSURANCE FRAUD

REAL CASE STUDIES

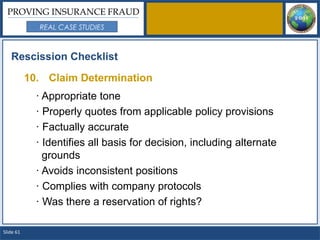

REAL CASE #4 Cynthia’s Kids v. Company and Agent

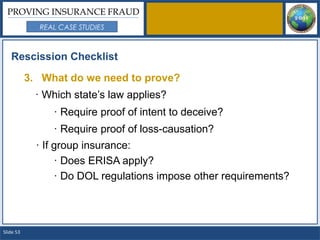

Autopsy Report

Death was the result of “[c]ardiomegaly associated with

hypertensive cardiovascular disease,” secondary to

obesity.

Height: 5’ 4”

Weight: 309 lbs.

Slide 27](https://image.slidesharecdn.com/provinginsurancefraud2011wcc-13385672788201-phpapp01-120601111557-phpapp01/85/Proving-Insurance-Fraud-Real-Case-Studies-27-320.jpg)