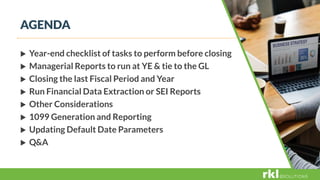

The document provides an agenda and checklist for tasks to complete year-end planning and closing for Sage X3, including running managerial reports, closing the fiscal period and year, updating default date parameters, generating 1099 forms, and other considerations. It discusses running a year-end simulation, closing procedures, financial reporting, updating budgets and standard costs, and default date parameters. Contact information is provided for questions.