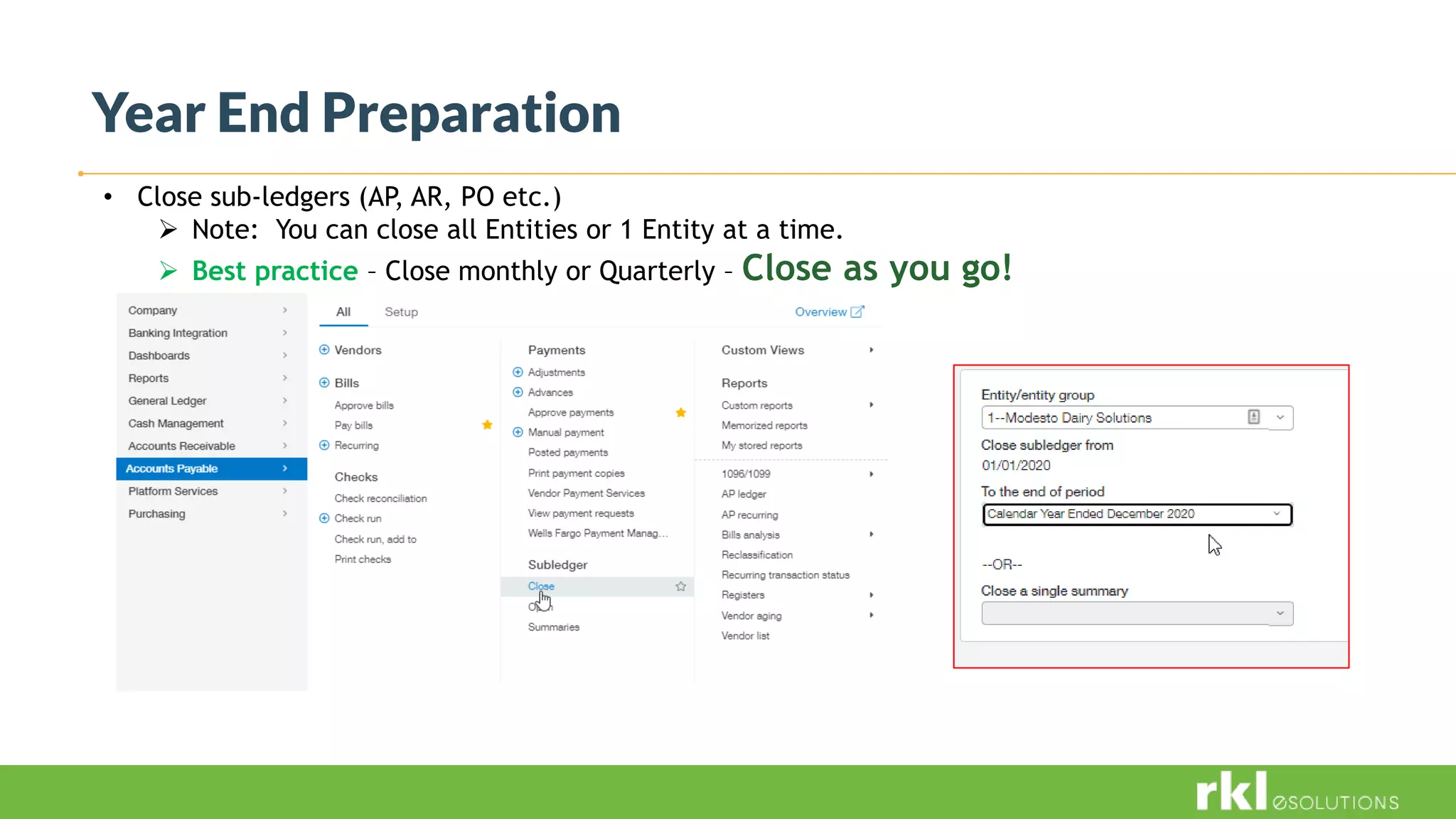

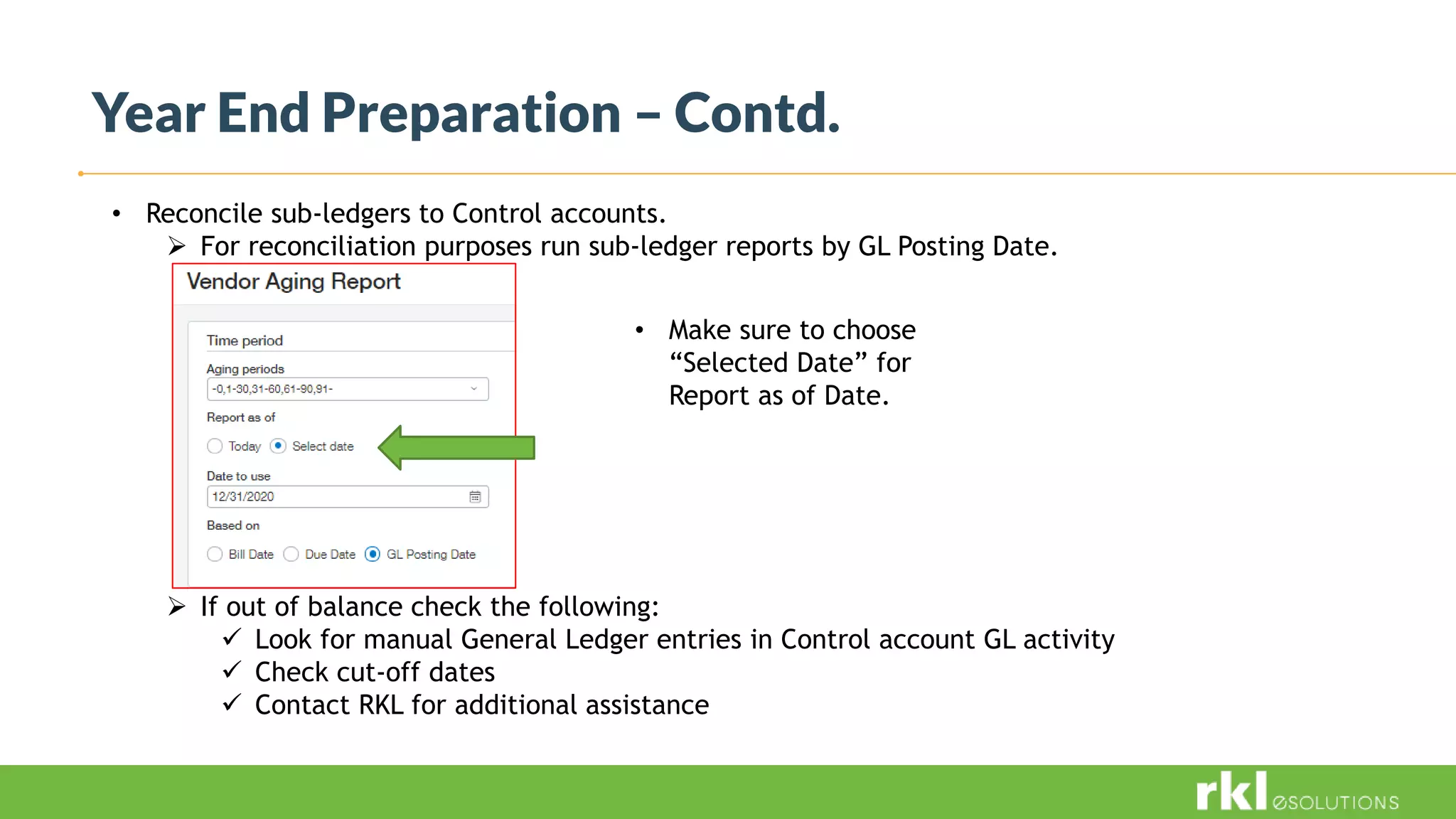

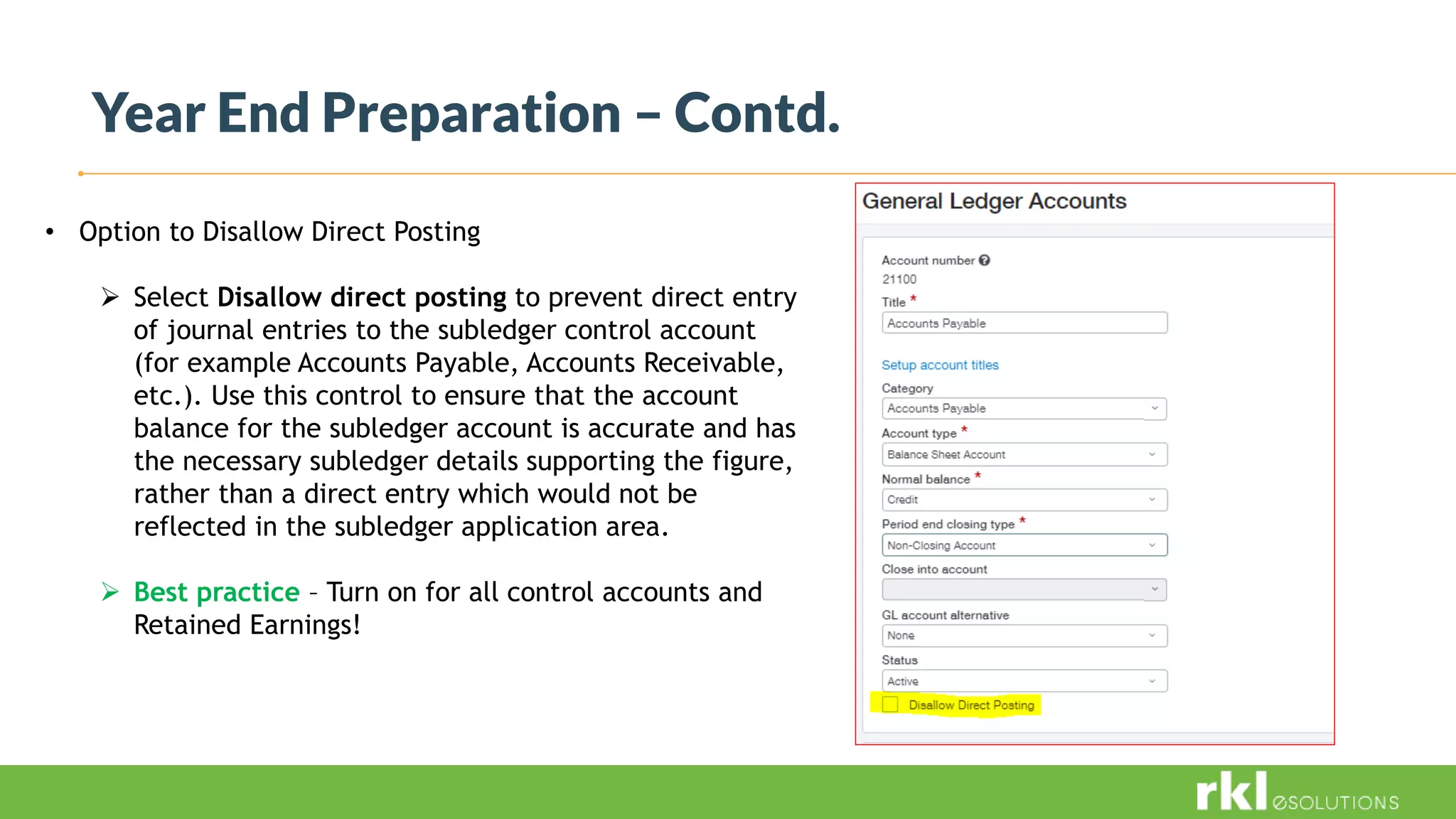

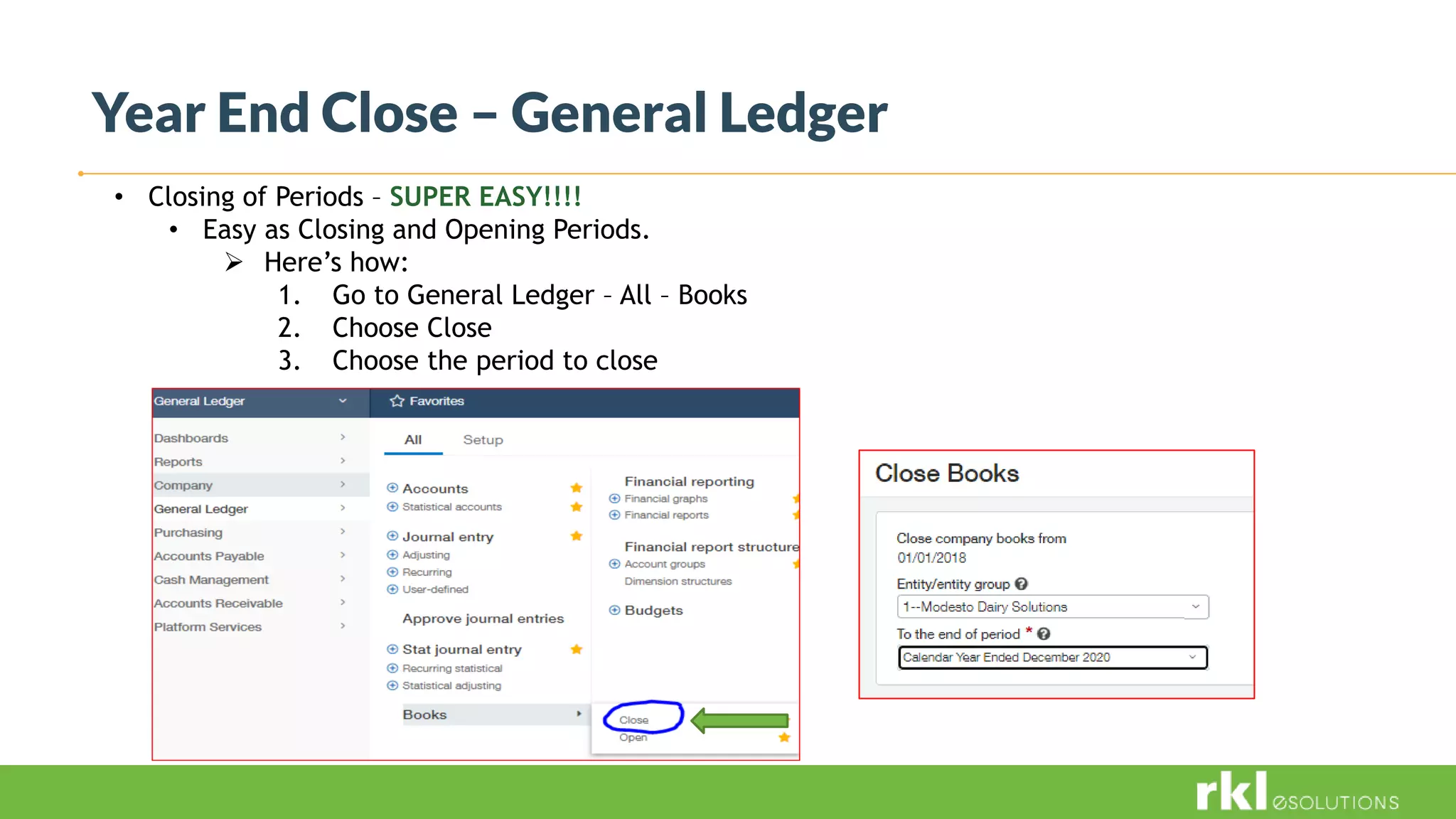

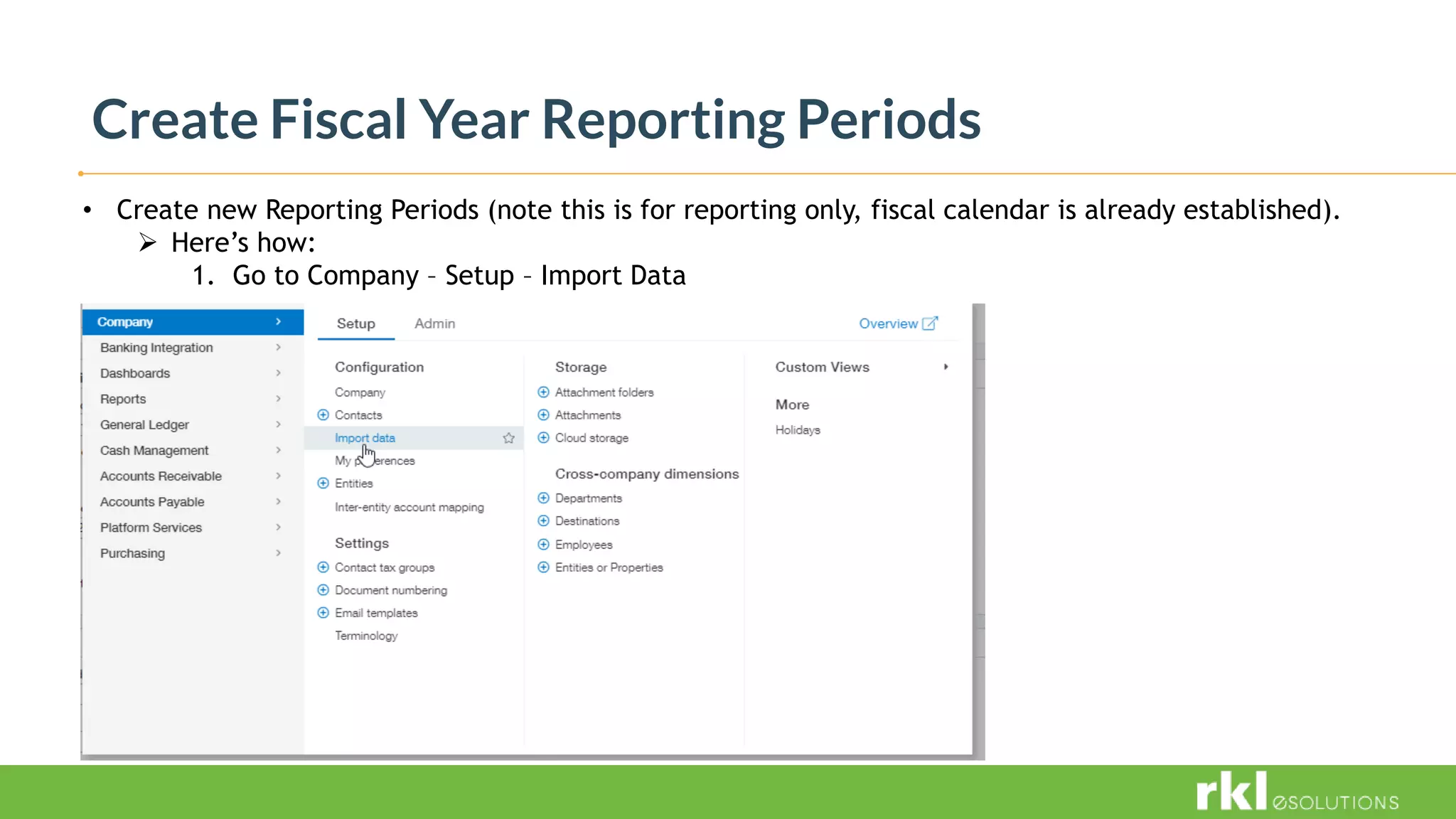

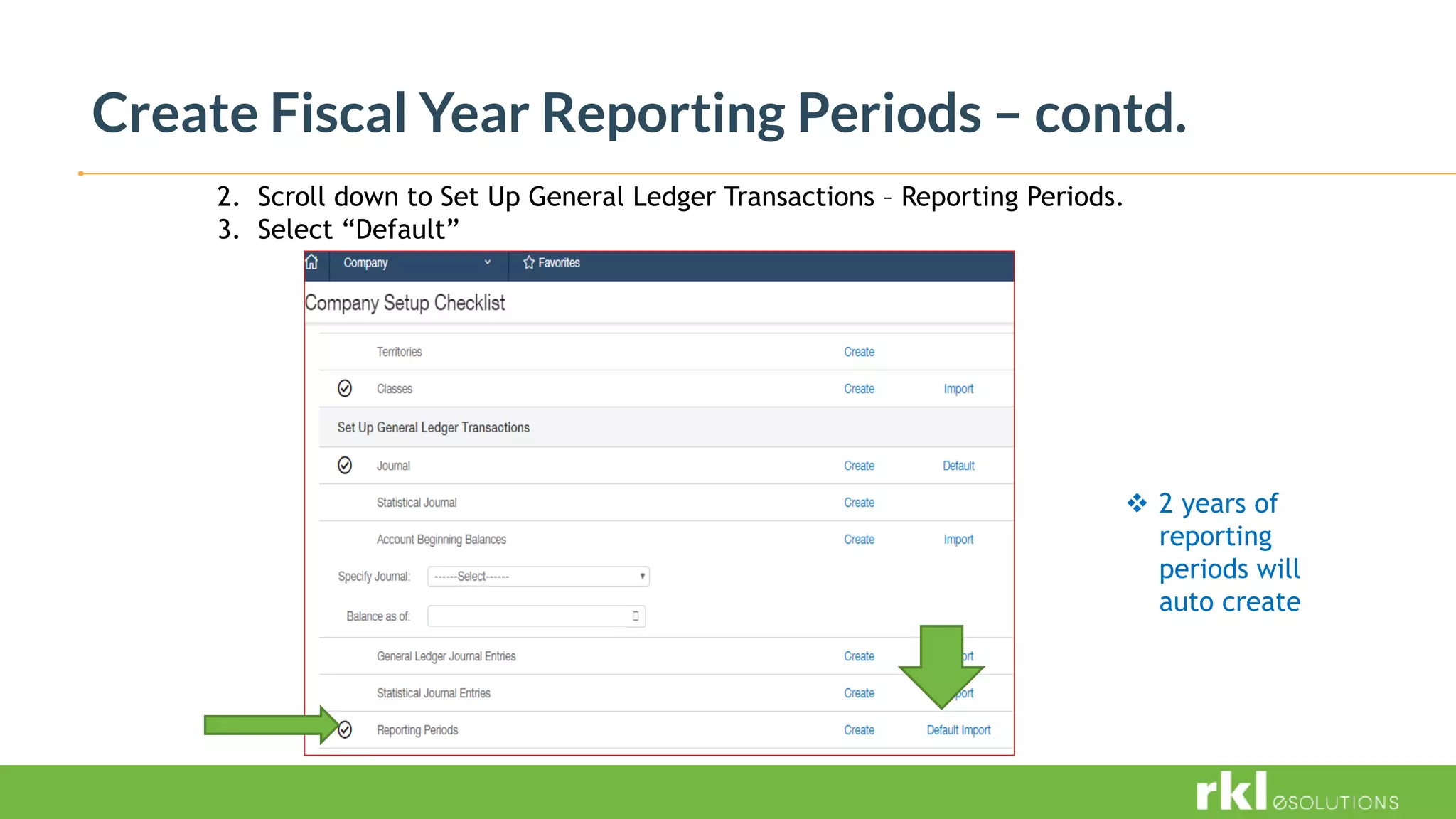

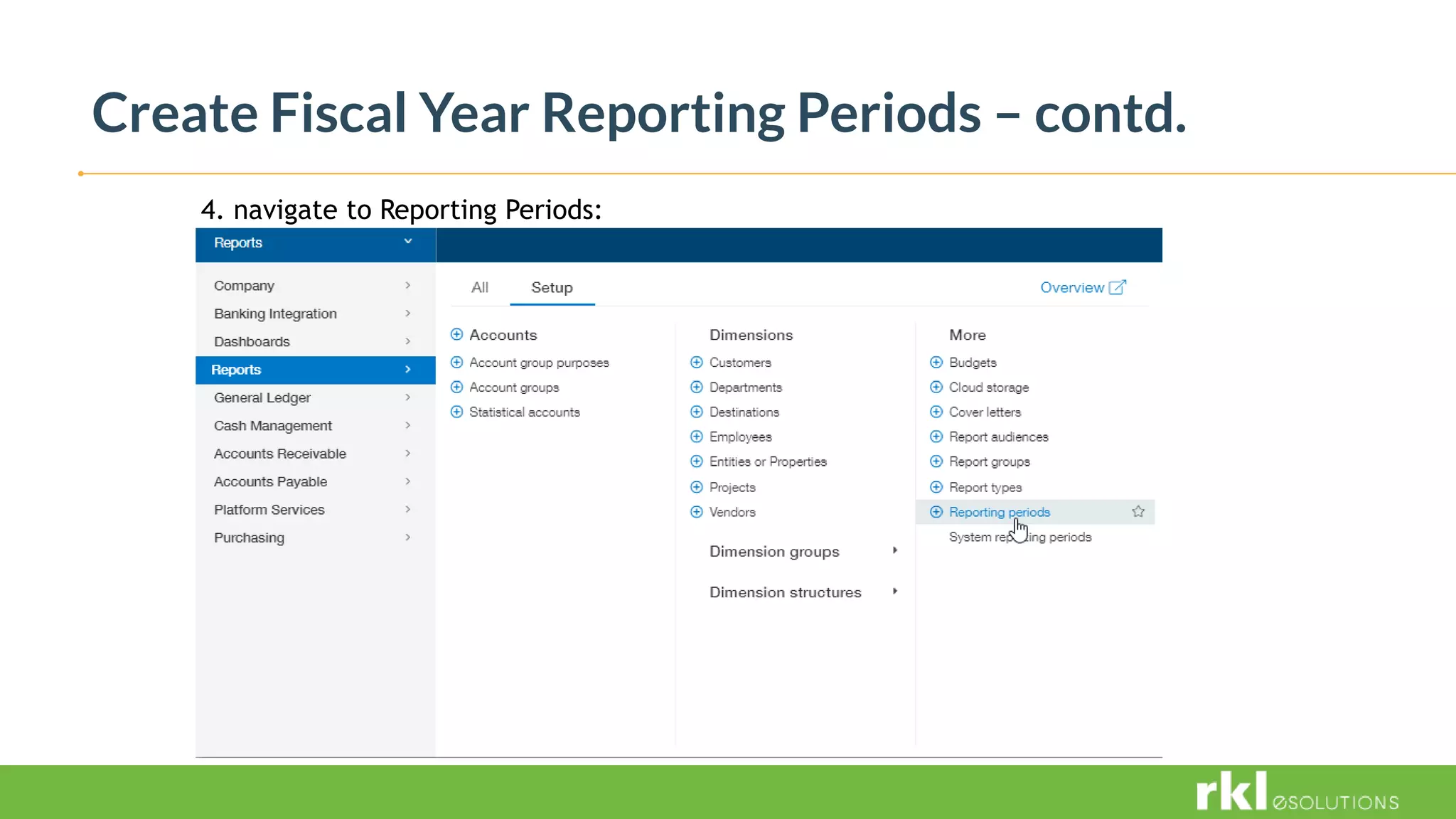

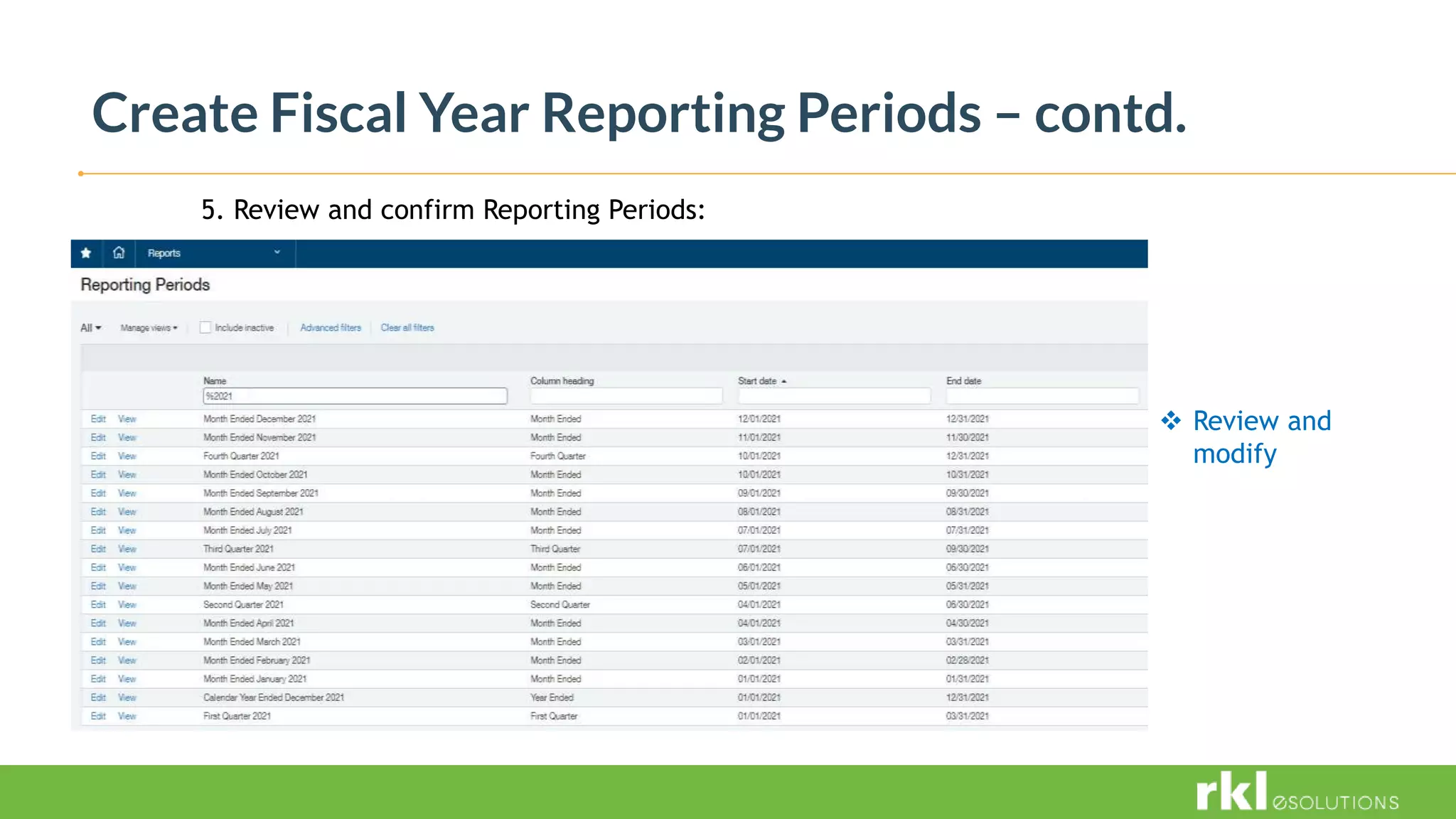

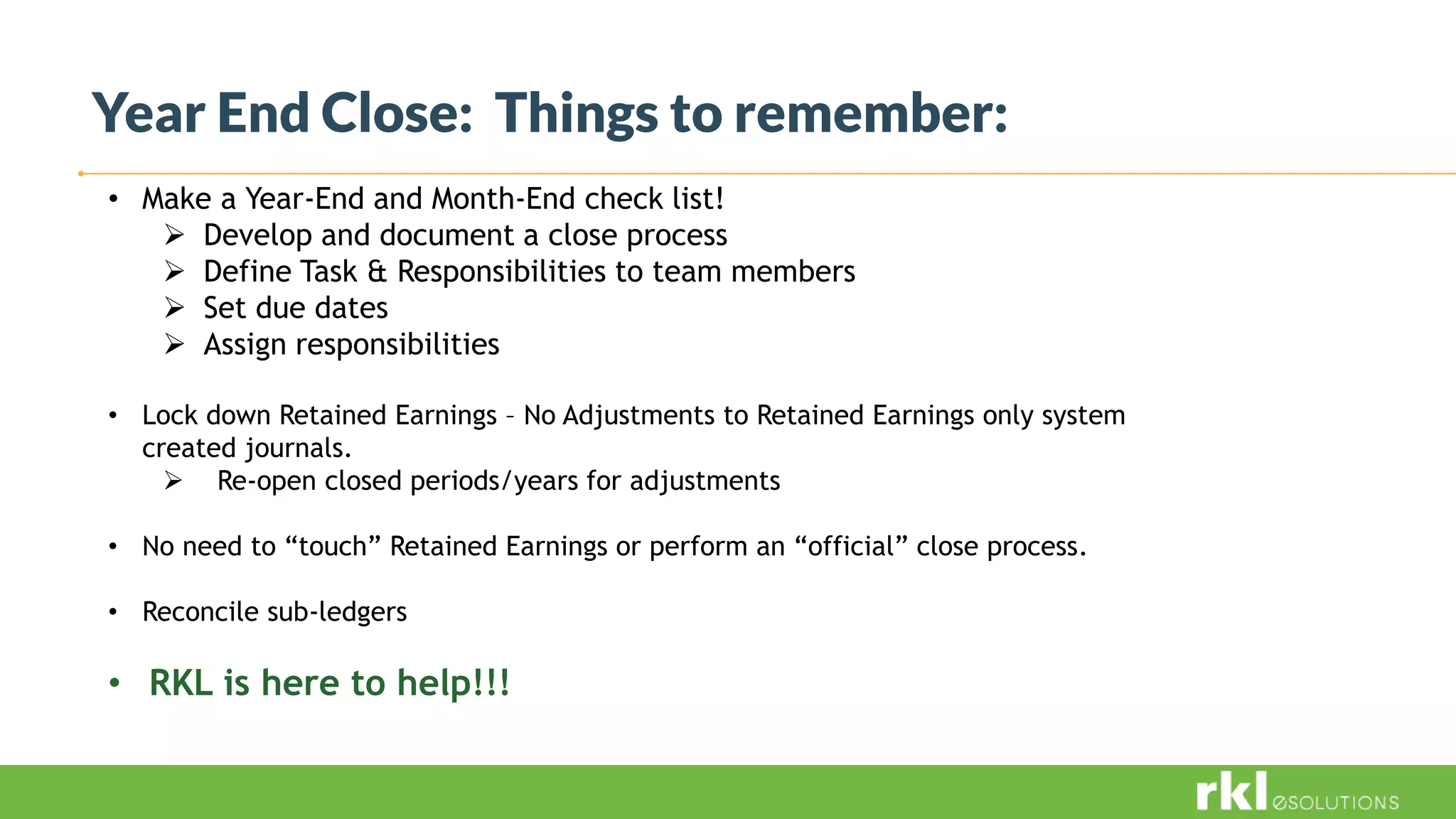

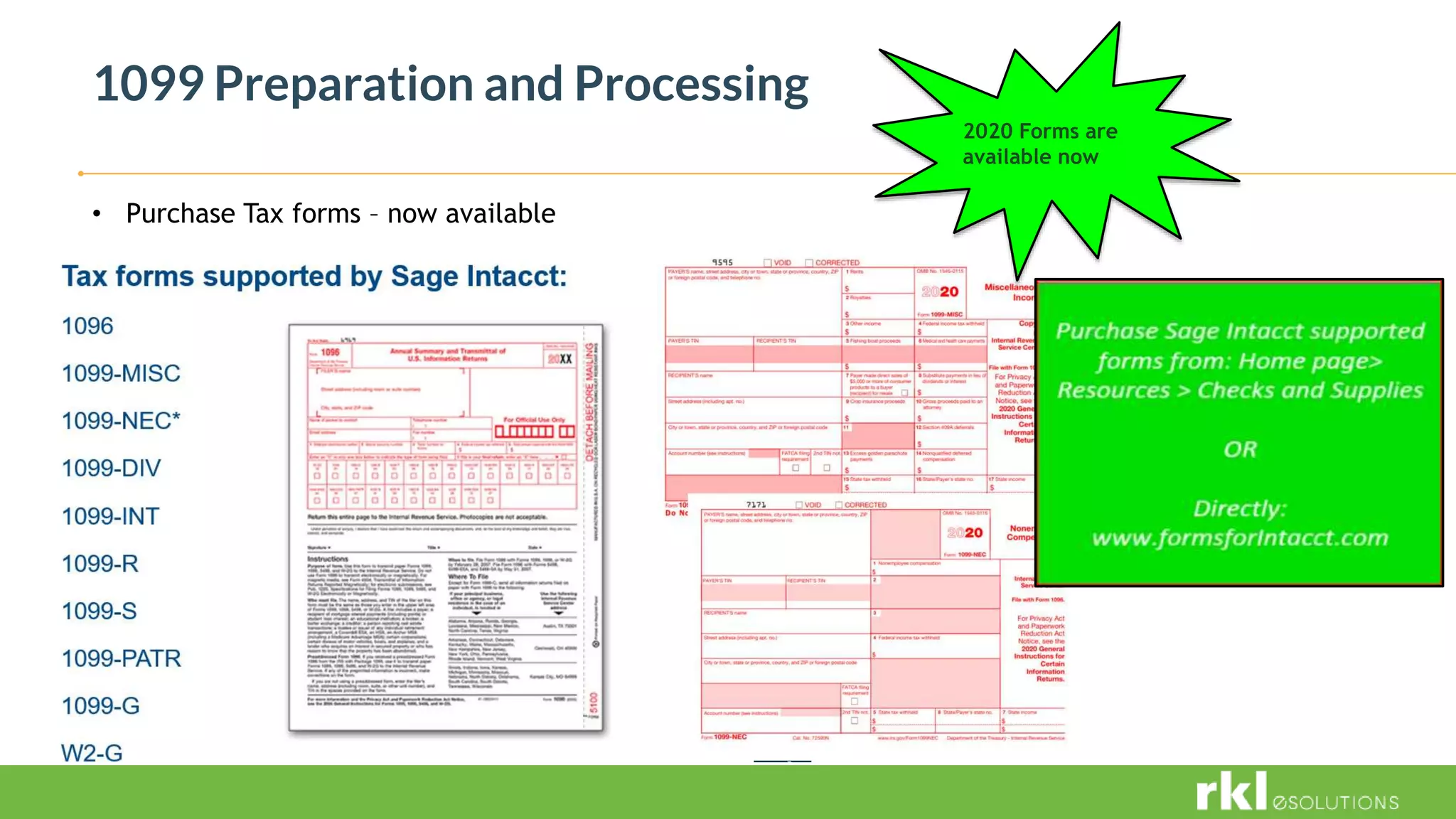

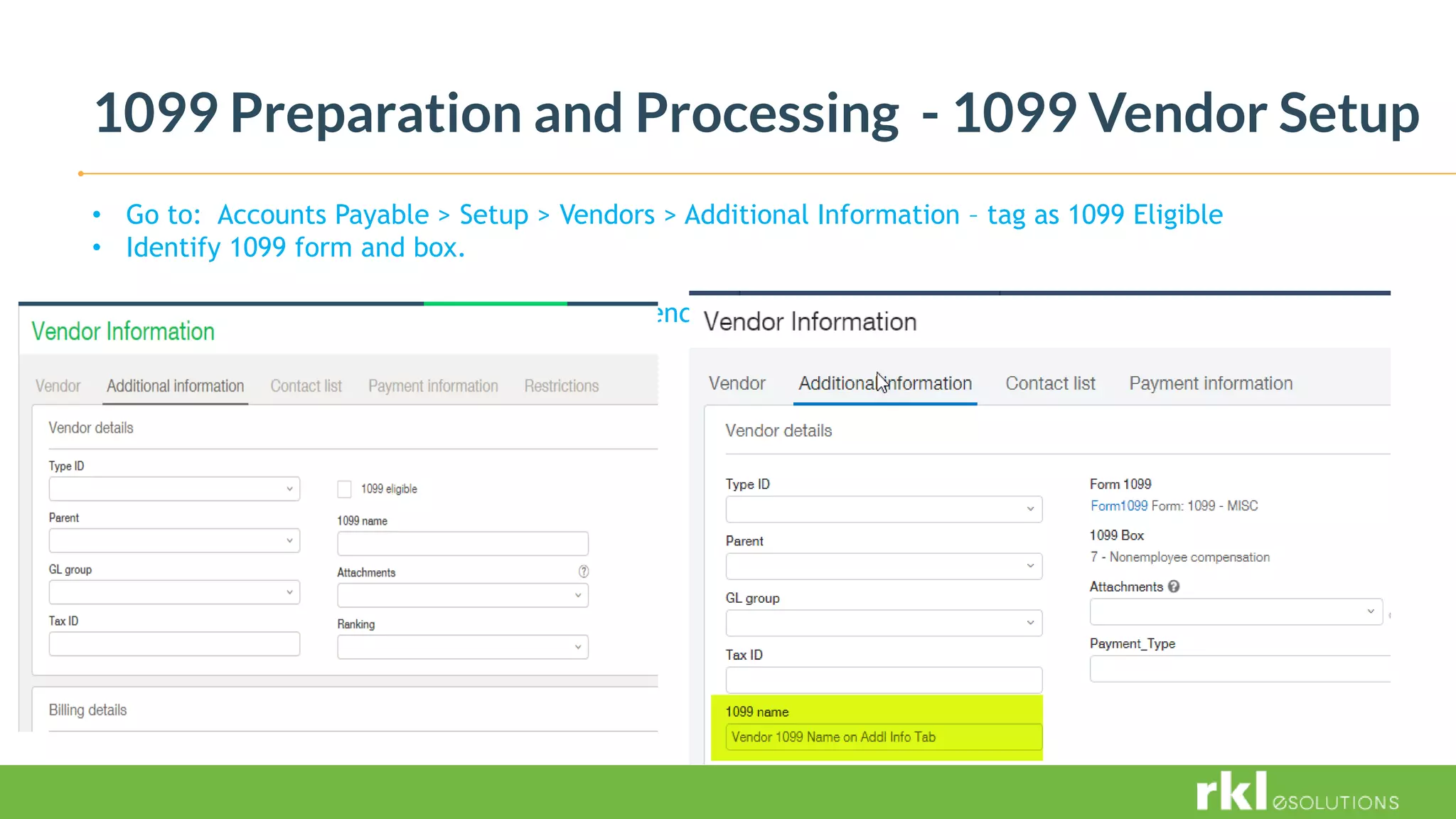

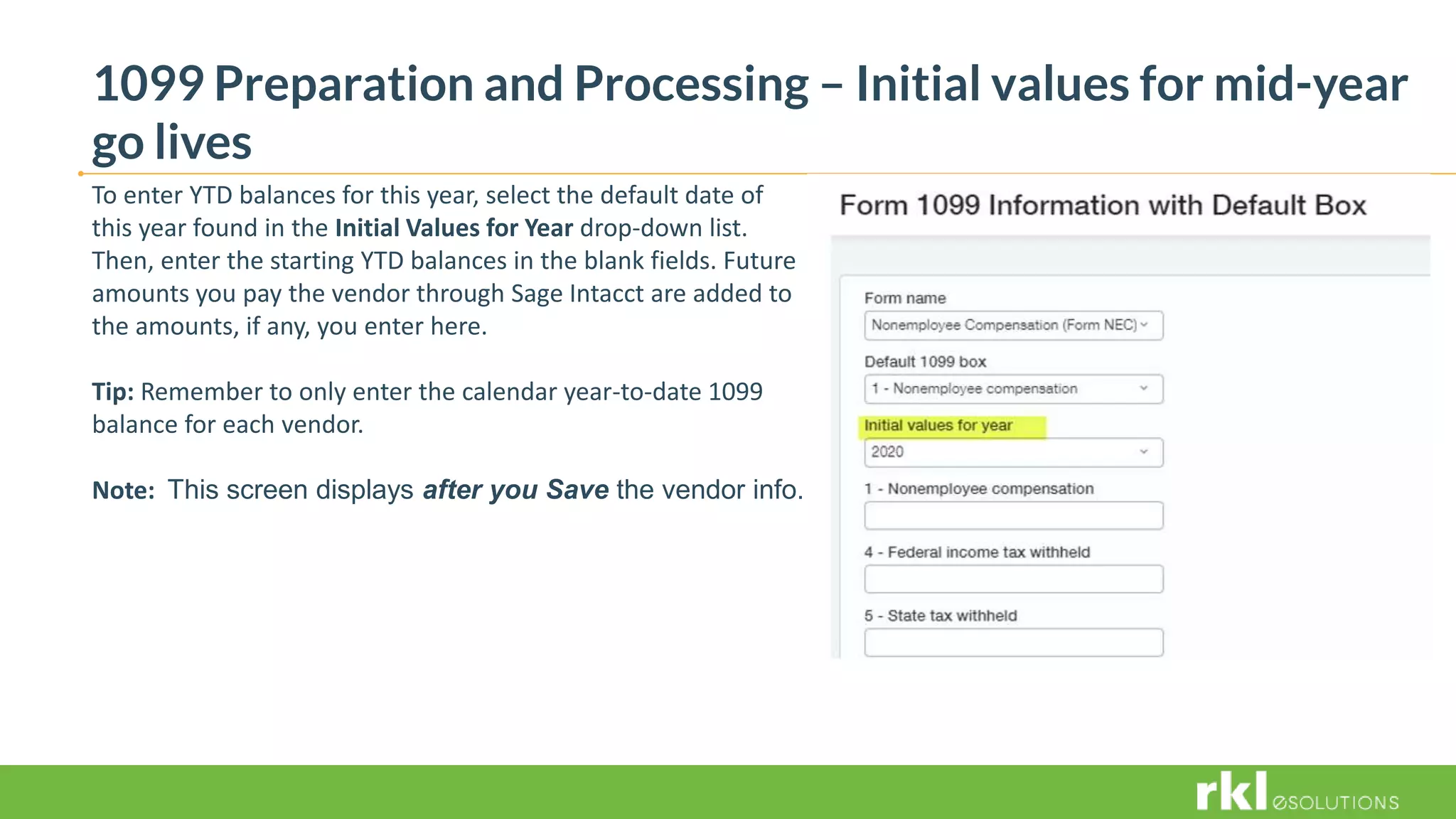

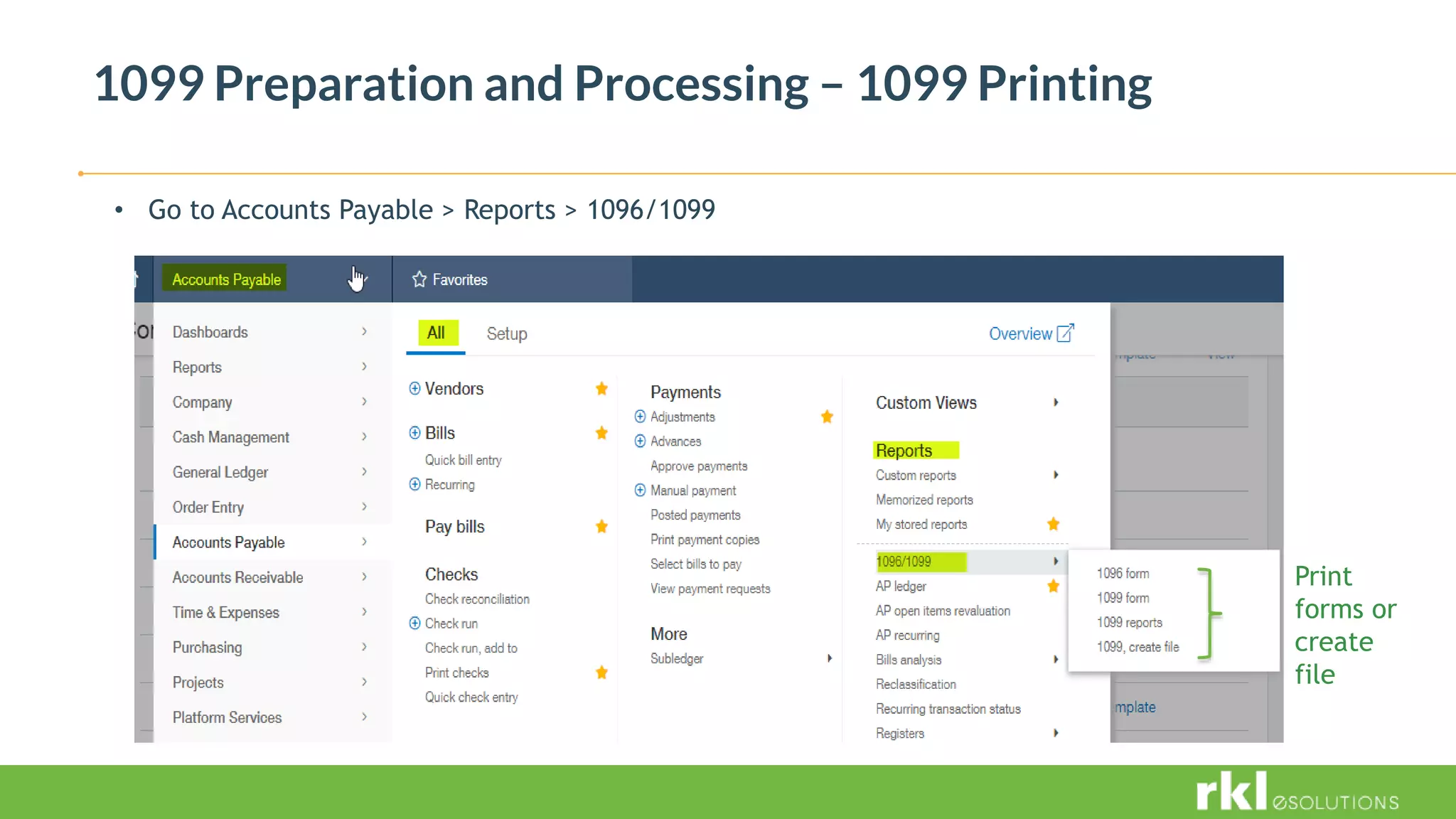

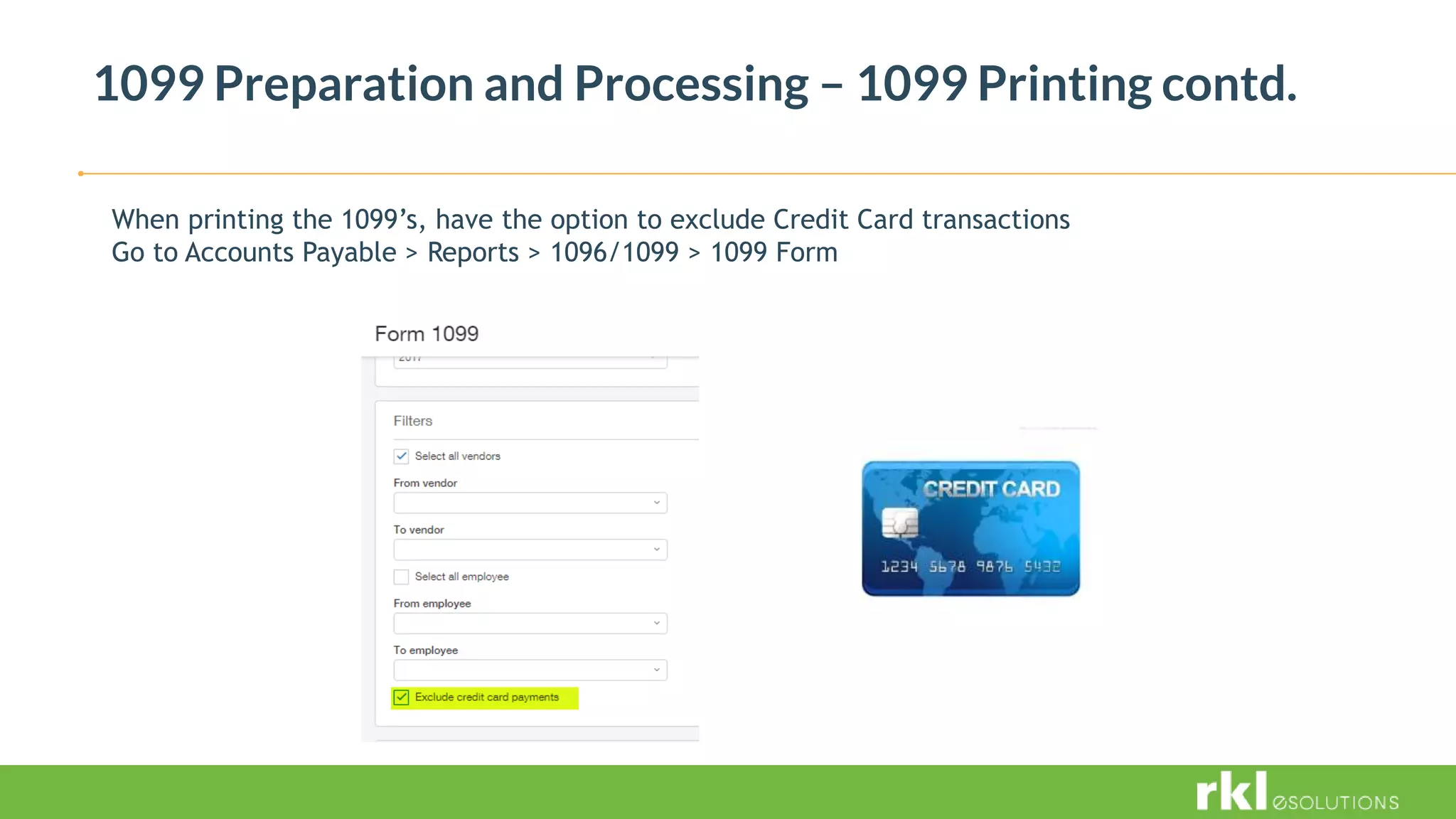

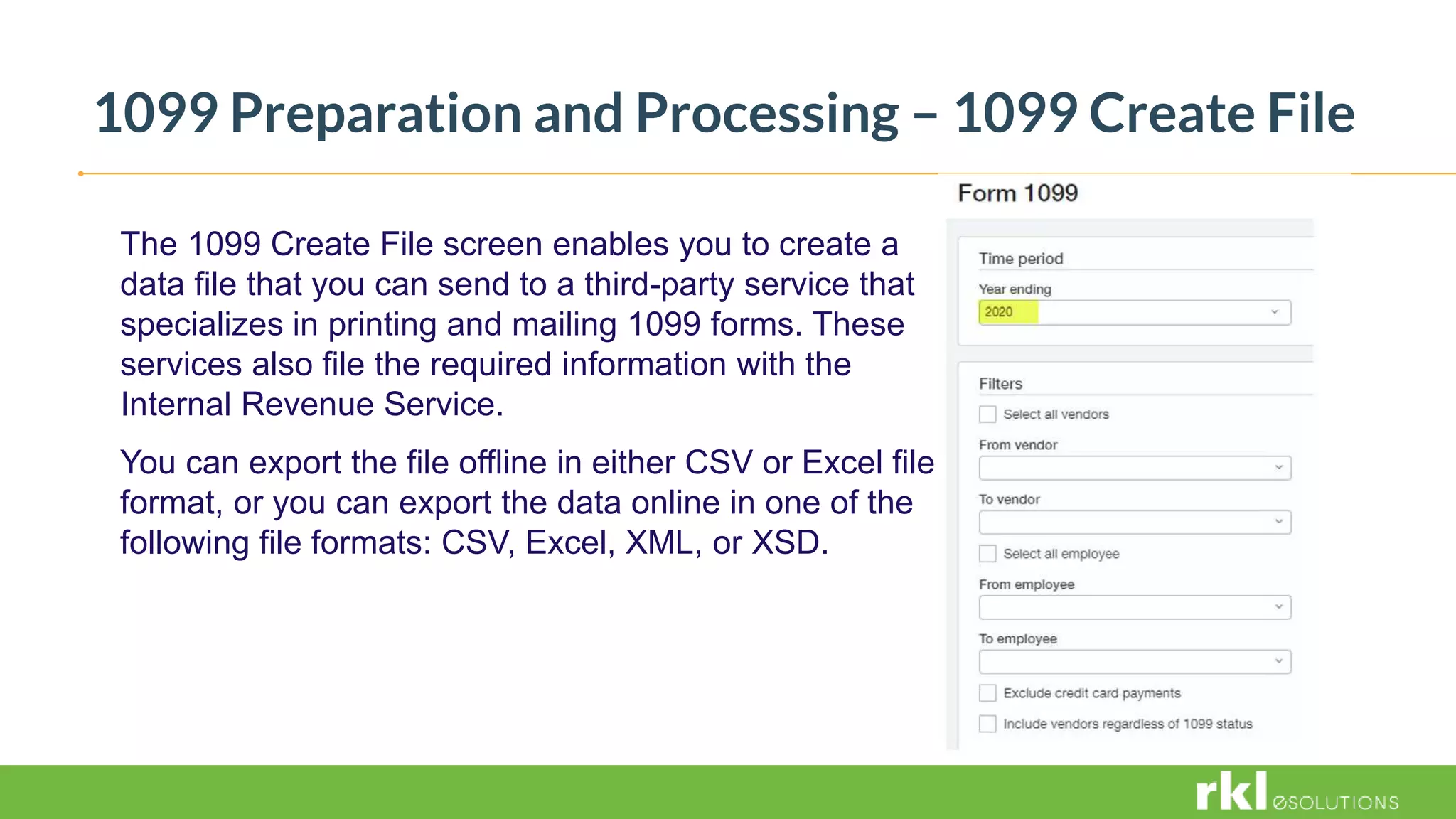

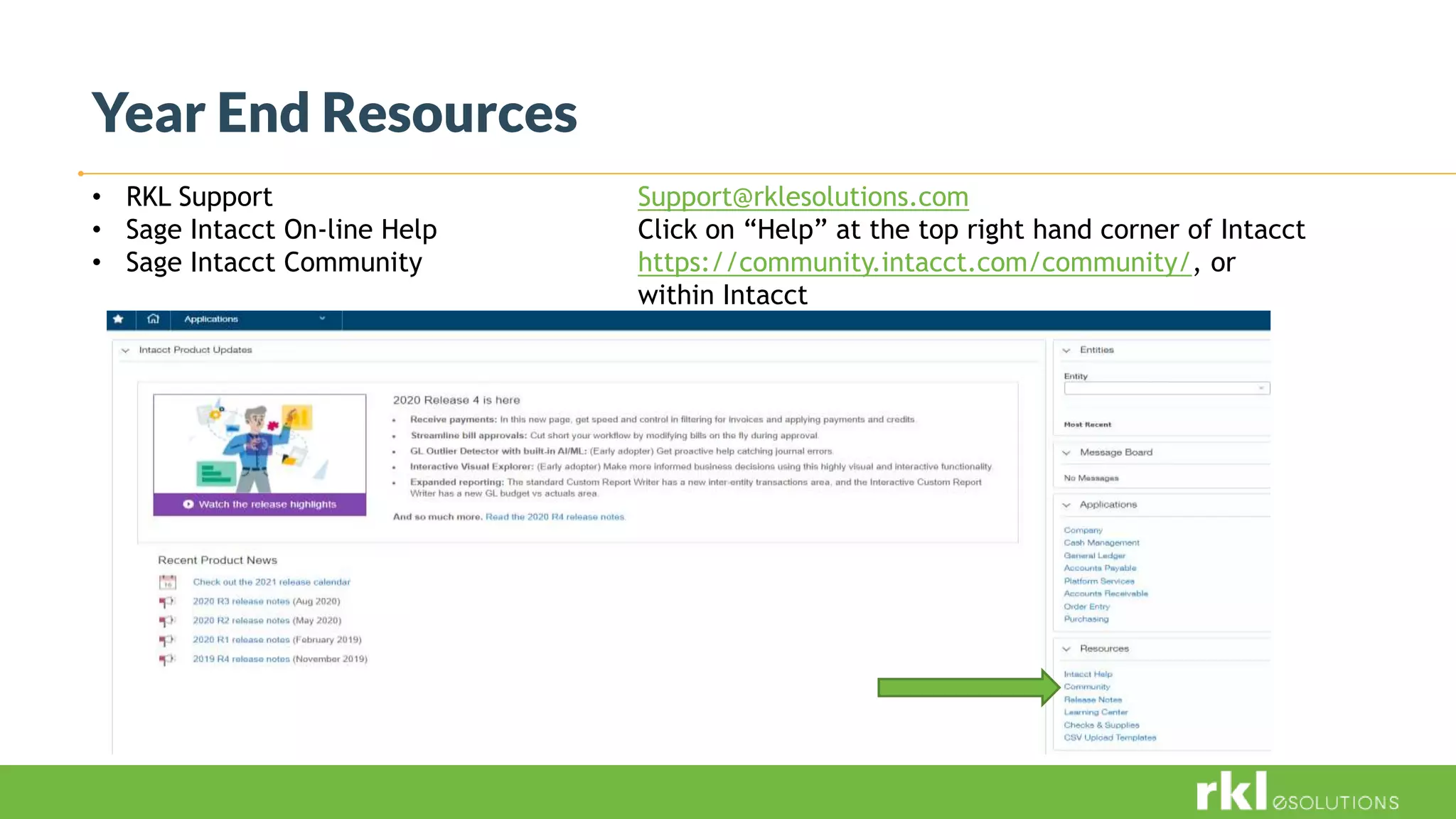

The document outlines year-end planning procedures for Sage Intacct, highlighting essential steps such as closing sub-ledgers, creating fiscal year reporting periods, and preparing 1099 forms. It provides best practices for improving accuracy in financial reporting and emphasizes the importance of proper reconciliation and control measures. Additionally, it includes resources for support and upcoming webinars related to Intacct's budgeting and planning functionalities.