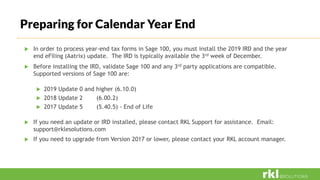

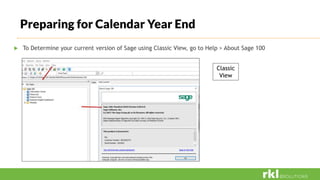

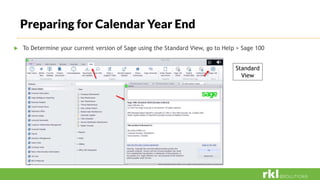

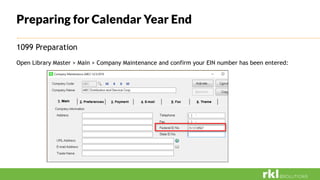

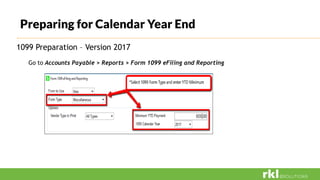

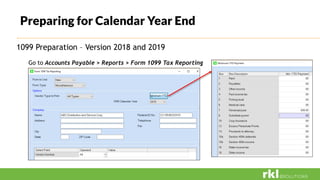

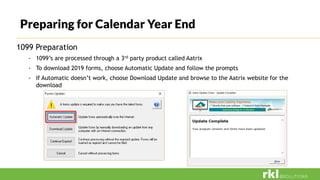

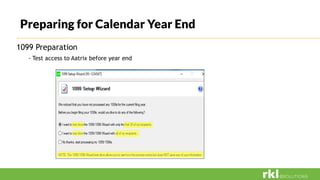

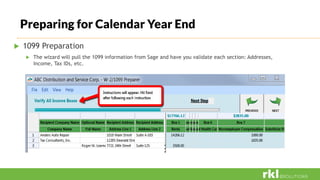

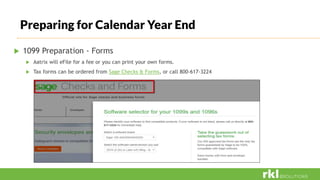

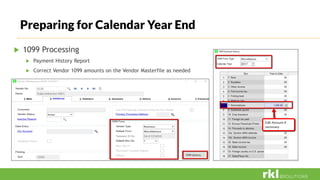

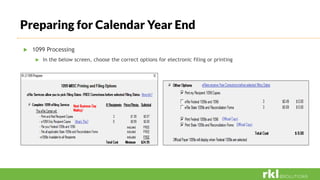

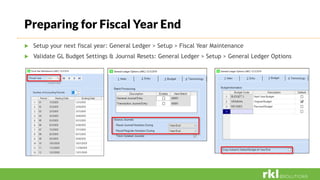

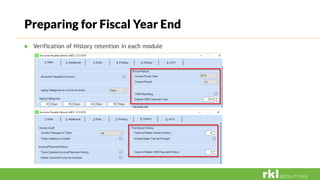

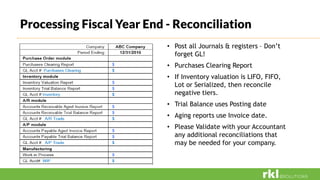

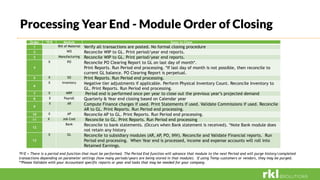

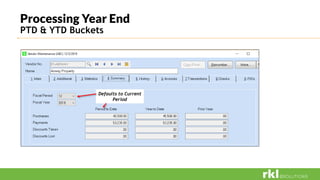

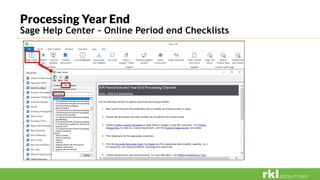

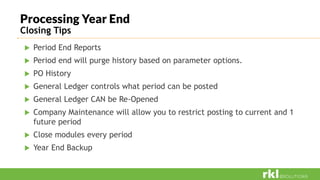

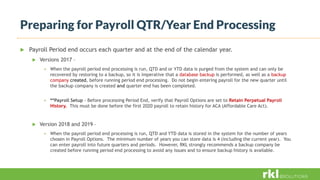

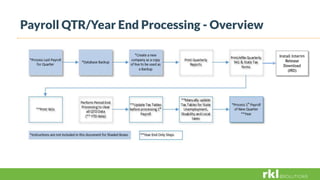

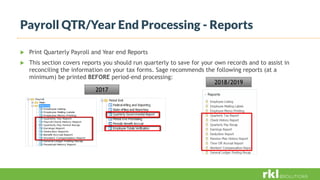

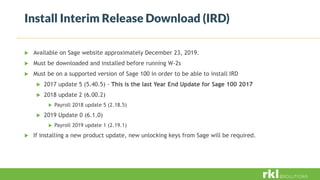

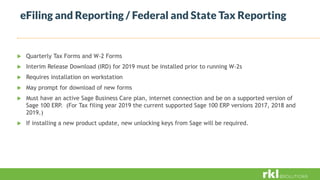

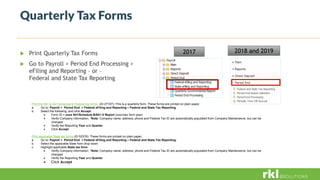

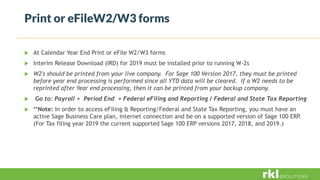

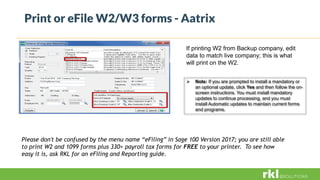

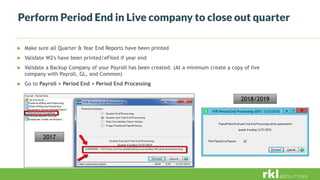

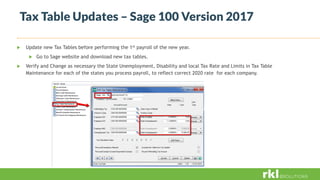

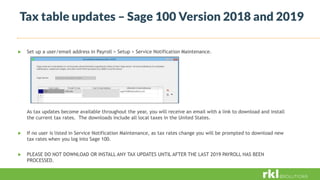

The document provides an extensive guide on year-end planning and processing for Sage 100, covering critical tasks such as preparing for 1099 and payroll year-end processing, setting up fiscal year maintenance, and completing necessary updates and reconciliations. It includes specific instructions for different versions of Sage 100 and emphasizes the importance of backups and validation before closing the year. Additional sections detail the processing order for various modules and the necessary forms for tax reporting and e-filing.