17 May Daily market report

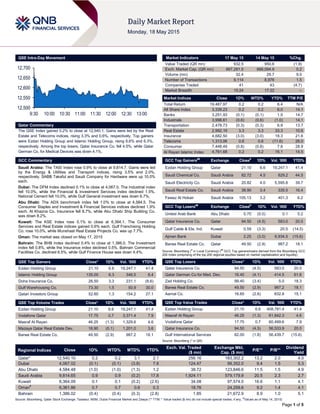

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 0.2% to close at 12,540.1. Gains were led by the Real Estate and Telecoms indices, rising 3.3% and 0.6%, respectively. Top gainers were Ezdan Holding Group and Islamic Holding Group, rising 6.6% and 6.3%, respectively. Among the top losers, Qatar Insurance Co. fell 4.5%, while Qatar German Co. for Medical Devices was down 4.1%. GCC Commentary Saudi Arabia: The TASI Index rose 0.9% to close at 9,814.7. Gains were led by the Energy & Utilities and Transport indices, rising 3.5% and 2.0%, respectively. SABB Takaful and Saudi Company for Hardware were up 10.0% each. Dubai: The DFM Index declined 0.1% to close at 4,067.0. The Industrial index fell 10.0%, while the Financial & Investment Services index declined 1.5%. National Cement fell 10.0%, while Gulf General investment was down 6.7%. Abu Dhabi: The ADX benchmark index fell 1.0% to close at 4,584.5. The Consumer Staples and Investment & Financial Services indices declined 1.9% each. Al Khazna Co. Insurance fell 8.7%, while Abu Dhabi Ship Building Co. was down 8.2%. Kuwait: The KSE Index rose 0.1% to close at 6,364.1. The Consumer Services and Real Estate indices gained 0.6% each. Gulf Franchising Holding Co. rose 10.0%, while Munshaat Real Estate Projects Co. was up 7.7%. Oman: The market was closed on May 17, 2015 Bahrain: The BHB Index declined 0.4% to close at 1,386.0. The Investment index fell 0.8%, while the Insurance index declined 0.5%. Bahrain Commercial Facilities Co. declined 6.5%, while Gulf Finance House was down 4.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 21.10 6.6 19,247.1 41.4 Islamic Holding Group 135.00 6.3 346.5 8.4 Doha Insurance Co. 26.50 3.3 231.1 (8.6) Gulf Warehousing Co. 73.30 1.5 50.9 30.0 Qatari Investors Group 52.60 1.3 154.2 27.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 21.10 6.6 19,247.1 41.4 Vodafone Qatar 17.75 0.7 3,371.4 7.9 Masraf Al Rayan 46.25 (1.3) 1,329.6 4.6 Mazaya Qatar Real Estate Dev. 18.90 (0.1) 1,201.0 3.6 Barwa Real Estate Co. 49.50 (2.9) 987.2 18.1 Market Indicators 17 May 15 14 May 15 %Chg. Value Traded (QR mn) 932.5 950.6 (1.9) Exch. Market Cap. (QR mn) 667,281.5 666,094.9 0.2 Volume (mn) 32.4 29.7 9.0 Number of Transactions 9,114 8,976 1.5 Companies Traded 41 43 (4.7) Market Breadth 15:24 17:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,487.97 0.2 0.2 6.4 N/A All Share Index 3,339.23 0.2 0.2 6.0 14.1 Banks 3,251.93 (0.1) (0.1) 1.5 14.7 Industrials 3,998.61 (0.6) (0.6) (1.0) 14.1 Transportation 2,478.73 (0.3) (0.3) 6.9 13.7 Real Estate 2,992.19 3.3 3.3 33.3 10.6 Insurance 4,682.50 (3.0) (3.0) 18.3 21.6 Telecoms 1,313.06 0.6 0.6 (11.6) 26.0 Consumer 7,448.49 (0.8) (0.8) 7.8 28.9 Al Rayan Islamic Index 4,761.68 0.2 0.2 16.1 14.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 21.10 6.6 19,247.1 41.4 Saudi Chemical Co. Saudi Arabia 82.72 4.5 829.2 44.5 Saudi Electricity Co. Saudi Arabia 20.82 4.0 5,595.8 39.7 Saudi Real Estate Co. Saudi Arabia 38.90 3.4 335.5 16.4 Fawaz Al Hokair Saudi Arabia 105.13 3.2 401.3 6.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Arab Bank Abu Dhabi 5.70 (5.0) 0.1 5.2 Qatar Insurance Co. Qatar 94.50 (4.5) 583.0 20.0 Gulf Cable & Ele. Ind. Kuwait 0.59 (3.3) 20.5 (14.5) Ajman Bank Dubai 2.25 (3.0) 6,934.5 (15.6) Barwa Real Estate Co. Qatar 49.50 (2.9) 987.2 18.1 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Co. 94.50 (4.5) 583.0 20.0 Qatar German Co for Med. Dev. 16.40 (4.1) 414.5 61.6 Zad Holding Co. 99.40 (3.4) 5.0 18.3 Barwa Real Estate Co. 49.50 (2.9) 987.2 18.1 Aamal Co. 16.65 (2.6) 832.8 15.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 21.10 6.6 408,781.4 41.4 Masraf Al Rayan 46.25 (1.3) 61,842.3 4.6 Vodafone Qatar 17.75 0.7 60,499.6 7.9 Qatar Insurance Co. 94.50 (4.5) 56,533.9 20.0 Gulf International Services 82.00 (1.8) 56,439.7 (15.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,540.10 0.2 0.2 3.1 2.1 256.16 183,302.2 13.2 2.0 4.0 Dubai 4,067.02 (0.1) (0.1) (3.8) 7.8 124.47 99,352.0 9.4 1.5 5.3 Abu Dhabi 4,584.48 (1.0) (1.0) (1.3) 1.2 38.72 123,846.6 11.5 1.5 4.9 Saudi Arabia 9,814.65 0.9 0.9 (0.2) 17.8 1,924.11 579,179.9 20.5 2.3 2.7 Kuwait 6,364.09 0.1 0.1 (0.2) (2.6) 34.08 97,574.0 16.6 1.1 4.1 Oman# 6,361.86 0.7 0.7 0.6 0.3 18.76 24,259.6 9.2 1.4 4.1 Bahrain 1,386.02 (0.4) (0.4) (0.3) (2.8) 1.85 21,672.9 8.9 1.0 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, MSM, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any, # Values as of May 14, 2015) 12,500 12,550 12,600 12,650 12,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index gained 0.2% to close at 12,540.1. The Real Estate and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Ezdan Holding Group and Islamic Holding Group were the top gainers, rising 6.6% and 6.3%, respectively. Among the top losers, Qatar Insurance Co. fell 4.5%, while Qatar German Co. for Medical Devices was down 4.1%. Volume of shares traded on Sunday rose by 9.0% to 32.4mn from 29.7mn on Thursday. Further, as compared to the 30-day moving average of 10.5mn, volume for the day was 208.2% higher. Ezdan Holding Group and Vodafone Qatar were the most active stocks, contributing 59.5% and 10.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn) 1Q2015 % Change YoY Operating Profit (mn) 1Q2015 % Change YoY Net Profit (mn) 1Q2015 % Change YoY Saudia Dairy & Foodstuff Co. (SADAFCO)* Saudi Arabia SR – – 155.6 -15.4% 141.5 -17.5% National Cement Co. (NCC) Dubai AED 72.2 77.1% – – 36.5 7.4% Hits Telecom Holding Co. Dubai KD 17.9 -48.2% 1.6 -19.0% 0.4 NA Islamic Arab Insurance Co. (Salama) Dubai AED 232.0 3.3% 32.1 528.1% 9.4 NA Gulf General Investments Co. (GGICO) Dubai AED 274.5 -20.5% – – 22.4 227.5% Agility Public Warehousing Co. (Agility) Dubai KD 318.1 1.2% – – 11.8 5.2% Waha Capital Abu Dhabi AED – – – – 182.2 20.2% Eshraq Properties Co. Abu Dhabi AED 6.9 -90.0% – – -7.2 NA Ras Al Khaimah National Insurance Co. (RAK Insurance) Abu Dhabi AED 52.9 30.6% 15.0 8.9% 14.7 -3.2% Abu Dhabi National Company for Building Materials (BILDCO) Abu Dhabi AED 8.5 17.0% – – -3.3 NA Global Investment House Bahrain KD 5.5 -9.7% – – 1.8 -41.7% Inovest Bahrain BHD 2.0 -56.1% -1.0 NA -1.0 NA Source: Company data, DFM, ADX, MSM News Qatar QNBK plans expansion in South East Asia – QNB Group (QNBK) CEO Ali Ahmed al-Kuwari, in the bank’s annual strategy conference held in Oman, said that QNBK is planning to expand in South East Asia given the growing ‘East-West’ trade between Qatar and Asia. He added that QNBK, which recently opened a representative office in Ho Chi Min City in Vietnam, views Asia as “strategically important”. The theme of the two-day conference was built around QNBK’s stated vision of being a “Middle East & Africa Icon” by 2017. QNBK’s presence through its subsidiaries and associates extends to more than 27 countries across three continents, providing a comprehensive range of value-added products and services. (Gulf-Times.com) QCSD raises CBQK’s foreign ownership to 49% – The Qatar Central Securities Depository (QCSD) has amended the foreign ownership percentage in the Commercial Bank of Qatar’s (CBQK) shares, increasing it to 49% of the total capital effective from May 18, 2015. This amendment is pursuant to Law no. 9 that allows foreign investors to own shares in listed companies by no more than 49% of each company’s capital listed on the Qatar Stock Exchange. The law also provides for the treatment of the GCC citizens as Qataris in terms of owning the shares of listed companies. (QSE) QNBFS: Qatari equities’ earnings remain resilient in 1Q2015 despite weak oil prices – QNB Financial Services (QNBFS) said in a report that Qatari equities’ (excluding Vodafone Qatar) earnings remained resilient in 1Q2015 despite weak oil prices and saw their net income grow 3.3% QoQ and a robust 21.9% YoY. The overall earnings of 43-listed stocks was driven by strong growth from real estate, banking, telecom and transportation sectors, but were constrained by a weak performance at industrials, insurance and consumer sectors. The earnings growth was restricted by a correction in commodity prices and the seasonal nature of some companies. Weak oil prices weighed heavily on investor sentiment as the Qatar Stock Exchange (the benchmark QSE Index) posted a decline of 4.7% in 1Q2015. Going forward, QNBFS believes Qatar’s long-term fundamental story remains intact. However, international oil prices will be the key to investor sentiment and the near-term direction of the market. (Gulf-Times.com) MDPS: Rayyan municipality tops building permits in April 2015 – Qatar’s Ministry of Development Planning and Statistics (MDPS), in its 4th edition of Building Permits Statistics, reported Overall Activity Buy %* Sell %* Net (QR) Qatari 67.29% 71.50% (39,167,907.33) GCC 9.05% 6.45% 24,306,454.79 Non-Qatari 23.66% 22.06% 14,861,452.54

- 3. Page 3 of 5 that Rayyan municipality (including Sheehaniya) topped the building permits recording an issuance of 267 building permits in April 2015 i.e. 36% of the total issued permits, while Doha municipality was at second place with 146 permits, i.e. 20%. As per the report, the new building permits constituted 60% (441 permits) of the total building permits issued during April 2015, while the additions permits constituted 35% (256 permits). Villas’ permits top the list of new residential buildings permits, accounting for 73% (283 permits), whereas commercial buildings were at the forefront of non-residential buildings permits with 46% (25 permits). (QSA) QPI sees rise in OPEC demand as price drop hits shale output – Qatar Petroleum’s (QP) foreign investment arm Qatar Petroleum International’s (QPI) CEO, Nasser Khalil Al-Jaidah said that the demand for OPEC’s crude will rise as the drop in oil prices below $100 a barrel continues to hinder shale production. He said that the coming period will witness an improvement in crude prices but they will not reach $100. Al Jaidah said that QP will benefit from lower oil prices as it restructures the company by “shedding added costs that have accumulated in the past”. He added that QPI will be taken over by its parent, which will focus more on foreign operations and investments as most domestic production projects have been completed. (Bloomberg) ‘Made in Qatar’ expo to focus on local firms – The 4th edition of 'Made in Qatar' exhibition will begin at the Doha Exhibition Center on Tuesday and continue till May 22. Qatar Chamber’s (QC) Chairman Sheikh Khalifa bin Jassim Al Thani hoped that the event will achieve its goal of helping the development of the Qatari industry. The exhibition will provide a platform for industry leaders to exchange knowledge. He said that the exhibition is part of QC's initiative to support the local industry and encourage investors. The exhibition also aims at supporting local companies to promote their products. More than 217 companies and about 200 productive families will participate in the exhibition. (Qatar Tribune) Alpen Capital: Qatar to witness highest food consumption growth in GCC – Alpen Capital, in its GCC Food Industry report, said that food consumption in Qatar is expected to witness highest growth in the GCC region over the next five years driven by rising population. Qatar’s food consumption is expected to grow at a compound annual growth rate (CAGR) of 5.5%, whereas food consumption in the GCC region is expected to grow at a CAGR of 3.5% over 2014-19. The report said that the Qatari food industry is strengthened by factors such as rising expatriate population, tourism and a developing taste for Western foods. The country’s food retail sales are estimated at $11bn in 2014, showing a 13.1% YoY increase and accounting for 46.4% of the total retail sales. (Peninsula Qatar) International Germany urges Greece to implement reforms to unlock funds – German politicians have kept up the pressure on Greece over the weekend to implement reforms, with Economy Minister Sigmar Gabriel warning Athens that a third aid package would not be on the cards unless Greece made some changes. Gabriel warned that the exit of Greece from the single currency bloc would not only be highly dangerous economically but also politically. The country is fast running out of cash and talks with its lenders have been deadlocked over their demands for Greece to implement reforms, including pension cuts and labor market liberalization. Athens has depended on money from its €240bn bailout by the European Union and the International Monetary Fund to pay its bills since 2010. However, it has not received any loan tranches since August 2014. (Reuters) London house prices plunge as election concerns hit market – Asking prices for London homes fell the most in nine months in May 2015 as concerns about potential property-tax changes before the election cooled demand. Prices dropped 2.3% MoM but were up 1.5% YoY. The prices slipped 0.1% nationally, posting the first decline in a May since the last general election in 2010. The property website operator, Rightmove said that concerns in the run-up to the election surrounding housing policy proposals – particularly those put forward by the opposition Labour Party – unnerved buyers and caused fewer homes to be put on the market. However, it expects a pick-up in prices as the Conservative Party’s victory removed threats, including a potential tax on the most expensive homes. (Bloomberg) Japan core machinery orders rise in March, outlook weak – According to data published by Cabinet Office, Japan's core machinery orders grew 2.9% MoM in March followed by a revised 1.4% drop recorded in February 2015. However, core orders are seen slipping in 2Q2015, suggesting that weak capital spending could further sap momentum from an economy struggling to rebound from a recession. Companies surveyed by the Cabinet Office forecasted that core orders, which exclude those of ships and electric power utilities, will fall 7.4% in 2Q2015. Core orders gained 6.3% QoQ in 1Q2015. The weak outlook for capital spending is a worry for policy makers since it is seen as crucial in driving a virtuous cycle of higher income, consumer spending and robust economic growth. (Reuters) China home prices in April raise hope of bottoming out – China's average new home prices in 70 major cities dropped for the eighth consecutive month by 6.1% YoY in April. However, the prices were flat MoM, further narrowing from a 0.1% fall registered in March, adding to hopes that a property downturn which is weighing heavily on the economy is beginning to bottom out. Home sales measured by floor area rebounded 7.7% YoY in April, the first growth since November 2013. But the real estate investment growth continued to slow in January- April 2015 – the lowest since May 2009 as new construction slumped, impacting demand for everything from steel and cement to appliances and furniture. Economists said that the property sector remains the biggest risk to Beijing's growth target of around 7% in 2015 and authorities will need to take bolder stimulus measures. (Reuters) Regional SPV established to develop Rafal Living by Kempinski – Albilad Capital, Zahran Group, Muhaidib Group and Rafal have signed an agreement to establish a special purpose vehicle (SPV) for developing Rafal Living by Kempinski in Riyadh, Saudi Arabia. Rafal Living by Kempinski presents first-ever lavish sky villas concept with 300 residential villas that are fully managed and serviced by Kempinski, and will be ready for inhabitance by 2018. (GulfBase.com) SADAFCO BoD recommends SR113.75mn dividend – Saudia Dairy & Foodstuff Company’s (SADAFCO) board of directors has recommended the distribution of 35% dividend (SR3.5 per share), amounting to SR113.75mn for the 2014-15 period. Shareholders, who are registered in the registers of the Securities Depository Center (Tadawul), will be eligible to receive the dividend on the closing date of the forthcoming general assembly meeting.(Tadawul) Alkhaleej Training & Education completes selling fractions shares – Alkhaleej Training & Education Company has completed selling of 3,282 fractions shares arising out of the company's capital increase. The company had sold the shares on May 3, 2015 for a value of SR181,330.50 at an average price

- 4. Page 4 of 5 of SR55.25. The Riyadh Bank will deposit the fractions shares amount into the company’s shareholders account on May 24, 2015. (Tadawul) Mobily joins VMware service provider network – Etihad Etisalat Company (Mobily) has joined the VMware vCloud Air Network as an enterprise-level service provider. The vCloud Air Network provides organizations with VMware-based enterprise- class security and infrastructure compatibility, as well as freedom to readily move workloads among private, public and hybrid clouds. (GulfBase.com) CDSI: KSA non-oil exports drop 19.4% in March; inflation at 2% in April – According to a report released by the Central Department of Statistics & Information (CDSI), Saudi Arabia’s non-oil exports dropped by 19.4% YoY in March 2015. As per the report, plastic products topped the Kingdom’s list of exports in March and registered 32.14% of non-oil exports valued at more than SR5bn. Petrochemical products were ranked second in non-oil exports and were valued at more than SR4bn, or 26.21%, of the total exports’ value; followed by ordinary metals & products by 9.15%, or SR1.4bn of the total value of exports. Further, the Kingdom’s imports have increased by 2.8% YoY to SR55.6bn in April 2015. The report added that equipment, machinery & electrical utensils captured the highest value of Saudi imports in March at SR14.9bn, or 26.86% of the total value of imports, followed by transport materials at the value of SR9.5bn, or 17.13%, and ordinary metals and their products at SR5.4bn, or 9.83%. Meanwhile, the UAE topped the list of major importers of Saudi non-oil products by 10.68% of the total value of exports in March, followed by China at 10.05% and India at 7.32%. China remained the biggest exporter to the Kingdom and captured 13.99% of the total Saudi imports in March, followed by the US at 12.22% and Germany at 6.90%. Moreover, the statistics from CDSI showed that the Kingdom’s inflation rose 2% YoY, while inflation increased by 0.3% MoM in April 2015. Prices of housing and utilities rose 3.1% YoY in April 2015, while food & beverage prices climbed 1.3% YoY. (GulfBase.com, Reuters) D&B BOI: KSA business community sentiments weaken in 2Q2015 – Dun & Bradstreet South Asia Middle East Ltd. (D&B), in association with the National Commercial Bank (NCB), has released the D&B Business Optimism Index (BOI) survey for Saudi Arabia for 2Q2015. The BOI survey highlighted lower optimism levels for both hydrocarbon and non-hydrocarbon sectors in the Kingdom. Further, the OPEC’s decision to maintain its output level in 2014 contributed to the most recent oil price slump, as the Kingdom insisted on retaining its market share against competing sources of crude. Saudi Arabia had produced 9.64mn barrels per day (bpd) of crude in 4Q2014 and maintained this level at the beginning of 2015, producing 9.68mn bpd in January 2015 and 9.64mn bpd in February 2015. Meanwhile, the Kingdom is ramping up the number of machines drilling for oil & gas despite the sharp fall in crude prices so as to preserve its spare capacity. Sharihan Al-Manzalawi, NCB economist, said that the continued volatility in oil markets since the beginning of 2015 has weighed negatively on the optimism in both the hydrocarbon and non-hydrocarbon sectors of 2Q2015. Accordingly, the hydrocarbon’s BOI dropped to 13 points, its lowest level since 2Q2009. Meanwhile, the non- hydrocarbon’s BOI declined modestly to 43 points as the government counter-cyclical fiscal policy, supported by its huge reserves, apparently offset the expected negative impacts due to the sharp fall in oil prices. (Gulf-Base.com) DP: Arabella Townhouses sell out on launch day – Dubai Properties (DP) has reported the sale of all the units at its upscale property, Arabella Townhouses which were launched for sale on May 16, 2015 at its Sales and Customer Care Center, Ras Al Khor. Further, the company has announced the release of additional units for sale to cater to the strong investor interest. (Gulf-Base.com) BofAML: ENBD’s sovereign exposure growing AED3.67bn every quarter – According to a report by Bank of America- Merrill Lynch (BofAML), Emirates NBD’s (ENBD) sovereign exposure has grown exponentially over the years, at AED3.67bn every quarter, reaching AED110.1bn in 1Q2015. According to BofAML, this is about 30% of the emirate’s GDP. Meanwhile, the bank’s loan growth climbed 4% YoY in 1Q2015 and is expected to grow around 5% in 2015. (GulfBase.com) Nakheel signs new deal with Landmark for retail venture – Nakheel has signed a new deal with Landmark Group to bring 25 retail brands to its Al Khail Avenue mall being developed in Dubai’s Jumeirah Village. With a total of 1.2mn square feet of retail space, Al Khail Avenue will have 350 shops, a diverse range of cafes and restaurants, including al fresco dining and a multi-storey car park with 4,400 spaces. The construction of the mall will begin in 2015 and is expected open in 2018. (GulfBase.com) Waha Capital to invest up to AED4bn by 2020 – Waha Capital is planning to invest up to AED4bn by 2020. The company is looking to invest in sectors with high growth potential such as energy, infrastructure, healthcare and education. Waha Capital has invested AED255mn in 1Q2015, out of which AED193mn was invested into capital markets and the remaining amount into its healthcare subsidiary. (Reuters) NCSI: Oman witnesses 68% surge in real estate transactions – According to the National Centre for Statistics & Information (NCSI), real estate transactions in Oman have surged by 68% YoY to reach OMR1,638.9mn during January- April 2015. The fees collected for these transactions stood at OMR16.1mn, reflecting an increase of 12.6% YoY, while the value of sale contracts fell by 0.9% YoY to reach OMR391.7mn. Meanwhile, the number of sales transactions witnessed a decline of 5.2% YoY to 28,543 contracts. A total of 85,346 title deeds were issued till the end of April 2015 as compared to 81,168 title deeds in 2014, witnessing a rise of 5.1% in 2014. Further, the number of title deeds issued to GCC nationals till the end of April 2015 declined by 27.2% to 996 contracts as compared to 1,369 title deeds issued during the same period in 2014. (GulfBase.com) CBO: Private deposits at Oman’s commercial banks rise to OMR11.38bn – The monthly statistical bulletin report of the Central Bank of Oman (CBO) has indicated that private deposits at Oman’s commercial banks have increased by 9.47% to OMR11.38bn during the period between January and February 2015 as compared to OMR10.4bn in January-February 2014. As per the report, the gross value for these deposits at the end of February 2015 includes the time deposits that stood at OMR3.22bn, savings deposits of OMR4.16bn and demand deposits of OMR3.8bn. The total value for these deposits includes OMR10.51mn and OMR867.1mn in foreign currencies. The demand deposits comprise 33% of the total private deposits, while the capital and reserves account for 18.5% of the total deposits. The rate of allocations and the retained interests to the total credit was 3.5%. (GulfBase.com)

- 5. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (*Value as of May 14, 2015) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 QSE Index S&P Pan Arab S&P GCC 0.9% 0.2% 0.1% (0.4%) 0.7% (1.0%) (0.1%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman* AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,224.06 0.2 3.0 3.3 MSCI World Index 1,807.06 0.2 0.7 5.7 Silver/Ounce 17.50 0.2 6.3 11.4 DJ Industrial 18,272.56 0.1 0.4 2.5 Crude Oil (Brent)/Barrel (FM Future) 66.81 0.3 2.2 16.5 S&P 500 2,122.73 0.1 0.3 3.1 Crude Oil (WTI)/Barrel (FM Future) 59.69 (0.3) 0.5 12.1 NASDAQ 100 5,048.29 (0.0) 0.9 6.6 Natural Gas (Henry Hub)/MMBtu 2.96 2.9 6.9 (1.2) STOXX 600 396.45 0.1 0.9 9.3 LPG Propane (Arab Gulf)/Ton 47.88 (0.5) (3.0) (2.3) DAX 11,447.03 (0.5) (0.4) 9.8 LPG Butane (Arab Gulf)/Ton 57.88 (6.3) (11.1) (11.6) FTSE 100 6,960.49 (0.2) 0.8 7.2 Euro 1.15 0.4 2.3 (5.3) CAC 40 4,993.82 (0.2) (0.1) 10.4 Yen 119.25 0.1 (0.4) (0.4) Nikkei 19,732.92 0.6 2.1 13.1 GBP 1.57 (0.3) 1.8 1.0 MSCI EM 1,043.40 0.7 0.8 9.1 CHF 1.09 (0.4) 1.6 8.6 SHANGHAI SE Composite 4,308.69 (1.6) 2.6 33.3 AUD 0.80 (0.6) 1.3 (1.7) HANG SENG 27,822.28 2.0 0.9 17.9 USD Index 93.14 (0.3) (1.8) 3.2 BSE SENSEX 27,324.00 0.5 1.4 (0.8) RUB 49.53 (1.1) (2.7) (18.4) Bovespa 57,248.63 1.5 0.3 1.5 BRL 0.33 (0.1) (0.7) (11.6) RTS 1,074.73 1.9 1.4 35.9 180.2 144.4 130.1