QNBFS Daily Market Report September 12, 2017

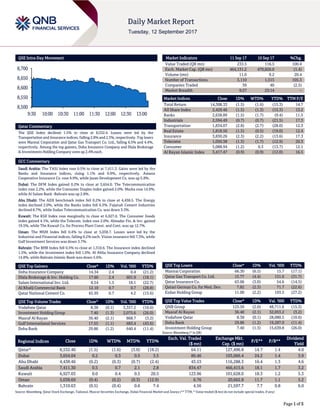

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.5% to close at 8,532.4. Losses were led by the Transportation and Insurance indices, falling 2.8% and 2.3%, respectively. Top losers were Mannai Corporation and Qatar Gas Transport Co. Ltd., falling 6.5% and 4.4%, respectively. Among the top gainers, Doha Insurance Company and Dlala Brokerage & Investments Holding Company were up 2.4% each. GCC Commentary Saudi Arabia: The TASI Index rose 0.5% to close at 7,411.3. Gains were led by the Banks and Insurance indices, rising 1.1% and 0.9%, respectively. Amana Cooperative Insurance Co. rose 9.9%, while Jazan Development Co. was up 5.8%. Dubai: The DFM Index gained 0.2% to close at 3,654.0. The Telecommunication index rose 2.2%, while the Consumer Staples index gained 2.0%. Marka rose 14.9%, while Al Salam Bank -Bahrain was up 2.8%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,438.5. The Energy index declined 2.0%, while the Banks index fell 0.3%. Fujairah Cement Industries declined 8.7%, while Sudan Telecommunication Co. was down 3.3%. Kuwait: The KSE Index rose marginally to close at 6,927.0. The Consumer Goods index gained 4.1%, while the Telecom. index rose 2.0%. Almadar Fin. & Inv. gained 19.5%, while The Kuwait Co. for Process Plant Const. and Cont. was up 12.7%. Oman: The MSM Index fell 0.4% to close at 5,038.7. Losses were led by the Industrial and Financial indices, falling 0.2% each. Vision insurance fell 7.3%, while Gulf Investment Services was down 3.7%. Bahrain: The BHB Index fell 0.5% to close at 1,310.6. The Insurance index declined 1.5%, while the Investment index fell 1.0%. Al Ahlia Insurance Company declined 14.8%, while Bahrain Islamic Bank was down 5.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Doha Insurance Company 14.34 2.4 0.4 (21.2) Dlala Brokerage & Inv. Holding Co. 17.60 2.4 601.9 (18.1) Salam International Inv. Ltd. 8.54 1.5 18.1 (22.7) Al Khalij Commercial Bank 12.10 0.7 0.7 (28.8) Qatar National Cement Co. 65.95 0.7 4.2 (15.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.38 (0.1) 3,357.2 (10.6) Investment Holding Group 7.40 (1.3) 2,075.6 (26.0) Masraf Al Rayan 36.40 (2.1) 868.7 (3.2) Gulf International Services 17.55 (1.1) 683.4 (43.6) Doha Bank 29.86 (1.2) 640.4 (11.4) Market Indicators 11 Sep 17 10 Sep 17 %Chg. Value Traded (QR mn) 233.5 116.5 100.4 Exch. Market Cap. (QR mn) 464,131.2 470,826.0 (1.4) Volume (mn) 11.0 9.2 20.4 Number of Transactions 3,110 1,515 105.3 Companies Traded 39 40 (2.5) Market Breadth 9:27 23:14 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 14,308.33 (1.5) (1.6) (15.3) 14.7 All Share Index 2,429.46 (1.5) (1.3) (15.3) 13.2 Banks 2,638.89 (1.5) (1.7) (9.4) 11.5 Industrials 2,594.49 (0.7) (0.7) (21.5) 17.3 Transportation 1,834.07 (2.8) (2.7) (28.0) 12.3 Real Estate 1,818.50 (1.5) (0.5) (19.0) 12.4 Insurance 3,830.26 (2.3) (2.2) (13.6) 17.3 Telecoms 1,050.38 (1.3) (1.7) (12.9) 20.3 Consumer 5,088.94 (1.2) 0.3 (13.7) 12.1 Al Rayan Islamic Index 3,417.47 (0.9) (0.9) (12.0) 16.5 QSE Top Losers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 66.30 (6.5) 15.7 (17.1) Qatar Gas Transport Co. Ltd. 15.77 (4.4) 131.6 (31.7) Qatar Insurance Co. 63.06 (3.0) 54.6 (14.5) Qatari German Co. for Med. Dev. 7.82 (2.3) 71.7 (22.6) Ezdan Holding Group 11.00 (2.2) 193.5 (27.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 125.50 (2.0) 48,711.6 (15.3) Masraf Al Rayan 36.40 (2.1) 32,053.2 (3.2) Vodafone Qatar 8.38 (0.1) 28,080.5 (10.6) Doha Bank 29.86 (1.2) 19,287.0 (11.4) Investment Holding Group 7.40 (1.3) 15,639.8 (26.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,532.40 (1.5) (1.6) (3.0) (18.2) 64.11 127,496.8 14.7 1.4 4.0 Dubai 3,654.04 0.2 0.3 0.5 3.5 80.46 103,066.4 24.2 1.4 3.9 Abu Dhabi 4,438.46 (0.2) (0.3) (0.7) (2.4) 43.53 116,288.3 16.4 1.3 4.6 Saudi Arabia 7,411.30 0.5 0.7 2.1 2.8 834.47 466,415.6 18.1 1.7 3.2 Kuwait 6,927.03 0.0 0.4 0.5 20.5 123.96 101,628.0 18.3 1.2 5.3 Oman 5,038.69 (0.4) (0.2) (0.3) (12.9) 6.76 20,662.8 11.7 1.1 5.2 Bahrain 1,310.63 (0.5) (0.4) 0.6 7.4 4.56 21,597.7 7.7 0.8 6.0 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,500 8,550 8,600 8,650 8,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 1.5% to close at 8,532.4. The Transportation and Insurance indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari and GCC shareholders. Mannai Corporation and Qatar Gas Transport Co. Ltd. were the top losers, falling 6.5% and 4.4%, respectively. Among the top gainers, Doha Insurance Company and Dlala Brokerage & Investments Holding Company were up 2.4% each. Volume of shares traded on Monday gained by 20.4% to 11.0mn from 9.2mn on Sunday. Further, as compared to the 30-day moving average of 7.1mn, volume for the day was 56.3% higher. Vodafone Qatar and Investment Holding Group were the most active stocks, contributing 30.4% and 18.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change QNB Group S&P Qatar LT-FIC/ST-FIC/LT- LIC/ST-LIC A/A-1/A/A-1 A/A-1/A/A-1 – Negative – Qatar Islamic Bank S&P Qatar LT-FIC/ST-FIC/LT- LIC/ST-LIC A-/A-2/A-/A-2 A-/A-2/A-/A-2 – Negative – Doha Bank S&P Qatar LT-FIC/ST-FIC/LT- LIC/ST-LIC A-/A-2/A-/A-2 A-/A-2/A-/A-2 – Negative – Commercial Bank S&P Qatar LT-FIC/ST-FIC/LT- LIC/ST-LIC BBB+/A- 2/BBB+/A-2 BBB+/A- 2/BBB+/A-2 – Negative – Ooredoo Fitch Qatar LT-IDR A+ A Negative – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, FIC – Foreign Issuer Credit, LIC – Local Issuer Credit) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/11 Japan Economic and Social Research Institute Japan Machine Orders MoM July 8.0% 4.1% -1.9% 09/11 Japan Economic and Social Research Institute Japan Machine Orders YoY July -7.5% -7.8% -5.2% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar S&P affirms ratings on Qatari banks, revises outlook to negative – On Aug. 25, 2017, S&P affirmed 'AA-/A-1+' ratings on Qatar and assigned a negative outlook. The credit ratings agency is now affirming its ratings on QNB Group, The Commercial Bank of Qatar, Doha Bank and Qatar Islamic Bank, while removing them from CreditWatch negative, where S&P placed them on June 8, 2017. (Bloomberg) Hamad Port to emerge as region’s leading trading hub – Citing the Hamad Port's “great capabilities,” modern facilities, and advanced systems, an official of Qatar Chamber said the mega project will increase volume of trade between Qatar and the rest of the world. With rapid growth expected “in the coming years,” Qatar Chamber’s Director General, Saleh Hamad Al-Sharqi said Hamad Port will transform Doha into a regional trade center, which would promote inter-trade in the Middle East region and enhance the region’s trade with the world. Al-Sharqi said Hamad Port provides “a golden opportunity” for the private sector and Qatari businessmen to activate their business and promote the import and export of various commodities. He added, “The port provides great capabilities for receiving all types and sizes of ships, allowing Qatari traders to import and export all goods.” (Gulf-Times.com). Poland, Qatar sign MoU on maritime business – HE the Minister of Transport and Communications Jassim Seif Ahmed Al-Sulaiti took part in the opening of the 19 th International Exhibition and Conferences BALTEXPO 2017, in Gdansk, Poland. Addressing the opening ceremony of the three-day event, he highlighted the key role the marine transport sector plays in world trade. On the sidelines of the event, HE Minister Al-Sulaiti and Poland’s Minister of Marine Economy and Inland Waterways Marek Gróbarczyk, and Qatar’s Ambassador to Poland Ahmed Bin Saif Al-Mu’adadi witnessed the signing ceremony of a memorandum of understanding (MoU) between Qatar Ports Management Company (Mwani Qatar) and the Port of Gdansk Authority. The agreement aims to promote mutually beneficial partnership and cooperation in the maritime business and in maintaining close bilateral relations in maritime business. (Gulf-Times.com) NICC wins Al Wa’ab central district contract – In its quest to fulfill a vision of delivering a highly connected, mixed Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 47.69% 49.88% (5,108,463.45) Qatari Institutions 26.43% 16.71% 22,687,686.09 Qatari 74.12% 66.59% 17,579,222.64 GCC Individuals 1.26% 0.88% 877,217.15 GCC Institutions 0.72% 0.94% (506,591.78) GCC 1.98% 1.82% 370,625.37 Non-Qatari Individuals 4.92% 3.93% 2,303,725.79 Non-Qatari Institutions 18.99% 27.66% (20,253,573.80) Non-Qatari 23.91% 31.59% (17,949,848.01)

- 3. Page 3 of 5 community within the existing fabric of Doha, Al Wa’ab City has commissioned the infrastructure works of its central district to National Industrial Contracting Company (NICC). Al Wa’ab City offers diverse products for both Qataris and expats, including luxury villas, contemporary apartments, retail destinations, office clusters, and street-front showrooms at Salwa Road. (Peninsula Qatar) Ooredoo notes Fitch Ratings revision – Ooredoo noted Fitch Ratings’ revision of Ooredoo’s long term corporate credit ratings from ‘A+’ to ‘A’ and its ‘Negative’ outlook. (QSE) Maxus Qatar secures 9% share within one year of entering the market – Maxus Qatar has secured “a whopping 9% market share” within one year of its entry into the Qatar market, authorized distributor Auto Class announced. Auto Class is a Nasser Bin Khaled subsidiary. The Maxus line-up includes the V80 and G10 passenger and cargo vans that come in various options to cater to different customers and business needs. “The V80 and G10 with their innovative yet classic style are designed to drive businesses to success as they can accommodate all business needs,” the company stated. (Gulf- Times.com) International ECB’s officials pave way for gradual policy tightening – Six European Central Bank’s (ECB) policymakers prepared the ground on September 11, for a gradual roll-back of the ECB’s aggressive monetary stimulus, in light of stronger economic growth in the Eurozone. After 2-1/2 years of unprecedented money printing, the ECB is preparing to dial back its 2.3tn Euros bond-buying program, which has helped boost growth in the Eurozone, but is also blamed for creating real estate and financial bubbles. ECB’s board directors, Sabine Lautenschlaeger, Yves Mersch and Benoit Coeure, and the central bank’s Governors of the Netherlands, Austria and Estonia all discussed the prospect on September 11 of a gradual reduction in ECB support. Eurozone price growth has stabilized just above 1%, stemming fears of deflation, or a sustained drop in prices. Yet it is still far from the ECB’s target of almost 2%. (Reuters) China’s central bank relaxes Yuan hedging rules as currency strengthens, capital outflows ease – China’s central bank scrapped two measures that were put in place to support the Yuan when it was under significant selling pressure, suggesting Beijing is anxious to quash one way bets on the Yuan as outflows ease and exporters face strain. The move comes as the Yuan bounced sharply this year to hit a near two-year peak on the Dollar last week, giving authorities the confidence to relax their grip on a currency that had stumbled badly in 2016 and raised risks to economic stability. With China’s economy humming along at a solid pace and putting to bed concerns of a sharper slowdown, the central bank is likely to pursue a more neutral Yuan rate with the potential for increased two-way volatility, analysts said in the wake of the rules changes. The People’s Bank of China has scrapped reserve requirements for financial institutions settling foreign exchange forward Yuan positions. The PBOC has also stopped requiring foreign banks to put aside reserves for offshore Yuan deposits in China. Both changes are effective immediately. (Reuters) India’s August inflation seen at 5-month high on rising food costs – India’s retail inflation is expected to have picked up to a five-month high in August, largely driven by higher food costs, a Reuters poll showed, easing pressure on the Reserve Bank of India (RBI) to cut interest rates again after poor growth data. Consumer prices were forecasted to be up at 3.20% in August from a year ago, jumping from July’s 2.36%, according to the poll taken September 5-8 of nearly 40 economists. Forecasts for the data, scheduled to be released on September 12, ranged from 2.50% to 3.55%. If the consensus is met, it would be the highest since April, but below the RBI’s medium-term target of 4.0% for the tenth consecutive month. (Reuters) Regional BMI: Global oil prices to strengthen through remainder of 2017 – Global oil prices will strengthen from the year-to-date levels through the remainder of 2017, driven by a rebound in OPEC/non-OPEC compliance to production cuts and a continued slowdown in 2017 supply-growth drivers: the US, Libya and Nigeria, BMI Research has said in a report. In 2018, BMI expects supply-side additions from the existing global projects pipeline will keep prices flat at $55 per barrel on average for the year. (Gulf-Times.com) GCC construction projects value hits $2.4tn – The total value of 21,893 active construction projects in the Gulf Cooperation Council (GCC) reached $2.4tn at the beginning of September 2017, according to a report. Of these, the total value of urban construction projects reached $1.18tn, according to the BNC Construction Intelligence report. The urban construction contracts constitute 80% of the contracts awarded for all sectors in the GCC and in dollar terms this translates to 49% of the total contracts awarded. GCC accounts for 85% of all active projects in the MENA region and in dollar terms, these projects account for 68% of the total estimated value. (GulfBase.com) New investment avenues opening in the GCC’s education sector – Population growth in the GCC is spurring new investment opportunities in the region’s education sector, according to a new report by Strategy&. However, regulatory transparency coupled with higher demand increases risks. As the sector matures, new opportunities are expected to crop up in education support services such as textbook distribution; education infrastructure; and information technology, Strategy&, a PwC subsidiary, said. GCC population is projected to reach 65mn people by 2030, and a third of that number will be under the age of 25. (GulfBase.com) GCC to witness massive wave of digital transformation – The soon-to-be implemented Valued Added Tax (VAT) in Gulf Cooperation Council (GCC) countries is expected to initiate a massive wave of digital transformation as businesses prepare to ensure compliance with the new tax law, an Oracle and Harvard Business Review (HBR) study predicts. The study that is based on a poll of 450 senior company executives from across GCC reveals that 73% of businesses consider VAT implementation as a key opportunity to initiate wider digital transformation projects within their organization. (Peninsula Qatar) Saudi Aramco sees opportunity to use Egypt as a hub for Saudi oil – Saudi Aramco is looking into opportunities to increase pumping of Saudi crude through Sumed pipeline, Egypt’s oil

- 4. Page 4 of 5 ministry said. The company is also considering storing Saudi crude in Egypt and to market petroleum products in the country and in the neighboring nations. (Bloomberg) Saudi Airlines Catering, Flyadeal ink deal for products sale on board aircrafts – Saudi Airlines Catering announced signing a one-year contract with Flyadeal to provide catering services, retail selling of food, beverages, and other products on board aircraft. The value of the deal amounts to SR9mn, Saudi Airlines Catering said in a statement to the Saudi Stock Exchange. (Tadawul) UAE’s AI investments to rise to $9bn this year – UAE’s investments in Artificial Intelligence have been growing by 70% over the past three years, and are projected to hit $9bn by the end of this year, according to analysts. The figures drive home the fact that UAE is ready to embrace AI technologies, managing in a few years to be a role model for adopting state- of-the-art technologies across all economic sectors, reported Wam, the Emirates official news agency. UAE is leading the adoption of digitization and innovation in the region and comes at the forefront of introducing smart services, said Ali Salah, Head of the Economic Studies Section at the Future Centre for Strategic Studies and Research. (GulfBase.com) UAE, China geared for nurturing trade alliances – UAE’s GDP growth rate outpaced its global equivalent over the past five years, according to a top executive at the UAE Ministry of Economy, who attributed the jumbo leaps secured by the country’s domestic economy to a robust energy sector and an agile economic diversification program embraced by the wise leadership of the country. Addressing a roundtable meeting at the Belt & Road Summit held at the Hong Kong Convention and Exhibition Centre, Abdullah Ahmed Al Saleh, Undersecretary of Foreign Trade and Industry at the Ministry of Economy, said Chinese investments in the UAE reached in excess of $2.3bn in 2015, with the non-oil sectors being the beneficiaries of the growing relations between the two nations. Al Saleh expected non-oil industries to grow by 3.3% during 2017, and by 3.4% next year on the back of significant growth recorded in local investments and the country’s booming international trade. (GulfBase.com) Deyaar plans to borrow about AED300mn next year – Dubai- based property developer, Deyaar will borrow AED300mn next year to fund South Bay project, CEO Saeed Mohammed Al Qatami said. It plans to build hotels, serviced apartments for recurring income and expects to see impact of recurring revenue in 2019. (Bloomberg) Union Properties hires Chinese firm to develop Dubai MotorCity – Union Properties signed an agreement with China State Construction Engineering Corp. to develop its AED8bn MotorCity, the Dubai-based property company said. Union Properties will finance its AED8bn MotorCity project through bonds or Sukuk, Chairman Nasser Butti Omair Bin Yousef stated. (Bloomberg) Dubai’s non-oil private sector growth robust in August – Growth of Dubai’s non-oil private sector was sustained at a robust pace during August, supported by further gains in output, new orders and employment. The seasonally adjusted Emirates NBD Dubai Economy Tracker Index, a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy, remained unchanged from July at 56.3 in August. The data pointed to sharp growth across the three key sectors monitored by the survey. Wholesale and retail was the best performing category (index at 56.3), followed by construction (55.8) and travel and tourism (55.1). (GulfBase.com) Al Hilal Bank issues $100mn private placement Sukuk – Aiming to diversify its funding base and tenors, Al Hilal Bank issued a $100mn private placement Sukuk. This is the third issuance under Al Hilal Bank’s $2.5bn Euro Medium Term Note (EMTN) program. The two-year $100mn RegS floating rate Sukuk was priced at three-month LIBOR + 90 bps. The deal was settled on 14th August, 2017. The first issuance under the EMTN program was a five-year senior unsecured $500mn Sukuk, due in October 2018 and registered on the Irish Stock Exchange. The second issuance was a $225mn, 2.7 year private placement due in January 2019 and was a landmark deal recognized for being the first ever issuance of a private placement Sukuk by a UAE financial institution. (GulfBase.com) Bahrain’s real estate sector grows 4.5% in first quarter – The Bahrain Economic Development Board said the country's real estate sector grew 4.5% in the first quarter of 2017, adding $1.7bn to the country's economy, as recent reforms to bolster investment in property sparked an increase in demand. Khalid Al Rumaihi, Chief Executive of the economic development board said, “Recent figures demonstrate the resilience of Bahrain's real estate sector and highlight the increasing demand for housing, not only in the Kingdom but across the wider region.” The Bahrain Economic Board said that real estate transactions in the country were valued at $770mn in the first quarter of 2017, an 8.1% increase in the same period last year. The hotels and restaurants sector grew 12.3% YoY. Demand for residential units in Bahrain is growing at a rate of 5,000 units a year, according to the ministry of housing. Visitors to Bahrain have also been increasing, bolstering demand for tourism and retail facilities. (GulfBase.com) Bahrain expected to offer premiums to issue multi-tranche bond – The government of Bahrain is expected to offer investors significant premiums over its outstanding debt when it issues bonds this week, because of growing concern over its finances in an era of cheap oil, according to sources. A triple-tranche issue may follow, including a long seven-year Sukuk issue maturing in 2025, a 12-year conventional bond and, subject to investor interest, a 30-year conventional bond. The sources added that Bahrain’s issuance this week could total $1.5bn- $2.5bn. (Reuters)

- 5. Contacts Saugata Sarkar, CFA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 QSEIndex S&PPanArab S&PGCC 0.5% (1.5%) 0.0% (0.5%) (0.4%) (0.2%) 0.2% (2.0%) (1.0%) 0.0% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,327.46 (1.4) (1.4) 15.2 MSCI World Index 1,981.97 0.9 0.9 13.2 Silver/Ounce 17.80 (0.9) (0.9) 11.8 DJ Industrial 22,057.37 1.2 1.2 11.6 Crude Oil (Brent)/Barrel (FM Future) 53.84 0.1 0.1 (5.2) S&P 500 2,488.11 1.1 1.1 11.1 Crude Oil (WTI)/Barrel (FM Future) 48.07 1.2 1.2 (10.5) NASDAQ 100 6,432.26 1.1 1.1 19.5 Natural Gas (Henry Hub)/MMBtu 2.85 0.7 0.7 (22.7) STOXX 600 379.43 0.6 0.6 19.1 LPG Propane (Arab Gulf)/Ton 84.25 0.7 0.7 17.4 DAX 12,475.24 0.9 0.9 23.3 LPG Butane (Arab Gulf)/Ton 94.00 0.1 0.1 (3.1) FTSE 100 7,413.59 0.4 0.4 10.8 Euro 1.20 (0.7) (0.7) 13.7 CAC 40 5,176.71 0.8 0.8 20.8 Yen 109.39 1.4 1.4 (6.5) Nikkei 19,545.77 0.3 0.3 9.3 GBP 1.32 (0.3) (0.3) 6.7 MSCI EM 1,099.18 0.7 0.7 27.5 CHF 1.05 (1.3) (1.3) 6.5 SHANGHAI SE Composite 3,376.42 (0.3) (0.3) 15.7 AUD 0.80 (0.4) (0.4) 11.4 HANG SENG 27,955.13 1.0 1.0 26.1 USD Index 91.88 0.6 0.6 (10.1) BSE SENSEX 31,882.16 0.6 0.6 27.3 RUB 57.22 (0.3) (0.3) (7.0) Bovespa 74,319.22 1.7 1.7 29.8 BRL 0.32 (0.5) (0.5) 4.8 RTS 1,126.74 0.6 0.6 (2.2) 95.1 94.7 87.9