QSE Daily Movement

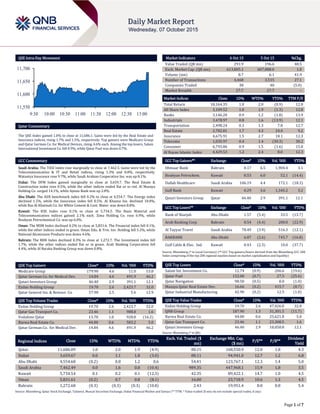

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 1.0% to close at 11,686.1. Gains were led by the Real Estate and Insurance indices, rising 1.7% and 1.5%, respectively. Top gainers were Medicare Group and Qatar German Co. for Medical Devices, rising 4.6% each. Among the top losers, Salam International Investment Co. fell 0.9%, while Qatar Fuel was down 0.7%. GCC Commentary Saudi Arabia: The TASI Index rose marginally to close at 7,462.5. Gains were led by the Telecommunication & IT and Retail indices, rising 1.3% and 0.8%, respectively. Wataniya Insurance rose 9.7%, while Saudi Arabian Cooperative Ins. was up 8.1%. Dubai: The DFM Index gained marginally to close at 3,659.7. The Real Estate & Construction index rose 0.5%, while the other indices ended flat or in red. Al Mazaya Holding Co. surged 14.1%, while Ajman Bank was up 2.8%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,554.7. The Energy index declined 1.5%, while the Insurance index fell 0.5%. Al Khazna Ins. declined 10.0%, while Ras Al Khaimah Co. for White Cement & Cont. Mater. was down 8.8%. Kuwait: The KSE Index rose 0.1% to close at 5,734.5. The Basic Material and Telecommunication indices gained 2.1% each. Zima Holding Co. rose 6.9%, while Boubyan Petrochemical Co. was up 6.0%. Oman: The MSM Index declined 0.2% to close at 5,831.6. The Financial index fell 0.1%, while the other indices ended in green. Oman Edu. & Trin. Inv. Holding fell 5.2%, while National Aluminium Products was down 4.6%. Bahrain: The BHB Index declined 0.3% to close at 1,272.7. The Investment index fell 1.7%, while the other indices ended flat or in green. Arab Banking Corporation fell 4.4%, while Al Baraka Banking Group was down 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 179.90 4.6 11.0 53.8 Qatar German Co. for Medical Dev. 14.84 4.6 491.9 46.2 Qatari Investors Group 46.40 2.9 391.1 12.1 Ezdan Holding Group 19.70 2.6 2,423.7 32.0 Qatar General Ins. & Reinsur. Co. 57.90 2.5 5.6 12.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 19.70 2.6 2,423.7 32.0 Qatar Gas Transport Co. 23.46 1.1 988.8 1.6 Vodafone Qatar 13.78 1.0 928.8 (16.2) Barwa Real Estate Co. 44.00 0.6 583.2 5.0 Qatar German Co. for Medical Dev. 14.84 4.6 491.9 46.2 Market Indicators 6 Oct 15 5 Oct 15 %Chg. Value Traded (QR mn) 291.9 196.6 48.5 Exch. Market Cap. (QR mn) 613,805.1 607,888.0 1.0 Volume (mn) 8.7 6.1 41.9 Number of Transactions 4,468 3,515 27.1 Companies Traded 38 40 (5.0) Market Breadth 27:7 27:7 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,164.35 1.0 2.0 (0.9) 12.0 All Share Index 3,109.52 1.0 1.9 (1.3) 12.8 Banks 3,146.20 0.9 1.2 (1.8) 13.9 Industrials 3,478.97 0.8 1.6 (13.9) 12.1 Transportation 2,498.24 0.3 1.3 7.8 12.7 Real Estate 2,782.81 1.7 4.3 24.0 9.2 Insurance 4,675.91 1.5 2.7 18.1 12.3 Telecoms 1,035.97 0.4 1.4 (30.3) 30.2 Consumer 6,793.86 0.9 1.5 (1.6) 15.8 Al Rayan Islamic Index 4,429.53 1.2 2.4 8.0 12.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ithmaar Bank Bahrain 0.17 6.5 1,904.4 3.1 Boubyan Petrochem. Kuwait 0.53 6.0 52.1 (14.4) Dallah Healthcare Saudi Arabia 106.19 4.4 172.1 (18.3) Gulf Bank Kuwait 0.29 3.6 1,345.2 3.2 Qatari Investors Group Qatar 46.40 2.9 391.1 12.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Bank of Sharjah Abu Dhabi 1.57 (5.4) 33.5 (15.7) Arab Banking Corp Bahrain 0.54 (4.4) 200.0 (22.9) Al Tayyar Travel Saudi Arabia 78.49 (3.9) 516.3 (12.1) RAKBANK Abu Dhabi 6.87 (2.6) 745.7 (16.8) Gulf Cable & Elec. Ind. Kuwait 0.43 (2.3) 10.0 (37.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Salam Int. Investment Co. 12.74 (0.9) 206.6 (19.6) Qatar Fuel 152.00 (0.7) 27.5 (25.6) Qatar Navigation 98.50 (0.5) 0.0 (1.0) Mazaya Qatar Real Estate Dev. 16.66 (0.2) 415.7 (8.7) Qatar Industrial Manufacturing 42.90 (0.2) 12.5 (1.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 19.70 2.6 47,426.0 32.0 QNB Group 187.90 1.3 31,301.5 (11.7) Barwa Real Estate Co. 44.00 0.6 25,621.8 5.0 Qatar Gas Transport Co. 23.46 1.1 23,308.5 1.6 Qatari Investors Group 46.40 2.9 18,050.8 12.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,686.09 1.0 2.0 1.9 (4.9) 80.15 168,550.9 12.0 1.8 4.3 Dubai 3,659.67 0.0 1.1 1.8 (3.0) 88.11 94,941.0 12.7 1.2 6.8 Abu Dhabi 4,554.68 (0.2) 0.8 1.2 0.6 54.41 123,767.1 12.3 1.4 5.0 Saudi Arabia 7,462.49 0.0 1.6 0.8 (10.4) 989.35 447,968.1 15.9 1.8 3.5 Kuwait 5,734.54 0.1 0.2 0.1 (12.3) 42.35 89,422.1 14.7 1.0 4.5 Oman 5,831.61 (0.2) 0.7 0.8 (8.1) 16.00 23,718.9 10.6 1.3 4.5 Bahrain 1,272.68 (0.3) (0.3) (0.3) (10.8) 2.43 19,951.4 8.0 0.8 5.4 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,550 11,600 11,650 11,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index gained 1.0% to close at 11,686.1. The Real Estate and Insurance indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Medicare Group and Qatar German Co. for Medical Devices were the top gainers, rising 4.6% each. Among the top losers, Salam International Investment Co. fell 0.9%, while Qatar Fuel was down 0.7%. Volume of shares traded on Tuesday rose by 41.9% to 8.7mn from 6.1mn on Monday. Further, as compared to the 30-day moving average of 8.3mn, volume for the day was 5.4% higher. Ezdan Holding Group and Qatar Gas Transport Co. were the most active stocks, contributing 27.8% and 11.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/06 US Census Bureau Trade Balance August -$48.33b -$48.00b -$41.81b 10/06 US Bloomberg IBD/TIPP Economic Optimism October 47.3 44.5 42.0 10/06 EU Markit Markit Eurozone Retail PMI September 51.9 – 51.4 10/06 France Markit Markit France Retail PMI September 49.6 – 49.5 10/06 Germany Deutsche Bundesbank Factory Orders MoM August -1.80% 0.50% -2.20% 10/06 Germany Bundesministerium fur Wirtscha Factory Orders WDA YoY August 1.90% 5.60% -1.30% 10/06 Germany Markit Markit Germany Construction PMI September 52.4 – 50.3 10/06 Germany Markit Markit Germany Retail PMI September 54.0 – 54.7 10/06 UK Lloyds TSB Halifax House Prices MoM September -0.90% 0.10% 2.70% 10/06 UK Lloyds TSB Halifax House Price 3Mths/Year September 8.60% 9.10% 9.00% 10/06 Spain INE House transactions YoY August 24.20% – 13.90% 10/06 Italy Markit Markit Italy Retail PMI September 51.7 – 48.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 52.56% 60.85% (24,202,589.55) GCC 4.55% 5.56% (2,940,052.55) Non-Qatari 42.89% 33.60% 27,142,642.10

- 3. Page 3 of 7 News Qatar QIGD to disclose financial statements on Oct 19 – Qatari Investors Group (QIGD) will announce its financial reports for the period ending September 30, 2015 on October 19, 2015. (QSE) SIIS to announce financial statements on Oct 20 – Salam International Investment Limited (SIIS) will disclose its financial reports for the period ending September 30, 2015 on October 20, 2015. (QSE) GWCS to announce financial statements on Oct 21 – Gulf Warehousing Company (GWCS) will disclose its financial reports for the period ending September 30, 2015 on October 21, 2015. (QSE) QATI to announce financial statements on Oct 25 – Qatar Insurance Company (QATI) will disclose its financial reports for the period ending September 30, 2015 on October 25, 2015. (QSE) QIMD to disclose financial statements on Oct 22 – Qatar Industrial Manufacturing Company (QIMD) will announce its financial reports for the period ending September 30, 2015 on October 22, 2015. (QSE) QISI to disclose financial statements on Oct 25 – Qatar Islamic Insurance Company (QISI) will announce its financial reports for the period ending September 30, 2015 on October 25, 2015. (QSE) CBQK completes squeeze-out process of Alternatifbank, to disclose financial statements on Oct 18 – The Commercial Bank (CBQK) has completed a formal squeeze-out process of its Turkey-based subsidiary - Alternatifbank A.S. CBQK that held 74.25% in Alternatifbank, completed the squeeze-out process along with Anadolu Endustri Holding, owning 17.21%, and Anadolu Motor Uretim ve Pazarlama, holding 7.79% shares of Alternatifbank. Following the transaction, CBQK has acquired further 0.75% shares of Alternatifbank from the Bourse Istanbul, which takes its holding to 75%. Following the squeeze-out process, the Alternatifbank shares have been delisted from the Bourse Istanbul. Meanwhile, CBQK announced that it would disclose its financial reports for the period ending September 30, 2015 on October 18, 2015. (QSE) QCSD raises QNNS’ foreign ownership to 49% – The Qatar Central Securities Depository (QCSD) has amended the foreign ownership percentage in Qatar Navigation Company (QNNS), increasing it to 49% of the total capital, effective from October 7, 2015. This amendment is pursuant to Law No. (9), that allows foreign investors to own shares in companies, listed on the Qatar Stock Exchange, by not more than 49% of each company’s capital. The law also provides for the treatment of the GCC citizens as Qataris in terms of owning the shares of the listed companies. (QSE) QPMC signs $500mn shipping contract with Hyundai Glovis – Qatar Primary Materials Company (QPMC) has clinched a $500mn deal with Hyundai Glovis Company to ship construction material. Under the deal, Hyundai Glovis will ship 50mn tons of aggregates from the UAE and Oman to a pier located in the southern part of Qatar. The shipping contract will be effective from January 2016 to December 2020. According to the statement, 10mn tons will be shipped each year. The total number of flights will reach up to 806 during the five years, which is equivalent to 161 flights per year. The vessel will carry 75,000 metric tons per trip. All quantity will be allocated for the benefit of QPMC and the Public Works Authority (Ashghal). Hyundai Glovis is the logistics unit of South Korean auto giant Hyundai Motor Group. (QNA) Sysorex inks $91mn deal in Qatar – US-based Sysorex has signed a $91mn contract to make its software and information systems the central nervous system for a new state-of-the-art smart community centre being developed to house 4,000 employees working on construction projects in Qatar. Under the terms of the 15-year contract, Sysorex will operate as the community’s intelligent infrastructure providing a full range of services, including information technology, AirPatrol location-based security products, data analytics, cashless payment systems, campus-wide WiFi and Internet-based TV, facilities management and public safety management for police, fire and medical personnel. (Bloomberg) BRF makes binding offer for stake in QNIE unit – Brazil’s BRF SA, the world's largest poultry producer, has signed a binding MoU to acquire a stake in frozen food distribution unit of Qatar National Import and Export Company (QNIE). The transaction is valued at $140mn, and is subjected to Qatari regulatory approval. (Reuters) Over 30 Qatari SMEs shortlisted to tender for QDB, Qatar Shell opportunities – Over 30 Qatari small and medium enterprises (SMEs) have been shortlisted to tender for seven specific business opportunities offered by Qatar Development Bank (QDB) and Qatar Shell. The successful SMEs will become part of the supply chain for Pearl GTL, the world’s largest gas-to-liquids plant, delivered by Qatar Petroleum and Qatar Shell. According to a QDB spokesman, the successful SMEs will be awarded contracts, with an estimated aggregate value of over QR15bn, in a special ceremony on December 13, 2015. (Gulf-Times.com) International IMF cuts global growth forecasts again, cites commodity and China worries – The International Monetary Fund (IMF) has cut its global growth forecasts for a second time in 2015, citing weak commodity prices and a slowdown in China. It has warned that policies aimed at increasing demand were needed. The Fund forecast that the world economy would grow at 3.1% in 2015 and by 3.6% in 2016. Both new forecasts are 0.2 percentage point below its July forecast and are 0.4 percentage point and 0.2 percentage point below its April outlook, respectively. The downgrades come after central banks in major industrial economies have cut rates to near zero and spent around $7tn in quantitative easing programs in the seven years since the global financial crisis. Despite these measures, investment, growth and productivity are stuck below pre-crisis levels and there is a lack of consumer demand. Among major economies, the US is expected to grow by 2.6% in 2015 and by 2.8% in 2016, the Eurozone is forecast to grow by 1.5% and 1.6%, respectively, with Japan seen at 0.6% and 1.0%. The Fund sees growth in China slowing to 6.8% this year and 6.3% in 2016. The biggest hit to growth will come in emerging economies where the IMF cut its growth forecast to 4% in 2015, due to a sharp slide in commodity prices. Meanwhile, the IMF said The Bank of Japan (BoJ) should be ready to ease monetary policy further if needed to accelerate inflation toward its 2% target, preferably by buying government bonds with longer maturity. (Reuters) US trade deficit widens as exports sag, imports from China surge – Exports in the US had taken a hit from an ailing global economy in August while imports from China surged, fueling the largest expansion of America’s trade deficit in five months. The data released by the Commerce Department illustrates the US economy's vulnerabilities to a strong dollar and weak demand in foreign markets, which could impose further caution on the Federal Reserve's plans to hike interest rates. According to data that is adjusted for seasonal factors, the trade deficit swelled by 15.6% to $48.3bn in August 2015. The scope of the increase was accentuated by the unusually narrow trade deficit registered in July. Furthermore, imports likely got a temporary boost from inflows of cellphones ahead of the release of Apple's new iPhone model. However, the size of the trade gap has risen far above the

- 4. Page 4 of 7 average levels seen in recent years and the onus for stronger US economic growth is now falling squarely on consumers. (Reuters) German industry orders fall on weak non-Eurozone demand – German industrial orders had unexpectedly fallen in August as demand from non-Eurozone countries weakened. Rising worries of a slowdown in China would cut into exports from Europe’s biggest economy. The economy ministry said contracts for German goods declined by 1.8% on the month. Reuters had forecast a rise of 0.5%. The data enhances a picture of waning demand from abroad, especially China and other emerging markets. That suggests the strong exports that supported growth in 1H2015 could lose momentum. German factories got 1.2% fewer bookings from abroad, driven by a 3.7% slide in demand from countries outside the Eurozone. (Reuters) Abe: TPP would have strategic significance if China joined – Japanese Prime Minister Shinzo Abe has welcomed the pan-Pacific agreement struck in the US, which would liberalize trade in 40% of the world economy. He, however, said bringing China into the deal in future would increase its strategic significance. Twelve Pacific Rim countries reached the most ambitious trade pact in a generation, although the deal faces scepticism from US lawmakers, who can vote the deal down. If approved, the Trans-Pacific Partnership (TPP) pact would cut trade barriers and set common standards from Vietnam to Canada. It would also furnish a legacy- shaping victory for US President Barack Obama and a political win for Abe, who has touted TPP as a way to boost growth in an economy checked by a shrinking population. The agreement has also been pitched as a way to counter China's rising economic and political clout in the region. Abe, whose ruling bloc faces a national election in July 2016, stressed TPP would benefit Japanese consumers, workers, rural regions and companies of all sizes, not just major corporations. (Reuters) SWIFT: China jumps to fourth most-used world payment currency, overtakes yen – Global transaction services organization SWIFT has said that Chinese yuan had become the fourth most-used world payment currency in August, overtaking the Japanese Yen. The yuan has surpassed seven currencies in the past three years as a payment currency and is now only after the US dollar, the euro and the sterling pound. According to SWIFT, overall global yuan payments increased in value by 9.13% in August, while payments across all currencies decreased by 8.3%. The yuan reached a record high market share of 2.79% in global payments for the month, compared to 1.39% in January 2014. More than 100 countries used the yuan for payments in August, of which over 90% of flows were concentrated in 10 countries. Singapore processed 24.4% followed by the UK with 21.6%. (Reuters) IMF estimates favorable growth in India, urges structural reforms – The International Monetary Fund (IMF) has said that growth prospects for India remain favorable despite a slowdown in the global economy. However, the government should speed up structural reforms and relax supply constraints in the energy, mining, and power sectors. The Fund marginally lowered India's growth forecast to 7.3% in 2015, from its earlier estimate of 7.5%, and said that a faster-than-expected deceleration in inflation provides leeway for modest cuts in interest rates. (Reuters) Regional KSA ranks 17th in Wealth-X’s global ranking of UHNW population – According to a new Wealth-X study, Saudi Arabia and the UAE jointly account for over 45% of the UHNW (ultra high net worth) population in the Middle East (Mideast). The UAE is ranked 22nd in Wealth-X’s global ranking of UHNW population by country, behind Saudi Arabia (17) but ahead of Kuwait (32). Saudi has the largest UHNW population (1,495) and UHNW wealth ($320bn) in the region, while in the UAE there are 1,275 such individuals, worth a combined $255bn, representing 20% of the total ultra wealthy population in the Middle East. (GulfBase.com) EY: GCC public pension funds amount to around $400bn – According to Ernst & Young’s (EY) GCC Wealth and Asset Management 2015 report, public pension funds across the GCC amount to $397bn, representing almost a quarter of gross domestic product (GDP) and $15,000 per national. Kuwait has the best capitalized fund, relative to the size of its economy and citizen population. This follows an initiative to recapitalize the pension fund from the budget since 2008, filling an actuarial deficit that had been estimated at nearly $40bn. Qatar’s pension assets are also sizeable relative to the population, following a capital injection from the Ministry of Finance in 2012. (GulfBase.com) Mobily taps Cisco for network managed services – Etihad Etisalat Company (Mobily), in cooperation with Saudi National Fiber Network (SNFN) and Integrated Telecommunications Company (ITC), has signed a contract with Cisco Middle East Company in Saudi Arabia to provide the managed network services through smart management solutions, specially designed to manage fiber optic network. The contract is valid for a period of three years and is extendable for two more years. (GulfBase.com) Flynas to launch Bahrain flights – Flynas has announced the launch of flights from Riyadh and Jeddah to Bahrain starting from December 1, 2015. The country will be the airline’s third destination within the GCC following the UAE and Kuwait. The service will consist of three flights per week from Jeddah to Bahrain and three flights per week from Riyadh to Bahrain. (GulfBase.com) Societe Generale appoints Saudi head – Societe Generale has appointed Antoine Toussaint as its Chief Country Officer & Chief Executive Officer (CEO) in Saudi Arabia. Mr. Toussaint will be based in Riyadh and report to Societe Generale's CEO in the Middle East, Richad Soundardjee. (Reuters) JLL: Riyadh, Jeddah real estate markets sustain growth in 3Q2015 – According to JLL, the real estate markets in Riyadh and Jeddah had sustained steady growth in 3Q2015. Jamil Ghaznawi of JLL KSA said the Kingdom’s office sector had shown signs of stability, attributable to continued demand for existing office space as well as further delays in the delivery of mega-projects King Abdullah Financial District (KAFD) and the IT & Communications Complex (ITCC). Demand remains strong within the residential sector, particularly as high-end residential properties and community developments, such as the Rafal and Damac projects, continue to be active and on track for scheduled completion in 2016 and 2017. Riyadh’s residential sector showed 4,000 units were completed during 3Q2015 bringing the total supply to 984,000 units. Sale prices for villas and apartments declined in line with a 10% decrease in residential transactions during 3Q2015. The retail sector in Riyadh saw no additional retail completions in 3Q2015. Total supply remains at 1.4mn square meters of high quality office space. (GulfBase.com) Saudi CMA approves Al Wasatah Al Maliah request to amend business profile – Saudi Capital Market Authority (CMA) has approved Al Wasatah Al Maliah Company's request to amend its business profile by cancelling advising activity. The company is now authorized to conduct dealing as principal and underwriter, investment fund management, discretionary portfolio management and arranging & custody activities. (Tadawul) UAE’s first Islamic banking index launched – The UAE’s first Islamic Banking Index was unveiled by Emirates Islamic CEO Jamal Bin Ghalaita at the 2015 Global Islamic Economy Summit (GIES). (GulfBase.com) UAE non-oil business growth slows in September 2015 – According to the latest data, non-oil private sector growth remains resilient

- 5. Page 5 of 7 against the steep drop in oil prices. The seasonally adjusted Emirates NBD UAE Purchasing Managers’ Index (PMI) fell to 56 in September 2015, down from the six-month high figure in August 2015 of 57.1, but still strong enough to indicate rises in output and new orders. Any score above 50 indicates that the economy is expanding. The international benchmark Brent crude has plummeted by over 50% to less than $50 per barrel since reaching $115 in June 2014, affecting the rate of economic growth in the UAE. The expansion of total new orders was impacted in September by a drop in new exports, the first since May 2010, which some companies attributed to slower foreign orders due to increased competition. (GulfBase.com) UAE's energy investments on track – The UAE Minister of Energy, Suhail bin Mohammed Faraj Al Mazroui has said that the country will continue with its investment program to explore its massive hydrocarbon potential and it will not be affected by the recent plunge in oil prices. He said downward oil prices will not affect or delay plans to increase its daily output to 3.5mn barrels per day (bpd) by 2017 from 2.7mn bpd in 2013. (GulfBase.com) Euromonitor International: UAE visitor attraction revenues to double by 2019 – Euromonitor International’s latest report has revealed a positive future for hotels in the UAE with annual revenues forecast to reach $10.9 billion in 2019, almost doubling from the $5.9bn figure recorded in 2013. Visitor attraction revenues are also forecast to double from $521mn recorded in 2013 to over $1.2bn by 2019. In 2015, the UAE hotel revenues are forecast to reach $7.3bn, while visitor attraction revenues would hit $638mn. (GulfBase.com) JLL: Dubai apartment prices fall 11% YoY, more declines likely – According to JLL, Dubai’s apartment prices have fallen 11% YTD and would decline further because of tighter regulations, rising inflation and a strong UAE currency. Apartment sales prices had fallen 3% in 3Q2015 versus the preceding three months and 11% YoY, while rents had dropped 1% on a both QoQ and YoY basis. As per the report, the authorities have set mortgage ceilings and raised transaction taxes to reduce speculation in the property market, while the UAE dirham is pegged to the US dollar, which has gained 13% against the euro in 2014. These factors have combined to make buying property more expensive for foreign residents and foreign-based investors, while a shortage of middle- income housing in Dubai is a growing problem. JLL predicted that prices are expected to continue softening over the remainder of 2015 and into 2016, before they again rise ahead of Dubai hosting the Expo 2020 exhibition. House prices had also fallen in 3Q2015, with sales down 3% on 2Q2015 and 7% YoY, while rents were down 2% over both time frames. (Reuters) Mohammed Bin Rashid fund for SME support doubles seed capital loan – Mohammed Bin Rashid Fund for SME Support has increased the maximum limit of its seed capital loan to AED1mn from AED500,000 while maintaining the AED5mn maximum limit for the credit scheme loan. The fund is an affiliate of Mohammed bin Rashid Establishment for SMEs. (GulfBase.com) Dubai repays $500mn bond certificates on maturity – The Government of Dubai, acting through the Department of Finance, announced that it has redeemed a $500mn, fixed-rate note issued in October 2010 on its maturity. The note is a part of its $4bn Medium Term Note Program dated October 2009, reached maturity on October 5, 2015. It added that all the notes were redeemed in full by making the required payment through the paying agent to the holders of the notes, along with accrued interest. (Bloomberg) KFH expects more profit in 2015 as compared to 2014 – Kuwait Finance House (KFH) is expecting to surpass 2014 profit due to projected increase in finance income and shedding of non-core assets. KFH is also restructuring its Malaysian unit, a process that may take up to a year, to boost profitability after ruling out a merger or sale of its subsidiary. The lender is eyeing expansion in the Middle East and North Africa (MENA) market, especially in Egypt through an acquisition, once the opportunity arises. (GulfBase.com) Hassani Group buys 2.5mn shares of ANC Holding – Dhofar Fisheries & Food Industries Company (DFII) has advised that 2,518,003 shares in ANC Holding LLC were sold to Hassani Group of Companies at OMR1.085 per share. The share transfer has been approved by the Capital Market Authority. (MSM) Port Services announces resignation of executive management staff – Port Services Corporation has announced that Engineer Hamid Abdulrahman Mohammed Al Kadi, Assistant Chief Executive Officer (CEO) – Operations, and Captain Talib Khamiis Al Wahaibi, General Manager Harbor & Marine Services, have opted to accept the voluntary end of service payment scheme offered by Port Services, in coordination and jointly with the Government authorities, as disclosed earlier on August 23, 2015. Accordingly, the above-mentioned employees have submitted their resignations on their own accord. Their last working day with the Corporation will be October 15, 2015. (MSM) Eight global firms prequalify for Salalah ammonia project contract – Salalah Methanol Company (SMC) has cleared prequalification of eight prominent international engineering firms to bid for a contract to build a major ammonia plant downstream its facilities. The state-run petrochemical company is planning to develop the 1,000 metric tons per day (MTPD) capacity ammonia plant using rich hydrogen purge gas fed from the adjacent 3,000 MTPD methanol plant. (GulfBase.com) Moody's assigns provisional (P) A1 rating to Oman’s proposed sovereign – Moody’s Investors Service has assigned a provisional rating of (P) A1 to the proposed Omani rials certificates to be issued by Oman Sovereign Sukuk, a special purpose vehicle incorporated in Oman and wholly-owned by the Government of Oman. Moody’s expects to remove the provisional status of the rating upon the closing of the proposed issuance and a review of its final terms. The rating agency also notes that its Sukuk rating does not express an opinion on the structure’s compliance with Shari’ah law. The payment obligations associated with these certificates are direct obligations of the Government of Oman. (GulfBase.com) GFH repays debt of $37.5mn in 2015 – GFH Financial Group has announced that it has repaid $37.5mn to its debt holders. These payments are in addition to $33mn of payment made by GFH to debt holders in 2014 and represent over 30% of GFH’s outstanding facilities. Currently, GFH has outstanding debt of $137mn from three facilities, which will be fully amortized by 2018/2019. As of June 2015-end, GFH’s debt-to-equity ratio stood at only 0.24 underscoring the strength of GFH’s balance sheet. (DFM) Bahrain to promote ‘Made in Bahrain’ brand globally – Bahraini Industry, Commerce and Tourism Minister Zayed Al Zayani has said that Bahrain is set to implement a set of legislations that will encourage more businesses to be set up with emphasis on small and medium scale enterprises (SMEs). He said the ministry was drawing up new branding strategies focusing on tourism to promote the ‘Made in Bahrain’ brand globally. Mr. Zayani said plans are being discussed for the new exhibition and convention centre at the Bahrain International Circuit to allow more conferences and events to take place. (GulfBase.com) Citigroup appoints CEO of Bahrain and Islamic investment bank – Citigroup has appointed Usman Ahmed as the Chief Executive Officer (CEO) of its Bahrain business as well as its Islamic

- 6. Page 6 of 7 investment banking division. Mr. Usman takes over from Mazin Manna, who had held the roles since 2010. But in July 2015, Manna joined Credit Agricole as senior regional officer of the Middle East and North Africa. (Reuters)

- 7. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns; #Market closed on October 06, 2015) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC 0.0% 1.0% 0.1% (0.3%) (0.2%) (0.2%) 0.0% (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,147.24 1.0 0.7 (3.2) MSCI World Index 1,640.98 0.2 2.1 (4.0) Silver/Ounce 15.89 1.5 4.2 1.2 DJ Industrial 16,790.19 0.1 1.9 (5.8) Crude Oil (Brent)/Barrel (FM Future) 51.92 5.4 7.9 (9.4) S&P 500 1,979.92 (0.4) 1.5 (3.8) Crude Oil (WTI)/Barrel (FM Future) 48.53 4.9 6.6 (8.9) NASDAQ 100 4,748.36 (0.7) 0.9 0.3 Natural Gas (Henry Hub)/MMBtu 2.35 1.3 4.0 (21.5) STOXX 600 360.41 1.3 3.8 (2.1) LPG Propane (Arab Gulf)/Ton 50.25 3.6 6.9 2.6 DAX 9,902.83 1.6 3.9 (6.4) LPG Butane (Arab Gulf)/Ton 67.13 3.7 7.0 7.0 FTSE 100 6,326.16 0.9 3.4 (5.8) Euro 1.13 0.8 0.5 (6.8) CAC 40 4,660.64 1.6 4.7 1.5 Yen 120.23 (0.2) 0.3 0.4 Nikkei 18,186.10 1.2 2.2 3.5 GBP 1.52 0.5 0.3 (2.2) MSCI EM 828.68 0.9 3.1 (13.3) CHF 1.03 0.9 0.5 2.8 SHANGHAI SE Composite# 3,052.78 0.0 0.0 (7.9) AUD 0.72 1.2 1.7 (12.3) HANG SENG 21,831.62 (0.1) 1.5 (7.5) USD Index 95.46 (0.7) (0.4) 5.7 BSE SENSEX 26,932.88 0.5 3.4 (5.0) RUB 63.43 (1.7) (4.4) 4.4 Bovespa 47,735.11 2.1 4.7 (34.3) BRL 0.26 1.5 2.0 (31.2) RTS 826.65 2.7 8.1 4.5 139.9 115.8 111.7