QNBFS Daily Market Report September 24, 2018

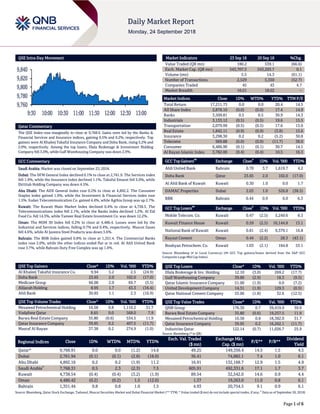

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose marginally to close at 9,768.9. Gains were led by the Banks & Financial Services and Insurance indices, gaining 0.5% and 0.2%, respectively. Top gainers were Al Khaleej Takaful Insurance Company and Doha Bank, rising 5.2% and 2.0%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 3.0%, while Gulf Warehousing Company was down 2.9%. GCC Commentary Saudi Arabia: Market was closed on September 23, 2018. Dubai: The DFM General Index declined 0.1% to close at 2,761.9. The Services index fell 1.9%, while the Insurance index declined 1.1%. Takaful Emarat fell 5.0%, while Ekttitab Holding Company was down 4.5%. Abu Dhabi: The ADX General Index rose 0.2% to close at 4,892.2. The Consumer Staples index gained 1.9%, while the Investment & Financial Services index rose 1.5%. Sudan Telecommunication Co. gained 4.4%, while Agthia Group was up 2.7%. Kuwait: The Kuwait Main Market Index declined 0.4% to close at 4,738.5. The Telecommunications index fell 2.1%, while the Banks index declined 1.2%. Al Eid Food Co. fell 14.3%, while Tameer Real Estate Investment Co. was down 12.2%. Oman: The MSM 30 Index fell 0.2% to close at 4,486.4. Losses were led by the Industrial and Services indices, falling 0.7% and 0.4%, respectively. Muscat Gases fell 4.6%, while Al Jazeera Steel Products was down 3.6%. Bahrain: The BHB Index gained 0.8% to close at 1,351.4. The Commercial Banks index rose 2.0%, while the other indices ended flat or in red. Al Ahli United Bank rose 3.7%, while Bahrain Duty Free Complex was up 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Insurance Co. 9.94 5.2 2.5 (24.9) Doha Bank 23.65 2.0 102.0 (17.0) Medicare Group 66.00 2.0 69.7 (5.5) Alijarah Holding 8.95 1.7 43.3 (16.4) Ahli Bank 30.85 1.1 2.3 (16.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.58 0.8 1,110.2 31.7 Vodafone Qatar 8.65 0.0 568.0 7.9 Barwa Real Estate Company 35.80 (0.6) 534.5 11.9 Qatar Insurance Company 39.95 0.2 407.5 (11.7) Masraf Al Rayan 37.38 0.2 274.9 (1.0) Market Indicators 23 Sep 18 20 Sep 18 %Chg. Value Traded (QR mn) 180.2 539.1 (66.6) Exch. Market Cap. (QR mn) 543,707.3 543,293.7 0.1 Volume (mn) 5.5 14.3 (61.1) Number of Transactions 2,529 5,350 (52.7) Companies Traded 45 43 4.7 Market Breadth 16:21 18:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,211.73 0.0 0.0 20.4 14.5 All Share Index 2,878.10 (0.0) (0.0) 17.4 14.9 Banks 3,509.81 0.5 0.5 30.9 14.3 Industrials 3,133.12 (0.5) (0.5) 19.6 15.5 Transportation 2,079.99 (0.5) (0.5) 17.6 13.0 Real Estate 1,842.11 (0.9) (0.9) (3.8) 15.6 Insurance 3,298.30 0.2 0.2 (5.2) 30.8 Telecoms 969.88 (0.0) (0.0) (11.7) 38.0 Consumer 6,486.90 (0.1) (0.1) 30.7 14.1 Al Rayan Islamic Index 3,782.00 (0.4) (0.4) 10.5 16.3 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Ahli United Bank Bahrain 0.70 3.7 1,619.7 4.2 Doha Bank Qatar 23.65 2.0 102.0 (17.0) Al Ahli Bank of Kuwait Kuwait 0.30 1.0 0.0 1.7 DAMAC Properties Dubai 2.03 1.0 526.8 (38.5) BBK Bahrain 0.44 0.9 6.0 6.3 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Mobile Telecom. Co. Kuwait 0.47 (2.5) 5,249.6 8.3 Kuwait Finance House Kuwait 0.59 (2.5) 10,144.8 13.1 National Bank of Kuwait Kuwait 0.81 (2.4) 9,379.1 16.8 Raysut Cement Oman 0.44 (2.2) 28.3 (43.1) Boubyan Petrochem. Co. Kuwait 1.03 (2.1) 184.8 53.1 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding 12.10 (3.0) 269.2 (17.7) Gulf Warehousing Company 39.80 (2.9) 18.3 (9.5) Qatar Islamic Insurance Company 51.00 (1.9) 0.0 (7.2) United Development Company 14.31 (1.9) 129.3 (0.5) Qatar National Cement Company 55.06 (1.8) 32.6 (12.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 176.30 0.7 39,419.9 39.9 Barwa Real Estate Company 35.80 (0.6) 19,257.5 11.9 Mesaieed Petrochemical Holding 16.58 0.8 18,382.0 31.7 Qatar Insurance Company 39.95 0.2 16,262.1 (11.7) Industries Qatar 122.14 (0.7) 11,026.7 25.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,768.91 0.0 0.0 (1.2) 14.6 49.25 149,356.4 14.5 1.5 4.5 Dubai 2,761.94 (0.1) (0.1) (2.8) (18.0) 36.41 74,882.1 7.4 1.0 6.1 Abu Dhabi 4,892.16 0.2 0.2 (1.9) 11.2 16.91 132,168.7 12.9 1.5 4.9 Saudi Arabia# 7,768.31 0.5 2.3 (2.3) 7.5 605.91 492,331.6 17.1 1.7 3.7 Kuwait 4,738.54 (0.4) (0.4) (3.2) (1.9) 89.54 32,542.0 14.6 0.9 4.4 Oman 4,486.42 (0.2) (0.2) 1.5 (12.0) 1.37 19,263.0 11.0 0.8 6.1 Bahrain 1,351.44 0.8 0.8 1.0 1.5 4.93 20,754.5 9.1 0.9 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of September 20, 2018) 9,760 9,780 9,800 9,820 9,840 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose marginally to close at 9,768.9. The Banks & Financial Services and Insurance indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Al Khaleej Takaful Insurance Company and Doha Bank were the top gainers, rising 5.2% and 2.0%, respectively. Among the top losers, Dlala Brokerage & Investment Holding Company fell 3.0%, while Gulf Warehousing Company was down 2.9%. Volume of shares traded on Sunday fell by 61.1% to 5.5mn from 14.3mn on Thursday. Further, as compared to the 30-day moving average of 6.2mn, volume for the day was 11.0% lower. Mesaieed Petrochemical Holding Company and Vodafone Qatar were the most active stocks, contributing 20.0% and 10.2% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QNBK QNB Group 10-Oct-18 16 Due DHBK Doha Bank 17-Oct-18 23 Due UDCD United Development Company 17-Oct-18 23 Due QIGD Qatari Investors Group 21-Oct-18 27 Due CBQK The Commercial Bank 23-Oct-18 29 Due Source: QSE News Qatar QNBK to disclose 3Q2018 financial statements on October 10 – QNB Group (QNBK) announced its intent to disclose the 3Q2018 financial statements for the period ending September 30, 2018, on October 10, 2018. (QSE) CBQK to disclose 3Q2018 financial statements on October 23 – The Commercial Bank (CBQK) announced its intent to disclose 3Q2018 financial statements for the period ending September 30 2018, on October 23, 2018. (QSE) DHBK to disclose 3Q2018 financial statements on October 17 – Doha Bank (DHBK) announced its intent to disclose the 3Q2018 financial statements for the period ending September 30 2018, on October 17, 2018. (QSE) ABQK to disclose 3Q2018 financial statements on October 21 – Ahli Bank (ABQK) announced its intent to disclose the 3Q2018 financial statements for the period ending September 30 2018, on October 21, 2018. (QSE) Doha Insurance Group rating affirmed at ‘A-’ – Doha Insurance Group announced that Standard and Poor’s Rating Services rating is affirmed at ‘A-’ the outlook remains ‘Stable’. (QSE) Government policies ensure highest growth rate for pension funds – HE Minister of Finance Ali Shareef Al-Emadi said Qatar is proceeding with the development of investment policies to achieve the highest growth rates for pension funds, taking into account the risks they can face in the medium and long term. In his statement, which topped the annual report of the General Retirement and Social Insurance Authority (GRSIA) for the year 2017, Al-Emadi said investment policies were developed following extensive technical studies, which would enhance the ability of the GRSIA to continue to provide the best returns to investors. The GRSIA has taken deliberate measures to enable the pension funds to maintain their investment performance, with a growth rate of 6% in investment revenues compared to 2016, Al-Emadi said. Over the past year, pension fund investments have reached QR90bn. The annual report of the GRSIA also referred to 98.8% of the total investment portfolio of the funds. The report indicated that the fund's insurance revenue grew 53% compared with 47% of investment revenue from total fund revenue in 2017, with 7% growth in total revenues for 2016. The number of active civilian participants reached 68,000, an increase of 2,391, or 3.6%, compared with 2016, according to GRSIA data. (Gulf- Times.com) IFRS 9 adoption seen to strengthen provision coverage at Qatar banks – The adoption of IFRS 9 appears to have strengthened the provision coverage at Qatar’s commercial banks, according to experts. “Its adoption since this year has already started showing positive results,” a top official of a leading accounting firm said. IFRS 9 is an International Financial Reporting Standard (IFRS) promulgated by the International Accounting Standards Board (IASB). In 2009, the IASB issued IFRS 9 Financial Instruments as the first step in its project to replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 introduced new requirements for classifying and measuring financial assets that had to be applied starting January 1, 2013, with early adoption permitted. Under the new IFRS 9 standard, banks and financial entities will be mandated to set aside a certain proportion of profit against losses for unseen reasons. In this regard, the official highlighted that the banking industry’s provision coverage has risen, indicating the Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 35.90% 41.02% (9,234,645.88) Qatari Institutions 16.97% 27.62% (19,176,701.89) Qatari 52.87% 68.64% (28,411,347.77) GCC Individuals 0.86% 0.42% 794,043.55 GCC Institutions 0.61% 7.43% (12,280,665.93) GCC 1.47% 7.85% (11,486,622.38) Non-Qatari Individuals 8.19% 8.27% (138,305.47) Non-Qatari Institutions 37.47% 15.25% 40,036,275.62 Non-Qatari 45.66% 23.52% 39,897,970.15

- 3. Page 3 of 6 extent to which lenders have made provisions towards non- performing loans (NPLs). (Gulf-Times.com) Firms can submit names for exit permit next week – The Ministry of Administrative Development, Labor and Social Affairs will start receiving requests from private companies from next week seeking exit permit requirement for five percent of their employees under the new law. The new Law No. 13 of 2018, for regulating the entry, exit and residency of expatriates stipulates that employers may submit for approval to the Ministry of Administrative Development, Labor and Social Affairs the names of workers for whom a “no objection certificate” would still be required, with a justification based on the nature of their work. (Peninsula Qatar) Bank brokerages leading trade turnover on QSE – Commercial banks’ brokerage outfits collectively constituted more than 52% of the total share trade turnover on the Qatar Stock Exchange (QSE) in the first eight months of this year, indicating the increased prominence of non-interest earnings in their revenue portfolio, according to the bourse data. QNB Financial Services (QNBFS), a QNB Group subsidiary, continued to maintain its lead among the 10 brokerage houses on the QSE, accounting for 26.22% of the total share trade turnover during January-August this year. Only four of the 10 brokerage entities witnessed YoY gains in their trade turnover during this January-August. QNBFS’ trade turnover amounted to QR28.55bn during this January-August, rising 36.8% YoY. The transactions saw about 1% growth to 154,313 at the end of August 31, 2018. The Group Securities’ share stood at 19.71%; its trading turnover declined 16.82% YoY to QR21.46bn during January-August 2018. The deals through it grew 9.14% to 502,358 as on August 31, 2018. (Gulf-Times.com) PM launches MME's 5-year sustainable strategic plan – Prime Minister (PM) and Interior Minister HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani inaugurated the ‘Sustainable Strategic Plan 2018-2022’ of the Ministry of Municipality and Environment (MME) during a ceremony held in Doha. The new strategic plan includes six sectors including urban planning, agriculture, fisheries, environment, municipalities and public and joint services. The objectives of the strategy focus on the performance of the different sectors of the Ministry of Municipality and Environment to serve the homeland, the citizens and the institutions in accordance with a strategic planning and government work, in the context of specific development objectives and capacity building at all levels. (Peninsula Qatar) Big 5 Qatar officially opens at DECC today – More than 240 exhibitors from 21 countries are participating in ‘The Big 5 Qatar’, which opens today (September 24), at the Doha Exhibition and Convention Center (DECC) and will run until September 26, 2018. Aside from showcasing the latest construction solutions, the event will host live product demonstrations and 40 free-to-attend education workshops. (Gulf-Times.com) Berlin’s property market attracting more Qatari investors – Berlin’s real estate market is emerging as one of the most favorite destinations for Qatari investors compared to any other big European cities due to several positive and attractive factors the German city ensures to the property owners, according to a senior official of a Berlin-based real estate services provider. Some of the important incentives the capital city of Europe’s largest economy offers to real estate investors include sharp rise in capital gains, high rents and occupancy rates of properties, and robust future economic and financial stability of the German economy. (Peninsula Qatar) International Asian firms shuffle production around the region as China tariffs hit – A growing number of Asian manufacturers of products ranging from memory chips to machines tools are moving to shift production from China to other factories in the region in the wake of US President Donald Trump’s tariffs on Chinese imports. Companies including SK Hynix of South Korea and Mitsubishi Electric, Toshiba Machine Co. and Komatsu of Japan began plotting production moves since July, when the first tariffs hit, and the shifts are now under way, company representatives and others with knowledge of the plans told Reuters. Others, such as Taiwanese computer-maker Compal Electronics and South Korea’s LG Electronics, are making contingency plans in case the trade war continues or deepens. The company representatives and other sources spoke on condition of anonymity because of the sensitivity of the issue. (Reuters) China’s Premier Li says China will reduce import-export costs, red tape – China will cut import and export costs for foreign firms, Premier Li Keqiang said in comments posted by the central government, as the world’s second largest economy looks to promote an image of being open for business. The move comes as China is embroiled in a trade standoff with the US, its largest trading partner. Beijing has made various pledges to open up sectors from autos to finance to more overseas investment. China will this year look to cut the amount of documentation needed for imports and exports by a third, lower customs fees and reduce the time needed to get customs clearance, the government said. Li, speaking at the World Economic Forum in the Chinese port city of Tianjin, said that China will continue to cut import tariffs on some goods and resolutely protect intellectual property, moves aimed at placating concerns from overseas trade partners. (Reuters) Regional OPEC, Russia rebuff Trump's call for immediate boost to oil output – OPEC’s leader Saudi Arabia and its biggest oil-producer ally outside the group, Russia, ruled out any immediate, additional increase in crude output, effectively rebuffing US President, Donald Trump’s calls for action to cool the market. The price rally mainly stemmed from a decline in oil exports from OPEC member Iran due to fresh US sanctions. Saudi Arabia’s Energy Minister, Khalid Al-Falih said Saudi Arabia had spare capacity to raise output but such a move was not required at the moment and might not be needed next year as, according to OPEC’s projections, a stellar rise in non-OPEC production could exceed global demand growth. “The markets are adequately supplied. I don’t know of any refiner in the world who is looking for oil and is not able to get it,” Falih said, adding that Saudi Arabia could raise output by up to 1.5mn barrels per day (bpd) if needed. “Given the numbers we saw today, that (an output increase in 2019) is highly unlikely unless we have surprises on the supply and demand,” Falih added. (Reuters)

- 4. Page 4 of 6 OPEC projects $11tn of investments in oil industry – Global oil industry is required to invest an estimated $11tn over 2018- 2040. The upstream investments alone need almost $8.3tn during 2018-2040. In the Middle East, petrochemical sector investment is expected to be in the range of $60bn to $80bn in the next few years, OPEC revealed in its World Oil Outlook (WOO). The WOO 2018-2040 analyzes the industry’s various linkages, its shifting dynamics and considers developments in areas such as the global economy, energy demand, oil supply and demand, both in the upstream and downstream, policy and technology developments, and environment and sustainable development concerns. Most of the projected investments are in non-OPEC countries, and over the medium-term they are estimated to invest on average around $350bn per annum. The medium-term number for OPEC member countries is an estimated average of more than $40bn per annum, and then over $60bn annually in the long-term. Average annual long- term upstream investment requirements for non-OPEC are forecast to decline to around $280bn on the back of declining crude supply. (Peninsula Qatar) Saudi Aramco Products Trading Company aims for 50% rise in oil trade volume in 2020 – Saudi Aramco Products Trading Company (ATC) expects to increase its oil trading volume to 6mn bpd in 2020, 50% higher than current levels, according to the company’s President and CEO, Ibrahim Al-Buainain. About 50% of the 2.5mn bpd of oil products it trades currently is hedged. The company is also looking at building its capacity in trading liquefied natural gas (LNG), using its Singapore office as a trading hub, Buainain said. ATC plans to set up its European office in either Geneva or London and also aims to have an office in Fujairah to manage oil storage, he said. (Reuters) Saudi Airlines Cargo Company signs SR1.2bn Islamic loan – Saudi Arabian Airlines’ cargo unit signed a SR1.2bn Islamic loan, according to a statement issued by a law firm working on the deal. The proceeds will fund the expansion of Saudi Airlines Cargo Company’s facilities at King Abdul Aziz International Airport in Jeddah and King Khalid International Airport in Riyadh. HSBC Saudi Arabia, Saudi British Bank and Al Rajhi Bank provided the loan, with Clifford Chance and Saudi Arabia- based Abuhimed Alsheikh Alhagbani Law Firm (AS&H) advising the banks. (Reuters) Saudi Arabia unveils over SR685bn development projects – In a major boost to the country's economy, Saudi Arabia announced 10 major projects and development programs worth more than SR685bn as the Kingdom celebrates its 88 th National Day. These projects reflect the Kingdom’s vision under the leadership of King Salman and that of Crown Prince Mohammed bin Salman to provide a brighter future through diversifying sources of national income, tackling environmental challenges and increasing investment and prosperity, Arab News stated, citing a report released by The Council of Saudi Chambers focusing on economic achievements in 2017. The Chamber report also highlighted the important decisions related to the Saudi Arabian business sector including the launch of a private sector incentive program worth SR72bn, the privatization of 10 government sectors and the establishment of the General Authority for Real Estate. (GulfBase.com) Saudi Arabia is a land of opportunities for British businesses, UK diplomats say – Current and former British Ambassadors to Saudi Arabia have urged UK businesses to seize the chance to benefit from the Kingdom's Vision 2030 ambitions. Alan Munro, who served as Ambassador from 1989-1993, and the current Ambassador Simon Collis, said rapid change, both on business and social fronts, was underway and cited Saudi Arabia's youthful population, its inspiring Crown Prince Mohammed bin Salman and the Kingdom’s wealth as main reasons the vision ought to succeed. Collis and Munro spoke at a conference in London attended by British businessmen interested in Saudi Arabian opportunities. Professional services, consultancies, project management, financial services, technology, education and health care were areas where the UK’s knowledge could be particularly well utilized, Collis noted. (GulfBase.com) Sharjah, ASEAN explore economic ties – Sharjah welcomed the ASEAN community’s growing interest in the Emirate’s robust and rapidly diversified economy, which attracted $1.63bn in foreign direct investments in 2017, recording a sizeable jump in growth compared to 2016. Investors, diplomats, expanding enterprises and private businesses representing ASEAN members were brought together on a networking platform, the Sharjah-ASEAN Business Roundtable, organized by the Sharjah FDI Office (Invest in Sharjah) in collaboration with the ASEAN Business Councils Alliance, recently. (GulfBase.com) Emirates Global Aluminium to delay its IPO – US tariffs on aluminum imports have prompted Emirates Global Aluminium, which produces about 4% of the metal globally, to delay an initial public offering (IPO). The company confirmed the decision but attributed it to unfavorable market conditions, according to sources. Emirates Global Aluminium, owned equally by Abu Dhabi’s sovereign fund Mubadala Investment Co. (Mubadala) and the Investment Corp. of Dubai, exports about 90% of its output and considers the US a key market. Mubadala’s CEO Khaldoon Al Mubarak said in May that Emirates Global Aluminium could go public in the second half of the year or early 2019. (Bloomberg) Dubai real estate transactions top AED131bn in 8 months – Dubai Land Department stated that its service centers across Dubai have served more than 39,000 investors, after helping them complete their investments with a total value of AED131bn from January to August. In the latest report issued by Dubai Land Department, the number of transactions provided in service centers during the period mentioned amounted to 42,000, distributed between 24,000 transactions for the transfer of ownership, and 18,000 that provided excellent services to investors. (GulfBase.com) London court extends injunction against Djibouti in DP World dispute – Dubai’s government stated that a London court had extended an injunction prohibiting the government of Djibouti from interfering in the management of a port terminal seized from DP World. The government of Djibouti seized the Doraleh Container Terminal from DP World in February over a dispute dating back to at least 2012. Dubai government-controlled DP World, which operated the terminal under a concession, has called the seizure illegal. (Reuters) United Energy Group to buy Kuwait Energy Public Ltd. Co. for up to $650.9mn – United Energy Group agreed to acquire

- 5. Page 5 of 6 Kuwait Energy Public Ltd. Co., an upstream oil and gas company with exploration, appraisal, development and production activities in a number of countries including Iraq, Egypt, Yemen and Oman, for as much as $650.9mn, according to statement to Hong Kong stock exchange. The transaction is to be implemented by way of a scheme of arrangement under Jersey law. (Bloomberg) Sohar Port plans 1 GW solar farm project – A world-scale solar farm project of around 1 gigawatts (GW) at full capacity is envisioned for development at Sohar Port and Freezone, part of a multifaceted strategy to support sustainable green energy initiatives at the industrial hub. The ambitious project, according to Mark Geilenkirchen, CEO, will be implemented in phases with output earmarked for consumption by industrial tenants at the port and adjoining free zone. “Our renewable energy strategy is taking off. We plan to have a large solar farm that will cater to the energy needs of a few of our industries. We are currently in the phase of signing contracts,” Geilenkirchen said. (GulfBase.com)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of September 20, 2018) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&P Pan Arab S&P GCC 0.5% 0.0% (0.4%) 0.8% (0.2%) 0.2% (0.1%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia# Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,199.00 (0.7) 0.5 (8.0) MSCI World Index 2,200.01 0.2 1.5 4.6 Silver/Ounce 14.29 (0.2) 1.6 (15.7) DJ Industrial 26,743.50 0.3 2.3 8.2 Crude Oil (Brent)/Barrel (FM Future) 78.80 0.1 0.9 17.8 S&P 500 2,929.67 (0.0) 0.8 9.6 Crude Oil (WTI)/Barrel (FM Future) 70.78 (0.0) 2.6 17.1 NASDAQ 100 7,986.96 (0.5) (0.3) 15.7 Natural Gas (Henry Hub)/MMBtu 3.02 (1.6) 3.8 (14.7) STOXX 600 384.29 0.3 2.6 (3.6) LPG Propane (Arab Gulf)/Ton 104.25 0.1 (1.3) 6.6 DAX 12,430.88 0.7 3.4 (6.0) LPG Butane (Arab Gulf)/Ton 116.13 0.3 (1.0) 9.9 FTSE 100 7,490.23 0.4 2.6 (5.7) Euro 1.17 (0.2) 1.1 (2.1) CAC 40 5,494.17 0.6 3.6 1.0 Yen 112.59 0.1 0.5 (0.1) Nikkei 23,869.93 0.7 2.8 4.8 GBP 1.31 (1.5) 0.0 (3.3) MSCI EM 1,051.43 1.4 2.2 (9.2) CHF 1.04 0.0 0.9 1.7 SHANGHAI SE Composite 2,797.49 2.4 4.5 (19.8) AUD 0.73 (0.0) 1.9 (6.6) HANG SENG 27,953.58 2.2 2.9 (6.5) USD Index 94.22 0.3 (0.7) 2.3 BSE SENSEX 36,841.60 (1.0) (3.7) (4.5) RUB 66.44 0.3 (2.4) 15.3 Bovespa 79,444.29 2.9 8.9 (14.9) BRL 0.25 0.7 3.1 (18.2) RTS 1,149.53 0.8 5.0 (0.4) 79.7 77.3 75.9