26 May Daily market report

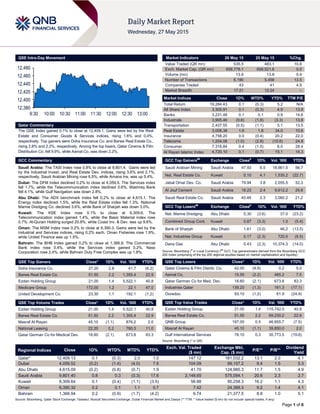

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 0.1% to close at 12,409.1. Gains were led by the Real Estate and Consumer Goods & Services indices, rising 1.6% and 0.4%, respectively. Top gainers were Doha Insurance Co. and Barwa Real Estate Co., rising 2.8% and 2.2%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 9.9%, while Aamal Co. was down 2.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.8% to close at 9,801.4. Gains were led by the Industrial Invest. and Real Estate Dev. indices, rising 3.6% and 2.1%, respectively. Saudi Arabian Mining rose 6.5%, while Amana Ins. was up 5.4%. Dubai: The DFM Index declined 0.2% to close at 4,059.5. The Services index fell 1.7%, while the Telecommunication index declined 0.6%. Mashreq Bank fell 4.1%, while Gulf Navigation was down 2.8%. Abu Dhabi: The ADX benchmark index fell 0.2% to close at 4,615.1. The Energy index declined 1.5%, while the Real Estate index fell 1.3%. National Marine Dredging Co. declined 3.6%, while Bank of Sharjah was down 3.0%. Kuwait: The KSE Index rose 0.1% to close at 6,309.6. The Telecommunication index gained 1.4%, while the Basic Material index rose 0.7%. Al-Qurain Holding surged 20.8%, while Coast Inv. & Dev. was up 9.6%. Oman: The MSM Index rose 0.2% to close at 6,390.3. Gains were led by the Industrial and Services indices, rising 0.2% each. Oman Fisheries rose 1.9%, while United Finance was up 1.5%. Bahrain: The BHB Index gained 0.2% to close at 1,366.9. The Commercial Bank index rose 0.4%, while the Services index gained 0.2%. Nass Corporation rose 2.4%, while Bahrain Duty Free Complex was up 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Doha Insurance Co. 27.20 2.8 41.7 (6.2) Barwa Real Estate Co. 51.50 2.2 1,355.4 22.9 Ezdan Holding Group 21.00 1.4 5,522.1 40.8 Medicare Group 172.00 1.2 22.1 47.0 United Development Co. 23.30 1.1 192.1 (1.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 21.00 1.4 5,522.1 40.8 Barwa Real Estate Co. 51.50 2.2 1,355.4 22.9 Masraf Al Rayan 45.10 (1.1) 876.2 2.0 National Leasing 22.20 0.2 780.3 11.0 Qatar German Co for Medical Dev. 18.60 (2.1) 673.8 83.3 Market Indicators 26 May 15 25 May 15 %Chg. Value Traded (QR mn) 535.5 483.1 10.8 Exch. Market Cap. (QR mn) 658,778.1 658,521.6 0.0 Volume (mn) 13.9 13.8 0.4 Number of Transactions 6,190 5,456 13.5 Companies Traded 43 41 4.9 Market Breadth 17:21 12:24 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,284.43 0.1 (0.3) 5.2 N/A All Share Index 3,305.91 0.1 (0.3) 4.9 13.9 Banks 3,231.48 0.1 0.1 0.9 14.6 Industrials 3,905.46 (0.6) (1.8) (3.3) 13.8 Transportation 2,437.55 (0.5) (1.1) 5.1 13.5 Real Estate 3,008.38 1.6 1.8 34.0 10.6 Insurance 4,758.20 0.0 (0.4) 20.2 22.0 Telecoms 1,254.08 (1.0) (2.9) (15.6) 24.8 Consumer 7,318.84 0.4 (1.0) 6.0 28.4 Al Rayan Islamic Index 4,720.10 0.1 (0.7) 15.1 14.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Arabian Mining Saudi Arabia 47.93 6.5 18,661.5 56.7 Nat. Real Estate Co. Kuwait 0.10 4.1 1,535.2 (22.7) Jabal Omar Dev. Co. Saudi Arabia 79.94 3.8 2,055.5 52.3 Al Jouf Cement Saudi Arabia 18.23 2.4 9,612.2 29.8 Saudi Real Estate Co. Saudi Arabia 40.49 2.3 3,060.2 21.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Marine Dredging Abu Dhabi 5.30 (3.6) 37.0 (23.2) Combined Group Cont. Kuwait 0.87 (3.3) 1.0 (5.4) Bank of Sharjah Abu Dhabi 1.61 (3.0) 46.2 (13.5) Nat. Industries Group Kuwait 0.17 (2.3) 720.5 (9.5) Dana Gas Abu Dhabi 0.43 (2.3) 10,374.3 (14.0) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distrib. Co. 42.00 (9.9) 0.2 5.0 Aamal Co. 15.55 (2.2) 485.2 7.5 Qatar German Co for Med. Dev. 18.60 (2.1) 673.8 83.3 Industries Qatar 139.20 (1.3) 161.3 (17.1) Ooredoo 93.10 (1.2) 61.9 (24.9) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 21.00 1.4 115,742.0 40.8 Barwa Real Estate Co. 51.50 2.2 69,230.2 22.9 QNB Group 197.00 0.5 46,655.7 (7.5) Masraf Al Rayan 45.10 (1.1) 39,850.0 2.0 Gulf International Services 78.10 0.3 30,773.5 (19.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,409.13 0.1 (0.3) 2.0 1.0 147.12 181,032.2 13.1 2.0 4.1 Dubai 4,059.52 (0.2) (1.4) (4.0) 7.6 104.09 99,157.2 9.4 1.5 5.3 Abu Dhabi 4,615.09 (0.2) (0.8) (0.7) 1.9 41.70 124,985.3 11.7 1.5 4.9 Saudi Arabia 9,801.40 0.8 0.3 (0.3) 17.6 2,148.65 575,094.1 20.6 2.3 2.7 Kuwait 6,309.64 0.1 (0.4) (1.1) (3.5) 56.88 95,258.3 16.2 1.1 4.3 Oman 6,390.32 0.2 0.1 1.1 0.7 7.42 24,389.3 9.2 1.4 4.1 Bahrain 1,366.94 0.2 (0.9) (1.7) (4.2) 6.74 21,377.5 8.8 1.0 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,380 12,400 12,420 12,440 12,460 12,480 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index gained 0.1% to close at 12,409.1. The Real Estate and Consumer Goods & Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Doha Insurance Co. and Barwa Real Estate Co. were the top gainers, rising 2.8% and 2.2%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 9.9%, while Aamal Co. was down 2.2%. Volume of shares traded on Tuesday rose by 0.4% to 13.9mn from 13.8mn on Monday. However, as compared to the 30-day moving average of 12.6mn, volume for the day was 10.1% higher. Ezdan Holding Group and Barwa Real Estate Co. were the most active stocks, contributing 39.9% and 9.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Al-Ain Ahlia Insurance Co. Moody's Abu Dhabi IFSR A3 A3 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, IFSR – Insurance Financial Strength Rating) Earnings Releases Company Market Currency Revenue (mn) 1Q2015 % Change YoY Operating Profit (mn) 1Q2015 % Change YoY Net Profit (mn) 1Q2015 % Change YoY Etihad Atheeb Telecommunications Co.* Saudi Arabia SR – – -292.6 NA -56.2 NA The National Investor (TNI)* Abu Dhabi AED – – – – 23.0 -71.4% United Paper Industries (UPI)* Bahrain BHD – – – – 0.9 64.0% Source: Company data, DFM, ADX, MSM (* FY2014-15) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/26 US FHFA FHFA House Price Index MoM March 0.30% 0.70% 0.60% 05/26 US FHFA House Price Purchase Index QoQ 1Q2015 1.30% 1.10% 1.40% 05/26 US S&P/Case-Shiller S&P/CS 20 City MoM SA March 0.95% 0.90% 1.21% 05/26 US S&P/Case-Shiller S&P/CS Composite-20 YoY March 5.04% 4.60% 4.99% 05/26 US S&P/Case-Shiller S&P/Case-Shiller US HPI MoM March 0.12% 0.50% 0.35% 05/26 US S&P/Case-Shiller S&P/Case-Shiller US HPI YoY March 4.14% – 4.16% 05/26 US S&P/Case-Shiller S&P/Case-Shiller US HPI NSA March 168.0 – 166.7 05/26 US Markit Markit US Composite PMI May 56.1 – 57 05/26 US Markit Markit US Services PMI May 56.4 56.5 57.4 05/26 Spain Ministerio de Hacienda Spain Budget Balance YtD April -11.98B – -9.85B Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 50.07% 66.49% (87,879,030.53) GCC 3.76% 9.12% (28,702,487.51) Non-Qatari 46.17% 24.40% 116,581,518.04

- 3. Page 3 of 6 News Qatar Kuwait’s UFIG planning to set up new company in Qatar – The financial portal Mubasher reported that Kuwaiti listed firm United Foodstuff Industries Group (UFIG) is working toward establishing a new company in Qatar. UFIG will control 50% stake in the new company. (Peninsula Qatar) DHBK hosts forum to promote Qatar-Singapore trade ties – Doha Bank (DHBK), in collaboration with the Singapore Business Federation (SBF) and International Enterprise Singapore (IES), hosted a business forum in Doha to promote trade and investment relations between Qatar & Singapore and encourage stronger bilateral cooperation across the key economic sectors. Qatari and Singaporean companies from several different industries – including oil & gas, real estate, building materials, education and finance – participated in the business forum. (Gulf-Times.com) Qatar-UAE trade reaches QR33.5bn in 2014 – The Minister of Economy & Commerce, HE Sheikh Ahmed bin Jassim bin Mohamed Al Thani revealed that the trade volume between Qatar and the UAE jumped 23.2% to QR33.5bn in 2014, making UAE the fifth largest trading partner of Qatar. Speaking at the Qatar-UAE Economic Forum in Doha, he said that the number of UAE companies operating in Qatar has also increased at a rapid pace. The minister, while highlighting various projects that are to be executed in the coming years, stated that the time is ripe for many more UAE companies to enter the Qatari market. The UAE Economy Minister Sultan bin Saeed Al Mansoori, who led the UAE delegation at the forum, pointed out that international events like 2020 Expo in Dubai and 2022 FIFA World Cup in Qatar will open hundreds of investment opportunities in the two countries. (Qatar Tribune) Qatar to favor countries granting flight slots to QA – Qatar Airways (QA) CEO Akbar al-Baker said that Qatar is likely to favor countries whose airports grant take-off and landing slots to QA, in handing out lucrative public procurement contracts. Al Baker said that QA plans to make important announcements at the June 15-21 Paris Airshow. Meanwhile, QA will launch new services to Amsterdam from June 16, 2015. The route will operate six times a week with a Boeing 787 Dreamliner. (Reuters, Peninsula Qatar) International US services sector growth slows, consumer confidence gains in May; home sales, business spending rise in April – According to preliminary figures released by the financial firm Markit, US services sector PMI slipped to 56.4 in May from a final reading of 57.4 in April. The data indicated that the services sector expansion slowed for the third straight month in May, weakening alongside new business activity. The composite PMI, a weighted average of manufacturing and services indexes, dropped to 56.1 from 57 in April. Further, the US Commerce Department said that new single-family home sales increased 6.8% in April to a seasonally adjusted annual rate of 517,000 units, suggesting the housing market recovery was gaining traction. March's sales pace was revised up to 484,000 units from the previously reported 481,000 units. Another report from the Commerce Department showed that non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, rose 1.0% in April after an upwardly revised 1.5% increase in March. In a separate report, the Conference Board said its index of consumer attitudes rose to 95.4 in May from 94.3 in April. The rebound in business spending, together with a sturdy labor market, a strengthening housing market and firming underlying inflation, should keep the Federal Reserve on course to raise interest rates later this year. (Reuters) Brazil signs investment cooperation agreement with Mexico – Brazil and Mexico have signed an investment cooperation accord and pledged to work together to boost growth and expand the middle class in Latin America’s two biggest economies. The agreements aim to facilitate investment, increase air travel and cooperate on tourism. Brazil’s President Dilma Rousseff said that while the two nations have strengthened ties in recent years, Brazil can do more to invest in Mexico. Mexican investment in Brazil is currently about $23bn a year, while Brazil invests just $2bn annually in Mexico. (Bloomberg) South African economic growth slows in 1Q2015 – South Africa’s economy grew at a slower pace in 1Q2015 as power outages curbed factory output and a drought cut harvests, undermining job creation. GDP rose an annualized 1.3% from 4Q2014, when it expanded by 4.1%. Manufacturing, which contributes around 13% to the economy, fell at an annualized 2.4% in 1Q2015, while agricultural output contracted 16.6% because of drought. However, expansion in mining output and financial services helped to offset the slump in manufacturing and farming, increasing at an annualized 10.2% and 3.8% respectively. The unemployment rate climbed to 26.4%, the highest level in 11 years. (Bloomberg) Regional SASCO signs credit facility agreement worth SR150mn with SABB – Saudi Automotive Services Company (SASCO) has signed a Shari’ah-compliant bank facility agreement worth SR150mn with the Saudi British Bank (SABB). The loan duration starts from May 25, 2015 and lasts until January 31, 2016. The facility agreement entails a long-term loan worth SR100mn, in addition to banking guarantees worth SR50mn, while the collateral of this facility are promissory notes. SASCO will use the bank facility agreement to partially finance the capital expenditure, as well as carry out its expansion plan of buying new lands and constructing new stations. (Tadawul) Almarai board approves capital investment of SR21bn – Almarai Company’s board has approved its strategic five year plan for the 2016-20 period, which includes a capital investment of SR21bn. The board has set objectives to increase its presence and investments in all the segments and geographies where it operates; and also to double the consolidated sales while improving the company’s financial performance. In addition to Almarai’s financing capabilities, either through the traditional bank facilities – SIDF and ADF funds, or via the Sukuk program that is currently in place, the growing ‘operating cash flow’ will be dedicated to finance these investments. (Tadawul) RCJY signs contracts worth SR120.26mn – The Royal Commission for Jubail and Yanbu (RCJY) has signed contracts worth SR120.26mn with both the national and international companies. The new deals are related to the development and expansion works in Jubail and Ras Al-Khair industrial cities. The first contract with V3 Middle East Engineering Consultants Co. and Childs Bertman Tseckares (CBT) involves the preparation of economic and technical studies, as well as a general plan for environment protection in the two industrial cities. The second contract with Construction & Roads Services Est. is for General Contracting. (GulfBase.com) Cayan Group signs investment deal with MEFIC Capital – Saudi-based property developer Cayan Group has signed an

- 4. Page 4 of 6 investment-fund deal with Saudi Arabia-based MEFIC Capital for the construction of a commercial property in Riyadh. The fund will be utilized for a project to be built on King Fahd Road and will comprise quality office space. The construction work is expected to begin in 3Q2015 and is expected to complete during 3Q2017. (GulfBase.com) Mobily signs SR180mn contract with Accenture – Etihad Etisalat Company (Mobily) has signed a three-year contract worth SR180mn with Accenture to help speed up delivery, and enhance customer experience for its Mobily subscribers in Saudi Arabia. Under the terms of the agreement, Accenture will provide application development services to Mobily, encompassing end-to-end software development, delivery and implementation across Mobiliy’s business support systems (BSS) platforms and technologies, with a focus on time-to- market and cost reductions. (GulfBase.com) NWC plans to implement 62 projects worth SR9bn – National Water Company (NWC) is planning to start awarding projects to develop infrastructure of Jeddah and implement a number of drainage networks. Further, NWC will create water treatment projects and implement a strategy for water tanks, including stations at 62 projects, at an estimated cost of SR9bn. The company said that there are 50 projects worth SR8bn, which are under construction, while another 12 projects worth SR1.2bn will be awarded in 2015. (GulfBase.com) Saudi CMA to raise proportion of shares allocated to institutional investors – The Saudi Capital Market Authority (CMA) would raise the proportion of shares allocated to institutional investors in initial public offers (IPO) with an aim to reduce market volatility. The Saudi Stock Exchange (Tadawul), which is set to open to qualified financial institutions on June 15, 2015, is dominated by retail investors in terms of daily trading volumes. CMA, which did not reveal the nature of the new allocation levels, has said that 90% of institutional shares would go to institutions that catered to retail investors, so that retail investors could indirectly own the equity. (Reuters) APC board recommends SR123mn dividend for 2Q2015 – Advanced Petrochemical Company’s (APC) board of directors has recommended the distribution of 7.5% dividend (SR0.75 per share), amounting to SR123mn for 2Q2015. Meanwhile, shareholders, who are registered in the registers of the Securities Depository Center (Tadawul) on June 30, 2015, will be eligible to receive the dividend. The dividend will be distributed on July 9, 2015. (Tadawul) Egypt-based MNHD board approves joint mall project with Al Hokair – Egypt-based Medinet Nasr for Housing and Development’s (MNHD) board has approved an offer to build a mall at MNHD's Teegan development from a unit of Saudi Arabian retailer Fawaz Abdulaziz Al Hokair & Company (Al Hokair). Under the proposed usufruct deal, Al Hokair will own and operate the mall for 50 years before transferring it to MNHD, who will receive a share of the mall's revenues in the meantime. MNHD said the new mall would have a gross leasable area of 68,500 square meters, and would take three years for construction. (Reuters) Jarir Marketing opens new showroom in Riyadh – Jarir Bookstore, a retail chain operated by Jarir Marketing Company, has opened a new showroom in Riyadh taking the number of its local branches to 33. The new showroom consists of two floors with 4,000 square meter spaces. Jarir Bookstore has invested more than SR70mn in the new site, and some other new showrooms measuring 10,000 square meters have been established for rental. The financial impact for this new mall opening will start from 2Q2015. (Tadawul) EGA to spend $5bn to boost capacity – Emirates Global Aluminium (EGA) is spending $5.2bn to boost capacity at its smelter in Dubai, and build an alumina refinery in Abu Dhabi. The company is adding about 40,000 tons per annum to the 1mn tons per annum smelter at Dubal, which is expected to commence operations in 2017, and is building a 2.2mn tons per annum alumina refinery in Al Taweelah in Abu Dhabi, which is slated to be online in 1Q2018. EGA was formed in 2014 with the merger of Abu Dhabi’s Emirates Aluminium (Emal) and Dubai Aluminium (Dubal). (GulfBase.com) Amlak assures investors as it prepares for return to Dubai bourse – Amlak Finance has assured investors of its financial viability. Amlak will start trading again on the Dubai Financial Market on June 2, 2015. The company is confident that it will continue to generate annual profits and intends to put itself back into a leadership position, as a premier and specialized property financing provider in the UAE. Amlak had completed a restructuring of debt worth $2.7bn in August 2014, paving the way for its shares to resume trading. (DFM) Marka expects to turn profitable in 2016 – Marka’s Managing Director, Khaled Almheri said that the company is expected to turn profitable in 2016. Earlier in January 2015, Marka had announced profit expectations for 4Q2015. Moreover, the company has been boosting its revenue with new acquisitions, and also acquired a 65% stake in Icons, a football memorabilia company, for AED15.3mn. (Reuters) ENR: UAE money supply growth slows further in April – According to the Emirates NBD Research (ENR), money supply (M2) growth declined 0.8% MoM in April, with the annual growth rate slowing to 4.1% from 4.9% in March, the slowest growth rate in more than two years. The slower liquidity growth in April 2015 was a result of quasi-money which has been the case for several months. M1 (cash and demand deposits) growth remained relatively robust, rising 0.8% MoM and 8.1% YoY in April. Meanwhile, a decline in M2 in April was partially offset by higher government deposits, which rose 4.7% MoM and 14.6% YoY. Total banking sector deposits had declined to AED8.1bn (0.6% MoM) in April, with the annual growth rate slowing to 7.2% YoY from 8.8% in March. Moreover, bank lending had increased by AED11.3bn (0.8% MoM) in April, with the annual growth rate picking up slightly to 8.4% YoY from 8.2% in March. Due to faster loan growth in April, the gross loan-to-deposit ratio increased to 98.6% from 97.3% in March. (GulfBase.com) Nakheel signs up 100 restaurants for waterfront project – Nakheel has confirmed nearly 100 restaurants and shops at its new AED800mn waterfront retail, dining and entertainment complex called ‘The Pointe’ which is under construction on Palm Jumeirah in Dubai, UAE. The project is expected to be completed in 2016. (GulfBase.com) UAQ Cement to begin dividend distribution – Umm Al Qaiwain Cement Company (UAQ Cement) will begin the distribution of dividends worth 7 fils per share starting May 27, 2015. Shareholders registered as of April 28, 2015 will be entitled to receive the dividends. (ADX) EIU: Private investment raising healthcare quality – According to the Economist Intelligence Unit (EIU) report ‘Investing in quality’, released by Waha Capital, private investment is helping drive the UAE toward its goal of implementing international best-practices in healthcare by 2021, but the sector needs to work harder to attract and retain skilled staff. The report, called ‘Investing in quality’, said that the growing private sector involvement and greater international accreditation are helping to lift quality standards markedly. This should persuade more people to seek healthcare services in the

- 5. Page 5 of 6 UAE, rather than travelling abroad, which can result in much higher expenses for families – often a cost borne by the government budgets. A Gallup survey in 2012 showed that two in five Emiratis had a preference for treatment abroad. (ADX) Gulf Capital, Carbon Holdings sign AED92mn debt financing deal – Gulf Capital has signed a debt financing agreement worth AED92mn with Egyptian petrochemical company, Carbon Holdings to support their mega industrial projects in Ain Al Sokhna on the Suez Canal in Egypt. The five- year loan facility was extended by Gulf Capital’s credit fund, GC Credit Opportunities Fund to finance the development and expansion of three Carbon Holdings petrochemical projects including Egypt Hydrocarbon Corporation, Oriental Petrochemicals Corporation and Tahrir Petrochemicals Corporation. (GulfBase.com) Etisalat extends strategic partnership deal with Ericsson – Emirates Telecommunication Corporation (Etisalat) and Ericsson have extended a strategic partnership deal to extend collaboration in new areas and strengthen their market position as ICT (information and communications technology) partners in business. Both the entities will jointly evaluate and identify enterprise opportunities for collaboration. (GulfBase.com) NBK: Resident credit growth picks up in March 2015 – According to the National Bank of Kuwait (NBK), resident credit growth picked up in March 2015, though growth eased to 5.4% YoY on basis effects. Meanwhile, credit was up KD214mn, its strongest gain in four months. Most of the gain was in household debt, credit for securities purchases and real estate. Money supply saw a strong month due to large gains in private deposits, mainly in foreign currency. The non-bank financial sector remained in deleveraging mode, with credit falling by KD47mn. The decline was the largest in five months, though the decline in sector debt over 2014 continued to slow to 7.9% YoY. Moreover, the month of March in 2015 has witnessed a large increase in private deposits, mostly related to bank dividend payments during the month. Still, money supply (M2) growth eased to 3.6% YoY on basis effects. Private deposits were up by KD960mn, most of them in foreign currency deposits (KD656mn) and KD time deposits (KD308mn). Further, M1 growth eased to 1.4% YoY. (GulfBase.com) Ahli Bank’s SSB Chairman resigns – Ahli Bank’s Board has accepted the resignation of Dr. Fareed Mohammed Hadi, the Chairman of Sharia Supervisory Board (SSB) of Al Hilal Islamic Banking Services - Ahli Bank. (MSM) Oman cuts defense and subsidy spending – According to the provisional finance ministry figures, Oman's government has responded to low oil prices by reducing the spending on defense and subsidies; while continuing to invest in diversifying the economy. The falling crude oil prices since 2014 has slashed the government's net oil revenues, which shrank by 35% from a year earlier to reach OMR1.67bn in the 1Q2015. The government posted a budget deficit of OMR544.6mn in 1Q2015 from a OMR215.4mn surplus in 1Q2014. Public investment spending rose by 2.3% to OMR555.4mn, with a slight decline in investments in oil production, and a 35% increase in investments in natural gas production. (GulfBase.com) UPI BoD recommends 20% cash dividend – United Paper Industries’ (UPI) board of directors (BoD) has recommended 20% cash dividends. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Apr-11 Apr-12 Apr-13 Apr-14 Apr-15 QSE Index S&P Pan Arab S&P GCC 0.8% 0.1% 0.1% 0.2% 0.2% (0.2%) (0.2%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,187.32 (1.3) (1.6) 0.2 MSCI World Index 1,781.14 (1.3) (1.2) 4.2 Silver/Ounce 16.76 (2.6) (2.1) 6.7 DJ Industrial 18,041.54 (1.0) (1.0) 1.2 Crude Oil (Brent)/Barrel (FM Future) 63.72 (2.7) (2.5) 11.1 S&P 500 2,104.20 (1.0) (1.0) 2.2 Crude Oil (WTI)/Barrel (FM Future) 58.03 (2.8) (2.8) 8.9 NASDAQ 100 5,032.75 (1.1) (1.1) 6.3 Natural Gas (Henry Hub)/MMBtu 2.82 (2.2) (2.2) (5.9) STOXX 600 403.61 (1.6) (2.3) 6.1 LPG Propane (Arab Gulf)/Ton 39.00 (9.3) (9.3) (20.4) DAX 11,625.13 (2.9) (2.9) 6.2 LPG Butane (Arab Gulf)/Ton 50.50 (6.0) (6.0) (19.5) FTSE 100 6,948.99 (1.7) (1.7) 4.6 Euro 1.09 (1.0) (1.3) (10.1) CAC 40 5,083.54 (1.5) (2.5) 7.1 Yen 123.10 1.3 1.3 2.8 Nikkei 20,437.48 (1.0) (0.3) 13.8 GBP 1.54 (0.5) (0.7) (1.2) MSCI EM 1,026.45 (0.9) (1.1) 7.3 CHF 1.05 (0.9) (1.2) 4.3 SHANGHAI SE Composite 4,910.90 2.0 5.3 51.9 AUD 0.77 (1.1) (1.1) (5.4) HANG SENG 28,249.86 0.9 0.9 19.7 USD Index 97.30 1.3 1.3 7.8 BSE SENSEX 27,531.41 (0.9) (2.2) (1.0) RUB 50.84 1.6 1.7 (16.3) Bovespa 53,629.78 (2.9) (3.9) (9.8) BRL 0.32 (1.7) (1.9) (16.0) RTS 1,025.16 (1.6) (2.5) 29.7 178.3 143.2 129.7