1 November Daily market report

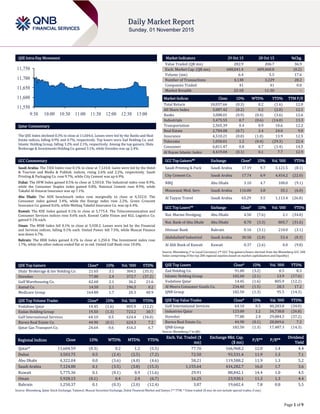

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 11,604.6. Losses were led by the Banks and Real Estate indices, falling 0.9% and 0.7%, respectively. Top losers were Zad Holding Co. and Islamic Holding Group, falling 3.2% and 2.1%, respectively. Among the top gainers, Dlala Brokerage & Investments Holding Co. gained 3.1%, while Ooredoo was up 2.4%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 7,124.8. Gains were led by the Hotel & Tourism and Media & Publish. indices, rising 2.6% and 2.2%, respectively. Saudi Printing & Packaging Co. rose 9.7%, while City Cement was up 6.9%. Dubai: The DFM Index gained 0.5% to close at 3,503.8. The Industrial index rose 8.9%, while the Consumer Staples index gained 0.8%. National Cement rose 8.9%, while Takaful Al-Emarat Insurance was up 7.1%. Abu Dhabi: The ADX benchmark index rose marginally to close at 4,322.0. The Consumer index gained 3.4%, while the Energy index rose 2.2%. Green Crescent Insurance Co. gained 8.6%, while Methaq Takaful Insurance Co. was up 6.4%. Kuwait: The KSE Index gained 0.1% to close at 5,775.4. The Telecommunication and Consumer Services indices rose 0.6% each. Kuwait Cable Vision and KGL Logistics Co. gained 9.1% each. Oman: The MSM Index fell 0.1% to close at 5,928.2. Losses were led by the Financial and Services indices, falling 0.1% each. United Power fell 7.5%, while Muscat Finance was down 6.7%. Bahrain: The BHB Index gained 0.1% to close at 1,250.4. The Investment index rose 1.7%, while the other indices ended flat or in red. United Gulf Bank rose 10.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala' Brokerage & Inv Holding Co. 21.65 3.1 304.5 (35.3) Ooredoo 77.80 2.4 372.7 (37.2) Gulf Warehousing Co. 62.60 2.1 36.2 21.6 Aamal Co. 14.50 2.1 196.3 0.2 Medicare Group 164.80 1.7 20.3 40.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.45 (1.6) 805.9 (12.2) Ezdan Holding Group 19.50 (1.3) 723.2 30.7 Gulf International Services 64.10 0.5 624.4 (34.0) Barwa Real Estate Co. 44.90 (0.1) 624.3 7.2 Qatar Gas Transport Co. 24.64 0.6 416.3 6.7 Market Indicators 29 Oct 15 28 Oct 15 %Chg. Value Traded (QR mn) 282.9 206.7 36.9 Exch. Market Cap. (QR mn) 608,041.4 609,460.8 (0.2) Volume (mn) 6.4 5.5 17.6 Number of Transactions 4,138 3,229 28.2 Companies Traded 41 41 0.0 Market Breadth 22:18 11:30 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,037.66 (0.3) 0.2 (1.6) 12.0 All Share Index 3,087.42 (0.2) 0.2 (2.0) 12.1 Banks 3,088.01 (0.9) (0.4) (3.6) 12.6 Industrials 3,475.55 0.7 (0.6) (14.0) 13.3 Transportation 2,565.39 0.4 0.9 10.6 12.2 Real Estate 2,784.08 (0.7) 2.4 24.0 9.0 Insurance 4,510.21 (0.0) (1.0) 13.9 12.5 Telecoms 1,050.01 1.2 (0.4) (29.3) 22.4 Consumer 6,811.47 0.8 0.7 (1.4) 14.5 Al Rayan Islamic Index 4,419.04 (0.1) 0.1 7.7 12.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Printing & Pack Saudi Arabia 17.19 9.7 3,121.5 (8.1) City Cement Co. Saudi Arabia 17.74 6.9 4,454.2 (22.0) NBQ Abu Dhabi 3.10 4.7 100.0 (9.1) Mouwasat Med. Serv. Saudi Arabia 116.00 3.8 35.1 (6.0) Al Tayyar Travel Saudi Arabia 65.29 3.5 1,113.4 (26.8) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Marine Dredging Abu Dhabi 4.50 (7.6) 2.1 (34.8) Nat. Bank of Abu Dhabi Abu Dhabi 8.70 (3.3) 805.7 (31.6) Ithmaar Bank Bahrain 0.16 (3.1) 210.0 (3.1) Alabdullatif Industrial Saudi Arabia 30.58 (2.8) 53.4 (8.3) Al Ahli Bank of Kuwait Kuwait 0.37 (2.6) 0.0 (9.8) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Zad Holding Co. 91.00 (3.2) 0.5 8.3 Islamic Holding Group 102.60 (2.1) 13.9 (17.6) Vodafone Qatar 14.45 (1.6) 805.9 (12.2) Al Meera Consumer Goods Co. 234.40 (1.5) 28.3 17.2 QNB Group 182.50 (1.3) 95.5 (14.3) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 64.10 0.5 40,283.8 (34.0) Industries Qatar 123.00 1.2 34,738.8 (26.8) Ooredoo 77.80 2.4 29,084.3 (37.2) Barwa Real Estate Co. 44.90 (0.1) 28,069.6 7.2 QNB Group 182.50 (1.3) 17,487.3 (14.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,604.59 (0.3) 0.2 1.2 (5.5) 77.76 166,968.2 12.0 1.4 4.4 Dubai 3,503.75 0.5 (2.4) (2.5) (7.2) 72.50 93,531.4 11.9 1.3 7.1 Abu Dhabi 4,322.04 0.0 (3.6) (4.0) (4.6) 58.21 119,588.2 11.9 1.3 5.2 Saudi Arabia 7,124.80 0.1 (3.5) (3.8) (15.3) 1,155.64 434,282.7 16.0 1.7 3.6 Kuwait 5,775.36 0.1 (0.1) 0.9 (11.6) 29.91 88,842.1 14.4 1.0 4.5 Oman 5,928.15 (0.1) 0.4 2.4 (6.7) 16.25 23,930.1 11.3 1.3 4.4 Bahrain 1,250.37 0.1 (0.3) (2.0) (12.4) 3.87 19,602.4 7.8 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,550 11,600 11,650 11,700 11,750 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QSE Index declined 0.3% to close at 11,604.6. The Banks and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari and GCC shareholders. Zad Holding Co. and Islamic Holding Group were the top losers, falling 3.2% and 2.1%, respectively. Among the top gainers, Dlala Brokerage & Investments Holding Co. gained 3.1%, while Ooredoo was up 2.4%. Volume of shares traded on Thursday rose by 17.6% to 6.4mn from 5.5mn on Wednesday. However, as compared to the 30-day moving average of 7.3mn, volume for the day was 12.1% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 12.6% and 11.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY National Central Cooling Co. (Tabreed) Dubai AED 335.6 -2.5% 112.8 -0.2% 100.4 4.7% Orient Insurance* Dubai AED 138.0 25.0% 30.0 -16.4% 48.6 2.2% Abu Dhabi Aviation (ADA)* Abu Dhabi AED 1,646.5 41.7% 387.3 16.8% 210.5 17.5% Ras Al Khaimah National Insurance Co. (RAKNIC)* Abu Dhabi AED 75.9 69.2% 13.6 -1.4% 11.4 -20.3% Ooredoo Oman Oman OMR 65.0 12.3% – – 10.2 -5.6% Seef Propoerties* Bahrain BHD 3.8 20.5% 3.3 19.4% 2.5 40.6% BMMI* Bahrain BHD 21.7 -11.5% 2.1 24.8% 2.2 -7.7% Source: Company data, DFM, ADX, MSM (*9M2015 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/29 US Department of Labor Initial Jobless Claims 24-October 260k 265k 259k 10/29 US Bureau of Economic Analysis GDP Annualized QoQ 3Q2015 1.50% 1.60% 3.90% 10/29 US Bureau of Economic Analysis Personal Consumption 3Q2015 3.20% 3.30% 3.60% 10/29 US Bloomberg Bloomberg Consumer Comfort 25-October 42.8 – 43.5 10/29 US National Assoc. of Realtors Pending Home Sales MoM September -2.30% 1.00% -1.40% 10/29 US National Assoc. of Realtors Pending Home Sales NSA YoY September 2.50% 7.30% 6.60% 10/30 US Bureau of Labor Statistics Employment Cost Index 3Q2015 0.60% 0.60% 0.20% 10/30 US Bureau of Economic Analysis Personal Income September 0.10% 0.20% 0.40% 10/30 US Bureau of Economic Analysis Personal Spending September 0.10% 0.20% 0.40% 10/30 US Bureau of Economic Analysis Real Personal Spending September 0.20% 0.20% 0.40% 10/30 US Bureau of Economic Analysis PCE Core MoM September 0.10% 0.20% 0.10% 10/30 US Bureau of Economic Analysis PCE Core YoY September 1.30% 1.40% 1.30% 10/29 EU European Commission Economic Confidence October 105.9 105.1 105.6 10/29 EU European Commission Business Climate Indicator October 0.4 0.3 0.4 10/29 EU European Commission Industrial Confidence October -2.0 -2.7 -2.3 10/29 EU European Commission Services Confidence October 11.9 12.0 12.4 10/30 EU Eurostat Unemployment Rate September 10.80% 11.00% 10.90% 10/30 EU Eurostat CPI Estimate YoY October 0.00% 0.00% -0.10% 10/30 EU Eurostat CPI Core YoY October 1.00% 0.90% 0.90% 10/30 France INSEE PPI MoM September 0.10% – -1.00% 10/30 France INSEE PPI YoY September -2.60% – -2.10% 10/30 France INSEE Consumer Spending MoM September 0.00% 0.30% 0.10% 10/30 France INSEE Consumer Spending YoY September 2.60% 2.60% 1.80% 10/30 Germany Destatis Retail Sales MoM September 0.00% 0.40% -0.70% 10/30 Germany Destatis Retail Sales YoY September 3.40% 4.10% 2.10% 10/29 Germany Destatis CPI MoM October 0.00% -0.10% -0.20% 10/29 Germany Destatis CPI YoY October 0.30% 0.20% 0.00% 10/29 Germany Deutsche Bundesbank Unemployment Change (000's) October -5k -4k 2k Overall Activity Buy %* Sell %* Net (QR) Qatari 65.92% 56.07% 27,856,405.91 GCC 8.95% 5.26% 10,460,611.90 Non-Qatari 25.13% 38.68% (38,317,017.81)

- 3. Page 3 of 9 10/29 Germany Deutsche Bundesbank Unemployment Claims Rate SA October 6.40% 6.40% 6.40% 10/30 UK Lloyds Bank Commercial Banking Lloyds Business Barometer October 50.0 – 42.0 10/29 UK Bank of England Net Consumer Credit September 1.3b 1.1b 1.3b 10/29 UK Bank of England Net Lending Sec. on Dwellings September 3.6b 3.3b 3.4b 10/29 UK Bank of England Mortgage Approvals September 68.9k 72.4k 70.7k 10/29 UK Bank of England Money Supply M4 MoM September -1.00% -- -0.50% 10/29 UK Bank of England M4 Money Supply YoY September -0.60% -- -0.20% 10/29 UK Bank of England M4 Ex IOFCs 3M Annualised September 4.00% 2.70% 1.90% 10/29 UK Confederation of British Indus CBI Reported Sales October 19.0 35.0 49.0 10/30 UK GfK NOP (UK) GfK Consumer Confidence October 2.0 4.0 3.0 10/29 Spain INE CPI MoM October 0.70% 0.70% -0.30% 10/29 Spain INE CPI YoY October -0.70% -0.60% -0.90% 10/30 Spain INE GDP QoQ 3Q2015 0.80% 0.80% 1.00% 10/30 Spain INE GDP YoY 3Q2015 3.40% 3.40% 3.10% 10/30 Spain Bank of Spain Current Account Balance August 1.7b – 3.0b 10/29 Spain INE Retail Sales YoY September 4.40% – 3.10% 10/30 Italy ISTAT Unemployment Rate September 11.80% 11.90% 11.90% 10/30 Italy ISTAT CPI EU Harmonized MoM October 0.50% 0.30% 1.60% 10/30 Italy ISTAT CPI EU Harmonized YoY October 0.30% 0.10% 0.20% 10/30 Italy ISTAT PPI MoM September -0.20% – -0.60% 10/30 Italy ISTAT PPI YoY September -3.80% – -3.50% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported MCCS Mannai Corp. 16-Oct-15 - Reported CBQK Commercial Bank 18-Oct-15 - Reported QIGD Qatari Investors Group 19-Oct-15 - Reported DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 - Reported KCBK Al Khaliji 20-Oct-15 - Reported DOHI Doha Insurance 20-Oct-15 - Reported QEWS Qatar Electricity & Water Company 20-Oct-15 - Reported SIIS Salam International Investment 20-Oct-15 - Reported AKHI Al Khaleej Takaful Insurance 20-Oct-15 - Reported IHGS Islamic Holding Group 20-Oct-15 - Reported QIIK Qatar International Islamic Bank 20-Oct-15 - Reported GWCS Gulf Warehousing Company 21-Oct-15 - Reported QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 - Reported QNCD Qatar National Cement Company 21-Oct-15 - Reported QCFS Qatar Cinema & Film Distribution Company 21-Oct-15 - Reported QIMD Qatar Industrial Manufacturing Company 22-Oct-15 - Reported WDAM Widam Food Company 22-Oct-15 - Reported QNNS Qatar Navigation (Milaha) 24-Oct-15 - Reported QATI Qatar Insurance Company 25-Oct-15 - Reported MARK Masraf Al Rayan 25-Oct-15 - Reported DHBK Doha Bank 25-Oct-15 - Reported QISI Qatar Islamic Insurance 25-Oct-15 - Reported QGRI Qatar General Insurance & Reinsurance 25-Oct-15 - Reported QOIS Qatar & Oman Investment 25-Oct-15 - Reported MCGS Medicare Group 25-Oct-15 - Reported GISS Gulf International Services 25-Oct-15 - Reported QGMD Qatar German Company for Medical Devices 25-Oct-15 - Reported UDCD United Development Company 26-Oct-15 - Reported QFLS Qatar Fuel Company 26-Oct-15 - Reported ERES Ezdan Real Estate Company 26-Oct-15 - Reported MERS Al Meera Consumer Goods Company 27-Oct-15 - Reported MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 - Reported

- 4. Page 4 of 9 BRES Barwa Real Estate Company 27-Oct-15 - Reported ORDS Ooredoo 28-Oct-15 - Reported IQCD Industries Qatar 28-Oct-15 - Reported AHCS Aamal Company 29-Oct-15 - Reported NLCS National Leasing (Alijarah) 29-Oct-15 - Reported ZHCD Zad Holding Company 29-Oct-15 - Reported VFQS Vodafone Qatar 12-Nov-15 11 Due Source: QSE

- 5. Page 5 of 9 News Qatar ZHCD bottom-line drops 69.6% in 3Q2015 – Zad Holding Company’s (ZHCD) bottom-line dropped by 69.6% QoQ (down 4.6% YoY) in 3Q2015 to QR17.0mn. ZHCD’s other income dropped 68.9% from 2Q2015 to QR11.6mn, while its top-line fell 7.3% QoQ to QR263.2mn, which majorly dented the company’s net profit. (QSE, QNBFS Research) AHCS net income slips in 3Q2015 on higher direct costs – Aamal Company (AHCS) recorded a decline of 10.9% QoQ in 3Q2015 net profit to QR105.0mn. Revenue edged up 1.7% QoQ to QR725.4mn. However, a 5.0% quarterly increase in direct costs to QR574.4mn offset the improvement in revenue, impacting the bottom-line negatively. EPS fell to QR0.17 in 3Q2015 from QR0.19 in 2Q2015. (QSE, QNBFS Research) NLCS reports lower net loss in 3Q2015 – Alijarah Holding (NLCS) recorded over 50% reduction in its net loss to QR14.7mn in 3Q2015 vs. a net loss of QR33.5mn in 2Q2015, as its total income climbed 36.8% QoQ to QR41.7mn. Loss per share amounted to QR0.30 in 3Q2015 vs. QR0.68 in 2Q2015. (QSE, QNBFS Research) QCB to issue T-bills worth QR4bn on Nov 3 – The Qatar Central Bank (QCB) will issue new three-month treasury bills worth QR2bn, along with six-month and nine-month T-bills worth QR1bn each on November 3, 2015. (QCB) MDPS: Qatar trade surplus drops to QR12.1bn in Sept 2015 – According to figures released by the Ministry of Development Planning & Statistics (MDPS), Qatar’s trade surplus more than halved YoY to QR12.1bn in September 2015, mainly on substantially lower exports of crude and non-crude as well as natural gas. Qatar’s trade surplus fell 11.2% as compared to August 2015 mainly due to shrinkage in exports of crude, non- crude and natural gas as well as increased imports of turbojets and motor cars. The country’s total exports (valued free-on-board) plunged 39.5% YoY to QR21.19bn and tanked 10.6% MoM, while total exports of domestic products sunk 42.1% to QR19.94bn in September 2015, down 12.9% against August 2015. Japan, South Korea, India, the UAE and Singapore were the top destinations for Qatar’s exports but shipments to most Asian countries witnessed a substantial double-digit drop YoY in September 2015. Total imports (valued at cost insurance and freight) shrunk 7.9% YoY to QR9.08bn in September 2015 on lower shipments from the US and Germany. Imports fell faster at 9.9% as compared to those in August 2015. China, the US, the UAE, Germany and Japan were among the top five destinations, from where Qatar imported merchandise goods. Meanwhile, MDPS said that the population in Qatar during September 2015 was 2.347mn people, reflecting a 7.3% increase as compared to September 2014. Visitors from outside the GCC were up 7.7% in 9M2015, while visitors from the GCC were up 45.2%. (Gulftimes.com, Peninsula Qatar) MERS opens 46th branch in Al Thumama – Al Meera Consumer Goods Company (MERS) has opened its Al Thumama branch, marking the 46th addition to its growing supermarket chain. MERS deputy CEO Dr. Mohamed Nasser al-Qahtani said the opening of the new branch came as a response to the needs of Al Thumama and its surrounding communities, and also as part of MERS’s aim to serve all areas in Qatar. The Al Thumama branch spans 3,770 square meters with two entrances for convenient access to shoppers, in addition to a huge parking space. In the near future, the branch will feature five shops that are set to open soon to provide customers with a variety of services. (Gulf-Times.com) Kafala replaced by job contract system – The Ministry of Interior’s Department of Border, Passport and Expatriates Affairs Assistant Director General Brigadier Mohammed Ahmed Al Atiq has said that the new law regulating entry, exit and residency of expatriates in Qatar has transformed the Kafala (sponsorship) system in the country into one controlled by employment contracts. To leave the country, he said, an employee needs to apply to the departments concerned at the Ministry of Interior through Metrash 2 system and inform his employer three days in advance. (Peninsula Qatar) WPS comes into force from Nov 2 – The new Wage Protection System (WPS) will come into force from November 2, 2015 making it mandatory for employers to transfer employees’ salaries to a bank or a financial institution. The new system is being implemented based on amendments in the labor law no. 14/2004. The ministerial decision on the WPS says employees’ salaries must be transferred to their bank accounts by the seventh day of every month. (Peninsula Qatar) ORDS launches medical referral management program – Ooredoo (ORDS) launched a new service to provide a 24x7 concierge medical referral management program that customers can access using their mobile phones. The service, ‘You Click, We Care’, is accessible from anywhere in the world and is designed to give patients access to speak to Western-trained healthcare professionals. Doctors will refer them to the best hospital, clinic, nutritionist or wellness service according to their needs in the neighboring area, wherever they are in the world. (Peninsula Qatar) Qatar offers growth potential for affordable hotels – Qatar’s hospitality sector offers huge growth potential for affordable hotels — mainly 2-star and 3-star hotels. Currently the country’s hospitality market is dominated by 4- and 5-star hotels. The sector in Qatar now provides approximately 17,900 keys, of which 84% are either 4-star or 5-star hotels. (Peninsula Qatar) RasGas: Buyer-seller tie-up key to maintaining balance in LNG market – RasGas Chief Executive Officer, Hamad Mubarak al- Muhannadi has said that the recent decline in liquefied natural gas (LNG) prices and the introduction of new players to the “LNG Club” will require a collaborative effort from both suppliers and buyers to adopt a long-term view for maintaining a sustainable LNG market. Speaking on the growing positive role LNG will play in the global fuel mix, Al Muhannadi pointed out that the ‘voice of gas’ is increasingly being heard supporting further penetration of natural gas in the energy supply mix. (Gulf-Times.com, Peninsula Qatar) International US GDP growth slows in 3Q2015 – The Commerce Department said that US economic growth braked sharply in 3Q2015 as businesses cut back on restocking warehouses to work off an inventory glut, but solid domestic demand could encourage the Federal Reserve to raise interest rates in December 2015. GDP increased at a 1.5% annual rate after expanding at a 3.9% clip in 2Q2015. The inventory drag, however, is likely to be temporary and economists expect growth to pick up in 4Q2015 given strong domestic fundamentals. (Reuters) Eurozone inflation zero in October, pressure on for more ECB easing – According to the European Union's statistics (Eurostat) estimate, Eurozone prices were flat YoY in October 2015 as expected, maintaining pressure on the European Central Bank (ECB) to further ease monetary policy despite some signs of more inflationary pressure. Eurostat estimated that consumer prices in the Eurozone were unchanged in October 2015 against October 2014 levels, after falling 0.1% YoY in September. Separately, Eurostat said unemployment in the Eurozone fell to 10.8% of the workforce in September from a downwardly revised 10.9% in August. (Reuters) BoJ holds rates despite overseas headwinds, stagnant inflation – The Bank of Japan (BoJ) held off on expanding its massive stimulus

- 6. Page 6 of 9 program, preferring to preserve its dwindling policy options in the hope that the economy can overcome the drag from China's slowdown without additional monetary support. However, the central bank is likely to remain under pressure to expand its already massive asset-buying program as slumping energy costs, weak exports, and a fragile recovery in household spending keep inflation well short of its 2% target. In a twice-yearly outlook report, the BoJ cut its rosy price forecasts and pushed back by around six months the expected timing for hitting its 2% inflation target. The report also warned that overseas headwinds, such as China's slowdown and sluggish emerging market demand, posed "strong downside risks" to Japan's economic outlook. BoJ Governor Haruhiko Kuroda, however, maintained his optimism that the economy will sustain a moderate recovery as exports and output pick up. (Reuters) China official factory PMI unchanged at 49.8 in October, shrinks for third month – According to the official survey, activity in Chinese manufacturing sector unexpectedly shrank for a third straight month in October 2015, fuelling fears that the economy may be cooling further in 4Q2015 despite a raft of stimulus measures. The official Purchasing Managers' Index (PMI) was at 49.8 in October, the same pace as in September and lagging market expectations of 50.0. Recent data showed the world's second-largest economy grew 6.9% YoY between July and September, dipping below 7% for the first time since the global financial crisis, though some market watchers believe current growth is much weaker than government figures suggest. To shore up growth, the government has cut interest rates six times since November and lowered the amount of cash that banks must hold as reserves four times in 2015. The latest cut in interest rates and banks' reserve requirement came in late October. Beijing has also ramped up infrastructure spending and eased restrictions on home purchases to revive the flagging property market. (Reuters) Russian central bank holds rates as high inflation trumps weak growth – Russia's central bank left its main lending rate on hold for the second time in a row, stressing inflation risks above worries about a stagnant economy. The decision leaves the bank's benchmark rate, the one-week minimum auction repo rate, unchanged at 11%. Russia faces painful policy dilemmas as it simultaneously grapples with inflation running above 15% and an economy set to slump by 4% in 2015 with only meager recovery prospects in sight. Low oil prices and Western sanctions over Russia's actions in Ukraine have hit the economy, causing a slide in the rouble that has stoked inflation while cutting household incomes and spending. Explaining its decision, the bank said that it was "in recognition of persistent substantial inflation risks". A majority of Reuters analysts had expected the bank to hold rates, although a significant minority believed the bank would make a half-point cut. (Reuters) Regional Ventures: GCC interior design market to top $7.9bn – According to a report by Ventures, demand for new hotels, retail spaces as well as schools and hospitals, will drive the GCC interior design projects to reach a record breaking $7.98bn in 2015 as against $7.35bn in 2014. (GulfBase.com) Reuters: OPEC output falls in October led by Saudi, Iraq – According to a survey by Reuters, the Organization of the Petroleum Exporting Countries’ (OPEC) oil output had fallen in October 2015 to 31.64mn barrels per day (bpd) from a revised 31.76mn bpd in September 2015, as declines in top producers Saudi Arabia and Iraq had outweighed higher supply from African members. As per the survey, the drops are not indicative of deliberate supply cuts to prop up prices. OPEC is still pumping close to a record high as major producers focus on defending market share. (Gulftimes.com) MFME: GCC fire safety market expected to touch $3.15bn by 2020 – Messe Frankfurt Middle East (MFME), quoting a study by Frost and Sullivan, has said that the Gulf Cooperation Council’s (GCC) fire safety market is expected to grow at an average of 15% to touch $3.15bn by 2020. The growth is predominantly driven by industrial and commercial investments, while segments such as retail, institutional buildings, and public infrastructure are also contributing to new demand. Saudi Arabia and the UAE are spearheading a GCC-wide surge in demand for fire detection and suppression equipment, as economic growth and increased construction activities put the region’s fire safety market on a double-digit growth path. (Zawya) Apple opens first Middle East outlets in UAE – Apple, a US-based technology giant, has launched its first two stores in the Middle East, with hundreds flocking to their openings in the Gulf emirates of Dubai and Abu Dhabi. Apple products were previously available in the UAE but not in one of Apple’s own retail outlets. (Peninsula Qatar) ITC: Demand for halal products rising – According to International Trade Centre’s (ITC) ‘Halal Goes Global’ report, the GCC countries are set to play a crucial role in the fast growing halal market in the coming years. The halal food and beverage market, spread across various countries and cultures, was estimated to be around $1.37tn at the end of 2014. As per the report, the global Muslim population exceeds 1.6bn, and is expected to reach 2.2bn by 2030. It is, therefore, not surprising that the market for halal products and services is attracting more attention. (Peninsula Qatar) SPA: Saudi advisory council may discuss land tax, MSCI inclusion – The Saudi Press Agency (SPA) reported that the Saudi Shura Council may meet on November 2, 2015 to discuss imposing a tax on undeveloped land. Earlier, in October 2015, the cabinet had submitted a proposal to the council to impose a fee of no more than SR100 per square meter on undeveloped land. The council was expected to complete its study of the proposal within 30 days. The SPA said the council would discuss a report by the stock market regulator on trying to have the Saudi market join MSCI’s emerging markets index. The council’s financial committee has recommended expediting and finalizing the necessary requirements to list Saudi stocks in MSCI’s emerging markets index. MSCI has indicated that any entry into its index, if it happens, would not occur before 2017. (Gulfbusiness) Saudi CMA approves Anfaal capital increase request – Saudi Capital Market Authority (CMA) has approved Anfaal Capital Company’s request to increase its capital from SR50mn to SR61.5mn. (Tadawul) Sipchem announces scheduled periodic maintenance shutdown of IMC plant – Saudi International Petrochemicals Company (Sipchem) is planning to shut down the International Methanol Company (IMC) plant for scheduled preventive maintenance in accordance with necessary standards in addition to performing significant turnaround and development in some essential parts of the plant. This shutdown, which was already listed in as part of the company business plan for the year of 2015, is expected to last for six weeks starting from November 1, 2015. The financial impact of the shutdown will be announced, along with the conclusion of the activity when it is completed, which will also be reflected in 4Q2015 results. The company has taken all necessary precautions to ensure its commitment toward its customers and without interruption of all of its supply agreements during this period. Sipchem owns 65% of IMC's capital, whereas a group of Japanese companies owns the remaining 35%. (Tadawul)

- 7. Page 7 of 9 City Cement BoD recommends SR189.2mn dividend – The City Cement Company board of directors (BoD) has recommended the distribution of 10% dividend (SR1 per share) amounting to SR189.2mn for the three quarters of 2015. Shareholders, who are registered in the registers of the Securities Depository Center (Tadawul) on November 1, 2015, will be eligible to receive the dividend. The dividend will be distributed on November 11, 2015. (Tadawul) BCIC gets SAMA approval for electronic sales of insurance products – Buruj Cooperative Insurance Company (BCIC) has obtained the Saudi Arabian Monetary Agency’s (SAMA) approval for electronic sales of insurance products via the company's website. The products include motor insurance (third party, comprehensive), individual medical insurance, travel insurance, medical malpractice insurance, householders insurance (fire, theft) and marine cargo insurance. (Tadawul) Wala’a discloses use of rights issue proceeds – Saudi United Cooperative Insurance Company (Wala’a) has said that gross proceeds from its rights issue, which had happened in May 2015, amounted to SR240mn and net SR230.1mn, after deducting direct and indirect expenses of SR9.9mn. An amount of SR20mn has been added to the statutory deposit consequent to the capital increase, while the remaining proceeds of SR210.1mn have been invested in short-term deposits. (Tadawul) Bahri announces expiry of MoU with Saudi Aramco, Sembcorp – The National Shipping Company of Saudi Arabia (Bahri) has said that the MoU with Saudi Arabian Oil Company (Saudi Aramco) and Singapore-based Sembcorp Marine has expired on October 29, 2015, without any financial commitments. The MoU was to develop an international maritime yard for shipbuilding and offshore manufacturing. The parties intend to continue their discussion and sign a new MoU or extend the expired MoU. Bahri will make an announcement when it signs the MoU or if any material development takes place. (Tadawul) S&P downgrades Saudi Arabia on oil price slide – Standard & Poor's (S&P) has lowered its rating on Saudi Arabia’s long-term foreign and local currency sovereign credit to ‘A plus/A-1' from 'AA minus/A-1 plus’ after the Kingdom’s deficit rose sharply because of low oil prices. The ratings agency maintained its negative outlook on Saudi, saying that the decision reflected the challenges of reversing the marked deterioration in the Saudi fiscal balance. S&P said it could further lower the ratings within the next two years if Riyadh fails to achieve a sizable and sustained reduction in the general government deficit. It said Saudi had seen its deficit climb to 16% of GDP in 2015 as compared to 1.5% in 2014, because of the plunge in the price of crude oil, Riyadh’s main source of revenues. S&P said government could cut back on key investments and cut subsidies on power, water & fuel that could strengthen government finances in the coming years. But it also made reference to political risk, saying that intrafamily issues around succession could make the Kingdom’s policy decisions more challenging and difficult to predict. Meanwhile, the Saudi Ministry of Finance said that the decision by S&P to cut Saudi’s credit ratings is unjustified and ignores the strength of the Kingdom’s economy. The ministry added that the kingdom’s economy remained fundamentally strong, with the government’s net assets exceeding 100% of GDP, backed by large foreign exchange reserves. (Economic Times, Reuters) Saudi Aramco awards SR19.3mn EPC contract to ZSCC – Zamil Steel Construction Company (ZSCC), a subsidiary of Zamil Industrial Investment Company (Zamil Industrial), has been awarded an engineering, procurement & construction (EPC) contract worth around SR19.3mn by Saudi Arabian Oil Company (Saudi Aramco). The contract is for the construction of Saudi Aramco’s new exhibition pavilion at Al-Janadriyah Village located on the outskirts of Riyadh in the central region of Saudi Arabia. (GulfBase.com) Saudi cabinet defers decision on 40-hour work week – The Saudi Arabian Labour Ministry has said that the cabinet has deferred, for further study, a decision on limiting the private sector work week to 40 hours. It is part of proposals designed to push more Saudis into private employment. The ministry said the cabinet had delayed its decision in light of feedback from business owners. (Gulftimes.com) UAB CEO steps down – According to sources, United Arab Bank (UAB) Chief Executive Officer (CEO) Paul Trowbridge has left the lender. Deputy CEO Samer Tamimi has taken the reins as acting CEO of UAB, which is a majority-owned by the Commercial Bank of Qatar. Reportedly, Mr. Paul was asked by the board recently to step down. (Reuters) CBD 9M2015 net profit grows 2.8% YoY to AED915.3mn – Commercial Bank of Dubai (CBD) reported a net profit of AED915.34mn in 9M2015, up 2.8% YoY as compared to AED890.11mn in 9M2014. Operating income for 9M2015 was 9% YoY higher at AED1.77bn as compared to AED1.62bn for 9M2014, driven by higher fees & commission income. Operating profit had increased by 3.8% YoY in 9M2015 to AED1.14bn as compared to AED1.09bn for 9M2014. The bank’s total assets had stood at AED53.31bn at the end of September 30, 2015 as compared to AED46.88bn on December 31, 2014. Net Loans & advances & Islamic financing reached AED38.99bn, while customers’ deposits & Islamic deposits stood at AED37.41bn. Capital adequacy ratio had continued to be robust at 18.1. EPS had amounted to AED0.33 in 9M2015 versus AED0.32 in 9M2014. (DFM) Aramex targets $150mn worth acquisitions – Aramex CEO Hussein Hachem has said that the company has several acquisitions in the pipeline and is expecting to close deals worth around $150mn in the next two quarters. He said Aramex wanted to raise its market share in the competitive logistics and transportation sector. Hussein said Aramex had secured a $150mn credit line from a consortium of banks and could easily increase that amount, if needed. The acquisition will help Aramex to increase its presence in growth markets. (GulfBase.com) DIC management team plans Doncasters buyout – According to sources, Dubai International Capital’s (DIC) management team is in talks to buy out Doncasters Group Limited with financial backing from Blackstone Group LP and Goldman Sachs Group. DIC, which is controlled by Dubai Holding, may sell the engineering aerospace group to a group of investors led by the DIC executives for as much as $2bn. The investment units of Blackstone and Goldman as well as AlpInvest Partners, an arm of Carlyle Group LP, are backing the transaction. Reportedly, the backers will partner with the DIC management team, led by Chief Executive Officer David Smoot, and hold an interest in a vehicle that will contain Doncasters, which is DIC’s largest remaining asset. They may also provide capital for future investments. The managers plan to work on splitting Doncasters, which operates in the US, Europe and Asia, and sell the operations piecemeal rather than as a whole after the transaction. The group has owned Doncasters since a 2005 buyout from Royal Bank of Scotland Group, which valued the company at $1.1bn. (Bloomberg) CBK assets drop 5.7% in August – The Central Bank of Kuwait’s (CBK) Economic Research Department, in its Monthly Monetary Statistics, reported that total private sector dinar deposits in local banks in August 2015 had dipped by 2.2% to KD28.92bn. Deposits in foreign currency had also shed 2.2% of their value to KD4.04bn, bringing the total value of the private sector’s deposits to KD32.97bn. The net value of foreign currency assets with local banks had inched down by 0.2% in August 2015 to a total of

- 8. Page 8 of 9 KD8.18bn. Moreover, the value of the CBK’s assets had dropped by 5.7% in August to KD8.27bn while the net value of bank’s foreign assets declined by 12.8% to KD8.18bn. (GulfBase.com) Bank Dhofar, Bank Sohar appoint consultants for merger process – Bank Dhofar and Bank Sohar have announced that they have appointed legal and financial consultants for due diligence in the process of their merger. This is in accordance with the non-binding MoU signed between both banks earlier in 2015. (MSM) Moody’s assigns definitive A1 rating to Oman’s maiden Sukuk – Oman’s maiden sovereign Sukuk issuance has been assigned a definitive rating of A1 by Moody’s Investors Service. The rating for these debt obligations follows the provisional rating assigned on October 5, 2015. Moody's noted that its Sukuk rating does not express an opinion on the structure's compliance with Shari’ah law. (GulfBase.com) BPCL, OOC in talks to sell 24% stake in Bina refinery – Bharat Petroleum Corporation Limited (BPCL) Chairman S. Varadarajan has said that foreign companies are in talks to buy a stake of up to 24% in the Bina refinery in India’s Madhya Pradesh state, which is jointly owned by BPCL and Oman Oil Company (OOC). He said, the expansion of the refinery, which has started to make money after quarters of losses, could cost $460mn and would be completed by 2018. The two owners want to boost the refinery’s capacity by around 30% from 120,00 barrels per day (bpd). BPCL and OOC could make a public share offer next year if a deal is not sealed. (Reuters) BisB reduces paid-up capital – Bahrain Islamic Bank (BisB) has reduced its paid-up capital by approximately 15.34% from BHD94.91mn to BHD80.35mn. Following the reduction, outstanding shares will be reduced to 803,472,454 from 949,070,234. This change was effective from October 29, 2015. (Bahrain Bourse)

- 9. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Inde x S&P Pa n Ara b S&P GCC 0.1% (0.3%) 0.1% 0.1% (0.1%) 0.0% 0.5% (0.4%) (0.2%) 0.0% 0.2% 0.4% 0.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,142.16 (0.3) (1.9) (3.6) MSCI World Index 1,705.80 (0.0) (0.0) (0.2) Silver/Ounce 15.55 (0.3) (1.8) (1.0) DJ Industrial 17,663.54 (0.5) 0.1 (0.9) Crude Oil (Brent)/Barrel (FM Future) 49.56 1.6 3.3 (13.6) S&P 500 2,079.36 (0.5) 0.2 1.0 Crude Oil (WTI)/Barrel (FM Future) 46.59 1.2 4.5 (12.5) NASDAQ 100 5,053.75 (0.4) 0.4 6.7 Natural Gas (Henry Hub)/MMBtu 1.94 (7.9) (14.4) (35.3) STOXX 600 375.47 0.4 (0.5) (0.2) LPG Propane (Arab Gulf)/Ton 45.00 2.3 5.6 (8.2) DAX 10,850.14 0.9 0.5 0.3 LPG Butane (Arab Gulf)/Ton 62.50 2.3 5.9 (4.6) FTSE 100 6,361.09 0.4 (0.6) (4.0) Euro 1.10 0.3 (0.1) (9.0) CAC 40 4,897.66 0.7 (0.5) 4.4 Yen 120.62 (0.4) (0.7) 0.7 Nikkei 19,083.10 1.1 1.8 8.2 GBP 1.54 0.8 0.7 (1.0) MSCI EM 847.84 0.2 (2.4) (11.3) CHF 1.01 0.2 (0.9) 0.7 SHANGHAI SE Composite 3,382.56 0.4 (0.4) 2.8 AUD 0.71 0.9 (1.1) (12.7) HANG SENG 22,640.04 (0.8) (2.2) (4.0) USD Index 96.95 (0.3) (0.2) 7.4 BSE SENSEX 26,656.83 (0.9) (3.5) (6.3) RUB 63.95 (0.7) 2.5 5.3 Bovespa 45,868.82 0.5 (2.7) (37.2) BRL 0.26 (0.2) 0.6 (31.3) RTS 845.54 0.7 (3.1) 6.9 138.9 111.6 108.1