QNBFS Daily Market Report March 10, 2019

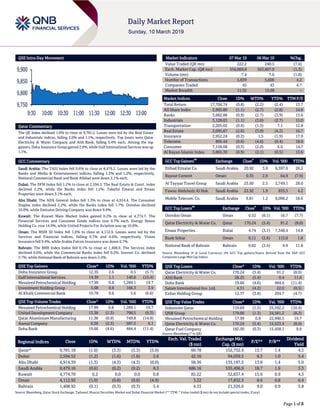

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index declined 1.0% to close at 9,781.2. Losses were led by the Real Estate and Industrials indices, falling 2.6% and 1.1%, respectively. Top losers were Qatar Electricity & Water Company and Ahli Bank, falling 5.4% each. Among the top gainers, Doha Insurance Group gained 2.6%, while Gulf International Services was up 1.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.6% to close at 8,479.2. Losses were led by the Banks and Media & Entertainment indices, falling 1.3% and 1.2%, respectively. National Commercial Bank and Bank Albilad were down 2.1% each. Dubai: The DFM Index fell 1.2% to close at 2,594.5. The Real Estate & Const. index declined 2.2%, while the Banks index fell 1.2%. Takaful Emarat and Emaar Properties were down 3.1% each. Abu Dhabi: The ADX General Index fell 1.3% to close at 4,914.4. The Consumer Staples index declined 2.2%, while the Banks index fell 1.7%. Ooredoo declined 10.0%, while Emirates Driving Company was down 9.9%. Kuwait: The Kuwait Main Market Index gained 0.2% to close at 4,774.7. The Financial Services and Consumer Goods indices rose 0.7% each. Energy House Holding Co. rose 14.9%, while United Projects For Aviation was up 10.0%. Oman: The MSM 30 Index fell 1.0% to close at 4,112.9. Losses were led by the Services and Financial indices, falling 0.7% and 0.6%, respectively. Vision Insurance fell 9.4%, while Arabia Falcon Insurance was down 6.7%. Bahrain: The BHB Index Index fell 0.1% to close at 1,408.9. The Services index declined 0.6%, while the Commercial Banks index fell 0.2%. Inovest Co. declined 3.7%, while National Bank of Bahrain was down 2.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 12.35 2.6 0.5 (5.7) Gulf International Services 14.39 1.1 140.6 (15.4) Mesaieed Petrochemical Holding 17.99 0.8 1,289.1 19.7 Investment Holding Group 5.08 0.8 166.3 3.9 Al Khalij Commercial Bank 10.78 0.6 5.6 (6.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 17.99 0.8 1,289.1 19.7 United Development Company 13.38 (1.3) 798.5 (9.3) Qatar Aluminium Manufacturing 11.38 (0.9) 749.8 (14.8) Aamal Company 9.38 (2.3) 587.5 6.1 Doha Bank 19.66 (4.6) 484.4 (11.4) Market Indicators 07 Mar 19 06 Mar 19 %Chg. Value Traded (QR mn) 222.2 240.5 (7.6) Exch. Market Cap. (QR mn) 556,069.8 563,607.9 (1.3) Volume (mn) 7.4 7.6 (1.8) Number of Transactions 5,839 5,606 4.2 Companies Traded 45 43 4.7 Market Breadth 11:32 13:28 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,704.74 (0.8) (2.2) (2.4) 13.7 All Share Index 2,993.80 (1.1) (2.7) (2.8) 14.6 Banks 3,682.88 (0.9) (2.7) (3.9) 13.6 Industrials 3,128.03 (1.1) (3.0) (2.7) 15.0 Transportation 2,205.02 (0.6) (1.3) 7.1 12.8 Real Estate 2,095.87 (2.6) (3.9) (4.2) 16.7 Insurance 2,952.24 (0.2) 1.5 (1.9) 17.9 Telecoms 895.44 (0.6) (4.6) (9.4) 18.9 Consumer 7,158.68 (0.3) (2.0) 6.0 14.7 Al Rayan Islamic Index 3,865.39 (0.9) (2.1) (0.5) 13.6 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Etihad Etisalat Co. Saudi Arabia 20.92 3.9 6,397.6 26.2 Raysut Cement Oman 0.35 2.9 64.9 (7.9) Al Tayyar Travel Group Saudi Arabia 25.60 2.5 2,749.1 28.0 Fawaz Abdulaziz Al Hok. Saudi Arabia 22.92 1.9 835.3 4.2 Mobile Telecom. Co. Saudi Arabia 9.81 1.2 8,096.2 18.6 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ooredoo Oman Oman 0.52 (6.1) 16.7 (7.7) Qatar Electricity & Water Co. Qatar 170.24 (5.4) 91.2 (8.0) Emaar Properties Dubai 4.74 (3.1) 7,348.4 14.8 Bank Sohar Oman 0.11 (2.6) 113.0 1.8 National Bank of Bahrain Bahrain 0.62 (2.4) 9.9 11.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Electricity & Water Co. 170.24 (5.4) 91.2 (8.0) Ahli Bank 28.25 (5.4) 0.4 11.0 Doha Bank 19.66 (4.6) 484.4 (11.4) Salam International Inv. Ltd. 4.31 (4.2) 22.0 (0.5) Ezdan Holding Group 12.37 (3.8) 204.7 (4.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 119.69 (1.5) 25,592.2 (10.4) QNB Group 179.00 (1.3) 24,581.2 (8.2) Mesaieed Petrochemical Holding 17.99 0.8 22,990.5 19.7 Qatar Electricity & Water Co. 170.24 (5.4) 15,523.4 (8.0) Qatar Fuel Company 182.50 (0.3) 15,458.1 9.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,781.18 (1.0) (3.3) (3.3) (5.0) 60.78 152,752.4 13.7 1.4 4.5 Dubai 2,594.52 (1.2) (1.6) (1.6) 2.6 42.16 94,039.5 8.3 1.0 5.4 Abu Dhabi 4,914.39 (1.3) (4.3) (4.3) (0.0) 58.36 135,197.3 13.8 1.4 5.0 Saudi Arabia 8,479.16 (0.6) (0.2) (0.2) 8.3 686.16 535,496.9 18.7 1.9 3.3 Kuwait 4,774.70 0.2 0.0 0.0 0.8 85.22 32,837.4 15.6 0.9 4.3 Oman 4,112.92 (1.0) (0.8) (0.8) (4.9) 3.22 17,832.5 8.6 0.8 6.4 Bahrain 1,408.92 (0.1) (0.3) (0.3) 5.4 4.53 21,326.6 9.0 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,750 9,800 9,850 9,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index declined 1.0% to close at 9,781.2. The Real Estate and Industrials indices led the losses. The index fell on the back of selling pressure from GCC shareholders despite buying support from Qatari and non-Qatari shareholders. Qatar Electricity & Water Company and Ahli Bank were the top losers, falling 5.4% each. Among the top gainers, Doha Insurance Group gained 2.6%, while Gulf International Services was up 1.1%. Volume of shares traded on Thursday fell by 1.8% to 7.4mn from 7.6mn on Wednesday. Further, as compared to the 30-day moving average of 8.7mn, volume for the day was 14.5% lower. Mesaieed Petrochemical Holding Company and United Development Company were the most active stocks, contributing 17.4% and 10.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change National Bank of Oman Moody's Oman ST-FBD/LT-FBD/ ST-LBD/LT-FCR/ ST-FCR/LT-DCR/ ST-DCR/LT-LBD/ ST/LT-CRA/ST- CRA P-3/Baa3/P-3/ Baa3/P-3/ Baa3/P-3/ Baa3/P-3/ Baa3(cr)/ P-3(cr) NP/Ba2/NP/Ba 1/NP/Ba1/NP/B a1/NP/Ba1(cr)/ NP(cr) Negative – Bank Dhofar Moody's Oman ST/LT-FBD/LT- LBD/ LT-CRA/ST- CRA/ ST-FBD/ST- LBD/LT-FCR/LT- DCR/ST-FCR/ST- DCR P-3/Baa3/Baa3/ Baa3(cr)/P-3(cr)/ P-3/P-3/ Baa3/ Baa3/ P-3/ P-3 NP/Ba2/Ba1/ Ba1(cr)/NP(cr)/ NP/NP/ Ba1/ Ba1/ NP/NP Negative – Bank Muscat Moody's Oman ST/LT-LBD/ST- LBD/ ABCA/LT- FCR/LT-CRA/ST- CRA/BCA/LT- DCR/LT-FBD/ST- FCR/ST-DCR P-3/ Baa3/ P-3/ baa3/ Baa2/ Baa2(cr)/ P- 2(cr)/ baa3/ Baa2/ Baa3/ P- 2/P-2 NP/ Ba1/ NP/ ba1/ Baa3/ Baa3(cr)/ P- 3(cr)/ ba1/ Baa3/ Ba2/ P- 3/P-3 Negative – HSBC Bank Moody's Oman LT-CRA/ST- CRA/LT-FCR/LT- DCR/ST-FCR/LT- FBD/LT-LBD/ST- DCR/ST-FBD/ST- LBD Baa2(cr)/ P- 2(cr)/ Baa2/Baa2/P-2/ Baa3/ Baa3/ P- 2/ P-3/ P-3 Baa3(cr)/ P- 3(cr)/ Baa3/Baa3/P-3/ Ba2/ Ba1/ P- 3/NP/NP Negative – Bank Sohar Moody's Oman LT-FBD Ba1 Ba2 Negative – Investcorp Bank CI Bahrain SR 4 3 – – Source: News reports (* LT – Long Term, ST – Short Term, FBD – Foreign Bank Deposits, LBD – Local Bank Deposits, CRA – Counterparty Risk Assessment, FCR – Foreign Counterparty Risk Rating, DCR – Domestic Counterparty Risk Rating, ABCA – Adjusted Baseline Credit Assessment, BCA –Baseline Credit Assessment, SR – Support Rating, NP – Not Prime) Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Filing and Packing Materials Manufacturing Co.* Saudi Arabia SR 163.5 6.4% -2.4 – -3.1 – Taiba Holding Co.* Saudi Arabia SR 443.2 -3.0% 162.4 -22.5% 64.4 -55.9% AWTAD Dubai AED 0.0 – 0.0 – -3.5 – Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 34.68% 28.60% 13,513,428.24 Qatari Institutions 21.38% 26.73% (11,889,937.85) Qatari 56.06% 55.33% 1,623,490.39 GCC Individuals 0.45% 0.61% (352,594.99) GCC Institutions 1.09% 5.00% (8,671,105.16) GCC 1.54% 5.61% (9,023,700.15) Non-Qatari Individuals 10.75% 8.39% 5,230,976.61 Non-Qatari Institutions 31.64% 30.67% 2,169,233.15 Non-Qatari 42.39% 39.06% 7,400,209.76

- 3. Page 3 of 8 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/07 US Department of Labor Initial Jobless Claims 2-March 223k 225k 226k 03/07 US Department of Labor Continuing Claims 23-February 1755k 1772k 1805k 03/07 EU Eurostat GDP SA QoQ 4Q2018 0.2% 0.2% 0.2% 03/07 EU Eurostat GDP SA YoY 4Q2018 1.1% 1.2% 1.2% 03/08 France INSEE National Statistics Office Industrial Production MoM January 1.3% 0.1% 0.0% 03/08 France INSEE National Statistics Office Industrial Production YoY January 1.7% 0.5% -2.5% 03/08 France INSEE National Statistics Office Manufacturing Production MoM January 1.0% -0.2% 0.4% 03/08 France INSEE National Statistics Office Manufacturing Production YoY January 0.9% -0.2% -2.0% 03/08 Japan Economic and Social Research Institute GDP SA QoQ 4Q2018 0.5% 0.4% 0.3% 03/08 Japan Economic and Social Research Institute GDP Annualized SA QoQ 4Q2018 1.9% 1.7% 1.4% 03/08 Japan Economic and Social Research Institute GDP Nominal SA QoQ 4Q2018 0.4% 0.3% 0.3% 03/09 China National Bureau of Statistics CPI YoY February 1.5% 1.5% 1.7% 03/09 China National Bureau of Statistics PPI YoY February 0.1% 0.2% 0.1% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status IGRD Investment Holding Group 12-Mar-19 2 Due DBIS Dlala Brokerage & Investment Holding Company 17-Mar-19 7 Due ERES Ezdan Holding Group 18-Mar-19 8 Due MRDS Mazaya Qatar Real Estate Development 20-Mar-19 10 Due AKHI Al Khaleej Takaful Insurance Company 25-Mar-19 15 Due QGMD Qatari German Company for Medical Devices 27-Mar-19 17 Due Source: QSE News Qatar AKHI postpones its board meeting to March 25, 2019 – Al Khaleej Takaful Insurance Company (AKHI) announced that the company will postpone its board meeting to March 25, 2019 instead of March 12, 2019 to discuss and approve the audited financial statements for the financial year ended at December 31, 2018. (QSE) ERES postpones its board meeting to March 18, 2019 – Ezdan Holding Group (ERES) announced that the company will postpone its board meeting to March 18, 2019 instead of March 10, 2019 to discuss and approve the audited financial statements for the financial year ended at December 31, 2018. (QSE) QSE announces partnership deal with Ride Of Champions 2019 aiming to challenge Qatar’s listed companies to participate in the event – Qatar Stock Exchange (QSE) has partnered with the Ooredoo Ride of Champions to launch the QSE corporate challenge, to promote healthy living within the community, as part of its corporate social responsibility strategy. The Ooredoo Ride of Champions is the biggest mass-participation cycling event in Qatar and the pinnacle of the community events organized by Qatar cyclists, as it offers rides that suits all ages and experience levels. More than 1,500 participants are expected to take part in this year’s event which will be hosted by Qatar Foundation on March 15, 2019. This partnership agreement is the first of its kind in Qatar and will see QSE offering prizes to its most active companies during the Ride of Champions. (QSE) Nikkei Qatar financial center PMI declines to 48.5 in February – Nikkei and IHS Markit released Qatar’s February financial center Purchasing Managers’ Index (PMI), fell to 48.5 in February 2019 from 50.5 in January 2019 and 52.8 in February 2018. This is the lowest reading since November 2018. Output also declined to 48.2 in February from 48.3 in January. This is the lowest reading since November 2018 and second consecutive month of contraction. (Bloomberg) Expansion possible in petrochemicals, fertilizers, says Industries Qatar’s official – Industries Qatar’s investments abroad, if any, will be in petrochemicals or fertilizers according to a senior official. Qatar Petroleum’s Privatized Companies Affairs Manager, Mohamed Jaber A. Al-Sulaiti said petrochemicals or fertilizers may form the bulk of Industries Qatar’s investments abroad as part of the group’s plans to selectively invest in capital investment projects. As the holding entity of Qatar Petrochemicals, Qatar Fertiliser, and Qatar Steel, Industries Qatar is currently looking at projects across

- 4. Page 4 of 8 the globe, including many efficiency projects in terms of facilities expansion and capacity increase across the group, Al- Sulaiti said. “Our international investments, if any, are going to be limited to either petrochemicals or fertilizers,” he told reporters on the sidelines of Industries Qatar’s Annual General Assembly. In terms of steel production, Al-Sulaiti said the Qatari demand currently accounts for 60% of the capacity of Qatar Steel, while the remainder of the capacity is exported in the region and in some Southeast Asian markets. “When you look at Qatar Steel, this is where we are. We’re not expanding further in steel; our main focus is in petrochemicals and fertilizers,” he pointed out. (Gulf-Times.com) FocusEconomics: Qatar’s merchandise trade balance to scale up to $53.4bn in 2023 – Qatar’s merchandise trade balance will scale up over the next four years and account for $53.4bn in 2023. This year, it will account for $46.8bn, FocusEconomics stated in its latest country report. The current account balance (as a percentage of the country’s GDP) will be 7.8% in 2023 compared with 7% this year. Qatar’s GDP is expected to reach $218bn by 2023, it stated. By the year-end, Qatar’s GDP will total $178bn. The country's economic growth in terms of nominal GDP will reach 4.9% in 2023 from 4.4% by the end- 2019. Qatar’s fiscal balance (as a percentage of the country’s GDP) has been estimated at 3.4% in 2023 compared to -0.2% this year. The report has projected Qatar’s international reserves at $31.1bn this year and $35.2bn in 2023. The international reserves will cover 8.7 months of imports in 2023 as against 10.6 months this year. The country’s inflation, the report noted, will be around 2% in 2023 from 1.6% this year. Qatar’s unemployment rate (as a percentage of active population) will stay at a meager 0.2% in 2023, unchanged from this year. It has estimated Qatar's public debt (as a percentage of the country’s GDP) to be at 54% this year, 53.5% in 2020, 51.3% (2021), 49% (2022) and 46.7% in 2023. Qatar’s public debt will fall gradually until 2023, the report stated. FocusEconomics stated Qatar’s growth this year will likely be supported by higher hydrocarbon production and infrastructure projects. FocusEconomics panelists forecast 2.7% growth in 2019, which is down 0.2 percentage points from last month’s estimate, and 2.9% in 2020. (Gulf-Times.com) Number of building permits in Qatar falls 15% MoM in February – The number of building permits issued in February declined 15% MoM to reach 675, official data showed. The Planning and Statistics Authority (PSA) released the monthly statistics of building permits and building completion certificates issued by all municipalities of Qatar. The data is considered an indicator of the performance of the construction sector, which makes a significant contribution to the national economy. The data showed that municipality of Al Rayyan was at the top of the municipalities where the number of building permits issued was 192, 28% of the total issued permits, while Doha municipality came in second place with 149 permits (22%), followed by municipality of Al Wakrah with 105 permits (16%) and Al Da’ayen municipality with 82 permits, (12%). The rest of the municipalities issued following number of permits: Al Khor 51 permits (8%), Umm Salal 48 permits (7%), Al Sheehaniya 28 permits (4%) and Al Shamal 20 permits (3%). This decrease was clearly noted in most municipalities: Al Wakrah (42%), Al Sheehaniya (18%), Al Rayyan and Al Da’ayen (12%) each, Doha (3%). (Qatar Tribune) CEO: QFZA targets high-value global companies – Qatar Free Zones Authority (QFZA) is in the final rounds of discussions with a significant number of global high-value companies. QFZA’s primary targets are companies from key sectors like logistics, downstream chemicals sectors, healthcare, new energy and food processing, according to QFZA’s CEO, Lim Meng Hui. In the new energy sector, QFZA has already signed a MoU with China Harbour Engineering Co. (CHEC), a world- renowned company which represents the overseas arm for its parent company China Communications Construction Company Ltd. CHEC is planning to cooperate with its sister company, under CCCC, which produces new energy vehicles, on the potential investment in Qatar Free Zones. CHEC will establish a clean energy bus assembly factory in the Qatar Free Zones, Hui said. Hui said discussions with some global Fortune 500 companies are also in the final stage. He said a significant number of world class companies are in the pipeline. (Peninsula Qatar) S’hail AGM approves 16.5% dividend shares – S’hail Shipping and Maritime Services (S’hail) held its Annual General Meeting (AGM) recently and approved all the items on the agenda of the meeting, including the board’s proposal to declare 16.5% dividend shares to all its shareholders. S’hail is a private joint stock company incorporated on December 11, 2016. Within a short span of time, the company has acquired five ships ranging from 52k dwt to 75k dwt dry bulk carriers. At the meeting, the Chairman and Managing Director of the company, Mohamed Khalifa Al Sada, said, “The company has made remarkable progress in the field of maritime transport and the ships are engaged in transportation of dry bulk materials globally even after all doors of navigation within major gulf ports were closed for Qatari owned and/or flagged ships.” (Peninsula Qatar) Qatar, European Union aviation deal to yield EUR3bn benefits – The aviation agreement reached between Qatar and the European Union last week will create thousands of jobs and billions of economic benefits. The agreement is expected to generate economic benefits worth EUR3bn in the coming years. “According to an independent economic study undertaken on behalf of the European Commission, the agreement, with its robust fair competition provisions, could generate economic benefits of nearly EUR3bn over the period 2019-2025 and create around 2,000 new jobs by 2025,” the European Commission stated. After the deal, Qatar will have direct access to 28 European Union countries, 500mn customers and a large cargo market, according to the European Cockpit Association. (Peninsula Qatar) Qatar-US trade volume grows by 40% to QR21.81bn in 2018 – Accelerated efforts to boost bilateral trade and economic cooperation between Qatar and the US have yielded positive results. Both trade exchange and trade balance (from the exchange of goods) between Qatar and the US witnessed sharp jump in 2018. The US trade surplus with Qatar in 2018 surged to QR10.37bn, up nearly 49% compared to QR6.99bn registered in the previous year, official data released for the full year showed. However, the US trade surplus against Qatar, despite registering extraordinary growth in 2018 remained far low

- 5. Page 5 of 8 compared to QR13.32bn recorded in 2016, which was the all- time high. In 2016 the Qatar-US bilateral trade peaked to QR22.14bn. With the recently released trade exchange figures for the month of December 2018 by the US Census Bureau, the combined value of bilateral trade (in goods) between Qatar and the US, for the full year of 2018, reached QR21.81bn, showing a significant growth of nearly 40% compared to QR15.70bn for the corresponding period in 2017. When compared to 2016, the bilateral trade in 2018 almost reached that level, despite the regional and global challenges. (Peninsula Qatar) MoCI: Qatar, New Zealand bilateral trade reaches QR300mn in 2018 – Bilateral trade between Qatar and New Zealand reached QR300mn in 2018, the Ministry of Commerce and Industry (MoCI) stated. HE the Minister of Commerce and Industry Ali bin Ahmed Al-Kuwari received in Doha, Fletcher Tabutu, New Zealand’s Parliamentary Under-Secretary for Foreign Affairs, who is currently visiting the country. At the meeting, opportunities available and steps needed to enhance bilateral trade were discussed. The two sides reviewed the bilateral relations between Qatar and New Zealand and discussed aspects of joint cooperation, particularly in trade, investment and industry, and means of enhancing and developing them in light of the ties between the two countries. The meeting reviewed investment opportunities available in all sectors, the legislation adopted by Qatar and the initiatives it launched to support the private sector. (Gulf-Times.com) International US weekly jobless claims fall; productivity improves – The number of Americans filing applications for unemployment benefits unexpectedly fell last week, pointing to strong labor market conditions despite signs that job growth was slowing. While other data showed an improvement in worker productivity in the fourth quarter, the trend remained sluggish. Labor costs continued to rise at a moderate pace in the last quarter, suggesting benign inflation pressures that support the Federal Reserve’s patient stance towards further interest rate increases this year. Initial claims for state unemployment benefits slipped 3,000 to a seasonally adjusted 223,000 for the week ended March 2, the Labor Department stated. Economists polled by Reuters had forecast claims would be unchanged at 225,000 in the latest week. The four-week moving average of initial claims, considered a better measure of labor market trends as it irons out week-to-week volatility, fell 3,000 to 226,250 last week, the lowest level in a month. (Reuters) ECB cuts growth, inflation forecasts – European Central Bank (ECB) slashed its growth and inflation forecasts for 2019 and lowered those for 2020 and 2021, acknowledging that Europe’s slowdown was longer and deeper than earlier thought. ECB’s President, Mario Draghi said that, unusually, the central bank had not changed its assessment that risks were balanced to the downside despite the policy changes. He said that was because, although decisions would increase the resilience of the Eurozone’s economy, it could not affect external factors such as rising protectionism and the still-uncertain course of Brexit. Moreover, ECB changed tack on its tightening plan, pushing out the timing of its first post-crisis rate hike until 2020 at the earliest and offering banks a new round of cheap loans to help revive the Eurozone’s economy. The bolder-than-expected move came as the US Federal Reserve and other central banks around the world are also holding back on rate hikes. It underlined how a global trade war, Brexit uncertainty and simmering debt concerns in Italy are taking their toll on economic growth across Europe. (Reuters) European Union’s trade Chief urges US to focus on industrials, cars in talks – European Union’s Trade Commissioner, Cecilia Malmstrom urged the US to negotiate removing tariffs on industrial goods, including vehicles, as a first step to rebuilding trust in their trade relationship before tackling thornier issues such as agriculture. “There is a lack of trust at this moment and that is why we’re proposing instead of increasing tensions between us, instead of having these tariffs, instead of saying that Europe is a security threat to the American economy, OK let’s rebuild that trust,” Malmstrom said. “If we start with industrial goods, which is much less complicated and which will be beneficial for both sides, we maybe can rebuild that trust,” she said, adding there’s no appetite in the EU right for a full- blown trade agreement with the US. Malmstrom said the European Union is willing to discuss autos in the negotiations, but she repeated the bloc wants farm products kept out of talks. The European Union still does not have a negotiating mandate, but Malmstrom said she hopes official discussions will start soon. (Bloomberg) Germany’s industrial orders post strongest drop in seven months – German industrial orders posted their biggest drop in seven months in January, a further sign that Europe’s largest economy had a subdued start to 2019, although December’s figure was revised to show a rise rather than the previously reported fall. Contracts for goods ‘Made in Germany’ were down by 2.6% on the month, Economy Ministry data showed, marking their steepest fall since June 2018 and confounding forecasts for a 0.5% increase. The figure for December was revised to an increase of 0.9% rather than the drop of 1.6% announced a month ago. The Federal Statistics Office put the revision down to large orders for December being reported late. Separate data from the VDMA engineering association published showed contracts in that sector has declining by 9% on the year in January as bookings from the Eurozone tumbled by 22%. (Reuters) QNB Group: ASEAN set to outperform other key EMs in growth, overall dynamism – Buffered by relatively strong external positions, the Association of Southeast Asian Nations (ASEAN) countries are set to outperform other key emerging markets in terms of both growth and overall dynamism, QNB Group stated in an economic commentary. With a more dovish US Federal Reserve (Fed) and positive developments in global trade disputes, emerging markets (EM) have benefited from a substantial recovery in risk sentiment. However, recent gains can easily be reversed should major global risks materialize, including resurgence in US-China trade jitters, an unexpected tightening by the Fed or a hard landing in China, QNB Group stated. New bouts of external pressure on vulnerable EM would be expected to follow any sudden reversal in risk sentiment. In this sense, it is ever more important to track and analyze the leading indicators of external vulnerability in key EM. QNB Group’s analysis delves into external financing requirements and foreign exchange liquidity positions of the four largest

- 6. Page 6 of 8 economies of the ASEAN – Indonesia, Thailand, Malaysia and the Philippines – drawing conclusions about their resilience to external shocks. (Gulf-Times.com) Japan’s fourth-quarter GDP revised up as investment rebounds but trade clouds outlook – The Japanese economy grew faster than initially estimated in the fourth quarter as capital investment staged a quick recovery from a series of natural disasters in the previous quarter. However, despite the upward revision to growth, economists are likely to temper their optimism on the outlook given disappointing data on exports and factory output and with the economy expected to weaken due to the Sino-US trade war. Japan’s GDP rose an annualized 1.9% in October-December, more than the initial estimate of a 1.4% expansion and the median estimate for a 1.8% increase, data from the Cabinet Office showed. That followed a revised 2.4% annualized contraction in the third quarter, which was the biggest decline in more than four years. Economists warn that capital expenditure and overall economic growth are likely to weaken in the first half of this year as exports dwindle and inventories pile up due to a slowdown in global trade. (Reuters) China's February producer inflation flat amid lackluster demand, consumer inflation eases – China’s factory-gate inflation in February stayed flat from a month earlier, while gains in consumer prices slipped to the lowest level in more than a year as muted price pressures point to lackluster demand in the world’s second-largest economy. The inflation data is the latest indication of slowing demand in China, as factory surveys also point to dwindling export orders amid a protracted US-Sino trade war. Signs of deflation could prompt the government to roll out more aggressive measures to halt a sharper slowdown after growth dipped to nearly 30-year lows in 2018. China’s Producer Price Index (PPI) in February rose 0.1% on year, data from the National Bureau of Statistics (NBS) showed, the slowest pace since September 2016, and compared with a 0.1% increase in January. Analysts polled by Reuters had expected producer inflation would pick up to 0.2%. On a monthly basis, producer prices have already been falling over the past four months. In February, PPI fell 0.1%, moderating from a 0.6% decrease in January. (Reuters) China’s February foreign exchange reserves rise to six-month high, eases outflow worry – China’s foreign exchange reserves in February rose to their highest in six months as growing optimism over US-China trade talks buoyed the Yuan currency, easing worries about capital outflows from the slowing economy. While China’s economy continues to cool, analysts believe the risk of strong capital outflows has greatly diminished in recent months as the Yuan regained its footing and foreign investors piled back into the country’s battered stock markets. Chinese foreign exchange reserves, the world’s largest rose by $2.26bn in February to $3.090tn, central bank data showed, marking the highest level since August 2018. Economists polled by Reuters had expected reserves would fall $920mn to $3.087tn. (Reuters) Regional IATA: Middle East airlines’ freight volumes contracts 4.5% in January – Middle Eastern airlines’ freight volumes contracted 4.5% in January compared to the corresponding period in 2018, International Air Transport Association (IATA) stated in a report. Capacity increased by 4.1% and seasonally-adjusted international air cargo demand, which trended upwards for the past three months helped by stronger trade to and from Europe and Asia, has started to decline, the report stated. IATA’s data for global air freight markets showed that demand, measured in freight ton kilometers (FTKs), decreased 1.8% in January 2019, compared to the same period in 2018. This was the worst performance in the last three years. Freight capacity, measured in available freight ton kilometers (AFTKs), rose by 4.0% YoY in January 2019. This was the eleventh month in a row that capacity growth outstripped demand growth. (Gulf-Times.com) GCC IT spend is projected to rise average 2.8% this year, says researcher – Spending on “disruptive” technologies in the Gulf Co-operation Council (GCC) region will increase this year, and IT budgets in the GCC are projected to rise, on average, by 2.8%, Vice President and Research Analyst at Gartner, Partha Iyengar said. Artificial intelligence (AI) is identified as the number one game-changing technology in 2019 by 38% of GCC CIOs. Data analytics is at number two, identified by 22% of respondents. “There are some interesting use cases of AI emerging in the market,” he said. “Cybersecurity is, today, a given and is the responsibility of the CIO; 44% of GCC CIOs are accountable for cybersecurity in their organization,” he added. The survey also found that 86% of GCC respondents have already deployed cybersecurity or plan to do so in the next 12 months, which is an increase of 26 percentage points YoY. However, cybersecurity is still seen predominantly as a “technology” issue within the GCC. “CIOs need to work with their business stakeholders to sensitize them to the fact that cybersecurity is very much a ‘business risk’-related issue and give it the required focus and importance,” he said. (Gulf-Times.com) Saudi Real Estate Refinance Company plans $2.3bn in Sukuk sales – Saudi Arabia’s first mortgage-refinancing firm is set to debut in the bond market with a plan to raise as much as $2.3bn this year as the Kingdom seeks to expand home ownership. The Saudi Real Estate Refinance Company (SRC), the state-run equivalent of Fannie Mae and Freddie Mac in the US, will tap domestic and international debt buyers with Islamic bonds, CEO, Fabrice Susini said. The refinance firm aims to fund around 80% of its assets with debt or loans, he added. Saudi Arabia has taken a number of measures to increase home construction and lending as it seeks to overcome one of the world’s lowest mortgage penetration rates. For years, the absence of financing firms like SRC limited the ability of banks to expand their mortgage books amid central-bank limits on loans to any one sector. The refinancing firm, which started in end of 2017, has been operating for one year. It was started with SR5bn in capital and has been working closely with the government’s Real Estate Development Fund. The fund also provides interest-free loans to middle and low-income citizens through commercial banks. The SRC plans to sell Sukuk domestically in the next two quarters and will tap international investors by the end of the year, he said. (Bloomberg) Saudi Arabia discovered large quantities of gas, Al-Falih says – Saudi Arabia has discovered large quantities of natural gas in the Red Sea, Saudi Arabian Energy Minister, Khalid Al-Falih said. Saudi Aramco will intensify the exploration during next

- 7. Page 7 of 8 two years after confirming the feasibility of the project. (Bloomberg) Saudi Aramco-Sabic deal will be announced 'within weeks' – Saudi Aramco and petrochemicals maker Saudi Basic Industries Corp. (SABIC) are at a “fairly advanced” stage of planning for the proposed acquisition and the Saudi Aramco bond issuance to finance the deal, Energy Minister, Khalid Al-Falih said. Saudi Aramco board will be briefed on the SABIC acquisition this month. Saudi Aramco could stagger payments for SABIC deal, the oil minister had said in January. Saudi Arabia is also looking at acquiring natural gas assets in the US, Russia and Australia; is also interested in Africa. (Bloomberg) Saudi Arabia’s Energy Minister reiterates Saudi Aramco IPO to happen within two years – Saudi Aramco’s Initial Public Offering (IPO) is expected to happen within two years, the Saudi Arabian newspaper Okaz reported, citing Saudi Arabian Energy Minister, Khalid Al-Falih. He had said in January that Saudi Aramco will be listed by 2021. (Reuters) Saudi Arabia says no current plans to raise Islamic tax for private sector – Saudi Arabia has no current plans to increase Islamic tax levels in the private sector, the General Authority of Zakat and Tax stated. Bloomberg had reported that Saudi Arabia is considering raising the tax to as much as 20% from the current 10%. “The authority wished to clarify that there are no current plans to increase the Zakat levels in the private sector,” the authority stated. Its body stated that it has started a public consultation on draft regulations for Islamic tax (Zakat) after making some amendments to the content of the regulation. “All stakeholders have responded positively and stated their comments which the Authority has received with interest and has expressed its appreciation for their input,” it stated. It also stated that the authority has made settlements with a number of financial institutions and others regarding their pending Zakat positions. (Reuters) Emirates NBD hires banks for Dollar bond issue – Emirates NBD has hired banks to arrange fixed income investor meetings before a potential issue of US Dollar-denominated bonds, a document issued by one of the banks showed. The bank has mandated BNP Paribas, Emirates NBD Capital, First Abu Dhabi Bank (FAB), HSBC, Nomura and Standard Chartered Bank. The planned deal will be of benchmark size, which generally means at least $500mn, and will be an Additional Tier 1 perpetual bond not callable for six years. Perpetual bonds are similar to an equity instrument in the fact that they have no maturity. (Reuters)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on March 8, 2019) Source: Bloomberg (*$ adjusted returns, # Market was closed on March 8, 2019) 45.0 70.0 95.0 120.0 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 QSEIndex S&P Pan Arab S&P GCC (0.6%) (1.0%) 0.2% (0.1%) (1.0%) (1.3%) (1.2%)(1.5%) (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,298.40 1.0 0.4 1.2 MSCI World Index 2,051.12 (0.5) (2.2) 8.9 Silver/Ounce 15.34 2.1 0.9 (1.0) DJ Industrial 25,450.24 (0.1) (2.2) 9.1 Crude Oil (Brent)/Barrel (FM Future) 65.74 (0.8) 1.0 22.2 S&P 500 2,743.07 (0.2) (2.2) 9.4 Crude Oil (WTI)/Barrel (FM Future) 56.07 (1.0) 0.5 23.5 NASDAQ 100 7,408.14 (0.2) (2.5) 11.6 Natural Gas (Henry Hub)/MMBtu 2.92 0.0 (8.6) (8.5) STOXX 600 370.57 (0.8) (2.1) 7.7 LPG Propane (Arab Gulf)/Ton 68.37 (0.9) 2.6 7.7 DAX 11,457.84 (0.4) (2.3) 6.6 LPG Butane (Arab Gulf)/Ton 70.25 (1.1) (3.4) 0.4 FTSE 100 7,104.31 (1.6) (1.5) 7.8 Euro 1.12 0.4 (1.1) (2.0) CAC 40 5,231.22 (0.6) (1.7) 8.5 Yen 111.17 (0.4) (0.6) 1.3 Nikkei 21,025.56 (1.5) (1.9) 4.5 GBP 1.30 (0.5) (1.4) 2.0 MSCI EM 1,030.13 (1.3) (2.0) 6.7 CHF 0.99 0.3 (0.9) (2.6) SHANGHAI SE Composite 2,969.86 (4.5) (1.0) 21.9 AUD 0.70 0.4 (0.5) (0.1) HANG SENG 28,228.42 (1.9) (2.0) 9.0 USD Index 97.31 (0.4) 0.8 1.2 BSE SENSEX 36,671.43 0.0 3.1 1.2 RUB# 66.28 0.0 0.5 (4.9) Bovespa 95,364.85 1.4 (1.4) 8.6 BRL 0.26 0.0 (2.4) 0.3 RTS# 1,179.58 0.0 (0.7) 10.4 97.0 91.4 81.1