QNBFS Daily Market Report April 02, 2017

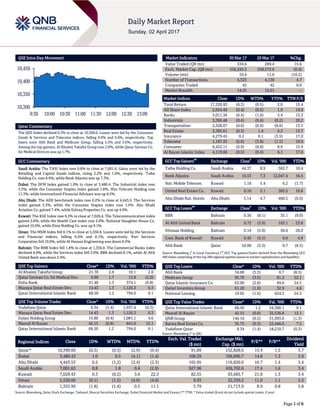

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 10,390.6. Losses were led by the Consumer Goods & Services and Telecoms indices, falling 0.9% and 0.6%, respectively. Top losers were Ahli Bank and Medicare Group, falling 5.3% and 3.6%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 2.8%, while Qatar German Co. for Medical Devices was up 1.7%. GCC Commentary Saudi Arabia: The TASI Index rose 0.8% to close at 7,001.6. Gains were led by the Retailing and Capital Goods indices, rising 2.2% and 1.9%, respectively. Taiba Holding Co. rose 8.9%, while Bank Aljazira was up 7.3%. Dubai: The DFM Index gained 1.0% to close at 3,480.4. The Industrial index rose 3.3%, while the Consumer Staples index gained 1.8%. Hits Telecom Holding rose 11.3%, while International Financial Advisors was up 8.5%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,443.5. The Services index gained 3.3%, while the Consumer Staples index rose 1.5%. Abu Dhabi Aviation Co. gained 7.4%, while Eshraq Properties Co. was up 4.9%. Kuwait: The KSE Index rose 0.3% to close at 7,029.4. The Telecommunication index gained 2.6%, while the Health Care index rose 2.0%. National Slaughter House Co. gained 10.0%, while Zima Holding Co. was up 9.1%. Oman: The MSM Index fell 0.1% to close at 5,550.6. Losses were led by the Services and Financial indices, falling 0.4% and 0.1%, respectively. Port Services Corporation fell 10.0%, while Al Hassan Engineering was down 8.5%. Bahrain: The BHB Index fell 1.8% to close at 1,356.0. The Commercial Banks index declined 4.0%, while the Services index fell 2.0%. BBK declined 8.1%, while Al Ahli United Bank was down 5.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 21.70 2.8 10.1 2.8 Qatar German Co. for Medical Dev. 9.90 1.7 15.8 (2.0) Doha Bank 31.40 1.3 374.1 (6.8) Mazaya Qatar Real Estate Dev. 14.43 1.3 1,126.3 0.3 Qatar International Islamic Bank 68.50 1.2 794.0 9.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.34 (1.4) 1,937.4 (0.3) Mazaya Qatar Real Estate Dev. 14.43 1.3 1,126.3 0.3 Ezdan Holding Group 15.80 (0.4) 1,081.1 4.6 Masraf Al Rayan 42.15 (0.8) 841.0 12.1 Qatar International Islamic Bank 68.50 1.2 794.0 9.1 Market Indicators 30 Mar 17 29 Mar 17 %Chg. Value Traded (QR mn) 334.6 289.4 15.6 Exch. Market Cap. (QR mn) 556,345.3 558,573.6 (0.4) Volume (mn) 10.4 11.6 (10.2) Number of Transactions 4,323 4,130 4.7 Companies Traded 42 42 0.0 Market Breadth 14:25 15:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,220.93 (0.3) (0.5) 2.0 15.4 All Share Index 2,924.40 (0.4) (0.5) 1.9 14.9 Banks 3,011.36 (0.4) (1.0) 3.4 13.3 Industrials 3,300.48 (0.4) (0.4) (0.2) 20.2 Transportation 2,328.07 (0.0) (0.9) (8.6) 13.1 Real Estate 2,385.61 (0.3) 1.4 6.3 15.7 Insurance 4,279.45 0.2 0.1 (3.5) 17.0 Telecoms 1,187.35 (0.6) (3.8) (1.5) 19.9 Consumer 6,422.11 (0.9) (0.8) 8.9 13.9 Al Rayan Islamic Index 4,119.06 (0.5) (0.4) 6.1 17.0 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Taiba Holding Co. Saudi Arabia 44.37 8.9 562.7 10.4 Bank Aljazira Saudi Arabia 16.53 7.3 12,047.4 16.5 Nat. Mobile Telecom. Kuwait 1.18 5.4 6.2 (1.7) United Real Estate Co. Kuwait 0.10 5.1 383.5 10.6 Abu Dhabi Nat. Hotels Abu Dhabi 3.14 4.7 460.5 (0.9) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% BBK Bahrain 0.36 (8.1) 35.1 (9.0) Al Ahli United Bank Bahrain 0.72 (5.9) 163.1 23.8 Ithmaar Holding Bahrain 0.16 (5.9) 50.0 28.0 Com. Bank of Kuwait Kuwait 0.43 (5.5) 6.6 4.9 Ahli Bank Qatar 34.00 (5.3) 0.7 (8.5) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ahli Bank 34.00 (5.3) 0.7 (8.5) Medicare Group 95.70 (3.6) 81.2 52.1 Qatar Islamic Insurance Co. 63.00 (2.8) 49.0 24.5 Qatari Investors Group 61.20 (1.9) 32.9 4.6 National Leasing 19.05 (1.6) 624.3 24.3 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar International Islamic Bank 68.50 1.2 54,300.1 9.1 Masraf Al Rayan 42.15 (0.8) 35,536.8 12.1 QNB Group 146.10 (0.5) 31,993.0 (1.3) Barwa Real Estate Co. 35.75 (0.3) 23,446.0 7.5 Vodafone Qatar 9.34 (1.4) 18,210.7 (0.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,390.60 (0.3) (0.5) (2.9) (0.4) 91.89 152,828.0 15.4 1.5 3.7 Dubai 3,480.43 1.0 0.5 (4.1) (1.4) 108.29 106,896.7 14.8 1.3 3.9 Abu Dhabi 4,443.53 0.2 (1.2) (2.4) (2.3) 165.95 116,820.0 16.7 1.4 5.4 Saudi Arabia 7,001.63 0.8 1.8 0.4 (2.9) 927.96 436,702.6 17.4 1.6 3.4 Kuwait 7,029.43 0.3 (0.2) 3.6 22.3 82.55 93,685.7 21.8 1.3 3.4 Oman 5,550.60 (0.1) (1.5) (4.0) (4.0) 9.93 22,330.2 11.0 1.1 5.3 Bahrain 1,355.99 (1.8) (1.4) 0.5 11.1 5.79 21,713.9 8.9 0.8 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,300 10,350 10,400 10,450 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.3% to close at 10,390.6. The Consumer Goods & Services and Telecoms indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Ahli Bank and Medicare Group were the top losers, falling 5.3% and 3.6%, respectively. Among the top gainers, Al Khaleej Takaful Group rose 2.8%, while Qatar German Co. for Medical Devices was up 1.7%. Volume of shares traded on Thursday fell by 10.2% to 10.4mn from 11.6mn on Wednesday. Further, as compared to the 30-day moving average of 13.2mn, volume for the day was 21.2% lower. Vodafone Qatar and Mazaya Qatar Real Estate Development were the most active stocks, contributing 18.7% and 10.9% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/30 US Bureau of Economic Analysis GDP Price Index 4Q2016 2.1% 2.0% 2.0% 03/30 US Bureau of Economic Analysis GDP Annualized QoQ 4Q2016 2.1% 2.0% 1.9% 03/30 US Department of Labor Initial Jobless Claims 25-March 258k 247k 261k 03/30 US Department of Labor Continuing Claims 18-March 2,052k 2,031k 1,987k 03/31 UK UK Office for National Statistics GDP QoQ 4Q2016 0.7% 0.7% 0.7% 03/31 UK UK Office for National Statistics GDP YoY 4Q2016 1.9% 2.0% 2.0% 03/30 EU European Commission Economic Confidence March 107.9 108.3 108 03/30 EU European Commission Industrial Confidence March 1.2 1.4 1.3 03/30 EU European Commission Services Confidence March 12.7 14 13.9 03/30 EU European Commission Consumer Confidence March -5 -5 -5 03/31 EU Eurostat CPI Estimate YoY March 1.5% 1.8% 2.0% 03/31 EU Eurostat CPI Core YoY March 0.7% 0.8% 0.9% 03/30 Germany German Federal Statistical Office CPI MoM March 0.2% 0.4% 0.6% 03/30 Germany German Federal Statistical Office CPI YoY March 1.6% 1.8% 2.2% 03/31 Germany Deutsche Bundesbank Unemployment Change (000's) March -30k -10k -14k 03/31 France INSEE CPI MoM March 0.6% 0.7% 0.1% 03/31 France INSEE CPI YoY March 1.1% 1.2% 1.2% 03/31 France INSEE PPI MoM February -0.2% – 1.0% 03/31 France INSEE PPI YoY February 3.9% – 3.6% 03/31 France INSEE Consumer Spending MoM February -0.8% 0.1% 0.6% 03/31 France INSEE Consumer Spending YoY February 0.5% 1.1% 1.7% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2017 results No. of days remaining Status QIBK Qatar Islamic Bank 16-Apr-17 14 Due UDCD United Development Company 17-Apr-17 15 Due ABQK Al Ahli Bank 17-Apr-17 15 Due QEWS Qatar Electricity & Water Company 17-Apr-17 15 Due DHBK Doha Bank 19-Apr-17 17 Due KCBK Al Khaliji 19-Apr-17 17 Due MARK Masraf Al Rayan 24-Apr-17 22 Due AKHI Al Khaleej Takaful Insurance 27-Apr-17 25 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 30.11% 40.10% (33,402,613.31) Qatari Institutions 30.24% 24.80% 18,217,704.26 Qatari 60.35% 64.90% (15,184,909.05) GCC Individuals 0.69% 0.45% 798,004.41 GCC Institutions 4.37% 0.53% 12,857,138.22 GCC 5.06% 0.98% 13,655,142.63 Non-Qatari Individuals 8.03% 7.57% 1,523,048.55 Non-Qatari Institutions 26.56% 26.56% 6,717.87 Non-Qatari 34.59% 34.13% 1,529,766.42

- 3. Page 3 of 6 News Qatar QSE announces trading suspension in the shares of MARK on April 2 – Qatar Stock Exchange (QSE) announced trading suspension in the shares of Masraf al Rayan (MARK) on April 2, 2017 due to its AGM being held on the day. (QSE) QSE index, QSE Al Rayan Islamic index and QSE All Share Index experience change in components – Medicare Group will replace Mazaya Qatar in QSE Index. Qatar First Bank will join QSE Al Rayan Islamic Index. Qatar First Bank will join QSE All Share Index and QSE Banks and Financial Services Index. (QSE) QIBK to disclose its 1Q2017 financial statements on April 16 – Qatar Islamic bank (QIBK) announced it would disclose its 1Q2017 financial statements on April 16, 2017. (QSE) AKHI to disclose its 1Q2017 financial statements on April 27 – Al-Khaleej Takaful Group (AKHI) announced its intent to disclose its 1Q2017 financial statements on April 27, 2017. (QSE) QISI’s AGM endorses all items on its agenda and approves the distribution of 35% cash dividend – Qatar Islamic Insurance Company (QISI) announced the results of the Ordinary General Assembly Meetings (AGM) held on March 29, 2017. The shareholders have approved the board of directors’ proposal to distribute to the shareholders cash dividends at the rate of 35% of the nominal value of the share equivalent to QR3.5 per share. (QSE) MDPS: CPI inflation in Qatar rose 2% YoY in 4Q2016 – Qatar’s consumer price index (CPI) inflation increased 2% YoY in 4Q2016, primarily on higher expenses towards transport, recreation, education, furnishing and housing and utilities. The CPI inflation, however, was down 0.1% compared to 3Q2016, mainly owing to lower prices for recreation as well as food and non-alcoholic beverages, according to the Ministry of Development Planning and Statistics (MDPS). The Transport index, which has a 14.59% weight in the CPI basket, surged 5.5% YoY in 4Q2016 but fell 0.1% QoQ. Personal transport became costlier by 14%, transport services by 3.4% and vehicles purchase by 1% YoY. The Recreation and Culture index, which has a 12.68% weight in the CPI basket, expanded 5.4% YoY in 4Q2016 but fell 2.3% QoQ. Package holidays became costlier by 6.1% YoY, recreation and culture services by 1.7%, and newspapers, books and stationary by 0.8%. (Gulf- Times.com) Qatar Museums, QDB team up to support SMEs across Qatar – Qatar Museums (QM) and Qatar Development Bank (QDB) have partnered to provide small and medium-sized enterprises (SMEs) with new business opportunities within each organization as part of efforts to support the private sector, including SMEs across Qatar. QM and QDB are calling on SMEs in the fields of hospitality, food & beverage, merchandising, retail, and creative products and design to develop and submit ideas on how they can add value to have the chance to join QM and QDB’s growing supply chain. QM will appoint SMEs in the related industry sectors, while QDB will design SME-friendly programs and assist in sourcing and selecting the SMEs to accommodate their needs. The partnership forms part of a nationwide strategy to promote and accelerate the development of the private sector in Qatar, and falls in line with the economic pillar of the Qatar National Vision 2030. (Gulf- Times.com) Msheireb awards JV contract to Teyseer & CCC – Msheireb Properties, developer of Msheireb Downtown Doha and Qatar’s leading sustainable real estate developer, announced, it has awarded the contract for major construction work of phase four to Teyseer Contracting Company and Consolidated Contractors Company (CCC). Spread over 132,000 square meters of gross floor area Phase Four is the last phase to complete Msheireb Downtown Doha. Featuring the development’s tallest building, phase four will consist of a major public plaza and 11 mixed-use buildings, which include commercial offices, residential and retail space, 5-star hotels, medical office building containing clinical and administrative spaces, and six car parking basements. This vibrant area will also offer residents and tenants access to Msheireb station, the largest Doha Metro station, which marks the crossing of Qatar Rail’s three metro lines, the Red, Green and Gold Lines. (Peninsula Qatar) Ministry: Fuel price in Qatar moderate – The Ministry of Energy and Industry said that revision of fuel prices in Qatar in line with international prices is intended to rationalize the use of fuel in the country and mitigate the negative environmental impacts. The ministry said in a statement that the prices of fuel in Qatar are on an average compared to the prices in other GCC states. The move is also aimed to curb fuel smuggling and ensure optimal use of the country’s resources. (Peninsula Qatar) International US consumer spending slows, but inflation is rising – US consumer spending barely rose in February amid delays in the payment of income tax refunds, but the biggest annual increase in inflation in nearly five years supported expectations of further interest rate hikes this year. The slowdown in consumer spending reported by the Commerce Department on March 31, 2017 is, however, likely to be temporary with consumer confidence at a more than 16-year high and a tightening labor market pushing up wage growth. The Commerce Department said consumer spending, which accounts for more than two- thirds of US economic activity, edged up 0.1%. That was the smallest gain since August and followed an unrevised 0.2% rise in January. Economists had expected a 0.2% increase. The government delayed the issuing of tax refunds this year as part of efforts to combat fraud. Spending last month was held back by a 0.1% dip in purchases of big-ticket items like automobiles. While unseasonably warm weather lowered households' heating bills, it restricted spending growth last month. (Reuters) German unemployment falls more than expected in March – German unemployment fell by more than expected in March, data from the Federal Labor Office showed, signaling that the robust labor market will continue to be the foundation for growth in Europe's largest economy. The seasonally adjusted jobless total fell by 30,000 to 2.556mn, the Labor Office said. That was more than the predicted fall of 10,000 in a Reuters poll. The adjusted unemployment rate fell to 5.8% from 5.9% in February, reaching the lowest level since German reunification in 1990. (Reuters)

- 4. Page 4 of 6 Caixin PMI: China March factory activity expands but at slower pace – Activity at China's factories expanded for a ninth straight month in March but at a softer pace as new export orders slowed, a private survey showed, raising questions about whether a recent pickup in global demand is losing steam. The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) fell to 51.2 in March, missing economist’s forecasts of 51.6 and down from February's 51.7. While the index was still well above the 50.0 mark which separates expansion from contraction on a monthly basis, the rates of growth in output, total new orders, input and output prices all slipped in March from the previous month. Growth in export orders slowed sharply, falling to a three-month low of 51.9 from 53.8 in February. The findings contrast with those of China's official factory survey, which showed activity grew the fastest in nearly 5 years in March. It also showed orders improved from home and abroad. (Reuters) Regional GCC's total bond & Sukuk issuances at $167.54bn – Kuwait Financial Centre “Markaz” has highlighted the trends pertaining to bonds and Sukuk issuances in the GCC region during 2016. The report stated that the aggregate primary issuance of bonds and Sukuk by GCC entities, including Central Banks Local Issuances (CBLI), GCC Sovereign and Corporate Issuances, totaled $167.54bn in 2016, a 41.20% increase from the total amount raised in 2015. A substantial increase in activities can be mainly attributable to sovereign issues by GCC governments as a response to plug the budget deficits due to persistently low oil prices. Saudi Arabia was the lead issuer in the GCC during 2016. During 2016, a total of $65.104bn was raised by the GCC central banks, namely by the Central Bank of Kuwait, Bahrain, Qatar, and Oman. The Central Bank of Kuwait raised the highest amount with $37.134bn, representing 57.04% of the total amount raised by CBLIs through 65 issuances. (Peninsula Qatar) Fitch downgrades nine Saudi Arabian Bank’s following sovereign downgrade – Fitch Ratings has downgraded the Long-Term Issuer Default Ratings (IDRs) of nine Saudi Arabian banks. The affected banks are Al Rajhi Bank (ARB), National Commercial Bank (NCB), Riyad Bank, SAMBA Financial Group (SAMBA), Arab National Bank (ANB), Alawwal Bank (AAB), Saudi Investment Bank (SAIB), Alinma Bank, and Bank Aljazira (BAJ). Fitch has also downgraded the Long-Term IDR of BAJ's wholly owned capital markets subsidiary Aljazira Capital (AJC). Fitch has also downgraded the Long-Term IDR of BAJ's wholly owned capital markets subsidiary Aljazira Capital (AJC). The IDRs of Banque Saudi Fransi (BSF) and Saudi British Bank (SABB), as well as the Viability Ratings (VRs) of all banks are unaffected by the sovereign rating action, as it is believed that the rationale for the sovereign downgrade is already considered in Fitch's assessment of the bank's standalone creditworthiness. The outlook on the Long-Term IDRs of all nine banks and AJC has been revised back to ‘Stable’ from ‘Negative’. The outlook on the Long-Term IDRs of BSF and SABB remains ‘Negative’ as their IDRs are driven by their respective VRs, which are unaffected. Following the downgrade of the sovereign rating, Fitch has revised downwards the Support Rating Floors (SRFs) of all 11 banks in Saudi Arabia by one notch. The Short-Term IDRs of ARB, NCB, Riyad and SAMBA have been affirmed at 'F1'. The Short-Term IDRs of AAB, Alinma, ANB, BAJ, SAIB and AJC have been affirmed at 'F2'. (Bloomberg) Saudi Aramco formally appoints banks to advice on share sale – According to sources, Saudi Aramco has formally appointed JPMorgan Chase & Co., Morgan Stanley and HSBC as international financial advisers for its initial public offering. The trio joins Moelis & Co. and Evercore, which have been appointed independent financial advisers. The company has also appointed Saudi Arabia's NCB Capital and Samba Capital as local advisers. (Reuters) Saudi Arabian top 20 brands valued at $37bn – The first BrandZ brand valuation ranking of Saudi Arabian brands by WPP and global research specialists Kantar Millward Brown, in partnership with Prince Mohammad bin Salman College of Business and Entrepreneurship (MBSC), showed that Saudi Telecom Company (STC) is the most valuable brand in the Kingdom worth $6.6bn. In the first ranking of its kind in Saudi Arabia, the findings show that the Top 20 brands are worth a combined brand value of $37bn. BrandZ brand valuation studies are the largest brand-building platform worldwide and the only consumer-focused source of brand equity knowledge and insight. (GulfBase.com) UAE healthcare market on track to top $28bn – A shift in demand for preventive care, a rise in specialist services and digital health will drive the UAE healthcare market to surge from the current $17bn to over $28bn by 2021. According to Mena Research Partners (MRP), more efficiently integrated healthcare solutions, as well as the high growth potential within specific medical device and pharmaceutical sub-sectors will be the other factors that will contribute to a massive 60% growth of the healthcare sector in the UAE in five years. Medical tourism and mandatory insurance will also contribute to the sector’s growth. The country aims to achieve a world- class healthcare system and become among the leading countries, not only regionally, but in the world in terms of quality of healthcare, according to the UAE Vision 2021 National Agenda. To achieve that, the National Agenda emphasizes the importance of preventive medicine and seeks to reduce lifestyle-related diseases to ensure a longer, healthier life for citizens. (GulfBase.com) Damac to approve dividends at AGM on April 16 – Damac Properties said it plans to hold its Annual General Meeting (AGM) on April 16, when shareholders will approve dividends for last year among other items on the agenda. The board had approved a distribution of cash dividend to shareholders amounting to 25% of the share capital or 25 fils per share. (GulfBase.com) Gulf Investment Corp acquires 35% stake in Sudair Pharmaceuticals – Gulf Investment Corporation which is based in Kuwait announced that it has successfully completed acquisition of a significant minority stake in Sudair Pharmaceuticals Company. Mohammad Abdulaziz Al-Fares, Head of Diversified Projects Division, Gulf Investment Corporation, said “In line with the strategy of Gulf Investment Corporation to invest in the healthcare and pharmaceutical sector, the corporation has entered as a major investor with a

- 5. Page 5 of 6 stake of 35% of the share capital of Sudair Pharmaceuticals Company, which will enhance the role of the corporation in the development of the specialized pharmaceutical industries sector in the region. In addition, this type of vital investments will effectively contribute to the support of drug security by providing these products of a sensitive nature to a critical segment of patients at competitive prices in accordance with the highest international standards.” (GulfBase.com) Bank Dhofar EGM approves increase of authorized capital to OMR500mn – The Extraordinary General Meeting (EGM) approved the increase of authorized capital from OMR220mn to OMR500mn and amendment of Articles of Association. Also approved was the update for the setup of the Euro Medium Term Note (EMTN) program. (GulfBase.com) Small industries get a boost from Sharakah – Sharakah’s total investment in Small and Medium Enterprises (SMEs) rose by OMR27,000 to OMR807,000, despite the challenges the economy is facing due to the financial crisis. Sharakah has supported 127 projects since establishment and the total investment in SMEs has exceeded OMR5.4mn. The majority of SMEs supported by Sharakah are performing well and a number of them have either opened additional branches or expanded their market reach. (GulfBase.com) Batelco AGM approves $110.3mn cash dividend – The Annual General Meeting (AGM) of Batelco Group approved a full year cash dividend of $110.3mn, at a value of 25 fils per share, for 2016. The meeting, held at Batelco’s Hamala headquarters, was attended by shareholders, company directors and executive management. Out of the approved dividend, 10 fils per share was already paid during 3Q2016 with the remaining 15 fils to be paid in the coming weeks. (GulfBase.com)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 QSE Index S&P Pan Arab S&P GCC 0.8% (0.3%) 0.3% (1.8%) (0.1%) 0.2% 1.0% (2.1%) (1.4%) (0.7%) 0.0% 0.7% 1.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,249.35 0.5 0.5 8.4 MSCI World Index 1,853.69 (0.3) 0.4 5.9 Silver/Ounce 18.27 0.8 2.8 14.7 DJ Industrial 20,663.22 (0.3) 0.3 4.6 Crude Oil (Brent)/Barrel (FM Future) 52.83 (0.2) 4.0 (7.0) S&P 500 2,362.72 (0.2) 0.8 5.5 Crude Oil (WTI)/Barrel (FM Future) 50.60 0.5 5.5 (5.8) NASDAQ 100 5,911.74 (0.0) 1.4 9.8 Natural Gas (Henry Hub)/MMBtu 3.10 0.9 6.2 (15.8) STOXX 600 381.14 0.1 0.2 7.0 LPG Propane (Arab Gulf)/Ton 61.25 0.2 6.5 (15.1) DAX 12,312.87 0.4 1.0 8.8 LPG Butane (Arab Gulf)/Ton 63.25 (1.6) 2.8 (45.9) FTSE 100 7,322.92 (0.1) 0.2 4.2 Euro 1.07 (0.2) (1.4) 1.3 CAC 40 5,122.51 0.6 1.0 6.8 Yen 111.39 (0.5) 0.0 (4.8) Nikkei 18,909.26 (0.7) (2.2) 3.7 GBP 1.26 0.7 0.6 1.7 MSCI EM 958.37 (1.1) (1.1) 11.1 CHF 1.00 (0.2) (1.1) 1.6 SHANGHAI SE Composite 3,222.51 0.6 (1.4) 4.8 AUD 0.76 (0.2) 0.1 5.8 HANG SENG 24,111.59 (0.8) (1.1) 9.3 USD Index 100.35 (0.1) 0.7 (1.8) BSE SENSEX 29,620.50 (0.2) 1.5 16.6 RUB 56.24 0.3 (1.2) (8.6) Bovespa 64,984.07 (0.3) 1.3 12.1 BRL 0.32 0.9 (0.4) 4.2 RTS 1,113.76 (2.1) (1.0) (3.3) 121.8 101.3 99.7