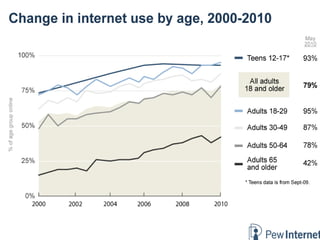

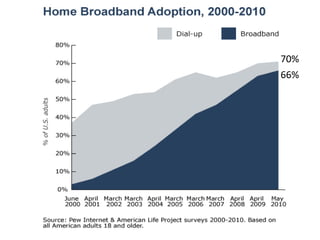

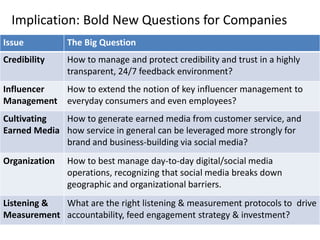

Pete Blackshaw and Lee Rainie presented on the changing consumer landscape driven by new technologies like the internet, broadband, mobile connectivity, and social networking. Some key points included:

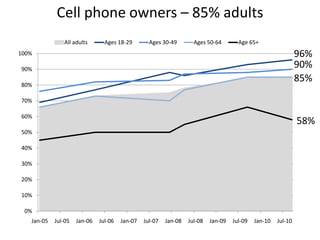

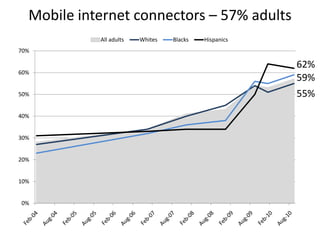

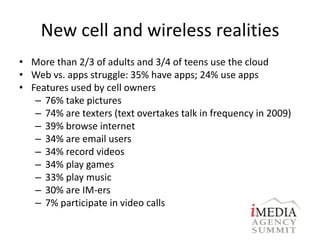

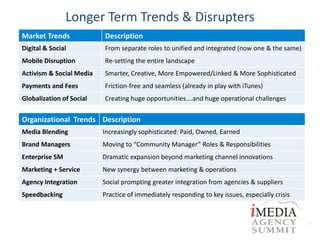

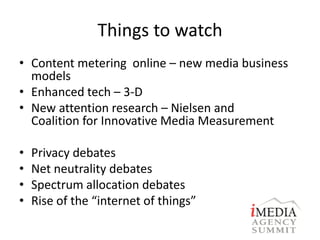

- 70% of Americans now have broadband internet and 66% own smartphones, fragmenting markets and metrics.

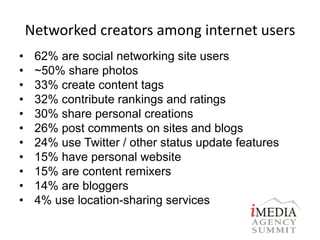

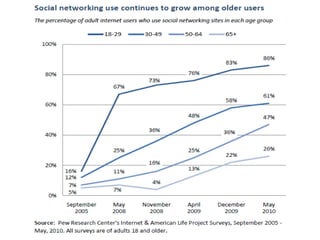

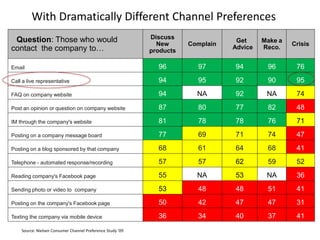

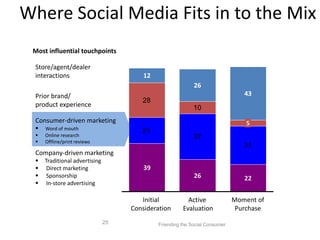

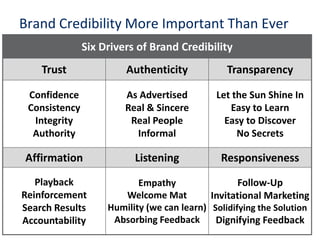

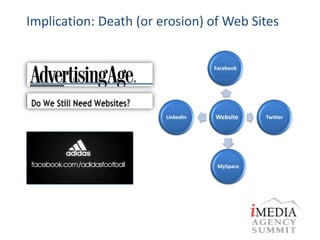

- Social media has led to an explosion in user-generated content and networked creators. Brands must navigate constant feedback across fragmented channels.

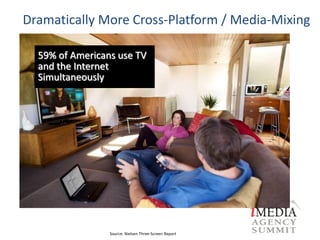

- Mobile connectivity allows information access anywhere, blending of media, and changed consumer habits centered around wireless devices.

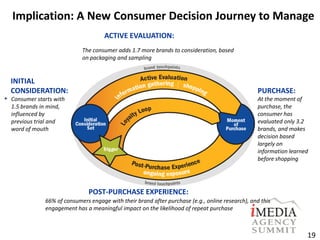

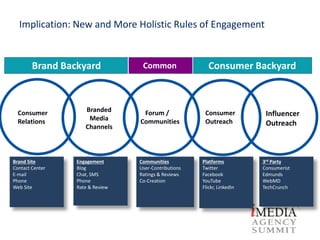

- Social networks now act as information evaluators, forums for action, and sentries through word-of-mouth, changing how brands should engage with consumers.

- Speakers