Forecasting Economic Activity using Asset Prices

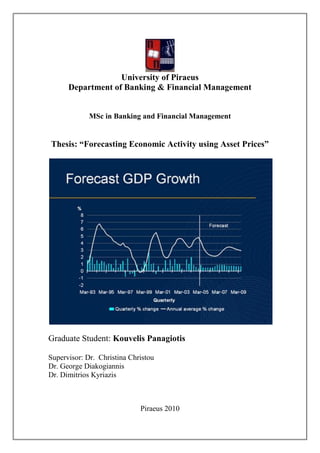

- 1. University of Piraeus Department of Banking & Financial Management MSc in Banking and Financial Management Thesis: “Forecasting Economic Activity using Asset Prices” Graduate Student: Kouvelis Panagiotis Supervisor: Dr. Christina Christou Dr. George Diakogiannis Dr. Dimitrios Kyriazis Piraeus 2010

- 2. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 2 To my sister

- 3. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 3 ABSTRACT This dissertation evaluates how well the asset prices and, in particular the term spread, the short rate and the real stock returns, forecast the GDP growth and the Industrial Production. The study is applied with data of seven countries (Canada, France, Germany, Italy, Japan, United Kingdom and United States) and it covers a period of time between 1966 until now. The research finds that the asset prices have forecasting power for one quarter/month but they lose their power when the forecasting horizon increases. Moreover, the paper evaluates that the real stock return is the best predictor of the GDP growth and that the short rate has more predictive content than the term spread. Keywords: Term spread, short rate, stock returns, output growth, forecasting horizon, out-of-sample statistics

- 4. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 4 Acknowledgements This work would not have been possible without the support and encouragement of my professor Dr. Christina Christou, under whose supervision I chose this topic and began the thesis. With her inspiration and her great efforts to explain things clearly and simply, she helped me to pursue the dissertation. Throughout my thesis-writing period, she provided encouragement, sound advice, good teaching and she was always willing to answer any of my questions. I am very grateful also to the PhD student Christos Bouras who offered me his advice and help. Above all I would like to sincerely thank my beloved family; my parents, Evangelos and Konstantina, and my sister, Lily, who supported me throughout the whole year.

- 5. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 5 PAGE Abstract 3 Acknowledgements 4 Table of Contents 5 CHAPTER 1 INTRODUCTION 6 CHAPTER 2 LITERATURE REVIEW 8 2.1 Stock Returns, output growth and/or inflation 8 2.2 Term Spread, output growth and/or inflation 13 2.3 Stock Returns and Stock volatility 19 CHAPTER 3 PREVIOUS METHODOLOGY 19 CHAPTER 4 METHODS FOR EVALUATING FORECASTING ABILITY 24 4.1 In-sample measures 24 4.2 Out-of-sample measures 25 CHAPTER 5 DATA 26 5.1 Data for the Industrial Production 26 5.2 Data for the GDP growth 27 CHAPTER 6 METHODOLOGY AND MODELS 29 6.1 Forecasting Models 29 6.2 Methodology 32 CHAPTER 7 RESULTS 34 7.1 Results from the in-sample tests 34 7.1.1 Industrial Production 34 7.1.2 GDP growth 37 7.2 Results from the out-of-sample tests 39 7.2.1 GDP growth 40 7.2.2 Industrial Production 45 CHAPTER 6 CONCLUSIONS 48 Appendix 51 References 56

- 6. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 6 1. INTRODUCTION Many papers were written and a lot of studies were executed in order to find methods and variables, which can help people to predict the output growth and the inflation. A lot of researchers consider that the asset prices are forward-looking variables and as a result of this behavior they constitute a great tool in the technique of forecasting. But, all those who are interested to create forecasts they need to know exactly which predictor is the most reliable, which predicts better the GDP growth than the inflation and which predicts better one quarter than two years ahead. The purpose of this paper is to evaluate whether the asset prices are good predictors of the output growth. The study is applied with data of seven countries (Canada, France, Germany, Italy, Japan, United Kingdom and United States) and it covers a period of time between 1966 until now. The predictive power of the candidate variables was evaluated with two methods. Using the Granger causality method with the whole sample (in-sample) we checked the causality between the dependent and the independent variable. Using the out-of-sample method we compared the mean square forecasting error (MSFE) of a benchmark model with the MSFE of the model, which involved the candidate variable. In our study the variables we used as candidate predictors are the term spread, the real stock returns and the short rate. This study can be useful for anyone who wants to understand the main methods of the forecasting and how the results of these methods are evaluated. This work is an effort to extend the research until nowadays using a large sample of data and to give the opportunity to someone to find a useful guide for the forecasting power of three main variables. Moreover, it tests in detail the predictive content of one predictor (the short rate) in which had not been given the appropriate emphasis in previous studies. The main results of this paper can be summarized as follows. First, using the whole sample we can check whether one indicator can be used as a predictor. But, although, the in-sample tests like the Granger causality test can be helpful and easy to make this work we cannot be sure about the reliability and the stability of this test. Second, although, most of the indicators prove to have a predictive power to forecast the output growth and the industrial production for forecasting period of one quarter or one month ahead, it seems to lose their ability to forecast when the forecasting

- 7. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 7 period increases. Third, one indicator appears to be a useful tool to predict a specific dependent variable for one country, but not for other countries. From the second and the third results we conclude that some asset prices have substantial and statistically significant predictive content for some countries and for some specific forecasting horizon. In this conclusion have Stock and Watson also been led in their paper in 2003. Finally, we can note more thoroughly for our candidate variables that for the forecasting period of one quarter or one month ahead the research found similar predictive power in the short rate and the real stock returns when they are used to predict the GDP growth. However, when the forecasting horizon extend the real stock returns provide the most accurate forecasts since their predictive content remains quite stable independent of the horizon. For the Industrial production our results showed that no variable is a good predictor since their predictive content becomes really low when the forecasting horizon increases. The paper is organized as follows. In section 2 we reviewed all the previous papers that deal with the link between asset prices and other variables. We tried to separate this section in parts in order to be easier for reading. Thus, we present all the papers that examined the link between stock returns/term spread/short rate with either the inflation or output growth. In section 3 we write in detail the previous methodology of some papers. In section 4 we present the basic methods for evaluating the predictive content. Section 5 presents all the data that have been used in the dissertation. In section 6 we describe the models, the variables and the methodology applied. In section 7 we present the results of our tests and finally the section 8 concludes.

- 8. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 8 2. LITERATURE REVIEW The current survey reviews papers that use asset prices (stock returns, yield curve, short rate and metal and oil prices….) as predictors of economic activity (industrial production, output growth and / or inflation). Forecasts using asset prices: 2.1 Stock returns, output growth and/or inflation. Output growth It has been observed that stock price changes represent the efficient source of new information. Thus, stock returns could become a useful tool with great ability to forecast output growth and / or inflation. This link between economic activity and stock prices was examined by several researchers. Mitchell and Burns (1938), Grossman and Shiller (1981) and Fischer and Merton (1984) are some of these. The stock market contains information helpful for predicting GNP. However, this forecasting ability is not as accurate as someone would want and any predictive content is decreased by including lagged output growth (Harvey 1989). In another study, Titman and Warga (1989) observed whether stock returns predict changes in interest rates. They use both short-term and long-term interest rates on stock returns lagged one and two months and they execute regressions to examine the results. Their results show that a positive relation between stock returns and interest rate changes exists, especially during the period of November 1979 and October 1982. Fama (1990) used in his test continuously compounded real returns and proved that monthly, quarterly and annual stock returns are greatly connected with the prospective production growth rates for 1953-1987. He noted that the degree of correlation increases with the length of the time period for which returns were calculated. In other words, he said that annual returns have more predictive ability than quarterly returns and these with its turn more than monthly returns. He, also, argued that the relation between current stock returns and future production growth reflects information about future cash flows, which is impounded in stock prices. Schwert (1990) examined the

- 9. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 9 constancy of the results that Fama found in his study using an additional 65 years of data. Following Fama, Schwert used the tests trying to explain the relation between real stock returns and future production growth rates. The fact that this relation is confirmed even with 100 years data makes Fama’s results more intense. All the above researches (Grossman and Shiller (1981), Fischer and Merton (1984), Harvey (1989), Titman and Warga (1989), Fama (1990), Cochrane (1991)) analyse data of several decades but their results are not influenced from the recent stock market boom which occurred in the early 1980s. Binswanger (2000) tested if the Fama’s results also hold up for the period from the early 1980s till now. He ran regressions for the whole period from 1953 to 1995 and compared the results to regressions over the subperiods from 1953 to 1965 and 1984 to 1995. He separated the periods like this because the first one is the first stock market growth period and the second one consists the second stock market growth period. He presented his results and he noted that the results of the regressions over the period from 1953 to 1995 seem to confirm the Fama’s findings (1990). But, things seem to change if one looks at the regressions which specifically cover the recent boom on the stock market since the early 1980s. Binswanger’s research presents strong evidence that a break occurred in the relation between stock returns and real activity since 1980s.And this result is confirmed even if someone uses monthly, quarterly or annual returns or whether real activity is symbolized by GDP growth rates or production growth rates. Moreover, one can see in the results that the information the stock returns contain in the last period (early 1980s until 1995) is different and it is not as significant as it used to be in previous periods. Binswanger confirmed this difference observing the correlation between the stock returns and the real activity. The correlation in the first period (1953 to 1965) is high, but the second high growth period (1984 to 1995) is characterized by an absence of this correlation. He saw that not even one of coefficients with a positive sign was significant in the equation. However, these conclusions cannot be certain because the subperiod 1984-1995 is a short period of time and the results that occurred can only be temporary. Additionally, Binswanger gave some possible explanations why this difference happened. Paulo Mauro (2000) examined the relation between the output growth and lagged stock returns in seventeen (17) advanced and eight (8) emerging countries. Data used for real stock returns and GDP were annual for at least 22 years. The results showed that the correlation for these two variables (GDP and stock returns) is positive and significant

- 10. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 10 for both emerging and advanced economies. Thus, stock returns contain useful content to predict the output growth for both types of economies. Furthermore, he found “stronger link in countries which have high market capitalization, a large number of listed domestic companies and initial public offerings, and English (or non- French) origin of the regulations governing the stock market”. Moreover, he has shown that elements of stock returns exist, which have the power to influence the strength of the correlation between output growth and lagged stock returns. Another one who has studied the ability that stock returns have to forecast the future economic activity is Owen Lamont (2001). He constructed economic tracking portfolios and with their help examined the relation between the asset prices and economic variables. According to Lamont economic tracking portfolio “is a portfolio of assets whose returns track an economic variable, such as expected output, inflation, returns”. The portfolios he constructed had unexpected returns with high correlation with economic activities that would occur in the future. He noticed in his out-of-sample results that it is possible an economic tracking portfolio to give forecasts for macroeconomic variables but also it can be a useful tool for hedging these activities. He also suggested that anyone can take daily returns and make an economic tracking portfolio which will give daily updates for the inflation, GDP and any other economic variable. Campbell et all. (2001) noted “that the variance of stock returns rather, than the returns themselves, could have predictive content for output growth”. Gilchrist and Leahy (2002) performed a number of experiments using three different models: a real business cycle model, a new Keynesian model and the RBC model to see the impact of shocks in real economy. Their conclusions were different from the once we have presented until now. They said that asset prices do not contain information valuable for forecasting. Stock and Watson (2003) executed an extensive research on this subject, using a large number of candidate variables and seven countries in their work. Thus, we consider that it is useful to describe in detail their paper. Their analysis was comprised of quarterly data on as many as 43 variables from each of seven developed economies (Canada, United States, the United Kingdom, France, Japan, Italy and Germany) over 1959-1999. They collected their data from the International Monetary Fund IFS database, the OECD database, the DRI Basic Economic Database and the DRI International Database. They summarized the basic econometric methods used in bibliography to measure the forecasting ability of economic predictors. They divided

- 11. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 11 them into two groups: the in-sample measure and the out-of-sample measure of predictive content. Furthermore, they reviewed all the papers that presented the relation between the asset prices and economic activity and divided into groups the indicators that can be useful predictors. Thus, they presented all the bibliography about the interest rates, the term spread and the output growth, the stock returns, the default spreads, the dividend yields and other financial variables (like housing prices, the consumption-wealth ratio). They checked the forecasting ability of all the variables using both the in-sample statistics and out-of-sample statistics. They applied the same process to make the out-of-sample forecasts for two periods of time, from 1971 to 1984 and from 1985 to 1999. After this analysis they ended up to four main conclusions. First of all, they noted that some asset prices have been useful tools for predicting output growth in some countries in some time periods. They do not have the same predictive content all the times for all the countries. As a result of this, one can say that no one knows a priori which predictor is required for which country and for which time period. For example in their paper they found that the term spread could be a useful predictor for the inflation of the USA in the first period of their study but not in the second period for the USA or not for the first period in the other countries. In their second conclusion, they noted that forecasts based on individual indicators are unstable. They found that an indicator which predicts better in the first out-of-sample period than an autoregression does, will not do the same in the second period. This instability indeed appears as the normal. These considerations suggest that one predictor forecasts successfully in one country or in one period, but not in the next one. In the third conclusion, they said that although some of the most common econometric methods of measuring the predictive content rely on in-sample significance tests, doing so provides little assurance to make stable conclusions. Indeed, in-sample Granger causality tests contain little or no information about the forecasting performance of one indicator. They found that although the Granger- causality test shows that some variables have forecasting power for all the countries the out-of-sample statistics show that this predictability does not remain for most of the countries. Finally, in the fourth conclusion, they noticed that a simple combination of forecasts improves the forecasting ability upon the benchmark model or the models

- 12. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 12 with individual predictors. For example, they showed that some simple combination forecasts – the median and the trimmed mean of the panel of forecasts – were stable and reliably outperformed a univariate autoregressive benchmark forecast. We will analyze the methodology that Stock and Watson used in their paper in the next section. The last paper that examined the relationship between the stock returns and economic activity is the paper of Andersson and D’Agostino (2008). In their study, they checked if the sectoral stock prices give more information for the economic activity than the traditional asset prices, such as the term spread, the dividend yield, the exchange rates and money growth, do. They used data for this study from 1973 until 2006 to execute a standard pseudo out-of-sample forecast exercise. The forecasting power of the candidate variables were evaluated in relation to an autoregressive model. Their study extends the literature of the forecasting in two new ways. First, they presented the sectoral prices as useful tools for predicting the GDP growth. Second, they compared the predictive content of asset prices before and after the introduction of the euro. Their research concluded in three main findings. They showed that for the time 1973-1999 the term spread is the best predictor (term spread produces the lowest MSFE) among all the candidate variables, but after that year sectoral stock prices became the leading indicator for predicting economic activity and especially for forecasting horizons above a year. The last finding was that the introduction of Euro improves the predictability of some variables. Inflation Not a lot of studies exist that they have examined the link between stock returns and another one economic variable, the inflation. Some of these have been presented earlier in this text. Titman and Warga (1989) suggested there is a possible relation between inflation and stock returns for the period 1979-1982.This matter was, also, analyzed by Lamont (2001) who noted that tracking portfolios can be useful for forecasting macroeconomic activities, like inflation. Goodhart and Hofmann (2000) used quarterly data from twelve developed economies for the period 1970-1998 and found that stock returns do not have significant predictive ability for inflation. Stock and Watson (2003) were led to the four same conclusions for the inflation as for the output growth, which previously have been pointed out. Deductively, we can say that

- 13. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 13 stock returns contain a great deal of information for the change of output growth, but on the other hand they provide almost no information for the inflation. 2.2 Term spread, output growth and/or inflation. Output growth Another indicator which can be used to predict economic variables is the term structure. According to Stock and Watson “term spread is the difference between interest rates on long and short maturity debt, usually government debt”. A lot of researchers investigated the relationship that term structure and economic activity have. Fama (1986), Laurent (1989) and Harvey (1989) were some of the first examiners that studied this matter. Stock and Watson (1989) and Gikas Hardouvelis and Arturo Estrella (1991) examined this relation for the United States, Harvey (1991) for the G-7 and Cozier and Tkacz (1994) for Canada. All the above concluded that the yield spread is one of the most useful indicators and has the ability to predict output growth for some countries. More specifically, Eugene Fama used in-sample statistics and found that the term spread has the ability to predict real rates and this ability strengthens for shorter periods. Gikas Hardouvelis and Arturo Estrella used quarterly data from 1955 through the end of 1988 so as to observe whether the dependent variable, which is GNP, has an important correlation with the term structure. They concluded that the slope of the yield curve has a more significant predictive content than the lagged output growth, the lagged inflation, the level of real short-term of interest rates and the index of indicators have. They indicated that the slope of the yield curve can forecast collective changes in real output for up to 4 years and consecutive marginal changes in real output up to a year and a half into the future. Hardouvelis and Estrella noted that the yield curve can predict all elements of real GNP like consumption, investment and consumer durables. They, also, noticed that this information can be helpful not only for private investors, but also for the Federal Reserve; however, they emphasized that it is not clear whether this predictive ability will continue to exist in the future. Thus, no one knows if the slope is quite useful to be adopted from Fed as a forecasting indicator. Plosser and Rouwenhorst (1994) studied data for three industrialized countries in order to confirm the relation between

- 14. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 14 term structure and output growth. They found that term structure is a great leading indicator for long-term economic growth. Furthermore, they proved that information, which is contained in the term structure about future output growth is independent from information about monetary policy. Joseph Haubrich and Ann Domborsky (1996) using out-of sample and in- sample statistics examined reasons that the yield curve might be a good predictor and compared this predictive skill with other traditional indicators. They used out-of sample statistics for the United States and they found their data from the Federal Reserve. They ran out-of-sample statistics for the period from 1961:Q1 through1995:Q3. They decided to take the 10-year CMT rate minus the secondary- market three-month Treasury bill rate for the spread. Moreover, they based on the previous work of Estrella and Mishkin (1997) to study how well the yield curve predicts the severity of recessions. Their results showed that the yield curve had a significant forecasting power over the years 1955 to 1985. But this predictive content has diminished since 1985 and they tried to explain the reasons for this phenomenon. To the same results with the latter had Michael Dotsey (1998) been led using both out-of-sample and rolling in-sample statistic. Dueker (1997) has noted that the yield spread has a significant power to forecast recessions in the future. Arturo Estrella and Frederic Mishkin (1997) studied in their paper the link between the yield curve and real activity. They took their sample from the major European economies (Germany, Italy, the United Kingdom and France) and they investigated whether the information revealed from the term structure is useful for the European Central Park. They checked the correlation between term spread and GDP but also the relation between short rate and economic activity and how useful is to use both variables in the regression. They concluded that in many cases the term structure has a significant forecasting content which has a time period of two years ahead for predicting real activity. Moreover, they checked if the term structure had an effect on the monetary policy actions. Their results showed that this relationship changed over time and as a consequence, also changed the relation between term structure and real activity. Taking into consideration all the above, Estrella and Mishkin noted that "a term spread is a simple and accurate measure that should be viewed as one piece of useful information which, along with other information (short rate), can be used to help guide European monetary policy”. Fabio Canova and Gianni De Nicolo (1997) using in sample Var statistics tried to explain the link between inflation, GDP and

- 15. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 15 term structure. They used the VAR model, because it is a good approximation to the GDP, and they examined data from three countries, the United States, Germany and Japan. They separated the results for each country and they concluded that the predictive content of the term structure has something to say for the forecasting economic activity although the power of this content is limited. Frank Smets and Kostas Tsatsaronis (1997) examined the ability of the yield curve to forecast the economic activity in Germany and the United States. Their results were focused in two points relative to the predictive content of the yield curve. First, they noticed that it is not possible to remain invariant over time because the factors, which determine the economic conditions, influence the yield curve; if these factors change the predictive content of the yield curve will also change. Secondly, the predictive content is not policy-independent. It gets different as the monetary policy alters. Thus, Smets and Tsatsaronis concluded that it is not secure to say that the relation between the output growth and the yield curve is stable over time. James Hamilton and Dong Heom Kim (2002) in their paper re-examined the ability of the yield spread to predict the economic activity and investigated the results of previous studies. They used the ten-year T-bond rate and three-month T-bill rate and real GDP from 1953 to 1998. Finally, they confirmed the usefulness of the term spread to predict future output growth. Moreover, they noted that the term premium (“the term spread minus its predicted component under the expectations hypothesis of the term structure of interest rates”) is also a very good leading indicator with significant predictive content. Some of the above researchers noticed that the link between the term structure and the output growth indeed exists. However, most of them said that this relation perhaps does not remain stable over time. So, Arturo Estrella, who has examined this link thoroughly, Anthony Rodrigues and Sebastian Schich (2003) tested the stability of the predictive content of the yield curve. They used in-sample break tests to see whether this relation was in fact stable. To predict the economic activity a d recessions they used respectively continuous and binary models. They found data for two countries, the United States and Germany. Data for the US was from January 1955 to December 1998 and for Germany from January 1967 to December 1998. After running the models they ended up to some conclusions. Each time, someone uses the yield curve to predict economic activity or recessions he first must test the stability of the predictive content of the yield curve over time. They also showed that binary models have achieved better performance in

- 16. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 16 the tests than the continuous models. Another paper, which presented the term structure as a forecasting indicator of economic activity is the work of Andrew Ang, Monica Piazzesi and Min Wei (2006). They built a dynamic model for GDP growth which completely characterized the expectations of the GDP. Then, they tried to check whether the predictability of the term spread was confirmed and if the short rate is, also, a good predictor of the output growth. They used out-of sample statistics and zero-coupon yield data for maturities 1,4,8,12,16 and 20 quarters from 1952 to 2001. They, also, used seasonally adjusted data on real GDP. First, they checked the forecasting power of the term spread using a simple linear regression model without lags of the GDP growth. Then, they added into the model the lagged GDP growth and one more candidate variable, which is the short rate. They involved lags because they said that the GDP is autocorrelated. Finally, they made out-of sample forecasts and checked the MSFE of the benchmark and the candidate models and concluded that the term structure is a good predictor, although the best indicator to forecast US GDP growth during the 1990s is the short rate. In October 2001, Ivan Paya, Kent Matthews and David Peel examined something different from the other papers. Most of the studies examined the link between the term spread and economic activity in the post-war period. But this paper aimed to test the stability of this relation and in the inter-war period for the US economy. They found that the term spread had the ability to forecast economic growth in that period and this prognostic power was stronger in periods of price instability. Moreover, they showed that the predictive content of the term structure did not remain invariant to regime changes Inflation Many researchers, including some of the already named, have dealt with the subject term spread and inflation. Fama (1984a), Fama (1990), Bernanke and Mishkin (1992), Canovo and De Nicolo (1997) are some of them. Mishkin has executed an analytical research on this subject. He has written four papers, which examine the predictive content of the term spread related to inflation. Taking into consideration, the importance of the inflation for monetary policy actions Mishkin (1990a) examined what information one can draw from the term structure of real

- 17. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 17 interest rates. Moreover, he investigated the movement of the term structure of real interest rates that is influenced by the change of the term structure of nominal interest rates. His methodology focused on the “inflation-change equation”. He used the change between m-period interest rates and n-period interest rates and saw how this change can give information about the change of the inflation over n-months and m- months into the future. For his research he used monthly data on inflation rates and one-to twelve-month U.S. Treasury bills from February 1964 to December 1986. He concluded that the maturity of the bond played an important role for the predictive ability of the term structure. Consequently, for maturities of six months or less the term structure has a very poor predictive power for the inflation changes, however the term structure of the nominal interest rates provides a great deal of information for the term structure of real rates. He considered that these results would change if the maturities became larger. For maturities of nine and twelve months the term structure is a useful tool to predict the inflation, although it contains little information about the term structure of real interest rates. In order to confirm his concerns, Mishkin (1990b) examined again this relation using data from 1953 to 1987 for inflation and U.S. Treasury bonds with maturities of one to five years. The results he found supported the aforementioned conclusion that for long maturities the term structure plays an important predictive role for inflation, but contains a little information for the term structure of real interest rates. Elias Tzavalis and M.R. Wickens (1996) presented in their paper new details about the forecasting skill of the term spread. Data used for the interest rate were monthly United States zero coupon government bonds with maturity of 1, 3, 6 and 12-month and for the inflation they were based on the Consumption Price Index. Their results came in contradiction to previous results arguing that the greater the time horizon the stronger the predictive power of the term spread. They found that the forecasting power of the term spread is very limited and that the real interest rate is a far better indicator than the slope of the yield curve. Arturo Estrella and Frederic Mishkin (1997) studied in their paper the link between the term spread and inflation. They showed that in many cases the term spread has the faculty to predict inflation with a horizon more than two years ahead but it is not a great predictor for one-year horizon. So, they ended up to the same conclusion for the inflation as for the output growth. The yield curve is a simple and accurate predictive tool, which becomes more useful in combination with other indicators. Sharon Kozicki (1997) using data from 1970 to

- 18. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 18 1996 examined the ability of the term spread and the short rate to forecast output growth and inflation. Furthermore, she presented in detail the predictive horizon of the yield spread and studied whether the short rate gives more information about the future output and inflation than the yield spread does. Initially, she presented three hypotheses that showed the reasons why the term spread is a good predictor of inflation and output growth. First, the yield spread reflects the posture of monetary policy. Second, it contains information on credit market conditions. Finally, the yield spread moves in the same way with the change of future inflation. Kozicki concluded to two results in her work. First she noted that the term spread has maximum predictive power for real growth over the next year or so and three years ahead for inflation. Moreover, she underlined that the term spread is a better predictor for real growth than the level of yields, but for the inflation the level of short rates makes better predictions than the term spread. An additional paper, which focused on the term structure of interest rates, was written by Jan Marc Berk (1997). He investigated the link between the yield curve and inflation and if the yield curve is a useful tool for monetary policy. Furthermore, he presented why this indicator is worth as a predictor of inflation. Moreover, the three considerations which establish the usefulness of the yield curve for monetary policy were noted. These three are stability, predictability and controllability. In his results he found that the relationship between these two is complicated. He noticed that, although, the yield curve contains information about the forecasting changes of the inflation, this information is not stable. Arturo Estrella (2005), again, examined the roots of the predictive ability of the yield curve for inflation and output growth as well. He applied an extensive model which was consisted of a Philips curve and IS equation. This model gives the opportunity to be considered both as a backward- looking and a forward-looking model. Their results showed that the yield curve has the ability to predict output growth and inflation. Another result which emanated from the model was the dependence of the predictive power from the monetary policy and its changes. More precisely, some reactions of the monetary policy characterize the yield curve as the optimal predictor of output growth or inflation or both and other reactions lead the predictive power of the yield curve to disappear. For example, on the one hand, if we have “strict” or “flexible” inflation the yield curve is a significant predictor. On the other hand, according to Estrella “if the monetary policy reactions to

- 19. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 19 both inflation and output deviations approach the infinity” the yield curve is not a useful tool for predictions any more. To summarize, the term structure has some predictive power for the changes of output growth, but every time someone wants to examine the output growth must test the stability of the link between these two variables. For the inflation changes, the term structure has something to say to the researchers, but with some lag, and for better predictions one should use bonds with long maturities (nine months or bigger). 2.3 Stock returns and stock volatility Hui Guo (2002) tried to show that there is a relation between stock market returns and volatility and, also, whether there is a link between them and economic activity. According to Hui Guo “returns relate positively to past volatility, but negatively to contemporaneous volatility”. As a result, stock market volatility predicts output growth because it affects the cost of capital through its link with the expected stock market return. He ran in-sample and out-of-sample regressions using postwar data and proved that sometimes volatility indeed contains forecasting information, but other times this predictive ability weakens. And he concluded that if volatility affects the economic activity only through the cost of capital, stock market returns play a more significant role than volatility does in forecasting economy. 3. PREVIOUS METHODOLOGY In this section we present the methodologies that some researchers used to evaluate the forecasting power of the variables. We show the variables and the equations the researchers used to find the relationship between the dependent and independent variables. Estrella and Hardouvelis (1991) selected quarterly real GNP from 1955 through the end of 1988 as the dependent variable in their regression. They used the annually cumulative percentage change of real GNP:

- 20. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 20 where k symbolizes the forecasting horizon in quarters and yt+k the level of real GNP during quarter t+k. Moreover Yt,t+k indicates the percentage change from t quarter to t+k. Estrella and Hardouvelis examined the predictive ability of the term spread. To estimate the term spread they used the difference between two rates; the 10-year government bond (RL ) and the 3-month T-bill (RS ): . Their basic regression equation has the general form: , where Yt,t+k and SPREAD are given by the equations above. Xit represents other information variables available during quarter t. They used in-sample statistics to check whether the term spread is more significant predictor than the lagged output growth. Estrella and Mishkin (1997), also, examined the predictive power between the term spread and GDP. For the calculation of the term spread they used the contemporaneous end-of-month observations for the central bank rate (CB), the 3- month government security rate (BILL) and the 10-year government security rate. (BOND). Thus, the following regression gives the estimation of the SPREAD: . They estimated a regression in which the value of the spread that is calculated above is used to forecast the change in real economic activity over the following k periods. This equation has the form: , where yt k is the variable of economic activity (GDP). They do not take into consideration the lags of the GDP, because they noticed that they are generally insignificant. In their model if the a1 is ≠ 0 then the today’s value of the term spread can be used to predict the value of yt in k periods ahead. They checked the economic significance of the term spread using the mean R2 . Estrella and Mishkin checked whether the term spread has better predictive content above and beyond other variables. To confirm this hypothesis they used the regression equation: , where the Xt is the contemporaneous measure of the monetary policy, the short rate for example. In the same way as above they checked the significance of

- 21. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 21 and Xt. Furthermore, they used a probit regression to find out whether the economy will be in a recession. Sharon Kozicki examined the predictive power of the term spread in seven countries and compared this skill with the forecasting ability of the level of the yield curve. He used the following equation: , where GDPgrowtht+h-4,t+h is the real GDP growth over the four quarters beginning in the quarter t+h-4 and ending in the quarter t+h, the SPREADt is the yield spread in the quarter t, the GDPgrowtht-4, is real GDP growth over the four quarters beginning in the t-4 and ending in the t quarter and errort is the prediction error in the quarter t and h is the forecasting horizon in quarters. Kozicki tried to determine whether the term spread has the ability to forecast one, two and three years ahead. So, the h is set to 4, 8 and 12 quarters respectively. In order to see if the term spread has predictive content beyond that contained in current growth rates an equation including only the current real growth was estimated. Kozicki estimated the coefficient of the spread and underlined the significant coefficients. Also, he estimated R2 which showed the percent of the variation in real GDP growth that is explained by the term spread and R2 NO SPREAD that showed the percent of the variation in real GDP growth that is explained from the current growth. The difference between R2 and R2 NO SPREAD reflects the predictive power of the spread. Moreover, he also used the same methodology to see if the level of the yield curve has more predictive content than that of the term spread. The equation he used is the following: where real ratet is the short rate in t period and is equal to the product of the spread in quarter t and the short rate in the same period. Testing the significance of the coefficients on the level of the yield curve and the difference between and he concluded that the term spread has predictive content beyond the current growth and the level of the short rate.

- 22. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 22 Mathias Binswanger (2000) used the same methodology with the Fama (1990) to re-examine the results of Fama for a longer period. First of all he used the Augment Dickey-Fuller unit root test for quarterly stock returns and the quarterly production and GDP growth rates to see if the series were stationary. The second step in his research was the Granger causality test. He used this test in order to find out whether past stock returns still predict future production growth rates. He also chose two smaller periods (1953-1965, 1984-1995) and applied the same tests. The estimated equations used have the following form: , where IPt-T is the production growth rate from t-T to t. Thus, for monthly, quarterly and annual production growth rate he used T=1, 3, 12 respectively. The term RT-3k+3 is the stock return for the quarter from t-3k to t-3k+3. To test the predictability of the stock index he saw whether the coefficients of the regression are significant at the 5% level and the adjusted R2 . All the above researchers used in-sample statistics to confirm the link between the economic activity and the variables they used to make predictions. Stock and Watson (2003) make both in-sample and out-of sample forecasts to evaluate this relation. They used data for seven countries from 1959 to 1999. Real GDP and industrial production are selected to measure the economic activity. The regression that they used has the form: , where and Xt is an economic variable (asset prices). For the in-sample analysis Stock and Watson selected a fixed length of four lags (Xt….Xt-3 and Yt….Yt-3). They used the whole sample (in-sample statistics) to make the heteroskedasticity-robust Granger-causality test statistic and the QLR test for coefficient stability. With the first they tested the statistic and economic significance of the coefficients. The Granger causality tested the null hypothesis that β1 (L) =0 and β2 (L) =0. The QLR statistic tests the null hypothesis of constant regression coefficients against the alternative that the regression coefficients change over time.

- 23. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 23 For the out-of sample statistics Stock and Watson used one AR model and the model with the variable Xt. The lags they used for the models are data-dependent. They have chosen the number of the lags from the Akaike (AIC) criteria. Thus, for the AR model the AIC-determined lag length was restricted between 0 and 4. For the bivariate model, the lags of Yt ranged between 0 and 4 and between 1 and 4 for the lags of Xt. Then, they computed the Mean Squared Forecasting Error (MSFE) for both models. From the form they estimate the reason between the two MSFEs, where Ŷh i,t+h/t is the ith candidate pseudo-out-of sample forecasts of Yh t+h, which was made using data through time t. If the result of this equation is less than one the candidate forecast is estimated to have performed better than the benchmark. Arturo Estrella, Anthony Rodrigues and Sebastian Schich (2003) examined whether the equations, which were used to predict real activity stayed stable over time. They selected a linear equation with the following form: , ,where for the cumulative growth rates and for the marginal growth rates. They used the spread between the nominal yields on q and n period bonds to predict the annualized growth rate in industrial production over the subsequent k periods. The variable k takes the price k=12, 24, 36 for one, two and three-years horizons respectively and the term spread was calculated from the difference between the 10,5 or 2-year long rate and 1- year short rate. For each case they checked the R2 of the equation, the p value of a sup LM test and the analogous p value of a sup PR test. Estrella, Rodrigues and Schich also used probit models to see if these models do predict recessions and this ability stays stable over time. Magnus Andersson and Antonello D’Agostino (2008) had a specific purpose in their paper. To test whether the stock prices and, in particular, the sectoral stock prices can be a useful tool to predict the euro area GDP. To check this predictability of the sectoral stock prices they tested if the MSFE of a benchmark model (they applied an AR model as benchmark) improved when the sectoral prices

- 24. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 24 were included in the model. They used similar models for their study with the previous work of Stock and Watson. Their basic model has the form: , where Xt is the return on the various financial assets, the error term and Q1 and Q2 the lag lengths having been computed with Akaike criteria. The forecast horizon h is ranged between one and eight quarters. To estimate the appropriate equation they used data from 1973;Q1 to 1984;Q4 and they made their out-of sample forecasts until the end of their sample, namely 2006;Q1. The form that they applied to find the MSFE for the AR and the candidate model is: Where r is for the restricted benchmark model and u refers to the unrestricted candidate model. Then, they looked the result of the form . When this is less than one, we have better forecasting performance with the candidate model than with the AR model. Moreover, they tested the predictive accuracy using the MSFE-F statistic proposed by Clark and McCracken (2005), defined as: , where P is the number of observations utilized for the out-of-sample evaluation, h the forecast horizon and , where is a quadratic loss differential. 4. METHODS FOR EVALUATING FORECASTING ABILITY In this section we present the methods that have been used in the previous bibliography for measuring the predictive content. We can divide in two groups: in- sample and out-of-sample methods. 4.1 In-sample measures Using this method we can find whether a candidate variable, X, is useful to forecast the variable Y. For instance, , could be the value of the real stock returns and we want to forecast the real GDP. Using one simple linear regression model we can

- 25. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 25 examine the forecasting ability of the candidate variable. The linear model will have this form: where b0 and b1 are unknown parameters and et is the error of the regression. To see whether the Xt has predictive ability we must examine if b1≠0. The t-statistic can be used to check the null hypothesis that Xt has no predictive content. Another tool to measure the economic significance of the candidate variable is the R2 and the adjusted R2 . In the aforementioned case we did not take into consideration that Yt+1 can be serially correlated. However, in the most cases of the time series variables the above hypothesis is wrong. Thus, the past values of Yt+1 are themselves helpful tools for forecasting. So, we must examine now if the candidate variable has more predictive content than the past values of Yt+1. In addition, values of with lag can be useful predictors. Thus, the linear regression model (1) will change form and the lags of the variable, Y, and candidate variable, X, will be added in the model. Then the extended regression model is the autoregressive distributed lag model: where b1(L) and b2(L) symbolize lag polynomials. To test whether the candidate variable has predictive content above and beyond the past values of we examine the null hypothesis that b1(L) =0. This can be done with the F-statistic or Granger causality test. To generalize, a model must have the following form to forecast h-steps ahead: 4.2 Out-of-sample measures This method simulates the real-time forecasting. For example, in order to make forecasts using a candidate variable(s) for the first month of 2000 a researcher must estimate a model using data available through the 12th month of 1999. Estimating the model is not a simple process, because a researcher must choose among a large number of models. So, he needs to have something to compare the ability of the models. Often, they use an information criterion to solve this problem, such as the Akaike criteria or Bayes criteria (AIC or BIC) and choose the model with

- 26. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 26 the smallest value. Then he uses this model to forecast the value of the variable Y in 2000m01. This process will continue throughout the sample creating a sequence of pseudo out-of-sample forecasts. Then, the researcher computes the mean square forecasting error of the candidate model and that of a benchmark model (an AR model can be a benchmark model) and he compares these two MSFEs. From the form (4) they estimate the fraction between the two MSFEs, where Ŷh i,t+h/t is the ith candidate pseudo-out-of sample forecasts of Yh t+h using data through time t. If the result of this equation is less than one the candidate forecast is estimated to have performed better than the benchmark. 5. DATA In this section we present the data that have been used to examine the relation between the output growth and the term spread, the stock returns and the short rate. We focused the research in 7 countries which are Canada, France, Germany, Italy, Japan, United Kingdom and the United States. The data came in monthly and quarterly terms from DataStream and IFS. Output growth is measured in industrial production terms and GDP growth terms. We defined industrial production and GDP growth as the logarithmic differences. We used real stock returns and computed them with the form: Real Stock Returns= Stock Returns – Consumer Price Index (we defined both stock returns and CPI as logarithmic differences). We used levels for the term spread, which we named as the difference between the 10-year government bond and the 3-month Treasury bill rate. The 3-month Treasury bill rate was the short rate in our research; we were not sure whether they should be included in levels or in first differences, so we use both of them for the short rate. 5.1 DATA FOR THE INDUSTRIAL PRODUCTION We present now the data that have been used to check whether the industrial production has a link with the term spread, the real stock returns and the short rate.

- 27. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 27 For Canada, we used the Industrial Production Total Industry from January 1981 till May 2009 in monthly terms. For the same period we used the term spread and the short rate and the real stock returns. The General Price Index of Canada was the one for the stock returns. For France, the Industrial Production Total Industry, the term spread, real stock returns and the short rate were measured from January 1973 to December 2008. Also, the index of DataStream for France was used for the stock returns. The data came in monthly terms. As far as Germany is concerned, the period that the data covered for the Industrial Production and real stock returns was from July 1975 to 15 August 2009. The data for the term spread and short rate stopped on August 2007. General Index represented the stock returns. For Italy, we used for all variables data from February 1977 till December 2008. The general index of DataStream was concerned as stock returns. For Japan, Industrial Production Total Industry was used for the Industrial production and NIKKEI 225 for the stock returns. The period that the data covered was from October 1966 to May 2009. For United Kingdom, Industrial Production Total Industry which was chosen for the UK’s industrial production and the term spread and the short rate were from January 1968 to May 2009. Stock returns were represented by FTSE 100 Price Index from January 1988 till August 2009. Finally, for the United States of America, the Industrial Production, the term spread, the short rate and the real stock returns were used from January 1966 to March 2009. For all the countries above we used the Consumer Price Index for the inflation in order to transform the stock returns to real stock returns. The period of data for the CPI was the same as the period of the stock returns for each country. 5.2 DATA FOR THE GDP GROWTH This section contains the data that have been used to examine the link between GDP growth and the term spread, the real stock returns and the short rate. We used for all countries the index of the DataStream for the GDP growth. For the stock returns we used the indices that we reported above for the industrial production for each country. The same is in effect for the Consumer Price Index, the term spread and the

- 28. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 28 short rate. Thus, the only change we made for the section of the GDP growth in relation to the industrial production is the period of the data. For Canada, the period lasted from the first Quarter of 1965 to the first Quarter of 2009 for all the variables. For France we used data from the first Quarter of 1970 to the first quarter of 2009 for the GDP growth, the term spread and the short rate and from the first Quarter of 1990 until the first Quarter of 2009 for the stock returns. We have had data from the first Quarter of 1991 to the second Quarter of 2007 for Germany. For Italy our data begin in the first Quarter of 1981 and reach the first Quarter of 2009. For Japan they also reach the same point in time, but they begin from the third Quarter of 1985. For the United Kingdom we tested the link between GDP growth, the term spread and the short rate using data from the first Quarter of 1968 until the same Quarter of 2009. But the data for the stock returns last from the first Quarter of 1988 and stop to the first quarter of 2009. The last country is the United States of America, for which we have data from Quarter one of 1996 to Quarter one of 2009. All the Data are included in the following tables (table 01-table 02): Πίνακας 1: Δεδομένα για τα μοντέλα με τη Βιομ/κη Παραγωγή ανεξάρτητη μεταβλητή. INDUSTRIAL PRODUCTION INDEX CPI TERM SPREAD SHORT RATE OBS. CANADA 1981M01- 2009M05 1981M01- 2009M05 1981M01- 2009M05 1981M01- 2009M05 1981M01- 2009M05 344 FRANCE 1973M01- 2008M12 1973M01- 2008M12 1973M01- 2008M12 1973M01- 2008M12 1973M01- 2008M12 435 GERMANY 1975M07- 2009M08 1975M07- 2009M08 1975M07- 2009M08 1975M07- 2007M08 1975M07- 2007M08 413-385 ITALY 1977M02- 2008M12 1977M02- 2008M12 1977M02- 2008M12 1977M02- 2008M12 1977M02- 2008M12 387 JAPAN 1966M10- 2009M05 1966M10- 2009M05 1966M10- 2009M05 1966M10- 2009M05 1966M10- 2009M05 515 UNITED KINGDOM 1968M01- 2009M05 1988M01- 2009M08 1988M01- 2009M08 1968M01- 2009M05 1968M01- 2009M05 500-263 UNITED STATES 1966M01- 2009M03 1966M01- 2009M03 1966M01- 2009M03 1966M01- 2009M03 1966M01- 2009M03 522 Σημείωση:Γερμανία και Ηνωμένο Βασίλειο δεν έχουν το ίδιο δείγμα για όλες τις μεταβλητές

- 29. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 29 Πίνακας 2: Δεδομένα για τα μοντέλα με το Α.Ε.Π. ανεξάρτητη μεταβλητή. GDP GROWTH INDEX CPI TERM SPREAD SHORT RATE OBS. CANADA 1965Q01- 2009Q01 1965Q01- 2009Q01 1965Q01- 2009Q01 1965Q01- 2009Q01 1965Q01- 2009Q01 180 FRANCE 1970Q01- 2009Q01 1990Q01- 2009Q01 1990Q01- 2009Q01 1970Q01- 2009Q01 1970Q01- 2009Q01 160-80 GERMANY 1991Q01- 2007Q02 1991Q01- 2007Q02 1991Q01- 2007Q02 1991Q01- 2007Q02 1991Q01- 2007Q02 69 ITALY 1981Q01- 2009Q01 1981Q01- 2009Q01 1981Q01- 2009Q01 1981Q01- 2009Q01 1981Q01- 2009Q01 116 JAPAN 1985Q03- 2009Q01 1985Q03- 2009Q01 1985Q03- 2009Q01 1985Q03- 2009Q01 1985Q03- 2009Q01 98 UNITED KINGDOM 1968Q01- 2009Q01 1988Q01- 2009Q01 1988Q01- 2009Q01 1968Q01- 2009Q01 1968Q01- 2009Q01 168-89 UNITED STATES 1966Q01- 2009Q01 1966Q01- 2009Q01 1966Q01- 2009Q01 1966Q01- 2009Q01 1966Q01- 2009Q01 176 Σημείωση:Γαλλία και Ηνωμένο Βασίλειο δεν έχουν το ίδιο δείγμα για όλες τις μεταβλητές. 6. METHODOLOGY AND MODELS In this section we present the models that we used to make the predictions and to test the link between the dependent and independent variables. Moreover, we show step by step the methodology that we used for the in-sample and the out-of-sample statistics. 6.1 Forecasting Models In our analysis seven (7) models have been used for each country; three models to check the link between the GDP growth and the term spread or the short rate or the stock returns, another three to check the link between the candidate variables and the Industrial Production and one benchmark model. Specifically, we tested the predictability of the real stock returns and the term spread using the h-steps ahead linear regression model of the form (3). In this model the dependent variable, Yt+h , represents the output growth, where the output growth is measured by the real GDP and by the index of industrial production. The independent variable Xt is either the term spread or the real stock return depending on the model that we used, the h is the forecasting period in quarters

- 30. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 30 (1,4,8) or in months(1,12,24), b1(L) and b2(L) symbolize lag polynomials and the et+h is the error of the model. We used twice the model with the form of (3) to check (a) whether a relation exists between the industrial production and the term spread/real stock returns and (b) whether this link exists between the GDP growth and the term spread/stock returns. Furthermore, we used twice the same model, but adding one more variable, Zt, that symbolizes the short rate. Thus, this model is: In this model the variable, Xt , is only the term spread. The variables are transformed to eliminate stochastic and deterministic trends. We used the logarithm of output growth and stock returns to make the series stationary. For the short rate we utilized both the levels and the first differences of the series to check which has better predictive ability. Definitions of the dependent variable For the independent variables we used the GDP growth and the Industrial Production. We considered two different forms for these variables. The first one is . We ran all the regressions having the Yt+h in the (3.1) form and then we transformed the dependent variable to the second form (3.2) and we followed the same process. The second form of Yt+h is: Where the factor of standardizes the units in level to annual percentage growth rates. The number 400 was used for the GDP that is measured in a quarterly base and 1200 for the IP that is measured in a monthly base. Lag lengths We used in our models past values of dependent and independent variables. To check which model is the best one to give us useful information about the predictive content of candidate variables we utilized the Akaike criterion (AIC). For the in-sample statistics the number of lags ranged between one and five.

- 31. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 31 Candidate Variables In our study we checked the forecasting ability of three variables. From the bibliography we found that the term spread and the real stock returns can be a useful tool to predict the output growth and we decided to test their predictability. Our last candidate variable is the short rate that was not examined in detail in the previous literature, but it was referred to as a possible good predictor. Yield curve, term spread and short rate The yield on a government bond is the annual rate of return or the interest rate that would be earned by an investor, who holds the bond until it matures. The maturity is an important feature of the bond because yields differ with maturity. The yield curve describes the relationship between yields and maturities. Yield curve information is published daily by the financial press. The shape and the level of the yield curve changes daily as investors reassess the current and expected future economic conditions. The yield spread is the difference between yields on two different debt securities. The yield spread also provides information on the slope of the yield curve. The larger the spread is between a long-term and a short-term bond, the steeper the slope of the yield curve will be. Analysts look at the yield spread as a potential source of information about future economic conditions. Several hypotheses argue that the information in the yield curve is forward-looking and therefore, should have predictive power for real growth. In addition to the spread, the level of the yield curve may also provide useful information for helping predict real growth. Since overall demand for and supply of credit are reflected in the general level of interest rates across the maturity range, this information may provide predictive information in addition to that summarized by the yield spread. The yield spread does not contain information on the general level of interest rates because it is constructed as the difference between two rates. The level of the yield curve as measured by the short rates might help predict real growth because short rates may provide information on the monetary policy. Short-term interest rates move closely to the interest rate that serves as an instrument of monetary policy. While fluctuations in the yield spread may reflect shifts in policy, they may

- 32. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 32 also be caused by shifts in the risk premium. Thus, the level of short rates may provide a better measure of the monetary policy than the yield spread does. 6.2 Methodology First of all, for each country we computed both in-sample and out-of-sample statistics. Before running the regressions, we test for stationarity of all the variables included. We utilized the Augment Dickey-Fuller unit root tests. We observed that all the variables after the transformation (taking logarithms for the IP, GDP and stock returns) or without transformation (term spread) were stationary. We met a problem with the short rate which was not stationary for no-one country of our research. Thus, we took the first differences for the short rate for the in-sample method but for the out-of-sample we checked both the predictive content of the levels and the first differences of the short rate. In-sample statistics Using the whole sample we followed a process in three steps for each model and each country. First Step: Estimating the best model. We ran a VAR model for each group of the two variables (IP-term spread/short rate/stock returns and GDP-term spread/short rate/stock returns) using lags for these two variables. We used the Akaike criterion to conclude to the well defined VAR model and the lags of the model. Then, we collected all the prices of the coefficients of this model in tables. Second Step: Checking the economic significance of the candidate variable. We tested the economic significance of the (term spread, real stock returns) and (short rate) looking at the adjusted R2 . Third step: Checking the causality between the two variables. We wanted to see if the one variable of the model has a predictive ability to forecast the other variable. This can be done using the Granger-causality test and looking at the F-statistic (p-value). The null-hypothesis is that the candidate variable does not granger cause the dependent variable. All the results of the in-sample statistics are placed in the tables 3 to 8.

- 33. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 33 Out-of-sample statistics In our exercise we tested whether the predictive ability of a benchmark model improves when a candidate variable is added to this model. As a benchmark we used an AR (autoregressive) model with the form: To consider that a candidate model has better predictive content than the benchmark model we computed the MSFEB for the AR model and the MSFEC for the candidate model. To compute these two MSFEs we followed the following process. We estimate the equation (6) using a sub-sample calling the estimation window. The estimated coefficients are then used to forecast the dependent variable (GDP or IP) h- steps outside the estimation window. After that one new observation was included in the sub-sample, the coefficients were re-estimated and a new h-steps ahead forecast was computed. This process continued to the end of the sample creating a series of out-of-sample forecasts. We followed the same procedure for the candidate model and we have the MSFEs that we need. When the fraction MSFE is less than one, the inclusion of a candidate variable improves the forecasting precision of the benchmark model. We followed this process for one period (one month for the model of IP and one quarter for the model of GDP), one year and two years ahead forecasting periods for each model and for each country. For most series the out-of-sample forecasting exercise begins after accumulating fifteen or twenty years of data. In some countries with a later start date the period begins after ten years only. For the models that have been applied to forecast the industrial production the exercise starts between 1988 and 1992 in most cases. For the GDP this period of time ranges between 1986 and 2001. Overall, we ran our models three hundred and thirty six times (336) to make out-of-sample forecasts.

- 34. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 34 7. RESULTS 7.1 Results from the in-sample tests Most of the researchers of the previous decades used in-sample statistics to measure the predictive content of the candidate variables. Thus, in the first part of this section we present the in-sample results of our study. In the second part we show in detail the out-of-sample findings for each country and each variable for all forecasting periods. In both parts we try not only to present the results, but also to compare them with previous findings. 7.1.1 INDUSTRIAL PRODUCTION We applied the test of Granger causality three times for each country to test the causality between the IP and the term spread, the short rate and the real stock returns respectively. Our null hypothesis is that the candidate variable does not granger cause IP. Our results show that the real stock returns are a statistically significant predictor for Japan, Italy and the USA at the 1-percent level and for the United Kingdom and Canada at the 5-percent level; they are not significant for France and Germany (even at the 10-percent level). For the countries, where the stock returns look like a useful forecasting tool, the coefficients demonstrate a positive relation between the dependent and independent variables. Checking previous papers we see that researchers have had similar results for the stock returns. Fama (1990) and Mathias Binswanger (2000) examined this relation for the USA. The former showed that the stock returns were significant in explaining future industrial production for the period from 1953 to 1987. The latter increased the sample until 1995 and made the Granger causality test. Indeed, our paper found similar results to his paper for the USA. The F- statistic for the whole sample shows significance at the 1-percent level with 3 and 6 lags of stock returns. Close to our results is also the work of Stock and Watson, who showed that the Granger causality test rejected the null hypothesis for 40 percent of asset prices. Thus, the Granger causality test leads us to the conclusion that it is helpful to utilize the real stock returns as predictors of Industrial production.

- 35. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 35 All the above we said, about the results of our test, were pulled together in the following table 3. For the term spread the in-sample statistics showed that it might not be helpful to use it to forecast the industrial production, since we rejected the null hypothesis that the term spread does not granger cause IP only for two countries; for France it is rejected at 1-percent level and for the USA at 5-percent level. For all other countries of our research the test failed to reject the null hypothesis even at 10-percent level. But, if we use the short rate we can see an improvement in our results. The p-value of the F-statistic demonstrated that the short rate is a useful tool to predict the industrial production; we rejected that the coefficients of the candidate variable are equal to zero for the aforementioned countries (France and USA), but also for the United Kingdom and Germany at the 5-percent level. For Canada, Japan and Italy neither the short rate is statistically significant nor the term spread. Thus, we concluded that the in-sample statistics note that the real stock returns are the most useful predictor for the industrial production and that the short rate can be a better tool for forecasting than the term spread. Table 4 and Table 5 summarized all the above for the term spread and the short rate. TABLE 3: Granger causality tests ( Ho: Real stock returns do not granger cause Industrial Production) SAMPLE CANADA (1981M1- 2009M05) FRANCE (1973M02- 2008M12) GERMANY (1975M08- 2009M08) JAPAN (1966M10- 2009M05) ITALY (1977M02- 2008M12) UK (1988M01- 200905) USA (1966M06- 2009M03) F-statistic 2.41849 0.95471 0.63260 8.52222 7.75675 3.37521 9.34429 Prob. 0.04848* 0.41407 0.72070 0.0000011** 0.00050** 0.01037* 1.6E-08** Lags 4 3 2 3 2 4 5 AIC -9.748952 -11.87216 -11.70193 -11.78376 -10.70121 -13.46290 -13.87993 Adj R-squared 0.316239 0.136025 0.180914 0.151557 0.230047 0.074479 0.230730 Notes: The Granger causality test statistics is heteroskedasticity-robust and was computed in-sample (full sample). We present only the price of the Akaike criterion of the appropriate model that we estimated. Asterisks denote significance at the 5% (*) or at 1% (**) level.

- 36. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 36 We can see in table 4 that the p-value for Germany and United Kingdom is 0.36337 and 0.18036 respectively and changes to 0.01395 and 0.02325 when the short rate is included in the regression (table 5). If we look at the previous study we can find results for the forecasting ability of the term spread and the short rate. Sharon Kozicki (1997), Estrella and Mishkin (1997) and Stock and Watson (2003) used in sample statistics to compare the term spread and the short rate predictability. The conclusions of these papers will be presented in detail in the next part of this section, where the results of the GDP growth are discussed. TABLE 4: Granger causality tests ( Ho: Term Spread does not granger cause Industrial Production) SAMPLE CANADA (1981M1- 2009M05) FRANCE (1973M02- 2008M12) GERMANY (1975M08- 2007M08) JAPAN (1966M10- 2009M05) ITALY (1977M02- 2008M12) UK (1968M01- 200905) USA (1966M06- 2009M03) F-statistic 1.94056 7.04552 1.01504 1.56618 1.94885 1.71881 3.30880 Prob. 0.10341 0.00098** 0.36337 0.77956 0.10178 0.18036 0.01084* Lags 4 2 2 4 4 2 4 AIC -12.78949 -15.65873 -16.30884 -16.01751 -14.75179 -15.54090 -17.02628 Adj R-squared 0.312334 0.140987 0.185976 0.106481 0.223569 0.029216 0.179486 Notes: The Granger causality test statistics is heteroskedasticity-robust and was computed in-sample (full sample). We present only the price of the Akaike criterion of the appropriate model that we estimated. Asterisks denote significance at the 5% (*) or at 1% (**) level. TABLE 5: Granger causality tests ( Ho: Short Rate does not granger cause Industrial Production) SAMPLE CANADA (1981M1- 2009M05) FRANCE (1973M02- 2008M12) GERMANY (1975M08- 2007M08) JAPAN (1966M10- 2009M05) ITALY (1977M02- 2008M12) UK (1968M01- 200905) USA (1966M06- 2009M03) F-statistic 0.11094 3.66601 3.58687 0.65767 0.95961 2.85601 5.95291 Prob. 0.97864 0.01245* 0.01395* 0.65578 0.42966 0.02325* 0.00011** Lags 4 3 3 5 4 4 4 AIC -21.36245 -24.69139 -26.14800 -26.01026 -23.53568 -24.05668 -26.03385 Adj R-squared 0.315833 0.165757 0.216000 0.119938 0.216902 0.044798 0.212492 Notes: The Granger causality test statistics is heteroskedasticity-robust and was computed in-sample (full sample). We present only the value of the Akaike criterion of the appropriate model that we estimated. Asterisks denote significance at the 5% (*) or at 1% (**) level.

- 37. Forecasting Economic Activity using Asset Prices MSc in Banking & Financial Management Σελίδα 37 7.1.2 GDP GROWTH We used the test of Granger causality three times for each country to test the causality between the GDP and the term spread, the short rate and the real stock returns respectively. Our null hypothesis is that the candidate variable does not granger cause GDP. Our results for the forecasting ability of the real stock returns are not as good as before for the industrial production, but they demonstrate a strong link between the dependent and independent variables. The null hypothesis was rejected in four countries. For Canada, France and the United States at 1-percent level (0.00121- 0.00061-0.00053) and at 5-percent level for Japan (0.03679). For Germany, Italy and the United Kingdom the Granger causality test accepts the null hypothesis; the coefficients of the real stock returns are not statistically significant. If we check again the results of the Binswanger’s paper (2000) we see that for the United States for the period 1953-1995 the real stock returns have similar power to predict the GDP growth (0.0000022) as those of our sample. For the term spread we found that causality exists between itself and GDP growth in four countries again. For Canada, France and the United States at 1-percent level and for Japan at 5-percent level. Estrella and Mishkin (1997) ran similar tests for five countries (France, Germany, Italy, United Kingdom and United States) using data from 1973 to early 1995. Their results are consistent to ours as they find significance for USA, but not for Italy and the United Kingdom. However, they found a strong link between the two variables for Germany in contrast to our results. Stock and Watson (2003) noted that the term spread until 1999 was a useful predictor of GDP growth in France, United States, Germany and Canada, but not (even at the 10-percent level) in Italy, Japan and the UK. Paulo Mauro (2003) also checked the causality between the stock returns and the GDP growth for the emerging and the developed countries. They found that it appeared a strong link in France, Canada, Japan, United Kingdom and the United States, but not in Germany and Italy. From these three papers and from our results we can conclude that the term spread was and remains a useful forecasting tool of GDP growth in the United States, Canada and France, but not in Italy and the United Kingdom. The results are not obvious for Germany and Japan. The Granger causality tests of term spread and stock returns are summarized in the next two tables (table 6-table 7).