NewBase May 01-2022 Energy News issue - 1509 by Khaled Al Awadi.pdf

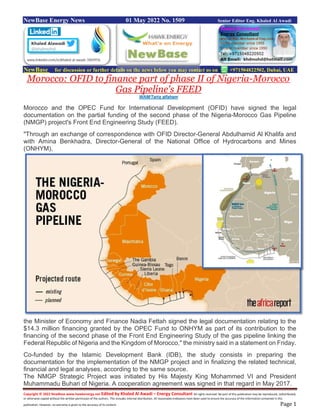

- 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 01 May 2022 No. 1509 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Morocco: OFID to finance part of phase II of Nigeria-Morocco Gas Pipeline's FEED WAM/Tariq alfaham Morocco and the OPEC Fund for International Development (OFID) have signed the legal documentation on the partial funding of the second phase of the Nigeria-Morocco Gas Pipeline (NMGP) project's Front End Engineering Study (FEED). "Through an exchange of correspondence with OFID Director-General Abdulhamid Al Khalifa and with Amina Benkhadra, Director-General of the National Office of Hydrocarbons and Mines (ONHYM), the Minister of Economy and Finance Nadia Fettah signed the legal documentation relating to the $14.3 million financing granted by the OPEC Fund to ONHYM as part of its contribution to the financing of the second phase of the Front End Engineering Study of the gas pipeline linking the Federal Republic of Nigeria and the Kingdom of Morocco," the ministry said in a statement on Friday. Co-funded by the Islamic Development Bank (IDB), the study consists in preparing the documentation for the implementation of the NMGP project and in finalizing the related technical, financial and legal analyses, according to the same source. The NMGP Strategic Project was initiated by His Majesty King Mohammed VI and President Muhammadu Buhari of Nigeria. A cooperation agreement was signed in that regard in May 2017.

- 2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The project is intended to be a catalyst for the economic development of the North-West African region. It carries a strong desire to integrate and improve the competitiveness and economic and social development of the region, through the development of the NMGP project. It also aims to boost the regional economy through the promotion of economic development in North West Africa, the development of job-generating industries, the reduction of gas "flaring" and the use of reliable and sustainable energy. Through its support for this project, a model of South-South cooperation, OPEC Fund strengthens, by the same token, its financial cooperation relations with Morocco and contributes to the economic and social dynamics of the Kingdom, the statement concluded. Additional Info, About Nigeria-Morocco Offshore and Onshore Gas Pipeline https://ejatlas.org/conflict/nigeria-morocco-offshore-gas-pipeline When King Mohammed VI visited President Muhammadu Buhari in December 2016, the two agreed on a grandiose scheme to bring Nigerian gas northwards. Moroccan officials have been keen to talk up prospects for this gas ‘highway’ linking 11 countries, who would feed in and take out gas along the way. Maikanti Kacalla Baru, Chairman and CEO of Nigerian National Oil Company (L), and Moroccan Director General of the National Board of Hydrocarbons and Mines Amina Benkhadra sign the Cooperation agreement documents of the Nigeria-Moroccan gas pipeline project, that will connect the two nations as well as some other African countries to Europe, at the King's Palace in Rabat, Morocco May 15, 2017. REUTERS/Youssef Boudlal Morocco and Nigeria sign partnership agreement in 2016 for a gas pipeline amid rejection by national, regional, and international NGOs and EJOs due to the environmental and socio-economic impacts of the project.

- 3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 In December 2016, King Mohammed VI of Morocco officially announced the construction of th e Nigeria-Morocco gas pipeline. The idea of a trans-Saharan gas pipeline was already proposed in the 1970s with a goal of diversifying Europe’s gas resources . “For economic, political, legal and security reasons, the choice was made on a combined onshore and offshore route,” Morocco’s National Office of Hydrocarbons and Mines (ONHYM) and the Nigerian National Petroleum Corporation (NNPC), the two authorities supervising the project said in the joint declaration. Project proponents cite the expected economic benefits to both countries, as well as to other West Africa countries. According to them, and to official statements, the strategic project could turn West Africa into an industrialised energy hub. Environmentalists and NGOs from the region cite the huge investment for the project that can be directed to renewable energy, the potential environmental cost, the environmental and socio- economic cost of the associated development and industrialisation policy and vision, as well as the exploitative colonialist nature of the project that will ultimately only serve to meet Europe energy needs at the expense of African countries and communities. A large number of organizations signed the following statement : " In December 2016, an announcement was made of a nearly 5000 km Nigeria-Morocco offshore gas pipeline which at today’s prices will cost an estimated 20 billion US dollars. In reality, the actual costs will likely be much higher. This pipeline would be a continuation of the existing 678 km long West African Gas pipeline (WAGP) that has been in service since 2010. It aims to serve 12 countries on the African continent and some 300 million potential consumers, with a possible extension to the Europe.

- 4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 China processe 14 MBPD crude oil, exported less gasoline & diesel Source: Graph by the U.S. EIA, based on data from China General Administration of Customs, as compiled by Bloomberg, L.P. China processed record amounts of crude oil in 2021 to meet rising domestic consumption of petroleum products. In the second half of the year, China processed slightly less crude oil and began exporting significantly less gasoline and diesel than in the first half of the year to ensure sufficient domestic supply. According to China’s National Bureau of Statistics, China processed a record 14 million barrels per day (b/d) of crude oil in 2021, a 4.6% increase from 2020. Crude oil processing in China was particularly high in the first half of 2021, in response to high demand both domestically and elsewhere in Asia. Despite more refinery capacity, crude oil processing decreased by 0.4 million b/d in the second half of 2021 compared with the first half. Beginning in August 2021, several COVID-19 outbreaks in China led to mobility restrictions, which in turn reduced domestic demand for petroleum products. Mobility restrictions during the Winter Olympics and COVID-19 travel restrictions that began in March 2022 in several parts of China continued to reduce demand for petroleum products in China at the beginning of this year. China’s crude oil processing has also declined because relatively high crude oil prices are making importing crude oil more expensive. In addition, China’s refiners met their petroleum product export quotas in the first half of the year. They were not granted a second batch of export quotas until August, and those quotas were relatively low. These quotas set the maximum amounts of each product that refiners can export and are disseminated on a rolling basis. China’s exports of diesel and gasoline ended 2021 at lower levels than at the beginning of the year. Low petroleum product exports have continued into 2022 because China’s first batch of export quotas in 2022 were 56% lower than its first batch in 2021. Because of these quotas, in February 2022, China exported the lowest amount of diesel since early 2015.

- 5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 U.K: targeting 1.3 billion barrels of oil and gas in North Sea Offshore Energy + NewBase The annual performance review for the UK’s top producers highlighted 33 new projects targeting 1.3 billion barrels of oil and gas, which will significantly bolster the country’s energy security, the country’s regulator has revealed. The North Sea Transition Authority (NSTA) revealed on Thursday that a total of 890 million barrels of those resources could be sanctioned as early as next year and the regulator expects operators to rapidly deliver projects, in line with its effective net zero test, in the interest of UK supply resilience. Furthermore, the regulator said that exploration and appraisal activity is expected to return to pre- pandemic levels, with 20 wells per year forecast from 2022-24. The appetite for exploration remains, and bodes well for NSTA’s plans to hold a new licensing round later this year, subject to the Climate Compatibility Checkpoint. The NSTA also used the 28 April Tier Zero meeting to stress that an ongoing proactive approach is essential to surpass the emissions reduction targets agreed in the North Sea Transition Deal. Held in Q2 every year, the Tier Zero gathers the managing directors of the sector’s 22 largest operators to review the performance of the basin.

- 6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Data, including from the annual UKCS Stewardship Survey, is used to show operators how they compare with peers across a series of benchmarking metrics, with a view to sharing best practice and driving improvement. Source: NSTA CO2 emissions for the UK upstream oil and gas industry fell 14 per cent to 12.1 megatonnes in 2021. Furthermore, flaring across the basin fell by 19 per cent year-on-year and venting was down by 24 per cent. The NSTA challenged industry chiefs to sustain these lower levels in 2022 when gas production is expected to rise. Eighty per cent of Tier Zero operators have forward plans covering asset upgrades, emissions reduction and platform electrification, which will be crucial to meeting, and exceeding, Deal targets. “Indeed, the sector already has well-developed proposals for electrification projects and a number of operators are involved in government-backed industrial decarbonisation clusters focused on carbon capture and storage (CCS) and hydrogen, currently being progressed,” the NSTA said. As a reminder, the NSTA last March rebranded and changed its name from the Oil and Gas Authority (OGA) to reflect its expanding role in energy transition, including as the carbon storage licence and permitting authority, monitoring of emissions, assessing a net-zero test for new developments, and stewarding domestic production. One of the areas highlighted in last year’s meeting was the need for a step-change in well decommissioning and highly positive signs are now evident, with campaign contracting models gaining traction and the NSTA Energy Pathfinder portal listing 470 wells awaiting decommissioning. The discussion this year also covered opportunities to repurpose infrastructure for decarbonisation projects, such as CCS and H2, which are now a key area of focus. The NSTA will be launching a Carbon Storage licensing round shortly.

- 7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 The NSTA urged companies to get production efficiency back on track, which slipped last year due to the large number of planned maintenance shutdowns on multiple installations, many of which were postponed the previous year due to Covid. Following years of improvement in production efficiency, culminating in the 80 per cent target being met in 2019, the metric dropped to 73 per cent in 2021. However, this indicator has long been a focus for the NSTA and industry and the managing directors confirmed their commitment to restore production efficiency to 80 per cent. Dr Andy Samuel, NSTA Chief Executive, said: “This meeting once again provided a good platform for positive action, supported by our suite of benchmarks and data insights. I am encouraged by the open, frank and productive dialogue. Many best practices and learnings were shared across the different operators. “Companies are now progressing new projects that will strengthen energy security while generating tax revenues, and creating and safeguarding thousands of UK jobs as part of an orderly transition to net zero. Importantly the industry reconfirmed commitment to halve production emissions by 2030 with progress well underway. The growing momentum on clean power to offshore installations, CCS and hydrogen was also very evident.” As recently reported, Samuel will be leaving his role at the end of the year and the NSTA is looking to appoint a successor in the summer so that the appointee can take up the role in time to allow for a period of handover.

- 8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S: Calcasieu Pass, LNG gas export terminal, begins production Source: Graph by the U.S. EIA, based on data from PointLogic and Federal Energy Regulatory Commission (FERC) The Federal Energy Regulatory Commission (FERC) has authorized Venture Global Calcasieu Pass, LLC, (Venture Global)—the developer of the Calcasieu Pass liquefied natural gas (LNG) export terminal—to commission the first six of nine liquefaction blocks. Each block contains two liquefaction systems called trains. The first authorization, issued in November 2021, was one of the initial steps toward full commercial service. Calcasieu Pass is a 1.3 billion cubic feet per day (Bcf/d) liquefaction facility located in Cameron Parish, Louisiana. Similar to nearby LNG terminals Sabine Pass and Cameron, Calcasieu Pass will export LNG through the Calcasieu Ship Channel located on the Gulf of Mexico. Calcasieu Pass is the seventh U.S. LNG liquefaction export facility to begin producing LNG since 2016. In addition to 18 mid-scale liquefaction trains, the Calcasieu Pass facility includes an onsite natural gas-fired plant to generate electricity for the facility’s operations, three pre-treatment trains, two LNG storage tanks (with a capacity of 4.4 Bcf each), and two shipping berths capable of loading LNG vessels with carrying capacities of up to 185,000 cubic meters (4 Bcf). The Calcasieu Pass terminal receives its feedgas through Venture Global’s 24-mile, 42-inch diameter TransCameron Pipeline, which has interconnections with the ANR, TETCO, and Bridgeline pipelines. Since November 2021, Venture Global has received FERC approval to commission Blocks 2–6, most recently on March 30, 2022. Natural gas deliveries to the terminal have increased throughout 2022, averaging approximately 0.7 Bcf/d in April, according to PointLogic. With only three blocks left to authorize for commissioning, and given the pace at which the terminal has received FERC approvals to commission blocks, Calcasieu Pass could reach its full LNG production capacity of 1.3 Bcf/d baseload (1.6 Bcf/d peak) by the third quarter of this year. On March 1, Calcasieu Pass loaded and shipped its first LNG cargo, often called a commissioning cargo, aboard the tanker Yiannis, chartered by JERA Global Markets, which delivered the LNG to ports in the Netherlands and France. Calcasieu Pass loaded its first cargo 30 months after its final investment decision, which was the shortest amount of time of all the LNG export projects in the United States. As of April 27, Calcasieu Pass has shipped nine cargoes, according to Bloomberg Finance, L.P.

- 9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 NewBase May 01-2022 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices reverse late in session as heating oil contract plunges Reuters + NewBase Summary Oil prices reverse but post monthly gains U.S. heating oil futures hit an all-time high before sinking OPEC+ likely sticks to output deal May 5 -sources China lockdowns weigh on oil demand outlook Oil prices fell on Friday, reversing in volatile trade, pulled downward by the U.S. heating oil contract that plummeted by more than 20% at one point on the day of its expiration. The front-month U.S. heating oil contract , which is a proxy for diesel prices, soared to a record high of $5.8595 a gallon before falling as low as $4.4067 a gallon. Diesel futures have climbed as investors worry about tight supplies globally following Russia's invasion of Ukraine. The heating oil contract expired on Friday, along with the global Brent benchmark and U.S. gasoline futures . Volumes in all three front-month contracts was low, creating outsized volatility in the market and leading to late-day sell-offs, analysts said. "The fireworks were all in the expiring diesel contract," said Andrew Lipow of Lipow Oil Associates in Houston. "Today's expiry is especially volatile and may not be reflective of actual tightness." The more-active second-month Brent crude futures contract fell 12 cents to settle at $107.14 a barrel. The expiring front-month contract rose $1.75 to settle at $109.34 a barrel. U.S. West Texas Intermediate crude , which does not expire on Friday, fell 67 cents to settle at $104.69 a barrel, as traders sold energy contracts across the board. Oil price special coverage

- 10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 The front-month heating oil contract's volatility was not mirrored in the more-active second-month U.S. heating oil contract , which gained $0.0088 a gallon to settle at $4.0172 a gallon. Both Brent and WTI rose for the week and posted their fifth straight monthly gain. Brent ended the month up 1.3%, while WTI ended up 4.4%. Prices have been buoyed by fears that Russian supply will continue to be disrupted by the conflict in Ukraine. Futures rose this week on the increased likelihood that Germany will join other European Union member states in an embargo on Russian oil. Russian oil production could fall by as much as 17% this year, an economy ministry document seen by Reuters showed on Wednesday, as Western sanctions over Russia's invasion of Ukraine hurt investments and exports. The oil and gas rig count, an indicator of future supply, showed U.S. oil rigs rose by three to 552 this week. The Organization of the Petroleum Exporting Countries and allies are likely to stick to their existing deal and agree another small output increase for June when it meets on May 5, six sources from the producer group told Reuters on Thursday. read more Still, there are bearish demand factors looming. China has shown no signs of easing lockdown measures which have hit its economy and global supply chains. Crude's rally could stall and prices could average just less than $100 a barrel this year, a Reuters poll found on Friday, as economic risks and China's COVID lockdowns counter supply shortfalls due to the Ukraine war.

- 11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase Special Coverage The Energy world –May -01 -2022 CLEAN ENERGY Europe's fragile energy market braces for Putin's next move Bloomberg + NewBase Europe may be hurtling towards a sudden halt of Russian gas, a scenario that would trigger energy rationing, higher inflation and a deep recession. A showdown over payment terms has already led Moscow to turn off taps to Poland and Bulgaria. With supply already tight, it won't take much more to send energy markets into shock. Europe's natural gas balance is "fragile and it remains just one supply disruption away from completely falling apart," said Shikha Chaturvedi, an analyst at JPMorgan Chase. Unless processes can be resolved to meet Kremlin demands while also steering clear of European Union sanctions, more countries are at risk of being shut off in coming days or weeks. Europe relies on Russian gas for one fifth of its electricity generation, and a minor disruption could quickly ripple across the continent. Storage levels are currently at just 32 per cent capacity, compared with the target of at least 80 per cent needed to keep homes heated and factories running through the winter. The shutoff of Poland and Bulgaria shows the strain. While the volumes are relatively low, the shortfall soaked up supplies from Germany and liquefied natural gas cargoes. That reduces the buffer to cope with further disruption.

- 12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 President Vladimir Putin has decreed that gas customers in Europe pay in roubles, which the EU says violates sanctions and has called for companies to continue paying in euros - leaving it up to the Kremlin to refuse or accept. While the bloc aims to cut its dependency on Russian gas by two thirds this year, an abrupt halt would come too soon. The EU has offered vague guidelines in an effort to stand up to Russia over its invasion of Ukraine while maintaining gas flows. On Friday (April 29), Russia clarified the rules on how European customers are required to pay, easing the terms slightly but still leaving doubts over the role of the country's sanctioned central bank in converting euros to roubles. EU energy ministers will gather in Brussels on Monday for an emergency meeting to discuss options to maintain energy supplies and the fallout from the move by state-owned Gazprom PJSC to cut off Poland and Bulgaria. The standoff risks creating divisions between heavy importers such as Germany and those less exposed like France. If Russia refused to send the fuel - critical for chemicals processes and powering auto factories - European governments would quickly implement rationing mechanisms. A complete halt in supplies across the region would lead to a 10 per cent reduction of industrial demand, according to energy consultancy Wood Mackenzie. Germany still relies on Russia for 35 per cent of its gas needs after starting to diversify even before the war started. Chancellor Olaf Scholz's administration has invoked the first step of an emergency plan, which includes closely monitoring usage.

- 13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 The next stage would involve directing supply. Even without energy rationing, Europe's economy is on shaky ground. The euro zone grew a slower-than-expected 0.2 per cent in the first quarter, reflecting a contraction in Italy, stagnation in France and weak expansion in Spain. Germany narrowly avoided a recession. "Russia is showing that it's ready to get serious," German Economy Minister Robert Habeck said in Berlin last week, acknowledging that the country won't be in position to offset Russian gas for more than a year. "That's not realistic, but we have to nonetheless attempt the unrealistic." If a cut off in gas supplies were to last more than a few months, it would have major economic implications for Europe. Higher gas prices would increase the risk for euro-zone inflation, already predicted to be at elevated levels of 7 per cent this year, according to Edward Gardner, a commodities analyst at Capital Economics. "Given the reliance of Germany's heavy industry on Russian gas, any interruption would represent a significant drag on economic growth," said Mark Haefele, chief investment officer at UBS Global Wealth Management. Uniper, Germany's largest importer of Russian gas, is pursuing a workaround that would see it opening a euro account in Russia and allowing the funds to be converted by Gazprombank - one of the few Russian lenders that hasn't been sanctioned. It has to make a payment in late May. Berlin has signalled the plan is in compliance with EU guidelines, but it's unclear if it will satisfy Moscow. Companies from Austria and Italy have also said they believe that they will be able to keep gas flowing. That optimism has kept a lid on prices, with European gas futures rising just 1.1 per cent last week despite the shutoff of two EU member states. Already contending with Europe's penalties and plans to phase out imports of Russian coal and oil, the Kremlin would risk eliminating another source of revenue if it plays hard ball over gas payments. "Russia's loss of export earnings would be significant," research group Energy Aspects said in a note this week. Even if a crisis is averted for now, Putin could still try again to use gas to hurt the EU and undermine the bloc's solidarity. "The concern for investors is that the move signals a growing willingness by Russia to use the termination of energy exports as a form of retaliation against nations opposing its invasion of Ukraine," said UBS's Haefele.

- 14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Energy News 01 May 2022 - Issue No. 1509 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15

- 16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16

- 17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17