Banking Sector Q4FY15 preview: Asset quality will remain under pressure

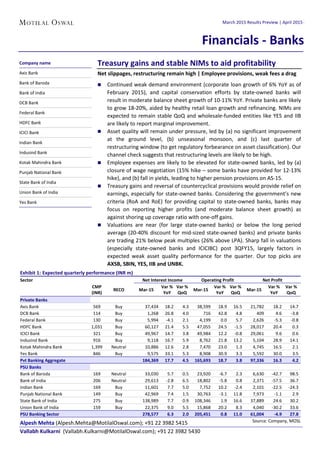

- 1. April 2015 136 Alpesh Mehta (Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415 Vallabh Kulkarni (Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430 Treasury gains and stable NIMs to aid profitability Net slippages, restructuring remain high | Employee provisions, weak fees a drag Continued weak demand environment (corporate loan growth of 6% YoY as of February 2015), and capital conservation efforts by state-owned banks will result in moderate balance sheet growth of 10-11% YoY. Private banks are likely to grow 18-20%, aided by healthy retail loan growth and refinancing. NIMs are expected to remain stable QoQ and wholesale-funded entities like YES and IIB are likely to report marginal improvement. Asset quality will remain under pressure, led by (a) no significant improvement at the ground level, (b) unseasonal monsoon, and (c) last quarter of restructuring window (to get regulatory forbearance on asset classification). Our channel check suggests that restructuring levels are likely to be high. Employee expenses are likely to be elevated for state-owned banks, led by (a) closure of wage negotiation (15% hike – some banks have provided for 12-13% hike), and (b) fall in yields, leading to higher pension provisions on AS-15. Treasury gains and reversal of countercyclical provisions would provide relief on earnings, especially for state-owned banks. Considering the government’s new criteria (RoA and RoE) for providing capital to state-owned banks, banks may focus on reporting higher profits (and moderate balance sheet growth) as against shoring up coverage ratio with one-off gains. Valuations are near (for large state-owned banks) or below the long period average (20-40% discount for mid-sized state-owned banks) and private banks are trading 21% below peak multiples (26% above LPA). Sharp fall in valuations (especially state-owned banks and ICICIBC) post 3QFY15, largely factors in expected weak asset quality performance for the quarter. Our top picks are AXSB, SBIN, YES, IIB and UNBK. Exhibit 1: Expected quarterly performance (INR m) Sector Net Interest Income Operating Profit Net Profit CMP (INR) RECO Mar-15 Var % YoY Var % QoQ Mar-15 Var % YoY Var % QoQ Mar-15 Var % YoY Var % QoQ Private Banks Axis Bank 569 Buy 37,434 18.2 4.3 38,599 18.9 16.5 21,782 18.2 14.7 DCB Bank 114 Buy 1,268 26.8 4.0 716 42.8 4.8 409 4.6 -3.8 Federal Bank 130 Buy 5,994 -4.1 2.1 4,199 0.0 5.7 2,626 -5.3 -0.8 HDFC Bank 1,031 Buy 60,127 21.4 5.5 47,055 24.5 -1.5 28,017 20.4 0.3 ICICI Bank 321 Buy 49,967 14.7 3.8 49,984 12.2 -0.8 29,061 9.6 0.6 IndusInd Bank 916 Buy 9,118 16.7 5.9 8,762 21.8 13.2 5,104 28.9 14.1 Kotak Mahindra Bank 1,399 Neutral 10,886 12.6 2.8 7,470 23.0 1.3 4,745 16.5 2.1 Yes Bank 846 Buy 9,575 33.1 5.3 8,908 30.9 3.3 5,592 30.0 3.5 Pvt Banking Aggregate 184,369 17.7 4.5 165,693 18.7 3.8 97,336 16.3 4.2 PSU Banks Bank of Baroda 169 Neutral 33,030 5.7 0.5 23,920 -6.7 2.3 6,630 -42.7 98.5 Bank of India 206 Neutral 29,613 -2.8 6.5 18,802 -5.8 0.8 2,371 -57.5 36.7 Indian Bank 169 Buy 11,601 7.7 5.0 7,752 10.2 -2.4 2,101 -22.5 -24.3 Punjab National Bank 149 Buy 42,969 7.4 1.5 30,763 -3.1 11.8 7,973 -1.1 2.9 State Bank of India 275 Buy 138,989 7.7 0.9 108,346 1.9 16.6 37,889 24.6 30.2 Union Bank of India 159 Buy 22,375 9.0 5.5 15,868 20.2 8.3 4,040 -30.2 33.6 PSU Banking Sector 278,577 6.3 2.0 205,451 0.8 11.0 61,004 -4.9 27.8 Source: Company, MOSL Technology Company name Axis Bank Bank of Baroda Bank of India DCB Bank Federal Bank HDFC Bank ICICI Bank Indian Bank Indusind Bank Kotak Mahindra Bank Punjab National Bank State Bank of India Union Bank of India Yes Bank December 2014 Results Preview | January 201 Financials - Banks March 2015 Results Preview | April 2015

- 2. April 2015 137 Subdued business growth marred by weak macros Weak demand environment is likely to result in 10-11% YoY deposit/loan growth in 4QFY15. While state-owned banks are likely to grow in line with or marginally lower than industry average (led by capital conservation effort and weak corporate loan growth of 6% YoY as of February 2015) of 10-11%, growth should remain healthy for private banks at 18-20% (helped by strong retail growth and refinancing). Corporate lenders are likely to report moderate growth, as disbursements are just matching repayments. For the industry, the large corporate segment grew by just 6% YoY as of February 2015. Our interactions with bankers suggest that though inquiries for new projects have started, sanctions are not picking up. Is asset quality bottoming out? Not yet! Focus to be on recoveries Asset quality trend is expected to remain weak, led by (a) challenging macros, (b) poor monsoon, (c) weak recovery, and (d) last quarter of asset classification forbearance on restructured loans. Our interactions with bankers and media reports suggest that RBI may consider the date of reference as against date of approval for the restructuring forbearance ending on March 31. We continue to factor high slippages (2.4% in 4QFY15 v/s 2.1% in 3Q). For most banks, we believe it would take at least couple of quarters for the delinquencies to subside significantly, especially in the new environment of asset classification upon restructuring. Relapse from restructured loans, a key factor for weak 3QFY15 earnings, remains a key for 4QFY15 earnings as well. Guidance on stress loans addition for FY16 will be the key thing to watch out for. Margins to remain largely stable; bulk borrowers might surprise positively Pricing at the industry level remains disciplined. Banks refrained from cutting base rate during the quarter (banks cut base rate in the first week of April 2015). Deposit rate cuts taken by banks in 2HFY15 will help in reduction in cost of deposits and in turn support margins. Our interactions with private bank managements also suggest that growth in high yielding unsecured loans and vehicle loans has picked up during the quarter, which will also support margins. Overall, we expect stable margins QoQ for both private and state-owned banks. NII growth for state-owned banks in 4QFY15 is expected to be 6.3% YoY (trailing loan growth), while private banks' growth is expected to be 17.7% YoY (4.5% higher QoQ). Trading gains, MTM and countercyclical provisions reversal to aid earnings Bond yields have declined by 10-30bp since end-3QFY15. While the fall is not that high in 4Q, over the last six months, the decline has been 50-70bp, which will aid earnings (either via trading gains or MTM reversals). Some banks with high equity portfolio can benefit from positive capital market performance in 4Q. During the quarter, RBI allowed banks to utilize 50% of the countercyclical/floating provisions available, which will help to shore up profits but will reduce PCR. Retail fees healthy, corporate fees muted; opex a drag on earnings Lack of new sanctions, moderate corporate loan growth and incremental corporate growth largely by refinancing continue to impact corporate fees. Retail fees is expected to be healthy, led by third-party distribution income, higher disbursements Weak corporate loan growth (6% YoY as of February 2015) leading to overall loan growth moderation, especially for state-owned banks Stress addition to be high for state-owned banks; slippage ratio at 2.4%; restructuring to rise, as asset classification norms relaxation came to an end at March 2015 NII growth is expected to be 6.3% YoY for state-owned banks, whereas private banks are expected to grow 17.7% YoY Core fees to remain under pressure; trading gains and recoveries from written-off accounts to help operating profit growth March 2015 Results Preview | April 2015

- 3. April 2015 138 in vehicle loans and unsecured loans, and continued momentum in housing loan growth. For state-owned banks, employee expenses would be a drag on earnings, led by AS-15 pension-related provisioning (fall in yields) and higher than expected wage negotiation (15% hike v/s 12-13% factored by some) related settlement. State-owned banks’ core profitability to remain under pressure State-owned banks’ PPP/PAT is likely to grow 1%/-5% YoY, despite a low base, higher net trading gains and one-off provision reversals during the quarter. Higher- than-expected NPAs (especially relapse from restructured loans) and restructuring related provisioning and employee expenses will be a drag on earnings. Over the last year, Indian banks, mainly state-owned banks, have sold ~INR500b worth assets to ARCs. We believe write-downs and resultant MTM provisioning for the same (as per RBI guidelines) would begin over the next one/two quarters. For private banks, healthy core operating performance and one-off income (repatriation of capital and dividend from subsidiaries) will help to manage earnings. We expect PPP and PAT growth of ~19% YoY and ~16% YoY, respectively. Sector strategy Unlike the 2003-08 cycle, this cycle is likely to see a gradual reduction in interest rates (rates were rising over FY04-08, led by higher inflation), providing healthy capital gains to banks (in turn, supporting earnings). Growth improvement coupled with lower interest rates and improving capital markets (in turn de-leveraging) would lead to deceleration in stress addition for banks. Private banks have emerged stronger from the downcycle, with (a) strong capacity in place for growth, (b) decadal high RoAs and RoEs, (c) strong improvement in liability profile, and (d) much diversified and granular loan book. While PSU banks are still grappling with the asset quality issues, reforms in the sector, focus on balance sheet consolidation and profitability are positive signs. Valuations are near (for large state-owned banks) or below the long period average (20-40% discount for mid-sized state-owned banks) and private banks are trading 21% below peak multiples (26% above LPA). Sharp fall in valuations (especially state- owned banks and ICICIBC) post 3QFY15, largely factors in expected weak asset quality performance for the quarter. Our top picks are AXSB, SBIN, YES, IIB and UNBK. High provisions and tax rate to dent profitability for state-owned banks; expect PAT decline of 5% YoY Top picks: AXSB, SBIN, YES, IIB and UNBK March 2015 Results Preview | April 2015

- 4. April 2015 139 Exhibit 2: State-owned banks – one-year forward P/BV Source: MOSL, Company Exhibit 3: Private banks – one-year forward P/BV Source: MOSL, Company Exhibit 4: Loan growth continues to moderate… Source: MOSL, Company Exhibit 5: …as does deposit growth Source: MOSL, Company Exhibit 6: CD rates declined further during the quarter (%) Source: MOSL, Company Exhibit 7: Decline in short-term yields to result in re-pricing benefit (%) Source: MOSL, Company 1.9 0.5 0.8 1.1 0.3 0.8 1.3 1.8 2.3 Mar- 05 Jun- 06 Sep- 07 Dec- 08 Mar- 10 Jun- 11 Sep- 12 Dec- 13 Mar- 15 PSU Banks Sector PB (x) LPA (x) 3.8 1.0 3.0 2.4 0.5 1.5 2.5 3.5 4.5 Mar- 05 Jun- 06 Sep- 07 Dec- 08 Mar- 10 Jun- 11 Sep- 12 Dec- 13 Mar- 15 Pvt Banks Sector PB (x) LPA (x) 34.1 34.3 37.7 39.4 40.9 41.5 43.7 46.9 47.6 48.1 50.3 53.5 54.0 56.5 57.6 60.1 61.2 62.7 63.5 63.9 64.4 65.6 21.9 19.2 24.5 21.5 20.0 19.5 16.0 18.7 16.5 15.9 15.1 14.0 13.5 17.5 14.5 14.3 13.3 11.0 10.5 10.7 10.4 9.5 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 Jan-15 Feb-15 Mar-15 Loans (INR t) Chg YoY (%) 46.4 47.1 49.9 52.1 54.9 56.3 58.3 61.0 62.3 64.1 64.7 69.0 70.7 73.3 75.0 77.4 79.5 82.9 83.4 84.0 84.6 85.9 15.0 14.4 16.8 15.9 18.5 17.5 17.0 14.4 13.5 13.9 11.0 13.1 13.5 14.4 15.9 14.6 12.4 13.1 11.5 11.6 11.8 11.4 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 Jan-15 Feb-15 Mar-15 Deposits (INR t) Chg YoY (%) 8.3 8.6 8.9 9.2 9.5 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 6 month CD (%) 12 month CD (%) 8.60 8.47 8.88 8.80 8.40 8.35 8.63 8.758.61 8.35 8.52 8.47 8.27 7.98 7.94 7.86 7.88 7.79 7.75 7.74 1 Yr - Gsec 3 Yr - Gsec 5 Yr - Gsec 10 Yr - Gsec 31-Mar-14 27-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15

- 5. April 2015 140 Exhibit 8: Net slippages (state-owned) to remain high (%, annualized) Source: MOSL, Company Exhibit 9: NIMs expected to remain stable (%) Source: MOSL, Company Exhibit 10: Relative performance - three-month (%) Source: Bloomberg, MOSL Exhibit 11: Relative performance – one-year (%) Source: Bloomberg, MOSL Exhibit 12: Comparative valuation Sector / Companies CMP EPS (INR) PE (x) PB (x) ROE (%) (INR) Reco FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E Banks-Private Axis Bank 569 Buy 31.3 37.5 44.0 18.2 15.2 12.9 3.0 2.6 2.2 17.8 18.4 18.5 DCB Bank 114 Buy 6.0 7.3 9.4 18.8 15.6 12.1 2.1 1.8 1.6 12.8 12.5 14.2 Federal Bank 130 Buy 11.5 13.0 15.6 11.3 10.0 8.4 1.4 1.3 1.2 13.5 13.7 14.7 HDFC Bank 1,031 Buy 41.1 51.3 62.6 25.1 20.1 16.5 4.2 3.6 3.1 19.5 19.3 20.2 ICICI Bank 321 Buy 19.3 23.0 27.1 16.6 14.0 11.9 2.4 2.1 1.9 15.1 15.8 16.4 IndusInd Bank 916 Buy 34.4 43.7 54.7 26.6 20.9 16.8 4.8 4.0 3.3 19.3 20.7 21.7 J&K Bank 103 Neutral 11.1 13.6 18.1 9.3 7.6 5.7 0.8 0.8 0.7 9.1 10.4 12.6 Kotak Mahindra Bank 1,399 Neutral 37.7 46.1 56.9 37.1 30.4 24.6 4.9 4.3 3.6 14.2 15.0 16.0 South Indian Bank 26 Buy 2.8 3.7 4.7 9.2 7.1 5.6 1.0 0.9 0.8 11.2 13.3 15.2 Yes Bank 846 Buy 48.5 60.4 76.2 17.4 14.0 11.1 3.0 2.6 2.2 21.4 19.7 21.1 Private Bank Aggregate 21.2 17.4 14.4 3.5 3.0 2.7 16.7 17.5 18.4 Banks-PSU Andhra Bank 79 Buy 11.0 17.9 22.5 7.2 4.4 3.5 0.5 0.5 0.4 7.3 11.0 12.7 Bank of Baroda 169 Neutral 16.1 24.1 30.8 10.5 7.0 5.5 1.0 0.9 0.8 10.1 13.7 15.7 Bank of India 206 Neutral 31.1 50.3 64.3 6.6 4.1 3.2 0.5 0.5 0.4 7.9 11.6 13.3 Corporation Bank 55 Neutral 9.0 16.5 21.9 6.1 3.4 2.5 0.4 0.4 0.4 7.3 12.3 14.7 Dena Bank 52 Neutral 5.7 9.7 13.6 9.1 5.3 3.8 0.4 0.4 0.4 4.7 7.7 10.0 IDBI Bank 72 Neutral 10.5 14.4 19.7 6.9 5.0 3.7 0.5 0.5 0.4 7.4 9.5 11.9 Indian Bank 169 Buy 21.7 28.7 33.5 7.8 5.9 5.1 0.6 0.6 0.5 8.5 10.4 11.2 Punjab National Bank 149 Buy 19.6 26.8 36.2 7.6 5.5 4.1 0.7 0.6 0.6 9.9 12.2 14.6 State Bank of India 275 Buy 23.2 29.0 36.2 11.8 9.5 7.6 1.3 1.2 1.1 12.0 13.5 15.0 Union Bank of India 159 Buy 27.4 36.6 47.1 5.8 4.4 3.4 0.6 0.5 0.4 9.9 12.0 13.9 PSU Bank Aggregate 10.0 7.4 5.8 1.0 0.9 0.8 9.9 12.2 14.0 Source: MOSL, Company 1.7 3.1 2.0 1.1 2.7 2.7 2.0 1.1 3.3 1.9 2.1 1.1 1.9 1.6 2.1 2.4 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15E Net Slippage Ratio (%) 3.1 3.3 3.4 3.3 3.0 3.0 3.0 2.9 2.8 2.8 2.8 2.7 2.7 2.7 2.7 2.6 3.4 3.5 3.6 3.7 3.6 3.7 3.7 3.8 3.8 3.8 3.8 3.8 3.9 4.0 3.9 3.9 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15E PSU Private 93 96 99 102 Jan-15 Feb-15 Mar-15 Apr-15 Sensex Index MOSL Financials Index 90 110 130 150 170 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Apr-15 Sensex Index MOSL Financials Index March 2015 Results Preview | April 2015

- 6. 9 April 2015 4 Metals | Coal auction Disclosures This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Motilal Oswal Securities Limited is under the process of seeking registration under SEBI (Research Analyst) Regulations, 2014. There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues Disclosure of Interest Statement Companies where there is interest § Analyst ownership of the stock SESA STERLITE § Served as an officer, director or employee No Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com

- 7. Motilal Oswal India Strategy Gallery