India Equity Analytics Today- Buy Stock of Jyothy Lab, ICICI BANK, Crompton Greaves Ltd and BANK OF INDIA

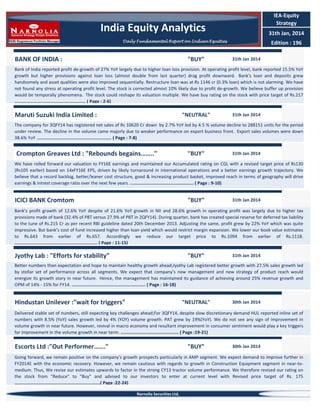

- 1. IEA-Equity Strategy India Equity Analytics 31th Jan, 2014 Daily Fundamental Report on Indian Equities BANK OF INDIA : "BUY" Edition : 196 31th Jan 2014 Bank of India reported profit de-growth of 27% YoY largely due to higher loan loss provision. At operating profit level, bank reported 15.5% YoY growth but higher provisions against loan loss (almost double from last quarter) drag profit downward. Bank’s loan and deposits grew handsomely and asset qualities were also improved sequentially. Restructure loan was at Rs 1146 cr (0.3% loan) which is not alarming. We have not found any stress at operating profit level. The stock is corrected almost 10% likely due to profit de-growth. We believe buffer up provision would be temporally phenomena. The stock could reshape its valuation multiple. We have buy rating on the stock with price target of Rs.217 ...................................................... ( Page : 2-6) Maruti Suzuki India Limited : "NEUTRAL" 31th Jan 2014 The company for 3QFY14 has registered net sales of Rs 10620 Cr down by 2.7% YoY led by 4.5 % volume decline to 288151 units for the period under review. The decline in the volume came majorly due to weaker performance on export business front. Export sales volumes were down 38.6% YoY ......................................................... ( Page : 7-8) Crompton Greaves Ltd : "Rebounds begains…….." "BUY" 31th Jan 2014 We have rolled forward our valuation to FY16E earnings and maintained our Accumulated rating on CGL with a revised target price of Rs130 (Rs105 earlier) based on 14xFY16E EPS, driven by likely turnaround in international operations and a better earnings growth trajectory. We believe that a record backlog, better/leaner cost structure, good & increasing product basket, improved reach in terms of geography will drive earnings & intrest coverage ratio over the next few years. ................................................ ( Page : 9-10) ICICI BANK Cromtom "BUY" 31th Jan 2014 Bank’s profit growth of 12.6% YoY despite of 21.6% YoY growth in NII and 28.6% growth in operating profit was largely due to higher tax provisions made of bank (32.4% of PBT versus 27.9% of PBT in 2QFY14). During quarter, bank has created special reserve for deferred tax liability to the tune of Rs.215 Cr as per recent RBI guideline dated 20th December 2013. Adjusting the same, profit grew by 22% YoY which was quite impressive. But bank’s cost of fund increased higher than loan yield which would restrict margin expansion. We lower our book value estimates to Rs.643 from earlier of Rs.657. Accordingly we reduce our target price to Rs.1094 from earlier of Rs.1118. ............................................................... ( Page : 11-15) Jyothy Lab : "Efforts for stability" "BUY" 31th Jan 2014 Better numbers than expectation and hope to maintain healthy growth ahead;Jyothy Lab registered better growth with 27.5% sales growth led by stellar set of performance across all segments. We expect that company’s new management and new strategy of product reach would energize its growth story in near future. Hence, the management has maintained its guidance of achieving around 25% revenue growth and OPM of 14% - 15% for FY14. ........................................................ ( Page : 16-18) Hindustan Unilever :"wait for triggers" "NEUTRAL" 30th Jan 2014 Delivered stable set of numbers, still expecting key challenges ahead;For 3QFY14, despite slow discretionary demand HUL reported inline set of numbers with 8.5% (YoY) sales growth led by 4% (YOY) volume growth. PAT grew by 19%(YoY). We do not see any sign of improvement in volume growth in near future. However, revival in macro economy and resultant improvement in consumer sentiment would play a key triggers for improvement in the volume growth in near term. ............................................ ( Page :19-21) Escorts Ltd :"Out Performer……." "BUY" 30th Jan 2014 Going forward, we remain positive on the company’s growth prospects particularly in AMP segment. We expect demand to improve further in FY2014E with the economic recovery. However, we remain cautious with regards to growth in Construction Equipment segment in near-tomedium. Thus, We revise our estimates upwards to factor in the strong CY13 tractor volume performance. We therefore revised our rating on the stock from "Reduce" to "Buy" and advised to our investors to enter at current level with Revised price target of Rs. 175 .................................................................( Page :22-24) Narnolia Securities Ltd,

- 2. BANK OF INDIA Company Update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty Stock Performance 1M Absolute -21.6 Rel.to Nifty -17.9 BUY 187 217 235 16 532149 BANKINDIA 393/126 12260 2271804 6074 31th Jan, 2014 Bank of India reported profit de-growth of 27% YoY largely due to higher loan loss provision. At operating profit level, bank reported 15.5% YoY growth but higher provisions against loan loss (almost double from last quarter) drag profit downward. Bank’s loan and deposits grew handsomely and asset qualities were also improved sequentially. Restructure loan was at Rs 1146 cr (0.3% loan) which is not alarming. We have not found any stress at operating profit level. The stock is corrected almost 10% likely due to profit de-growth. We believe buffer up provision would be temporally phenomena. The stock could reshape its valuation multiple. We have buy rating on the stock with price target of Rs.217. NII growth on the back of higher loan growth and margin expansion During quarter, Bank India reported NII growth of 17.8% YoY to Rs.2719 cr versus our expectation of Rs.2683 largely due to higher than expected loan growth, improvement in credit deposits ratio and margin expansion. Bank reported other 1yr -47.5 -47.5 YTD -18.1 -18.1 Share Holding Pattern-% Current 1QFY14 4QFY1 3 Promoters 64.1 64.1 64.1 FII 13.2 13.6 13.5 DII 15.3 15.6 16.3 Others 7.4 6.7 6.0 BANKINDIA Vs Nifty "BUY" income of Rs.1097 cr versus Rs.937 cr in last quarter and Rs.1097 cr in previous quarter. Total revenue grew by 17.6% YoY to Rs.3816 cr. Operating leverage remained stable Bank’s operating leverage remained stable at 0.3% which is quite impressive. In absolute term, operating expenses increased by 20.3% YoY in which employee cost and other operating expenses increased by 18.7% and 22.8% respectively. Healthy NII growth and higher operating cost led pre provisioning profit growth of 15.5% YoY. Loan loss provisions were almost double from last quarter, but asset quality improved Provisions and contingencies increased by 53.3% which includes loan loss provision of Rs.1173 cr which was double from last quarter. But in absolute term, GNPA marginally increased by 1.4% on sequential basis while in percentage to gross advance, it improved by 12.5 bps to 2.8% from 3%. Provisions were little higher by 4% in sequential basis taking almost flat improvement in net NPA. In percentage term, NPA improved to 1.7% from 1.9% in previous quarter. Provision coverage ratio without technical write-off was 38.7% and with technical write off, it stood at 63.8%. Slippage during the quarter was at Rs.1747 cr (2% of advance) versus Rs.1469 cr (1.8% of advance). Rs, Cr Financials 2011 2012 2013 2014E 2015E NII 7878 8313 9024 10578 10869 Total Income 10519 11635 12790 15082 15373 PPP 5398 6694 7458 8701 8917 Net Profit 2542 2678 2749 2776 3170 EPS 46.5 46.7 47.9 43.2 49.4 (Source: Company/Eastwind) 2 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report.

- 3. BANK OF INDIA Balance sheet growth impressive We are impressed with bank’s balance sheet growth trajectory during the quarter as bank reported deposits growth of 30% YoY higher than peers (result so far announced) led by term deposits growth of 35% YoY. Current deposits and saving deposits reported growth of 24% and 14% respectively taking overall CASA deposits growth of 16%. In percentage to total deposits, CASA ratio declined to 22.5% from 24.6% in 3QFY13 largely due to higher growth in term deposits than CASA deposits. Loan grew by 27.2% YoY which is highest so far result announced. Credit deposits ratio for the quarter stood at 77.4% as against 76.8% in previous quarter and 79.2% in last quarter. Margin expansion led by imrprovement in investment yield NIM for the quarter was 2.89%, an improvement of 50 bps YoY due to improvement of investment yield. However fund yield and cost of fund both were declined marginally in sequential but investment yield improved to 8.2% from 7.9% in previous quarter. Profit declined on account of higher loan loss provisions Bank of India (Bank India) profit was declined by 27.1% YoY to Rs.586 cr as against our expectation of Rs.602 cr. Profit growth was lower on account of 98% YoY rise in loan loss provisions. Overall provisions were increased by 53.3% YoY which drag PBT to 21.3% YoY de-growth. Tax rate were 21% versus 28.5% of PBT in previous quarter and 14.5 of PBT in 3QFY13. Total provisions for the quarter stood at 0.4% of net advances higher than 0.28% in 3QFY13. Valuation & View Bank of India reported profit de-growth of 27% YoY largely due to higher loan loss provision. At operating profit level, bank reported 15.5% YoY growth but higher provisions against loan loss (almost double from last quarter) drag profit downward. Bank’s loan and deposits grew handsomely and asset qualities were also improved sequentially. Restructure loan was at Rs 1146 cr (0.3% loan) which is not alarming. We have not found any stress at operating profit level. The stock is corrected almost 10% likely due to profit de-growth. We believe buffer up provision would be temporally phenomena. The stock could reshape its valuation multiple. We have buy rating on the stock with price target of Rs.217. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. BANK OF INDIA Fundamental Through Graph NII growth on the back of higher loan growth and margin expansion Loan loss provisions were almost double from last quarter, but asset quality improved Profit declined on account of higher loan loss provisions Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 4

- 5. BANK OF INDIA Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions Net Profit 3QFY14 7017 2207 546 9769 1097 10866 7050 2719 1097 3816 989 684 1672 2144 1404 586 2QFY14 6631 2129 479 9239 1100 10340 6712 2527 1100 3627 897 628 1525 2102 1232 622 3QFY13 % YoY Gr % QoQ Gr 3QFY14E Variation 5791 21.2 5.8 6910 -1.5 1809 22.0 3.7 2261 2.5 298 83.4 14.0 472 -13.5 8023 21.8 5.7 9644 -1.3 937 17.1 -0.3 1141 4.0 8960 21.3 5.1 10784 -0.8 5714 23.4 5.0 6960 -1.3 2308 17.8 7.6 2683 -1.3 937 17.1 -0.3 1141 4.0 3246 17.6 5.2 3824 0.2 833 18.7 10.2 931 -5.8 557 22.8 8.8 674 -1.3 1390 20.3 9.7 1606 -4.0 1856 15.5 2.0 2218 3.4 916 53.3 13.9 1382 -1.5 803 -27.1 -5.8 602 2.7 Balance Sheet Data Equity Capital Reserve & Surplus Deposits Borrowings Other liabilities and provisions Total Liability Cash in hand Cash and balances with reserve bank of india Investment Advance Fixed Assets Others Assets Total Assets 643 26,672 454,140 40,545 14,492 536,492 21,406 39,662 108,253 351,725 2,975 12,470 536,492 597 25,686 432,282 41,751 12,727 513,042 24,621 34,658 107,413 332,190 2,957 11,203 513,042 575 22,698 349,117 28,686 14,890 415,966 17,940 22,580 86,083 276,486 2,853 10,024 415,966 11.9 9881 6156 3.0 1.9 37.7 8765 5947.3 3.0 2.0 32.1 8898 5,228 3.5 2.0 41.2 Asset Quality GNPA NPA GNPA(%) NPA(%) PCR(%) Without technical write off 41.3 597 3.8 27,243 5.1 449,063 -2.9 42,513 -2.7 13.9 17.5 30.1 7.8 -7.2 2.1 -1.1 4.9 29.0 4.6 -100.0 19.3 -13.1 -100.0 75.7 14.4 -100.0 25.8 0.8 27.2 2,261 5.9 345,503 4.3 11.3 29.0 4.6 11.0 12.7 17.7 -1.8 0.6 24.4 -97.9 3.5 Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. BANK OF INDIA Financials & Assuption Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest on deposits Interest on RBI/Inter bank borrowings Others Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions Net Profit 2011 2012 2013 2014E 2015E 15570 5195 798 295 21858 2642 24500 12218 813 950 13981 7878 2642 10519 3492 1629 5121 5398 2909 2542 46.0 20241 7142 834 264 28481 3321 31802 17957 1145 1065 20167 8313 3321 11635 3069 1871 4941 6694 4016 2678 5.3 23139 7261 1257 251 31909 3766 35675 20238 1489 1158 22885 9024 3766 12790 3131 2201 5332 7458 4709 2749 2.7 27015 8562 1987 1 37565 4504 42069 29922 1419 1281 26987 10578 4504 15082 0 0 6381 8701 4766 2776 1.0 31171 10773 1987 1 43932 4504 48436 30362 1419 1281 33063 10869 4504 15373 3810 3656 6457 8917 5045 3170 14.2 299559 30 22021 -2 213708 26 86677 27 318216 6 32114 46 248833 16 86754 0 381840 20 35368 10 289367 16 94613 9 465844 22 43275 22 358816 24 117097 24 535721 15 49766 15 366720 2 134662 15 7.3 6.3 6.5 4.1 8.0 4.3 8.1 8.7 7.8 5.6 6.9 5.8 8.0 7.1 7.7 5.2 6.8 5.3 7.5 7.3 7.5 6.4 7.5 5.3 8.5 8.0 8.4 5.7 7.5 6.2 322.7 1.5 10.3 365.3 1.0 7.7 416.9 0.7 6.3 434.0 0.6 5.6 0.0 0.5 4.9 Key Balance Sheet Data Deposits Deposits Growth(%) Borrowings Borrowings Growth(%) Loan Loan Growth(%) Investment Investment Growth(%) Eastwind Calculation Yield on Advances Yield on Investments Yield on Funds Cost of deposits Cost of Borrowings Cost of fund Valuation Book Value P/BV P/E Source: Eastwind/Company Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 6

- 7. Maruti Suzuki India Limited Result Update NEUTRAL CMP Target Price Previous Target Price Upside Change from Previous 1638 1700 4% - Market Data BSE Code NSE Symbol 52wk Range H/L Market Cap (Rs/Cr) Average Daily Volume Nifty 532500 MARUTI 1864/1217 22,266 423015 6073 Stock Performance-% Absolute Rel. to Nifty 1M -7.1 -3.4 1yr 2.9 2.5 YTD 35.0 22.0 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 56.2 56.2 56.2 21.5 19.7 22.0 14.0 15.4 13.1 8.3 8.8 8.7 One Year Price Vs NIFTY "NEUTRAL" 31st Jan' 14 Result Analysis: The company for 3QFY14 has registered net sales of Rs 10620 Cr down by 2.7% YoY led by 4.5 % volume decline to 288151 units for the period under review. The decline in the volume came majorly due to weaker performance on export business front. Export sales volumes were down 38.6% YoY and 41.3% QoQ to 19,966 units. EBITDA for MSIL is up 52% YoY to Rs.1,355 Cr and EBITDA margin was up 448 bps YoY to 12.3%. However results are not comparable on yearly basis as 3QFY13 does not include impact of SPIL merger. Raw material cost as % of net sales is down 671 bps YoY.Employee cost as % of net sales is up 62 bps YoY but down 82 bps QoQ to 2.8%.Royalty payments for Q3 FY14 were around levels of H1 FY14. The net profits for the company during 3QFY14 came at Rs 681 Cr and NPM at 6.25 %.Effective tax rate is around 23.1%. On realization front, the Net realization for company is up 1.4% YoY to Rs.368547 however there is sequential decrease in net realization mainly due weak product mix, lower export sales number and higher contribution of Mini Segments. Discounts in 3QFY14 is at all time high to Rs.19412/unit vs. 17,500/unit QoQ. Recent Event : MSIL has announced that the proposed capacity expansion (1.5 Million units per annum) in Gujarat would be through a 100% Suzuki (parent) owned subsidiary. The subsidiary would be fully dedicated to Maruti. How we see the deal : 1.The near term effect of the deal on PAT is neutral, as this Greenfield facility at Gujrat will take 2 -3 year to get commissioned and another 1 year to get its full capacity utilization, this translates period FY17 onwards. 2.The MSIL is getting cars at cost of manufacturing plus portion of incremental capex which means MSIL will lose manufacturing margins and will getting only the trading margin. The newly formed company will be 100 % subsidiary of Suzuki Motors Limited. 3.The profit sharing from the upcoming Gujrat facility would depend on the stake of Suzuki Motor in MSIL. 4..In any case Suzuki Motor will make profit equal to its stake in MSIL whether it makes its own capex as in this case or MSIL made capex then why did Suzuki made this huge capex. View & Valuation: At CMP Rs 1638 the stock is trading at highest 5 year historical P/E multiple and in current scenario we donot see much upsides from hereon. Therefore we are Neutral for the stock with target price Rs 1700.The CMP seems to factored almost all the upsides including improving operational efficiency and volume growth. The stock may see some upward movement from current price on buzz that Suzuki may increase its stake in MSIL. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 10894 1355 681 12.4% 6.3% 2QFY14 10468 1321 669 12.6% 6.4% (QoQ)-% 4.1 2.6 1.8 (20bps) (10bps) 3QFY13 11200 891 501 8.0% 4.5% Rs, Crore (YoY)-% -2.7 52.0 35.9 450bps 180bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 7

- 8. Maruti Suzuki India Limited Graphical Represenation SALES & PAT TREND Net sales of Rs 10620 Cr down by 2.7% YoY led by 4.5 % volume decline to 288151 units for the period under review. (Source: Company/Eastwind) OPM & NPM TREND Raw material cost as % of net sales is down 671 bps YoY. Employee cost as % of net sales is up 62 bps YoY but down 82 bps QoQ to 2.8%. (Source: Company/Eastwind) REALIZATION PER VEHICLE Net realization for company is up 1.4% YoY to Rs.368547 however there is sequential decrease in net realization mainly due weak product mix, lower export sales number and higher contribution of Mini Segments (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. Crompton Greaves Ltd. V- "Accumulate" 31th Jan' 14 "Rebounds begains…….." Result update Accumulate CMP Target Price Previous Target Price Upside 110 130 120 15% 8% Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 500093 CROMPGREAV 72/137 4,251 775,133 6,074 Stock Absolute Rel. to Nifty 1M (14.2) (10.6) 1yr 2.3 2.3 YTD 17.9 11.0 Share Promoters FII DII Others 3QFY14 42.5 18.5 23.8 15.2 1 yr Forward P/B 2QFY14 42.5 16.6 24.5 16.5 1QFY14 41.7 15.2 23.7 19.4 Crompton consolidated net sales rose 12.8% on yearly basis to Rs 3351.9 crore during the quarter, which were inline with street expectations. Consolidated earnings before interest, tax, depreciation & amortisation (EBITDA) stands to Rs 169.3 crore and EBITDA margin at 4.9 percent. Power systems revenues increased 17.3 percent on yearly basis to Rs 2132.2 crore during Dec quarter FY14, and earnings before interest & tax (EBIT) from power segment during the quarter were Rs 53.3 crore. Meanwhile, its consumer products and industrial systems divisions posted single digit growth in topline during the quarter and it gone by 7.3% to Rs 651 crore. EBIT of consumer products rose to Rs 75.9 crore up by 19.9% and industrial systems' EBIT decreased by 42.7% to Rs 29.5 crore. Other income jumped 33.0% yoy to Rs 40.4 crore while finance cost climbed to Rs 26.7 crore up by 25.6% yoy. At the current level of INR 110, we maintain 'ACCUMULATE' at the Stock as Power sector has shown sign of revival by posting an EBIT of Rs 53.3 crore VS Loss of Rs 104.6 crore qoq and also performance of Consumer division was satisfactory with a sales growth of 7.25% yoy and EBIT Growth of 19.9%. Margin to improve further : Domestic power systems and consumer products segment were key margin drivers as they sustained healthy operating margins of 9.4% and 11.7%, respectively. Collectively, both segments constitute 41% of total consolidated revenue. Consumer products segment continued its market share expansion following higher distribution reach in categories like lighting (up 17% yoy and fans up 13% yoy. Order scenerio : Consolidated order book at the quarter ended Dec'14 was Rs. 10074 crore, up 9.12% yoy. Consolidated order inflow for the quarter was Rs. 2624 crore up 15.7% yoy. Crompton expects a robust order intake in high value-added segments like UHV/EHV in Asia, Automation/smart grid in the power segment, Motors in EMEA market, Railway transportation and electronic drives in the industrial segment. Valuations : We have rolled forward our valuation to FY16E earnings and maintained our Accumulated rating on CGL with a revised target price of Rs130 (Rs105 earlier) based on 14xFY16E EPS, driven by likely turnaround in international operations and a better earnings growth trajectory. We believe that a record backlog, better/leaner cost structure, good & increasing product basket, improved reach in terms of geography will drive earnings & intrest coverage ratio over the next few years. It has assumed break even EBIT level for international subsidiaries in FY14. Further, In our view, the stock's performance would largely be driven by an improvement in overseas business, though standalone performance would protect downsides. Financials Consolidated Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 3351.9 169.3 59.5 5.1% 1.8% 2QFY13 3204.9 161.3 57.8 5.0% 1.8% (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% 4.6% 5.0% 3.0% 10 bps 0 bps 3QFY13 2971.8 2.0 -69.0 0.1% -6.3% Rs, Crore (YoY)-% 12.8% 8322.4% 186.2% 500 bps 810 bps (Consolidated) 9

- 10. Crompton Greaves Ltd. Key financials PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 2016E 8737 74 8811 996 874 122 81 867 305 0 563 75 1.2 8.8 9141 110 9251 1278 1122 155 43 1190 365 35 860 82 1.3 13.4 10005 113 10118 1344 1150 194 34 1229 310 -38 881 82 1.3 13.7 11249 63 11311 804 544 260 57 550 182 0 368 52 0.8 5.7 12094 75 12170 383 180 203 71 185 101 -121 -37 30 0.5 -0.6 13304 110 13414 665 412 253 90 432 137 0 295 52 0.8 4.6 14634 110 14744 922 669 253 100 679 215 0 464 52 0.8 7.2 16098 110 16208 1014 736 278 110 736 233 0 502 52 0.8 7.8 11.4% 6.4% 13.0% 1.7% 30.7% 25.2% 14.0% 9.4% 5.2% 0.5% 34.3% 30.0% 13.4% 8.8% 5.1% 0.5% 26.9% 24.9% 7.1% 3.3% 4.1% 0.6% 10.2% 9.2% 3.2% -0.3% -0.6% 0.5% -1.0% 0.6% 5.0% 2.2% 4.2% 0.7% 8.4% 7.5% 6.0% 3.0% 6.6% 0.7% 11.8% 11.3% 6.0% 3.0% 7.1% 0.7% 11.4% 11.5% 1831 718 2549 64 68 2504 501 3005 64 256 3275 395 3670 64 268 3611 985 4596 64 138 3562 1851 5413 64 94 3529 2000 5529 64 110 3941 2000 5941 64 110 4391 2000 6391 64 110 28.5 2.4 10.8 8 39.0 6.6 26.2 19 51.0 5.3 33.5 20 56.3 2.5 9.6 24 55.5 1.7 2.5 55.0 2.0 4.6 24 61.4 1.8 6.7 15 68.4 1.6 6.7 14 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share (Adj) CMP Valuation Book Value P/B Int/Coverage P/E (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. ICICI BANK Result update ACCUMULATE CMP 981 Target Price 1094 Previous Target Price 1118 Upside 12 Change from Previous -2.147 Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 532174 ICICIBANK 358/127 11104 19.54 lakhs 6073 Stock Performance Absolute Rel.to Nifty 1M -11.3 -7.6 1yr -18.1 -18.1 YTD -18.1 -18.1 Share Holding Pattern-% Current 4QFY13 3QFY1 3 Promoters 66.7 64.1 64.1 FII 11.0 13.2 13.6 DII Others 15.4 6.9 ICICI Bank Vs Nifty 15.3 7.4 15.6 6.7 "ACCUMULATE" 31th Jan, 2013 Bank’s profit growth of 12.6% YoY despite of 21.6% YoY growth in NII and 28.6% growth in operating profit was largely due to higher tax provisions made of bank (32.4% of PBT versus 27.9% of PBT in 2QFY14). During quarter, bank has created special reserve for deferred tax liability to the tune of Rs.215 Cr as per recent RBI guideline dated 20th December 2013. Adjusting the same, profit grew by 22% YoY which was quite impressive. But bank’s cost of fund increased higher than loan yield which would restrict margin expansion. We lower our book value estimates to Rs.643 from earlier of Rs.657. Accordingly we reduce our target price to Rs.1094 from earlier of Rs.1118. Healthy NII growth on the back of higher loan growth and margin expansion During quarter, bank reported NII growth of 21.6% YoY to Rs.4256 cr on the back of higher than expected loan growth and loan yield led by credit deposits ratio and expansion NIM. Other income registered growth of 26.5% YoY to Rs.2801 cr versus Rs.2166 cr in previous quarter and Rs.2215 Cr in last quarter in corresponding quarter. Healthy NII along with higher support from other income, revenue of the bank grew by 23.5% YoY to Rs.7057 Cr. Stable operating leverage led healthy operating profit growth Operating leverage (opex to total assets) was remained very impressive and was stable at 0.46% versus 0.43% in 3QFY13. Cost to income ratio of the bank improved by 250 bps YoY to 37.4% as against 39.6%. Operating expenses increased by 15.7% YoY in which employee cost and other operating expenses increased by 6% and 23% YoY respectively. Healthy revenue growth and controlled operating expenses led operating profit growth of 28.6% YoY to Rs.4440 cr. Asset quality by and large stable sequentially but provision declined Bank reported deterioration in asset quality (GNPA) in sequential basis by 3.7% in absoluter term. In percentage to gross advance, GNPA stood at 3.07% versus 3.1% in previous quarter (marginally improved). Provisions were declined by 0.6% QoQ taking net NPA increased by 15.3% QoQ. In percentage to net advance, this ratio stood at 0.94% versus 0.85% in previous quarter. Lower provisions made PCR to 70.1% versus 73.1% in previous quarter. Financials NII Total Income PPP Net Profit EPS 2011 10739 42252 10950 6093 52.9 2012 10734 18237 10386 6465 56.0 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. Rs, Cr 2013 2014E 2015E 13866 17734 21111 22212 27035 30413 13199 16762 18856 8325 10658 11955 72.2 92.3 103.6 (Source: Company/Eastwind) 11

- 12. ICICI BANK Lower growth in deposits led by muted growth in term deposits In balance sheet front, bank’s deposits grew by 11% YoY lower than expectation largely due to lower growth in term deposits. Demand deposits and saving deposits grew by 9.3% and 11.8% YoY taking overall CASA deposits growth to 16% YoY. In percentage to total deposits, CASA stood at 42.9% versus 40.9% in last quarter. But in sequential basis, bank reported 40 bps declined in CASA and borrowing also increased by 4%. Overall cost of fund was increased by 32 bps in sequential basis which restricted margin expansion despite of improvement in loan yield. Higher loan growth led by retail loan followed by overseas and corporate loan Loan grew by 16% YoY higher than expectation. Incremental loan growth came from retail advances which grew by 22% YoY followed by oversea and corporate loan. Retail loan now constituted 39% of total loan versus 37% in last quarter. Retail loans are generally high yield in nature and higher loan constitute would result of margin sustaining at current level. We are susceptible about the margin improvement because of higher cost of fund as bank reported lower CASA and higher borrowing as a percentage to NDTL in sequential basis. Margin expansion marginally on account of higher cost of fund than deposits NIM improved marginally from previous quarter to 3.32% from 3.31% largely due to higher cost of fund than loan yield. Sequentially, cost of fund increased to 9.1% from 8.8% in previous quarter due to higher borrowing cost along with lower CASA ratio. Loan yield improved to 9.9% from 9.7% in previous quarter. We believe NIM of the bank would be highest as increasing cost of fund would cushion loan yield improvement. Valuation & View Bank’s profit growth of 12.6% YoY despite of 21.6% YoY growth in NII and 28.6% growth in operating profit largely due to higher tax provisions made of bank (32.4% of PBT versus 27.9% of PBT in 2QFY14). During quarter, bank has created special reserve for deferred tax liability to the tune of Rs.215 Cr as per recent RBI guideline dated 20th December 2013. Adjusting the same, profit grew by 22% YoY which was quite impressive. But bank’s cost of fund increased higher than loan yield would restrict margin expansion. We lower our book value estimates to Rs.643 from earlier of Rs.657. Accordingly we reduce our target price to Rs.1094 from earlier of Rs.1118. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 12

- 13. ICICI BANK Chart Focus NII growth on account of higher than expected loan growth and margin expansion Healthy revenue growth and impressive operating leverage led operating profit Despite of higher revenue grwoth and operating profit growth, net profit muted because of higher tax provisions against DTL Source: Company/Eastwind Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 13

- 14. ICICI BANK Quarterly Result Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit 3QFY14 8224 2923 34 275 11456 2801 14257 7200 4256 2801 7057 997 1620 2617 4440 695 3745 1212 2533 2QFY14 7737 2839 47 190 10813 2166 12980 6770 4044 2166 6210 872 1451 2322 3888 625 3263 911 2352 3QFY13 7066 2742 136 194 10138 2215 12353 6639 3499 2215 5714 941 1321 2261 3452 369 3084 834 2250 % YoY Balance Sheet Net Worth Deposits Borrowings Investment Loan 74057 316970 150940 171985 332632 73103 309046 145356 168829 317786 67119 286418 147149 166842 286766 10.3 1.3 10.7 2.6 2.6 3.8 3.1 1.9 16.0 4.7 10448 3121 3.1 0.9 70.1 10078 2707 3.1 0.9 73.1 9803 2185 3.4 0.8 77.7 Asset Quality GNPA (Rs Cr) NPA (Rs Cr) % GNPA % NPA PCR(w/o technical write-off)(%) 16.4 6.6 -75.3 42.1 13.0 26.5 15.4 8.4 21.6 26.5 23.5 6.0 22.7 15.7 28.6 88.4 21.4 45.4 12.6 % QoQ 3QFY14E Variation 6.3 7971 -3.1 2.9 3012 3.0 -28.5 52 55.8 44.7 236 -14.1 5.9 11271 -1.6 29.3 2325 -17.0 9.8 13597 -4.6 6.4 6766 -6.0 5.2 4505 5.9 29.3 2325 -17.0 13.6 6831 -3.2 14.4 0 -100.0 11.7 0 -100.0 12.7 2596 -0.8 14.2 4235 -4.6 11.2 657 -5.4 14.8 3578 -4.5 33.1 1073 -11.5 7.7 2504 -1.1 6.6 2.1 0.4 1.6 -98.2 -1.2 3.7 42.8 75608 318387 153387 3012 328689 15.3 Source: Company/Eastwind Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. ICICI BANK Financials & Assuption Quarterly Result Interest/discount on advances / bills Income on investments Interest on balances with Reserve Bank of India Others Total Interest Income Others Income Total Income Interest on deposits Interest on RBI/Inter bank borrowings Others Interest Expended NII Other Income Total Income Employee Other Expenses Operating Expenses PPP( Rs Cr) Provisions PBT Tax Net Profit Balance Sheet DEPOSITS Deposits Growth Borrowings Borrowings Growth(%) Investment Growth(%) Advances Growth(%) 2011 2012 2013 2014E 2015E 19098 9181 469 1334 30081 31513 61595 11315 1683 6345 19343 10739 31513 42252 4393 26910 31302 10950 4631 0 0 6093 22130 9684 491 1238 33543 7503 41045 14304 1469 7035 22808 10734 7503 18237 3515 4335 7850 10386 1583 8803 2338 6465 27341 11009 543 1182 40076 8346 48421 16889 2087 7234 26209 13866 8346 22212 3893 5120 9013 13199 1803 11397 3071 8325 31646 11785 184 946 44561 9302 53863 18217 0 10146 27812 16749 9302 26051 4451 5441 9892 16159 2592 13567 4071 9496 34992 13220 184 946 49342 9302 58644 20402 0 11364 28840 20502 9302 29804 5096 6229 11325 18478 2853 15626 4688 10938 259106 7.3 125839 8.8 209653 12.5 256019 13.4 255500 -1.4 140165 11.4 159560 -23.9 253728 -0.9 292,614 14.5 145,341 3.7 171,394 7.4 290,249 14.4 321,875 10.0 158,535 9.1 187,360 9.3 339,592 17.0 360,500 12.0 177,560 12.0 209,843 12.0 380,343 12.0 7.5 4.7 4.4 6.4 5.0 8.7 6.4 5.6 6.1 5.8 9.4 6.7 5.8 6.4 6.0 9.3 6.3 5.7 6.4 0.0 9.2 6.3 8.0 6.4 5.9 480 2.3 5.5 524 1.7 7.3 578 1.5 9.4 643 1.6 9.2 682 1.5 10.6 Eastwind Calculation Yield on Advances Yield on Investments Cost of deposits Cost of Borrowings Cost of fund Valuation Book Value P/BV P/E Source: Company/Eastwind Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 15

- 16. Jyothy Lab "BUY" 31st Jan' 14 "Efforts for stability" Result update CMP Target Price Previous Target Price Upside Change from Previous BUY 207 260 26% - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 532926 JYOTHYLAB 221/140 3741 51716 6074 Stock Performance 1M Absolute 7.9 Rel. to Nift 11.7 1yr 36.6 36.2 YTD 3.5 4.9 Share Holding Pattern-% Current Promoters FII DII Others 66.7 15.3 8.6 9.4 1 yr Forward P/B 2QFY14 1QFY14 63.7 16.0 9.8 10.5 63.7 17.0 9.1 10.2 Better numbers than expectation and hope to maintain healthy growth ahead; For 3QFY14, Jyothy Lab registered better growth with 27.5% sales growth led by stellar set of performance across all segments. Its synergy affect of the Henkel Integration and entry into new geographies combined with rural, urban, modern and traditional shops envisage its brilliant performance during the quarter. PAT grew by 60.5% on YoY basis. We expect that company’s new management and new strategy of product reach would energize its growth story in near future. Hence, the management has maintained its guidance of achieving around 25% revenue growth and OPM of 14% 15% for FY14. Volume growth: Volume grew by 22% while 5% was price/product mix growth. The dishwash and personal care grew higher versus overall volume growth while fabric care and HI grew slower. Margin impacted due to higher Ad spend: Company’s EBITDA margin declined 130bps (YoY) to 14.3% and improved 130bps sequentially. Company increased its RM cost from 28.5% (3QFY13) to 29.5% and Ad spend from 6.9%(3QFY13) to 9.2%. While, PAT margin improved by 180bps(YoY) and 270bps(QoQ) to 9.1%. Management expected to see EBITDA margin at a range of 14-15% and Ad spends at 10-12%, which is in-line. However, they will spend little more on Ad spend in coming quarters but it will not be more than 12%. Segments/ Brandwise Performance: In its bread and butter business detergent & soap segment which includes brands like Ujala, Henko, Exo, Pril, Margo, Mr. White, grew by 27.6%. Ujala fabric whitener continues to be the market leader with a market share of 72.5% by value. There was a strong over 25% growth in the dishwash segment especially Exo bars. Pril posted a modest growth. Home Care, which includes mosquito repellant Maxo and Exo scrubber, saw revenues growth of 26% . The coils saw moderation due to a weak season. Others business, which include brands like Fa and Neem, saw revenue to Rs 4cr from negative Rs 0.32cr (3QFY13). View and Valuation: Going forward, the company will focus on brand building with extension of current brands and continue to adapt to the continuous changes of consumers. Management is confident that these efforts will further strengthen brands and establish better consumer connect. The Company’s products are available through 2.9 mn outlets in India and expects the sub-stockist will increase by 20% from the current 2000 to 2400 by the end of FY14E. We believe the distribution restructuring would lead to generate sales and its presence in highly demanding categories would help to manage high margins and volume growth simultaneously. We maintain "BUY" view with a target price of Rs 260. At a CMP of Rs207, stock trades at 3.9x FY15E P/BV. Financials Rs, Cr 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 297.44 306.1 -2.8% 233.3 27.5% EBITDA 42.7 40 7% 36.5 17% PAT 27.2 19.6 39% 16.9 61% EBITDA Margin 14.4% 13.1% 130bps 15.6% (12bps) PAT Margin 9.14% 6.40% 270bps 7.24% 180bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 16

- 17. Jyothy Lab Sales and Sales Growth (YoY)-% The company has maintained its guidance of achieving around 22% - 25% revenue growth. (Source: Company/Eastwind) Sales Mix-segment (%) (Source: Company/Eastwind) Margin-% Management expected to see EBITDA margin at a range of 14-15% in FY14E. (Source: Company/Eastwind) RM Cost and Ad Spend-(% of sales) Company will spend little more on Ad spend in coming quarters but it will not be more than 12%. (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 17

- 18. Jyothy Lab Key takeaways from Conference call; 1) The company has maintained its guidance of achieving around 22% - 25% revenue growth. (2) EBITDA margin will be between 14-15% and ad spends will be 10-12% which is in-line and they will spend little more ad spend in coming quarters but it will not be more than 12%. (3) For FY15, the company will re-launch Henko with a completely new positioning and formulation in Q1 FY15, (4) They will extend Margo brand in skin care category and planned several activities for Maxo in FY15 including entry into low smoke coil. (4) The company will continue to invest aggressively in expanding its share of revenue from non-South markets. Next year target is 40% should be from south and 60% from rest of south India. And finally, 70-30% in favour of rest of India. Financials Rs in Cr Sales Raw Materials Cost Employee Cost Advertisement and Publicity Other expenses Total expenses EBITDA Depreciation Other Income EBIT Interest Cost Profit (+)/Loss (-) Before Taxes Provision for Taxes Net Profit (+)/Loss (-) Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Employee Cost Ad spend Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 596.32 317.19 75.38 26.62 85.31 504.5 91.82 12.36 17.8 79.46 1.7 95.56 21.48 74.08 FY11 626.39 320.27 81.31 33.99 111.52 547.09 79.3 13.03 16.91 66.27 1.99 81.19 15.43 65.76 FY12 912.99 502.99 113.67 41.79 170.46 828.91 84.08 24.65 22.73 59.43 23.83 58.33 19.94 38.39 FY13 1105.96 584.35 130.48 95.54 165.92 976.29 129.67 22.43 5.202 107.24 68.22 44.222 -14.87 59.092 FY14E 1373.60 714.27 151.10 137.36 185.44 1188.17 185.44 26.57 54.94 158.87 63.25 150.56 28.61 121.95 FY15E 1703.27 885.70 178.84 153.29 238.46 1456.29 246.97 32.95 68.13 214.03 49.25 232.91 44.25 188.66 65.3% 88.3% 93.0% 5.0% -13.6% -11.2% 45.8% 6.0% -41.6% 21.1% 54.2% 53.9% 24.2% 43.0% 106.4% 24.0% 33.2% 54.7% 53.2% 12.6% 4.5% 14.3% 22.5% 51.1% 13.0% 5.4% 17.8% 19.0% 55.1% 12.5% 4.6% 18.7% 34.2% 52.8% 11.8% 8.6% 15.0% -33.6% 52.0% 11.0% 10.0% 13.5% 19.0% 52.0% 10.5% 9.0% 14.0% 19.0% 15.4% 13.3% 12.4% 12.7% 10.6% 10.5% 9.2% 6.5% 4.2% 11.7% 9.7% 5.3% 13.5% 11.6% 8.9% 14.5% 12.6% 11.1% 169.85 7.3 387.8 10.1 53.1 19.1% 3.2 16.7 219.8 8.1 631.1 8.1 77.9 10.4% 2.8 27.1 155 16.1 612.4 2.4 38.0 6.3% 4.1 65.0 175 16 638.6 3.7 39.9 9.3% 4.4 47.4 207 16 713.4 7.6 44.6 17.1% 4.6 27.2 207 16 854.9 11.8 53.4 22.1% 3.9 17.6 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (Source: Company/Eastwind) 18

- 19. Hindustan Unilever "NEUTRAL" 30th Jan' 14 "wait for triggers" Result update CMP Target Price Previous Target Price Upside Change from Previous NEUTRAL 570 - Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 500696 HINDUNILVR 725/432 123161 2006314 6153 Stock Performance-% 1M Absolute 0.23 Rel. to Nifty 3.2 1yr 21.18 20.33 YTD 21.63 19.85 Share Holding Pattern-% Current Promoters FII DII Others 67.25 14.83 3.35 14.57 2QFY14 1QFY14 67.25 15.33 3.03 14.39 52.5 20.23 7.13 20.16 Delivered stable set of numbers, still expecting key challenges ahead; For 3QFY14, despite slow discretionary demand HUL reported inline set of numbers with 8.5% (YoY) sales growth led by 4% (YOY) volume growth. PAT grew by 19%(YoY). Increasing competitive intensity, slow consumer demand and expectation of hike in input cost in near term could be major concern for HUL. We expect that these concerns could play out over the next couple of quarters. We do not see any sign of improvement in volume growth in near future. However, revival in macro economy and resultant improvement in consumer sentiment would play a key triggers for improvement in the volume growth in near term. Steady margin growth: During the quarter, EBITDA margin inched up by 50bps(YoY) to 17% because of stable INR movement against the USD and stable set of RM cost than same quarter previous year. PAT margin also improved slightly to 17.4% on YoY. During the quarter, company has been efficient to manage cost inflation through judicious pricing and unwinding of promotions. Volume growth: Volume growth for the quarter was at 4%, which is slightly lower than the 5% registered in previous several quarters due to further deterioration in market growth rates and higher component of price versus volume in its core soaps and detergents category. Segment-wise performance: (a)Soaps and Detergents delivered a healthy performance. The company witnessed a price led growth in this segment during the quarter. Wheel was re-launched with superior formulation at quarter end. It has grown well compared to preceding last 2 quarters. (b)Household Care delivered another strong quarter with both Vim and Domex growing in double digits. (3)On Personal Products, Skin Care performing well with a revenue growth in mid teens in a slowing market and in spite of the delay in the onset of the winter season. P/BV (x) -1year forward Product Strategy: The company has launched premium range of hair care products Toni and Guy. This brands are sold through select top end outlets. However, its operating metrics was challenging given the volatile cost environment, led by the INR depreciation, and heightened competitive intensity during the quarter. View and Valuation: To continue to deliver strong growth, HUL is likely to continue with aggressive marketing and offer discounts/price cuts, especially in soaps, detergents and personal products and the company fights off competition rivals domestic as well as multi-national. we are confident of the medium to long-term growth prospects of the FMCG sector. At a CMP of Rs 570, stock trades at 29x FY15E P/BV. We have a NEUTRAL view on the stock. Financials Rs, Crore 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 7037.78 6747.2 4.3 6433.89 9.4 EBITDA 1226.8 1085.31 13.0 1088.99 12.7 PAT 1043.7 888.3 17.5 877.08 19.0 EBITDA Margin 17.4% 16.1% 130bps 16.9% 50bps PAT Margin 14.8% 13.2% 160bps 13.6% 120bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 19

- 20. Hindustan Unilever Volume and Pricing growth -%(YoY) Volume growth for the quarter was at 4%, which is slightly lower than the 5% registered in previous several quarters (Source: Company/Eastwind) Sales (cr) and Growth(YoY)-% (Source: Company/Eastwind) Seg Segments Soaps & Detergents Personal Products Beverages Packaged Foods Others % of Sales 47.0% 31.9% 11.8% 5.2% 3.8% Revenue Growth-% 3QFY13 2QFY14 3QFY14 19.9% 6.4% 7.1% 8.5% 11.8% 12.4% 18.2% 16.1% 7.2% 7.7% 8.7% 12.9% -33.4% 5.7% -4.7% 3QFY13 12.4% 28.3% 17.7% -0.7% -6.4% Margin-% 2QFY14 3QFY14 14.0% 13.3% 22.8% 28.6% 17.0% 16.2% 3.3% -3.6% 1.5% -4.9% EBITDA Margin up by 90bps to 13.3% from Soap and Detergent, flat margin growth on Personal Products. (Source: Company/Eastwind) Margin-% EBITDA margin inched up by 50bps(YoY) to 17% because of stable INR movement against the USD and stable set of RM cost than same quarter previous year. (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 20

- 21. Hindustan Unilever Key facts from HUL Con-call (attended on 28th Jan, 2014) (1)The mgmt stated that FMCG market growth continues to remain soft across the categories, with high competitive intensity and uncertain media environment. While, for medium to long term the mgmt is positive on FMCG sector. (2)The management expects to see some cost burden on promotion through media because of 12 minutes advertisement cap. (3)Rural growth continues to outpace urban growth by 200 bps and there is no clear-cut sign of uptick in urban demand as per available data from Nielsen. (4)Personal products and packaged foods both segments have headroom for growth and will remain focus area. (5)Tax rate is expected to rise by 300-400 bps for FY15. Financials Rs in Cr, Sales RM Cost Purchases of stock-in-trade WIP Employee Cost Ad Spend Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Ad Spend Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% P/BV P/E FY10 18025.6 6762.8 2173.1 75.7 970.9 2423.0 2783.2 15188.7 2836.9 191.9 82.7 2727.6 7.5 2720.2 615.3 2104.9 FY11 20022.6 7796.9 2692.8 -307.6 1014.9 2797.1 3317.4 17311.3 2711.2 207.5 255.2 2758.9 1.0 2757.9 650.3 2107.6 FY12 23436.3 9487.0 2919.5 95.2 1200.9 2697.0 3553.2 19952.8 3483.6 211.9 259.6 3531.3 1.7 3529.7 821.5 2708.1 FY13 27004.0 10987.8 3125.3 -26.0 1412.7 3290.0 4008.9 22798.7 4205.3 251.3 532.0 4486.0 25.7 4460.3 1226.7 3233.7 FY14E 28959.1 11873.2 3185.5 -27.9 1515.0 3619.9 4054.3 24219.9 4739.1 270.4 579.2 5047.9 25.7 5022.2 1406.2 3616.0 FY15E 31506.3 13075.1 3465.7 -30.3 1648.2 3938.3 4568.4 26665.4 4840.9 294.2 630.1 5176.9 27.0 5149.9 1442.0 3707.9 -13.4% -4.9% -16.1% 11.1% -4.4% 0.1% 17.0% 28.5% 28.5% 15.2% 20.7% 19.4% 7.2% 12.7% 11.8% 8.8% 2.1% 2.5% 37.5% 13.4% 5.4% 15.4% 22.6% 38.9% 14.0% 5.1% 16.6% 23.6% 40.5% 11.5% 5.1% 15.2% 23.3% 40.7% 12.2% 5.2% 14.8% 27.5% 41.0% 12.5% 5.2% 14.0% 28.0% 41.5% 12.5% 5.2% 14.5% 28.0% 15.7% 15.1% 11.7% 13.5% 13.8% 10.5% 14.9% 15.1% 11.6% 15.6% 16.6% 12.0% 16.4% 17.4% 12.5% 15.4% 16.4% 11.8% 238.7 218.2 2668.9 9.6 12.2 78.9% 19.5 24.7 284.6 215.9 2735.0 9.8 12.7 77.1% 22.5 29.2 419.0 218.2 3681.1 12.4 16.9 73.6% 24.8 33.8 483.3 216.2 2864.8 15.0 13.3 112.9% 36.5 32.3 570.00 216.26 3571.24 16.72 16.51 101.3% 34.52 34.09 570.00 216.26 4243.13 17.15 19.62 87.4% 29.05 33.24 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 21

- 22. Escorts Ltd. V- "Buy" 30th Jan' 14 "Out Performer……." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 125 175 105 40% 67% Market Data BSE Code NSE Symbol 52wk Range H/L Capital Mkt (Rs Crores) Average Daily Volume Nifty 500495 ESCORTS 48/96 1,505 225,953 6,120 Stock Performance-% Absolute Rel. to Nifty 1M (11.3) (8.2) 1yr 62.7 61.0 YTD 147.9 140.2 Share Holding Pattern-% Promoter's FII's DII's Others's 3QFY14 42.0 9.4 2.1 46.5 2QFY14 1QFY14 42.0 42.0 12.3 12.1 4.7 5.4 41.0 40.6 In 5QFY13 the company saw revenue growth of 12.8% to Rs 1159.6 crore. This result was mirrors the pent-up demand for tractor business, partly driven by improved crop cultivation and production and revival in farm equipment segment. In current quarter 84% of Escorts’ revenues come from the sale of tractors, and it saw volumes growth of 11.3% to 19047 in its tractor sales. Company construction equipment business witnessed a flattish of 1.4% to Rs. 130.9 crore and stands at 11% of company total revenue during this quarter. Lower inventory levels typical of this quarter, where sales are better than in the preceding quarter, translated into a 6.1% operating margin, up 100 basis points from the year-ago period. Further, A marginal price hike in the latter part of the December quarter also propped up realizations. More importantly, the improved financial position in the farm segment eased cash flows and working capital cycles, which in turn trimmed interest costs. Industry players expects the year 2013-14 to end with volume growth of around 15% After an all time high sales in Oct 2013, where the industry saw a volume growth of 28.8% YoY, Nov'13 volume growth was expected on lower side. While in Dec'13, the industry came back strongly with a 21.1% growth. In April-Dec'13 period, the industry saw a healthy 23.8% growth in volume. So while high growth is expected to tilt down in lean season, overall, the industry as a whole is still expected to end the year with a volume growth of about 15% for 2013-14. Key markets that supported the growth in FY'14 are Andhra Pradesh, Madhya Pradesh, Rajasthan and Chhattisgarh. Some of these markets grew by more than 30% YoY. All macroeconomic factors such as crop prices, productivity, soil moisture, government focus on rural spending etc are favoring the farm equipment business. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 22

- 23. Escorts Ltd. Penetration to high HP Tractors Escorts management aims to improve tractor margins from the current ~10% to 15% over the next 1-2 years led by change in focus to higher HP tractors and by cost rationalization measures. Higher tractor margins would take Escorts' company level EBITDA margins from ~6% to ~10%, as tractor segment contributes 80% to the company's overall sales. Moreover, the management's strategy to focus on higher HP tractors and increase presence in Southern markets will lead to faster-than-market growth. Outlook on Industry Despite being an agricultural nation, Tractors penetration in India is about 5% of total cultivable land. Going forward, we expect deeper penetration of Tractors to happen which will continue to drive strong demand for the sector. The growth in farm incomes will fuel the need for further mechanization, which will tend to accelerate as social welfare programs, urbanization and alternative occupations move farm labor to other sectors. So the demand for higher HP tractors will be the future growth within the sector. The proportion of higher power (greater than 50 HP+) segment has shown increase in total industry volume share by 380 bps from 12.6% in FY'08 to about 18% in FY'13. For tractor industry more than festive season it is the monsoons that matters a lot. The onset of positive sentiments because of monsoons, the reservoirs are full, the kharif crop sowing is more than 1,000 lakh hectors which is almost 6 percent up vis-à-vis last year. The prices of the crops declared by the government are pretty good and on top of it there are host of financiers who are financing the tractors and funds are available to prospective buyers and that is also leading to growth. Company Outlook The stock is currently trading at 6.5x FY14E EPS with a negative bias in case of construction equipment segment due to adverse macroeconomic conditions . At current price of Rs. 117, the stock is trading at P/E of 7.1 x for FY13E and 6.5 x the FY14E. Escorts could post EPS of Rs. 12.13 for FY14E and Rs. 12.98 for FY15E. An increase in volumes is an indication of healthy demand. Tractor sales revival has enabled the company to register strong result. Escorts’ EBITDA margin and bottom-line exceeded our expectations. Going forward, we remain positive on the company’s growth prospects particularly in AMP segment. We expect demand to improve further in FY2014E with the economic recovery. However, we remain cautious with regards to growth in Construction Equipment segment in near-tomedium. Thus, We revise our estimates upwards to factor in the strong CY13 tractor volume performance. We therefore revised our rating on the stock from "Reduce" to "Buy" and advised to our investors to enter at current level with Revised price target of Rs. 175 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 23

- 24. Escorts Ltd. Graphical representations : Revenue from operation : (Source: Eastwind Research) (Figures in crore) Operating profit : (Source: Eastwind Research) (Figures in crore) Net Profit : (Source: Eastwind Research) (Figures in crore) Trailling ROE % & Trailling Asset T/O : (Source: Eastwind Research) (Figures in crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 24

- 25. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.