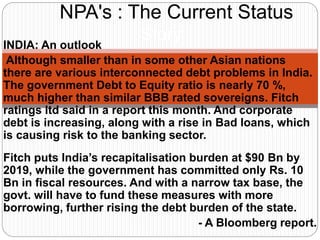

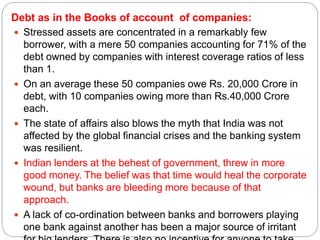

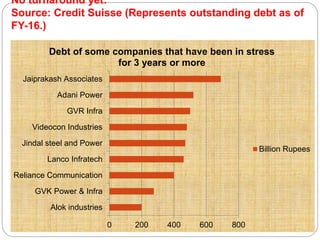

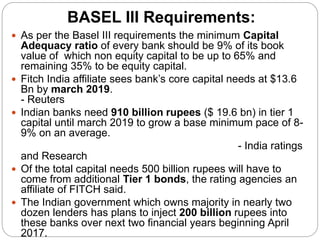

The document discusses India's rising non-performing assets (NPAs) in the banking sector. It notes that NPAs have ballooned to over $180 billion, equal to 11.17 lakh crores rupees, primarily driven by rising corporate debt. A small number of large companies account for the majority of stressed assets. The rising NPAs pose significant risks to banks and require large capital infusions to meet regulatory requirements. In the short-term, resolution of NPAs will be challenging but consumption growth and economic reforms could help reduce debt issues in the medium to long-term.