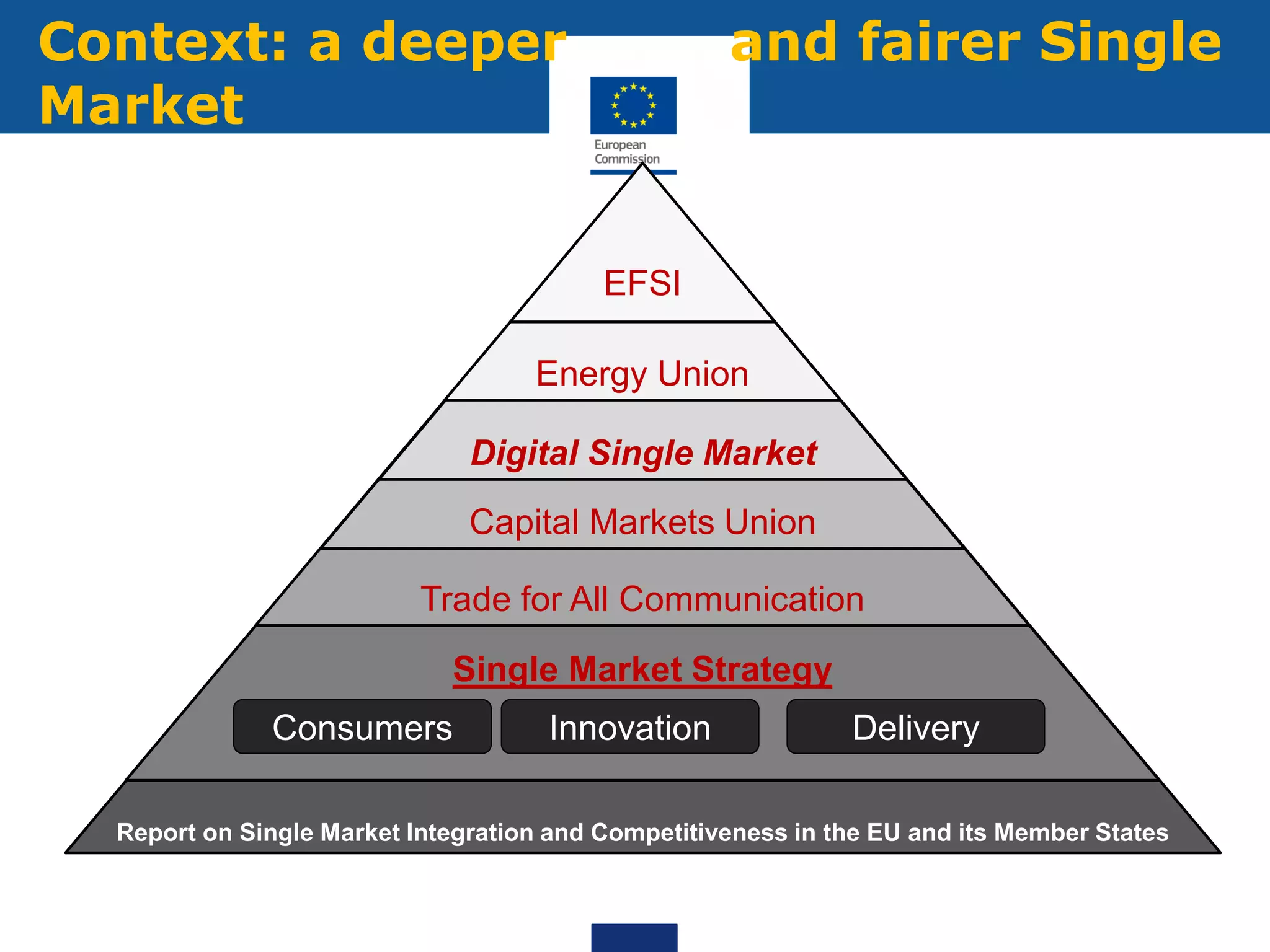

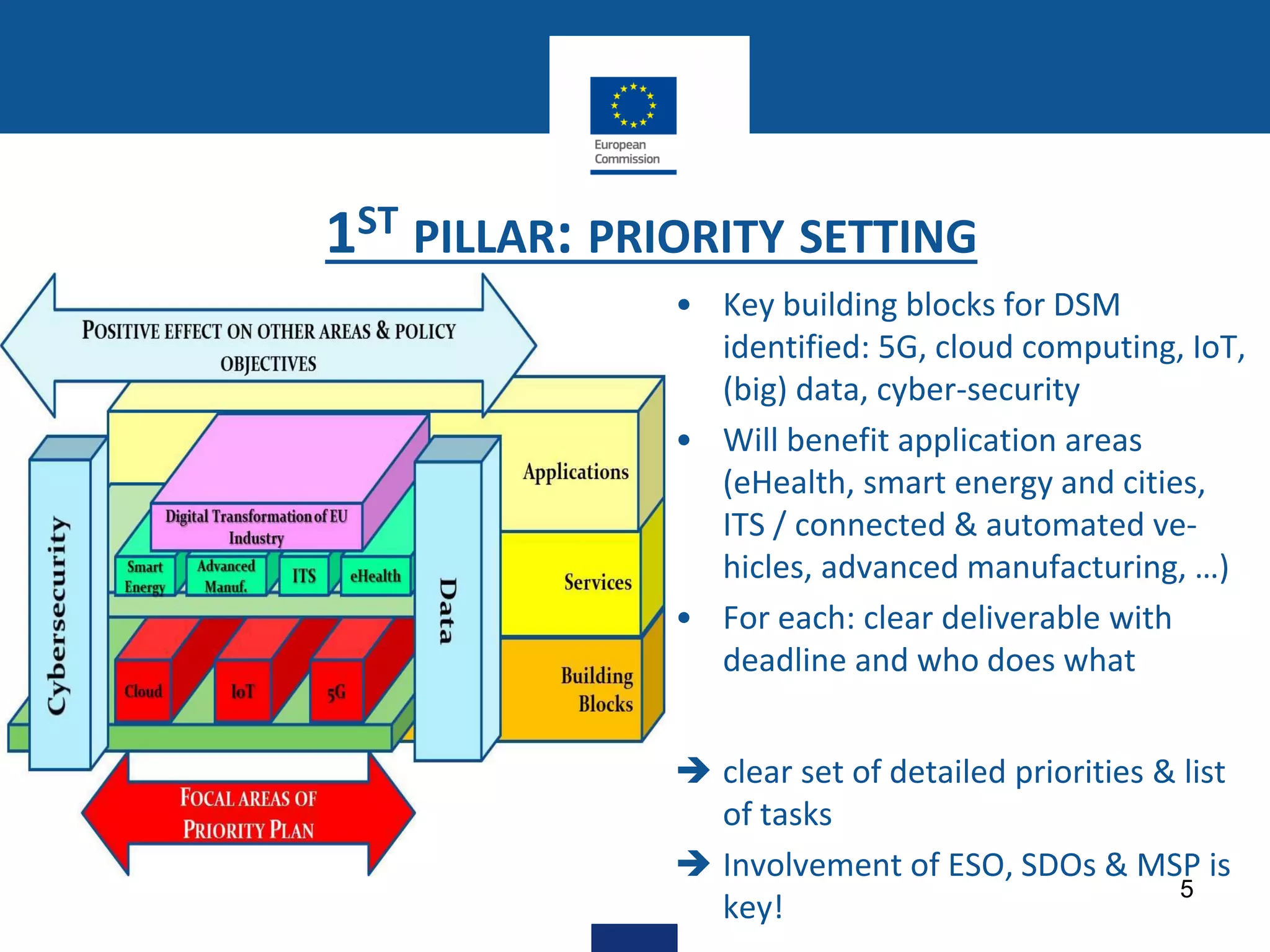

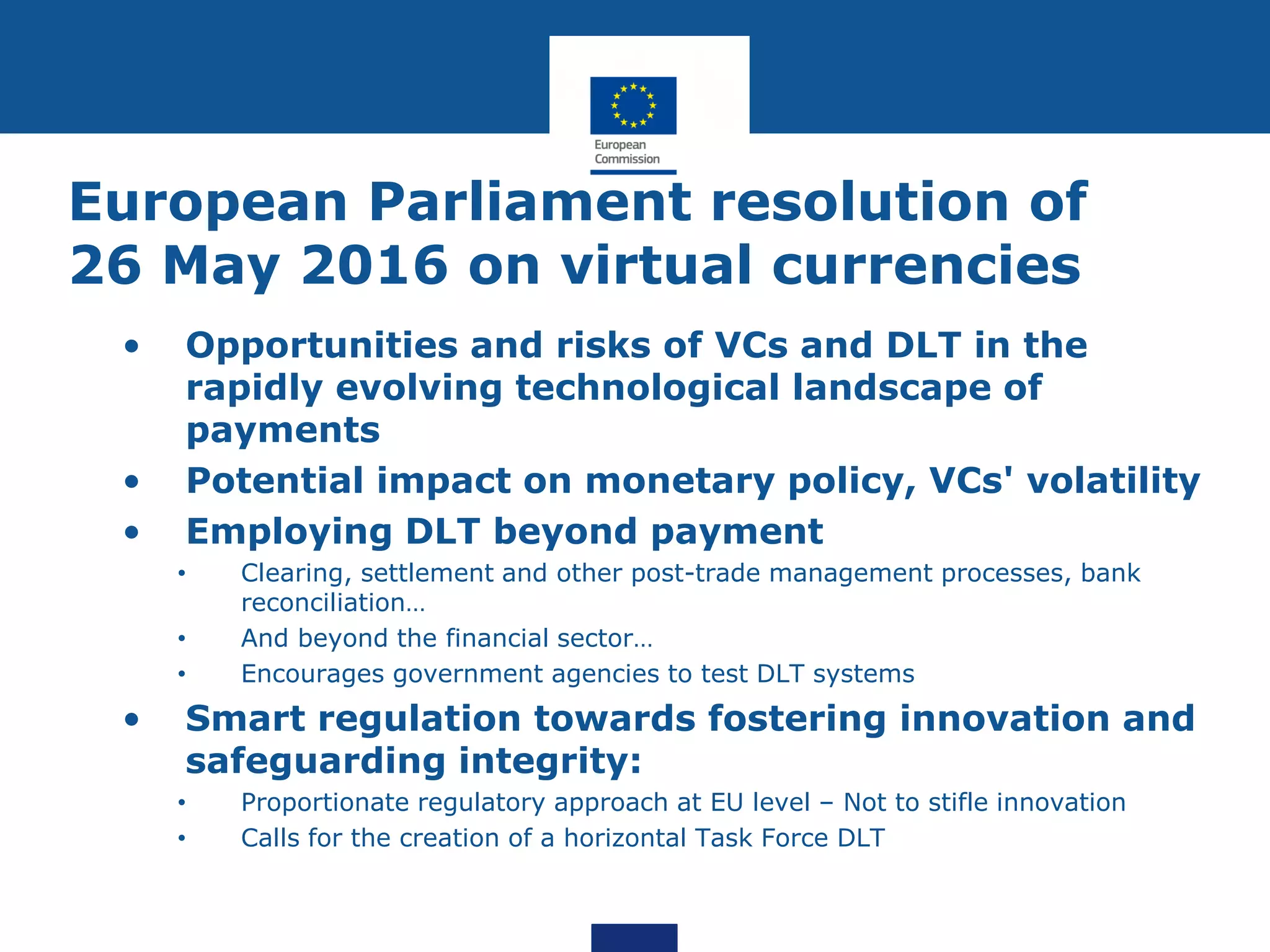

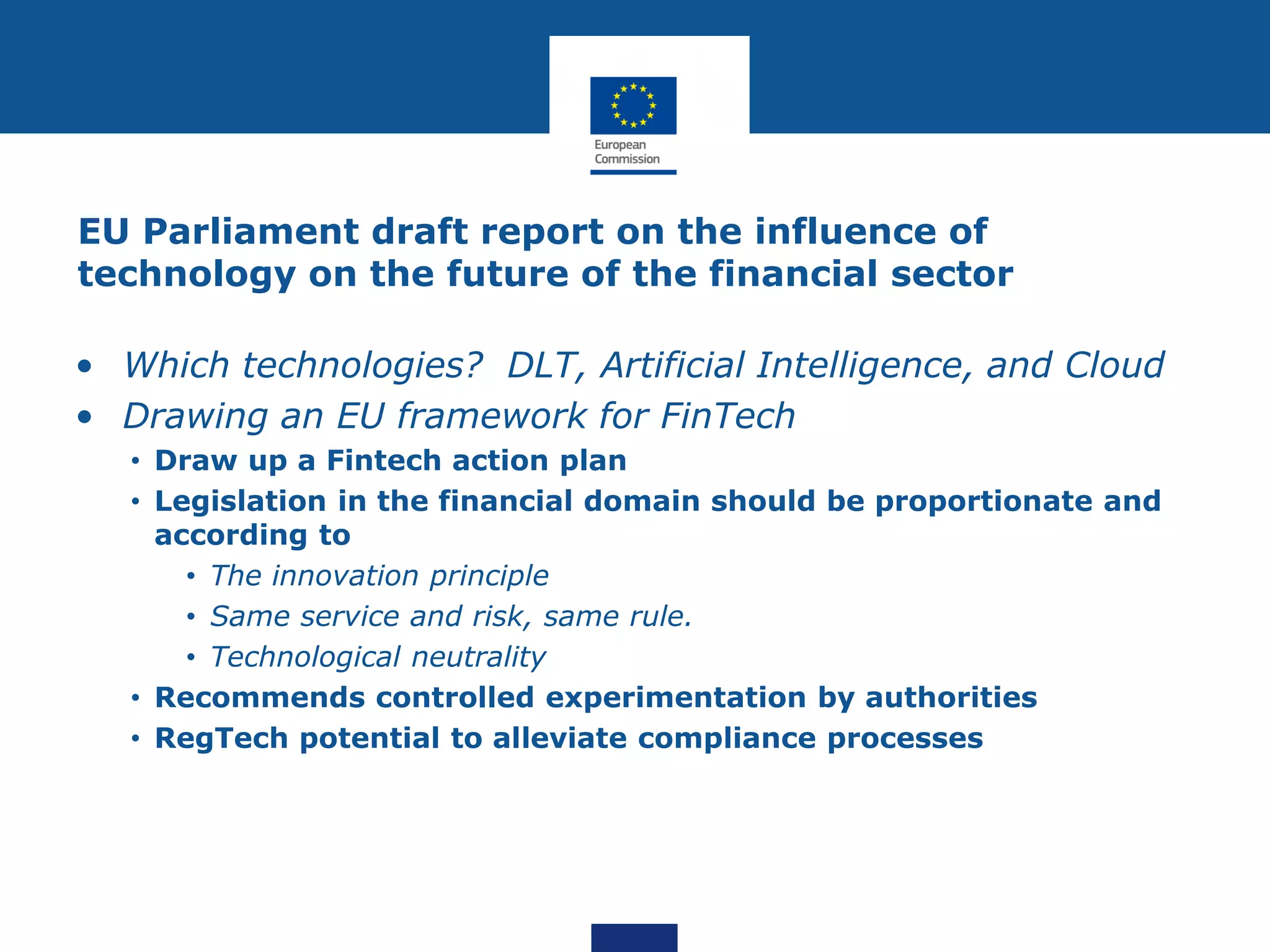

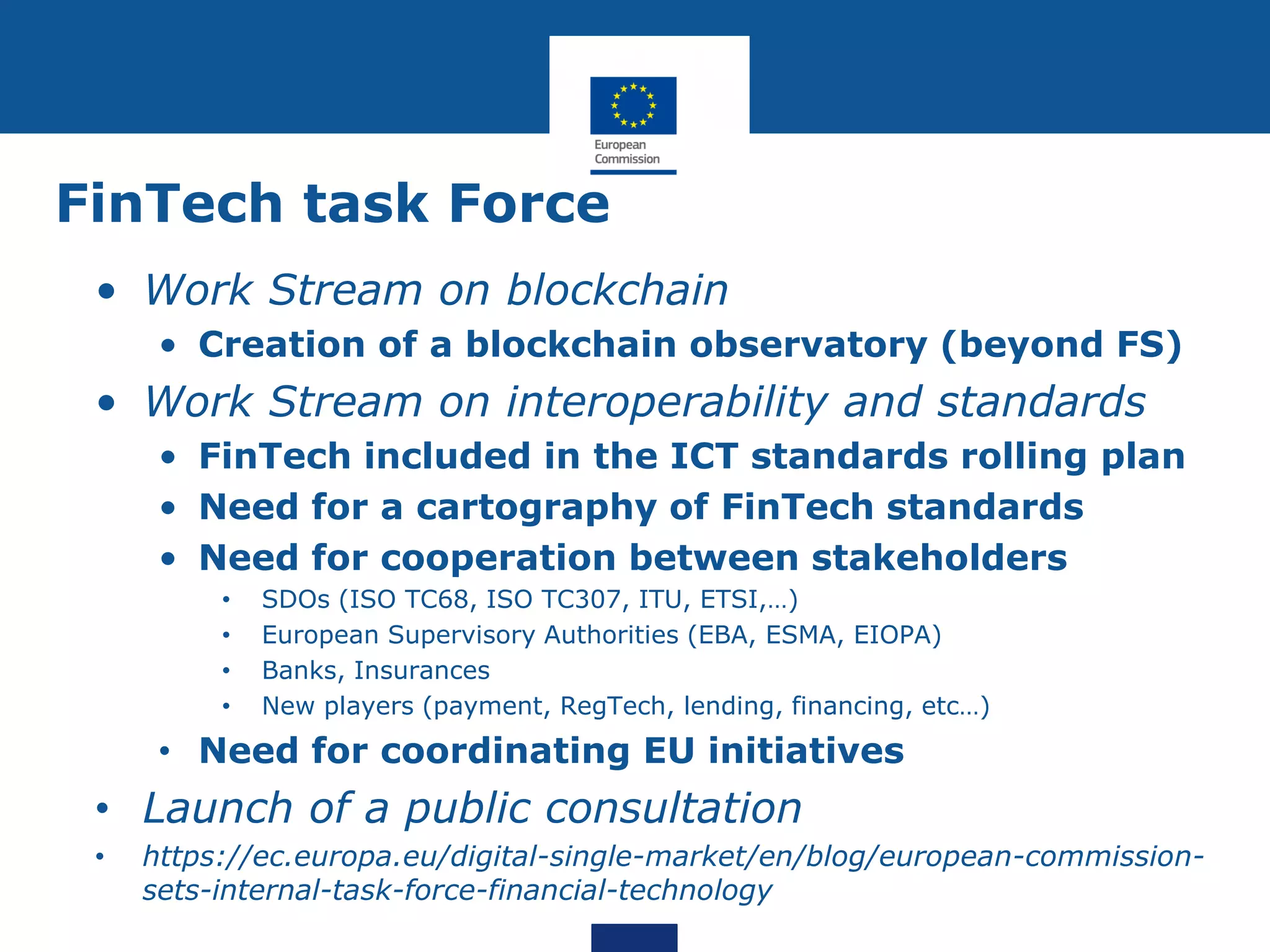

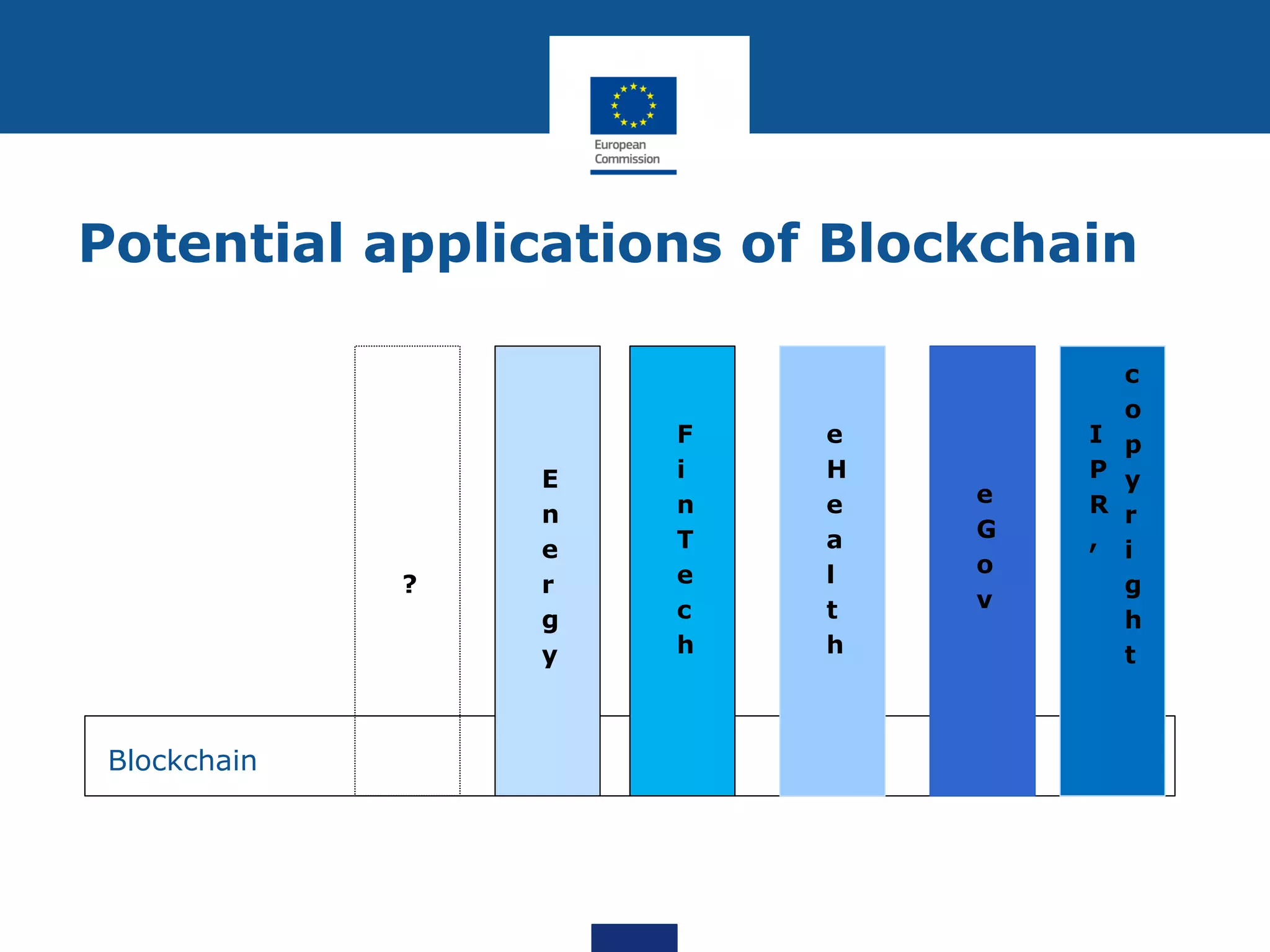

The document discusses the EU's policy perspective on blockchain and distributed ledger technologies, highlighting its importance for the digital single market and financial sector. It outlines strategic initiatives, regulatory frameworks, and potential applications of blockchain, emphasizing the need for innovation, security, and interoperability. Key areas covered include the role of various European supervisory authorities, the establishment of task forces, and proposed EU initiatives for knowledge sharing and technology standardization.