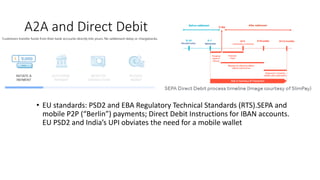

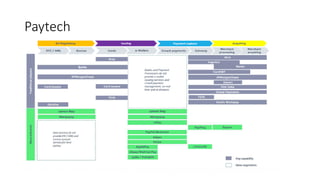

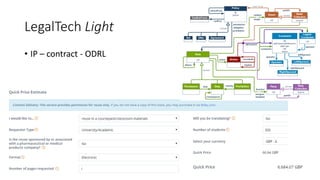

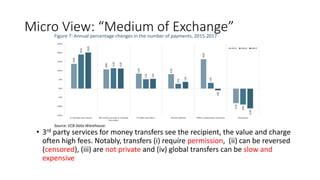

The document discusses various aspects of fintech, including the digital transformation of financial services, regulatory frameworks, and innovations in payment technologies. It highlights the evolution of money, legal perspectives, and economics behind financial instruments, while exploring the mechanisms of contemporary payment systems. Key topics include traditional and digital currencies, blockchain, tokenization, and the challenges involved in cross-border payments.

![Retail Money

• EMVCo = ISO 8583 (since 1987) duopoly

• Visa (1973): 780 pages long technical specification: 2bn cards; 2m ATM,

VisaNet @ 24 ktps; MasterCard: 319 pages long technical specification

• Technologies: [cash] – [cheque] - card – QR – Wallet - Account](https://image.slidesharecdn.com/indjicfintechweek5-191118084855/85/Indjic-fintech-week-5-10-320.jpg)