1) The document discusses a project by the OECD to analyze the implications of proliferating tokenization of assets for financial markets. It aims to understand benefits and challenges, disruptive effects, and policy implications.

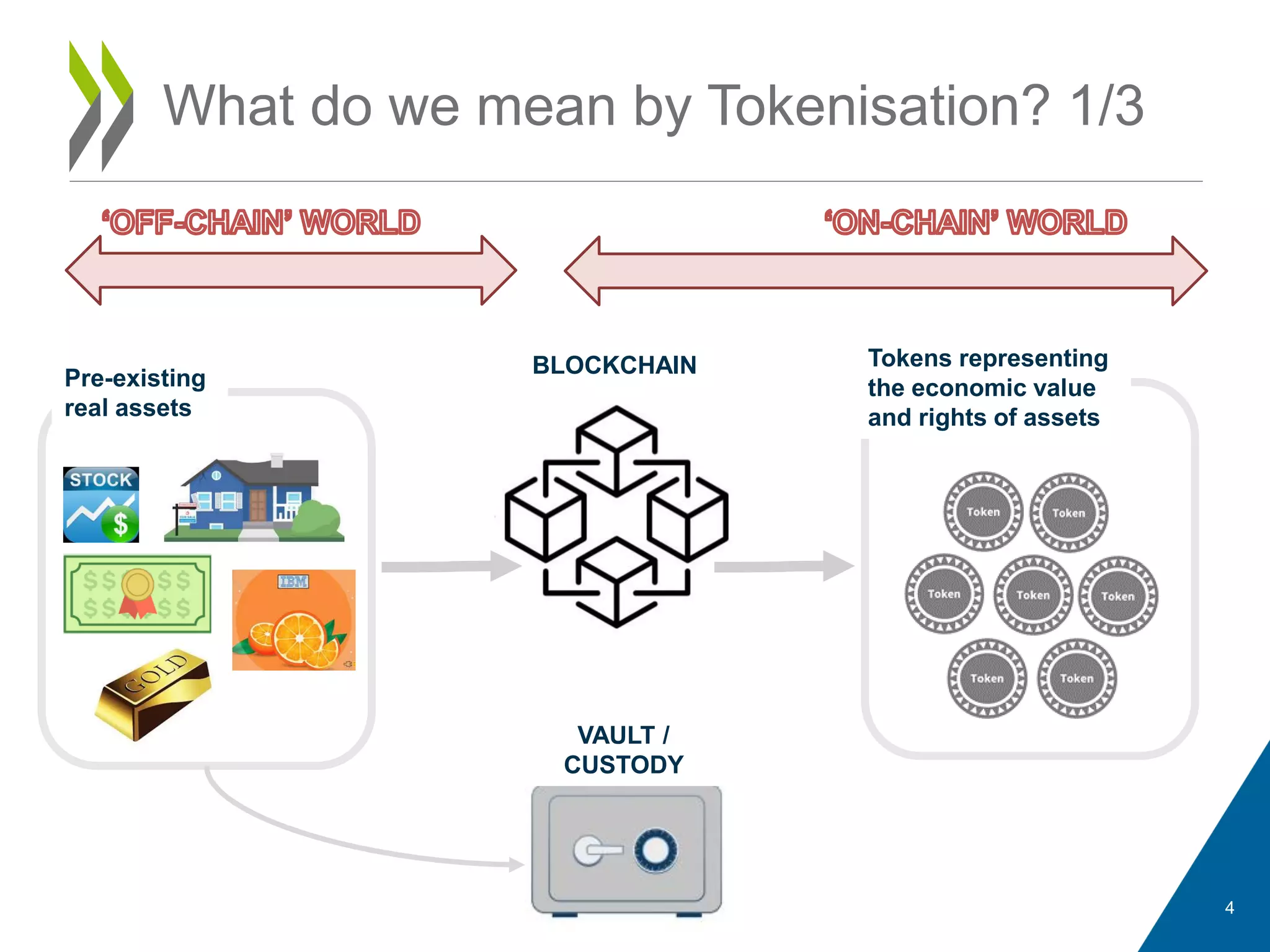

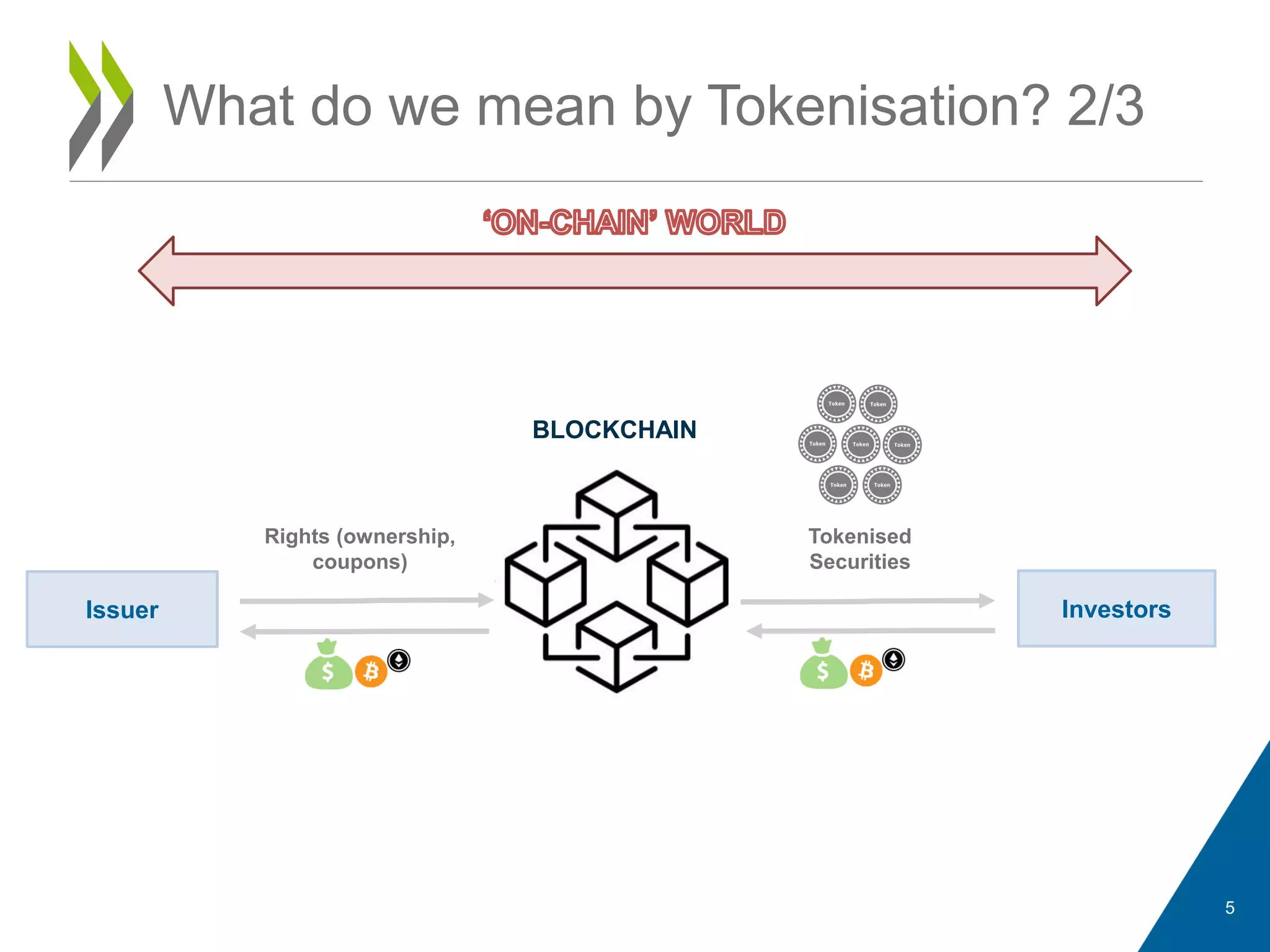

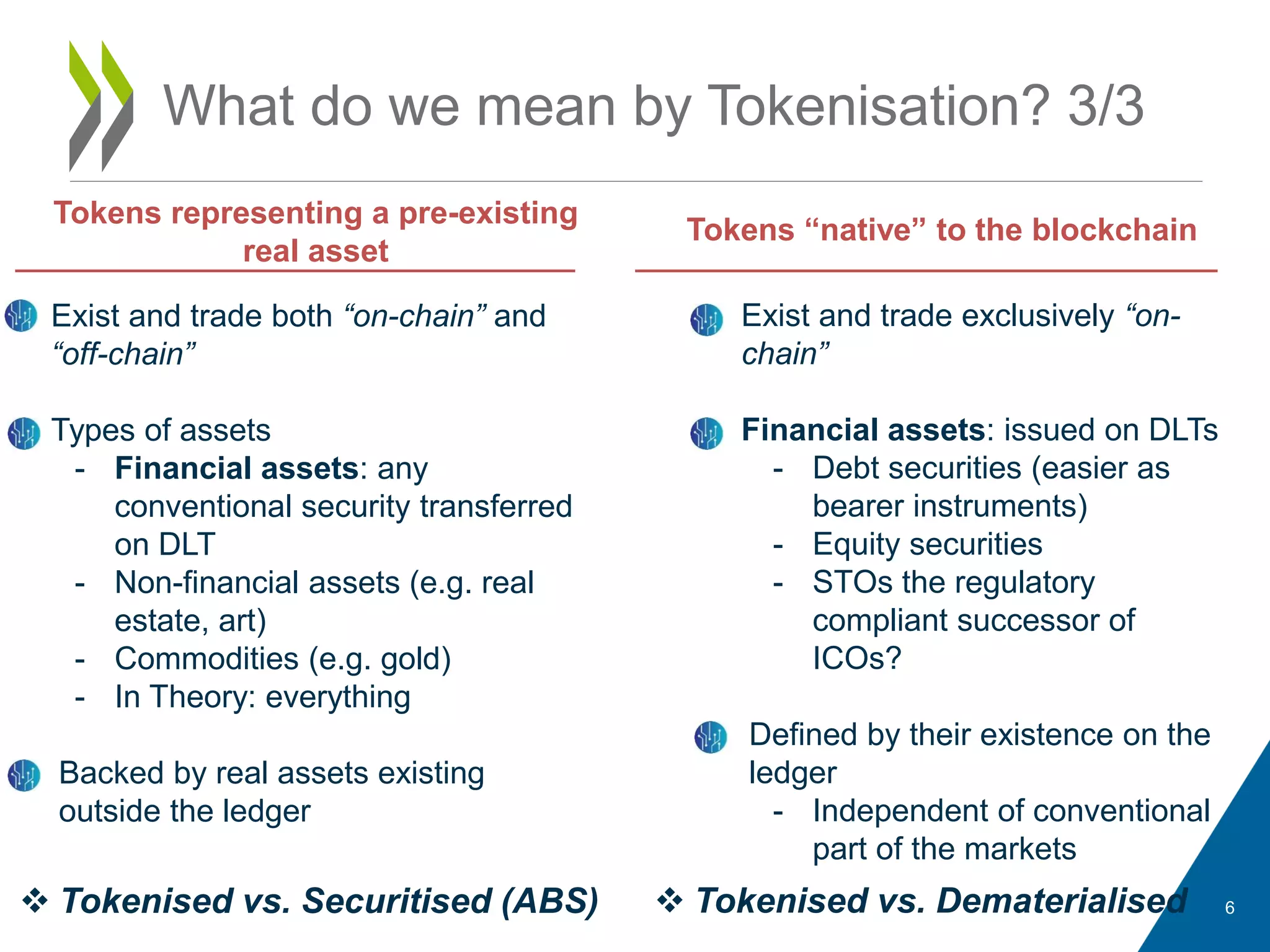

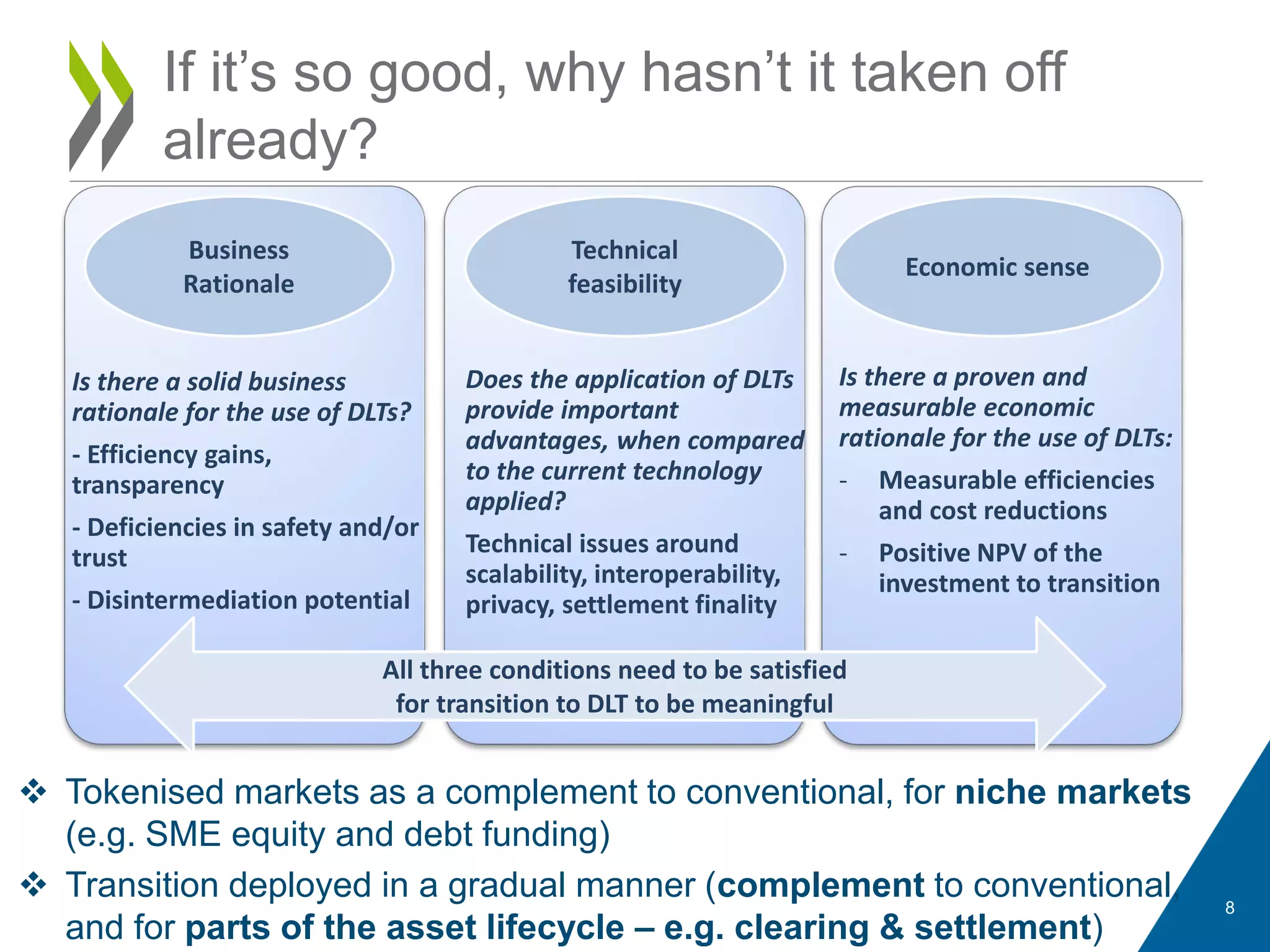

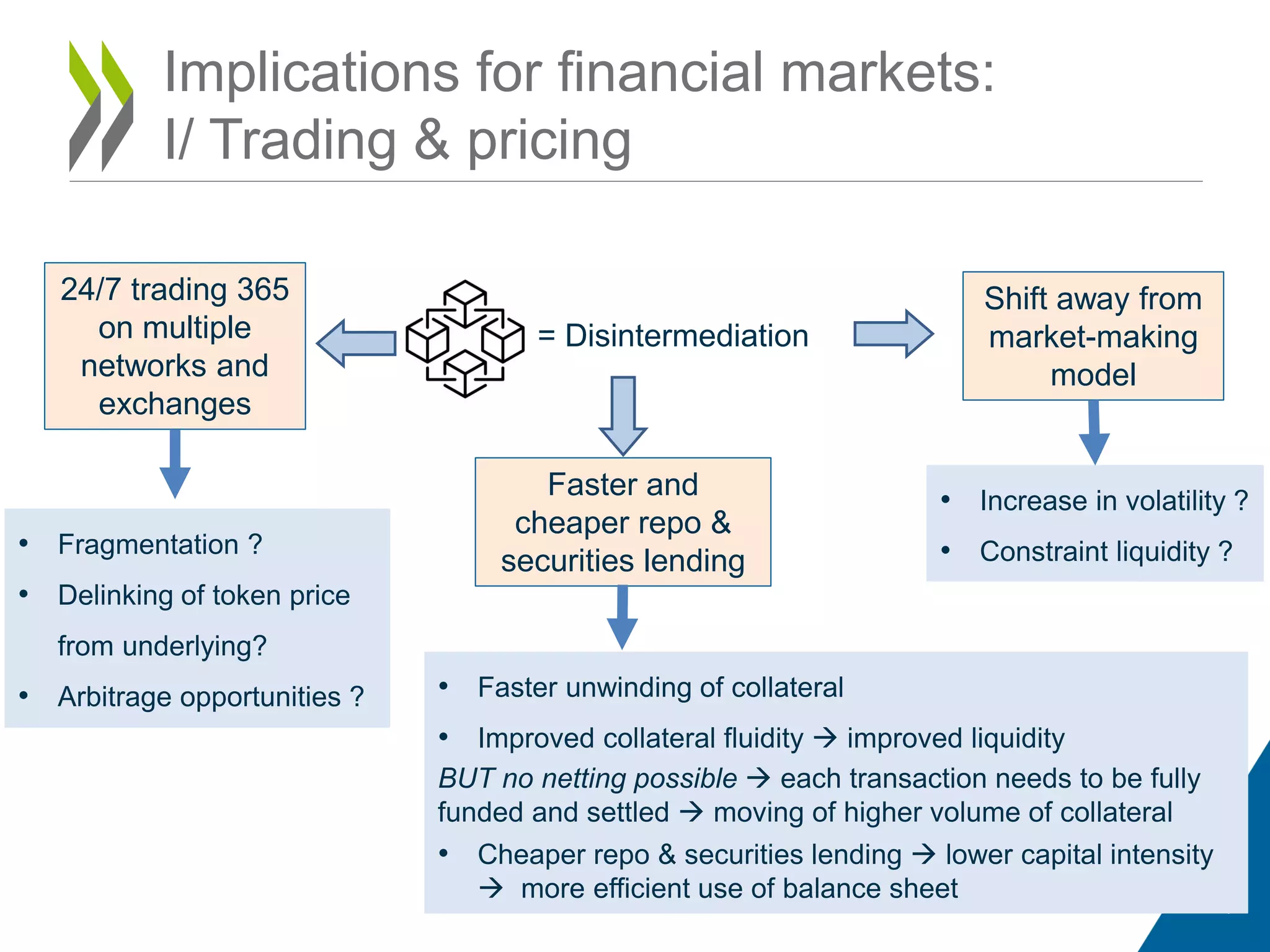

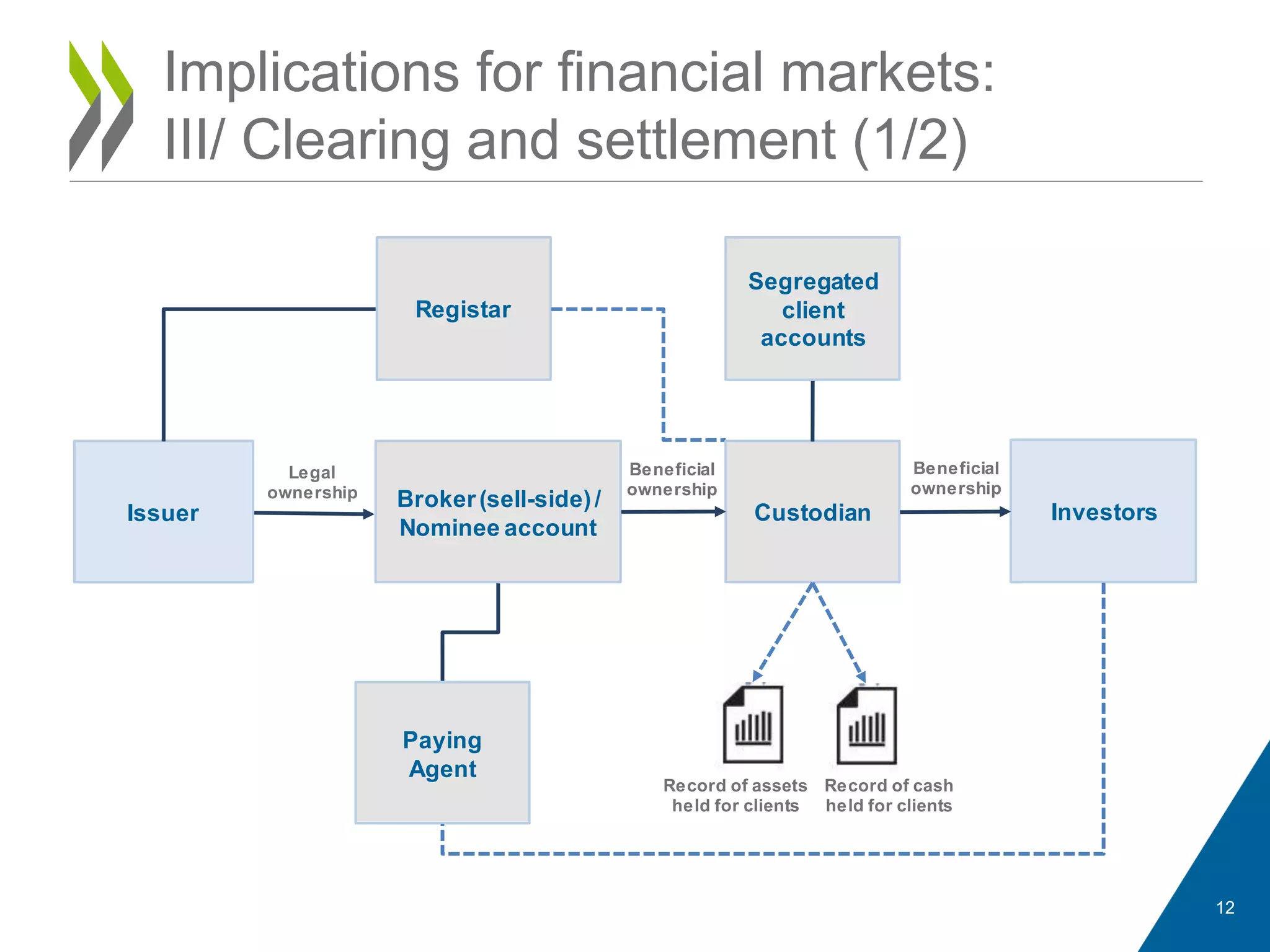

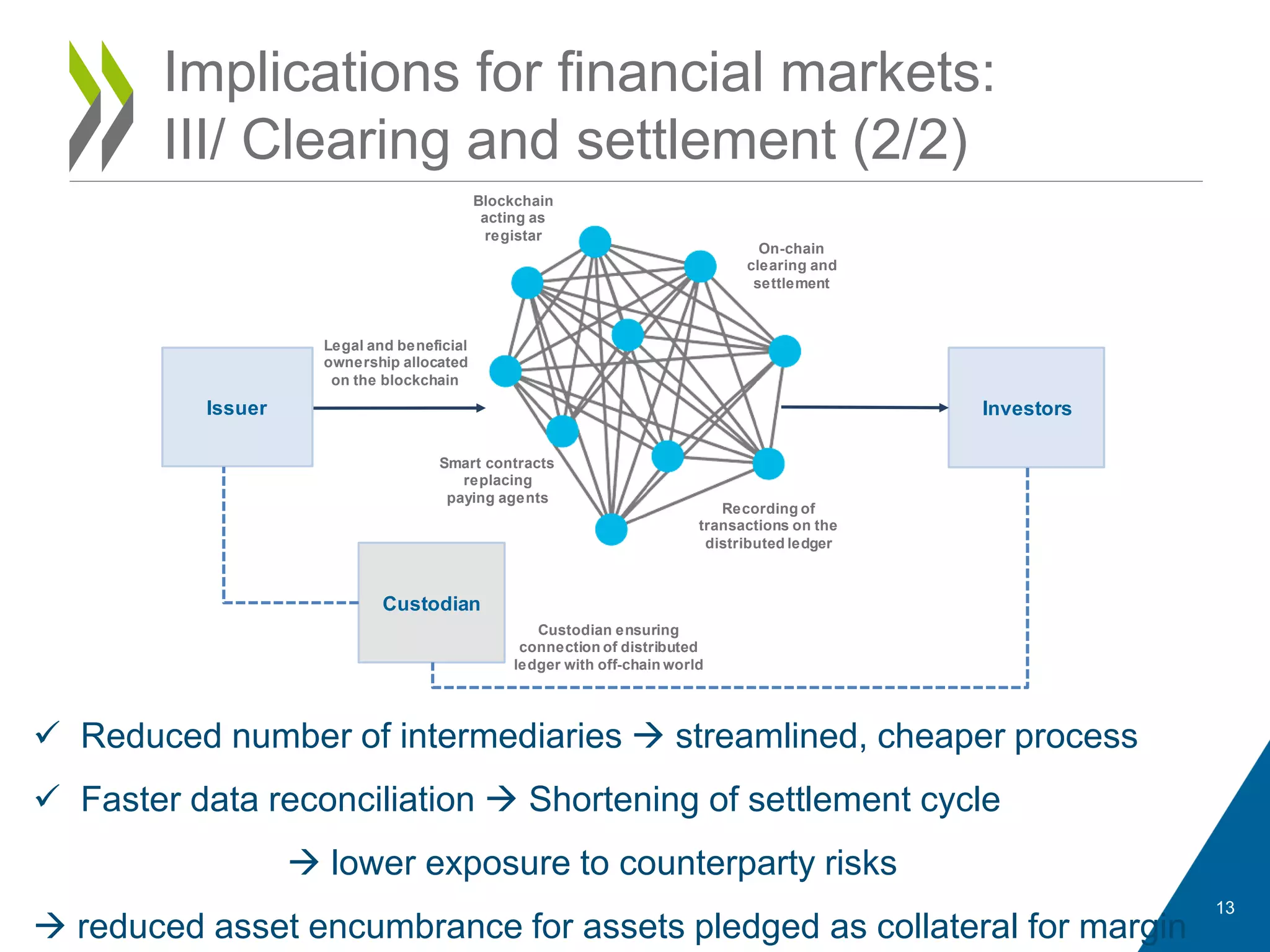

2) Tokenization refers to using blockchain or distributed ledger technology to issue tokens representing ownership of real-world assets. This could streamline clearing and settlement by reducing intermediaries.

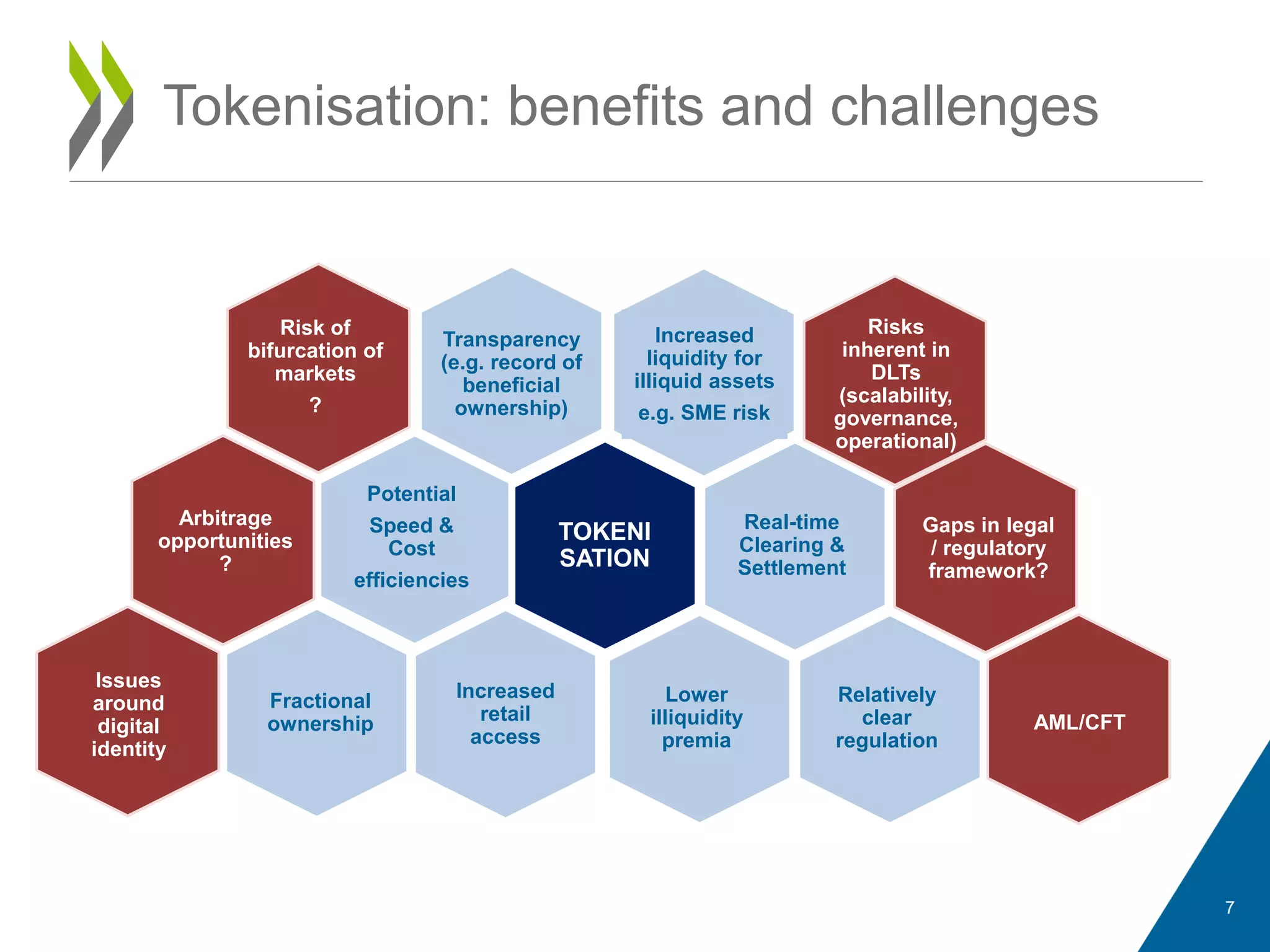

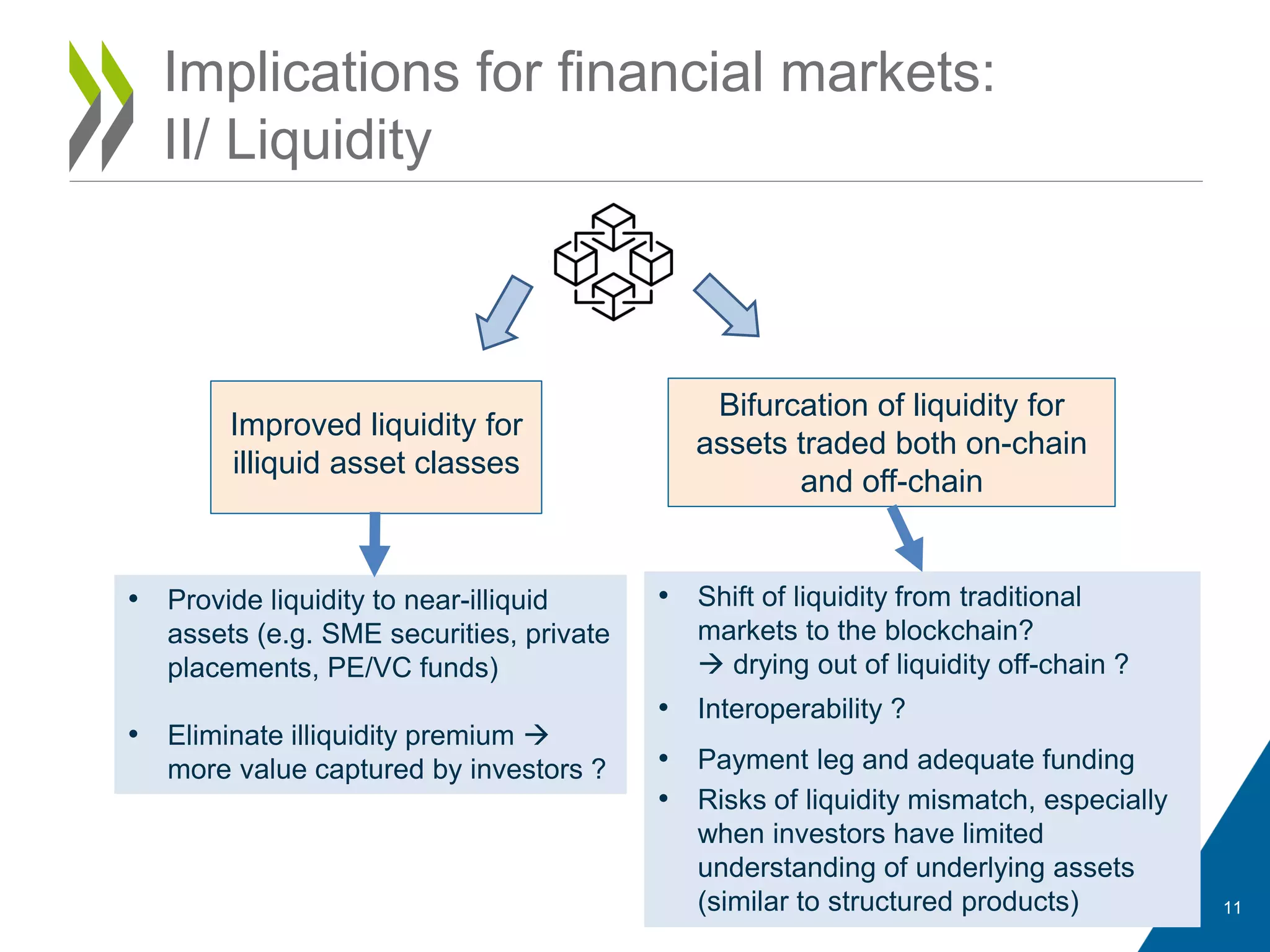

3) Tokenization may improve liquidity for illiquid assets and increase retail access but also risks market fragmentation and gaps in regulation. Policymakers should address potential issues and facilitate standardization where tokenization provides clear benefits.