The document summarizes the financial results of a company for the first 9 months of 2019. Key highlights include:

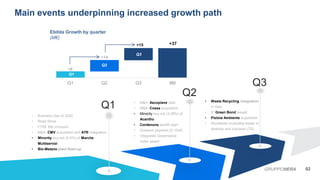

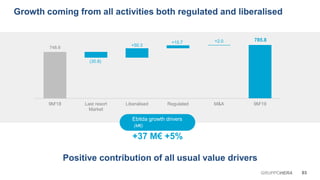

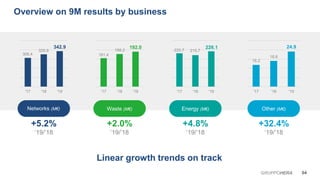

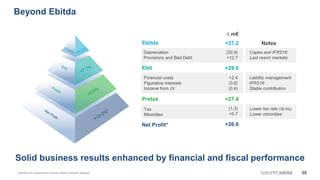

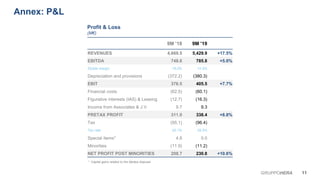

- EBITDA increased 5% to €785.8 million driven by growth across all business segments.

- Net profit increased 10.6% to €230.8 million.

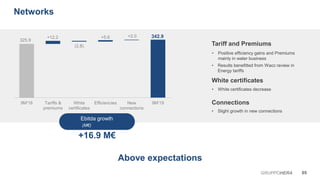

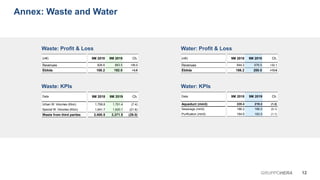

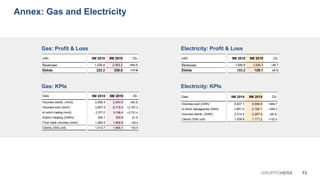

- Networks, Waste, Energy, and Other business segments all saw EBITDA growth compared to the same period last year.

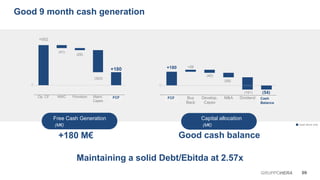

- Solid cash generation of €180 million and maintained a sound debt to EBITDA ratio of 2.57x.