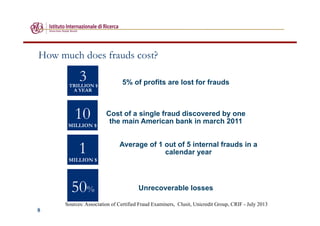

The document discusses the rising issue of banking fraud and the importance of identity management for prevention, focusing on internal and external fraud risks. It emphasizes that human factors often contribute to fraud incidents and details Securepass, a cloud service designed to ensure digital identity protection through multifactor authentication and centralized access management. The document concludes that identity management strategies can mitigate fraud risks in private banking, enhance transaction security, and support compliance with regulations.