Potential Gross Income (PGI) EstimatorPlease Only Change ite.docx

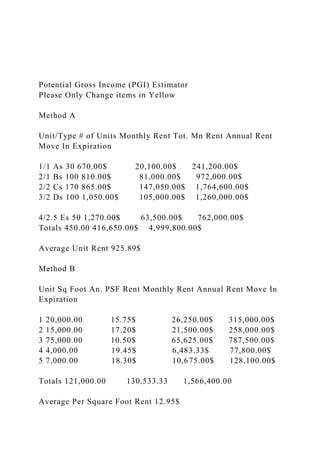

- 1. Potential Gross Income (PGI) Estimator Please Only Change items in Yellow Method A Unit/Type # of Units Monthly Rent Tot. Mn Rent Annual Rent Move In Expiration 1/1 As 30 670.00$ 20,100.00$ 241,200.00$ 2/1 Bs 100 810.00$ 81,000.00$ 972,000.00$ 2/2 Cs 170 865.00$ 147,050.00$ 1,764,600.00$ 3/2 Ds 100 1,050.00$ 105,000.00$ 1,260,000.00$ 4/2.5 Es 50 1,270.00$ 63,500.00$ 762,000.00$ Totals 450.00 416,650.00$ 4,999,800.00$ Average Unit Rent 925.89$ Method B Unit Sq Foot An. PSF Rent Monthly Rent Annual Rent Move In Expiration 1 20,000.00 15.75$ 26,250.00$ 315,000.00$ 2 15,000.00 17.20$ 21,500.00$ 258,000.00$ 3 75,000.00 10.50$ 65,625.00$ 787,500.00$ 4 4,000.00 19.45$ 6,483.33$ 77,800.00$ 5 7,000.00 18.30$ 10,675.00$ 128,100.00$ Totals 121,000.00 130,533.33 1,566,400.00 Average Per Square Foot Rent 12.95$

- 2. Method C Annual PGI 5,000,000.00$ Operating Statement Please Only Change items in Yellow Assumptions Method of PGI Calculation C (type A, B, or C in the box) Percentage of Vacancy Loss 10% Other Annual Income 20,000.00$ Potential Gross Income 5,000,000.00$ Vacancy & Collection Loss (500,000.00)$ Other Income 20,000.00$ Effective Gross Income 4,520,000.00$ Operating Expenses (Fill in one only one yellow column per row) Item % of EGI Amount Management 3% (135,600.00)$ Real Estate Taxes 685,000.00$ (685,000.00)$ Property Insurance 410,000.00$ (410,000.00)$ Payroll/Staff 200,000.00$ (200,000.00)$ Maintenance 500,000.00$ (500,000.00)$ Accounting & Legal 50,000.00$ (50,000.00)$ Utilities 35,000.00$ (35,000.00)$

- 3. Misc. 18,400.00$ (18,400.00)$ -$ -$ -$ -$ -$ Total Expenses (2,034,000.00)$ Expenses as a Percentage of EGI 45.00% Net Operating Income (NOI) 2,486,000.00$ Reserves for CAPX 5% (226,000.00)$ Annual Debt Service (1,444,325.01)$ Tax Payment or Savings -$ Annual Cash Flow 815,674.99$ Cash on Cash Return 10.11% Acquisition/Disposition Worksheet Please Only Change items in Yellow Acquistion Offer Generator Purchase Price 24,000,000.00$ Cap Rate you would like to pay 10% Purchasing Closing Costs 2% Loan Fees 2% Your Max Offer 24,860,000$ Due Diligence Expenses 50,000.00$ Purchasing Cap Rate 10.36%

- 4. Loan Information Max Loan to Value 70% Interest Rate 6% Amortization (in months) 240 Payoff Month 60 Max Loan Amount 16,800,000.00$ Monthly P&I Payment (120,360.42)$ Annual Debt Service (1,444,325.01)$ Payoff Loan Amount (14,263,132.54)$ Acquisition Cash Flow Purchase Price 24,000,000.00$ Due Diligence Costs 50,000.00$ Closing Costs 480,000.00$ Loan Fees 336,000.00$ Total Acquisition Cost 24,866,000.00$ Less Loan Amount (16,800,000.00)$ Total Equity Required 8,066,000.00$ (Cash Flow 0) Disposition Exit Cap Rate 10.50% Sales Commissions 2%

- 5. Closing Costs 2% Disposition Cash Flow Sale Price 28,516,366.31$ Sales Commissions (570,327.33)$ Closing Costs (570,327.33)$ Payoff Mortgage Balance (14,263,132.54)$ Disposition Cash Flow 13,112,579.11$ Acquisition/Disposition Worksheet Please Only Change items in Yellow Assumptions Growth Rate in EGI 3% Growth Rate in Expenses 2% Item Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Initial Cash Flow (8,066,000.00)$ Effective Gross Income 4,520,000.00$ 4,655,600.00$ 4,795,268.00$ 4,939,126.04$ 5,087,299.82$ 5,239,918.82$ Total Operating Expenses (2,034,000.00)$ (2,074,680.00)$ (2,116,173.60)$ (2,158,497.07)$ (2,201,667.01)$ (2,245,700.35)$ Net Operating Income 2,486,000.00$ 2,580,920.00$ 2,679,094.40$ 2,780,628.97$ 2,885,632.81$ 2,994,218.46$ Debt Service (1,444,325.01)$ (1,444,325.01)$ (1,444,325.01)$ (1,444,325.01)$ (1,444,325.01)$ Reserves for CAPX (226,000.00)$ (226,000.00)$ (226,000.00)$ (226,000.00)$ (226,000.00)$ Tax Costs/Benefits -$ -$ -$

- 6. -$ -$ Operations Cash Flow 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 1,215,307.79$ Disposition Cash Flow 13,112,579.11$ Total Cash Flow (8,066,000.00)$ 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 14,327,886.91$ Cash on Cash Returns 10.11% 11.29% 12.51% 13.77% 15.07% Internal Rate of Return 20.43% Percentage Split Method Please Only Change items in Yellow Assumptions Sponsor Equity Investment 50% Partner Equity Investment 50% Sponsor Investment 4,033,000.00$ Partner Investment 4,033,000.00$ Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cashflow (8,066,000.00)$ 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 14,327,886.91$ Sponsor (4,033,000.00)$ 407,837.49$ 455,297.49$ 504,384.69$ 555,151.98$ 7,163,943.45$ Partner (4,033,000.00)$ 407,837.49$ 455,297.49$ 504,384.69$ 555,151.98$ 7,163,943.45$

- 7. Sponsor IRR 20.43% Partner IRR 20.43% Sponsor X Return 1.25 Partner X Return 1.25 Fixed Return Method Please Only Change items in Yellow Assumptions Sponsor Equity Investment 10% Partner Equity Investment 90% Partner Rate of Return 10% Sponsor Investment 806,600.00$ Partner Investment 7,259,400.00$ Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cashflow (8,066,000.00)$ 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 14,327,886.91$ Partner (7,259,400.00)$ 725,940.00$ 725,940.00$ 725,940.00$ 725,940.00$ 7,985,340.00$ Sponsor (806,600.00)$ 89,734.99$ 184,654.99$ 282,829.39$ 384,363.95$ 6,342,546.91$ Sponsor IRR 62.47% Partner IRR 10.00%

- 8. Sponsor X Return 8.03 Partner X Return 0.50 Waterfall Method Please Only Change items in Yellow Assumptions Sponsor Equity Investment (Money) 10% Partner Equity Investment (Money) 90% Perferred Return to Money 8% 1st Tier - Sponsor Promote Split 30% 1st Tier - IRR Hurdle Rate 15% 2nd Tier - Spnsor Promote Split 50% Sponsor Investment 806,600.00$ Partner Investment 7,259,400.00$ Total Equity Investment 8,066,000.00$ Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cashflow (8,066,000.00)$ 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 14,327,886.91$ Required Perferred Return 645,280.00$ 645,280.00$ 645,280.00$ 645,280.00$ 8,711,280.00$ Perferred Return Paid 645,280.00$ 645,280.00$ 645,280.00$ 645,280.00$ 8,711,280.00$ Perferred Deficit -$ -$ -$ -$ -$ Perferred Carryover Accrual -$ -$ -$ -$ -$ Funds Left to Pay Accrual 170,394.99$ 265,314.99$

- 9. 363,489.39$ 465,023.95$ 5,616,606.91$ Payment to Accrual -$ -$ -$ -$ -$ New Accrual Balance -$ -$ -$ -$ -$ Total Perferred Payment (8,066,000.00)$ 645,280.00$ 645,280.00$ 645,280.00$ 645,280.00$ 8,711,280.00$ Balance for Waterfall 170,394.99$ 265,314.99$ 363,489.39$ 465,023.95$ 5,616,606.91$ (1,344,405.46)$ Test 1st Tier Split - Money 119,276.49$ 185,720.49$ 254,442.57$ 325,516.77$ 3,931,624.84$ Hit this Button To Recalculate Returns Test 1st Tier Split - Promote 51,118.50$ 79,594.50$ 109,046.82$ 139,507.19$ 1,684,982.07$ Hurdle Check Cash Flow (8,066,000.00)$ 764,556.49$ 831,000.49$ 899,722.57$ 970,796.77$ 11,298,499.38$ 1st Tier Waterfall 170,394.99$ 265,314.99$ 363,489.39$ 465,023.95$ 3,696,027.68$ 1st Tier Split - Money 119,276.49$ 185,720.49$ 254,442.57$ 325,516.77$ 2,587,219.38$ 2nd Tier Split - Promote 51,118.50$ 79,594.50$ 109,046.82$ 139,507.19$ 1,108,808.31$ Hurdle Check (8,066,000.00)$ 764,556.49$ 831,000.49$

- 10. 899,722.57$ 970,796.77$ 11,298,499.38$ Balance for 2nd Tier Waterfall 1,920,579.22$ 2nd Tier Split - Money 960,289.61$ 2nd Tier Split - Promote 960,289.61$ Total Cash Flow - Money (8,066,000.00)$ 764,556.49$ 831,000.49$ 899,722.57$ 970,796.77$ 12,258,788.99$ Total Cash Flow - Promote 51,118.50$ 79,594.50$ 109,046.82$ 139,507.19$ 2,069,097.92$ Sponsor Cash Flows (806,600.00)$ 127,574.14$ 162,694.54$ 199,019.07$ 236,586.86$ 3,294,976.82$ Partner Cash Flows (7,259,400.00)$ 688,100.84$ 747,900.44$ 809,750.31$ 873,717.09$ 11,032,910.09$ IRR to the Money 16.54% Sponsor IRR 44.63% Partner IRR 16.54% Sponsor X Return 3.98 Partner X Return 0.95 IRR 8.00% IRR 14.97% check 0.03%

- 11. irr 14.97% irr 16.54% Waterfall Output Time 0 Year 1 Year 2 Year 3 Year 4 Year 5 Net Cash Flow (8,066,000.00)$ 815,674.99$ 910,594.99$ 1,008,769.39$ 1,110,303.95$ 14,327,886.91$ Limited Partner Cash Flows (7,259,400.00)$ 688,100.84$ 747,900.44$ 809,750.31$ 873,717.09$ 11,032,910.09$ Sponsor Cash Flows (806,600.00)$ 127,574.14$ 162,694.54$ 199,019.07$ 236,586.86$ 3,294,976.82$ Deal CCR 10.11% 11.29% 12.51% 13.77% 177.63% Limited Partner CCR 9.48% 10.30% 11.15% 12.04% 151.98% Sponsor CCR 15.82% 20.17% 24.67% 29.33% 408.50% Deal IRR 20.43% Limited Partner IRR 16.54% Sponsor IRR 44.63% Deal Xtimes Return 1.25 LP Xtimes Return 0.95 Sponsor Xtimes Return 3.98 Rent Roll - PGIOperating StatementAcquisition - DispositionFive Year CashflowsPercentage Split PlanFixed Return MethodWaterfall MethodWaterfall Output

- 12. Fa10Name: ________________________________ Lab Report for Lab #5:What Are Stars Made Of? Questions: 1. Download and save or print out comparison spectra. The Astrophysics Data System (ADS) is a resource that houses electronically scanned refereed publications in astronomy. Find the article written by Jacoby, Hunter and Christian in 1984, published in the Astrophysical Journal Supplement (ApJS). The article is titled “A Library of Stellar Spectra.” The spectra that you are interested in begin on page 259 of this article. The ADS is found at http://adswww.harvard.edu/ 2. Describe the differences of the main spectral types. Considering only the letters that denote the spectral class (O, B, A, F, G, K, M), determine the characteristics that separate one class from another based upon their spectra. Be sure to notice both peak wavelength and absorption lines. [Type answers here] 3. Go to the ELODIE website to view stellar spectra. (http://atlas.obs-hp.fr/elodie/) Look up and view the spectra of the stars from the list below. Identify the spectral type of each star by comparing the spectrum on ELODIE with the library from the article found in step 1. Be sure to note both the peak wavelength of the curve and any absorption lines you notice. HD 191984 HD 194244 HD 206778 HD 209747

- 13. HD 210418 HD 211976 HD 212754 HD 212943 [Type answers here] 4. Use the WWT to find each star whose spectrum you identified. Use the research button to find out the correct spectral type for the star by checking the spectral type on SIMBAD. [Type answers here] OPTIONAL Step 5. Write a paper about the determination of spectral classes of stars. Write about what you have learned about the spectra of stars and how the spectra are related to the chemical composition of stars. Include anything you learn about the history of stellar spectral classification. Fa10 Name: _________________________________ What Are Stars Made Of? Description: When astronomers first started to study stars, they noticed that stars appeared to have different intrinsic colors. Later, with more sophisticated instrumentation, these color differences were verified to be distinct differences in the amount of light emitted at each wavelength – meaning the difference in color was real, and not perceived. More recently (in the early 20th century), astronomers used spectrographs to separate the light from stars

- 14. even further, and they noticed that the stars gave off absorption spectra. Different color stars gave off different spectra. It took decades for astronomers to put together the meaning of all these different pieces of data, but eventually they were able to determine what caused the different spectra and what stars are made of. In this exercise, students will look at stellar spectra and blackbody curves of stars to determine the stars’ temperatures. They will classify some spectra, using a comparison set of spectra. They will also note the peak wavelength of the spectra they classify. Introduction: Understanding what information can be gained from observing the light emitted from objects in space is vital to astronomy. One very important phenomenon of light that will be used in this exercise is the spectrum – this is light from an object that has been spread out by wavelength, similar to the way light can be spread out by wavelength when it passes through a prism or dust particles embedded in raindrops. There are two very distinct properties of a spectrum that will be important in this exercise: energy distribution and absorption lines. The energy distribution curve is sometimes called a blackbody curve because the shape of an energy distribution curve for a star is much light that of a theoretical blackbody. A theoretical blackbody is a substance that absorbs all light incident upon it and re-emits that light at all wavelengths with the peak wavelength of that emission corresponding to the temperature of the blackbody. You will be examining blackbody curves for several stars to determine the peak wavelength of that curve, and, thus, the temperature of the star that emitted that light. Absorption lines are dark lines where much less light is

- 15. observed. These occur at discrete wavelengths within the spectrum of a star. The reason that much less light is present is because that light was absorbed by an intervening gas. In the case of a star, the intervening gas is the atmosphere of the star. So, the absorption lines in the spectrum of a star’s light are due to materials found in the atmosphere of the star. 1. Download and save or print out comparison spectra. The Astrophysics Data System (ADS) is a resource that houses electronically scanned refereed publications in astronomy. Find the article written by Jacoby, Hunter and Christian in 1984, published in the Astrophysical Journal Supplement (ApJS). The article is titled “A Library of Stellar Spectra.” The spectra that you are interested in begin on page 259 of this article. The ADS is found at http://adswww.harvard.edu/ 2. Describe the differences of the main spectral types. Considering only the letters that denote the spectral class (O, B, A, F, G, K, M), determine the characteristics that separate one class from another based upon their spectra. Be sure to notice both peak wavelength and absorption lines. 3. Go to the ELODIE website to view stellar spectra. (http://atlas.obs-hp.fr/elodie/) Look up and view the spectra of the stars from the list below. Identify the spectral type of each star by comparing the spectrum on ELODIE with the library from the article found in step 1. Be sure to note both the peak wavelength of the curve and any absorption lines you notice. HD 191984 HD 194244 HD 206778 HD 209747

- 16. HD 210418 HD 211976 HD 212754 HD 212943 4. Use the WWT to find each star whose spectrum you identified. Use the research button to find out the correct spectral type for the star by checking the spectral type on SIMBAD. OPTIONAL Step 5. Write a paper about the determination of spectral classes of stars. Write about what you have learned about the spectra of stars and how the spectra are related to the chemical composition of stars. Include anything you learn about the history of stellar spectral classification. 4949-4977 International Dr Orlando, FL 32819 - Tourist Corridor Submarket Sale on 07/30/2008 for $85,000,000 ($825.38/SF) - Research Complete 456,892 SF Retail (Regional Mall) Building Built in 2007 SOLD 1 Non-Arms Length

- 17. Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: Lightstone Value Plus Real EstatePolo Florida Llc 5401 W Oak Ridge Rd Orlando, FL 32819 True Buyer: True Seller: Prime Retail 217 E Redwood St Baltimore, MD 21202 (410) 234-0782 - Seller Type: Developer/Owner-NTL Sale Date: Pro Forma Cap Rate: Price/SF: Sale Price: $825.38 $85,000,000-Confirmed 07/30/2008 (31 days on market) Bldg Type: Land Area:

- 18. Sale Conditions: Year Built/Age: GLA: 7.70% Retail - (Regional Mall) Built in 2007 Age: 1 456,892 SF 82.52 AC (3,594,475 SF) Partial Interest Transfer (22.54%) Percent Leased: 100.0% Transaction Details Asking Price: - Price/AC Land Gross: $4,570,012.35 InvestmentSale Type: Non-Market Reasons: Business Sale/Zero RE Allocation. ID: 2219848 - Tenancy: Multi

- 19. Escrow Length: 35 days Financing: Down payment of $19,600,000.00 (23.1%) * Other Institutional Lenders No. of Tenants: 37 Tenants at time of sale: Carter's; Dickies; Easy Spirit Outlet Store; Edy's Ice Cream Shop; Electronics Outlet; Gap Outlet; Kasper Outlet Store; KB Toy Outlet/Toy Liquidators; Lids; Liz Claiborne; Mikasa; NIKE Factory Store; Payless ShoeSource; Perfumania; Pfaltzgraff Factory Store; Phillips- Van Heusen Corporation; Piercing Pagoda; Rack Room Shoes; rue21; Samsonite Company Stores; Stride Rite; Sun Trust Bank ATM; The Children's Place; Timberland Factory Outlet; Today's Woman Of Florida Inc; Tommy Hilfiger; Traffic Shoes; Tuscany Pizza House; Ultra Diamonds; Van Heusen Direct; Vans; Vin & Esprit; Vitamin World; Welcome Home; Wendys Trend Silver; Wet Seal; World Cafe This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 1 Sale History: Portfolio sale of 52 properties sold for $2,300,000,000 ($314.48/SF) on 08/30/2010 Sold for $85,000,000 ($825.38/SF) on 07/30/2008 Non-Arms Length Spacer

- 20. Transaction Notes Lightstone acquired a 22.54% interest in Mill Run LLC. Mill Run is the beneficial owner of the Prime Outlets Orlando I and Orlando II. The acquisition price for the Mill Run 22.54% interest was $85M. An affiliate of the Lightstone Group, the Company's sponsor, is the managing member and majority owner of Mill Run. The Mill Run properties are leased to to tenants under long-term leases with expiration dates through 2023. All rents are NNN with escalations. The NOI for Mill Run Interest was $6.553M resulting in a cap rate of 7.7%. These figures are unaudited. The Mill Run interest is a non-managing interest. Property Type: Retail - (Regional Mall) Orlando Premium Outlets - Internationa Dr Built in 2007 Center Name: Bldg Status: Owner Type: REIT Current Retail Information GLA: 456,892 SF 0 SFTotal Avail:

- 21. Bldg Vacant: 0 SF % Leased: 100.0% Street Frontage: 2,594 feet on Floridas Turnpike 3,434 feet on Oak Ridge Road W 3,120 feet on SR - 400 1,724 feet on I-4 Expy 1,588 feet on Oak Ridge Rd Parking: 2250 free Surface Spaces are available Zoning: AC-3/SP, Orlando Owner Occupied: No CAM: - Rent/SF/Yr: - No. of Stores: 179 Land Area: 82.52 AC Features: Bus Line, Corner Lot, Dedicated Turn Lane, Enclosed Mall, Food Court, Freeway Visibility, Out Parcel, Pylon Sign, Signage, Signalized Intersection Expenses: 2009 Tax @ $1.61/sf Lot Dimensions: - ID: 761118 Building FAR: 0.13 Location Information

- 22. Orlando Tourist Corridor/Tourist Corridor Metro Market: Submarket: County: Orange Park Name: Orlando Premium Outlets - Internati Second Address: 5401 W Oak Ridge Rd CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer Located just across the I-4 - Kirkman Rd. interchange from Universal Studios and just 12 miles from Disney World, Belz Factory Outlet World, Orlando fronts I-4 and the Florida Turnpike-Florida's busiest intersection with 80,000 cars passing each day. Over 43 million tourists yearly make Orlando their vacation destination. Orlando is also one of the fastest growing metropolitan areas in the country, with a population of well over 1.6 million. Centered in the middle of this retail bonanza is Belz Factory Outlet World, the largest non-anchored factory outlet center of its kind in the country with 700,000 sq. ft. and over 170 outlets in two fully

- 23. enclosed malls and four strip centers. Property Notes 4949-4977 International Dr SOLD 456,892 SF Retail (Regional Mall) Building Built in 2007 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 2 Parcel Number: - -Legal Description: County: Orange Plat Map: 4949-4977 International Dr 4949-4977 International Dr SOLD 456,892 SF Retail (Regional Mall) Building Built in 2007 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 3 495 N Keller Rd - Maitland Promenade II

- 24. Maitland, FL 32751 - Maitland Center Submarket Sale on 06/25/2008 for $52,940,000 ($229.81/SF) - Research Complete 230,366 SF Class A Office Building Built in 2001 SOLD 2 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: NNN Maitland Promenade LLCFDG Maitland Promenade LLC True Buyer: True Seller: Grubb & Ellis Realty Investors, LLC 1551 N Tustin Ave Santa Ana, CA 92705 (714) 667-8252 Flagler Development Company 10151 Deerpark Blvd Jacksonville, FL 32256 (904) 279-3132 Buyer Type: Seller Type: Investment ManagerDeveloper/Owner-RGNL Buyer Broker: Listing Broker: No Listing Broker on DealHFF Danny Finkle (305) 448-1333

- 25. Manuel de Zarraga (305) 448-1333 Hermen Rodriguez (305) 448-1333 Sale Date: Pro Forma Cap Rate: Price/SF: Sale Price: $229.81 $52,940,000-Confirmed 06/25/2008 (0 days on market) Bldg Type: Land Area: Sale Conditions: Year Built/Age: RBA: 7.00% Office

- 26. Built in 2001 Age: 6 230,366 SF 9.20 AC (400,926 SF) 1031 Exchange Percent Leased: 100.0% Transaction Details Asking Price: - Price/AC Land Gross: $5,751,847.02 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $34,778,587 $30,933,234 $3,845,353 Percent Improved: 88.9% Land Assessed/AC: $417,791 InvestmentSale Type: Transfer Tax: $370,580

- 27. ID: 1551987 - Spacer Tenancy: Multi Escrow Length: 90 days No. of Tenants: 10 Tenants at time of sale: BE & K Building Group, Inc; BE&K Bldg Group; Custom Staffing, Inc.; First Data Corporation; Option One Mortgage Corporation; Opus South Corporation; Paysys International, Inc.; Sobik's Subs; The Mortgage Store; United HealthCare Services, Inc. This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 4 Parcel No: 27-2129-5482-00-020 Document No: 9719-6850 Sale History: Sold for $52,940,000 ($229.81/SF) on 06/25/2008 Sold for $44,393,000 ($192.71/SF) on 09/12/2005 Legal Desc: Lot 2 Maitland Promenade pltbk 47 pgs 14,15; lots 91,92 Willis R Munger's Subdivision sec 27 T21S R29E

- 28. Spacer Transaction Notes The buyer's agent reported that a 230,366 square foot building sold for $52,940,000. The property was part of a 1031 exchange, however, no further details were given. The buyer's agent reported an cap of 7% at the time of sale. The property was 8% vacant and the operating expenses were $9.50 per square foot per year. Income Expense Data ($512,546) $6,406,823 Effective Gross Income - Vacancy Allowance + Other Income Gross Scheduled IncomeIncome $2,188,477 $2,188,477 Total Expenses - Operating Expenses

- 29. - TaxesExpenses $3,705,800Cash Flow $3,705,800 - Capital Expenditure - Debt Service Net Operating IncomeNet Income Bldg Type: Office A 88,391 SF Class: Total Avail: Bldg Vacant: Tenancy: Owner Type: Owner Occupied 40,999 SF Multi Developer/Owner-RGNL

- 30. No Bldg Status: Built in 2001 82.2% Withheld % Leased: Rent/SF/Yr: Typical Floor Size: Land Area: Elevators: Zoning: 46,073 SF 9.20 AC 5 with 1 frt PD-NON, County Current Building Information RBA: 230,366 SF Core Factor: - Stories: 5 Building FAR: 0.57

- 31. Amenities: 24/7 Building Access, Card Key Access, Fitness Center, Food Service, Property Manager on Site, Restaurant Parking: 76 free Surface Spaces are available; Ratio of 4.60/1,000 SF Const Type: Masonry Expenses: 2010 Tax @ $2.00/sf; 2009 Ops @ $9.50/sf Setbacks: 1st-5th 46,067 sf ID: 596055 Location Information Orlando Maitland Center/Maitland Center Metro Market: Submarket: County: Orange Park Name: Maitland Promenade CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer

- 32. 495 N Keller Rd - Maitland Promenade II SOLD 230,366 SF Class A Office Building Built in 2001 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 5 495 N Keller Rd - Maitland Promenade II SOLD 230,366 SF Class A Office Building Built in 2001 (con't) Located within the heart of Maitland Center, Maitland Promenade II offers many amenities including rich lobby finishes, 24/7 security guard, an on site cafe, shower and locker room facilities in addition to its own self sufficient three-story parking garage. Property Notes This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 6 Parcel Number: 27-2129-5482-00-020 Lot 2 Maitland Promenade plat bk 47 pgs 14, 15 Por lots 91, 92 Willis R Mungers Subdiv plat bk E pg 7 Legal Description:

- 33. County: Orange Plat Map: 495 N Keller Rd - Maitland Promenade II 495 N Keller Rd - Maitland Promenade II SOLD 230,366 SF Class A Office Building Built in 2001 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 7 1000 Legion Pl - Gateway Center Orlando, FL 32801 - Downtown Orlando Submarket Sale on 01/18/2008 for $55,000,000 ($240.97/SF) - Research Complete 228,241 SF Class A Office Building Built in 1989 SOLD 3 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: FBEC-Gateway Cener LP FBEC-Gateway Center II LP Parkway Fund Orlando I LLC

- 34. True Buyer: True Seller: Jones Lang LaSalle America's Inc. Ty Spearing 200 E Randolph St Chicago, IL 60601 (312) 782-5800 Parkway Properties, Inc. Mandy Pope Steven Rogers 188 E Capitol St Jackson, MS 39201 (601) 948-4091 Buyer Type: Seller Type: Investment ManagerREIT Buyer Broker: Listing Broker: Jones Lang LaSalle Jeff Morris (407) 982-8690 Jones Lang LaSalle Jubeen Vaghefi (305) 789-6519 Jones Lang LaSalle Thomas Beneville

- 35. (212) 812-5740 David Krasnoff (212) 812-5700 Jones Lang LaSalle Natalee Gleiter (407) 982-8576 Sale Date: Pro Forma Cap Rate: Price/SF: Sale Price: Actual Cap Rate: $240.97 $55,000,000-Confirmed 01/18/2008 Bldg Type: Land Area: Year Built/Age: RBA:

- 36. 4.70% 6.80% Office Built in 1989 Age: 18 228,241 SF 4.01 AC (174,676 SF) Percent Leased: 76.5% Transaction Details Asking Price: - Price/AC Land Gross: $13,715,710.72 Total Value Assessed: Improved Value Assessed: $25,448,686 in 2007 $20,916,827 Percent Improved: 82.2% InvestmentSale Type: ID: 1470186 Tenancy: Multi

- 37. Escrow Length: - This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 8 Actual Cap Rate: 6.80% Improved Value Assessed: Land Value Assessed: $20,916,827 $4,531,859 Land Assessed/AC: $1,130,139 Transfer Tax: $385,000 - Spacer Parcel No: Financing: 23-2229-2963-00-010, 23-2229-2963-00-020, 23-2229-2963-00- 030 Down payment of $23,000,000.00 (41.8%) $33,000,000.00 from Massachusetts Mutual Life Insurance Company

- 38. Document No: 9572-3417 Sale History: Portfolio sale of 12 properties sold on 12/31/2011 Sold for $55,000,000 ($240.97/SF) on 01/18/2008 Sold for $28,575,000 ($125.20/SF) on 12/20/1999 No. of Tenants: 14 Legal Desc: Lots 1 & 3 & all that certain air space in & to lot 2 Gateway Center Replat A Replat bk 27 pgs 103 & 104 + easements Spacer Tenants at time of sale: Alliance Title Services, Ltd.; Department of Veterans Affairs; Fitness Center; Florida Choice Bank; Fox Sports Florida; GulfAtlantic Title; Jacobs Carter Burgess; R.W. Beck; Reynolds, Smith and Hills, CS, Incorporated; Severant Internet Service; Shuffield, Lowman & Wilson, P.A.; South Milhausen, P.A.; Tews Company, Inc.; Trammell Crow Company Transaction Notes Property consists of a 228,000 rentable square foot Class A office property, situated on 3 legal parcels totaling 4.01 acres. The building features a conferencing facility, corner location, food service and management on-site. There are eight passenger elevators and one freight. Building amenities include state-of-the-art fire and life safety systems, computer-controlled HVAC system, key card access and patrolling security and on-site showers and locker facilities. Tenant storage spaces are available. Floors 2-6 are parking floors,

- 39. visitor parking is free and there is no 13th floor. Sellers Cap Rate is based on in-place income at time of sale. The income factors in such fees as asset & property management, leasing and construction supervision services. When taking those out of the income stream, the cap rate would be a 4.7%. The property was 79% leased at time of sale. Buyers intend on spending an estimated $2.8 million for building improvements, leasing, tenant improvements, and closing costs. There were no reports of any funds used from a tax deferred exchange. There were no adverse conditions affecting the sale. There were no reports of deferred maintenance. Bldg Type: Office A 28,661 SF Class: Total Avail: Bldg Vacant: Tenancy: Owner Type: Owner Occupied

- 40. 28,661 SF Multi Pension Fund No Bldg Status: Built in 1989 91.8% $20.50 % Leased: Rent/SF/Yr: Typical Floor Size: Land Area: Elevators: Zoning: 21,834 SF 4.01 AC 9 with 1 frt AC3A/T/Orlando Current Building Information RBA: 228,241 SF

- 41. Core Factor: - Stories: 17 Building FAR: 1.31 Amenities: 24/7 Building Access, Banking, Bus Line, Conferencing Facility, Corner Lot, Food Service, Signage Parking: 876 Covered Spaces are available; 39 free Surface Spaces are available; Ratio of 3.50/1,000 SF Const Type: Masonry Setbacks: 1st-17th 21,000-30,000 sf ID: 380641 Location Information Orlando Downtown/Downtown Orlando Metro Market: Submarket: County: Orange Map(Page): Trakker 44-S19 CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL

- 42. CSA: Orlando-Deltona-Daytona Beach, FL 1000 Legion Pl - Gateway Center SOLD 228,241 SF Class A Office Building Built in 1989 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 9 1000 Legion Pl - Gateway Center SOLD 228,241 SF Class A Office Building Built in 1989 (con't) Map(Page): Trakker 44-S19 Spacer Gateway Center is on the north end of downtown Orlando. It has views of Lake Ivanhoe and easy access to Interstate 4 and the Orlando International Airport. The 17 story high-rise building, consisting of 228,241 sf building has an elegant lobby with flame cut granite and polished granite accents. The property fronts both North Orlando Avenue and Legion Place, with a wrap-around terrace, landscaped gardens and courtyard featuring Canary Island palm trees. Gateway Center has surface parking and a six story garage with a 3.5:1000 parking ratio. Building amenities include a state-of- the-art fire

- 43. and life safety systems, computer-controlled HVAC system, key card access and patrolling security and on-site showers and locker facilities. Tenant storage spaces are available. On-site cafe. An outdoor seating area is adjacent to the building. Nearby amenities include business hotels, restaurants, and retail shops. It is also adjacent Lake Ivanhoe that offers a pleasant walk through one of the city's beautiful, landscaped gardens. Floors 2-6 are parking floors, visitor parking is free and there is no 13th Floor. Property Notes This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 10 Parcel Number: 23-2229-2963-00-010, 23-2229-2963-00-020, 23-2229-2963-00-030 Lots 1 thru 3 Gateway Center plat bk 27 pgs 103, 104Legal Description: County: Orange Plat Map: 1000 Legion Pl - Gateway Center 1000 Legion Pl - Gateway Center SOLD 228,241 SF Class A Office Building Built in 1989 (con't)

- 44. This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 11 2301 Lucien Way - Maitland Colonnades Maitland, FL 32751 - Maitland Center Submarket Sale on 06/26/2007 for $51,000,000 ($196.15/SF) - Research Complete 260,000 SF Class A Office Building Built in 1986 SOLD 4 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: FBEC-Maitland Colonnades, LPCRP-2 Colonnades, LLC True Buyer: True Seller: Jones Lang LaSalle America's Inc. Ty Spearing 200 E Randolph St Chicago, IL 60601 (312) 782-5800 Colony Realty Partners Henry Brauer

- 45. 2 International Pl Boston, MA 02110 (617) 235-6300 Buyer Type: Seller Type: Investment ManagerInvestment Manager Buyer Broker: Listing Broker: Jones Lang LaSalle Thomas Beneville (212) 812-5740 Jay Miele (212) 314-0400 No Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $196.15 $51,000,000-Confirmed 06/26/2007 (82 days on market) Bldg Type:

- 46. Land Area: Year Built/Age: RBA: 6.20% Office Built in 1986 Age: 21 260,000 SF 14.07 AC (612,998 SF) Percent Leased: 90.6% Transaction Details Asking Price: - Price/AC Land Gross: $3,624,089.54 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $19,335,256 in 2006 $14,424,592 $4,910,664

- 47. Percent Improved: 74.6% Land Assessed/AC: $348,954 InvestmentSale Type: Transfer Tax: $357,000 ID: 1335852 - Spacer Tenancy: Multi Escrow Length: 40 days Parcel No: 35-2129-4579-01-000 No. of Tenants: 7 Legal Desc: Lot 1 Lake Lucien Executive Center Phase Two pltbk 15 pg 5 Tenants at time of sale: Commerce Title Company; Crawford & Company; Harbert Realty Services, Inc.; Nature’s Table Café; NuVox; Reliance Standard Life Insurance Company; Trane This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 12

- 48. Parcel No: 35-2129-4579-01-000 Document No: 9326-2575 Sale History: Sold for $51,000,000 ($196.15/SF) on 06/26/2007 Sold for $33,000,000 ($126.92/SF) on 12/21/1998 Spacer Transaction Notes The listing broker reported that a 260,000-square-foot office building sold for $51,000,000. The property was 9% vacant at the time of sale. The listing broker reported that if the existing parking structure is expanded the surface lot can be developed. Bldg Type: Office A 114,875 SF Class: Total Avail: Bldg Vacant: Tenancy: Owner Type: Owner Occupied

- 49. 33,640 SF Multi Investment Manager No Bldg Status: Built in 1986 87.1% $20.59 % Leased: Rent/SF/Yr: Typical Floor Size: Land Area: Elevators: Zoning: 65,000 SF 14.07 AC 2 IC-2, Maitland Current Building Information RBA: 260,000 SF

- 50. Core Factor: 13.0% Stories: 4 Building FAR: 0.42 Amenities: Atrium, Conferencing Facility, Fitness Center, Restaurant, Signage Elevator Banks: 1st-4th(2) Parking: 1008 free Covered Spaces are available; 360 free Surface Spaces are available; Ratio of 4.00/1,000 SF Const Type: Reinforced Concrete ID: 381012 Location Information Orlando Maitland Center/Maitland Center Metro Market: Submarket: County: Orange Park Name: Maitland Center Map(Page): Trakker 34-S15 CBSA: Orlando-Kissimmee-Sanford, FL

- 51. DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer Maitland Colonnades is a Four-Story, Three-Winged Class A office building in Maitland, FL with over 260,000 square feet of rentable area. Sitting on over 14 acres of land just off I-4 and Maitland Boulevard inside the Maitland Preserve Office Park, the property includes beautiful lake views of Lake Lucien, with an observation deck and a nature preserve. The property also sits in close proximity to major retail centers and the Orlando, Winter Park, Kissimmee, and Sanford Amtrak Stations. On-site amenities include a fitness center and a Nature’s Table Café. Property Notes 2301 Lucien Way - Maitland Colonnades SOLD 260,000 SF Class A Office Building Built in 1986 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 13 Parcel Number: 35-2129-4579-01-000 Lot 1 Lake Lucien Executive Center Phase 2, Plat Book 15 pg 5Legal Description:

- 52. County: Orange Plat Map: 2301 Lucien Way - Maitland Colonnades 2301 Lucien Way - Maitland Colonnades SOLD 260,000 SF Class A Office Building Built in 1986 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 14 800 N Magnolia Ave - One Orlando Centre Orlando, FL 32803 - Downtown Orlando Submarket Sale on 05/08/2007 for $90,625,000 ($254.72/SF) - Research Complete 355,783 SF Class A Office Building Built in 1988, Renov 1995 SOLD 5 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: One Orlando Associates LLCOCC Owner, LLC True Buyer: True Seller: The Praedium Group LLC Mark Lippman

- 53. 825 Third Ave New York, NY 10022 (212) 224-5600 Parkway Realty Services Joseph Kuipers 390 N Orange Ave Orlando, FL 32801 (407) 650-0593 Buyer Type: Seller Type: Investment ManagerDeveloper/Owner-RGNL Buyer Broker: Listing Broker: CBRE Ronald Rogg (407) 839-3194 No Buyer Broker on Deal Sale Date: Pro Forma Cap Rate: Price/SF: Sale Price: $254.72 $90,625,000-Confirmed

- 54. 05/08/2007 (127 days on market) Bldg Type: Land Area: Year Built/Age: RBA: 5.70% Office Built in 1988, Renov 1995 Age: 18 355,783 SF 5.66 AC (246,419 SF) Percent Leased: 92.4% Transaction Details Asking Price: - Price/AC Land Gross: $16,019,975.25 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $47,082,418 in 2006

- 55. $34,762,118 $12,320,300 Percent Improved: 73.8% Land Assessed/AC: $2,177,885 InvestmentSale Type: Transfer Tax: $634,375 ID: 1302174 - Spacer Tenancy: Multi Escrow Length: 30 days No. of Tenants: 20 Legal Desc: Blk A, Lots 4-5, Blk B, DR. R.A. Miller's Add. Orlando, PB C, P 70; Lots 1-13, FA Lewter's Subd., PB G, P 24; Lots 26-32, Cooper & Atha's ReSubd., PB G, P 30. Tenants at time of sale: 20 North Orange Corp.; Boyle Engineering; Cushman & Wakefield of Florida, Inc.; Dean, Mead, Egerton, Bloodworth, Capouano & Bozart; Deltacom Inc.; Enterprise Florida, Inc.; Hannover Life Reassurance Company of America; HRH Insurance; Hunton Brady Architects; Longbeach Mortgage; McGladrey & Pullen, LLP.; Menu Vantage; Premier Mortgage Capital; R.W.

- 56. Beck; Siemens AG; The Apartment Group; Turner Construction Company; U.S.Mortgage Advisor; Universal Mortgage Advisors; Wells Fargo Bank NA This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 15 Parcel No: 23-2229-5640-01-001 Document No: 9255-2329 Sale History: Sold for $90,625,000 ($254.72/SF) on 05/08/2007 Sold for $70,000,000 ($196.75/SF) on 03/07/2006 Legal Desc: Blk A, Lots 4-5, Blk B, DR. R.A. Miller's Add. Orlando, PB C, P 70; Lots 1-13, FA Lewter's Subd., PB G, P 24; Lots 26-32, Cooper & Atha's ReSubd., PB G, P 30. Spacer Transaction Notes The seller reported that the property was 92 percent leased at the time of sale. The seller reported that a 355,000-square-foot building sold for $90,625,000. The seller reported the proforma cap rate. Bldg Type: Office

- 57. A 66,802 SF Class: Total Avail: Bldg Vacant: Tenancy: Owner Type: Owner Occupied 35,210 SF Multi Developer/Owner-RGNL No Bldg Status: Built in 1988, Renov 1995 90.8% $23.81 % Leased: Rent/SF/Yr: Typical Floor Size:

- 58. Land Area: Elevators: Zoning: 18,000 SF 5.66 AC 6 AC-3A/T, Orlando Current Building Information RBA: 355,783 SF Core Factor: 14.0% Stories: 19 Building FAR: 1.44 Amenities: Banking, Bus Line, Conferencing Facility, Corner Lot, On Site Management, Property Manager on Site, Restaurant, Signage Parking: 1400 free Covered Spaces are available; Ratio of 3.50/1,000 SF Const Type: Masonry Expenses: 2009 Tax @ $3.74/sf ID: 380875 Location Information

- 59. Orlando Downtown/Downtown Orlando Metro Market: Submarket: County: Orange Map(Page): American Map Corp 306 CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer Located with close proximity to downtown Orlando and I-4, the building has a 24-hour guard, double door entry off the common elevator and an attached multi-level garage. 19 Stories Panoramic Views Covered Parking Garage Full Service Bank On-Site Management 24 Hour Security Guard Conference Center for Tenant Use Property Notes 800 N Magnolia Ave - One Orlando Centre SOLD

- 60. 355,783 SF Class A Office Building Built in 1988, Renov 1995 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 16 Parcel Number: 23-2229-5640-01-001 Lengthy Legal refer to supplemental dataLegal Description: County: Orange Plat Map: 800 N Magnolia Ave - One Orlando Centre 800 N Magnolia Ave - One Orlando Centre SOLD 355,783 SF Class A Office Building Built in 1988, Renov 1995 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 17 777 E Merritt Island Cswy - Merritt Square Mall Merritt Island, FL 32952 - Brevard County Submarket Sale on 10/09/2007 for $84,000,000 ($104.48/SF) - Research Complete

- 61. 804,000 SF Retail (Super Regional Mall) Building Built in 1970, Renov 2003 SOLD 6 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: Thor Merritt Square, LLCGlimcher Realty Trust True Buyer: True Seller: Thor Equities Andrew Schulman 25 W 39th St New York, NY 10018 Glimcher Realty Trust Lisa Indest Mark Yale 180 E Broad St Columbus, OH 43215 (614) 621-9000 Buyer Type: Seller Type: Developer/Owner-NTLREIT Buyer Broker: Listing Broker: Cushman & Wakefield, Inc. Mark Gilbert (305) 533-2866

- 62. Adam Feinstein (305) 533-2863 No Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $104.48 $84,000,000-Confirmed 10/09/2007 (141 days on market) Bldg Type: Land Area: Year Built/Age: GLA: 6.70% Retail - (Super Regional Mall) Built in 1970, Renov 2003 Age: 37 804,000 SF

- 63. 85 AC (3,702,600 SF) Percent Leased: - Transaction Details Asking Price: - Price/AC Land Gross: $988,235.29 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $61,000,000 in 2007 - - Percent Improved: - Land Assessed/AC: - InvestmentSale Type: ID: 1410720 - Spacer Tenancy: Multi

- 64. Escrow Length: 60 days No. of Tenants: 80 Tenants at time of sale: 5-7-9; A & W Restaurants Inc; Accessory Connection; Ace Luggage; Aeropostale; Audibel Hearing Care Center; Barnie's Coffee & Tea; Bath & Body Works, Inc.; Birneys Treasures; Bon Worth; Books-A-Million; Cajun Cafe & Grill; Candy Candy; Champs Sports; Chick-fil-A; Claire’s; Cobb Theatre; Cooks Cove; Creative Concepts; Dillard's; Emily's Bath Designs; Finish Line; Foot Locker; FYE--For Your Entertainment; GNC; Gold Corner; Gordon's Jewelers; Great American Cookie Company Inc; H&R Block; Hair Cuttery; Hallmark Gold Crown; Homes Plus; Island Eyes; Island Surf & Skate; JB Robinson Jewelers; JC Penney; Journeys; Kay Jewelers; KLDU Foundation; Lady Foot Locker; LensCrafters; Lids; Macy's; Male Attractions Inc; Manchu WOK; MasterCuts; Merle Norman; Nail Studio; Natural Mystique; Nature's Table Café; Pacific Sunwear; Payless ShoeSource; Pearle Vision; Perfume Collection; Petland; Piccadilly Cafeteria; Rack Room Shoes; Radioshack; Regis Salons; Ron Jon Cape Caribe Resort; Ruby Tuesday; Sbarro; Sears; Sid's Mens Fashions Inc; Sprint Kiosk; Steve & Barry's University Sportswear; Subway; Sunflower House; Sunglass Hut International Inc.; Tea Time International; The Dakota Watch Company; The Dollar Star; The Pretzel Twister; Things Remembered; T- Mobile; Trade Secret Beauty Express; Traffic Shoes; Verizon Wireless; Vitamin World; Zales Jewelers This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012

- 65. Page 18 Parcel No: Financing: 24-36-36-00-00254.1000.00, 24-36-36-00-00253.1000.00, 24- 36-36-00-00280.0000.00, 24-36-36-00-00556.0000.00, 24-36-36-00-00296.0000.00 $57,000,000.00 from Private Lender:: 5.35%,; Assumed loan type Sale History: Sold for $84,000,000 ($104.48/SF) on 10/09/2007 Sold for $64,400,000 ($80.10/SF) on 04/11/2005 Sold for $32,750,000 ($40.73/SF) on 12/18/2002 Legal Desc: Por sec 36 T24S R36E +easements Spacer Tenants at time of sale: 5-7-9; A & W Restaurants Inc; Accessory Connection; Ace Luggage; Aeropostale; Audibel Hearing Care Center; Barnie's Coffee & Tea; Bath & Body Works, Inc.; Birneys Treasures; Bon Worth; Books-A-Million; Cajun Cafe & Grill; Candy Candy; Champs Sports; Chick-fil-A; Claire’s; Cobb Theatre; Cooks Cove; Creative Concepts; Dillard's; Emily's Bath Designs; Finish Line; Foot Locker; FYE--For Your Entertainment; GNC; Gold Corner; Gordon's Jewelers; Great American Cookie Company Inc; H&R Block; Hair Cuttery; Hallmark Gold Crown; Homes Plus; Island Eyes; Island Surf &

- 66. Skate; JB Robinson Jewelers; JC Penney; Journeys; Kay Jewelers; KLDU Foundation; Lady Foot Locker; LensCrafters; Lids; Macy's; Male Attractions Inc; Manchu WOK; MasterCuts; Merle Norman; Nail Studio; Natural Mystique; Nature's Table Café; Pacific Sunwear; Payless ShoeSource; Pearle Vision; Perfume Collection; Petland; Piccadilly Cafeteria; Rack Room Shoes; Radioshack; Regis Salons; Ron Jon Cape Caribe Resort; Ruby Tuesday; Sbarro; Sears; Sid's Mens Fashions Inc; Sprint Kiosk; Steve & Barry's University Sportswear; Subway; Sunflower House; Sunglass Hut International Inc.; Tea Time International; The Dakota Watch Company; The Dollar Star; The Pretzel Twister; Things Remembered; T- Mobile; Trade Secret Beauty Express; Traffic Shoes; Verizon Wireless; Vitamin World; Zales Jewelers Transaction Notes Property Consists of an 804,000 rentable square foot shopping center situated on 85 acres. There were no conditions of sale. There were no exchanges. There was no deferred maintenance. There was 12,591 square feet of vacant space at time of sale. There was 41,724 of temp space at time of sale. Cap rate was based on income at time of sale. Market time and Escrow/Contract period was estimated. Property Type: Retail - (Super Regional Mall) Merritt Square Mall Built in 1970, Renov 2003

- 67. Center Name: Bldg Status: Owner Type: REIT Current Retail Information GLA: 804,000 SF 4,200 SFTotal Avail: Bldg Vacant: 2,700 SF % Leased: 99.7% Street Frontage: 1,211 feet on E Merritt Island CSWY (with 3 curb cuts) 1,864 feet on S Sykes Creek Pky Parking: 3452 Surface Spaces are available Zoning: BU1, County Owner Occupied: No CAM: - Rent/SF/Yr: Withheld No. of Stores: 95 Land Area: 85 AC Features: Corner Lot, Food Court, Kiosk/Cart Space, Out Parcel, Pylon Sign, Temporary Tenants

- 68. Lot Dimensions: - ID: 732093 Building FAR: 0.22 Location Information Orlando Brevard County/Brevard County Metro Market: Submarket: County: Brevard Park Name: Merritt Square Mall Map(Page): Trakker 84-Q30 CBSA: Palm Bay-Melbourne-Titusville, FL DMA: Orlando-Daytona Beach-Melbourne, FL Spacer 777 E Merritt Island Cswy - Merritt Square Mall SOLD 804,000 SF Retail (Super Regional Mall) Building Built in 1970, Renov 2003 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 19

- 69. 777 E Merritt Island Cswy - Merritt Square Mall SOLD 804,000 SF Retail (Super Regional Mall) Building Built in 1970, Renov 2003 (con't) Approximate Foodcourt seats=400 Property Notes This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 20 Parcel Number: 24-36-36-00-00254.1000.00, 24-36-36-00- 00253.1000.00, 24-36-36-00-00280.0000.00, 24-36-36-00-00556.0000.00, 24-36-36-00-00296.0000.00 Lengthy legal refer to deedLegal Description: County: Brevard Plat Map: 777 E Merritt Island Cswy - Merritt Square Mall 777 E Merritt Island Cswy - Merritt Square Mall SOLD 804,000 SF Retail (Super Regional Mall) Building Built in 1970, Renov 2003 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 21

- 70. 390 N Orange Ave - Bank of America Center Orlando, FL 32801 - Downtown Orlando Submarket Sale on 11/16/2006 for $96,250,000 ($228.58/SF) - Research Complete 421,069 SF Class A Office Building Built in 1987 SOLD 7 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: US Office Holdings LPACP/Utah Orange Avenue, LLC True Buyer: True Seller: Blue Capital Investment 19401-19415 S Dixie Hwy Miami, FL 33157 (305) 933-7100 Lacy, Ltd. 1620 Eye St NW Washington, DC 20006 (202) 822-9200 America's Capital Partners, LLC 3225 Aviation Ave

- 71. Miami, FL 33133 (305) 995-9998 Buyer Type: Seller Type: Pension Fund Developer/Owner-RGNL Developer/Owner-NTL Buyer Broker: Listing Broker: Cushman & Wakefield of Florida Inc. Mike Davis (813) 223-6300 Cushman & Wakefield of Florida, Inc. Rick Solik (407) 841-8000 No Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $228.58 $96,250,000-Confirmed 11/16/2006 (92 days on market)

- 72. Bldg Type: Land Area: Year Built/Age: RBA: 5.11% Office Built in 1987 Age: 19 421,069 SF 2.31 AC (100,624 SF) Percent Leased: 100.0% Transaction Details Asking Price: - Price/AC Land Gross: $41,666,666.67 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $55,610,292 in 2005 $49,005,935

- 73. $6,604,357 Percent Improved: 88.1% Land Assessed/AC: $2,859,029 InvestmentSale Type: Transfer Tax: $673,750 ID: 1181477 - Spacer Tenancy: Multi Escrow Length: 17 days This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 22 Parcel No: 26-2922-2263-00-020 Document No: 8977-2476 Sale History: Portfolio sale of 8 properties sold for $380,000,000 ($244.36/SF) on 04/08/2011 Sold for $96,250,000 ($228.58/SF) on 11/16/2006 Sold for $60,725,000 ($144.22/SF) on 03/18/1997

- 74. No. of Tenants: 26 Legal Desc: Lots 2 and 3 duPont Centre plat bk 16 pgs 47 and 48 Spacer Tenants at time of sale: Allstate Insurance Company; Baker, Donelson, Bearman, Caldwell & Berkowitz, PC; Bank of America, N.A.; Best and Anderson, P.A.; Beusse Wolter SanksMora & Maire, P.A.; Broad and Cassel; Chicago Title Insurance Co.; ClearSky Technologies, Inc.; Dermalogica; DIGITAL ASSURANCE CERTIFICATION, L.L.C.; Enterprise Florida, Inc.; Forizs & Dogali, P.L.; Giles & Robinson, P.A.; Grower, Ketcham, Rutherford, Bronson, Eide & Telan; Holtzman & Equels P.A.; Jackson Lewis; Jones Lang LaSalle; Latham, Shuker, Eden & Beaudine, LLP; Law Offices of America; McMillen Law Firm A Professional Association; MTV; Sands, White & Sands; Stanton & Gasdick, P.A.; TraveLeaders Group, Inc.; Wicker Smith O'Hara McCoy & Ford P.A.; Winderweedle, Haines, Ward & Woodman PA Bldg Type: Office A 77,756 SF Class: Total Avail: Bldg Vacant:

- 75. Tenancy: Owner Type: Owner Occupied 74,598 SF Multi REIT No Bldg Status: Built in 1987 84.4% $25.00 % Leased: Rent/SF/Yr: Typical Floor Size: Land Area: Elevators: Zoning: 15,038 SF 2.31 AC 10 with 1 frt

- 76. AC-3A/T, Orlando Current Building Information RBA: 421,069 SF Core Factor: 18.5% Stories: 28 Building FAR: 4.18 Amenities: Banking, Convenience Store, Corner Lot, Dry Cleaner, Fitness Center, On Site Management, Property Manager on Site, Restaurant, Security System Parking: 36 Surface Spaces are available; 851 Covered Spaces are available; Ratio of 2.10/1,000 SF Lot Dimensions: 307x295 Const Type: Masonry Expenses: 2011 Tax @ $2.86/sf; 2011 Est Ops @ $10.14/sf ID: 380776 Location Information Orlando Downtown/Downtown Orlando Metro Market: Submarket:

- 77. County: Orange Map(Page): American Map Corp 307 CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Cross Street: Livingston St Spacer Easy access to I-4, the 408 Expressway and Orlando International Airport On-site full-service banking with drive-through service, two ATM’s, cafe, hair salon, shoe shine/repair, auto detail and fitness center Bank of America Center has a unique architectural design that gives it one of the most outstanding images in Downtown Orlando. The courtyard provides a very relaxing area for tenants and guests. The beautiful interior finishes of wood, brass, marble and limestone are breathtaking, adding to the exquisite grand lobby. Property Notes 390 N Orange Ave - Bank of America Center SOLD 421,069 SF Class A Office Building Built in 1987 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012

- 78. Page 23 390 N Orange Ave - Bank of America Center SOLD 421,069 SF Class A Office Building Built in 1987 (con't) Parcel Number: 26-2922-2263-00-020 Lots 2,3 DuPonte CentreLegal Description: County: Orange Plat Map: 390 N Orange Ave - Bank of America Center This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 24 Plat Map: 390 N Orange Ave - Bank of America Center 390 N Orange Ave - Bank of America Center SOLD 421,069 SF Class A Office Building Built in 1987 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 25 300 S Orange Ave - Lincoln Plaza

- 79. Orlando, FL 32801 - Downtown Orlando Submarket Sale on 02/26/2010 for $52,250,000 ($212.30/SF) - Research Complete 246,117 SF Class A Office Building Built in 2000 SOLD 8 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: PRU-LPC St Center LLC300 South Orange, LLC True Buyer: True Seller: Prudential Real Estate Investors 8 Campus Dr Parsippany, NJ 07054 (973) 734-1300 GLL Real Estate Partners, Inc. 200 Orange Ave Orlando, FL 32801 (407) 233-1991 Buyer Type: Seller Type: Investment ManagerInvestment Manager Buyer Broker: Listing Broker: CWCapital LLC David Pepe (407) 999-9989

- 80. Rockwood Real Estate Advisors Dan McNulty (212) 286-5800 Michael Lerner (212) 286-5800 No Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $212.30 $52,250,000-Confirmed 02/26/2010 (117 days on market) Bldg Type: Land Area: Year Built/Age: RBA: 8.80%

- 81. Office Built in 2000 Age: 9 246,117 SF 1.29 AC (56,371 SF) Percent Leased: 93.0% Transaction Details Asking Price: $52,000,000 Price/AC Land Gross: $40,375,550.58 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $47,330,446 in 2009 $41,129,196 $6,201,250 Percent Improved: 86.9% Land Assessed/AC: $4,791,940 InvestmentSale Type: Transfer Tax: $365,750

- 82. ID: 1881641 - Spacer Tenancy: Multi Escrow Length: 90 days No. of Tenants: 19 Tenants at time of sale: Ameriprise Financial, Inc.; Asset Management Advisors; Berkadia Commerical Mortgage LLC; Digital Legal; Finlayson-Stripling, Inc.; Fisher & Phillips LLP; Ford & Harrison LLP; Larsen and Associates; Law Office of J. Christopher Norris; Lincoln Property Company; Merrill Lynch & Co.; Nature's Table Café; Nature's Table Inc.; Public Financial Management, Inc.; Randstad North America Lp; Retail Restaurant; Shutts & Bowen LLP; Trusco Capital Management; Walter P Moore This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 26 Parcel No: Financing:

- 83. 26-2229-0027-00-030 Down payment of $52,250,000.00 (100.0%) Document No: 10007-8998 Sale History: Sold for $52,250,000 ($212.30/SF) on 02/26/2010 Sold for $36,267,500 ($147.36/SF) on 09/21/2000 Non-Arms Length Legal Desc: Lot 3 Sun Bank Center sec 26 T22 R29 bk 22 pg 120 Spacer Tenants at time of sale: Ameriprise Financial, Inc.; Asset Management Advisors; Berkadia Commerical Mortgage LLC; Digital Legal; Finlayson-Stripling, Inc.; Fisher & Phillips LLP; Ford & Harrison LLP; Larsen and Associates; Law Office of J. Christopher Norris; Lincoln Property Company; Merrill Lynch & Co.; Nature's Table Café; Nature's Table Inc.; Public Financial Management, Inc.; Randstad North America Lp; Retail Restaurant; Shutts & Bowen LLP; Trusco Capital Management; Walter P Moore Transaction Notes The following details regarding the sales transaction were confirmed by the primary parties involved. On February 26, 2010, Prudential Real Estate Investors sold Lincoln Plaza, located at 300 S Orange Ave in Orlando, FL to GLL Real Estate Partners for $52.25 million, or $211.30 per square foot.

- 84. The subject property is a 246,100 SF office building with a 237,072 SF parking garage. It is located at the corner of S Orange Ave and W South St. The parking garage holds 591 parking spaces. The 16- story property was completed in 2000. At the time of sale, the subject property was 93.4% occupied by 19 tenants, all of which had full service lease deals. The seller built the subject property with Lincoln Property Company. They divested in this asset "to realize their gain" of this Class-A asset. This deal proved the property's attractiveness to the marketplace. No sales conditions were involved in this deal. Ashley Dedekind of Lincoln Property Company will continue to manage the subject property. The buyer did not acquire any financing in the acquisition of Lincoln Plaza. Projected pro forma data shows an NOI of $4.6 million for the end of the first year. Income Expense Data $3,077,012 $2,217,361 $859,651 Total Expenses

- 85. - Operating Expenses - TaxesExpenses Bldg Type: Office A 70,258 SF Class: Total Avail: Bldg Vacant: Tenancy: Owner Type: Owner Occupied 61,853 SF Multi Investment Manager No Bldg Status: Built in 2000 87.0% $26.13

- 86. % Leased: Rent/SF/Yr: Typical Floor Size: Land Area: Elevators: Zoning: 24,113 SF 1.29 AC 7 with 1 frt AC-3A/T, Orlando Current Building Information RBA: 246,117 SF Core Factor: - Stories: 16 Building FAR: 4.37 Amenities: 24/7 Building Access, Corner Lot, Energy Star Labeled, On Site Management, Security System Elevator Banks: 1st-10th(6) Parking: 591 free Covered Spaces are available; Ratio of 2.50/1,000 SF

- 87. Lot Dimensions: 241x237 Expenses: 2010 Tax @ $3.49/sf, 2012 Est Tax @ $3.73/sf; 2010 Ops @ $9.01/sf, 2012 Est Ops @ $8.68/sf ID: 380712 Location Information OrlandoMetro Market: 300 S Orange Ave - Lincoln Plaza SOLD 246,117 SF Class A Office Building Built in 2000 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 27 300 S Orange Ave - Lincoln Plaza SOLD 246,117 SF Class A Office Building Built in 2000 (con't) Orlando Downtown/Downtown Orlando Metro Market: Submarket: County: Orange Map(Page): Trakker 44-T21

- 88. CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer Adjacent to Orlando City Hall, SunTrust Center, Grand Bohemian Hotel and Church Street retail shops with easy access to Interstate 4 and East-West Expressway (408). This building was awarded an Energy Star label in 2009 for its operating efficiency. Property Notes This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 28 Parcel Number: 26-2229-0027-00-030 Lot 3 Adjusted Sun Bank Center A Replat plat bk 22 pages 120 and 121 less and except land deeded to City of Orlando Legal Description: County: Orange

- 89. Plat Map: 300 S Orange Ave - Lincoln Plaza 300 S Orange Ave - Lincoln Plaza SOLD 246,117 SF Class A Office Building Built in 2000 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 29 8151 Patterson Woods Dr - Patterson Court Apartments Orlando, FL 32821 - Tourist Corridor Submarket Sale on 10/29/2010 for $67,250,000 ($148.48/SF; $175,130/Unit) - Research Complete 384 Unit, 452,928 SF Apartment Units Building Built in 2008 SOLD 9 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: Alta Cast Housing LLCUS LSTAR I LLC True Buyer: True Seller: Wood Partners 3715 Northside Pky NW Atlanta, GA 30327 (404) 965-9965

- 90. USAA Real Estate Company 9830 Colonnade Blvd San Antonio, TX 78230 (800) 531-8182 Buyer Type: Seller Type: Developer/Owner-NTLInvestment Manager Buyer Broker: Listing Broker: CBRE Malcolm McComb (404) 923-1421 No Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $148.48 $67,250,000-Confirmed 10/29/2010 (60 days on market) Bldg Type: Land Area: Sale Conditions:

- 91. Year Built/Age: RBA: 6.75% Apartment Units Built in 2008 Age: 2 452,928 SF 21 AC (914,760 SF) Investment Triple Net Percent Leased: 100.0% Transaction Details Asking Price: - Price/AC Land Gross: $3,202,380.95 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $35,239,308 in 2009 $31,399,308 $3,840,000

- 92. Percent Improved: 89.1% Land Assessed/AC: $182,857 InvestmentSale Type: Transfer Tax: $470,750 GRM/GIM: -/- ID: 2002318 - Spacer Escrow Length: 60 days Parcel No: Financing: 23-2428-5111-01-000, 23-2428-5111-02-000 Down payment of $67,250,000.00 (100.0%) Document No: 10131-9160 Legal Desc: Lots 1 & 2 Little Lake Bryan Par 8 bk 69 pgs 147 thru 149 Spacer # Units:

- 93. Avg Unit Size: 1,111 SF 384 $175,130Price/Unit: Spacer Spacer This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 30 Spacer no of units bed/bath avg unit size (sf) complex % month rent/low month rent/high Unit Mix 96 1/1.0 772 25.0 - - 96 2/2.0 1,048 25.0 - - 192 3/3.0 1,312 50.0 - - Transaction Notes The following details were confirmed by the broker involved. On October 29, 2010, Wood Partners sold the Patterson Court Apartments in Orlando, Florida to USAA Real Estate Company for $67.25 million.

- 94. The subject property is a 452,928-SF, 384-unit apartment complex that sits on 21 acres. It was completed in December of 2008. The unit mix is as follows: 96 one bedroom/one bath; 96 two bedroom/two bath; 192 three bedroom/three bath. It has 885 parking space, of which 21 spaces are handicapped. The subject property was built as a build-to-suit project for the tenant. The subject property is master-leased to Walt Disney World Company, a subsidiary of The Walt Disney Co. The tenant then leases the subject property to students, who are enrolled in the Disney College Program, who live while working anywhere from three to twelve months. The subject property is one of four properties used in the program. The tenant's lease commenced May 2008 with the delivery of the first building. The initial contract term will expire May of 2018. The lease agreement has three 5-year options. The tenant, through an absolute net deal, pays all leasing, management and operational expenses (including taxes and insurance). The buyer is responsible for structural capital expenditures. The seller reported a 6.75% CAP Rate, based on the income in- place. The seller marketed this motivator in their marketing materials: "The high credit quality of passive cash flows coupled with excellent asset quality and a tremendous location near Orlando's major attractions make Patterson Court a compelling investment

- 95. opportunity." The lease deal in place was a definite factor in the inflated price. Once the tenant vacates the property, the subject property is permitted to be rented as apartments or converted into condos. This was an all cash deal. Income Expense Data $4,539,375 Effective Gross Income - Vacancy Allowance + Other Income Gross Scheduled IncomeIncome Cash Flow $4,539,375 - Capital Expenditure - Debt Service Net Operating IncomeNet Income 8151 Patterson Woods Dr - Patterson Court Apartments SOLD 384 Unit, 452,928 SF Apartment Units Building Built in 2008 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012

- 96. Page 31 8151 Patterson Woods Dr - Patterson Court Apartments SOLD 384 Unit, 452,928 SF Apartment Units Building Built in 2008 (con't) Bldg Type: Apartment Units 384 1,111 SF # Units: Avg Unit Size: Avg Vacancy: 0.0% Current Building Information Bldg Status: Built in 2008 452,928 SFBldg Size: Typical Floor Size: 38,234 SF Stories: 3 Parking: 899 Surface Spaces are available; Ratio of 1.20/1,000 SF; 2.34/Unit Bldg Vacant: 0 SF

- 97. Owner Type: Investment Manager Zoning: P-D Rent/SF/Yr: For Sale Only Elevators: 0 Land Area: 21 AC Expenses: 2009 Tax @ $1.02/sf ID: 7822263 Location Information Orlando Tourist Corridor/Tourist Corridor Metro Market: Submarket: County: Orange CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012

- 98. Page 32 Parcel Number: 23-2428-5111-01-000, 23-2428-5111-02-000 -Legal Description: County: Orange Plat Map: 8151 Patterson Woods Dr - Patterson Court Apartments 8151 Patterson Woods Dr - Patterson Court Apartments SOLD 384 Unit, 452,928 SF Apartment Units Building Built in 2008 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 33 12100 Sterling University Ln - Sterling Central Orlando, FL 32826 - University Submarket Sale on 12/01/2011 for $84,233,000 ($139.77/SF; $166,140/Unit) - Research Complete 507 Unit, 602,645 SF Apartment Units - Student Building Built in 2011 SOLD

- 99. 10 Buyer & Seller Contact Info Recorded Buyer: Recorded Seller: Sterling - UCF, LPHSRE- UCF I, LC True Buyer: True Seller: Lee Chira & Associates 800 N Highland Rd Orlando, FL 32803 (407) 297-1600 The Dinerstein Companies John Caltagirone 3411 Richmond Ave Houston, TX 77046 (832) 209-1200 Harrison Street Real Estate Capital Brian Thompson 71 S Wacker St Chicago, IL 60606 (312) 920-0500 Buyer Type: Seller Type: Individual Developer/Owner-NTL Investment Manager Buyer Broker: Listing Broker: No Listing Broker on DealNo

- 100. Buyer Broker on Deal Sale Date: Price/SF: Sale Price: Actual Cap Rate: $139.77 $84,233,000-Confirmed 12/01/2011 Bldg Type: Land Area: Year Built/Age: RBA: 6.50% Apartment Units - Student Built in 2011 602,645 SF 10.40 AC (453,024 SF) Percent Leased: 98.5%

- 101. Transaction Details Asking Price: - Price/AC Land Gross: $8,099,326.92 Total Value Assessed: Improved Value Assessed: Land Value Assessed: $67,721,514 in 2011 $30,530,655 $5,080,000 Percent Improved: 45.1% Land Assessed/AC: $488,461 InvestmentSale Type: GRM/GIM: -/- ID: 2223600 - Spacer Escrow Length: 60 days Financing: Down payment of $38,483,000.00 (45.7%) $45,750,000.00 from John Hancock Life Insurance Company

- 102. (U.S.A.) No. of Tenants: 1 Legal Desc: Lengthy legal...refer to deed. Tenants at time of sale: Sterling Central This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 34 Parcel No: 10-2231-8965-01-001, 10-2231-8965-01-000 Document No: 10301-0620 Legal Desc: Lengthy legal...refer to deed. Spacer # Units: Avg Unit Size: 1,206 SF 507 Avg Rent/Unit/Mo: Avg Rent/SF/Mo: $667 $0.55SF of all Units: 1,842,987

- 103. $166,140Price/Unit: Spacer Spacer Transaction Notes The information included in this report was gathered from public record, a third party news source, as well as from sources deemed reliable. This transaction represents the sale of Sterling Central, a 507- unit apartment complex in Orlando, FL. The property, located at 12100 Sterling University Lane near the University of Central Florida, sold on December 1, 2011 for $84,233,000. The owners assess the property on a per-bed basis, since each tenant on the building is on a seperate 12-month lease. Based on this assessment, the 1,527-bed property sold for $55,162 per bed. One of our sources reported the property was approximately 98.5% occupied at the time of the sale. The source reported that Sterling Central traded at approximately a 6.5% cap rate. The property delivered in two phases - the first in August 2010, and the second in August 2011. A source deemed reliable reported that the buyer entered in to negotiations with the seller and developer as the second phase was completing. This source reported that the buyers were attracted to the property because of nearby University of Central Florida's large student body

- 104. (currently the second largest in the nation), as well as the strength of the Orlando multi-family market in general. Income Expense Data $9,903,445 Effective Gross Income - Vacancy Allowance + Other Income Gross Scheduled IncomeIncome $4,428,300 $3,794,906 $633,394 Total Expenses - Operating Expenses - TaxesExpenses Cash Flow $5,475,145 - Capital Expenditure - Debt Service Net Operating IncomeNet Income

- 105. 12100 Sterling University Ln - Sterling Central SOLD 507 Unit, 602,645 SF Apartment Units - Student Building Built in 2011 (con't) This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 35 12100 Sterling University Ln - Sterling Central SOLD 507 Unit, 602,645 SF Apartment Units - Student Building Built in 2011 (con't) Bldg Type: Apartment Units - Student 507 1,206 SF # Units: Avg Unit Size: Avg Vacancy: 5.0% Current Building Information Bldg Status: Built in 2011 602,645 SFBldg Size: Typical Floor Size: 150,661 SF

- 106. Stories: 4 Parking: Free Covered Spaces; Free Surface Spaces Bldg Vacant: 0 SF Owner Type: Investment Manager Zoning: P-D Rent/SF/Yr: - Elevators: 0 Land Area: 10.40 AC Expenses: 2011 Tax @ $1.05/sf; 2011 Ops @ $6.30/sf Site Amenities: Balcony/Patio, Basketball Court, Breakfast/Coffee Concierge, Cable Ready, Ceiling Fans, Ceramic/Tile Floors, Close to Public Transportation, Courtyard, Fitness Center, Gameroom, Grill, High Speed Internet, Media Center/Movie Theater, Pool, Property Manager on Site, Stainless Steel Appliances, Tanning Salon, Volleyball Court, Walk-In Closets, Washer/Dryer, Wi-Fi at Pool and Clubhouse Metering: Individually Metered ID: 8136038 Location Information Orlando

- 107. University/University Metro Market: Submarket: County: Orange CBSA: Orlando-Kissimmee-Sanford, FL DMA: Orlando-Daytona Beach-Melbourne, FL CSA: Orlando-Deltona-Daytona Beach, FL Spacer This copyrighted report contains research licensed to University of Central Florida, School of RE - 441621. 7/22/2012 Page 36 Parcel Number: 10-2231-8965-01-001, 10-2231-8965-01-000 -Legal Description: County: Orange Plat Map: 12100 Sterling University Ln - Sterling Central 12100 Sterling University Ln - Sterling Central SOLD 507 Unit, 602,645 SF Apartment Units - Student Building Built in 2011 (con't) This copyrighted report contains research licensed to University

- 108. of Central Florida, School of RE - 441621. 7/22/2012 Page 37 Final Project Offering Memoranda & Spreadsheet DUE 7/31/2013 at 11:59pm on WebCourses PLEASE UPLOAD ONE FULLY FUNCTIONAL EXCEL FILE & ONE PDF FILE NOTE: THIS PROJECT WILL ALSO COUNT AS YOUR FINAL EXAM – NO OTHER TEST WILL BE GIVEN Use a property in the “Summer 2013 Costar” file. Select just ONE. Using the basic property data, build a spreadsheet and “Offering Memoranda” using the “Sale Price” and “Pro Forma Cap Rate” to set up your financials in the spreadsheet. Hence, you must “make up” or assume all the rent roll and operating expenses that justify the Price and Cap rate. (HINT, put the purchase price from the “sale price” filed an d adjust numbers logically until the Purchasing Cap Rate is equal to the “Pro Forma Cap Rate”. Using this turn in and create the following: 25% of Grade - Submit an Excel Workbook with the following

- 109. items, fully linked, updatable, and functional. Using the above property parameters: 1. Rent Roll – DOES NOT NEED the ABC thing, just the one method that works for your property 2. Operating Statement – with detailed expenses and CAPX 3. Acquisition – Disposition calculator, like in the example 4. Five Year Cashflow Statement – like in the example 5. Waterfall Method and Output sheets (like in example, have a PREF, 1st Tier, and 2nd Tier), MACRO enabled (NO OTHER METHOD IS NEEDED) This should be fully updateable and functional. Make sure you turn in a Macro Enabled Excel File. 30% of Grade – Offering Memoranda This one is a very creative project that will require the creation a word doc that you will PDF and turn in to “sell” someone on investing in the Limited Partner Equity Investment. Using your spreadsheet, make the deal “WORK”, hence make debt assumptions and equity payouts that make the deal profitable to you and the investor (Hint adjust the PREF return as needed if problems with profitability). Your project should have the following items below. The slides entitled “Capital Raising” have examples and hints. 1. Title/Cover Page 2. Introduction/Executive Summary (should describe the investment and why a good deal) 3. Sources and Uses

- 110. 4. Property Description 5. Financial Summary (basically, nice presented parts of your spreadsheet in the word doc) WARNING: Do not say “refer to spreadsheet” in the word doc, the goal and lesson is to summarize data out of a spreadsheet. If you do this, it is like omitting it from the project and will cost a TON of points. Be sure to clearly show how much money and IRR the investor will be making.