Capital budgeting kelompok 3 komplit email

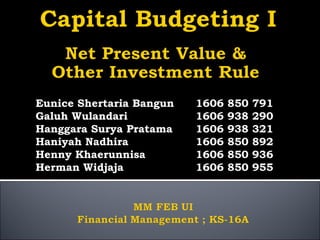

- 1. Eunice Shertaria Bangun 1606 850 791 Galuh Wulandari 1606 938 290 Hanggara Surya Pratama 1606 938 321 Haniyah Nadhira 1606 850 892 Henny Khaerunnisa 1606 850 936 Herman Widjaja 1606 850 955

- 2. Capital Budgeting Capital Budgeting Methods NPV (Net Present Value) Payback Period & Discounted payback IRR (Internal Rate of Return) PI (Profitability Index) Practice of Capital Budgeting Mini Case

- 3. Process to determine & evaluate potential investment projects, i.e. build a new plant, invest in a long-term venture Purpose: Determine which project yield the most return over an applicable period, given a limited amount of capital

- 4. Difference between present value of cash inflows and the present value of cash outflows NPV Rule: Accept a project if the NPV is > 0 Reject a project if the NPV is < 0

- 5. The Alpha Corp. is considering investing in a riskless project costing $100. The project receives $107 in one year and has no other cash flows. The discount rate is 6%. NPV = -$100 + $107 / 1.06 = $0.94 NPV > 0 Accept the project

- 6. NPV is considered the most common and effective valuation methods: Uses cash flows Uses all cash flows of the project Discount the cash flows properly

- 7. Definition the length of time required to recover the cost of an investment. Decision Rule Accept if the payback period is less than some preset limit

- 8. The project cost : $ 60.000 Assume we will accept the project if it pays back within two years. Accept or Reject? Why? Year 1 : $60.000 – 30.000 = 30.000 >> still to recover Year 2 : $30.000 – 20.000 = 10.000 >> still to recover Year 3 : $10.000 – 20.000 = -10.000 >> project pays back

- 9. Three project (initial cost $100) have the same three-year payback period PROBLEM 1: Timing of Cash flow within the Payback Period PROBLEM 2: Payment after the Payback Period PROBLEM 3: Arbitrary Standard for Payback Period Year A B C 0 -100 -100 -100 1 20 50 50 2 30 30 30 3 50 20 20 4 60 60 60.000 Payback period 3 3 3

- 10. Definition the length of time until the sum of the discounted cash flows is equal to the initial investment Rule Accept the project if its discounted payback is less than some prespecified number of years

- 11. The project cost : $100; discount rate 10% Assume we will accept the project if it pay back on discounted basis in 3 years. Accept or Reject? Why? Year 1 : $100 – 50/1.1 = $54.55 >> still to recover Year 2 : $54.55 – 50/(1.1)2 = $13.23 >> still to recover Year 3 : $13.23 – 20/(1.1)3 = -$1.8 >> project pays back

- 12. ADVANTAGES Include time value of money Easy to understand Does not accept negative estimated NPV investment DISADVANTAGES May reject positive investment Requires an arbitrary cutoff point Ignores cash flows beyond the cut off date

- 13. Definition IRR is a metric used in capital budgeting measuring the profitability of potential investments. Accept a project or an investment if the IRR is greater than the minimum required rate of return, typically the cost of capital (discount rate) Rules

- 14. 4 years project, that cost $500, with cash flow on table The IRR = 27.3% Notice that the Year 0 cash flow has a negative sign represent the initial cost of the project Year Cash Flow 0 -$500 1 100 2 200 3 300 4 400

- 15. Project A Project B Project C Dates: 0 1 2 0 1 2 0 1 2 Cash flows -$100 $130 $100 -$130 -$100 $230 -$132 IRR 30% 30% 10 % and 20% NPV @ 10% $18.2 -$18.2 0 Accept if market rate <30% >30% >10% but <20% Financing or Investing Investing Financing Mixture Project A has a cash outflow at date 0 followed by a cash inflow at date 1. its NPV is negatively related to the discount rate. Project B has a cash inflow ate date 0 followed by a cash outflow at date 1. its NPV is positively related to the discount rate. Project C has two changes of sign in its cash flows. It has an outflow ate date 0, an inflow at date 1, and outflow at date 2. Project with more than one change of sign can have multiple rates of return.

- 16. Investing or Financing? Project A : General rule apply Project B : The opposite of the general rule apply Multiple Rates of Return Project C NPV Rule : Accept the project if the discount rate is between 10% and 20%, and reject it if the discount rate is lies outside this range MIRR (modified IRR) : Which handles the multiple IRR problem by combining cash flows until only one change in sign remains.

- 17. Modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm's cost of capital, and the initial outlays are financed at the firm's financing cost. By contrast, the traditional internal rate of return (IRR) assumes the cash flows from a project are reinvested at the IRR. The MIRR more accurately reflects the cost and profitability of a project. Advantage of Modified Internal Rate of Return (MIRR) The MIRR allows project managers to change the assumed rate of reinvested growth from stage to stage in a project. The most common method is to input the average estimated cost of capital, but there is flexibility to add any specific anticipated reinvestment rate.

- 18. Flows Number of IRRs IRR Criterion NPV Criterion First cash flow is negative and all I Accept if IRR > R Accept if NPV > 0 remaining cash flows are positive Reject if IRR < R Reject if NPV < 0 First cash flow is positive and all I Accept if IRR < R Accept if NPV > 0 remaining cash flows are negative Reject if IRR > R Reject if NPV < 0 Some cash flows after first are positive May be more No valid IRR Accept if NPV > 0 and some cash flows after first are negative than I Reject if NPV < 0

- 19. The Scale Problem This Bussiness poposition illustrates a defect with the IRR criterion. The basic IRR rule indicate the selection of Opportunity I because the IRR is 50%. The IRR for opportunity II only 10%. The problem with IRR is that it ignores issues of scale. Although opportunity I has a greater IRR, the investment is much smaller. In other words, the high percentage return on opportunity I is more than offset by the ability to earn at least a decent return on much bigger investment under opprtunitu II The Timing Problem It arises when mutually exclusive project have different cash flow timing Cash flow at Cash flow at End of Class NPV IRR Beginning of Class (90 minutes later) Opportunity I -$1 + $1.5 $ 0.5 50% Opportunity II -$10 + $11 $ 1 10%

- 20. The Timing Problem It arises when mutually exclusive project have different cash flow timing

- 21. Profitability Index (PI) = Present Value of Future Cash Flows Initial Investment Required VIDEO PI

- 22. Hiram Finnegan Inc. (HFI), applies 12% discount rate to 2 investment project. Initial Investment CF 1st year CF 2nd year 1 -$20 $70 $10 $70,5 3,53 $50,5 2 -$10 $15 $40 $45,3 4,53 $35,3 1 - 2 -$10 $55 -$30 $25,2 2,52 $15,2 Profitability Index NPV at 12% disc rate ($ 000,000) PV at 12% disc rate ($ 000,000) Cash Flows ($ 000,000) Project CF 1st year CF 2nd year 1 + disc rate (1 + disc rate) 2 $70 $10 1,12 (1,12) 2 PV of Future Cash Flows + + = = PV of Future Cash Flows PV of Future Cash Flows = $70,5 $70,5 $20 Profitability Index = = 3,53 PV of Future Cash Flows Initial Investment Profitability Index =

- 23. Independent projects General Rules of PI Mutually exclusive projects Incremental cash flows (between 2 projects) $25,2 $10 Profitability Index = PV of Future Cash Flows Initial Investment Profitability Index = = 2,52

- 24. Capital Rationing i.e: budget investment $ 20 million Initial Investment CF 1st year CF 2nd year 1 -$20 $70 $10 $70,5 3,53 $50,5 2 -$10 $15 $40 $45,3 4,53 $35,3 3 -$10 -$5 $60 $43,4 4,34 $33,4 Project Cash Flows ($ 000,000) PV at 12% disc rate ($ 000,000) Profitability Index NPV at 12% disc rate ($ 000,000) If cash constraint forces the firm to choose either Project 1 or Project 2 & 3. Choose the higher PI Project 2 & Project 3.

- 25. Source : CA N Raja Natarajan (2016)

- 26. 1st Project 2nd Project NPV (+) NPV (+) Short Payback Long Payback High IRR Low IRR All systems go, agree NPV (+) Good investment, but getting conflicted signals. Need further analysis

- 28. Capital expenditures add up to enormous sum for the economy of company as a whole Capital budgeting of large firms are more sophisticated from small firm IRR & NPV are used more frequently than payback period, in both firms

- 30. Disclaimer: For academic purpose only. Some data has been modified for confidentiality reasons.

- 31. REVENUE YEAR I YEAR II YEAR III YEAR IV YEAR V FEE FEE FEE FEE FEE ANNUAL INCREMENT 10,000 10,000 10,000 10,000 MONDAY 150,000 160,000 170,000 180,000 190,000 TUESDAY 150,000 160,000 170,000 180,000 190,000 WEDNESDAY 150,000 160,000 170,000 180,000 190,000 THURSDAY 150,000 160,000 170,000 180,000 190,000 FRIDAY 150,000 160,000 170,000 180,000 190,000 SATURDAY 200,000 210,000 220,000 230,000 240,000 SUNDAY 200,000 210,000 220,000 230,000 240,000 VISITORS GUESTS GUESTS GUESTS GUESTS GUESTS MONDAY 120 140 140 140 140 TUESDAY 120 140 140 140 140 WEDNESDAY 120 140 140 140 140 THURSDAY 120 140 140 140 140 FRIDAY 200 220 220 220 220 SATURDAY 450 480 480 480 480 SUNDAY 500 540 540 540 540 ENTRANCE REVENUE MONDAY 18,000,000 22,400,000 23,800,000 25,200,000 26,600,000 TUESDAY 18,000,000 22,400,000 23,800,000 25,200,000 26,600,000

- 32. YEAR I YEAR II YEAR III YEAR IV YEAR V OTHER REVENUE LEASING F & B AREA 30,000,000 30,000,000 30,000,000 30,000,000 30,000,000 PARTY ROOM 32,000,000 32,000,000 40,000,000 40,000,000 40,000,000 TAX (property final) 10% -6,200,000 -6,200,000 -7,000,000 -7,000,000 -7,000,000 SPONSORSHIP 10,000,000 10,000,000 10,000,000 10,000,000 10,000,000 MONTHLY NET OTHER REVENUE AFTER TAX 65,800,000 65,800,000 73,000,000 73,000,000 73,000,000 ANNUAL NET OTHER REV 789,600,000 789,600,000 876,000,000 876,000,000 876,000,000

- 33. OPERATING COST EMPLOYEE COST Cost Per Unit Per Month (Gross) Cost X Unit Per Month GM 1 35,000,000 35,000,000 Head of Finance 1 22,000,000 22,000,000 Head of Operation 1 22,000,000 22,000,000 Admin Staff 1 4,500,000 4,500,000 Finance Staff & Cashier 6 4,500,000 27,000,000 Marketing Staff 1 4,500,000 4,500,000 Trainer and Safety Officer 10 4,500,000 45,000,000 Security 7 4,500,000 31,500,000 Cleaning Service 7 4,500,000 31,500,000 Driver 1 4,000,000 4,000,000 Other Contract Service 1 20,000,000 20,000,000 247,000,000 Utility (Electricity, Water, Internet & Telephone) 80,000,000 Other Expense 25,000,000 TOTAL MONTHLY OPERATING COST 352,000,000 annual cost increment 8%

- 34. INVESTMENT Equipment 8,000,000,000 annual depreciation (1,600,000,000) NON DEPRECIATED SETUP COST Consultant (building design) 50,000,000 Consultant (safety) 150,000,000 Others (graphic, legal, tax, permit) 200,000,000 Electricity 100,000,000 Renovation 700,000,000 1,200,000,000

- 35. area size 3003m2 Monthly Rent Per m2 Annual Rent Expense YEAR 1 Rp. 165,000 Rp. 5,945,940,000 YEAR 2 Rp. 165,000 Rp. 5,945,940,000 YEAR 3 Rp. 165,000 Rp. 5,945,940,000 YEAR 4 Rp. 175,000 Rp. 6,306,300,000 YEAR 5 Rp. 185,000 Rp. 6,666,660,000

- 36. LOAN 8.000.000.000 Interest 10% PRINCIPAL INTEREST PAYMENT OUTSTANDING month 1 103.309.691 66.666.667 169.976.358 8.000.000.000 month 2 104.170.605 65.805.753 169.976.358 7.896.690.309 month 3 105.038.693 64.937.664 169.976.358 7.792.519.704 month 4 105.914.016 64.062.342 169.976.358 7.687.481.010 month 5 106.796.633 63.179.725 169.976.358 7.581.566.994 month 6 107.686.605 62.289.753 169.976.358 7.474.770.362 month 7 108.583.993 61.392.365 169.976.358 7.367.083.757 month 8 109.488.860 60.487.498 169.976.358 7.258.499.764 month 9 110.401.267 59.575.091 169.976.358 7.149.010.904 month 10 111.321.277 58.655.080 169.976.358 7.038.609.637 month 11 112.248.955 57.727.403 169.976.358 6.927.288.360 month 50 155.146.918 14.829.440 169.976.358 1.779.532.801 month 51 156.439.809 13.536.549 169.976.358 1.624.385.883 month 52 157.743.474 12.232.884 169.976.358 1.467.946.075 month 53 159.058.003 10.918.355 169.976.358 1.310.202.601 month 54 160.383.486 9.592.872 169.976.358 1.151.144.598 month 55 161.720.015 8.256.343 169.976.358 990.761.112 month 56 163.067.682 6.908.676 169.976.358 829.041.097 month 57 164.426.579 5.549.778 169.976.358 665.973.415 month 58 165.796.801 4.179.557 169.976.358 501.546.836 month 59 167.178.441 2.797.917 169.976.358 335.750.035 month 60 168.571.594 1.404.763 169.976.358 168.571.594 --------------------------------------------------------------------------------------------------

- 37. (in Rupiah Millions) YEAR 0 YEAR I YEAR II YEAR III YEAR IV YEAR V FORMULA y = 0 y = 1 y = 2 y = 3 y = 4 y = 5 CASH FLOW FROM LOAN & INVESTMENT BANK LOAN a 8.000 -1.298 -1.434 -1.584 -1.750 -1.933 EQUIPMENT b -8.000 1.000 CASH FLOW FROM LOAN & INVESTMENT c 0 -1.298 -1.434 -1.584 -1.750 -933 c=a+b CASH FLOW FROM OPERATION+INTEREST INFLOW Revenue From Entrance Fee d 13.666 15.865 16.708 17.550 18.392 Other Revenue e 790 790 876 876 876 SUB TOTAL INFLOW f 0 14.455 16.655 17.584 18.426 19.268 f=d+e OUTFLOW Set Up Expense g -1.200 Operating Expense h -4.224 -4.562 -4.927 -5.321 -5.747 Rental Expense i -5.946 -5.946 -5.946 -6.306 -6.667 0 Interest Expense j -742 -606 -455 -290 -106 Provisi (0.75% of Loan) k -60 Marketing & Promotion (5% of Fee Rev) l -683 -793 -835 -878 -920 SUB TOTAL OUTFLOW m -7.206 -11.595 -11.907 -12.524 -13.155 -6.773 m=g+h+i+j+k+l CASH FLOW FROM OPERATION+INTEREST n -7.206 2.860 4.748 5.060 5.271 12.496 n=f+m Depreciation Expenses o -1.600 -1.600 -1.600 -1.600 -1.600 PROFIT AFTER DEPRECIATION BEFORE TAX p -7.206 1.260 3.148 3.460 3.671 10.896 TAX (25%) q -315 -787 -865 -918 -2.724 q=25% x p NET PROFIT AFTER TAX r -7.206 945 2.361 2.595 2.753 8.172 r=p+q NET CASH FLOW s -7.206 1.247 2.527 2.610 2.603 8.838 s=c+n+q DISCOUNTED NET CASH FLOW (16%) t -7.206 1.075 1.878 1.672 1.438 4.208 t=s/(1+12%)^y

- 38. IRR 28.5% PAYBACK 3 years 4 months DISCOUNTED PAYBACK (16%) 4 years 3 months NPV (16%) Rp 3,065 (millions) PROFITABILITY INDEX 1.43