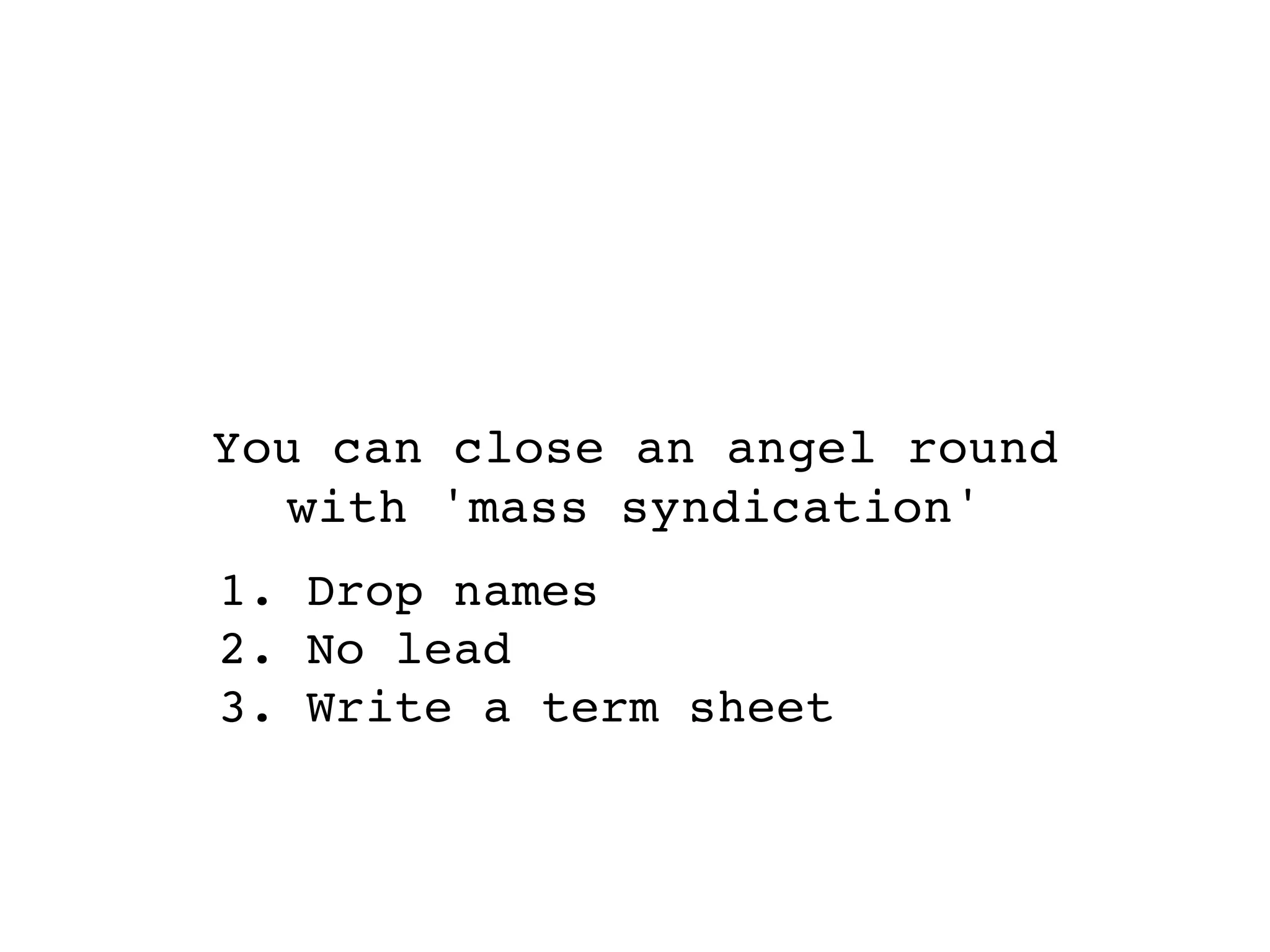

1. Use mass syndication to close an angel round by dropping names and not needing a lead investor.

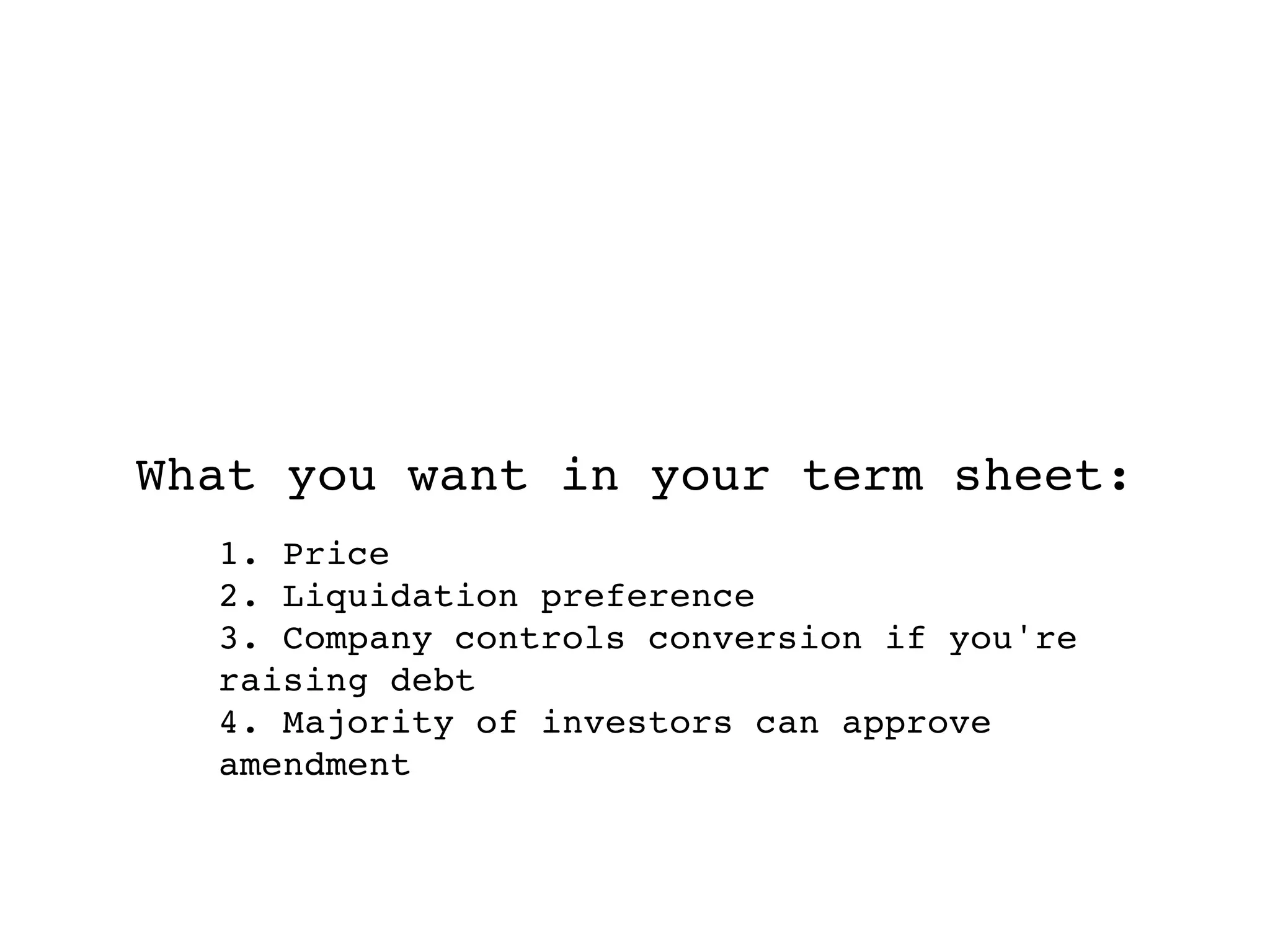

2. Set terms and valuation below market, including price, liquidation preference, and majority control of amendments.

3. Describe how the terms are investor-friendly, such as no minimum raise and vesting as a pre-nuptial agreement.