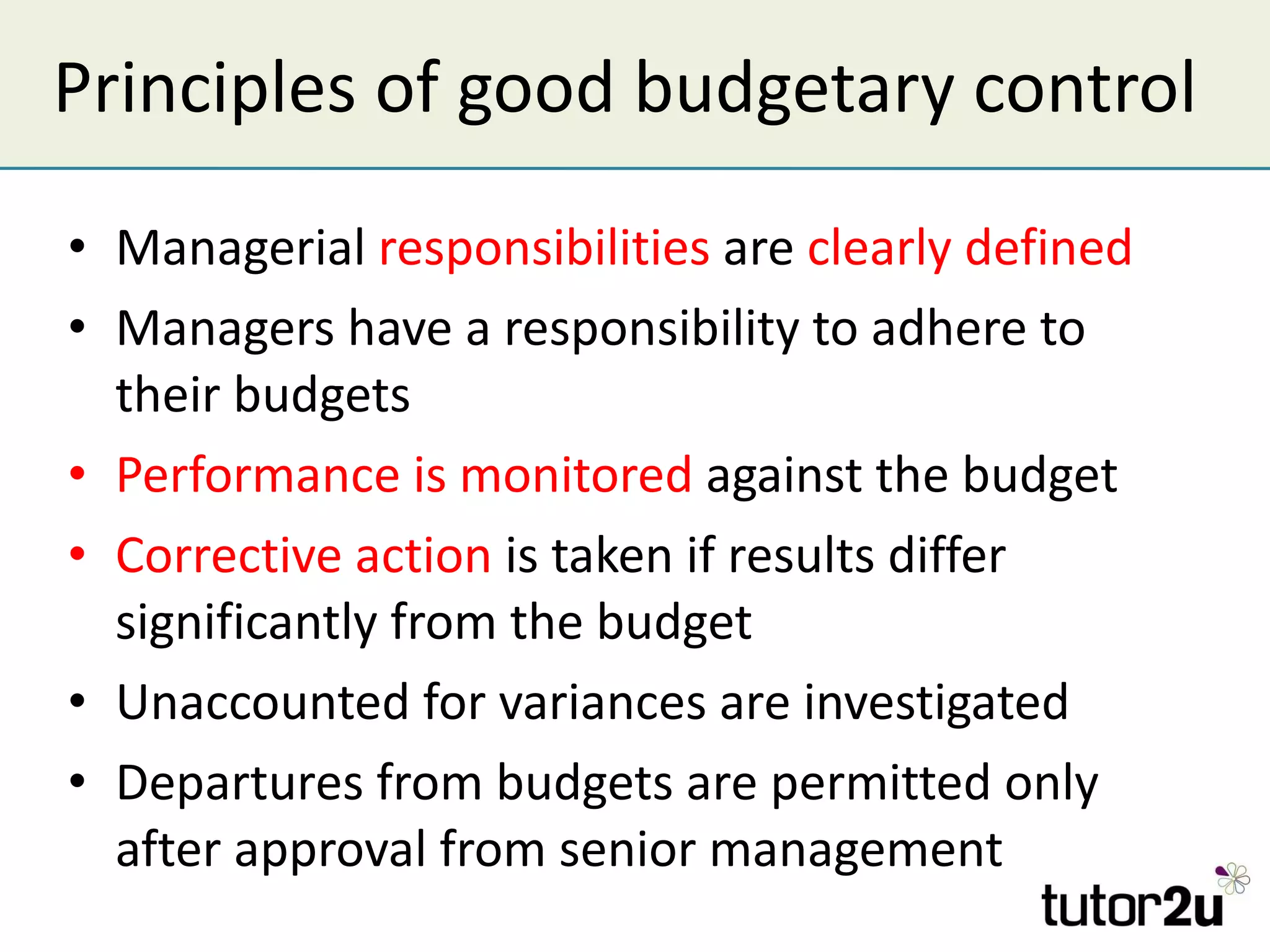

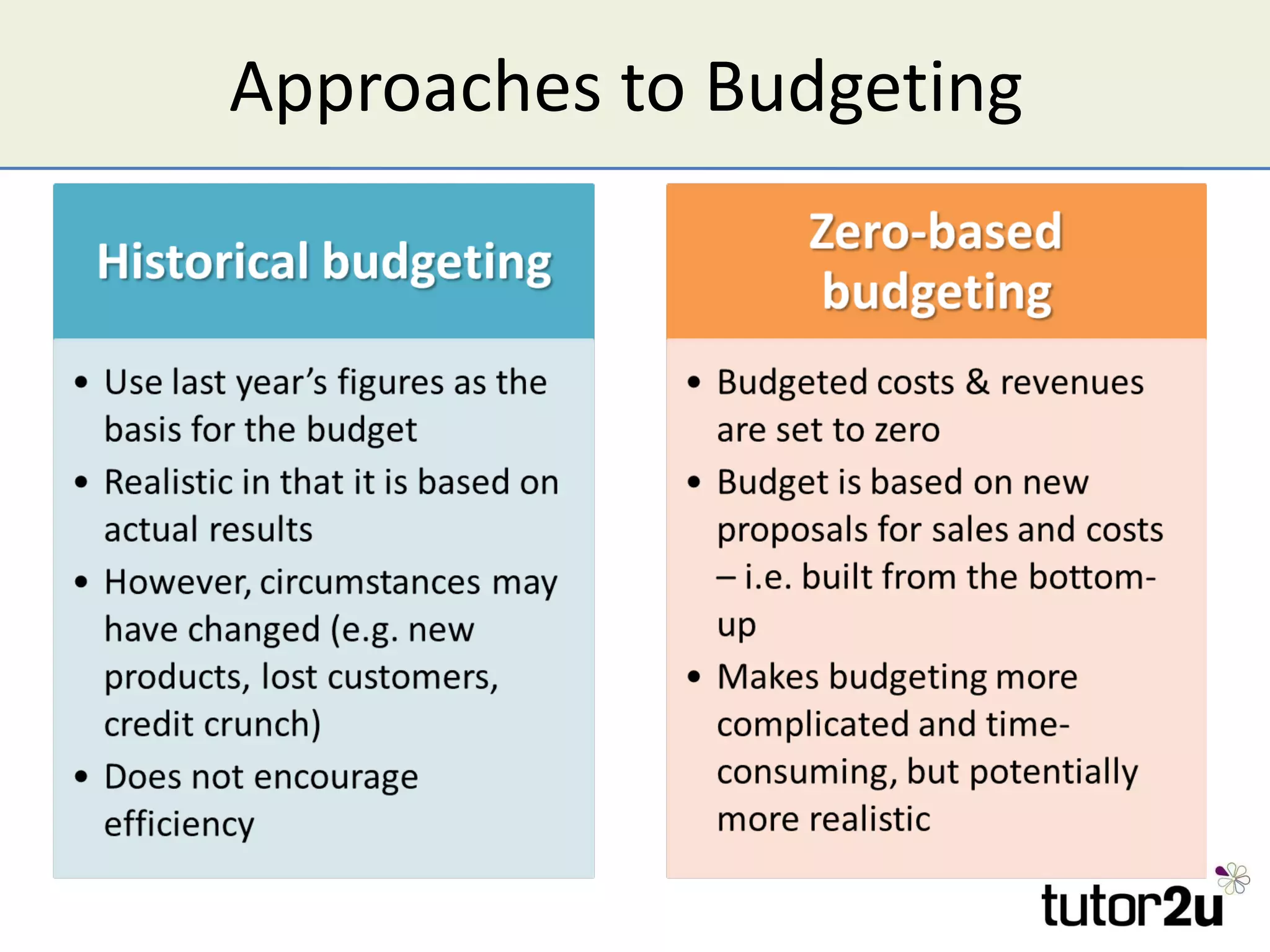

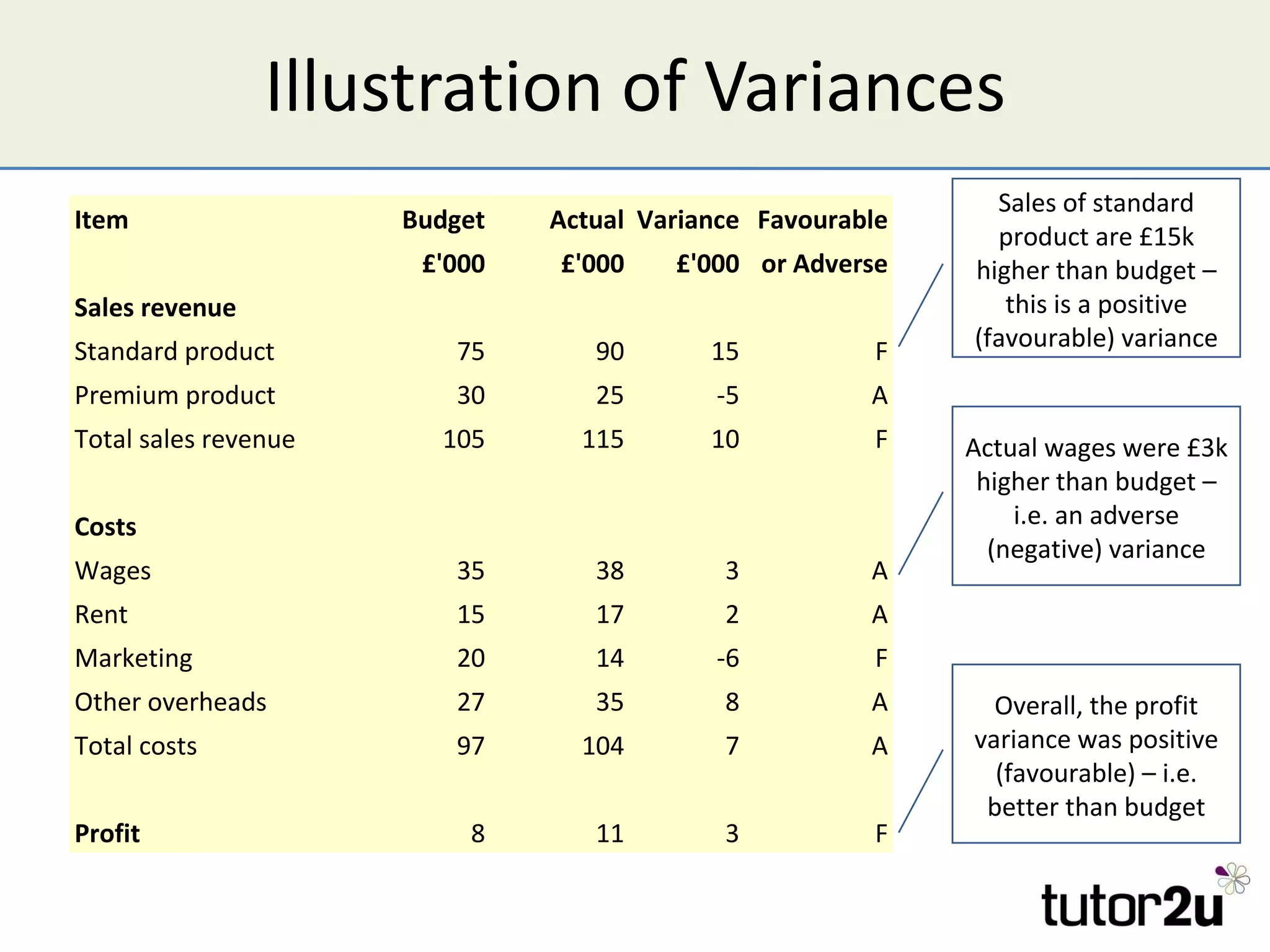

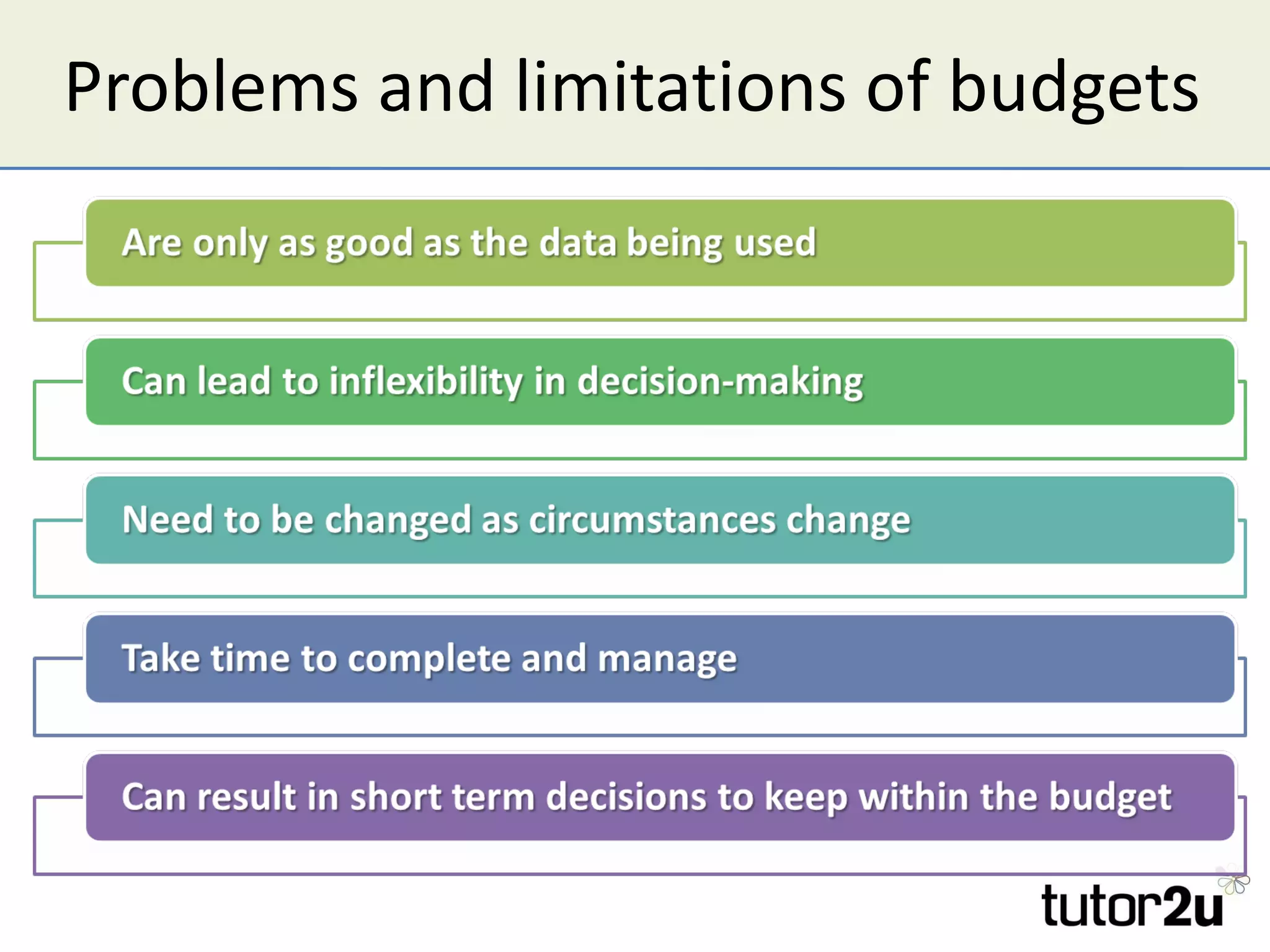

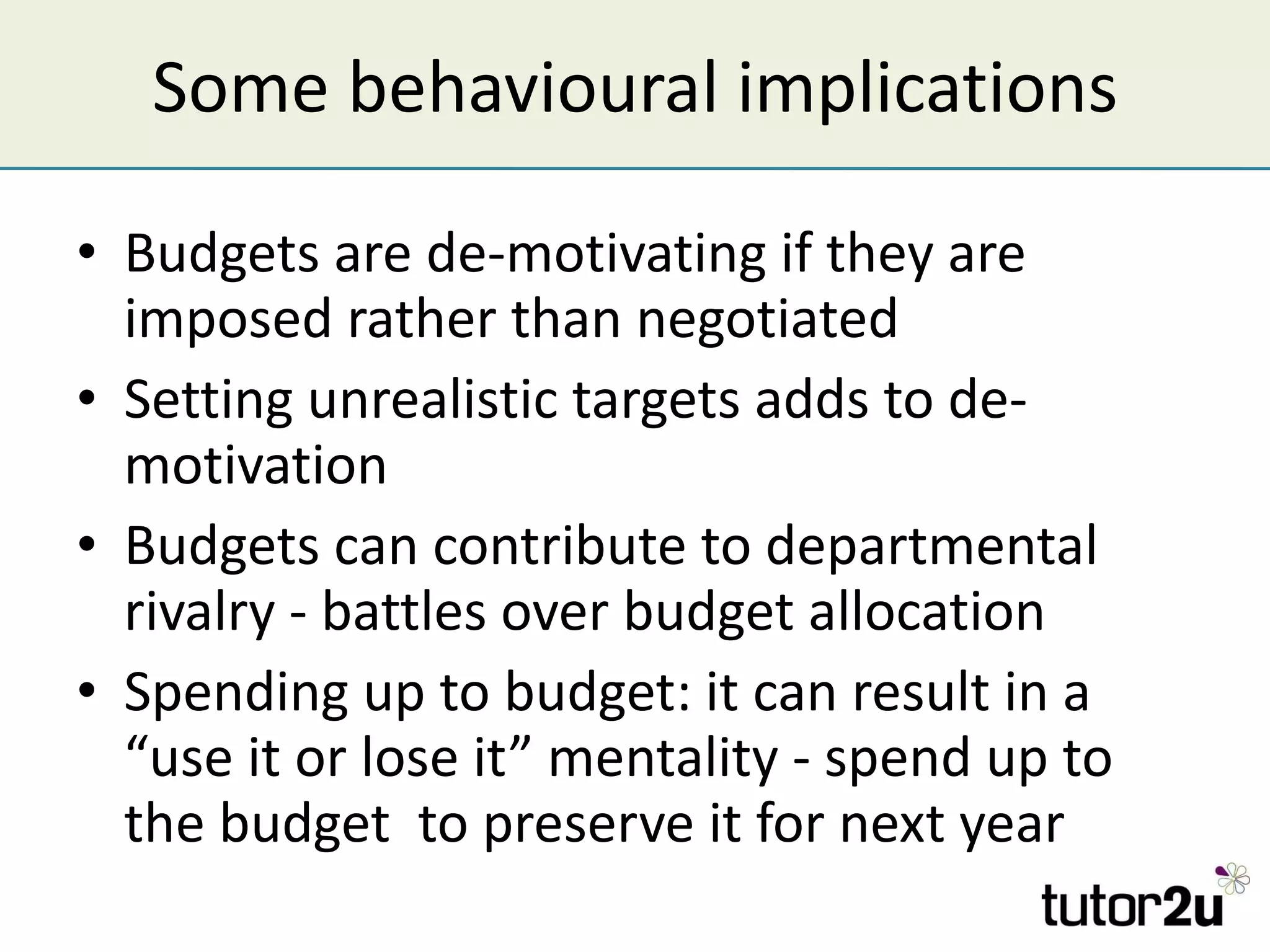

A budget is a financial plan that outlines expected revenues and costs over a period of time. Budgetary control involves preparing budgets in advance and comparing actual performance to identify variances. Managers are responsible for costs within their budgets and must take action if adverse variances are significant. Budgets help establish targets, assign responsibilities, and monitor performance to control income and expenditures. Variances measure differences between actual and budgeted amounts and can be favorable or adverse. Significant variances should be investigated and corrective action taken if needed.