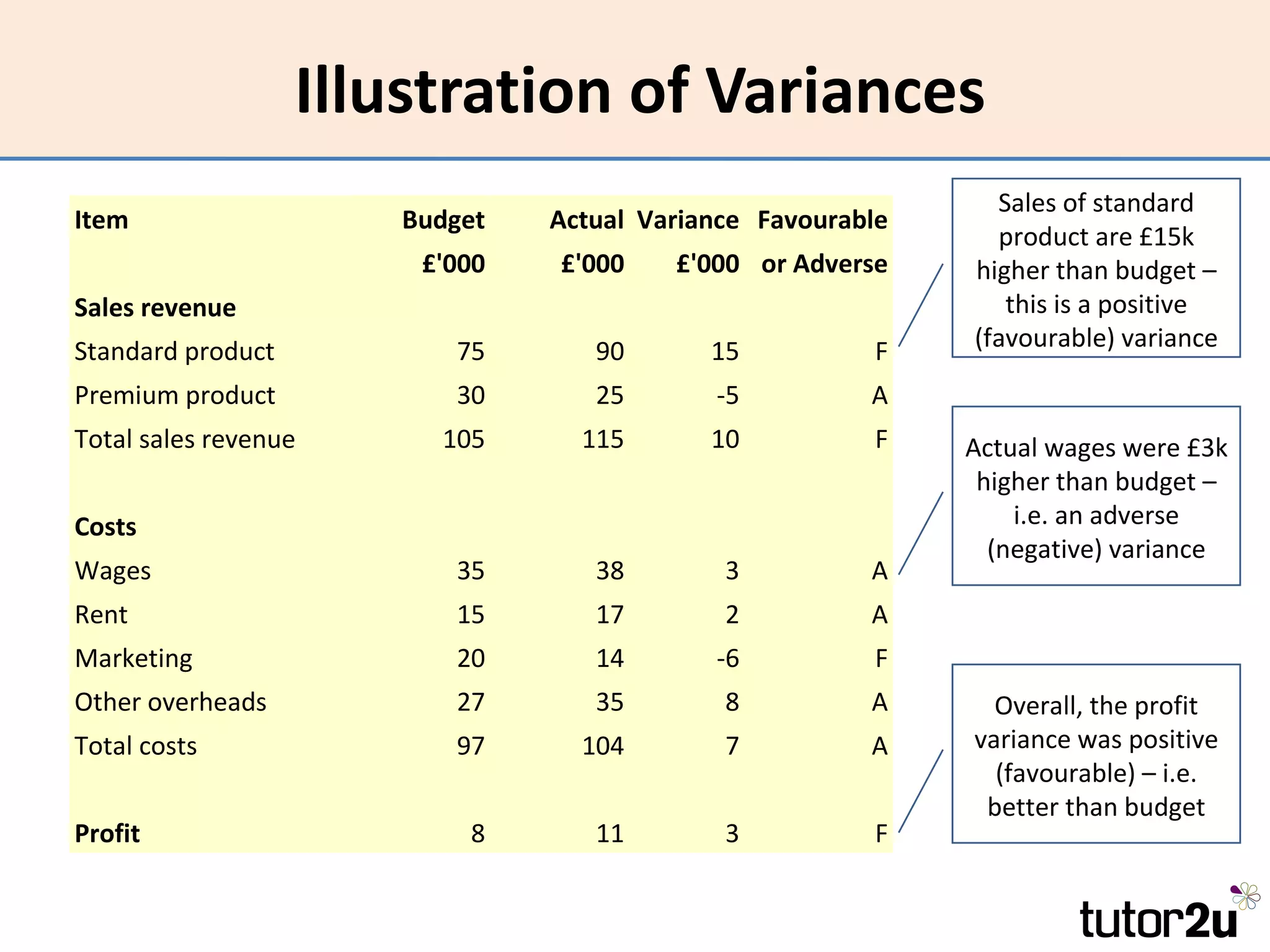

Budgets are financial plans that set targets for a business's revenues and costs over a given period. Managers are responsible for costs within their budgets and must take action if actual spending differs significantly. Variances occur when actual figures differ from budgets, and can be favorable or adverse. While budgets help control costs and monitor performance, they can also lead to inflexibility and departmental rivalry if not implemented carefully.