Fidor Bank introduction

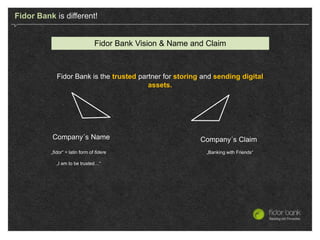

- 1. Fidor Bank is the trusted partner for storing and sending digital assets. Fidor Bank is different! Fidor Bank Vision & Name and Claim „fidor“ = latin form of fidere „I am to be trusted…“ Company´s Name „Banking with Friends“ Company´s Claim

- 2. Crowdsourcing, e. g. with a user-community, that allows peer-to-peer support, sharing of experiences and cooperation in order to solve financial questions; Crowdfunding, e. g. by getting paid by the bank for specific social interactions within Fidor Bank Community; User co-designed Products and user driven Prices, e. g. Product suggestions within the community, „Zins-Consenus-Group“ within Fidor Bank Community, „Like-Zins“, an interest rate that is directly connected to the amount of Likes on Fidor Bank´s Facebook profile. Crowdfunding, via third party platforms such as startnext and others; Peer to peer lending within FidorPay Account; A global payment offer, that will allow „account to account“ payments or „account to cash pick up“. Fidor Bank thinks different! Fidor Bank = GLOBAL PEER TO PEER BANKING.

- 3. Fidor Bank covers today´s (digital) Lifestyle in a unique way. Global Payment Banking Community Fidor Bank = Banking + Global Payment + Community

- 4. Fidor Bank operates in uncovered Niches. Global Payment Banking Community There are only very view Banks operating as efficient global Payment providers. No Payment Service offers full Banking services or is allowed to do so. No Payment Service offers the support by a User-community, peer to peer banking or crowdfunding. First steps are open APIs for shared development as Paypal offers that. But: No Community Platform has a Payment Offer or is allowed to operate one. No Bank operates a User-Community with the objective of crowd-sourcing and peer-to-peer support and Banking due to total lack of culture. No one offers Financial Services like Fidor Bank Banking & Community

- 5. - Part of Digital Lifestyle - Growing market segment - Digital goods, content etc. - Future Growth estimated 14% p. a. - Growing Importance - Higher social media activity - Always online Regaining Trust as a Bank by: - Integration of web 2.0 behaviour - Interactive users/Community - Integration Customers in value chain - Peer to peer Functionalities - Transparency - Part of Digital Lifestyle - Strong growing, international market - High need of regulated services - In-Game shopping - Virtual Currencies Fidor Bank operates within growing Markets. MOBILE INTERNET E-COMMERCE WEB 2.0 GAMING Global Payment Banking Community

- 6. Bank´s Name: „Fidor“ = Latin: I am to be trusted/trustful Claim: „Banking with friends“ Vision: Fidor Bank is the trustful and innovative Partner for sending and storing digital assets. Target-Groups: b-t-c b-t-b Strategy: Primary Banking Relation Best Banking Partner in web Promise: fair, transparent, easy fair, efficient, scalable, Understanding: a modern retail lifestyle a business within the web Pricing: (very) good, but not best Products: most modern, integration of new services, emerging out of the digital lifestyle, like crowdfunding, peer to peer lending etc. Fidor Bank is the Bank for the digital People. TRUST is the core of Fidor Banks brand positioning.

- 7. Simple Registration „KYC light“ (referal account needed) Full KYC Checking account look and feel/Services and Community Sending Money within FidorPay Sending Money to referal Account Like Zins Interest Rate Sending Money everywhere Fidor Prepaid MasterCard FX Precious Metals Saving Certificates Peer to peer lending (Smava) Low volume Peer to peer lending Virtual Currencies International Remittances R R R R R R R R R R R R R FidorPay Account: A primary Banking Relation to Retail Customers. World´s first Internet Payment & Interest Rate & Account Number & Full Banking …

- 8. All Apps and Offers of FidorPay Account Status May 2012:

- 9. FidorPay Account: Customer decides by KYC, if FidorPay Account is ane- Wallet or a full banking product. 1. Simple Registration 2. „KYC light“ (referal account needed) 3. Full KYC Checking account look and feel/Services and Community Sending Money within FidorPay Sending Money to referal Account Like Zins Interest Rate Sending Money everywhere Fidor Prepaid MasterCard FX Precious Metals Saving Certificates Peer to peer lending (Smava) Sending Money within FidorPay Data: Nickname, Email, Name Tec-Suppert: Facebook Connect Data: Referal Account Transaction Tec-Support: „Instant Payment Services“ such as „Sofort-Überweisen“ or „Giropay“ Data: 100% Legitimation Tec-Support: Cybits online Ident in Germany Status Data and Tec-Support Features open to Status Germany´s first Online Banking that allows users step by step „phase in“ avoiding offline legitimation.

- 10. Fidor Pay Corporate Account - Costfree corporate wallet with interest payment on balance - Internet payment: Sending money to mobile phone numbers, email adresses and social media domains - Classical Payment: (international) money transactions - Handling of virtual currencies - Digital KYC - Interface to accounting software Banking: Deposits & Lending - High interest Saving Certificates (in future) - FX Exchange - Precious Metals - Planned: Financing Growth Capital (in cooperation with innovative Partner) Specific „b-t-b-t-c“ Solutions - White label banking: creates stickyness and reduces payment-cost, increases earnings - Payment against installment (with partner): creates buying power at end-customers - Payment against invoice (with partner) helps increasing conversion rates. FidorPrepaid MasterCard - Co-Branding or Co-issuing Fidor Bank´s B-t-b Banking is focussed on e-commerce partners. Corporate Offer covers specific e-commerce demands.

- 11. 1. Multi Currency, Multi Language Preparing FidorPay Account for international expansion. 3. „App Store“ and „Local Hero“ Open to third party development and international partnerships via franchise 2. International Payment global payment via a deep integrated cooperation. 3 steps to act global will be executed in 2012 Concept of Fidor Bank is designed to act global.

- 12. Supplmenting FidorPay Account in a perfect way: Fidor Prepaid Mastercard A card is a Bridge from online- to offline-world. - Kick off Sales Compagne: KW 3 Jan 2012 - Completed Orders (May 2012):more than 2.000 Cards - Fully Paid and KYC (May 2012): more than 1.000 Cards - Total Transactions: 4.500 - Average Ticket: 85 € per Transaction - Customer-Price per Card 49 € - Special: Internet Shopping Insurance Future Development: - Partner Cards; - Cards for young people; - International Sales.

- 13. Unique: Transactional Combination of Banking, Payment and Community No Sales Force - but peer-to-peer-support: Fidor Bank Community. Future Development: - More transparent Communication of User-Transactions - Peer to Peer comparisons on cash/asset and transactions basis on Basis of new PFM solution. - Detailles Profile of Users to increase trust for future peer-to-peer Banking Sharing: Exchanging Opinions and Experiences Rating of Products and Advisors Surveys Cooperation: Question and Answers Comparison of financial profiles User driven pricing (Like Zins) Zins-Consensus Group peer to peer lending Collaborative Action: Crowdfunding (e. g. via Startnext) Bonus Programm: Social Interaction is rewarded Payout directly into FidorPay Account.

- 14. Fidor Bank´s 6th continent: Virtual Currencies FidorPay Account: World´s first Bank Account, that can handle virtual currencies. What is it? Alternative Payment Scheme Who creates it? Game Developers E-Commerce Social Media Platforms Communities Examples? Facebook Credits (issued by: Facebook) web cents (1und1/Web.de) Bitcoins (network) Linden Dollars (Secondlife) Flips (Fliplife) Fidelispay Full Service Offer for Game Developers exchanging real government money into virtual currencies and back. SPECIAL OFFER Definition

- 15. Fidor Bank knows how to combine social media DNA with banking. „Like Zins“ is the world´s first user driven interest rate Simple Principle: The more „LIKES“ Fidor Bank on Facebook, the higher the interest rate for all FidorPay Accounts. Easy Handover: Fidor Bank is Germany´s first bank supporting the user to register with a facebook connect process.

- 16. Fidor Bank knows how to combine social media DNA with banking. Facebook of increasing importance o First Step: Like Zins Campagne o More Community Features to be integrated to facebook. o Integration of Facebook Credits to FidorPay Account (if possible) o Sending Money to Facebook Accounts. o Status June: 4.700 Likes

- 17. Fidor Bank knows how to combine social media DNA with banking. Youtube: High Tec – High Touch o Giving Information and transporting the spirit and culture of Fidor Bank. o More tutorial videos in future, explaining how to use Fidor Pay Account.

- 18. Fidor Bank knows how to combine social media DNA with banking. Twitter: Active Exchange Platform o CEO tweeting; o Giving Bonus for selected tweets via Fidor Bank Bonus Programm; o High Interaction. o Sending Money to twitter usernames possible. o 2.200 Followers

- 19. Fidor Bank´s Customer „phase in“ allows efficient marketing spendings. 100.000 € Communication Spendings since Kick off 75.000 top Line User registrations year end 2011 1,33 € Cost per Registration 16,7 € Cost per Full KYC Customer in avg 2011 6.000 full KYC Customers in avg 2011 114,83 € net income/full KYC user in 2011 4 years estimated Lifetime of a customer 459 € Lifetime value/full KYC customer on current product range 2011: proof of the communication-concept

- 20. o Ttl. Marketing- & Communication Spendings since until Jan 2011: below 100.000 €. o Top Line Registration includes Nickname, Mailadress and Mobilenumber o Light KYC: approx. 30% of Topline Registrations – include referal account (e-Money reg.) o Full KYC: 15% of Top Line registred Users are fully legitimated (May 2012) -2000 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 2009 2010 2011 Jan 12 May 12 Full KYC Kunden 0 20000 40000 60000 80000 100000 120000 140000 160000 2009 2010 2011 Jan 12 May 12 Top Line Registrations Fidor Bank´s organic growth of Registrations and Full KYC Customers Retail Customer Growth fueled by Prepaid Card

- 21. Some final Facts and Figures about Fidor Bank: • Based in 80335 Munich/Germany, Sandstrasse 33. • Banking License since May 2009. • Operative since Jan 2010. • 25 Members of Staff (May 2012). • Listed at Entry Standard Frankfurt Stock Exchange • Members of Executive Board: - Kölsch M. (CRO), Kröner M. (CEO), Dr. Maier M. (COO), Seeger St. (CFO) • Main Shareholders: - venturecapital.de Fund(CFP FFM; e-commerce specialist) – ca. 20% - Professional Development GmbH (Fam. Kröner) – ca. 13% - Family of Martin Kölsch – ca. 11% - Anthemis (Investors in digital native finance) – ca. 10% - Xange (online investors) – ca. 10% Small Team – Efficient Organisation.

- 22. „… Lassen Sie mich aber vorab schon mal sagen, dass die Idee und Umsetzung der Fidor Bank für mich eine wirklich tolle Geschichte ist und alles was im Netz im Moment im Bereich "Social Media" unterwegs ist bei weitem übertrifft. Die gesamte Strategie ist durchdacht und stringent umgesetzt und befriedigt die Bedürfnisse des Marktes in einem hohen Maß. Für mich als Außenstehenden ist die Fidor Bank ein "Great Place to Work" mit einem sehr anspruchsvollen, glaubwürdigen und vertrauensvollem Ansatz. In ihrem Unternehmen wird die Idee Social Media wirklich verstanden und glaubhaft gelebt….“ Aus einem Mail an M. Kröner Feedback to Fidor Bank´s Approach, Culture and Strategy.

- 23. Thank you!

Editor's Notes

- Logos einfügen

- Logos einfügen

- Zahlen…. ? Marktgröße