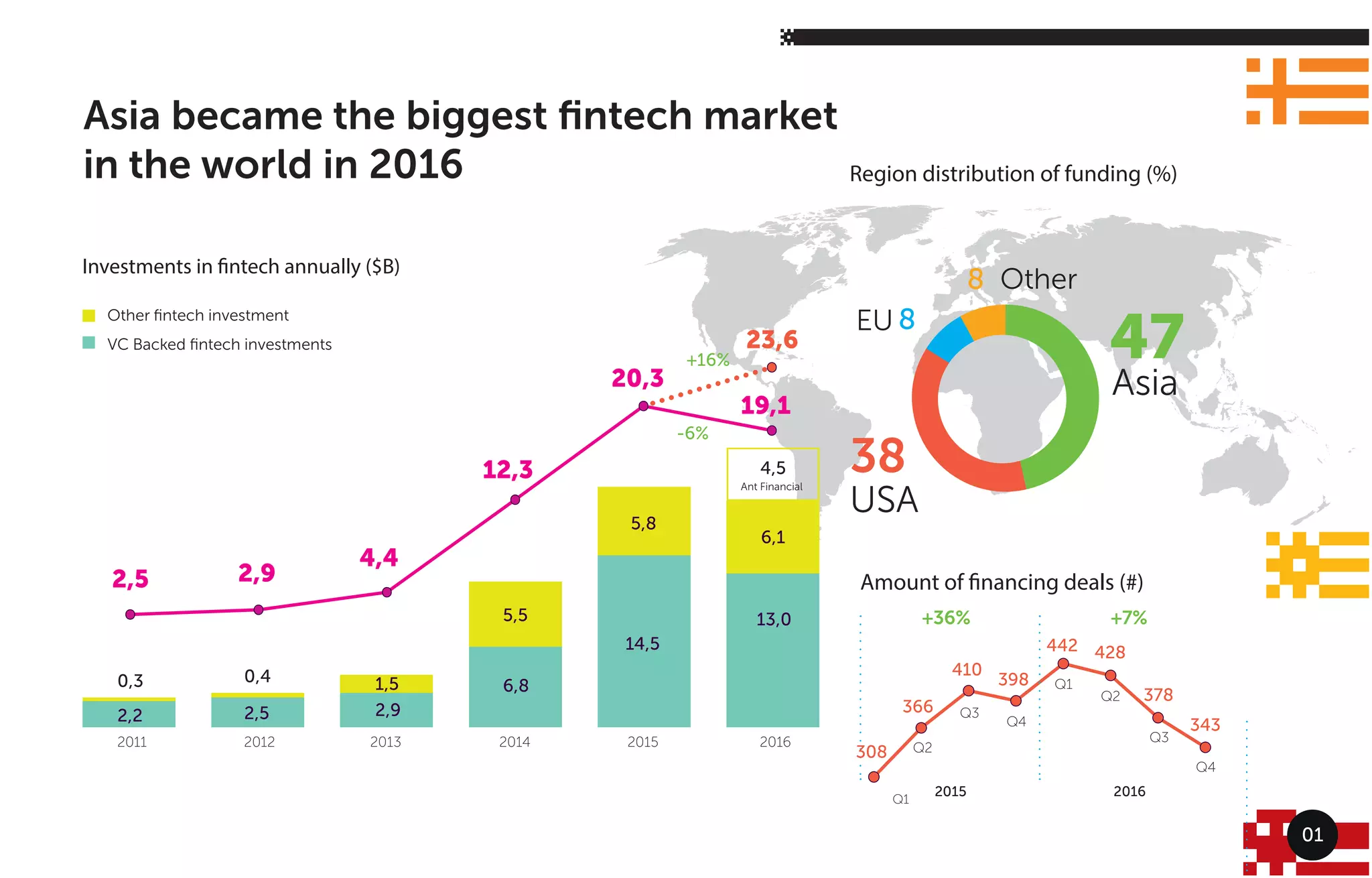

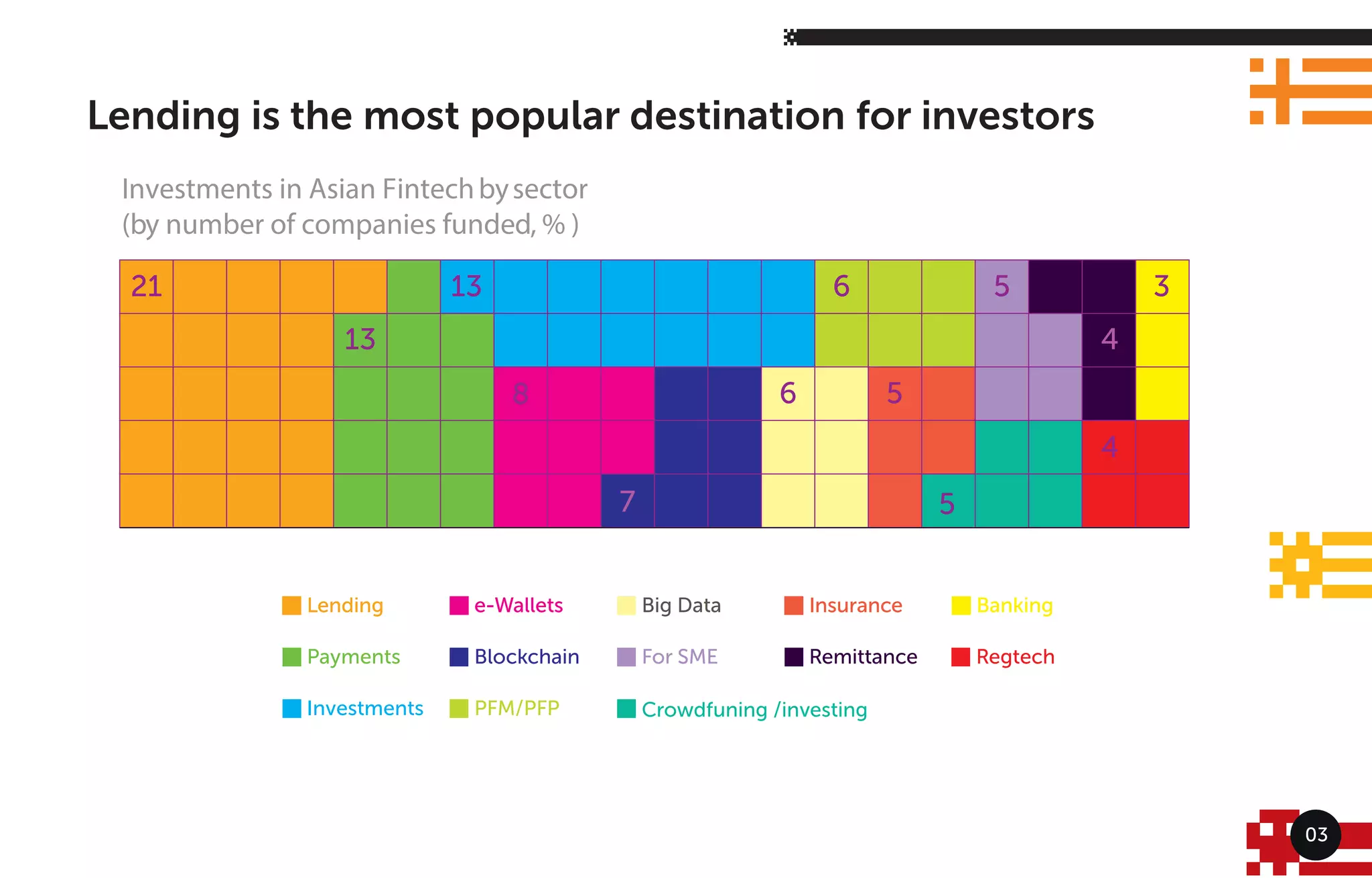

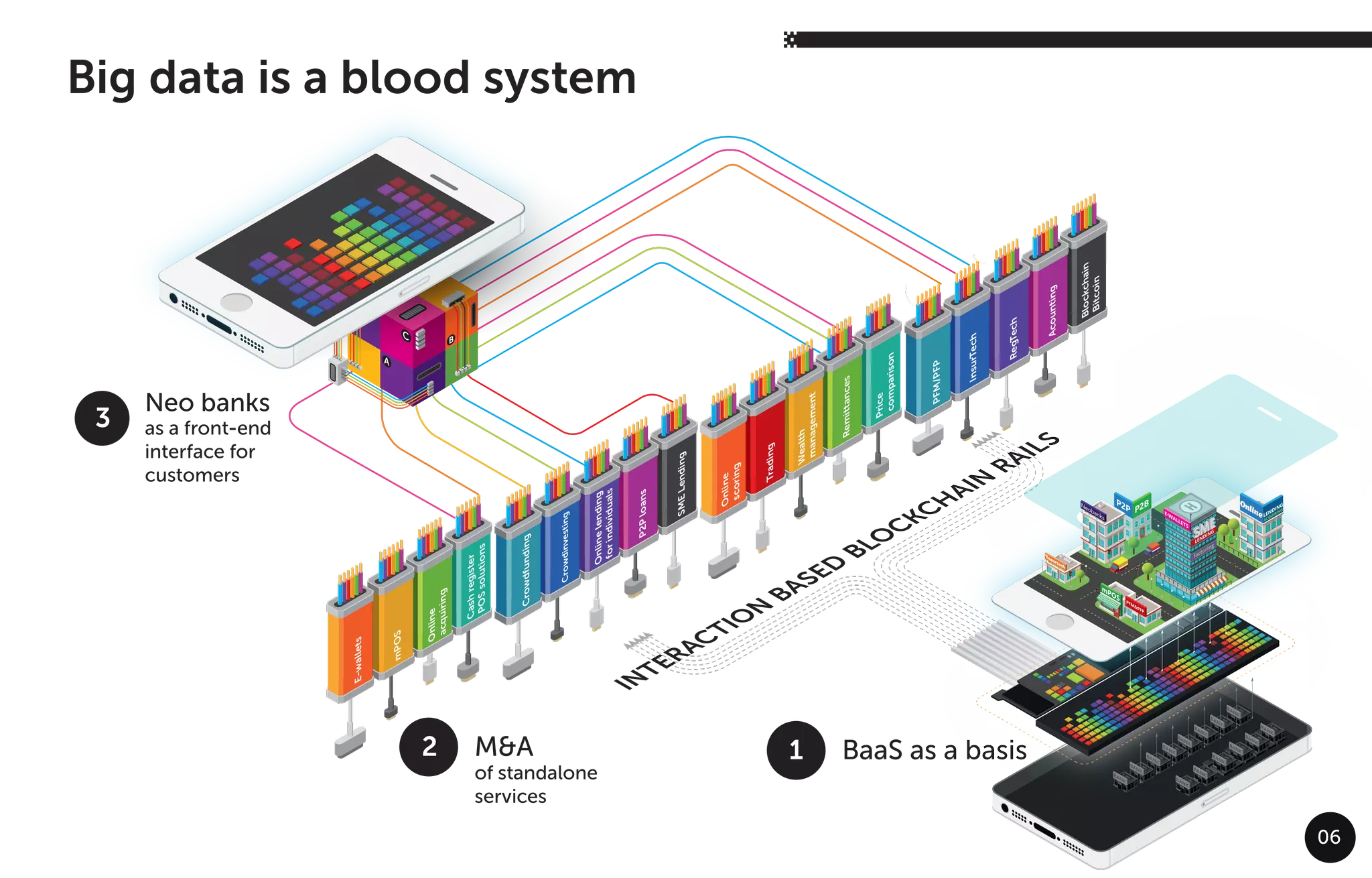

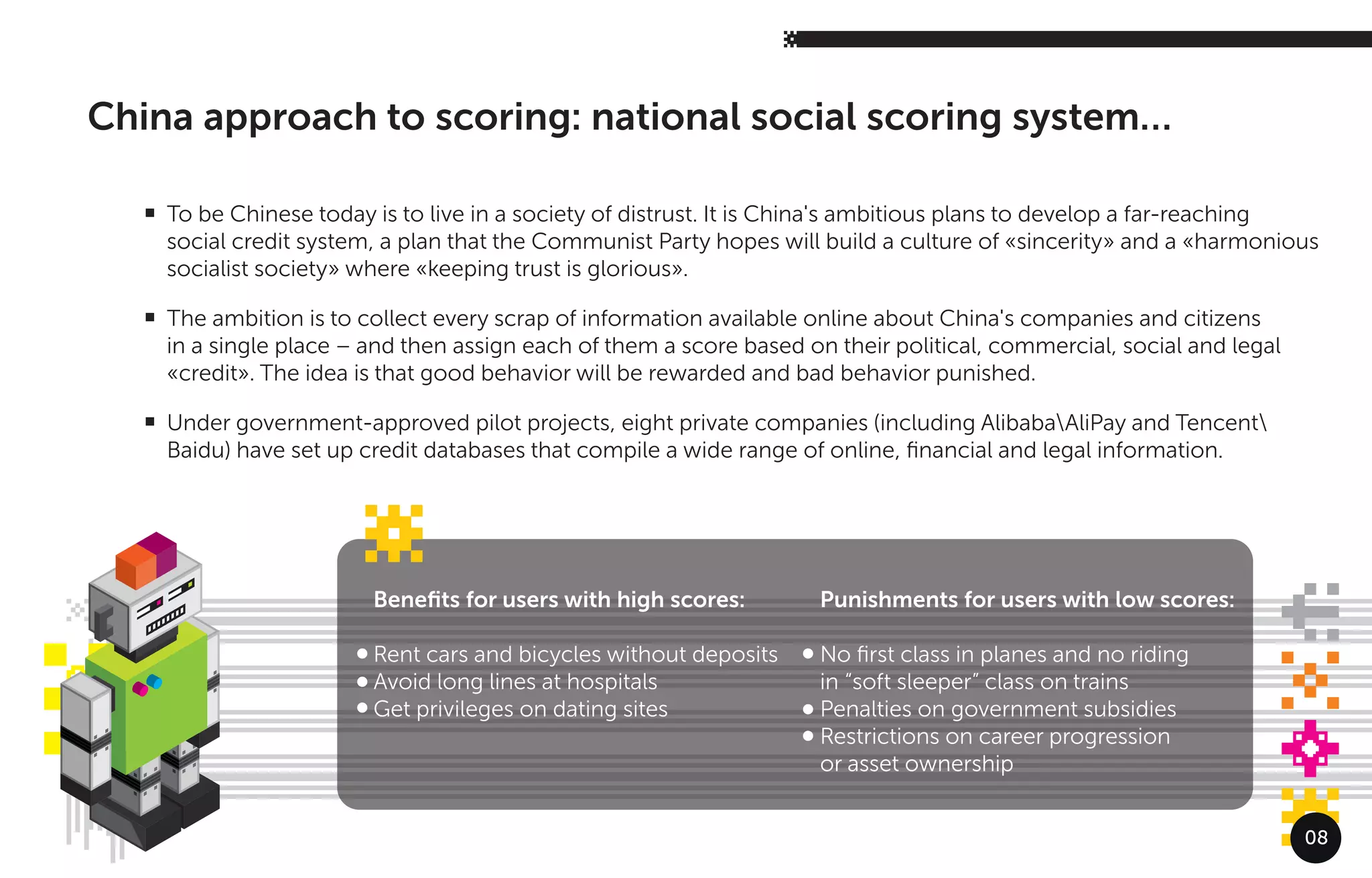

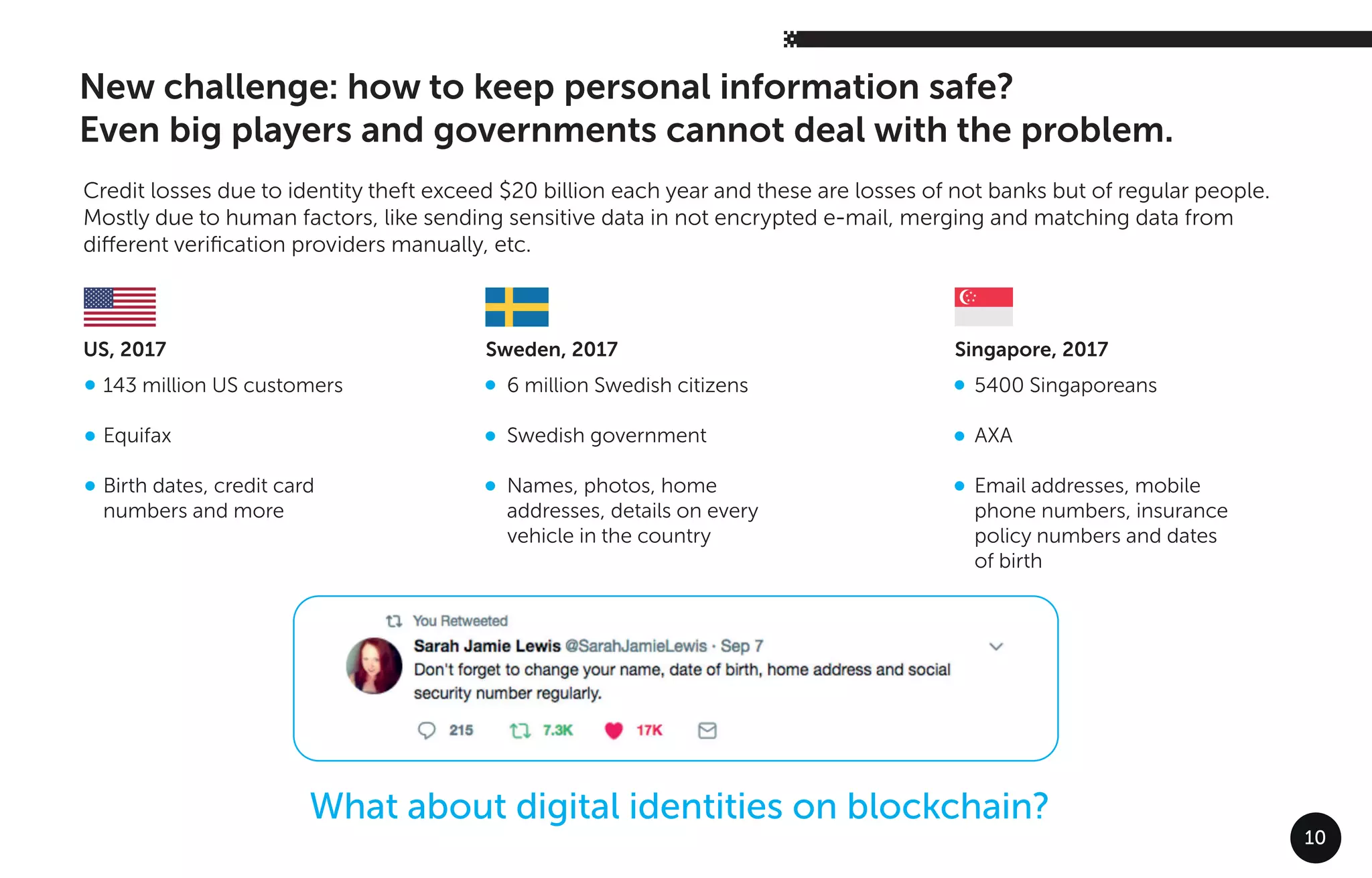

The document discusses the rise of fintech in Asia, particularly in lending and digital identity. It notes that Asia became the largest fintech market in the world in 2016, with lending being the most popular destination for investors. However, traditional credit scoring does not work well for many in Asia who are unbanked. New approaches using alternative data from smartphones and payments are being developed to enable scoring and lending to more people. Digital identity is also emerging as important beyond credit scoring, with some countries like China developing national social scoring systems. Blockchain may provide opportunities to give individuals more control over their digital identities and data.