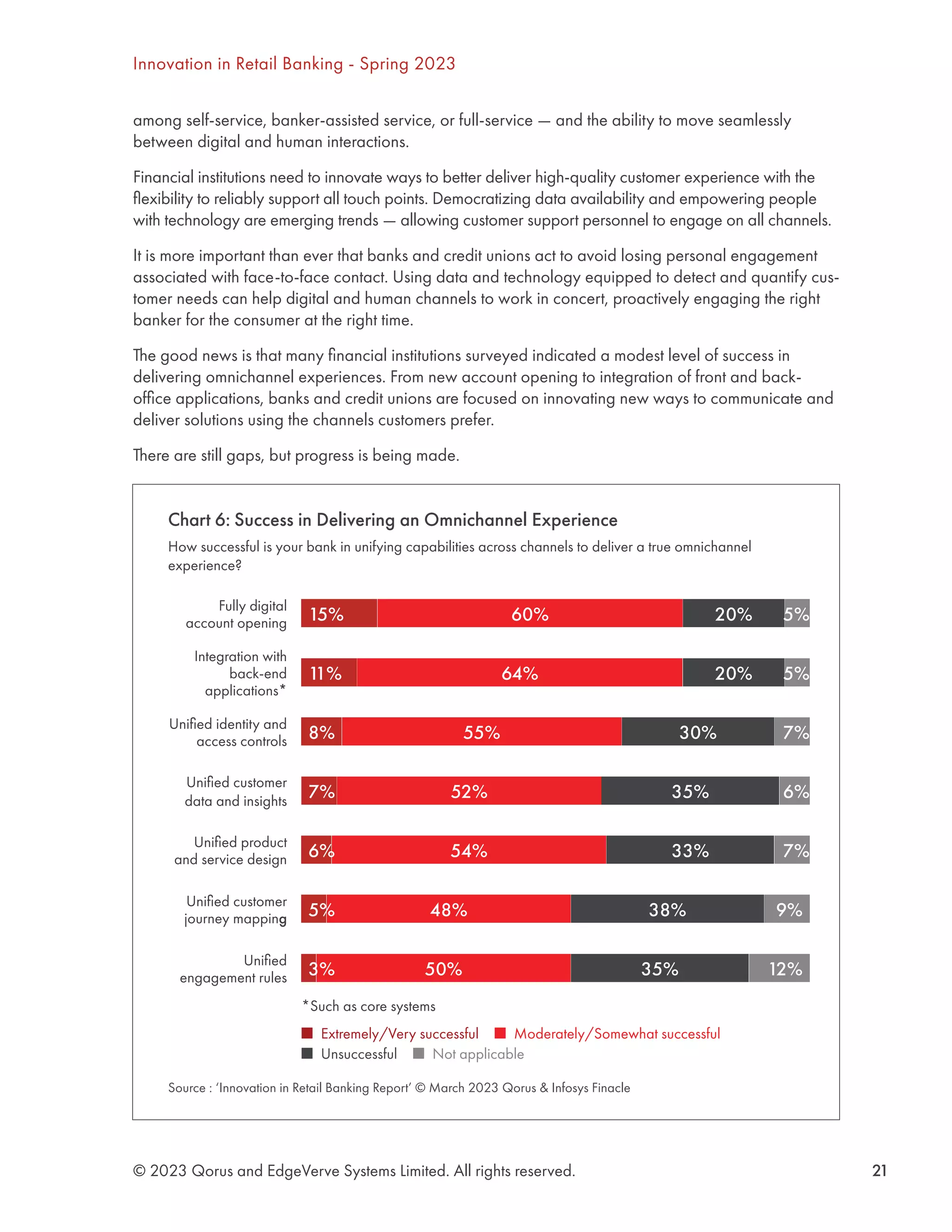

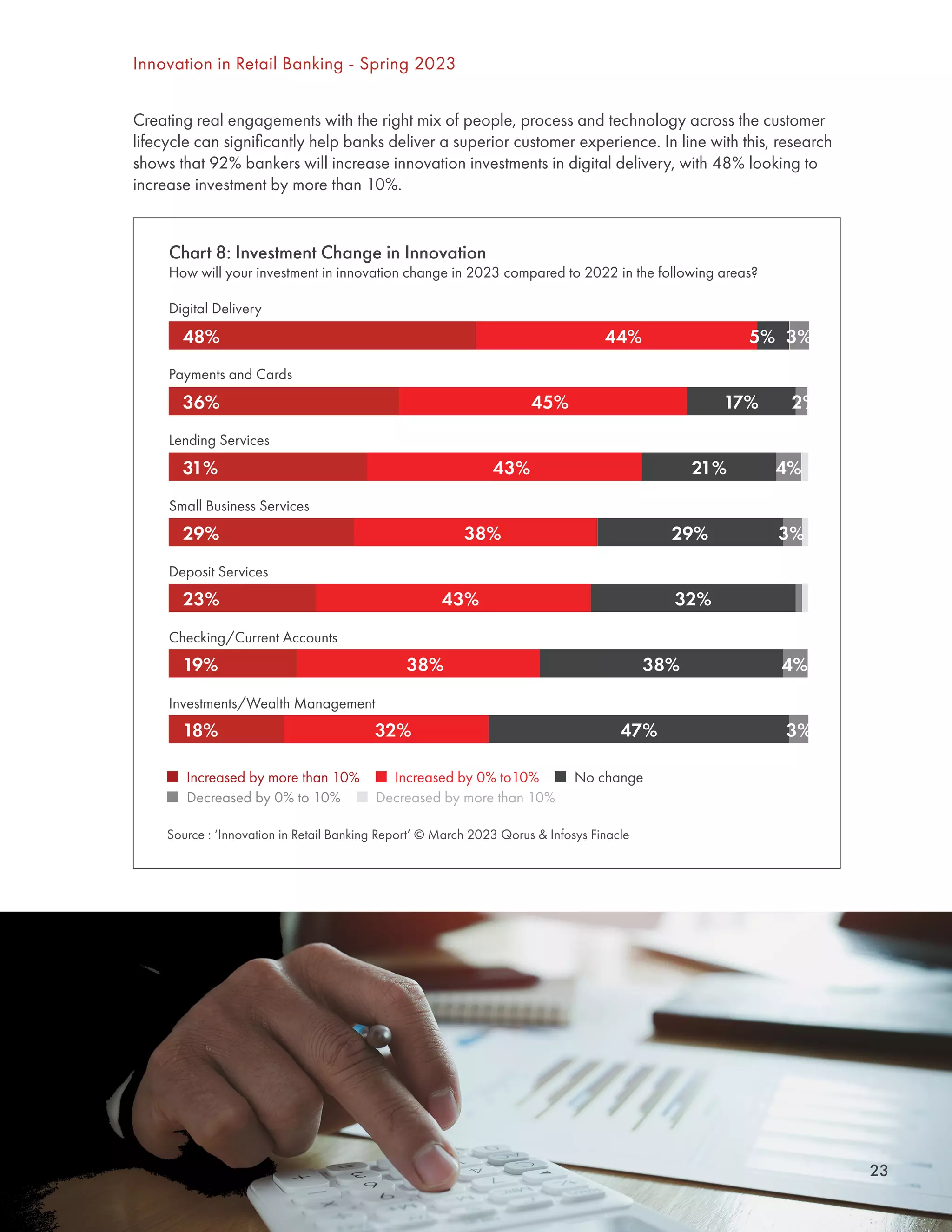

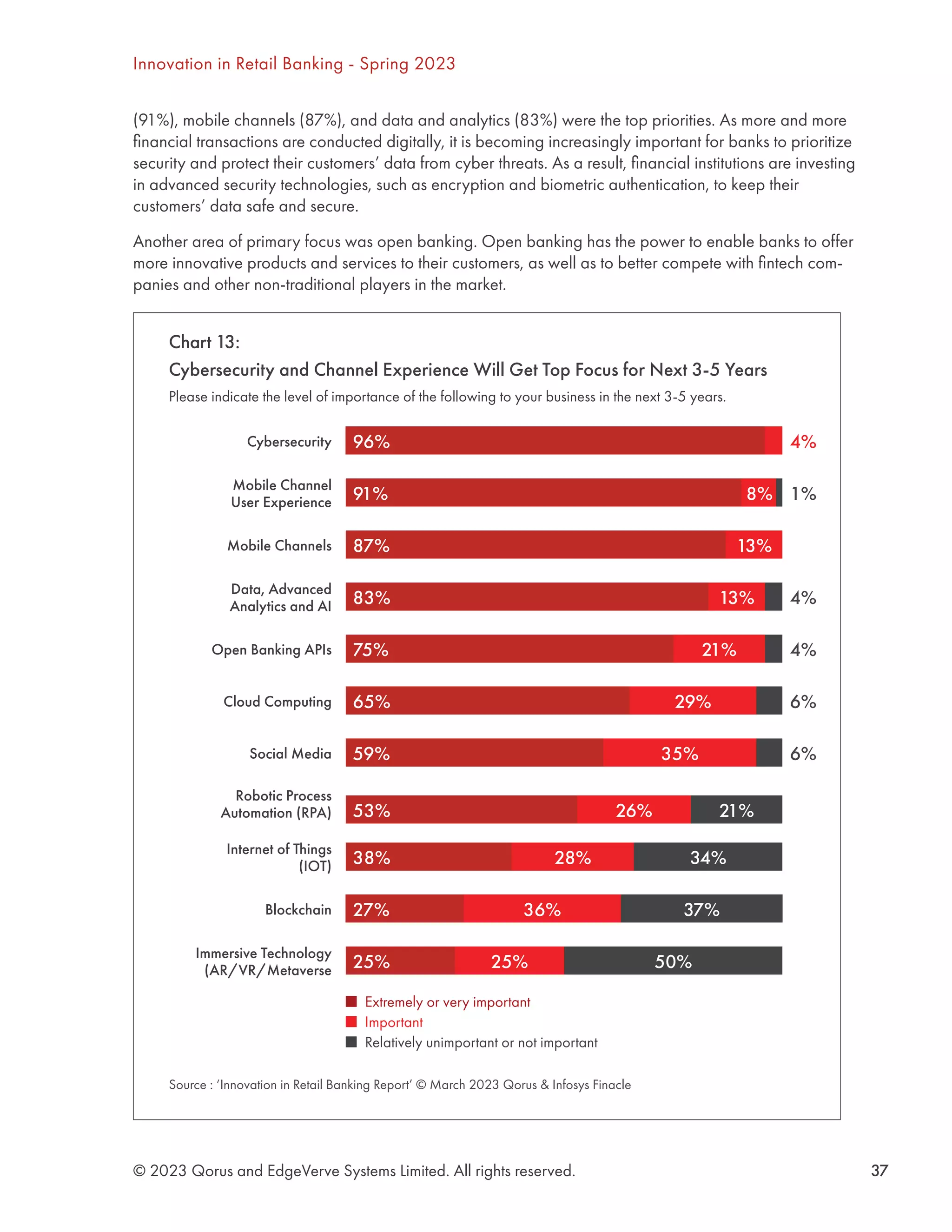

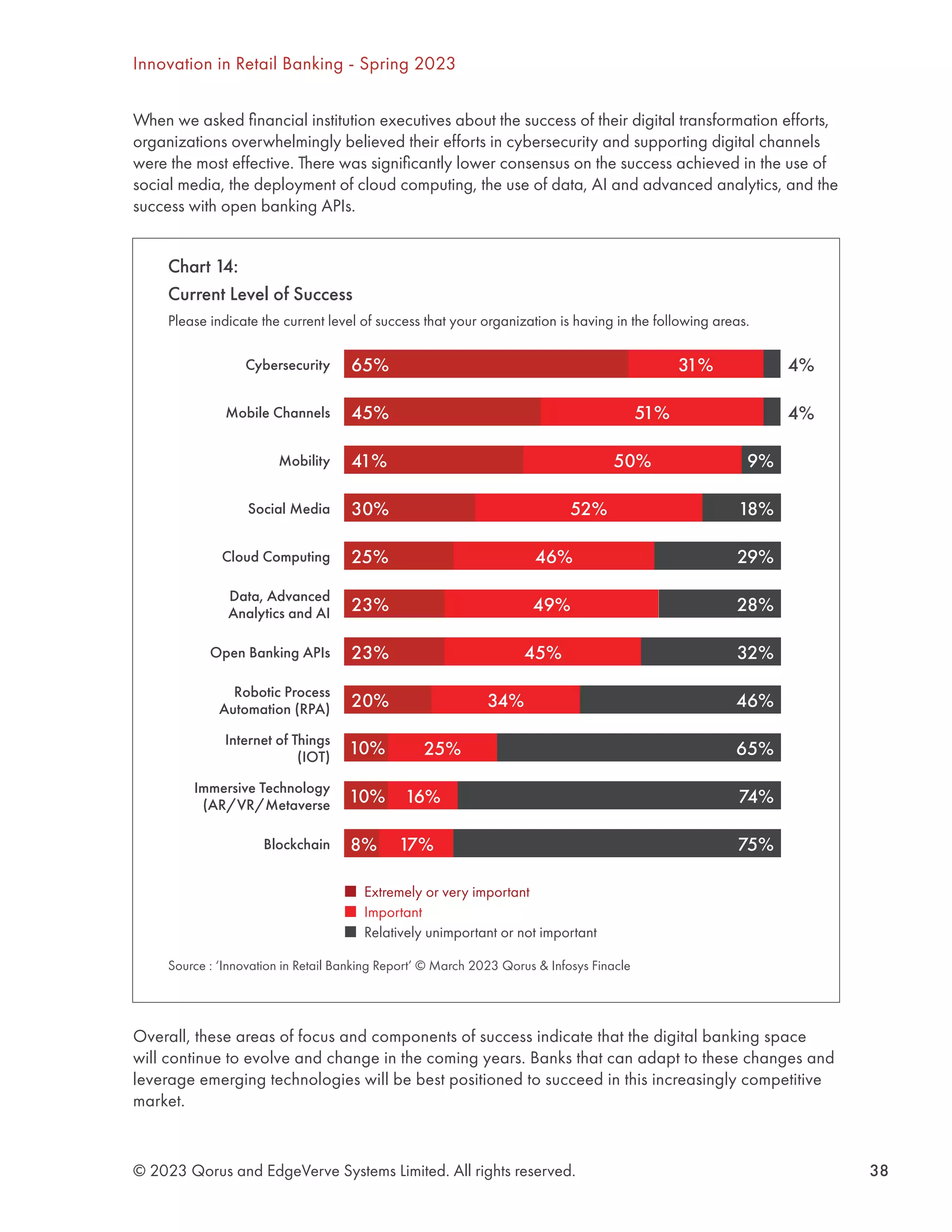

Banks are increasingly recognizing innovation as a driver of future revenue rather than just a cost. While economic uncertainty may lead some banks to scale back innovation investments, those that view innovation as revenue-generating will benefit most as the economy recovers. Areas of focus for banking innovation over the next five years include product delivery and development to better meet evolving customer needs and behaviors. However, structural challenges like legacy systems continue to hinder banks' innovation efforts. Most respondents reported somewhat or substantially more success with innovation in the past two years compared to before the pandemic, showing that efforts to improve innovation are gaining traction.