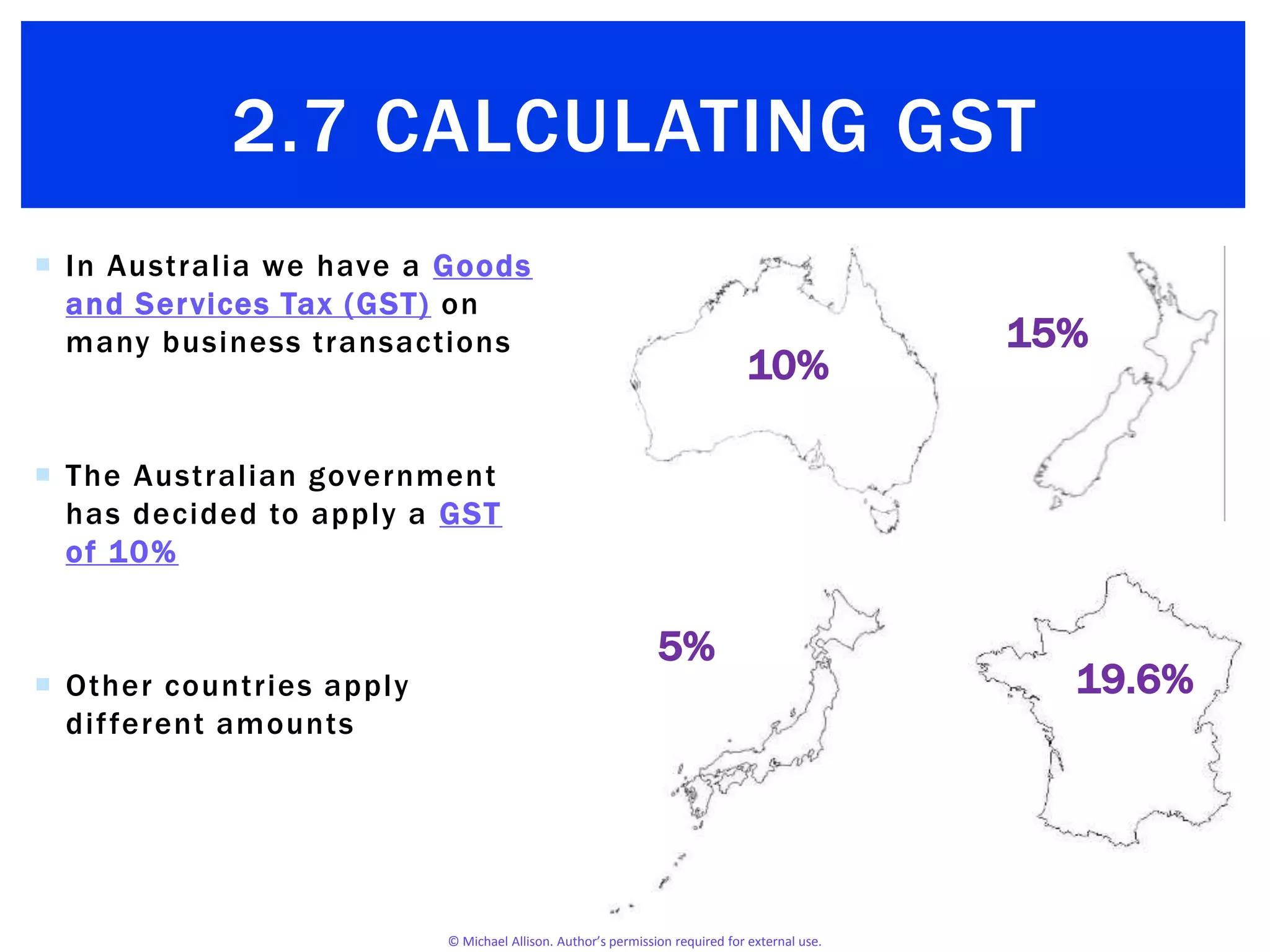

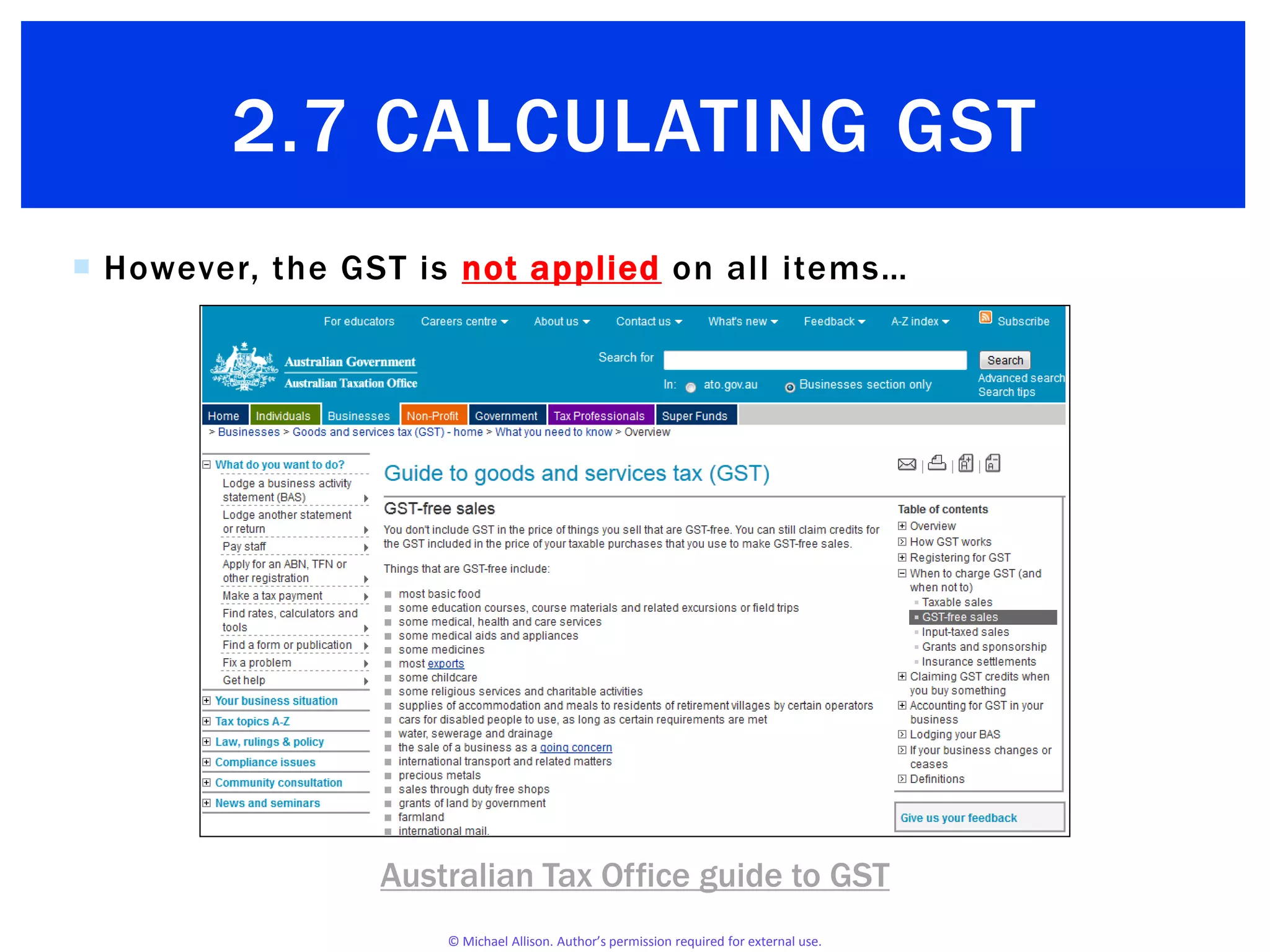

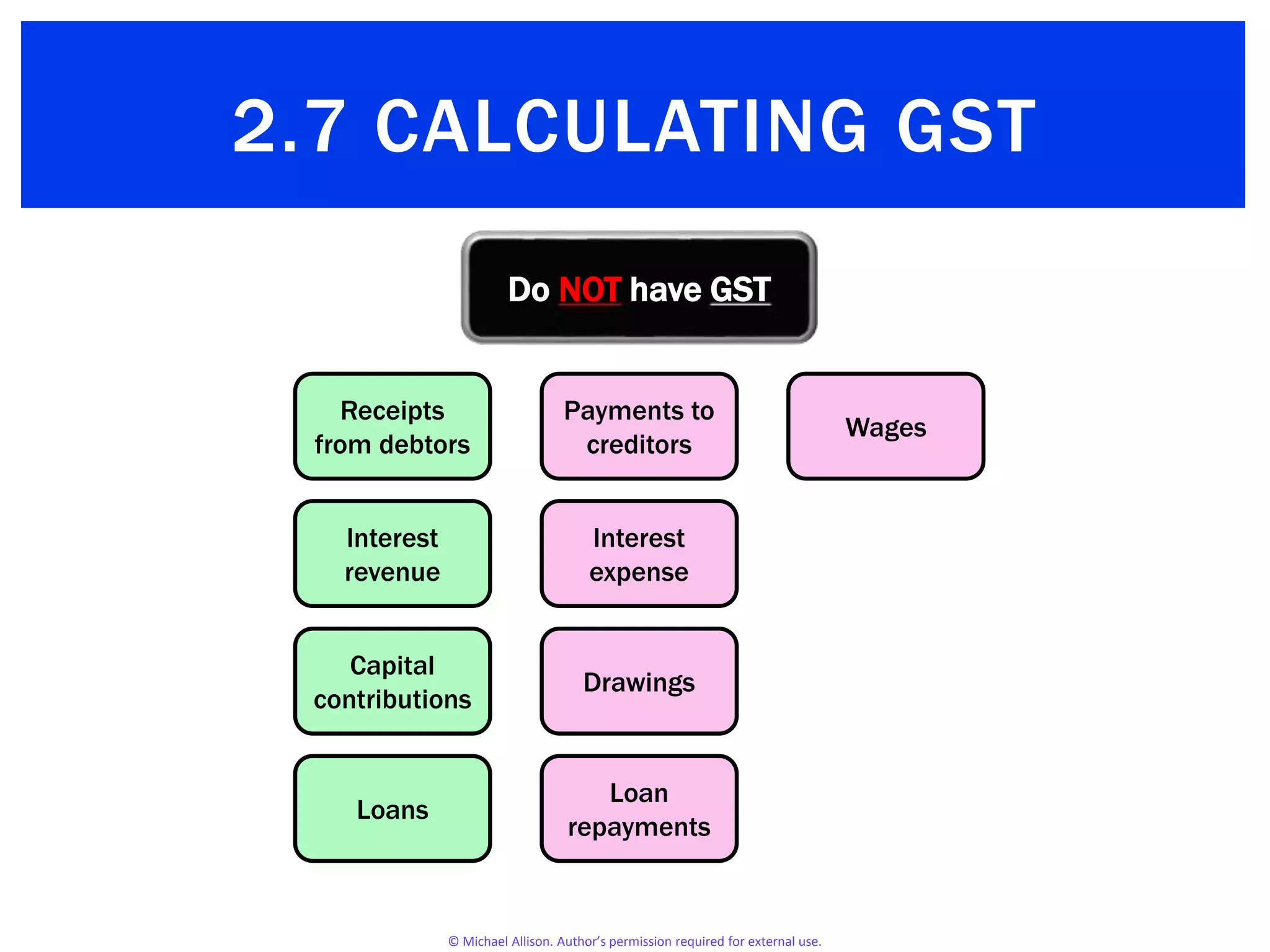

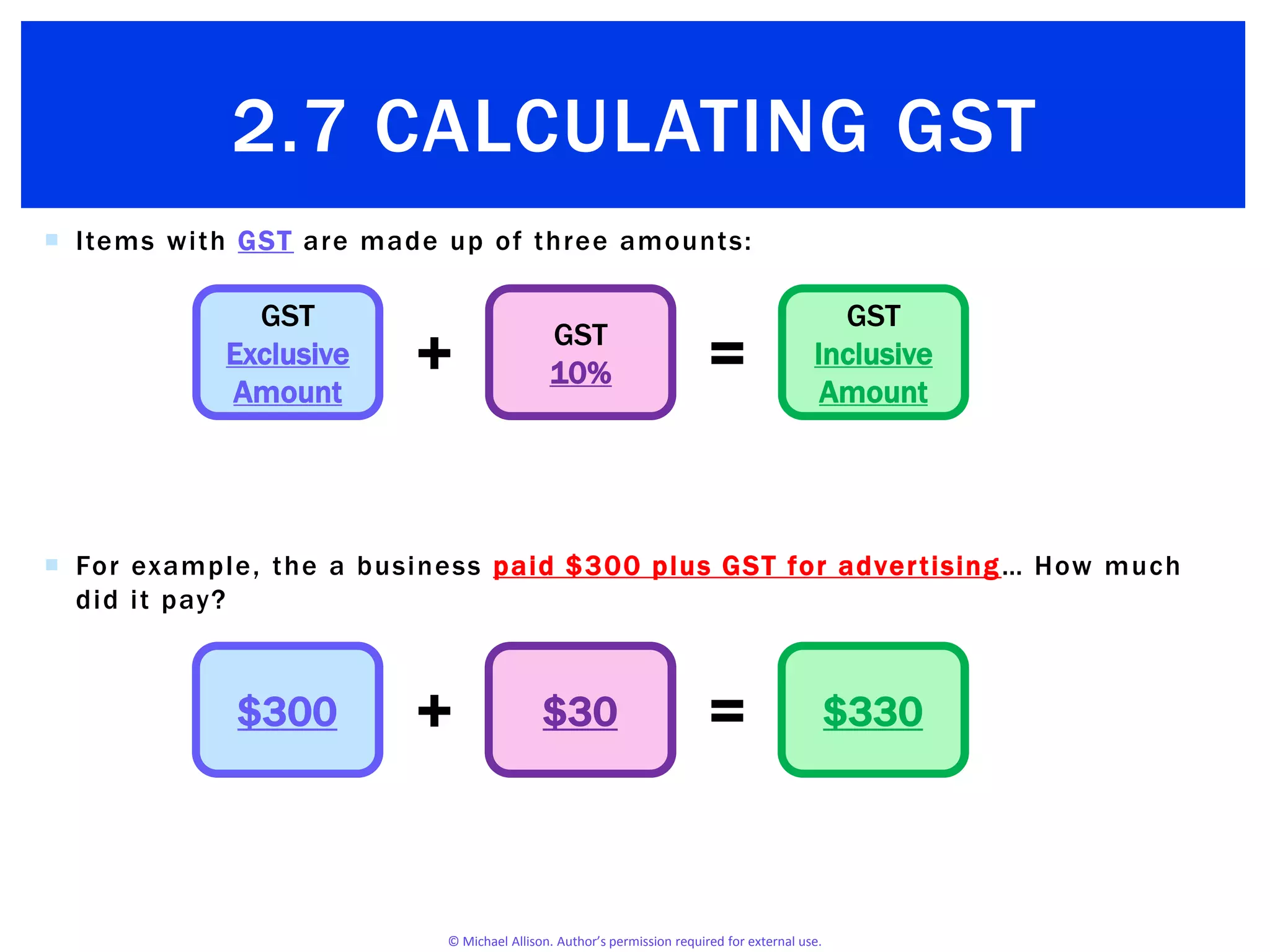

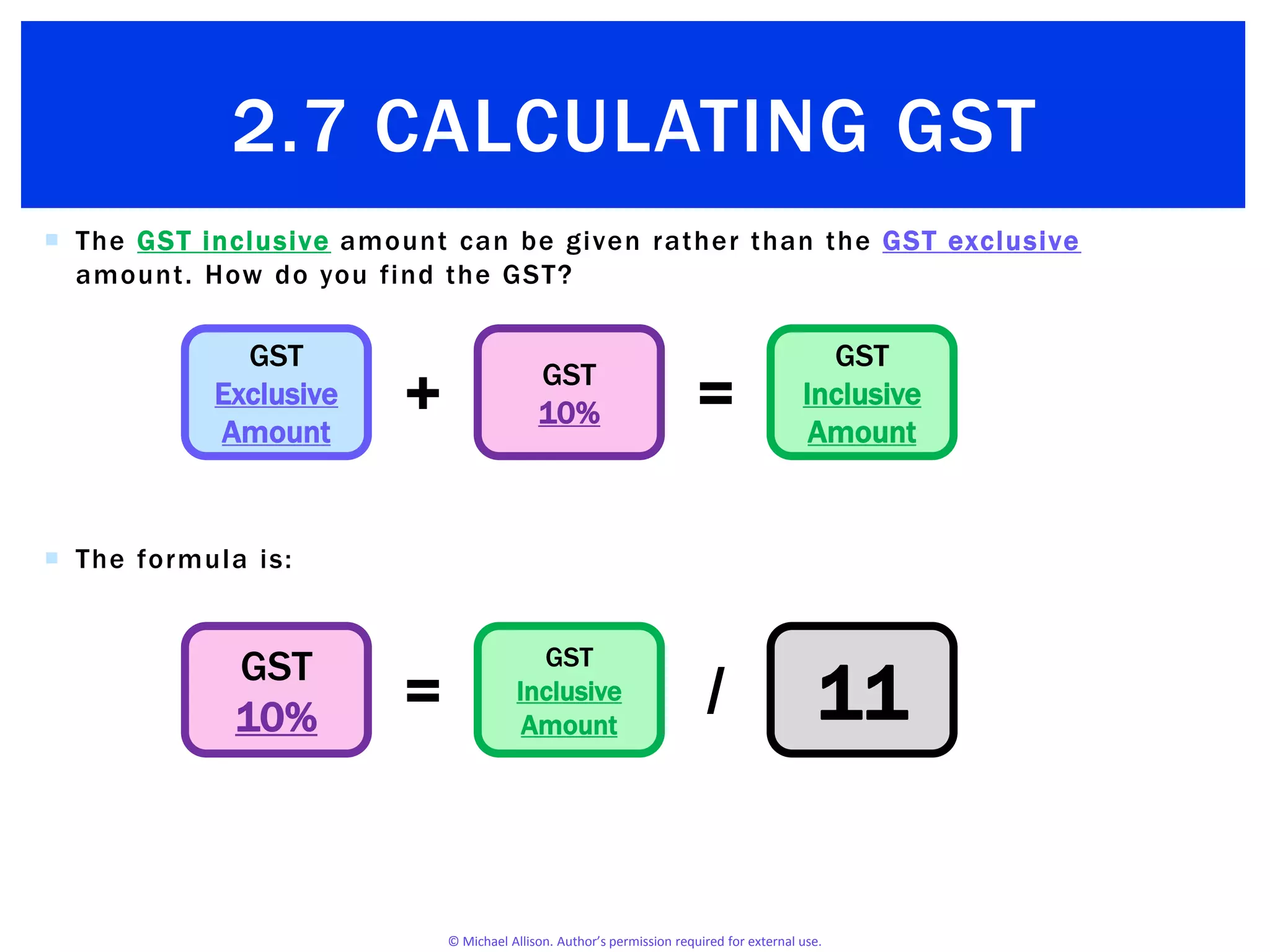

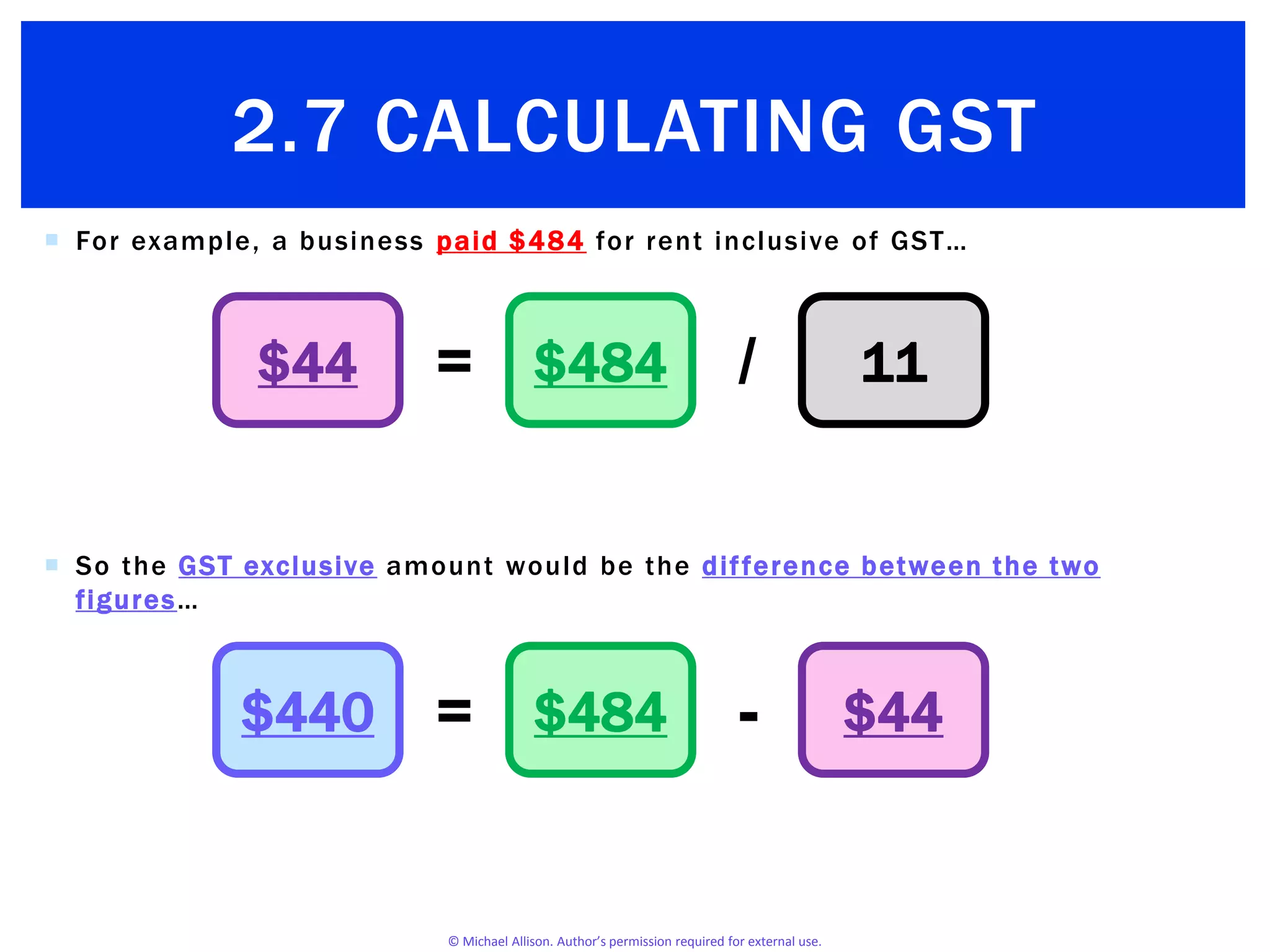

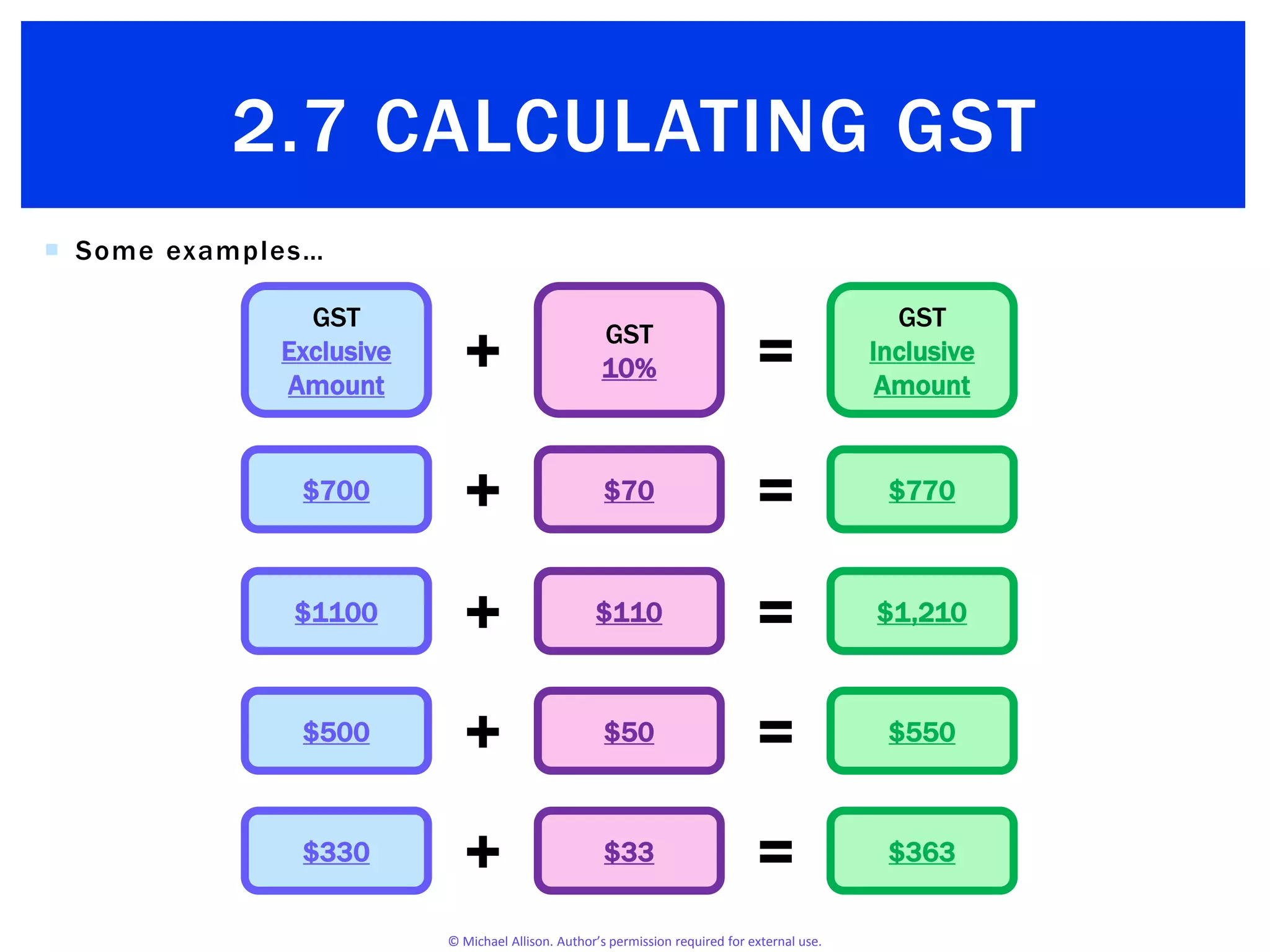

The document discusses the calculation of Goods and Services Tax (GST) in Australia, which is set at a rate of 10% on various business transactions. It provides examples of how to compute GST inclusive and exclusive amounts, illustrating the formula used for the calculation. Additionally, it mentions items that are exempt from GST, such as wages and loan repayments.