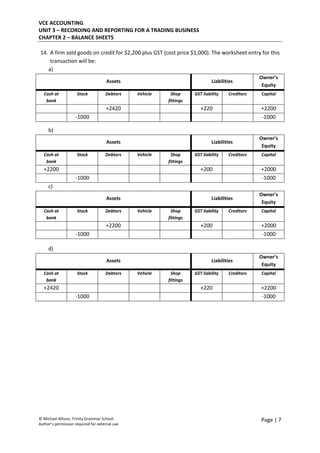

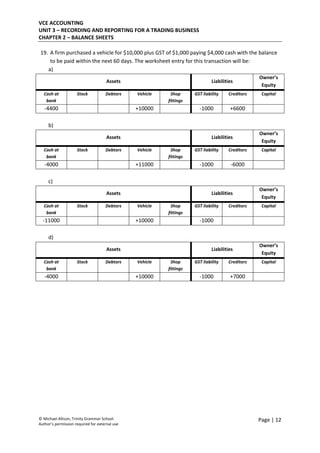

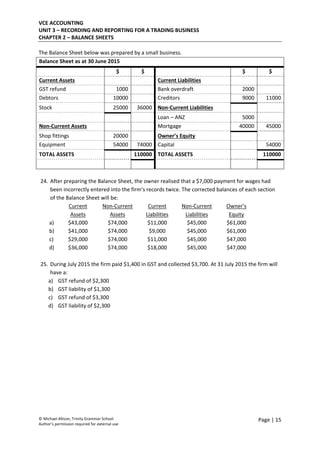

This document contains a 25 question multiple choice test on balance sheets for a VCE Accounting unit. The test covers topics such as identifying current and non-current assets and liabilities, calculating values from balance sheet information, and making correct journal entries for various business transactions that impact the balance sheet. For each question there are 4 possible answer choices labeled a-d. The document also provides context and explanations for some of the questions.