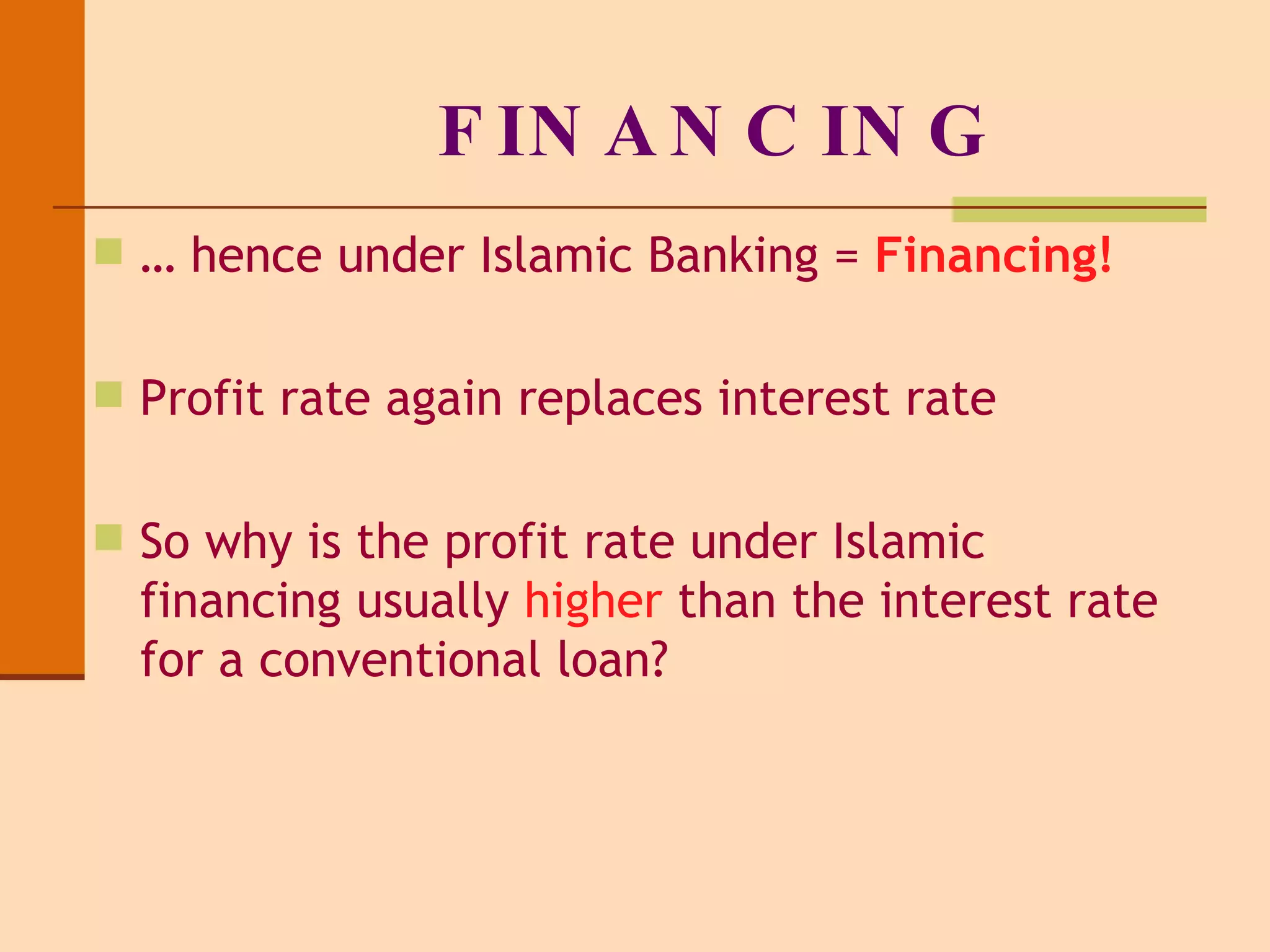

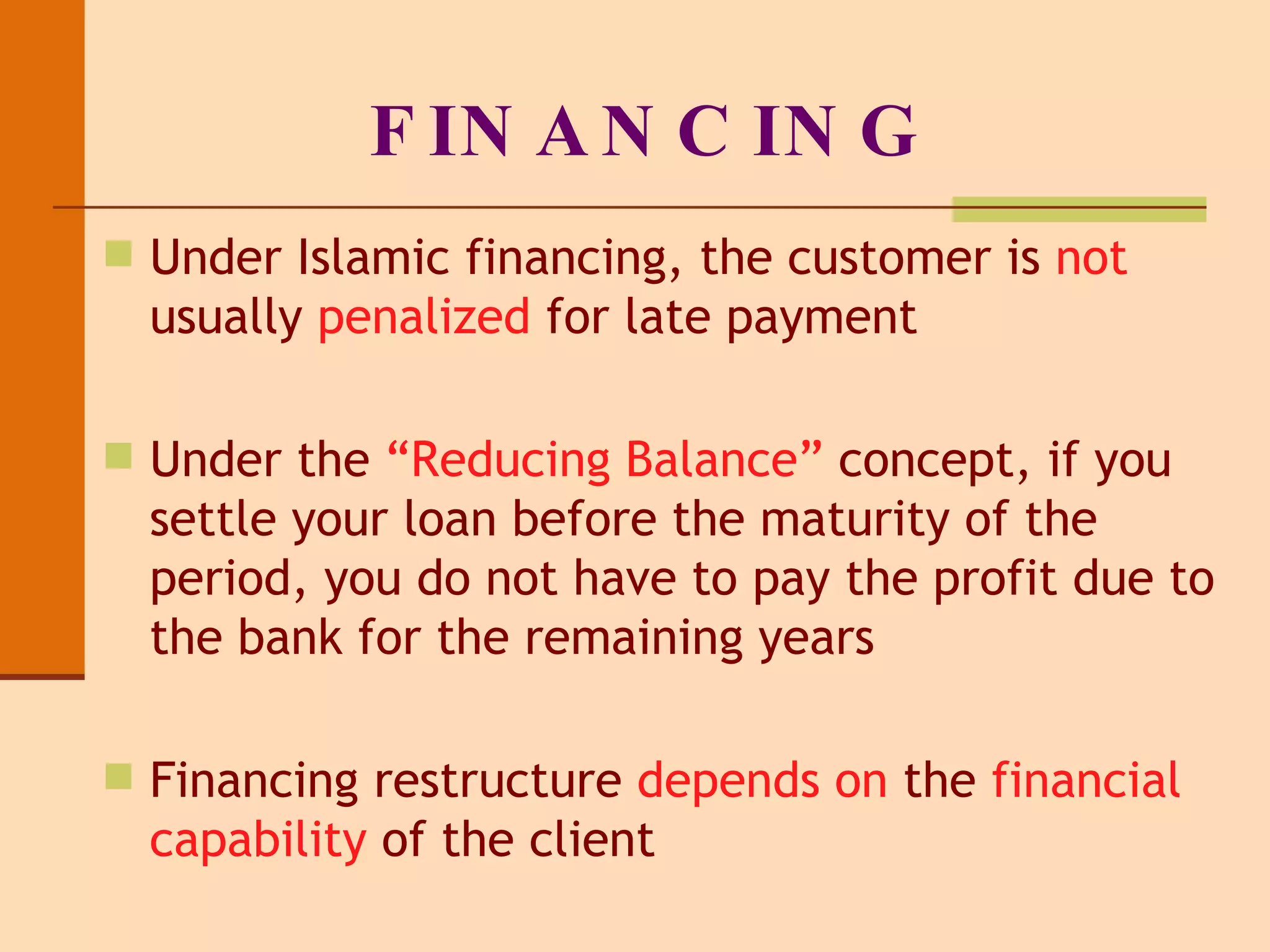

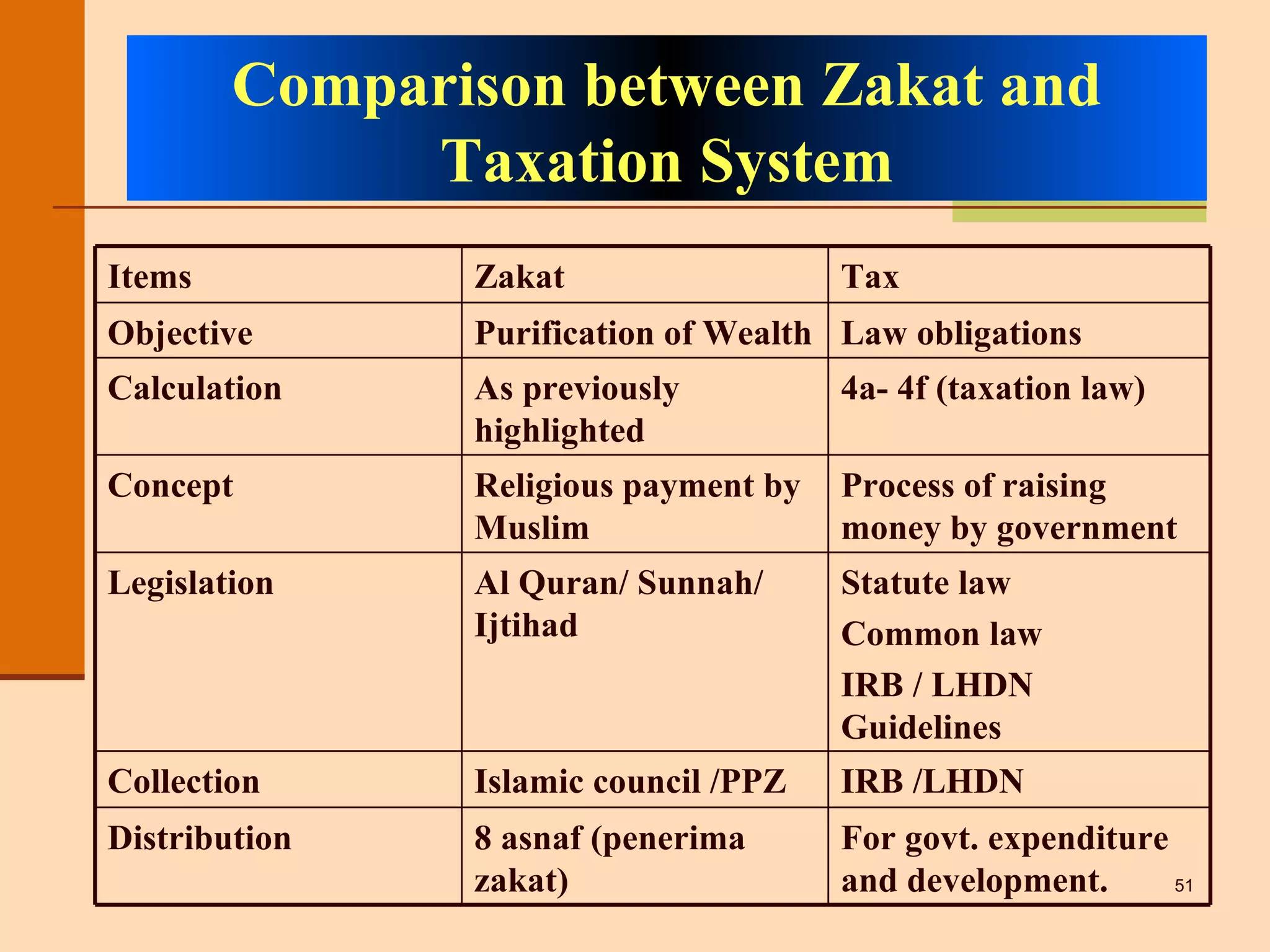

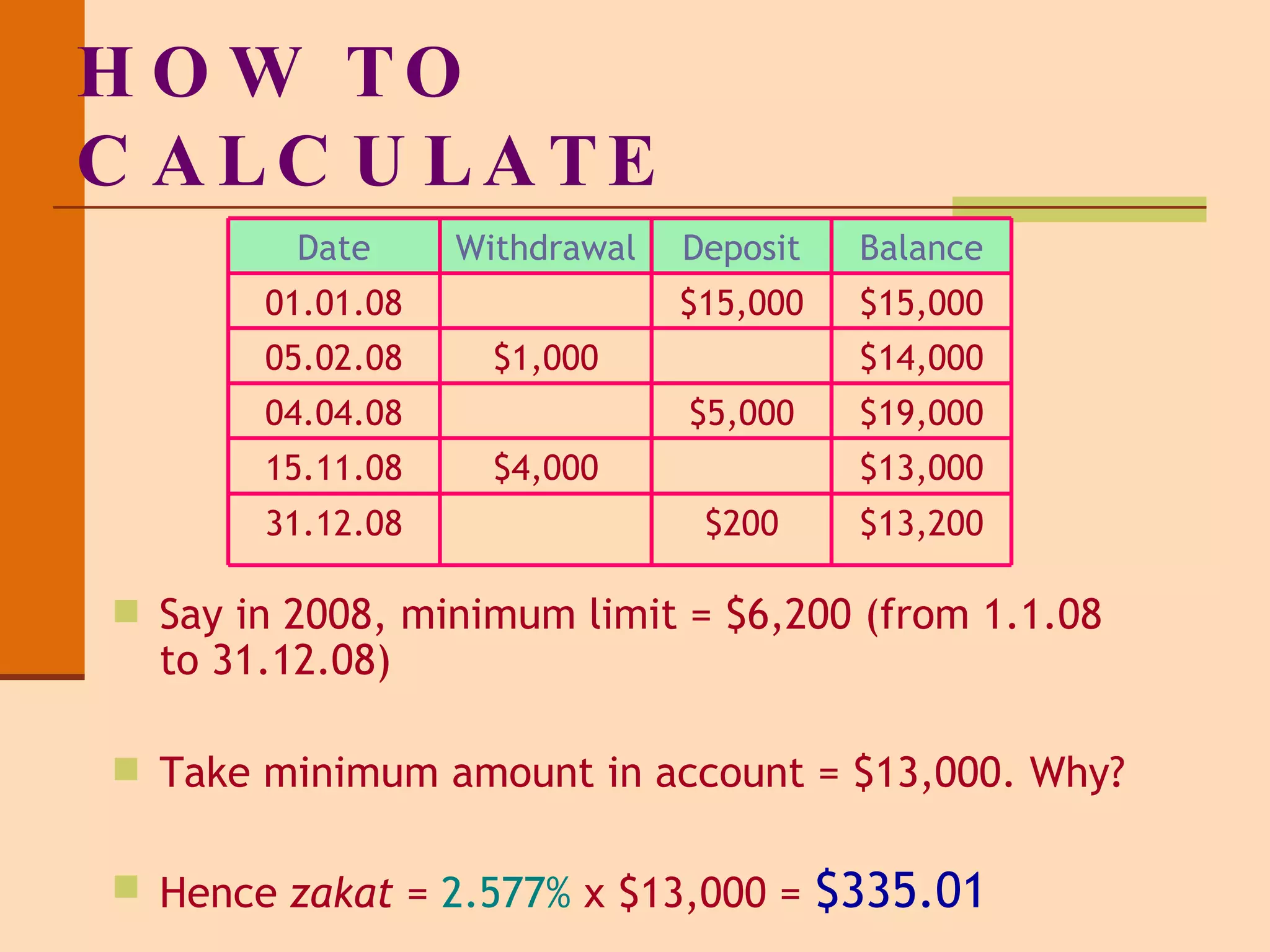

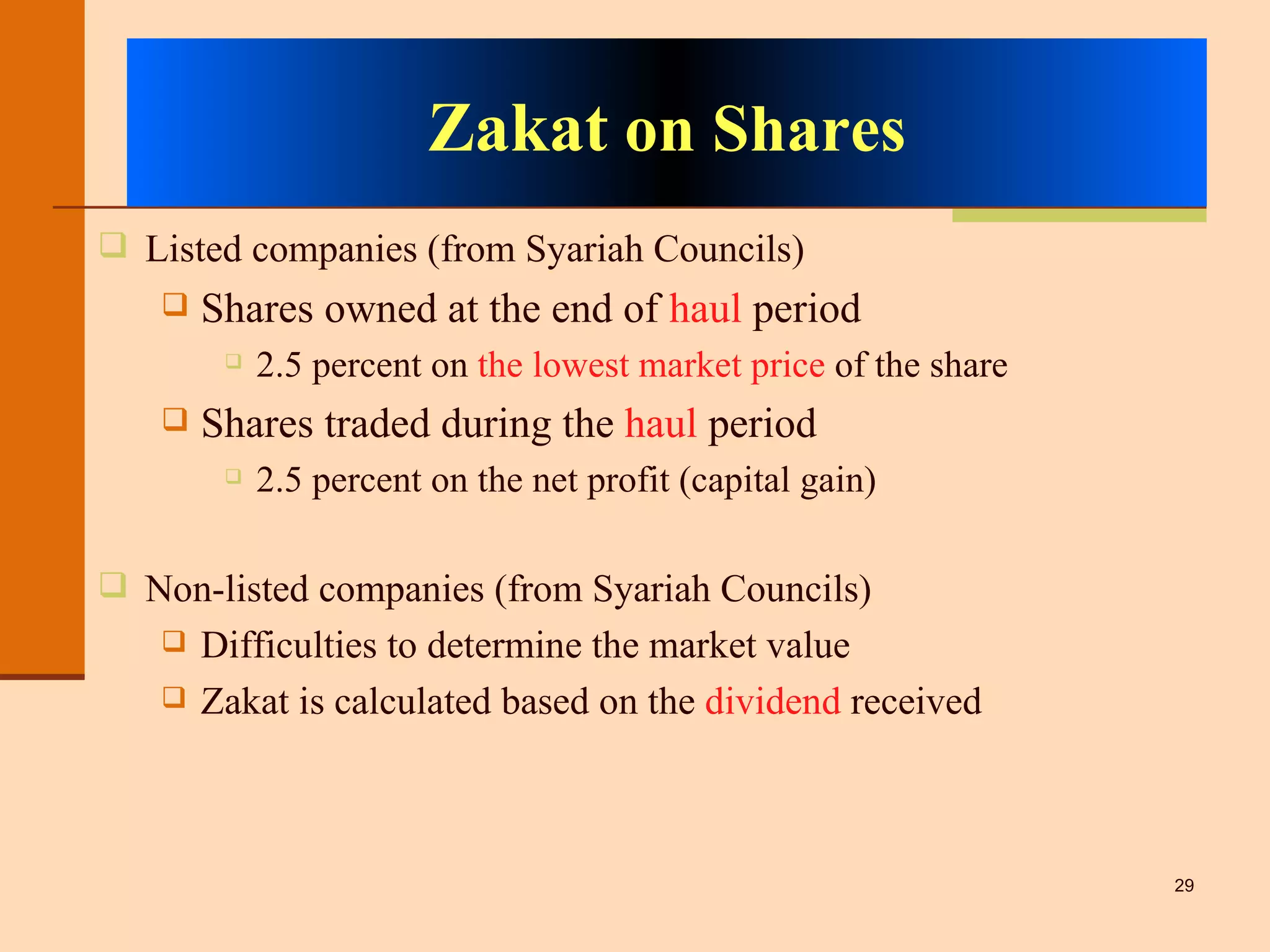

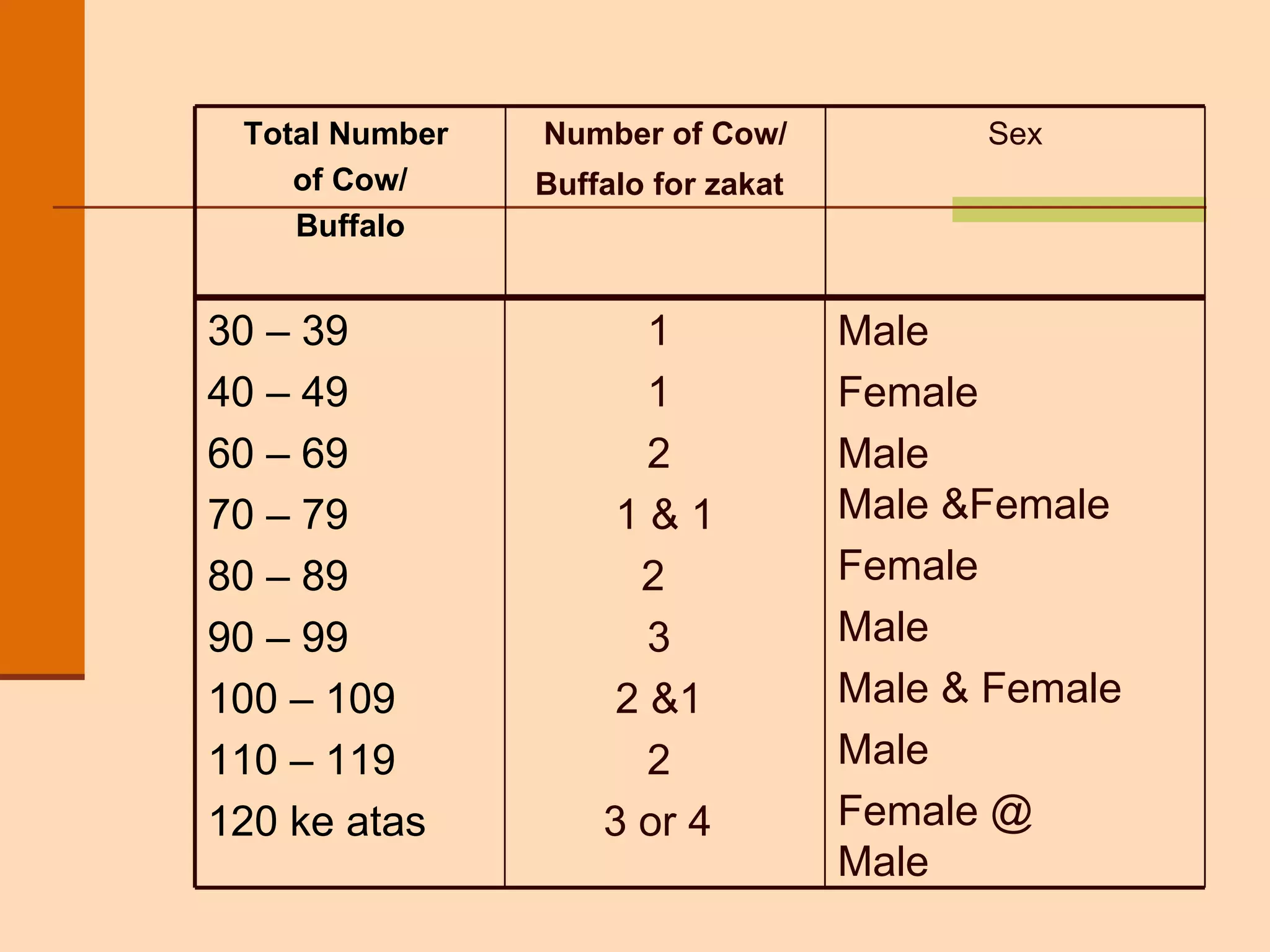

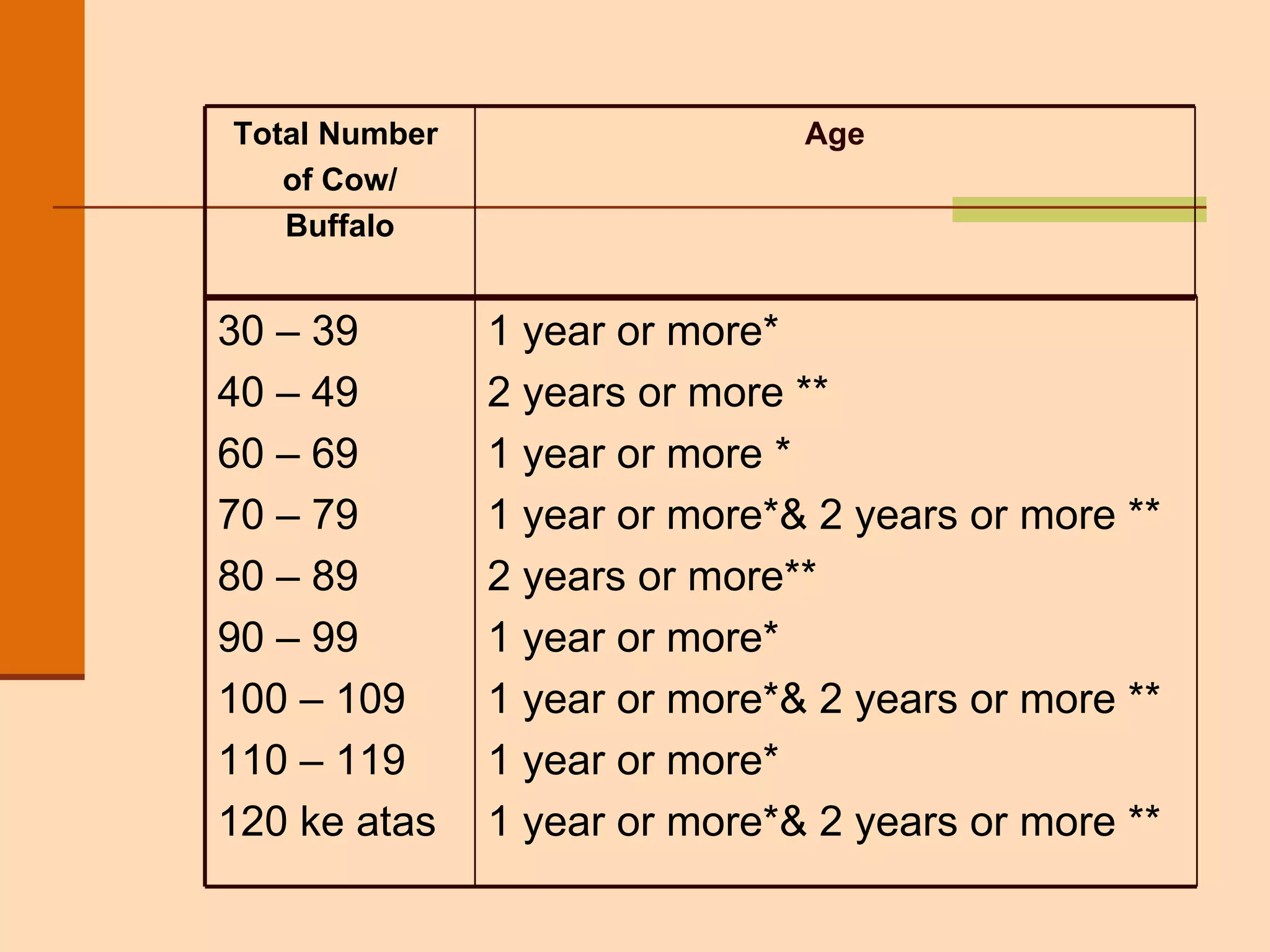

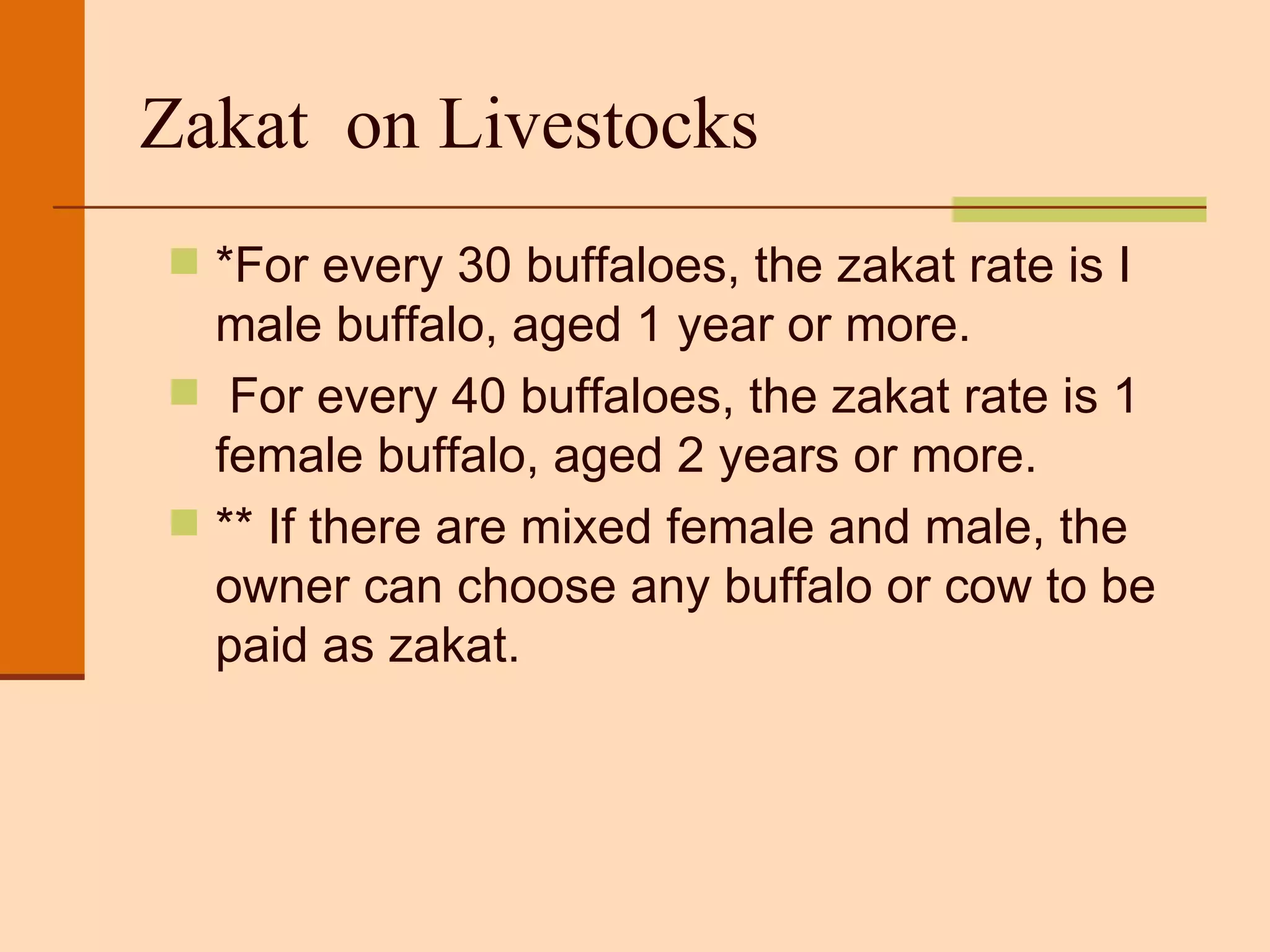

The document provides an overview of zakat (obligatory alms-giving in Islam) in Malaysia, including the different types of zakat, how to calculate zakat on various assets, and a comparison between zakat and taxation. It discusses zakat fitrah (paid during Ramadan), zakat on wealth/earnings from assets like gold/silver, business income, employment income, savings, shares, crops, and livestock. Examples are given for calculating zakat amounts based on asset values and ownership periods. Benefits of zakat are noted as balancing socioeconomic conditions and encouraging wealth distribution.

![Dalil (Sources)Benefits of zakat " Who is he that will lend to Allah a goodly loan, then (Allah) will increase it manifold to his credit (in repaying), and he will have (besides) a good reward (i.e. paradise)." [Surah Al Hadiid:11] “ Verily (Ketahuilah), those who give Sadaqah (i.e. Zakat and alms, etc.), men and women, and lend to Allah a goodly loan, it shall be increased manifold (to their credit), and theirs shall be an honourable good reward (i.e. paradise).” [Surah Al-Hadiid :18]](https://image.slidesharecdn.com/lecture4-typesofzakatandcalculation-100430155746-phpapp02/75/types-of-zakat-and-calculation-45-2048.jpg)

![Dalil (Sources)Benefits of zakat If you lend to Allah a goodly loan (i.e. spend in Allah's Cause) He will double it for you, and will forgive you. And Allah is Most Ready to appreciate and to reward, Most Forbearing." [Surah Ath-Thalaaq:17]](https://image.slidesharecdn.com/lecture4-typesofzakatandcalculation-100430155746-phpapp02/75/types-of-zakat-and-calculation-46-2048.jpg)