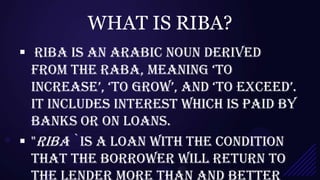

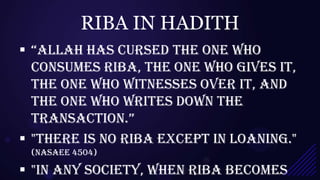

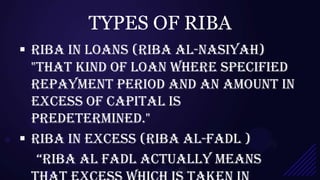

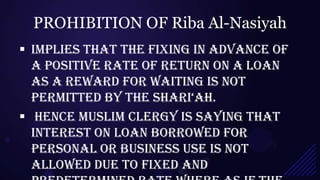

Riba refers to interest paid on loans, which is prohibited in Islam. There are two main types of riba - riba al-nasiyah which is interest on loans, and riba al-fadl which involves exploiting unequal exchanges of commodities. The Quran and hadith clearly forbid riba. Riba causes injustice, greed, inflation and burdens poor nations with unsustainable debt. Muslims should avoid taking out loans with interest and instead use riba-free banking options or borrow from family/friends interest-free. Strictly following Islamic financial principles can help society avoid the harms of riba.