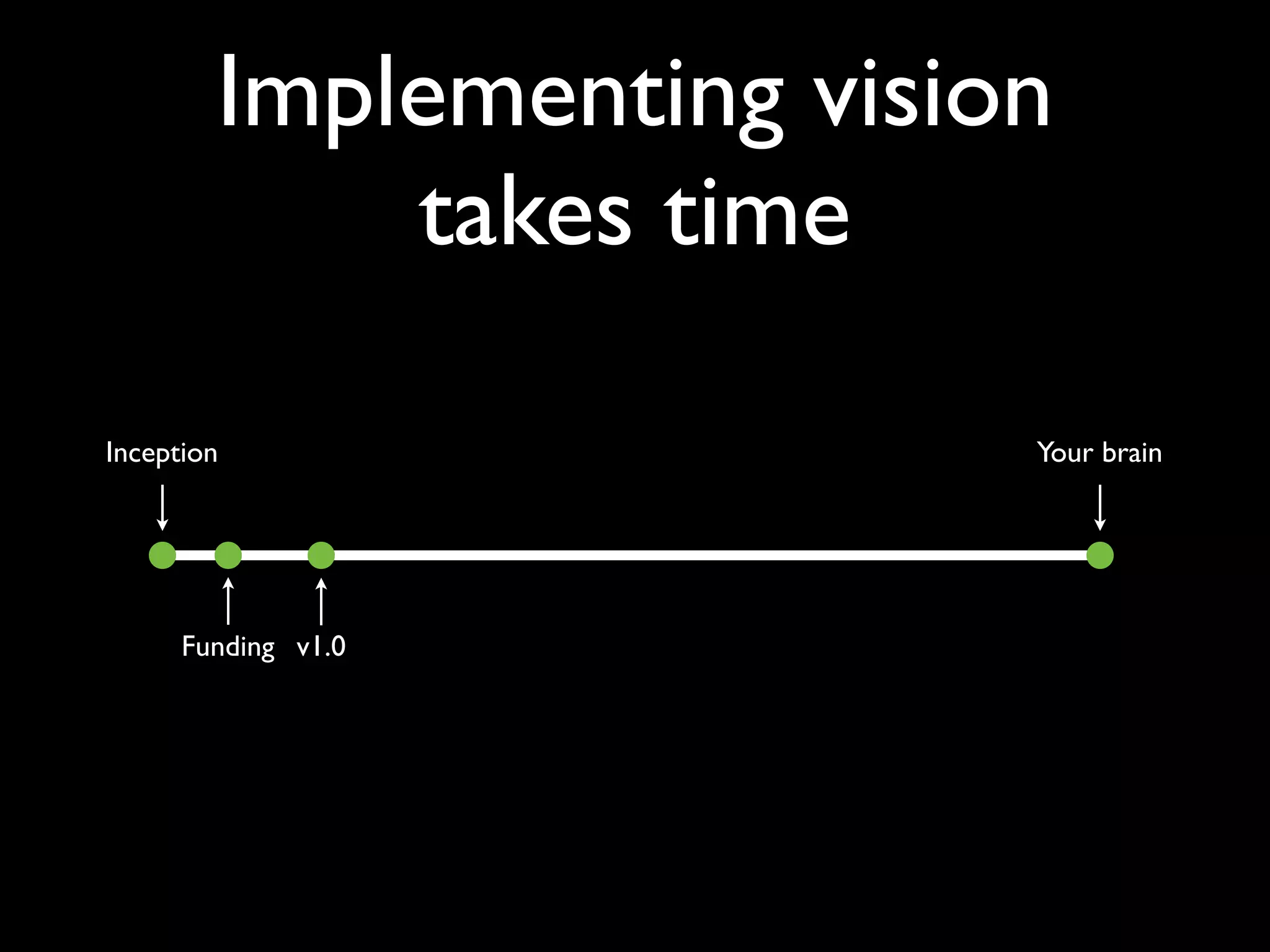

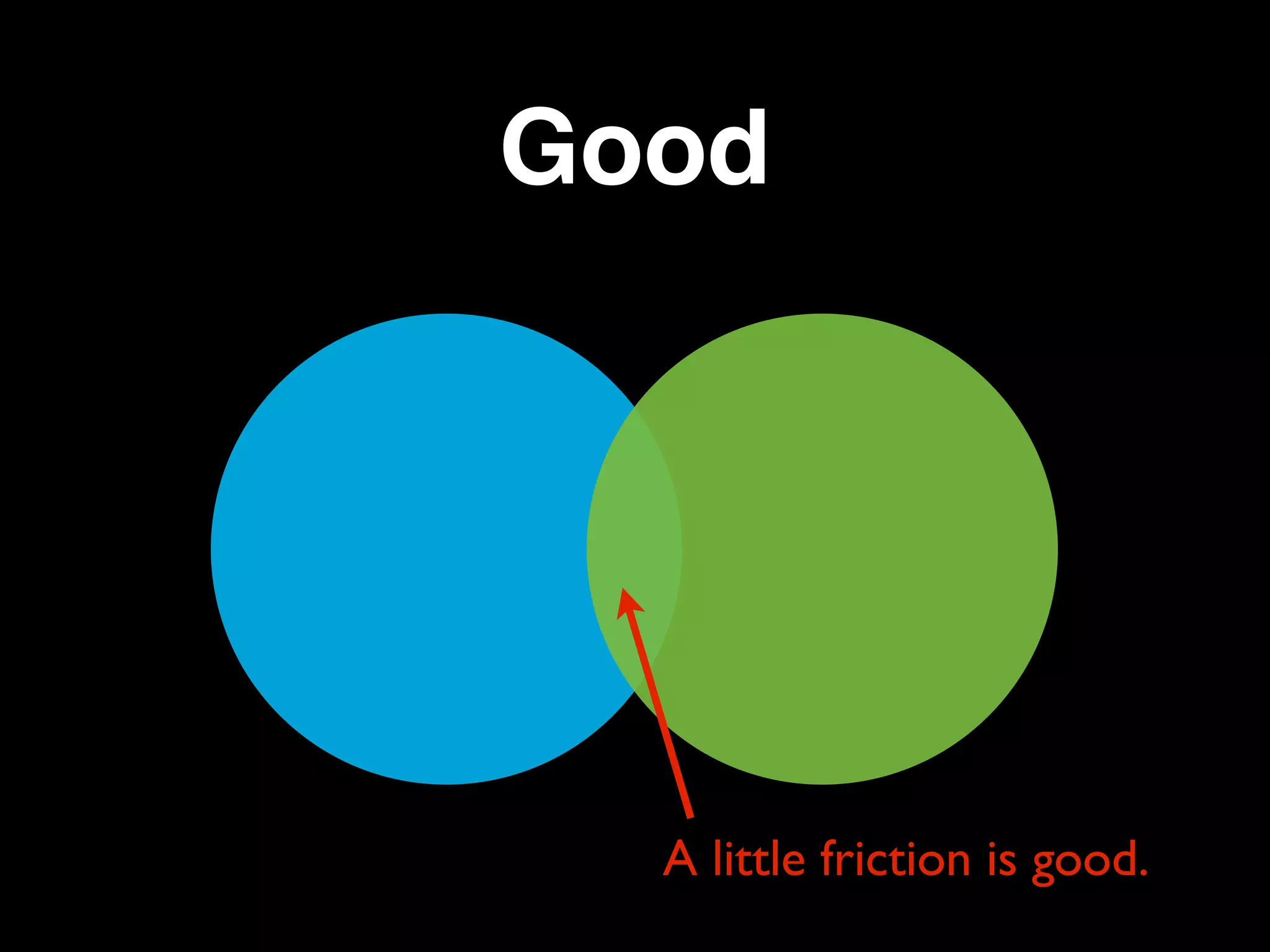

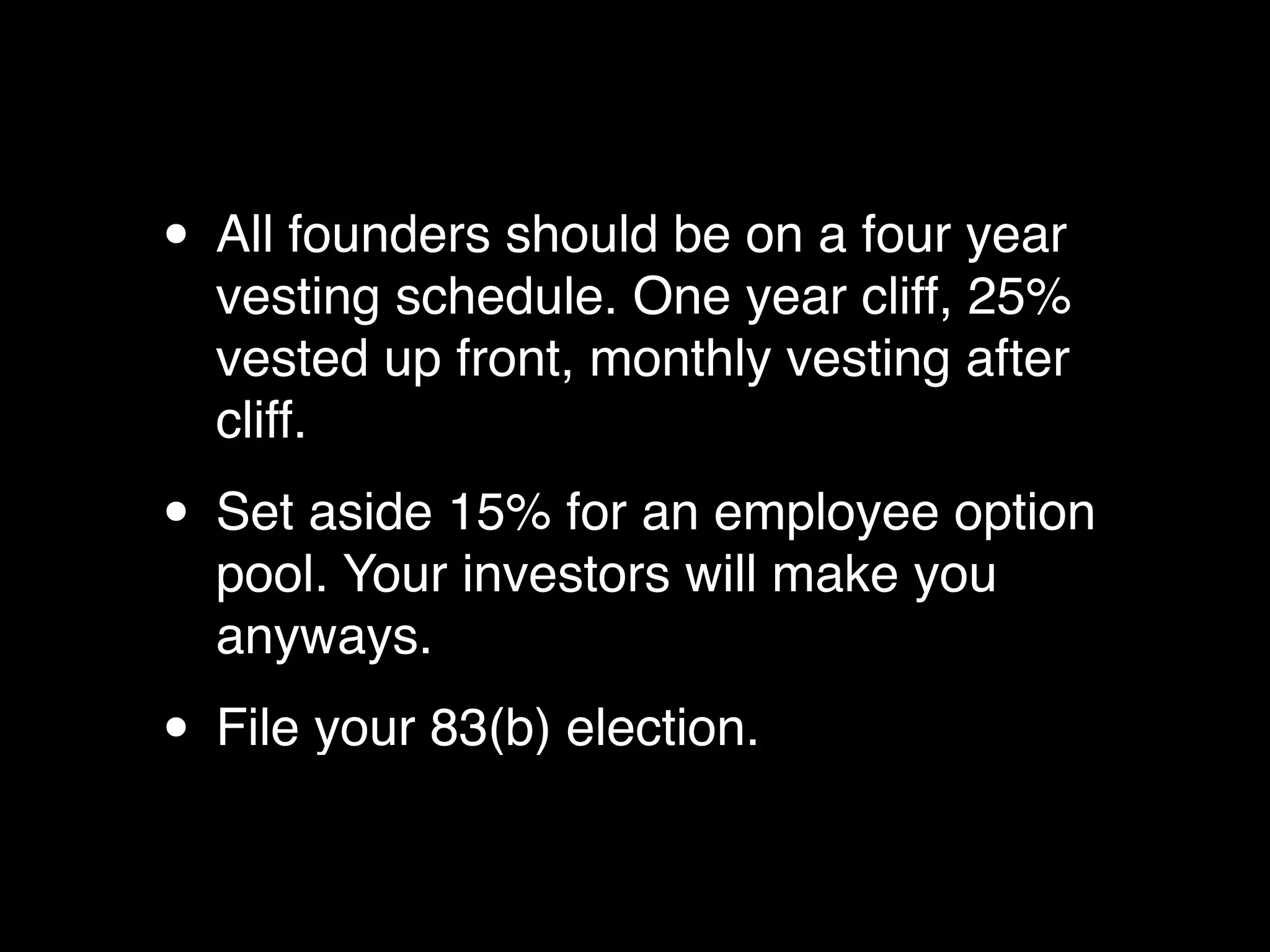

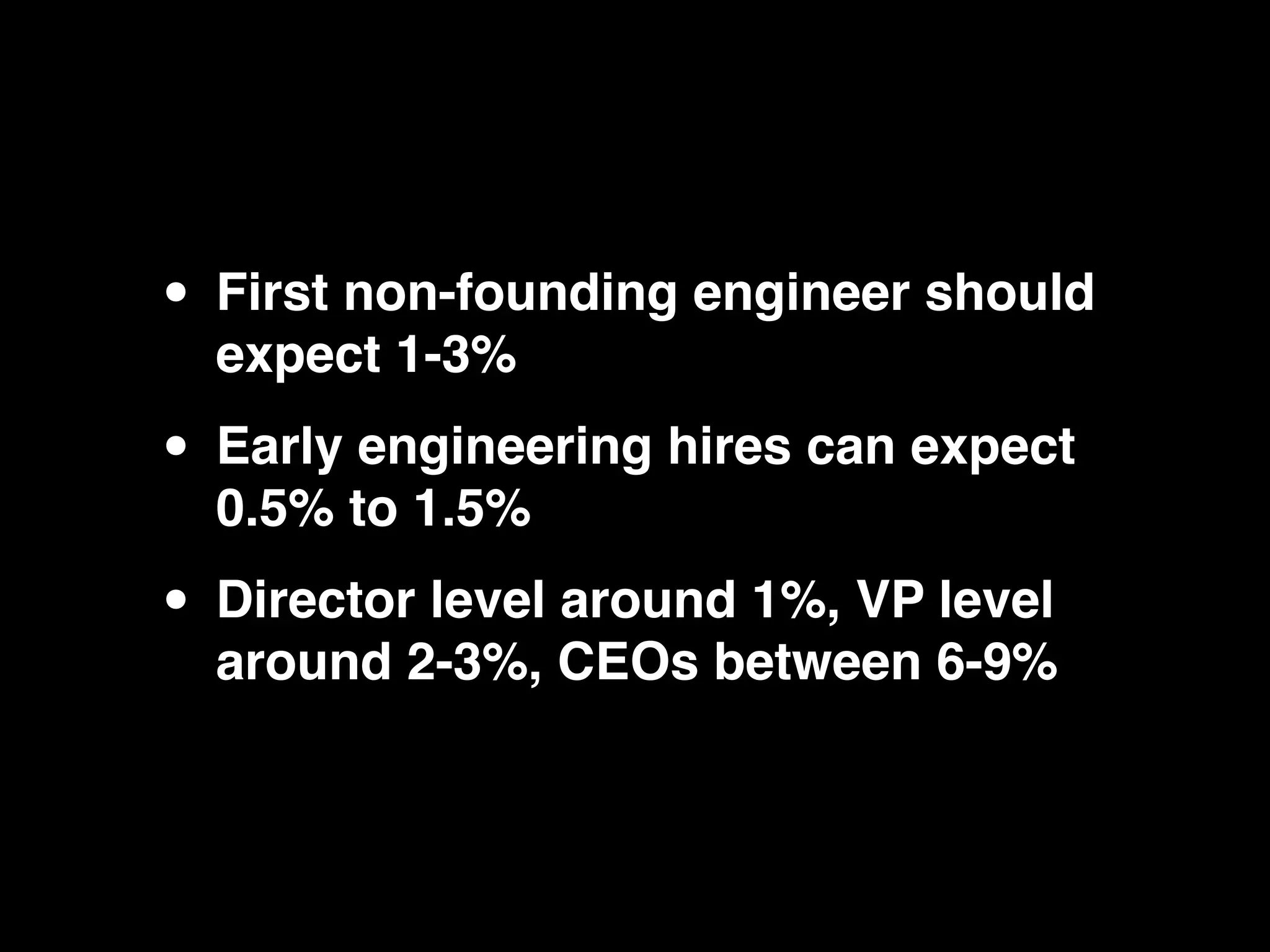

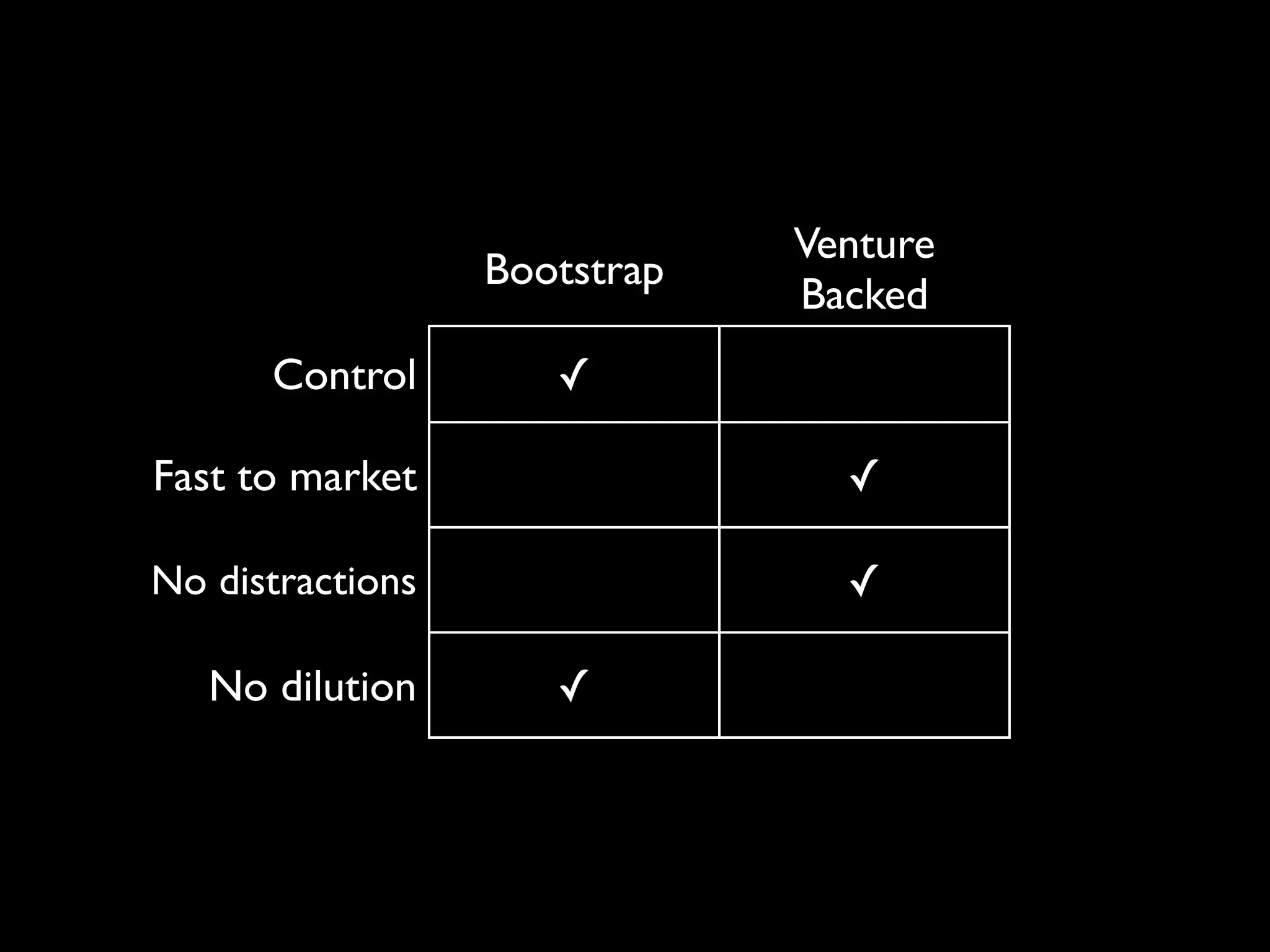

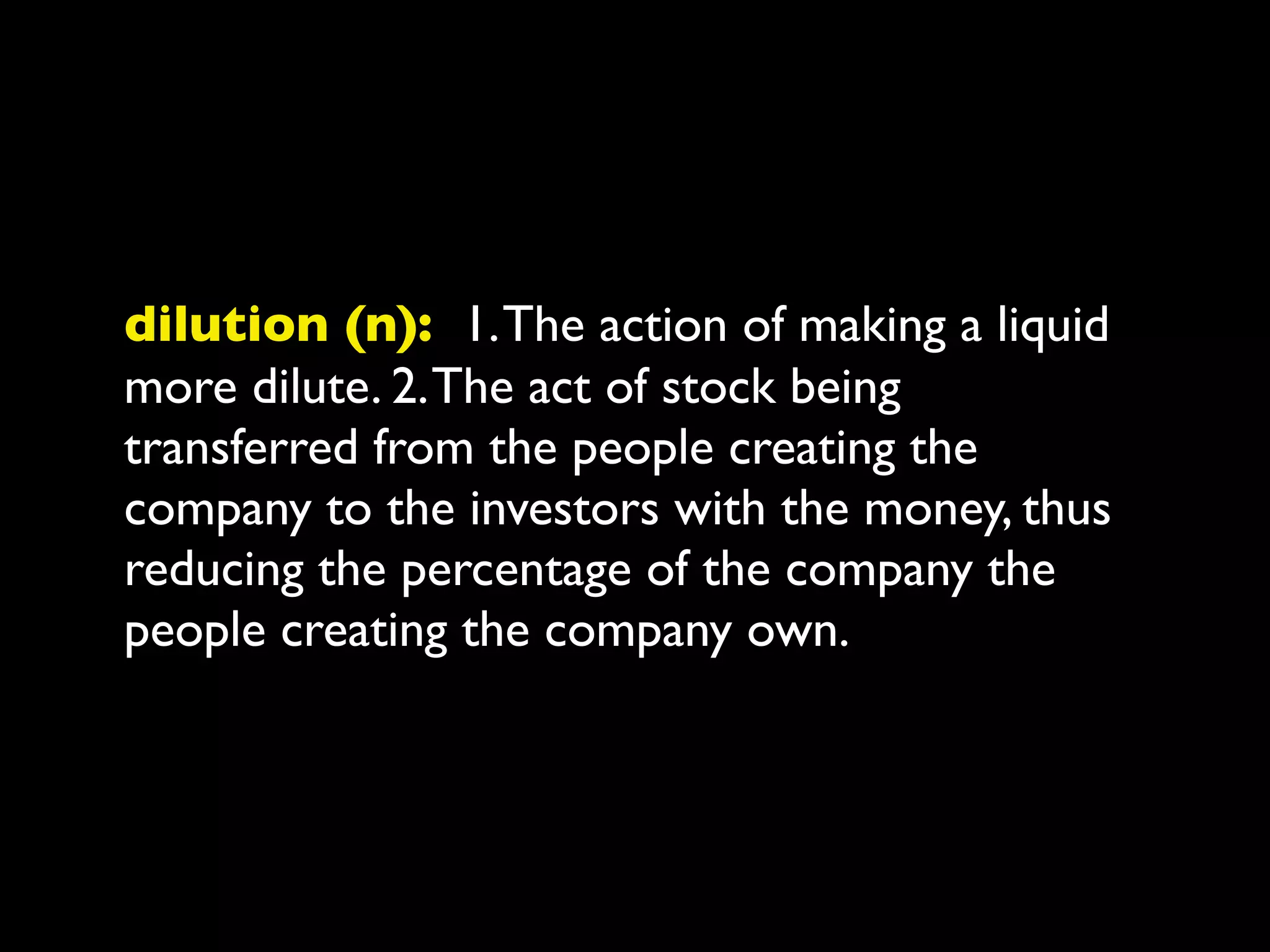

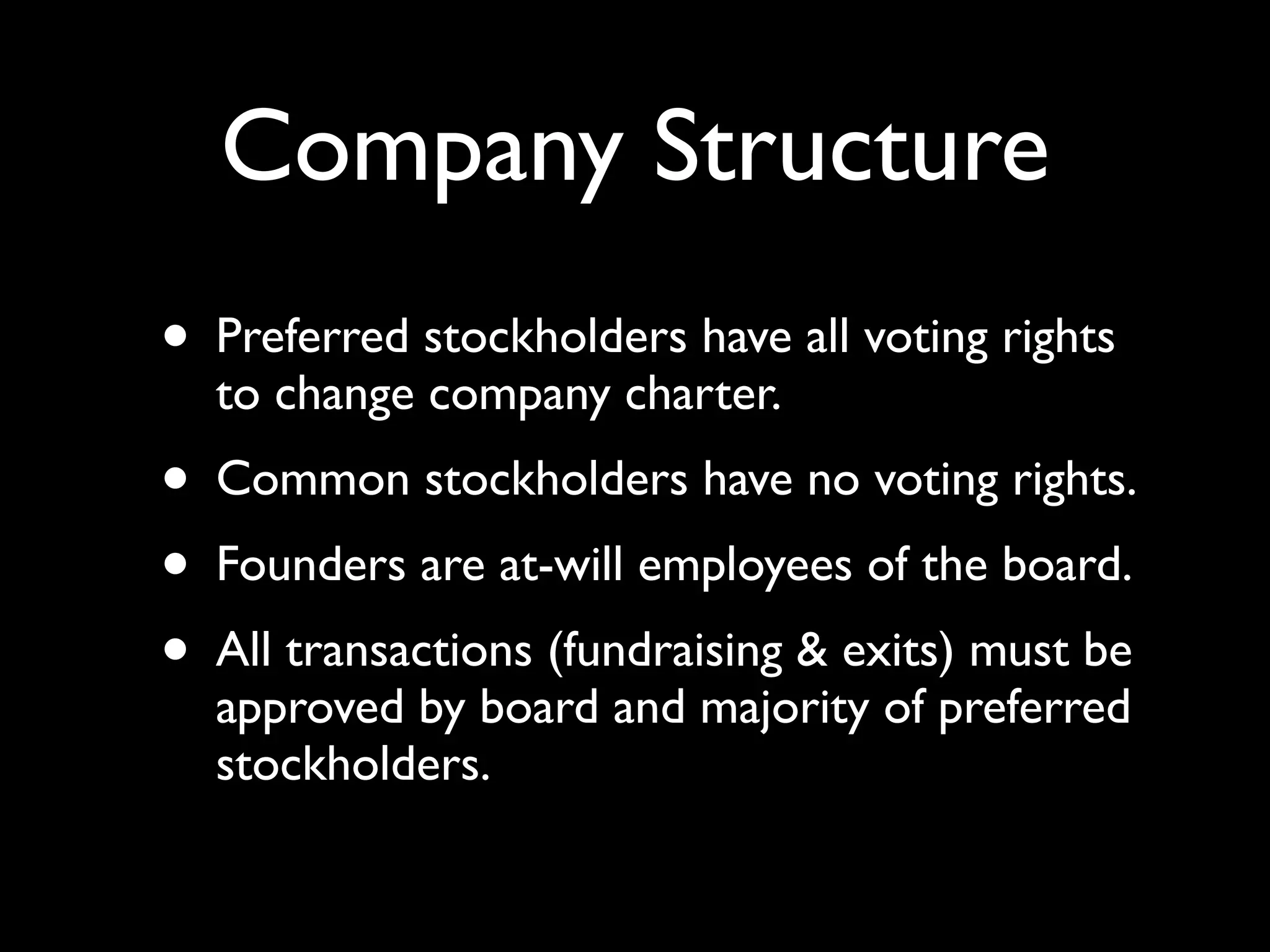

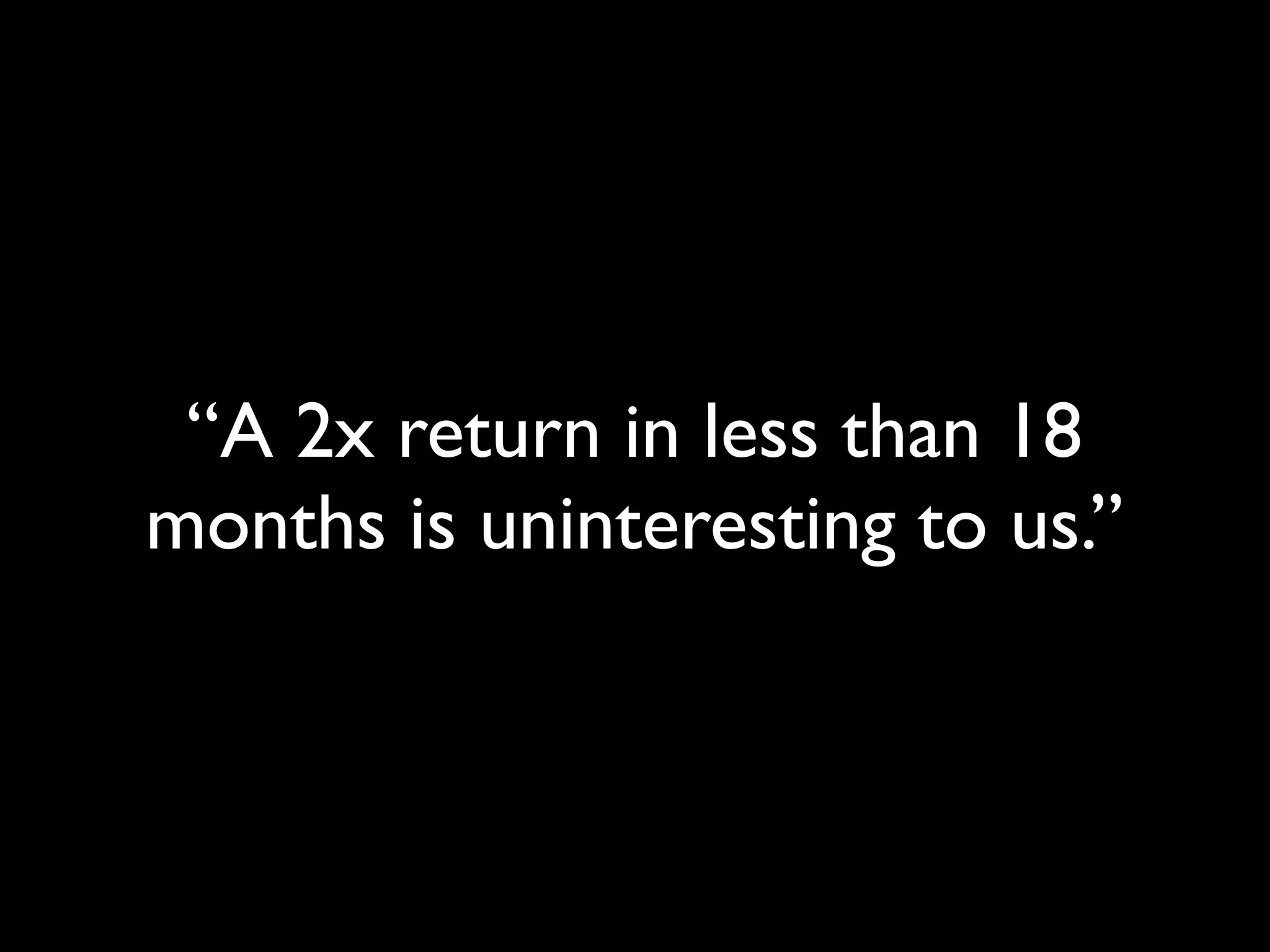

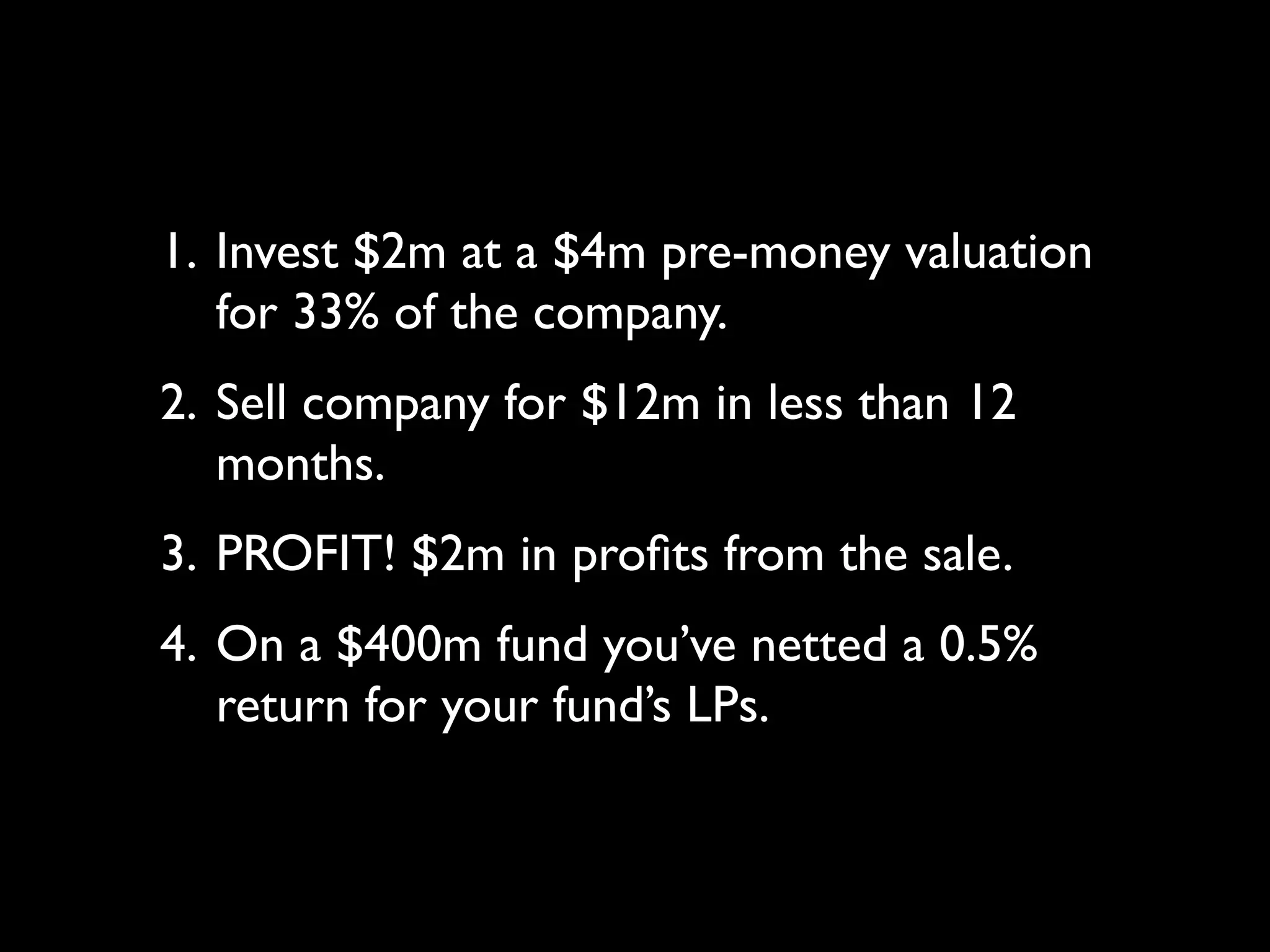

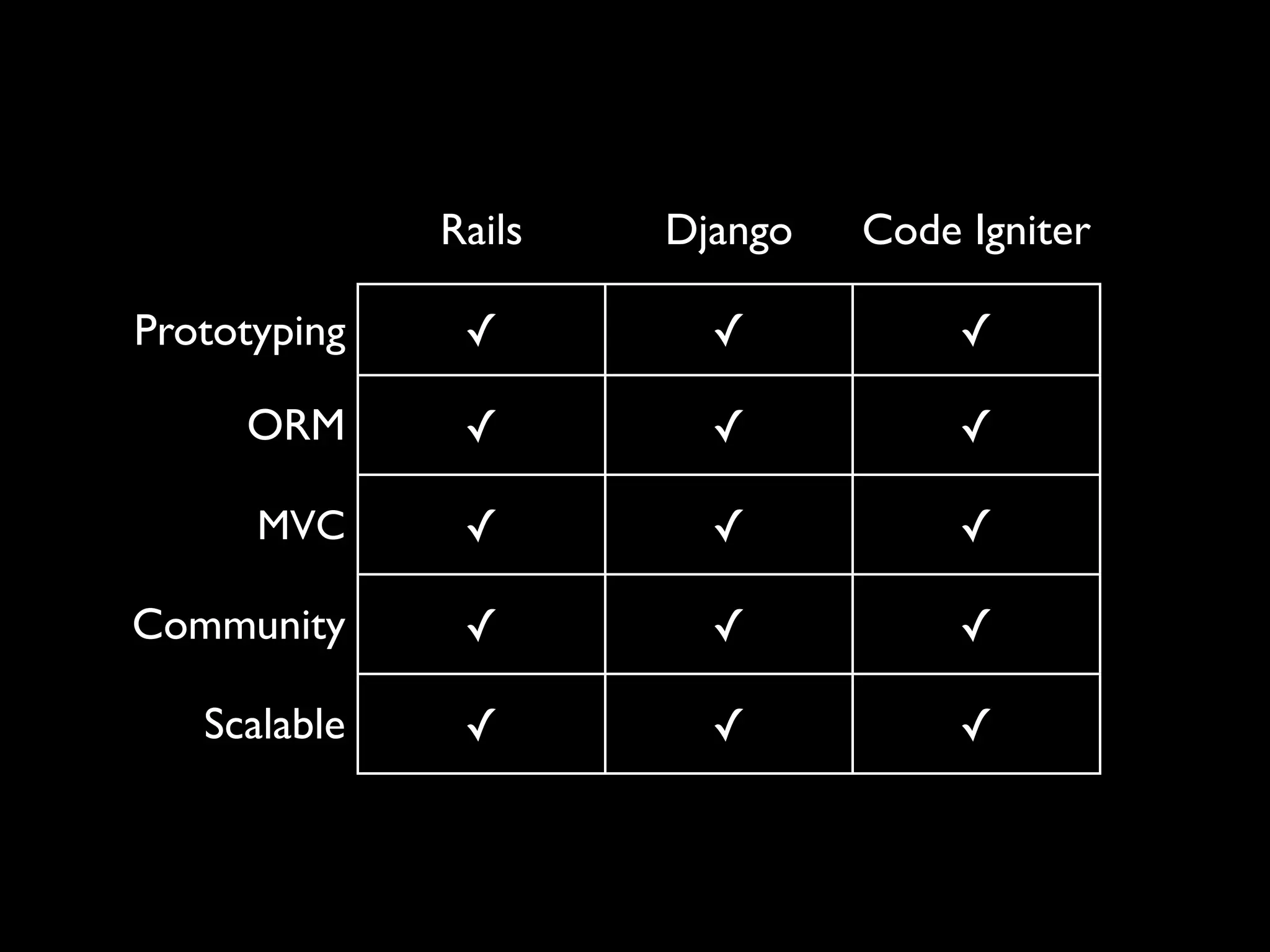

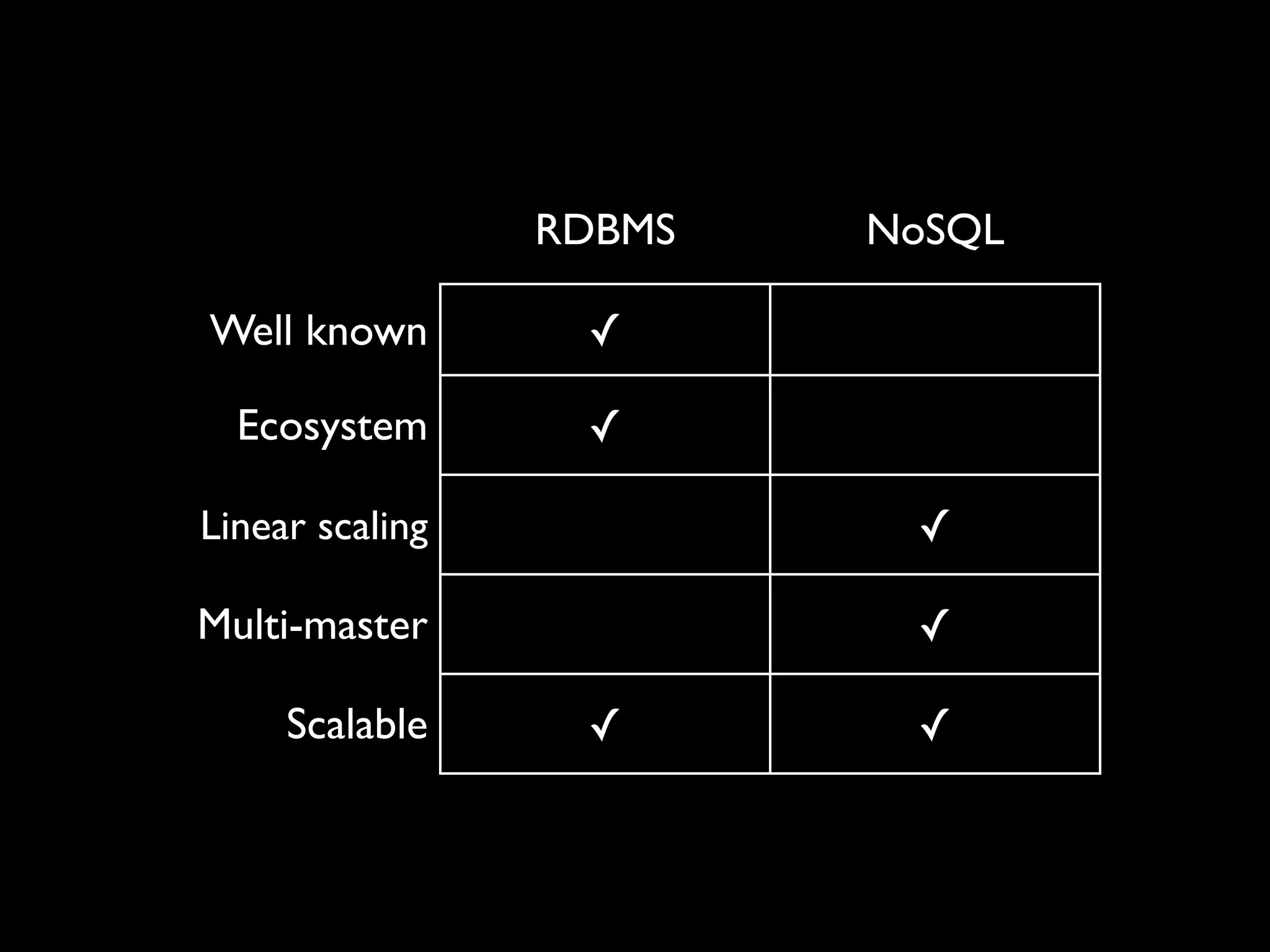

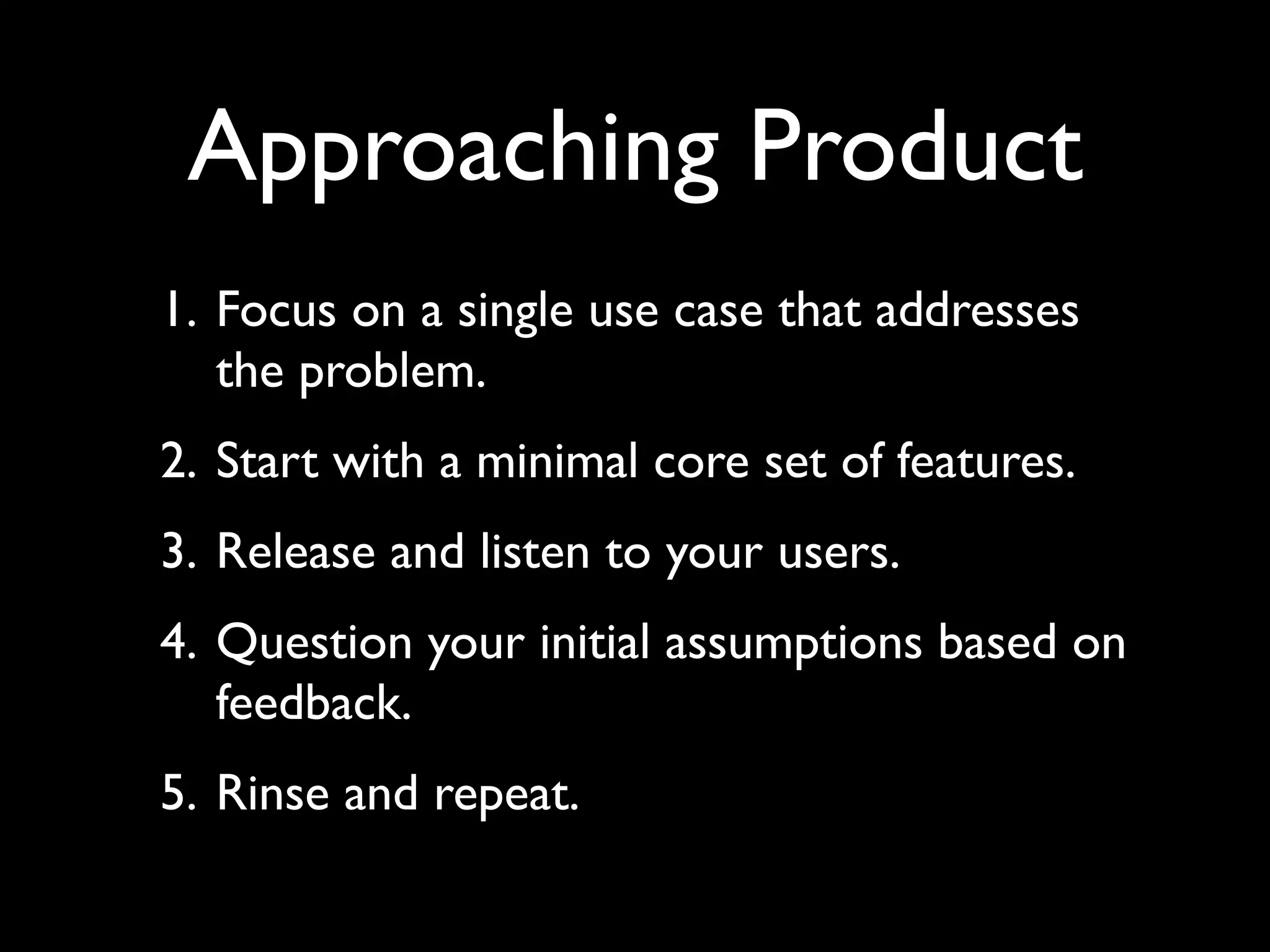

The document offers guidance for entrepreneurs on starting a startup, emphasizing the challenges and importance of obsession for success. Key advice includes choosing co-founders wisely, understanding funding dynamics, and focusing on a minimally viable product while being responsive to user feedback. It also discusses company structure, investor relations, and the significant role of technology choices in product development.