Embed presentation

Download to read offline

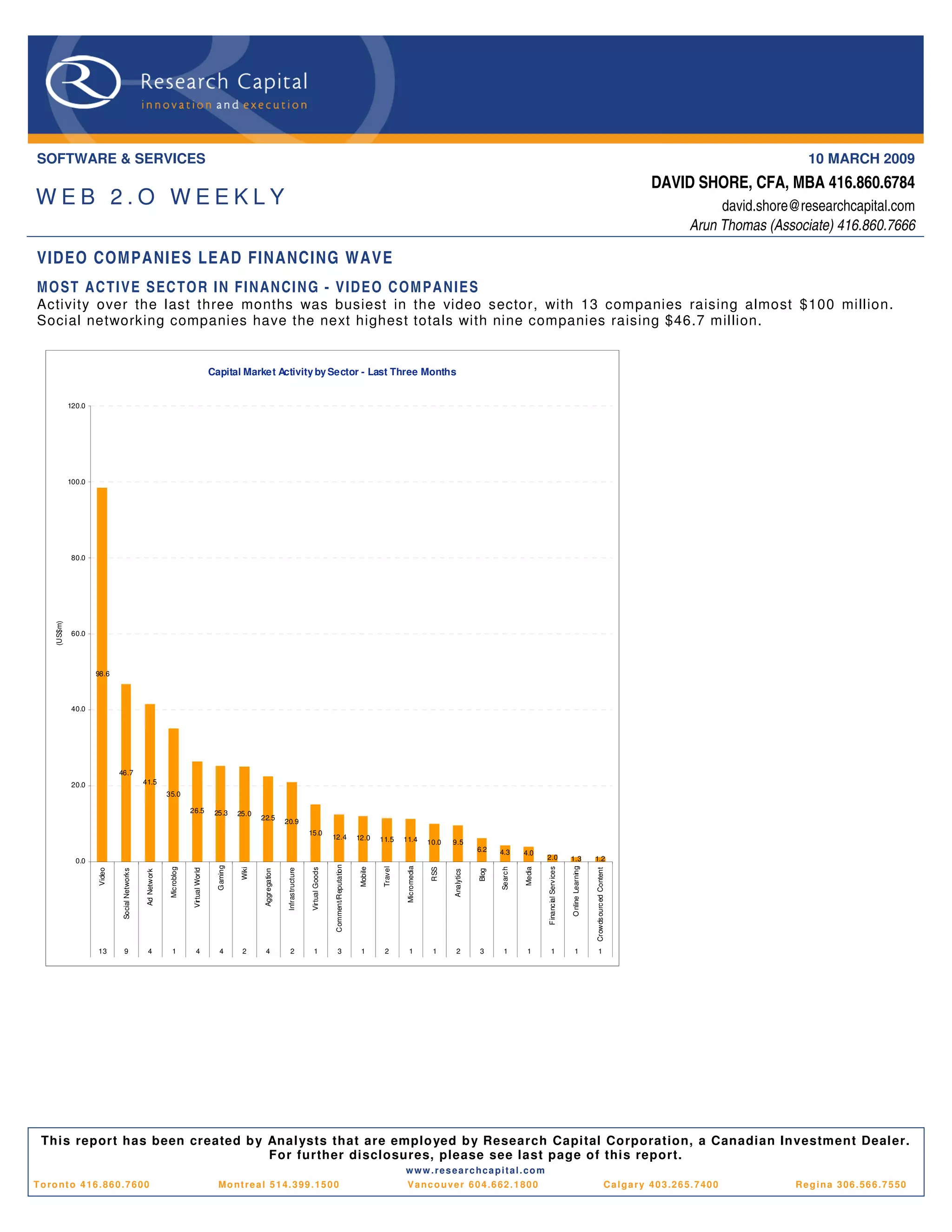

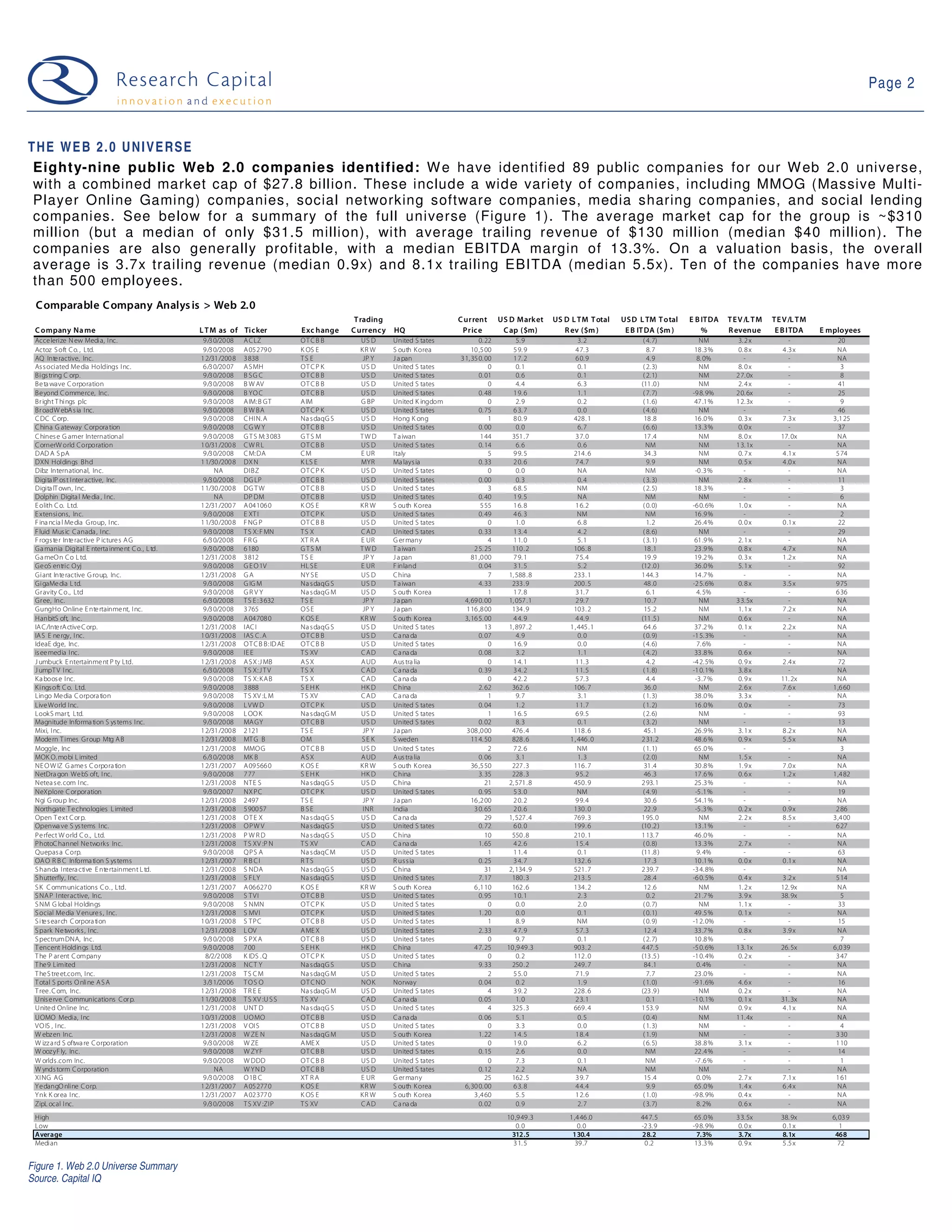

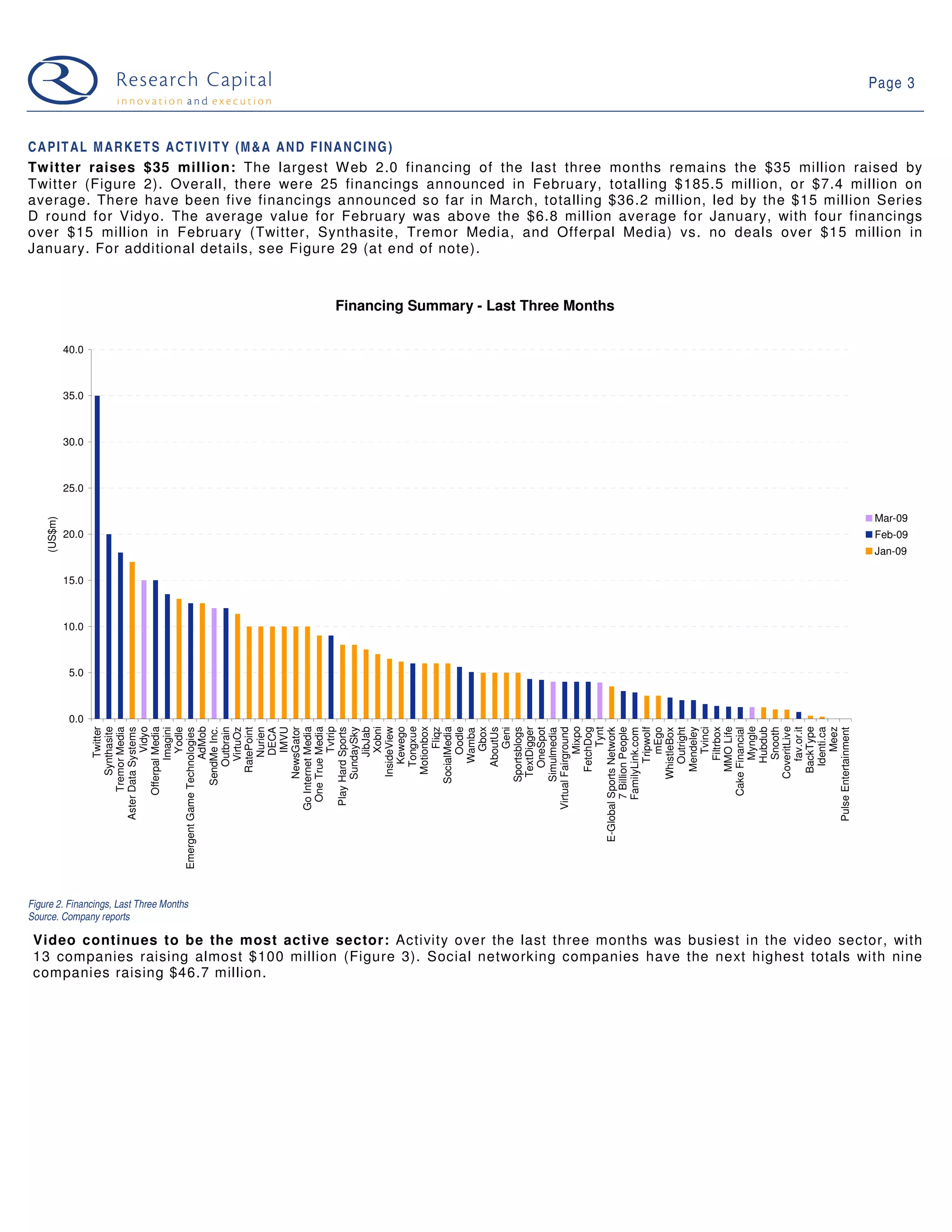

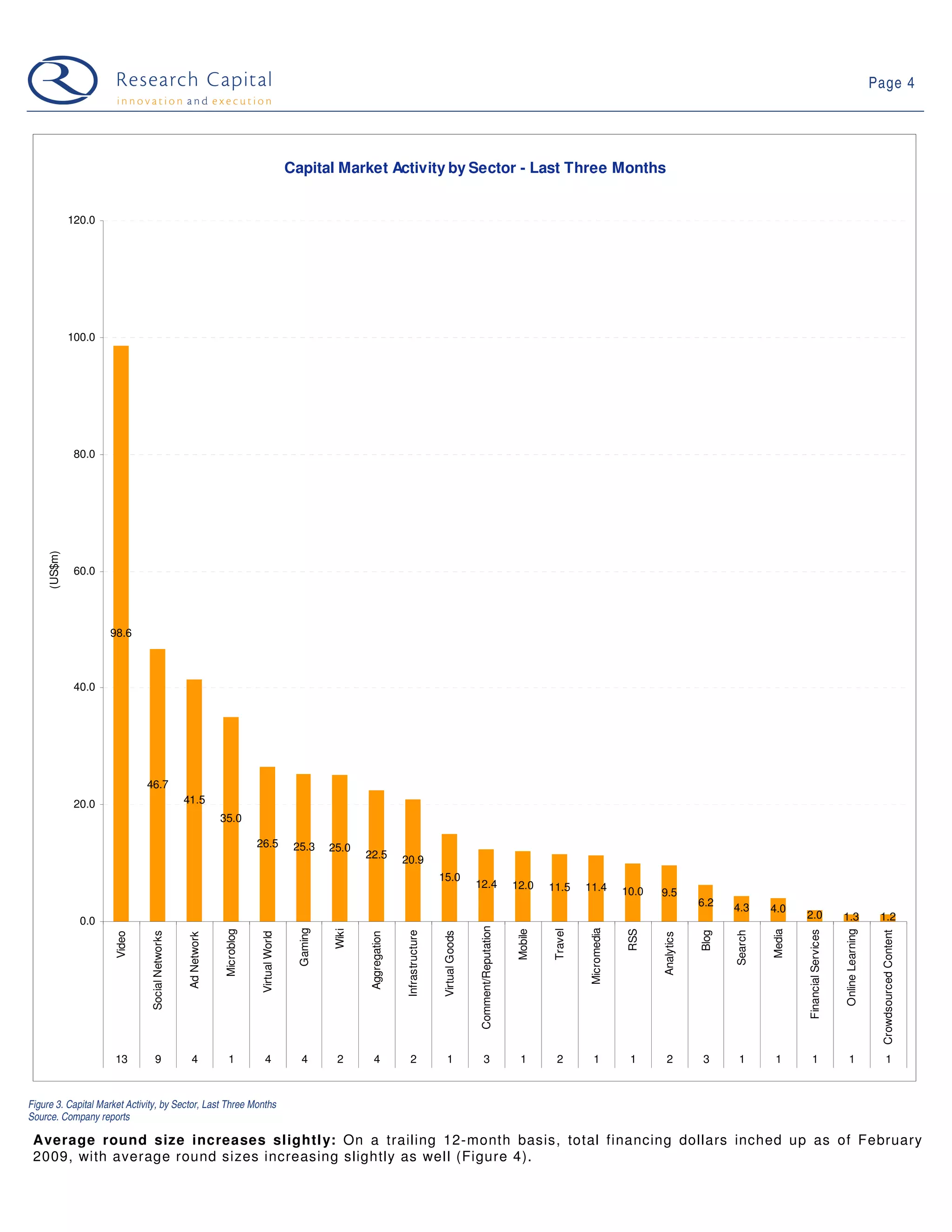

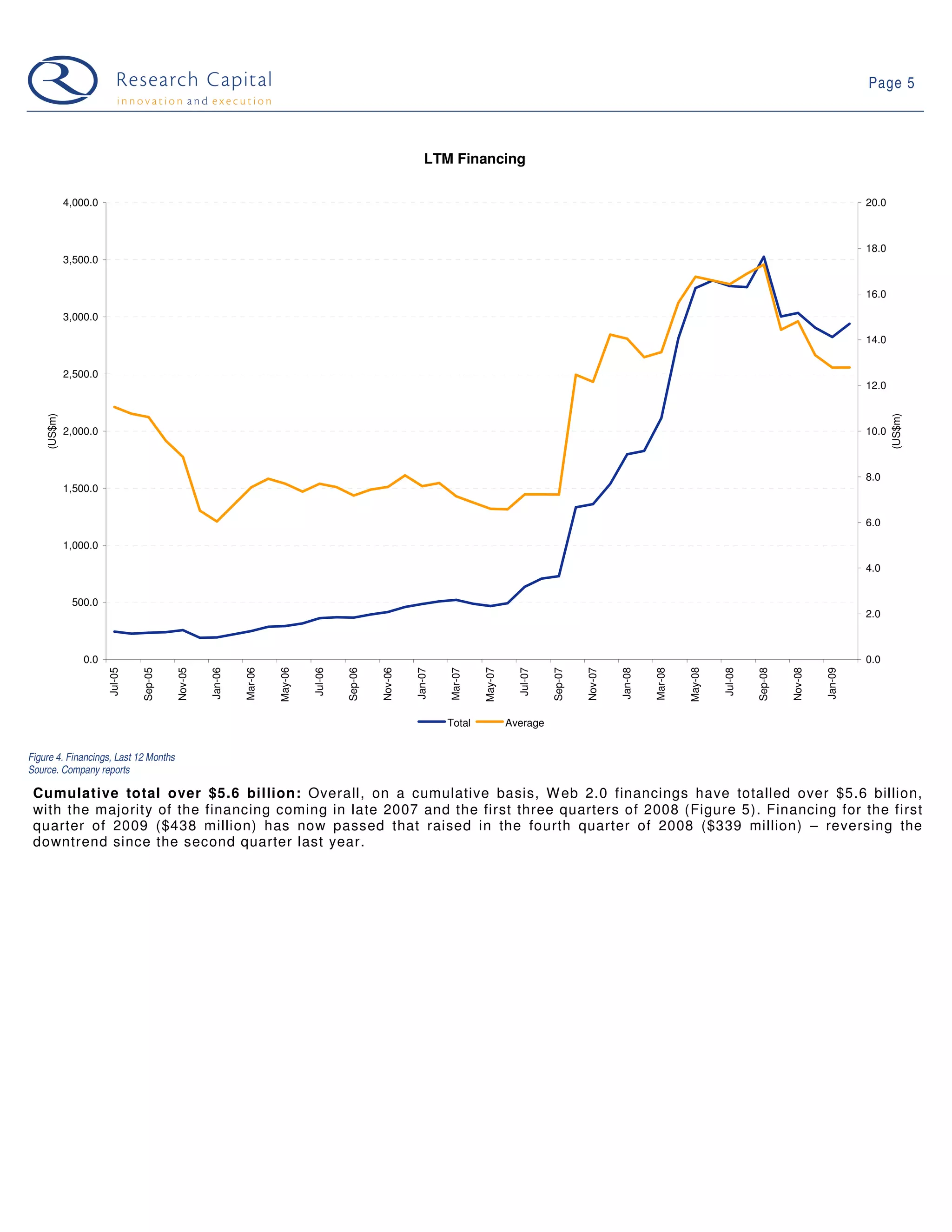

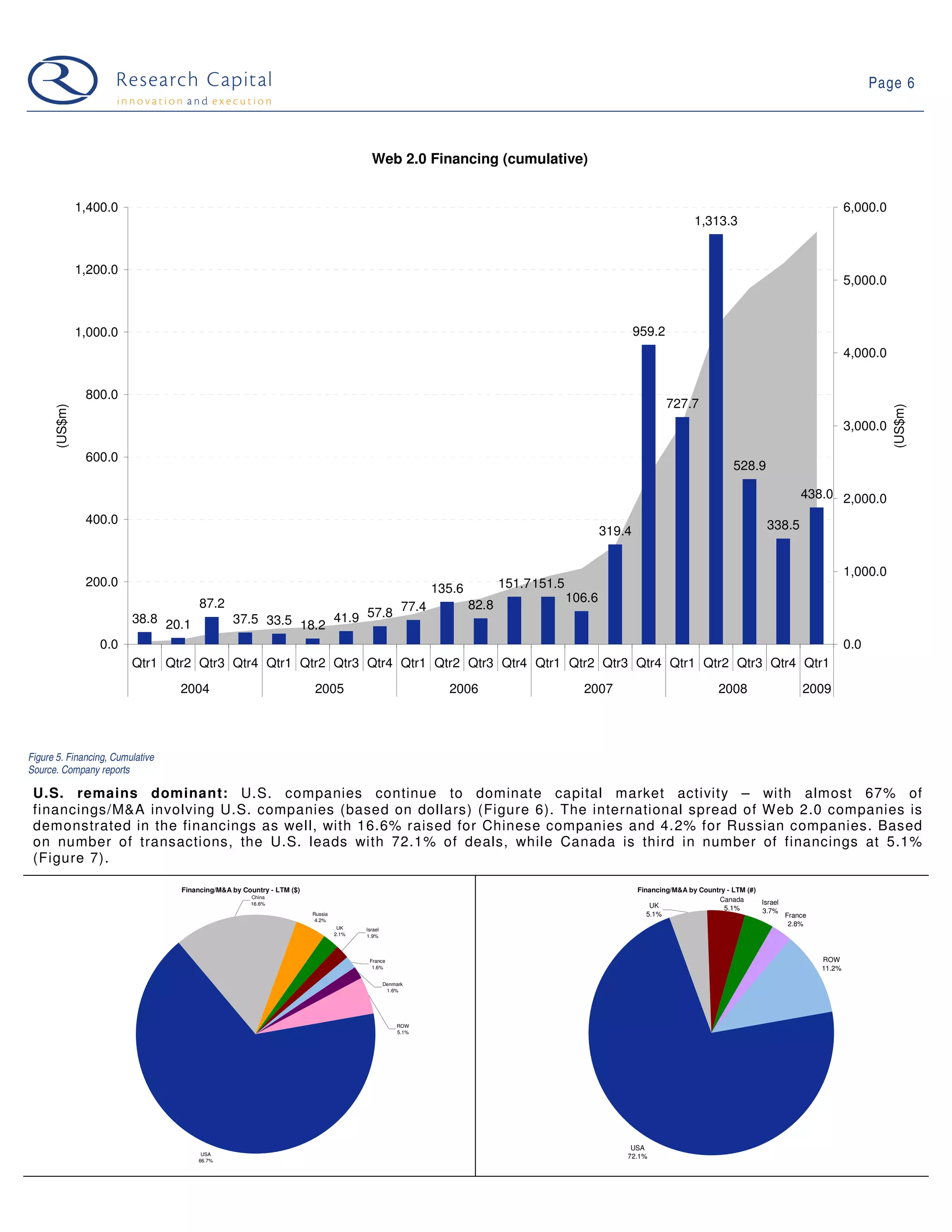

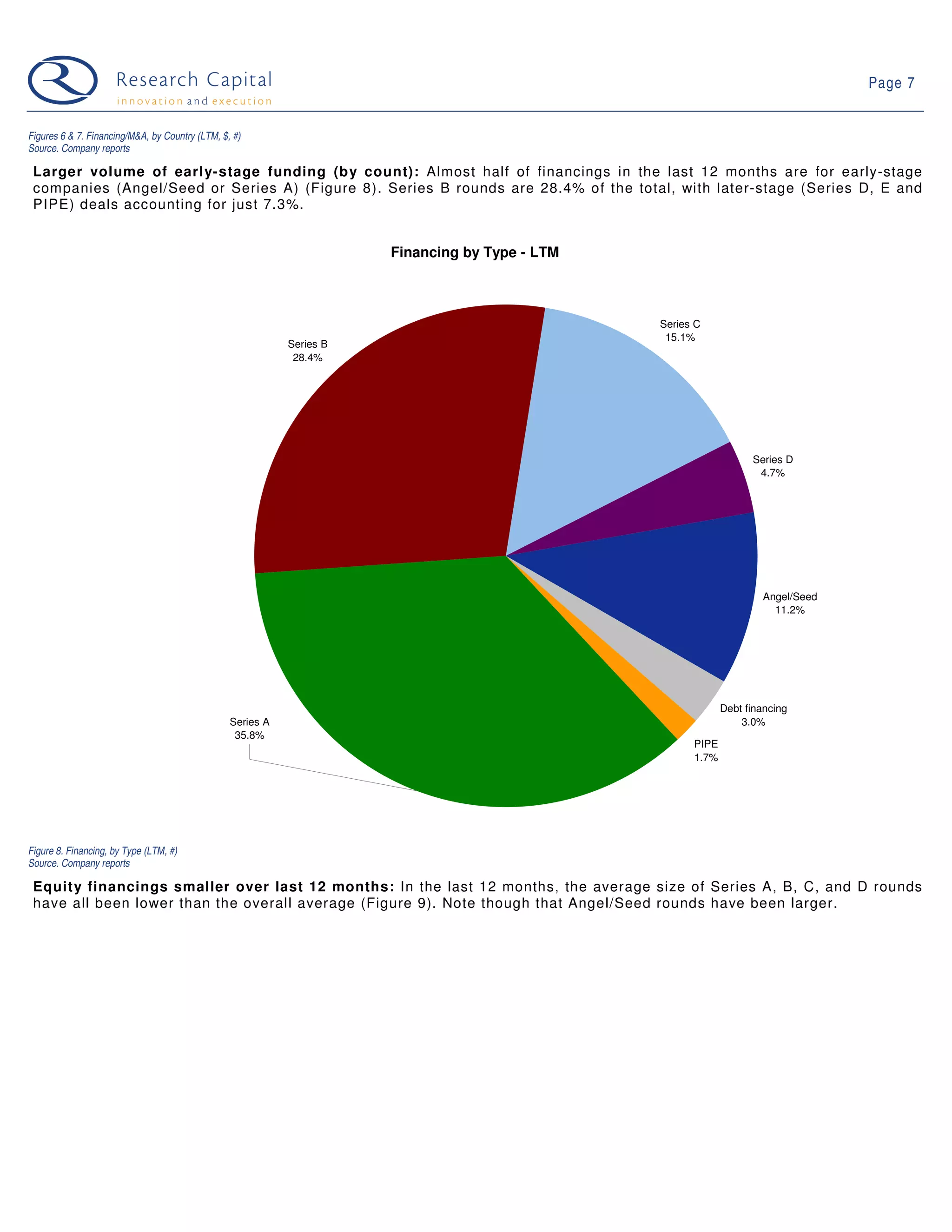

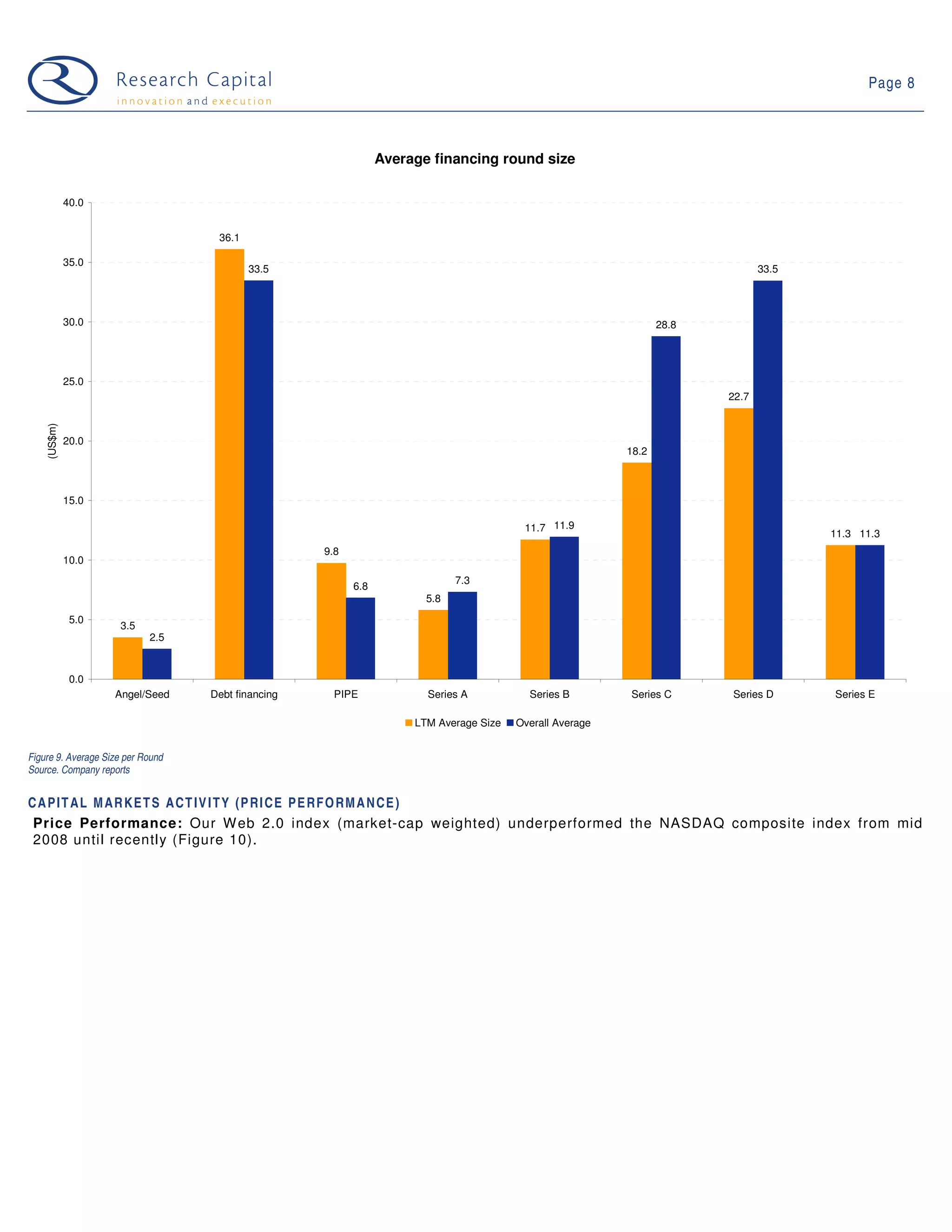

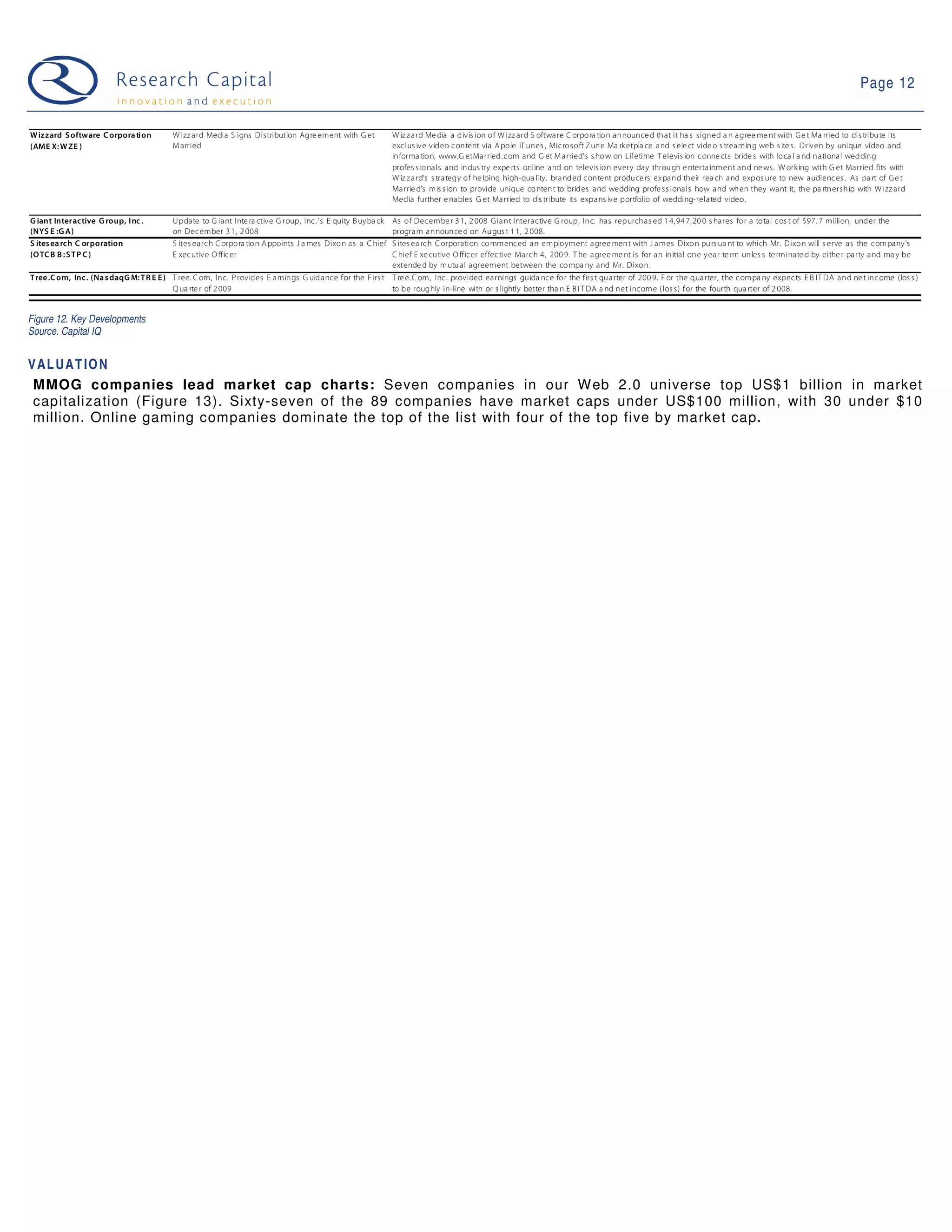

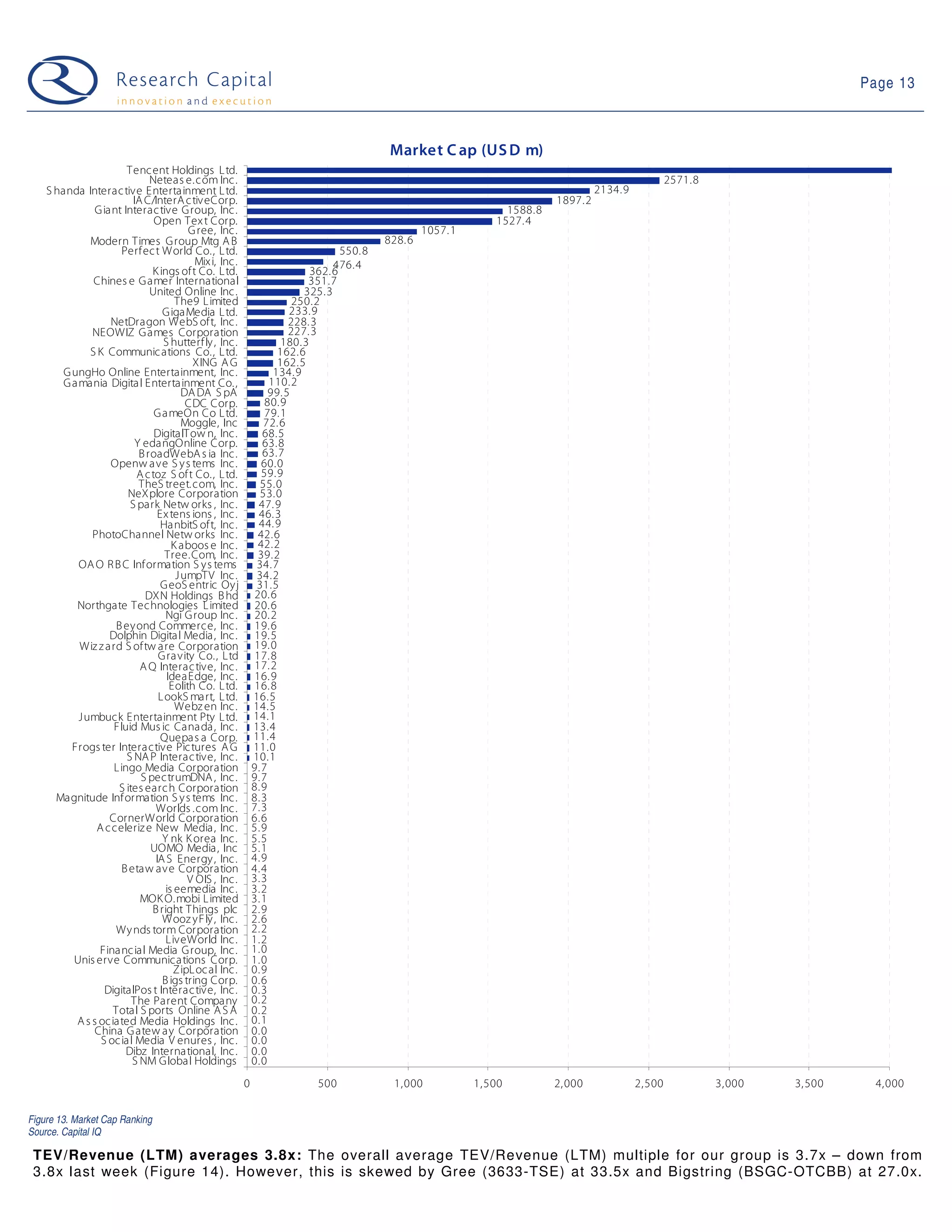

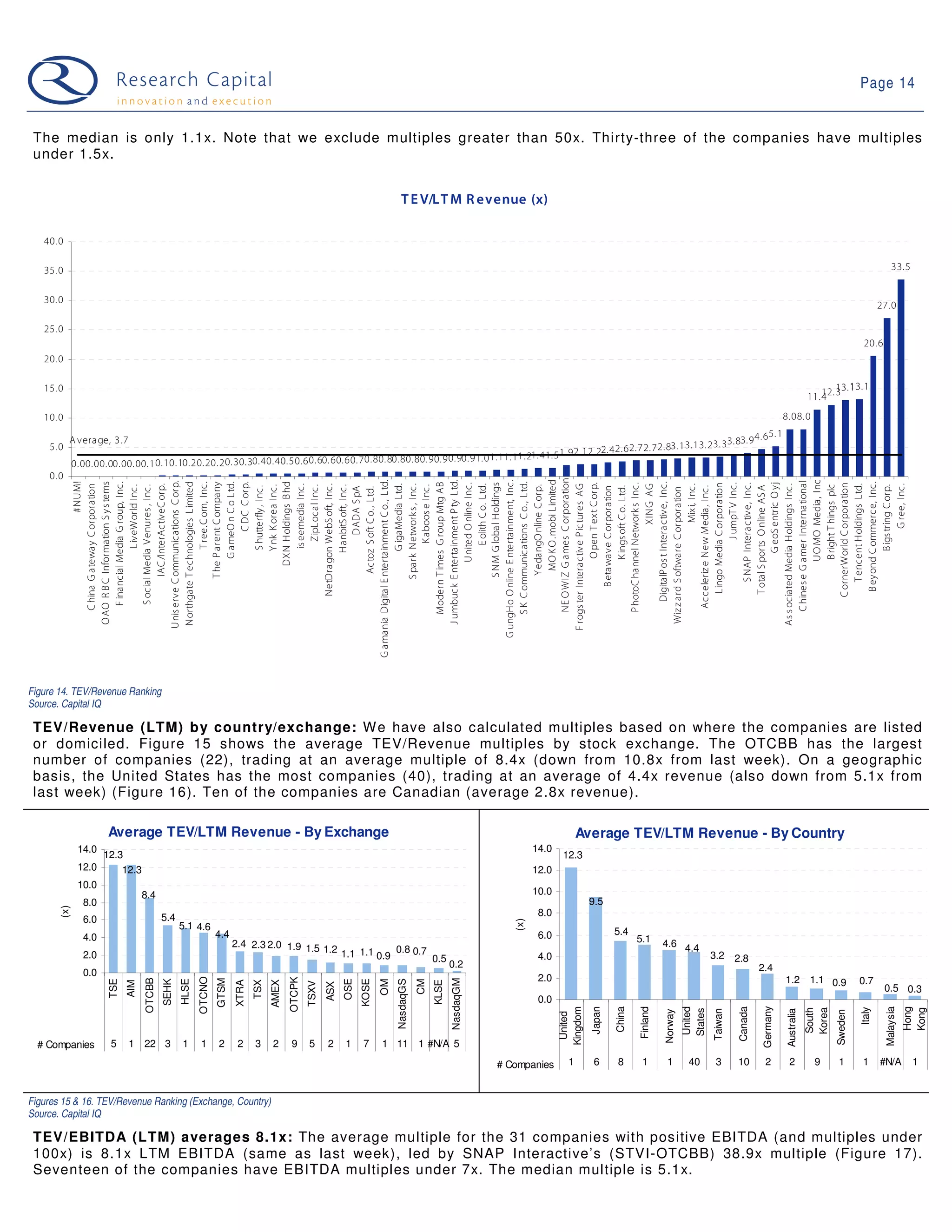

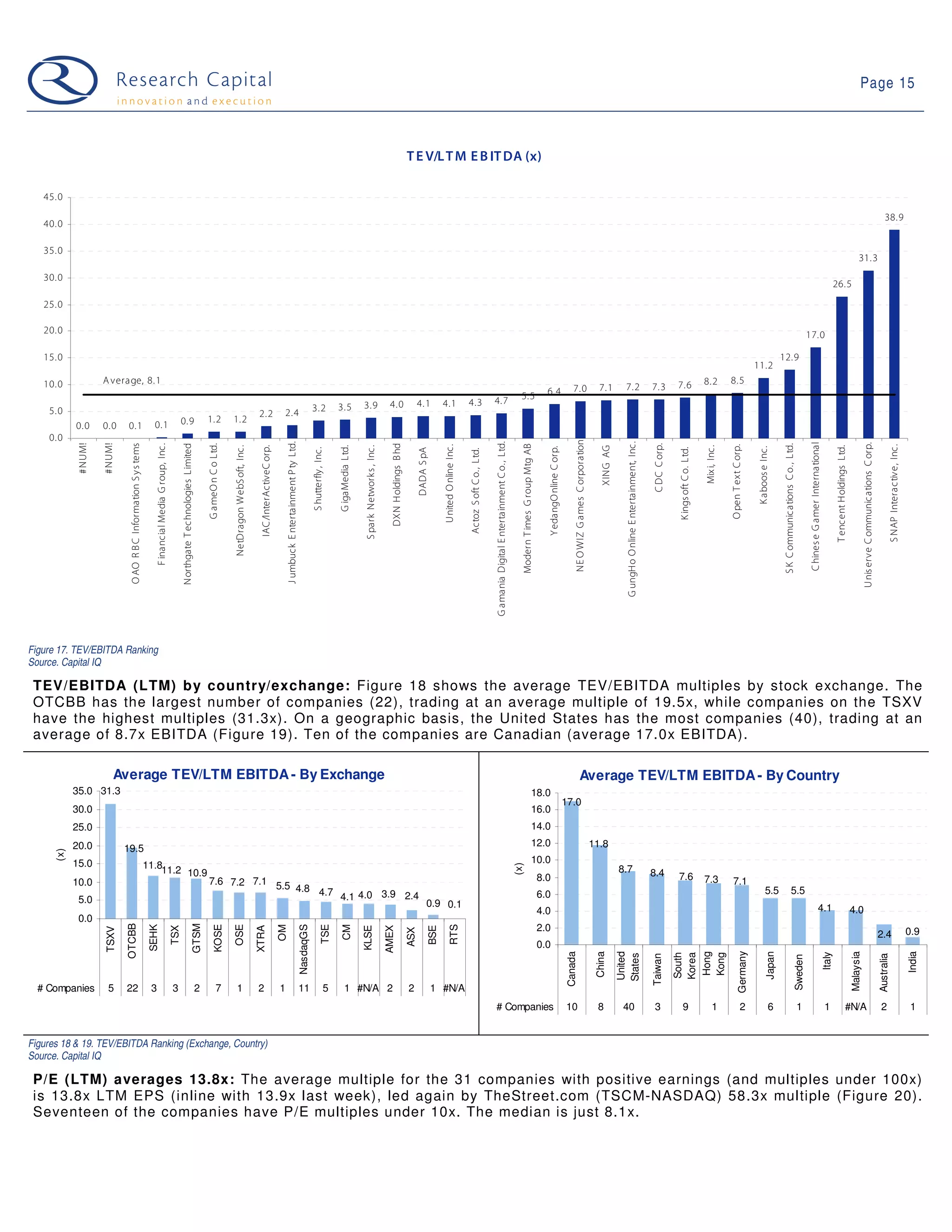

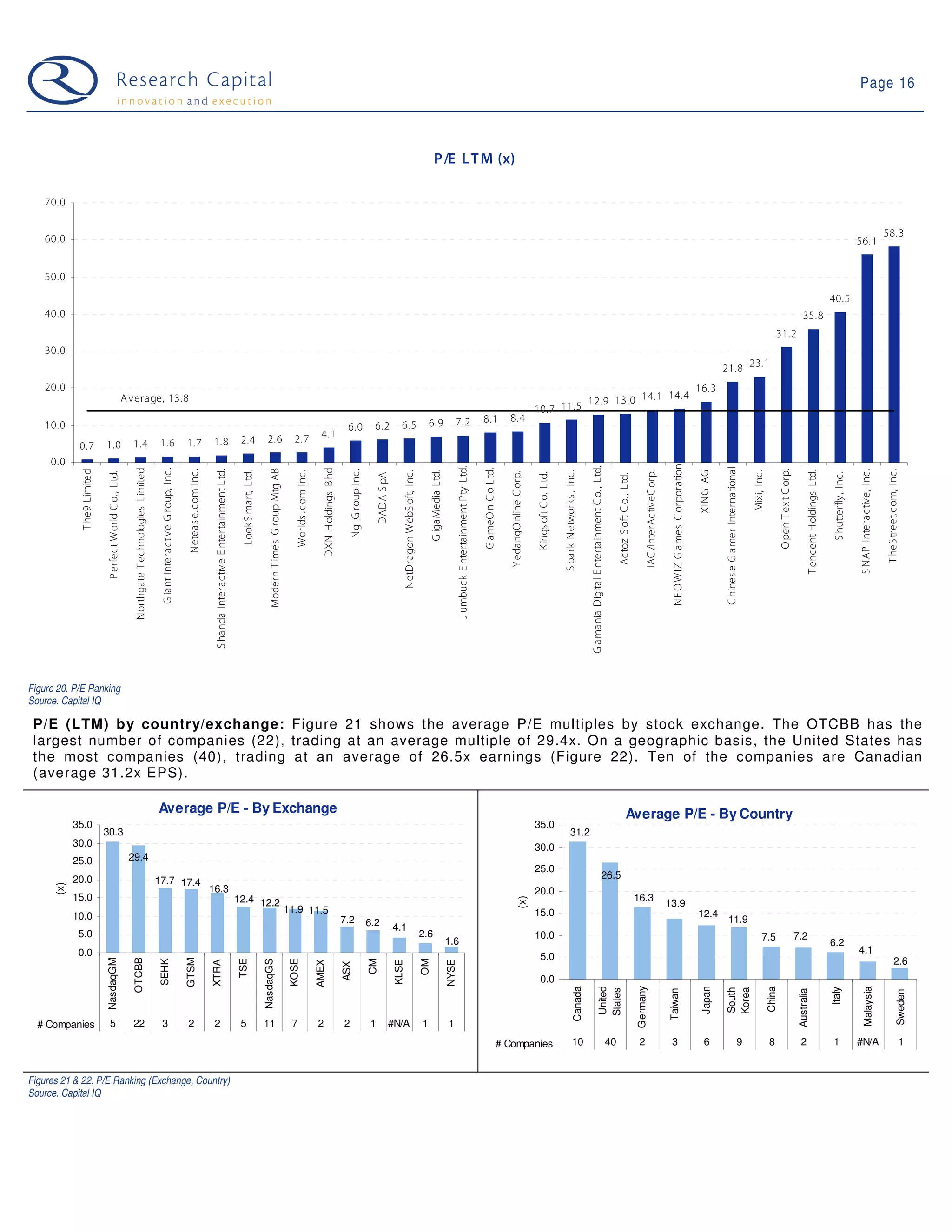

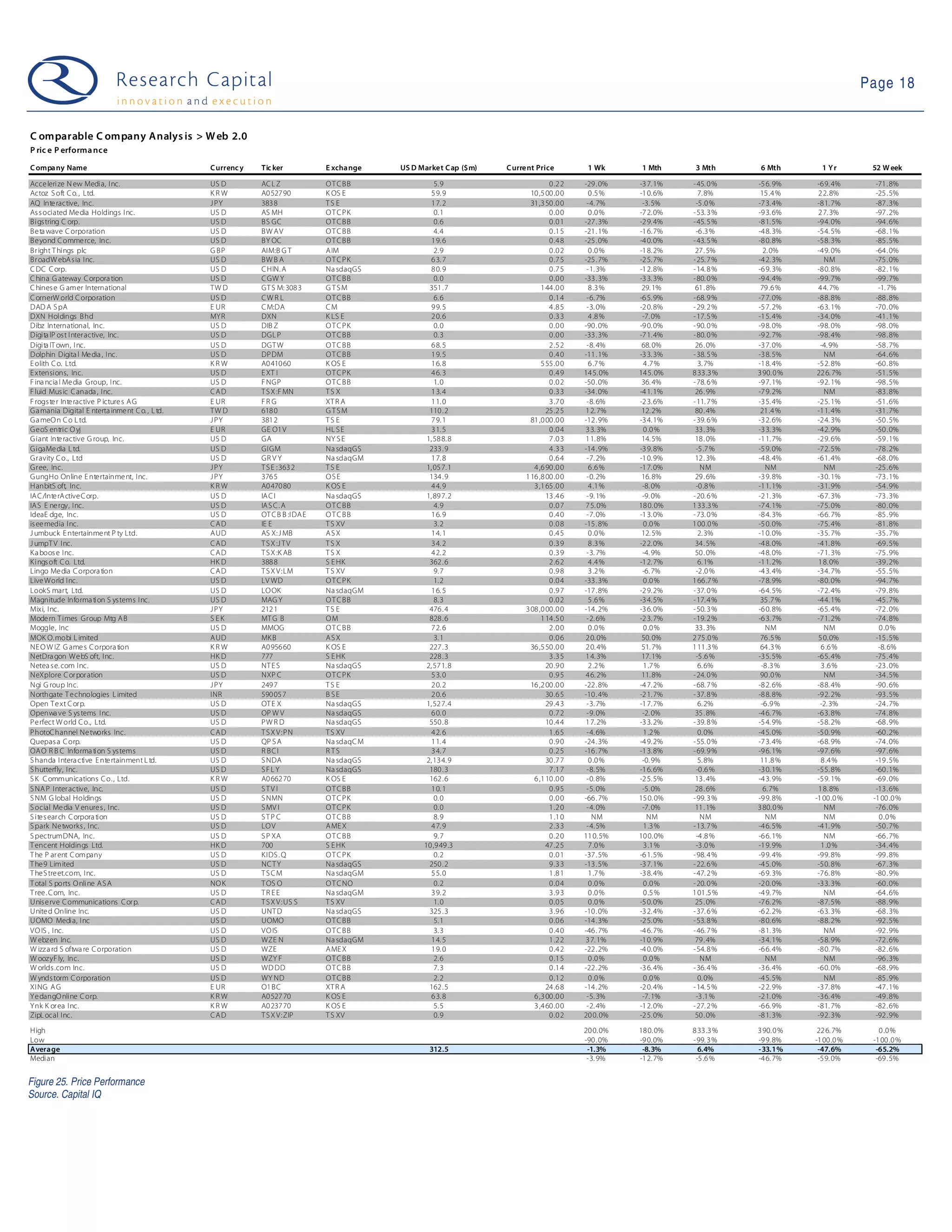

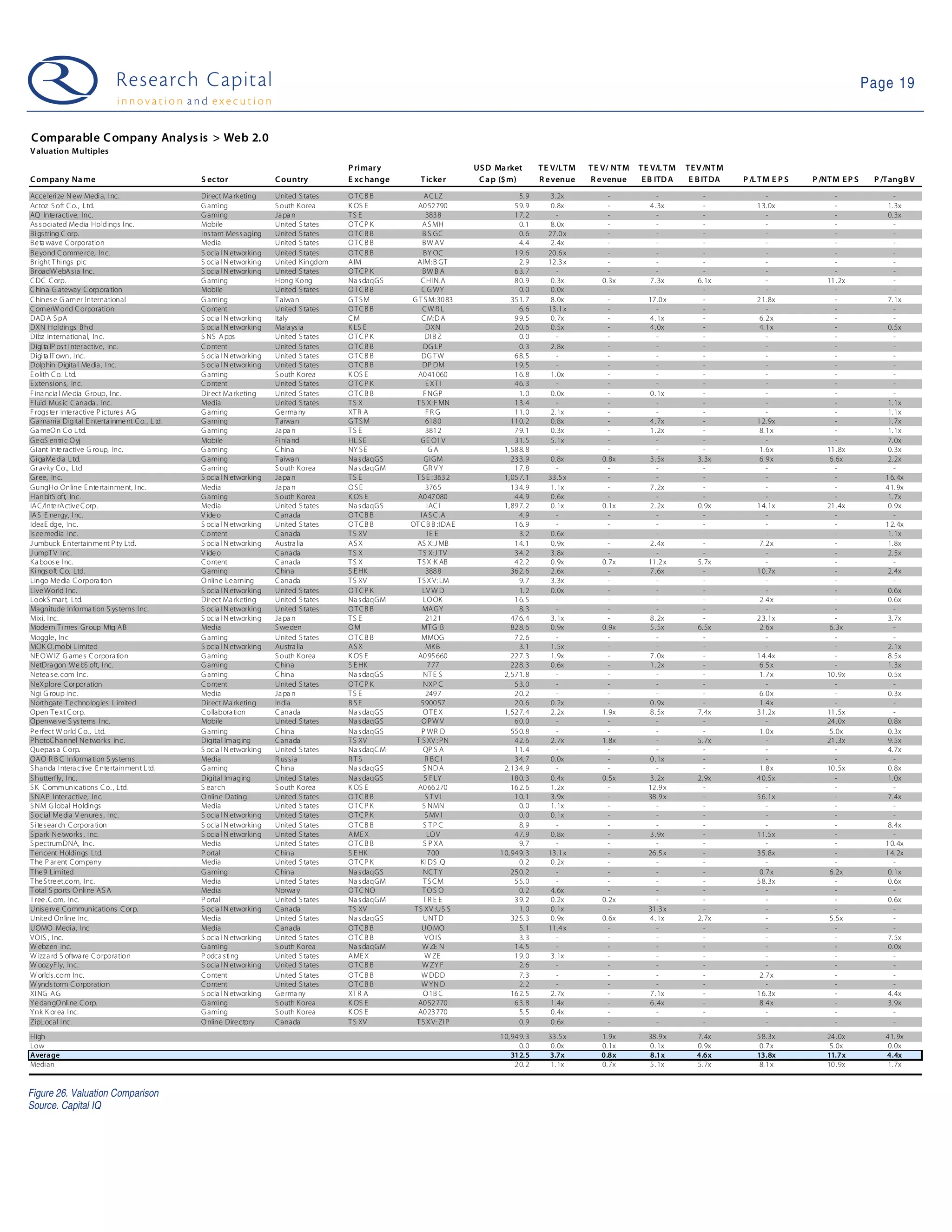

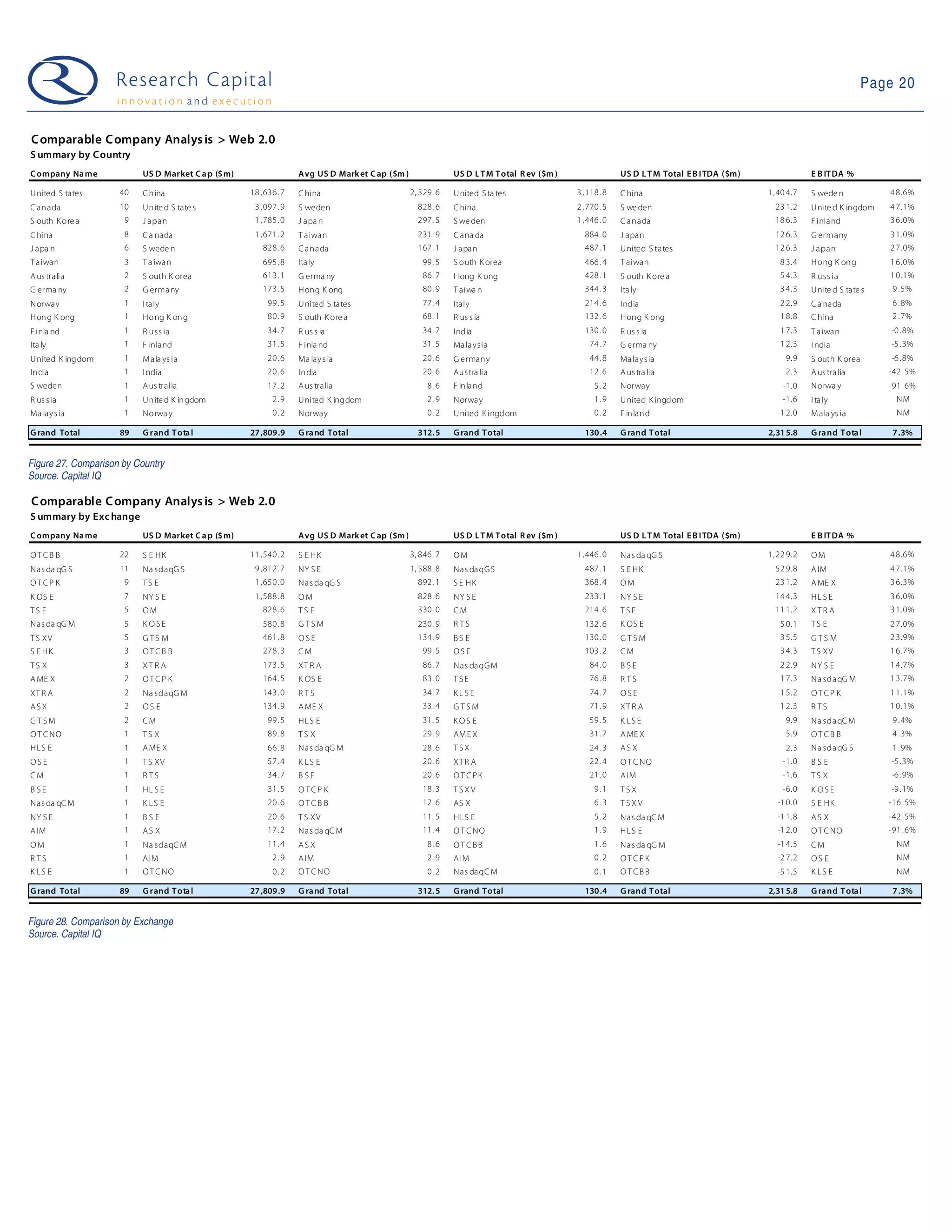

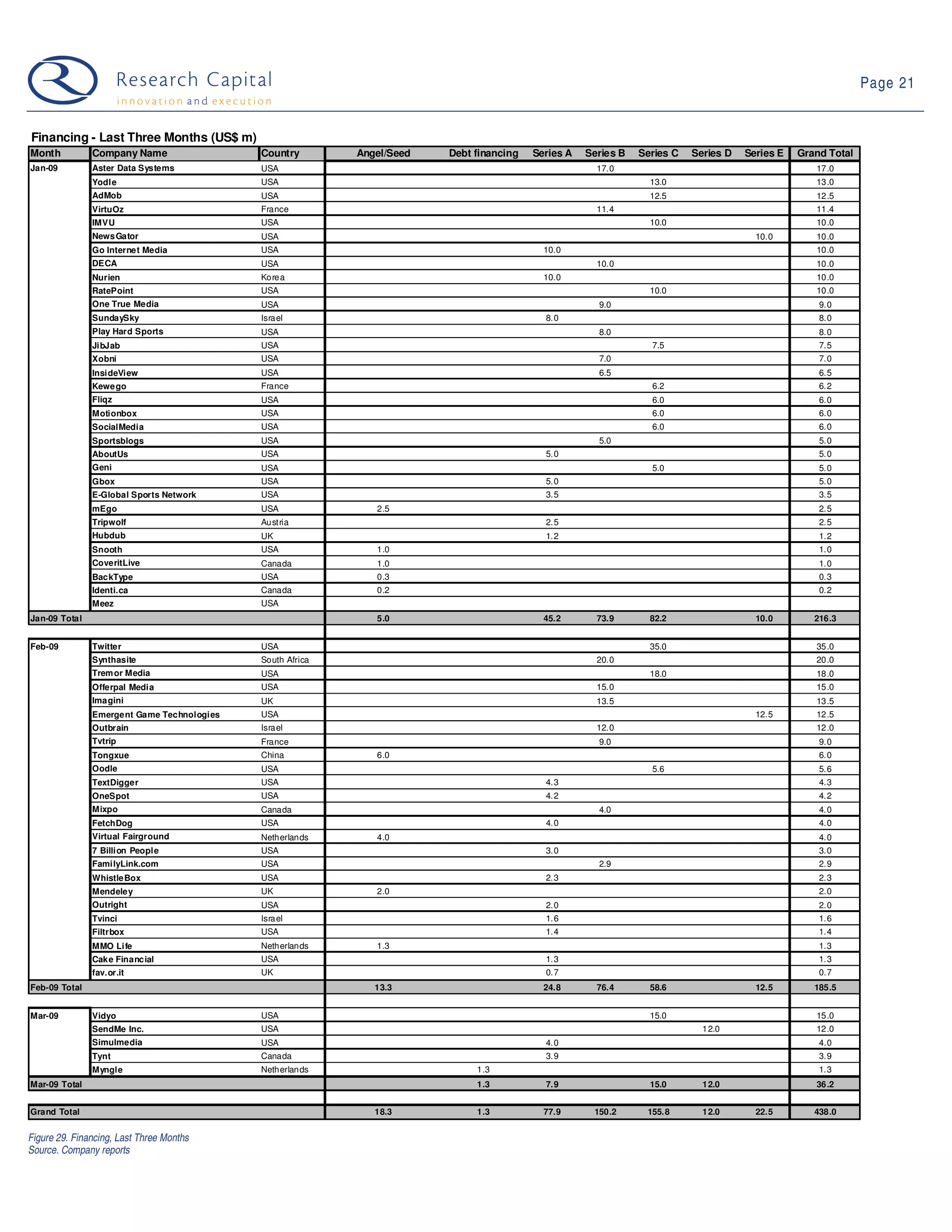

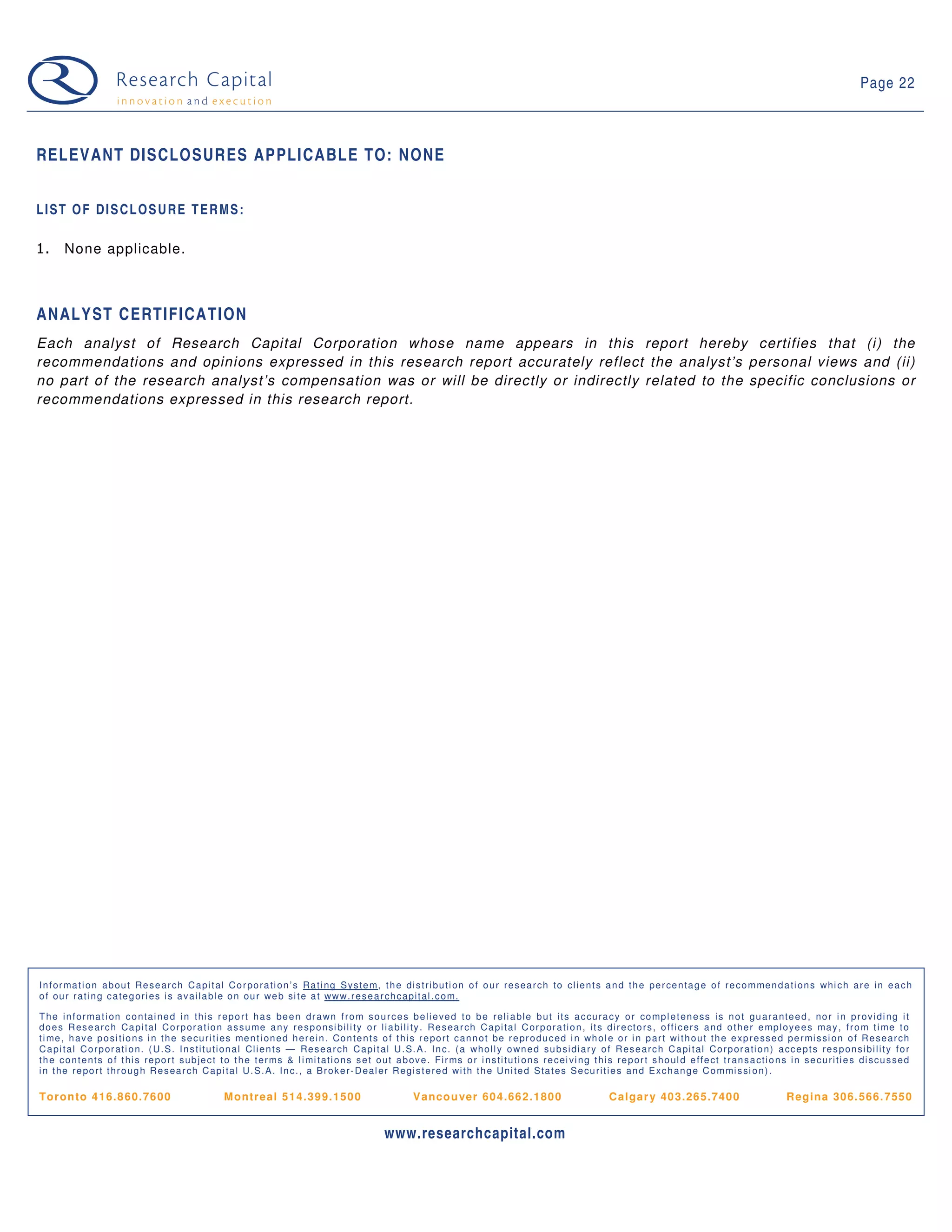

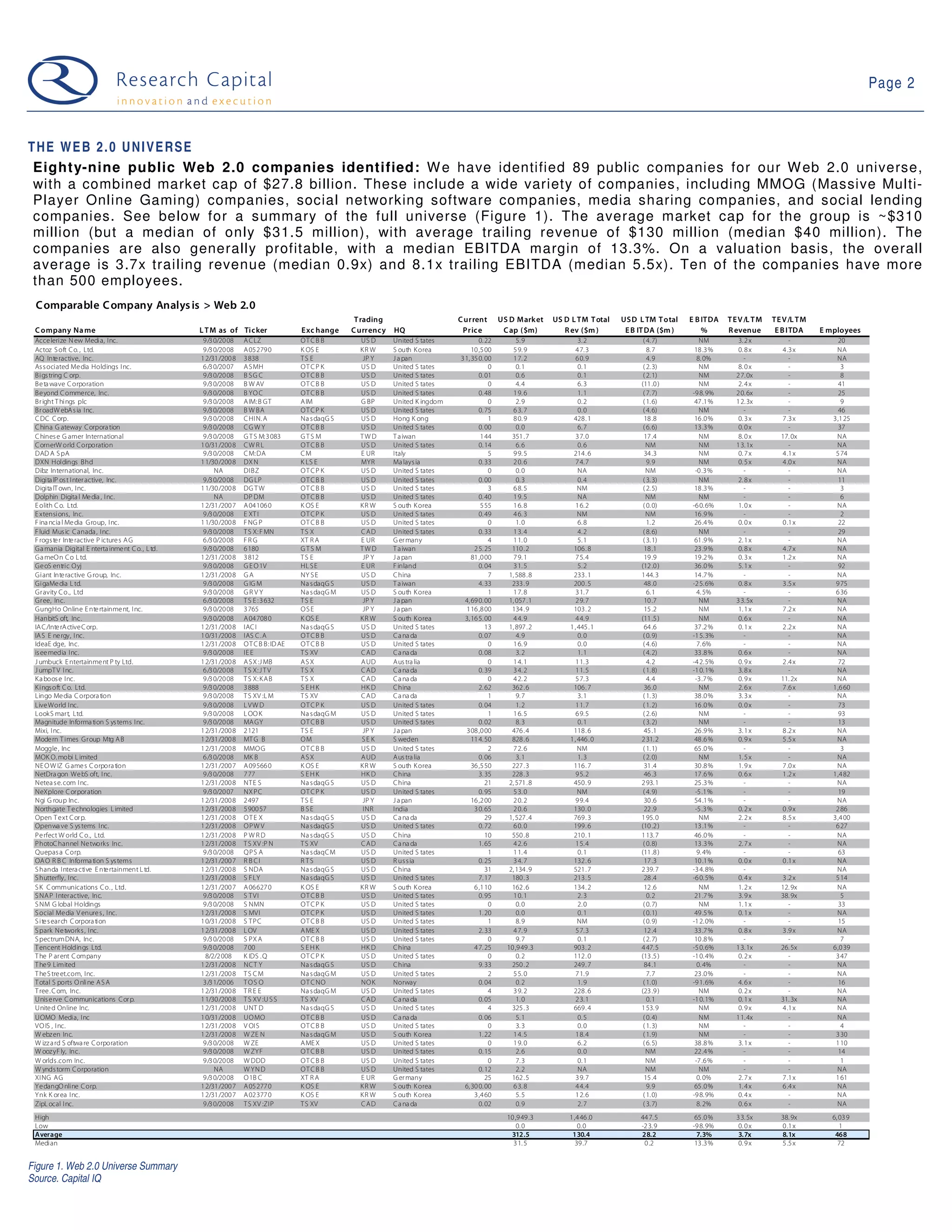

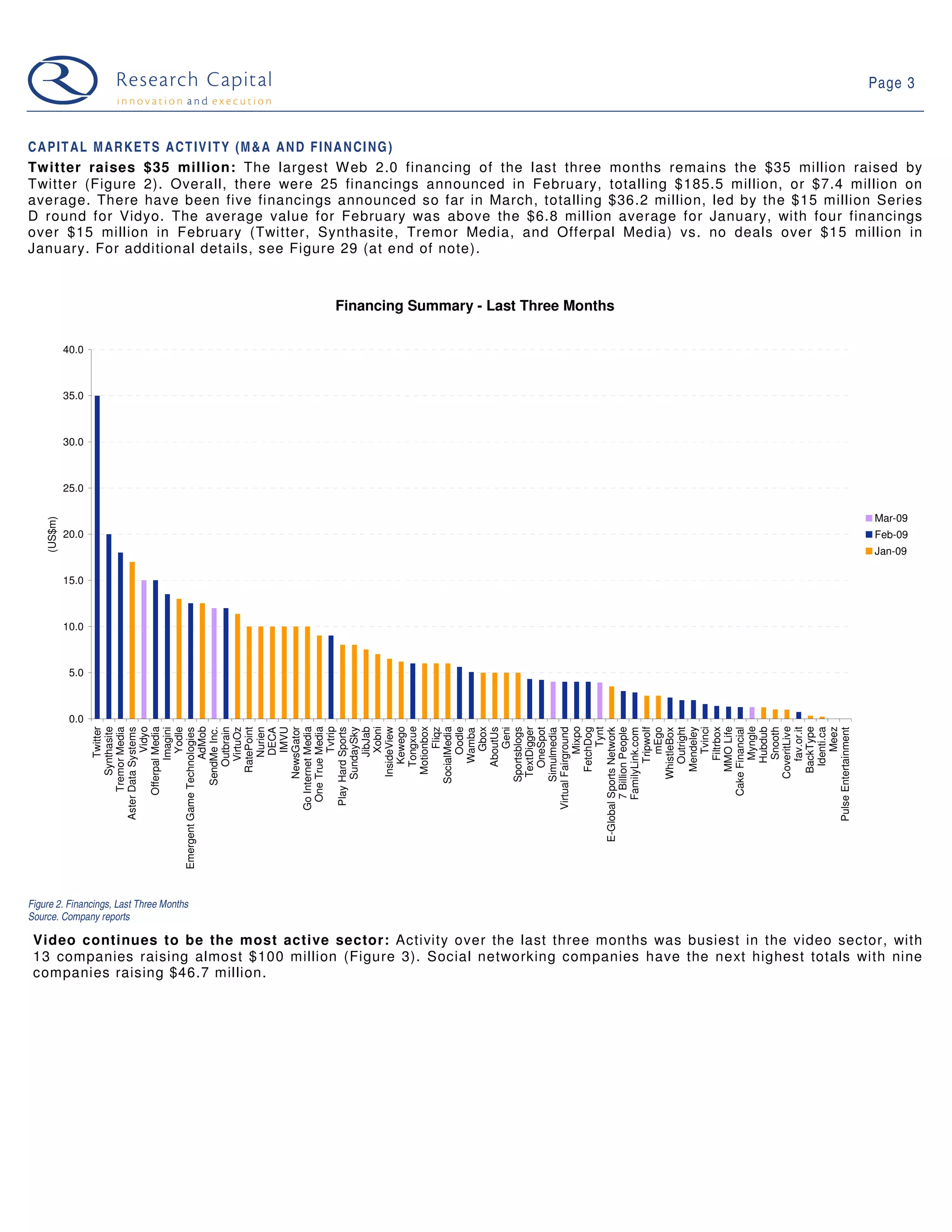

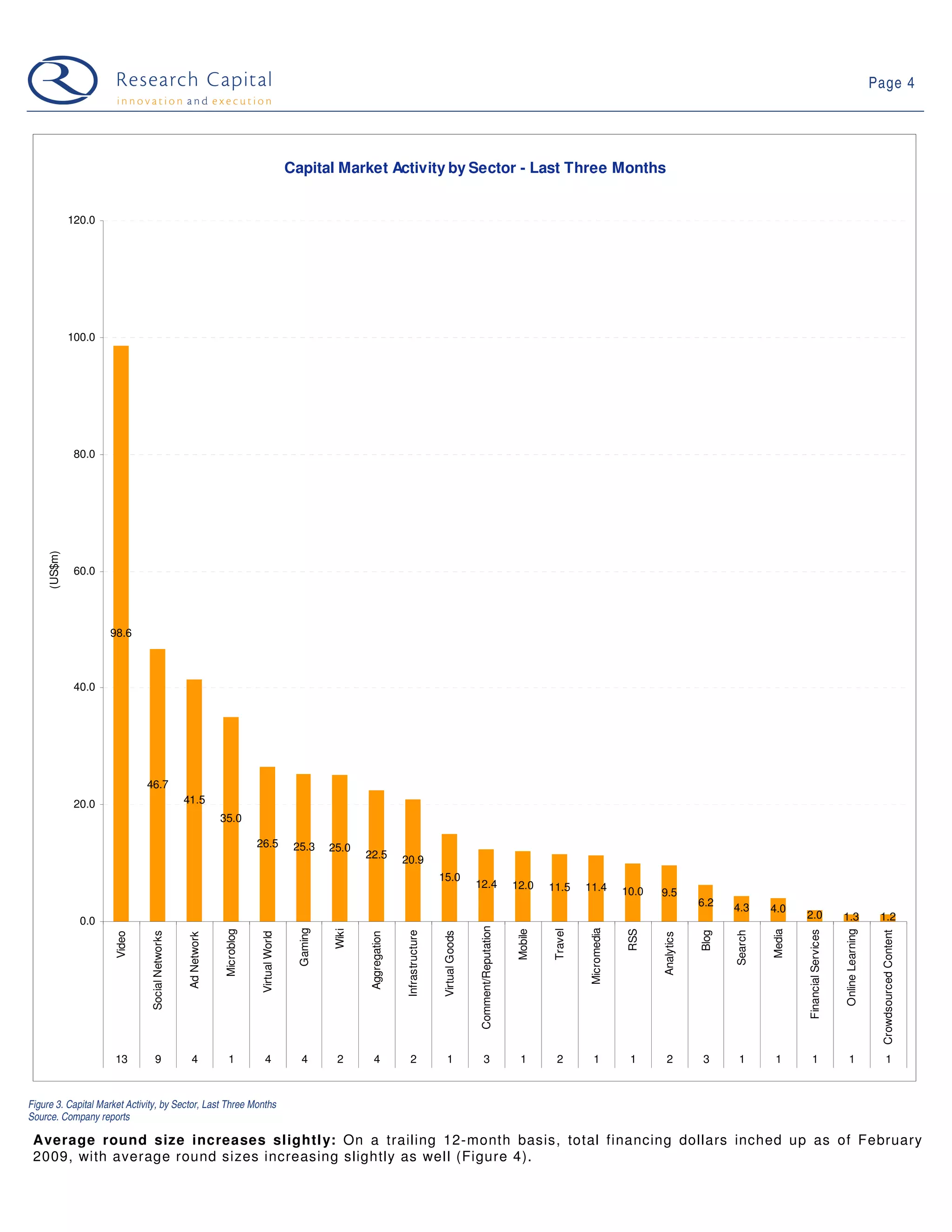

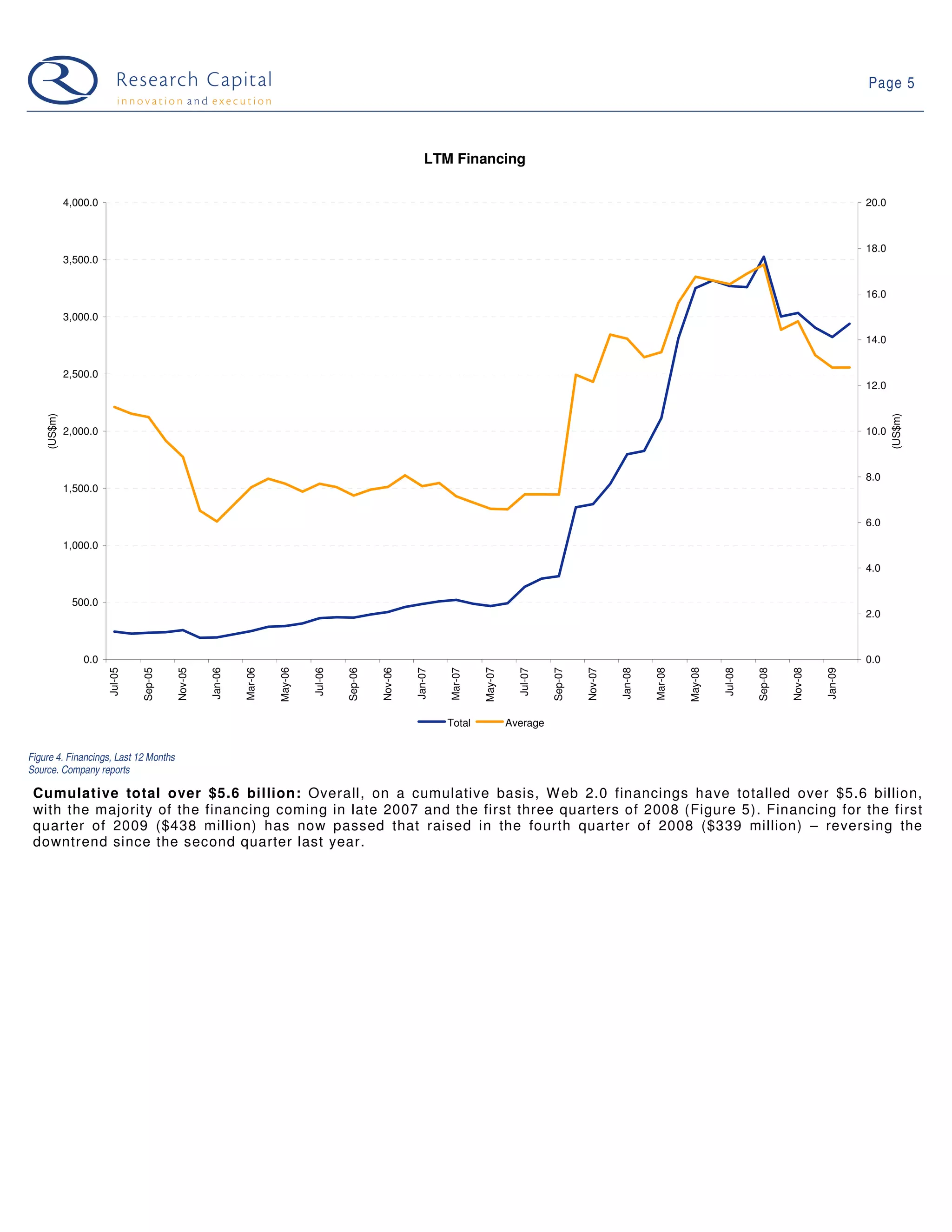

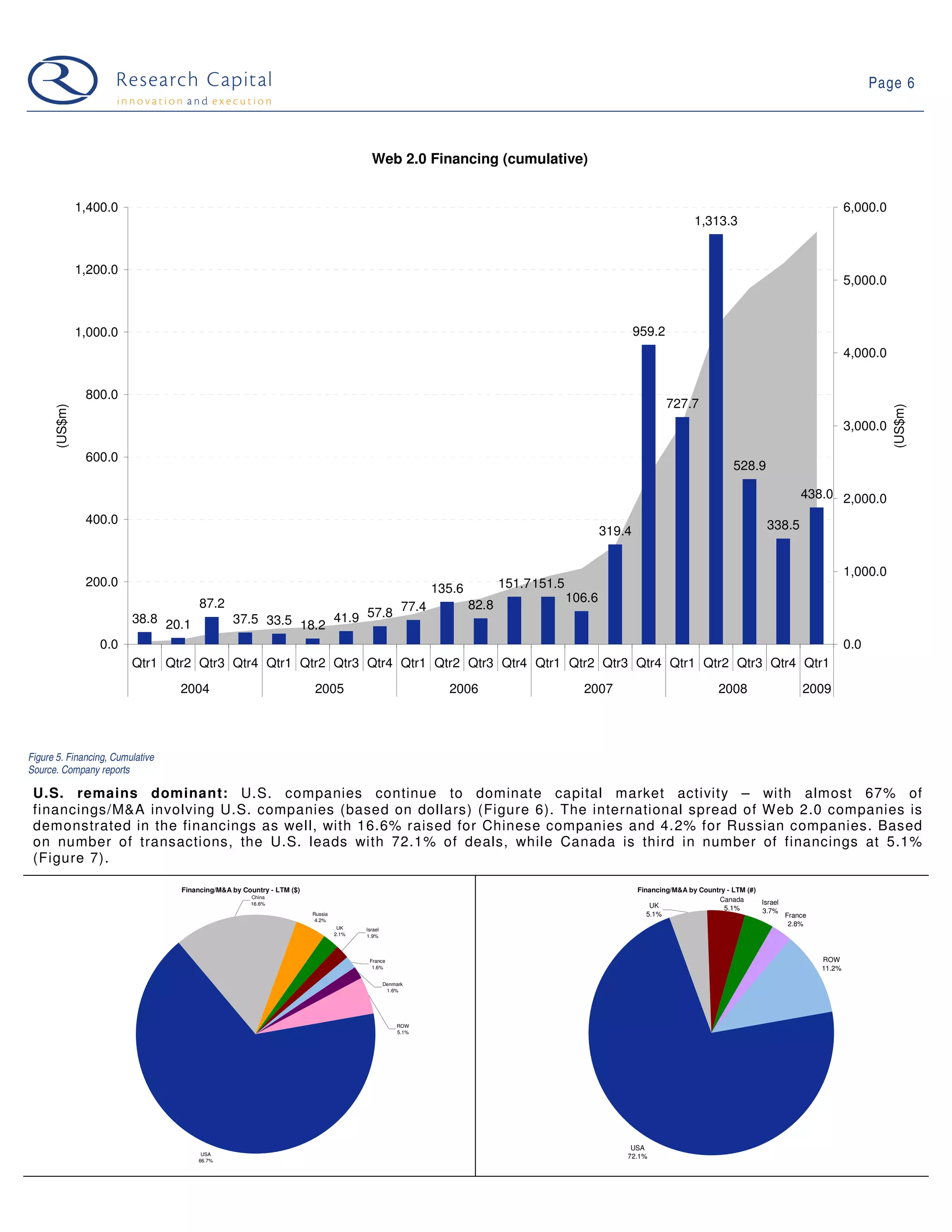

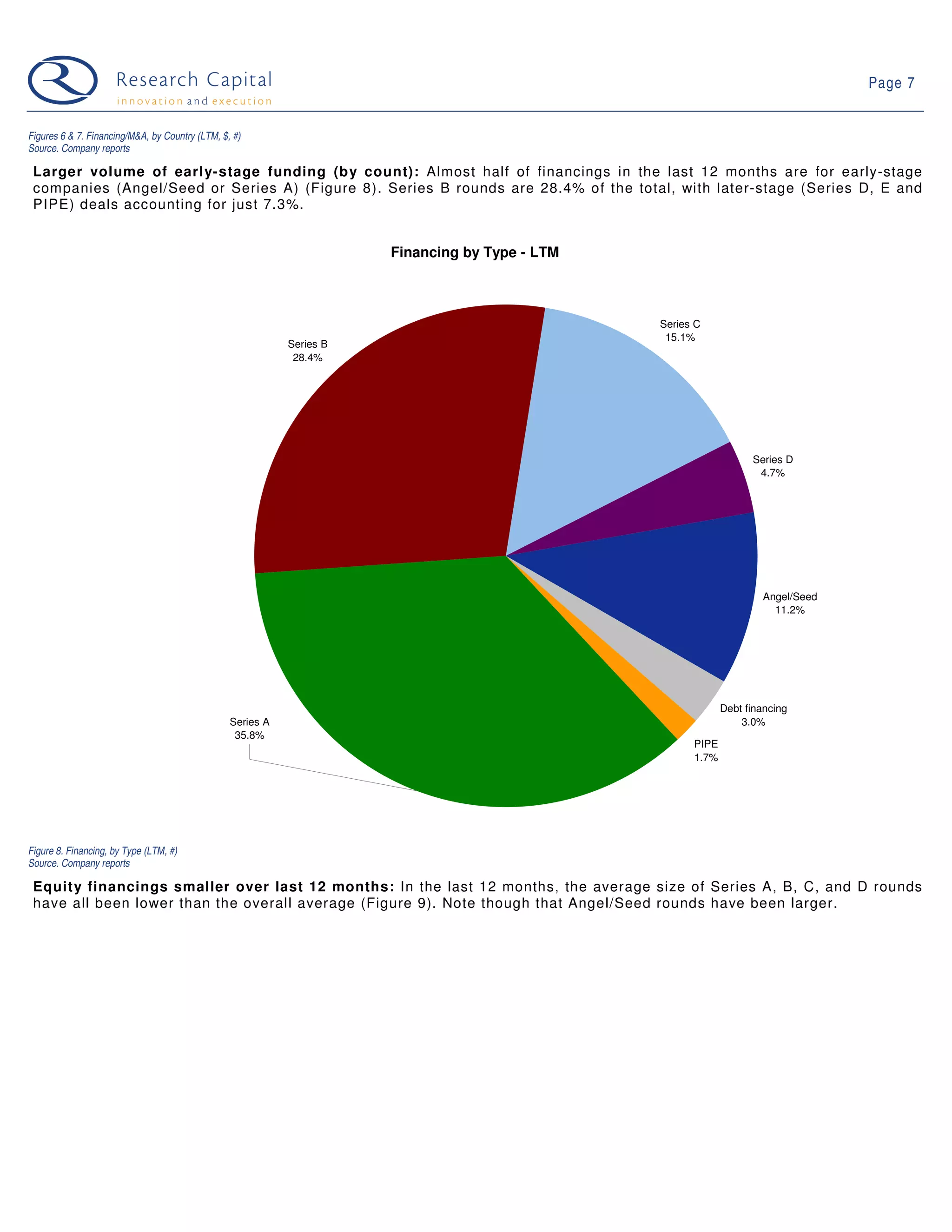

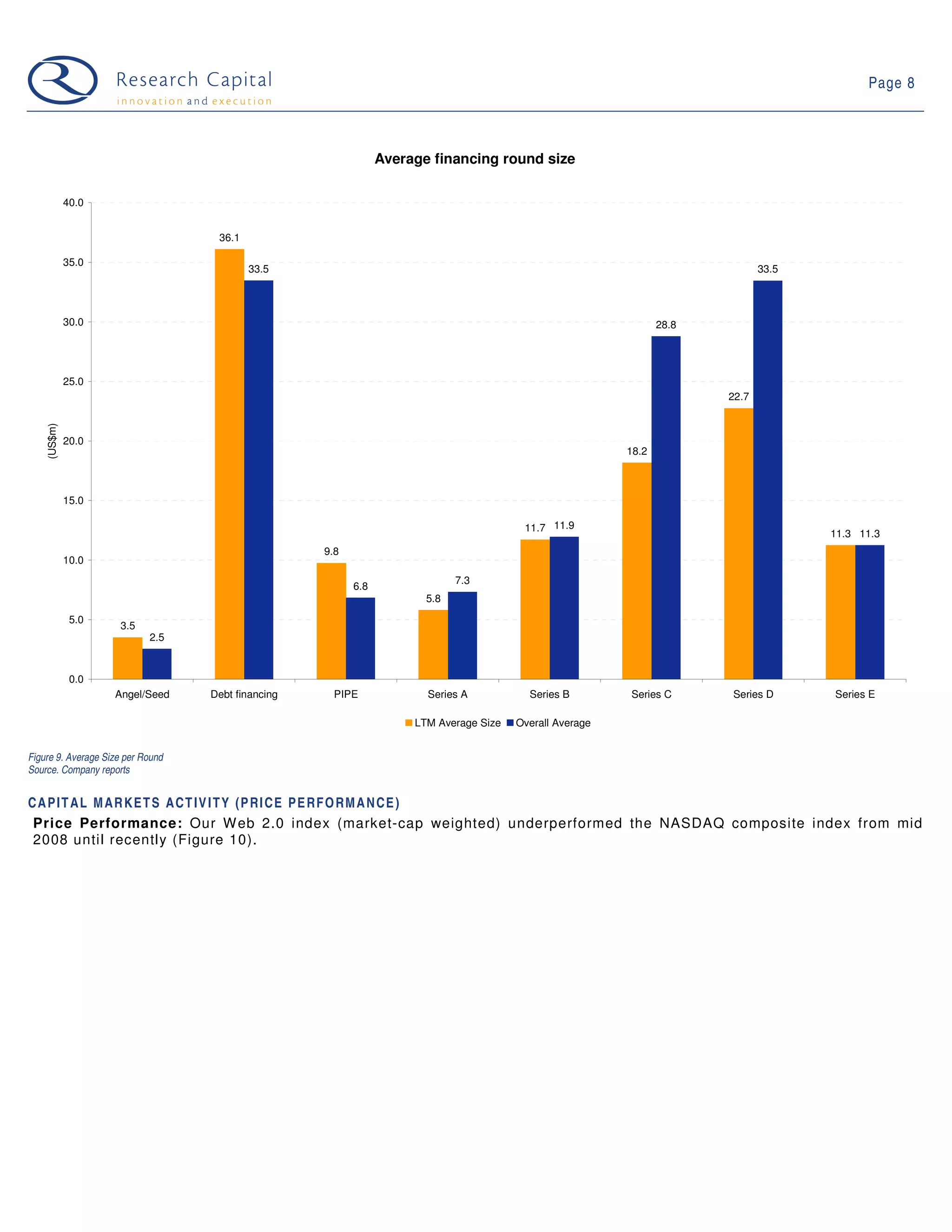

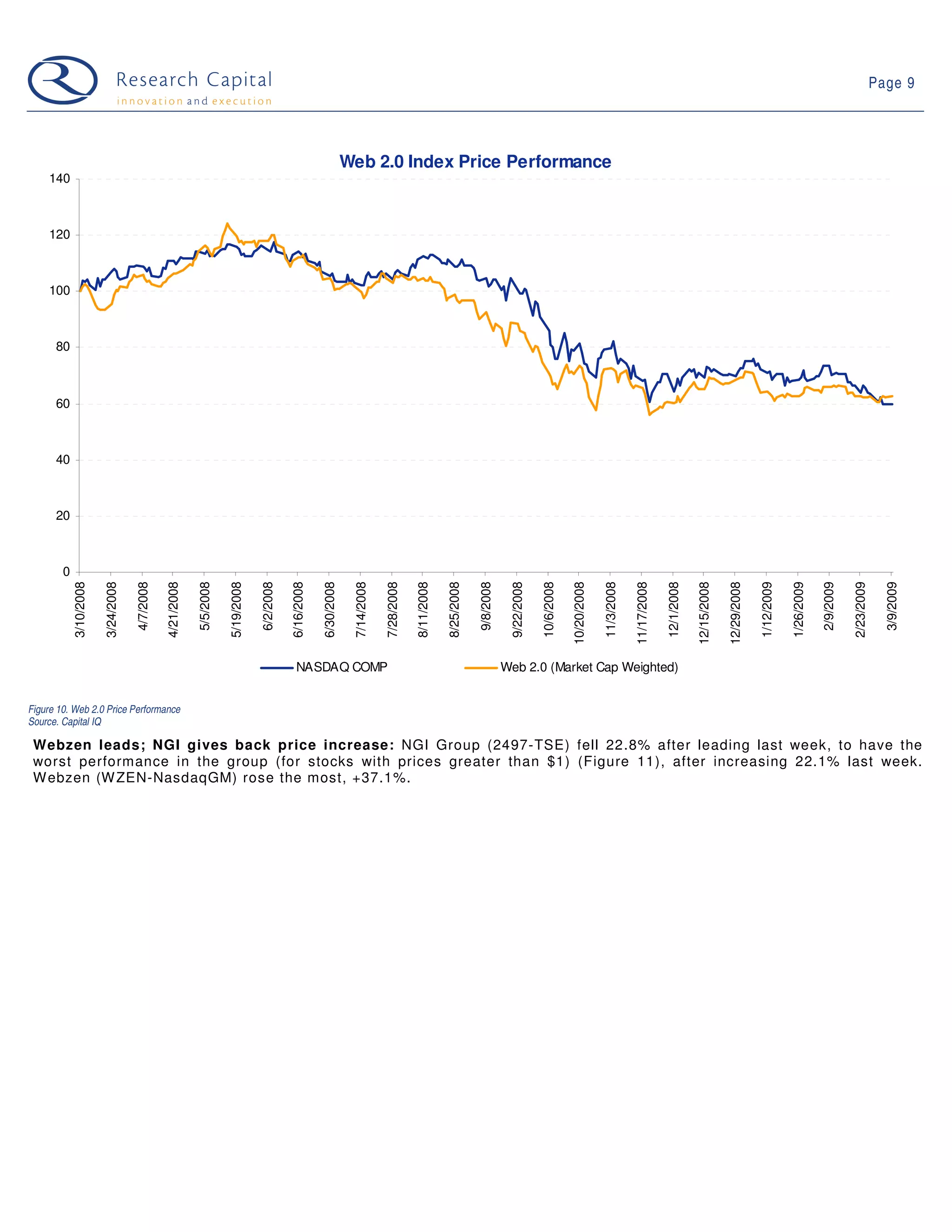

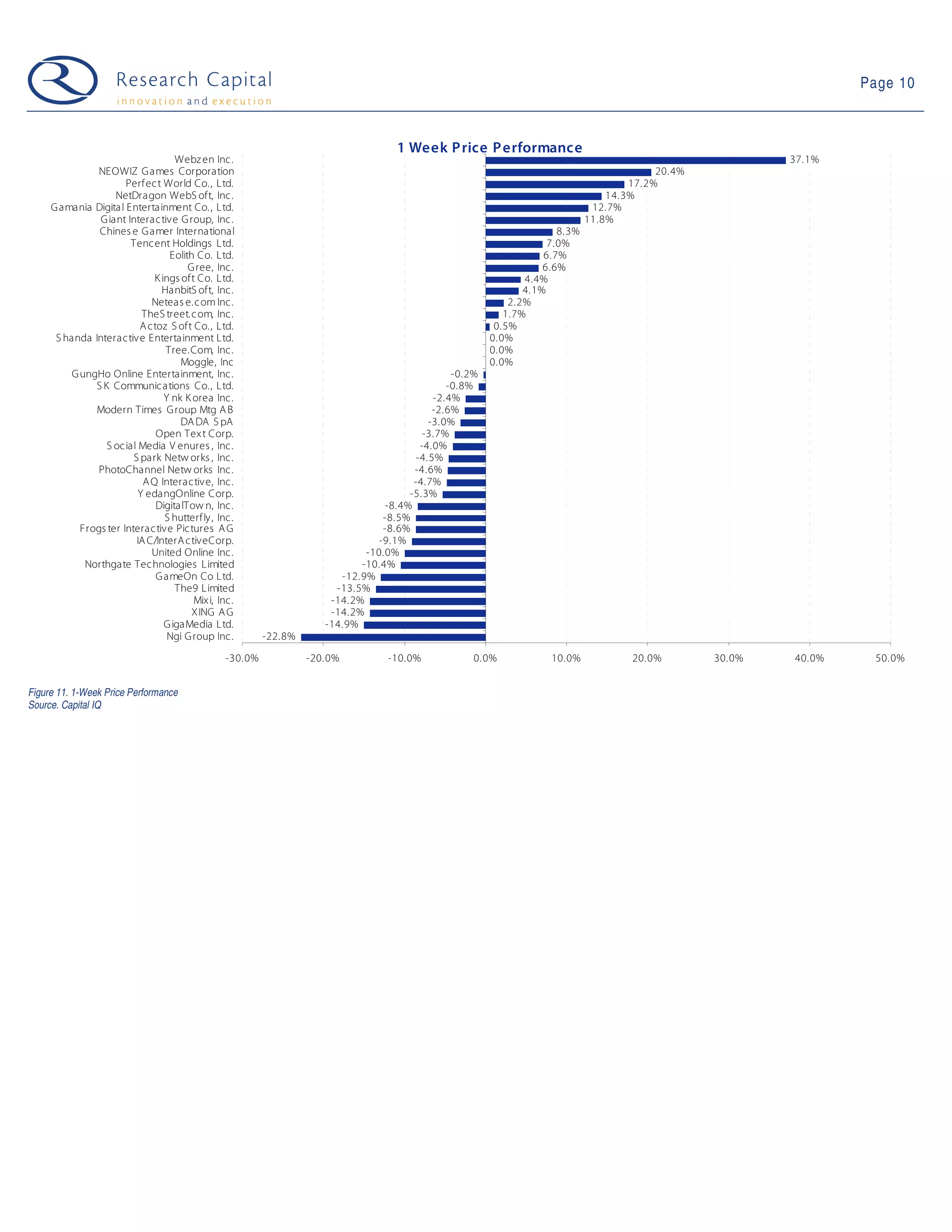

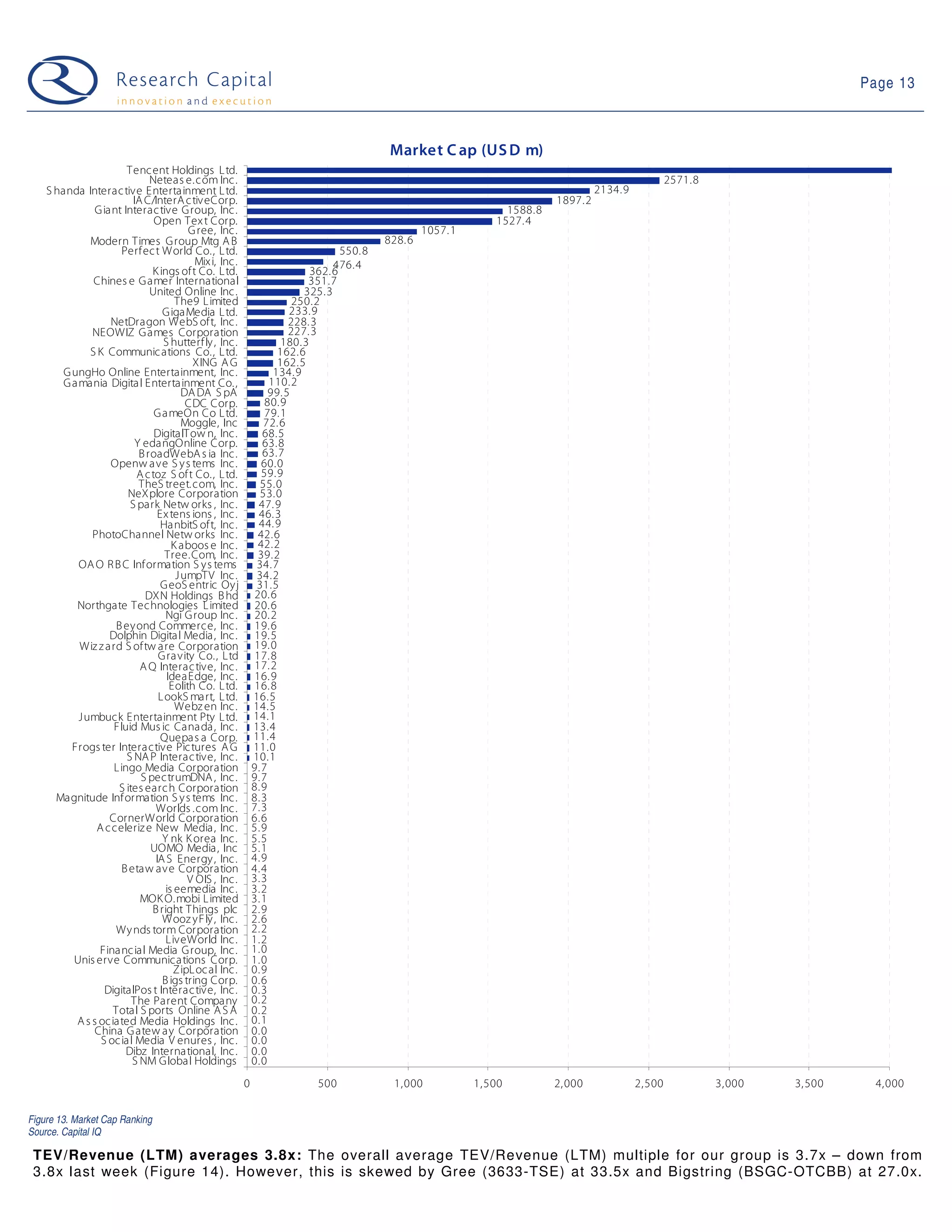

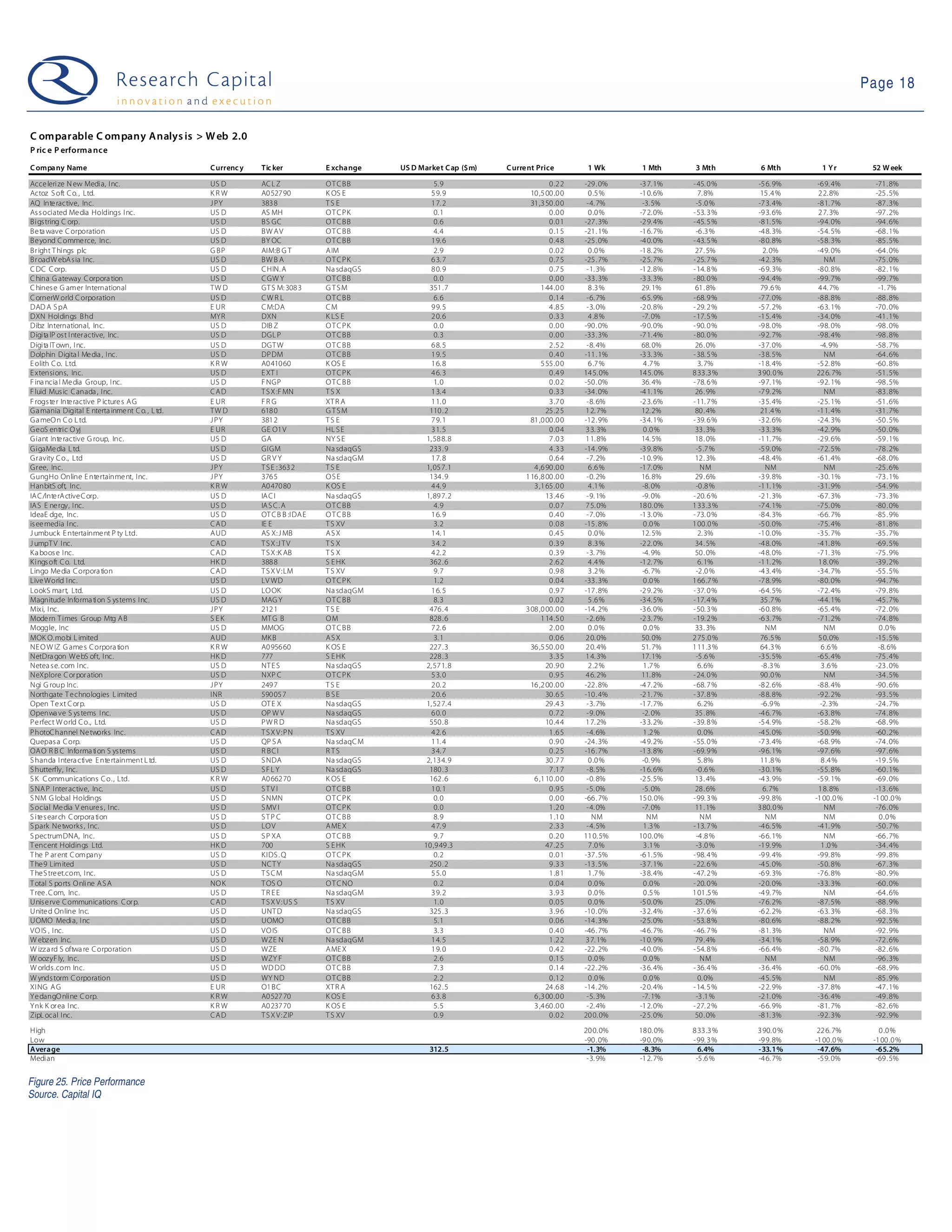

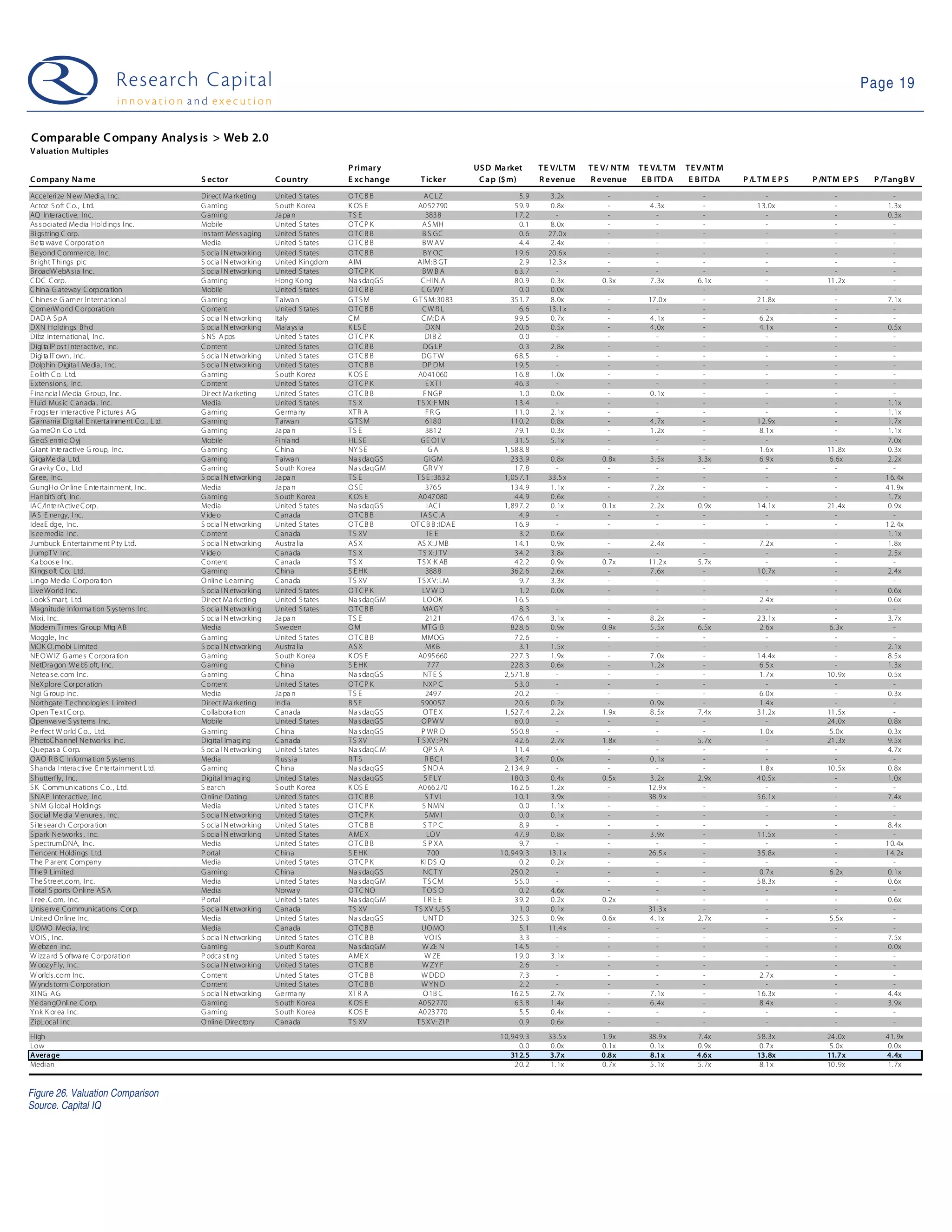

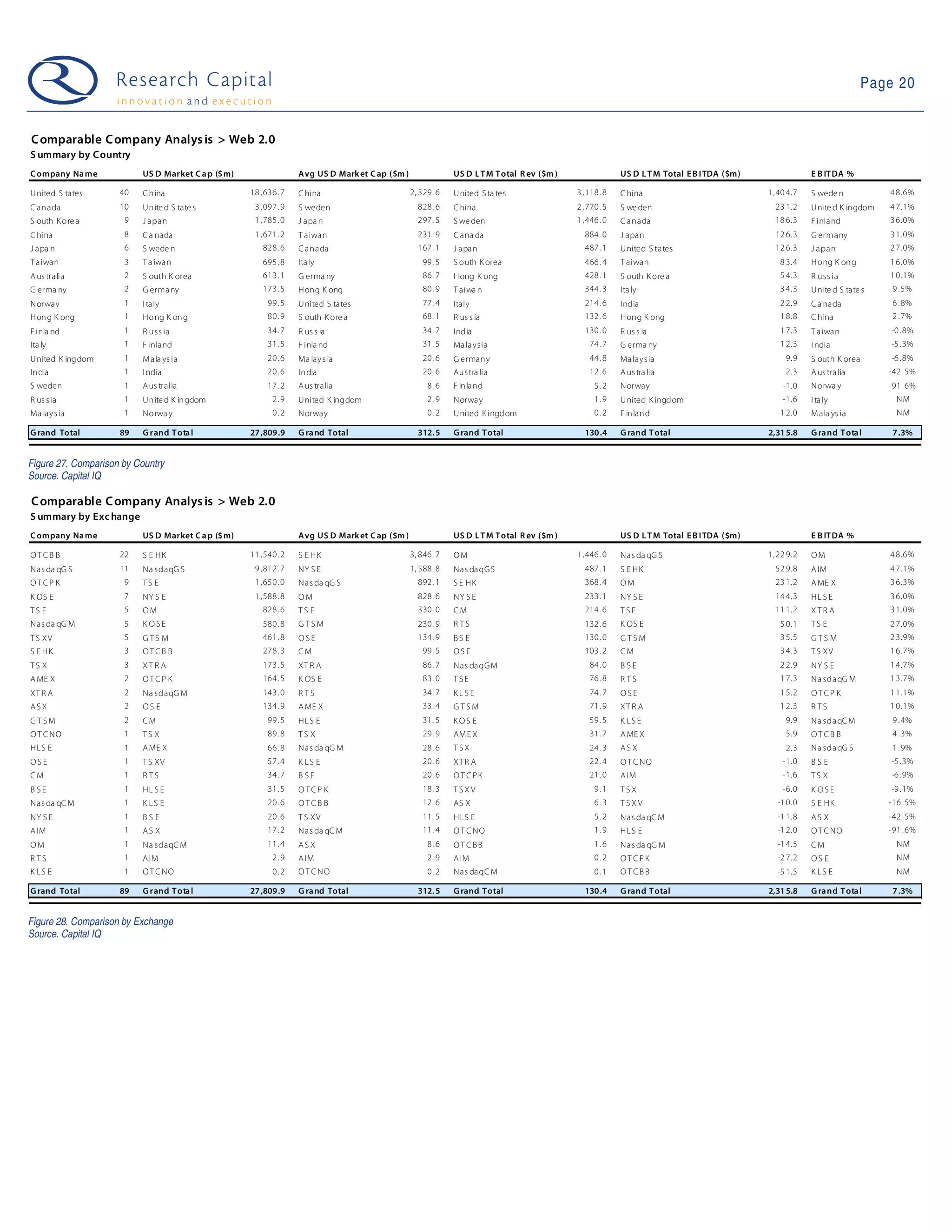

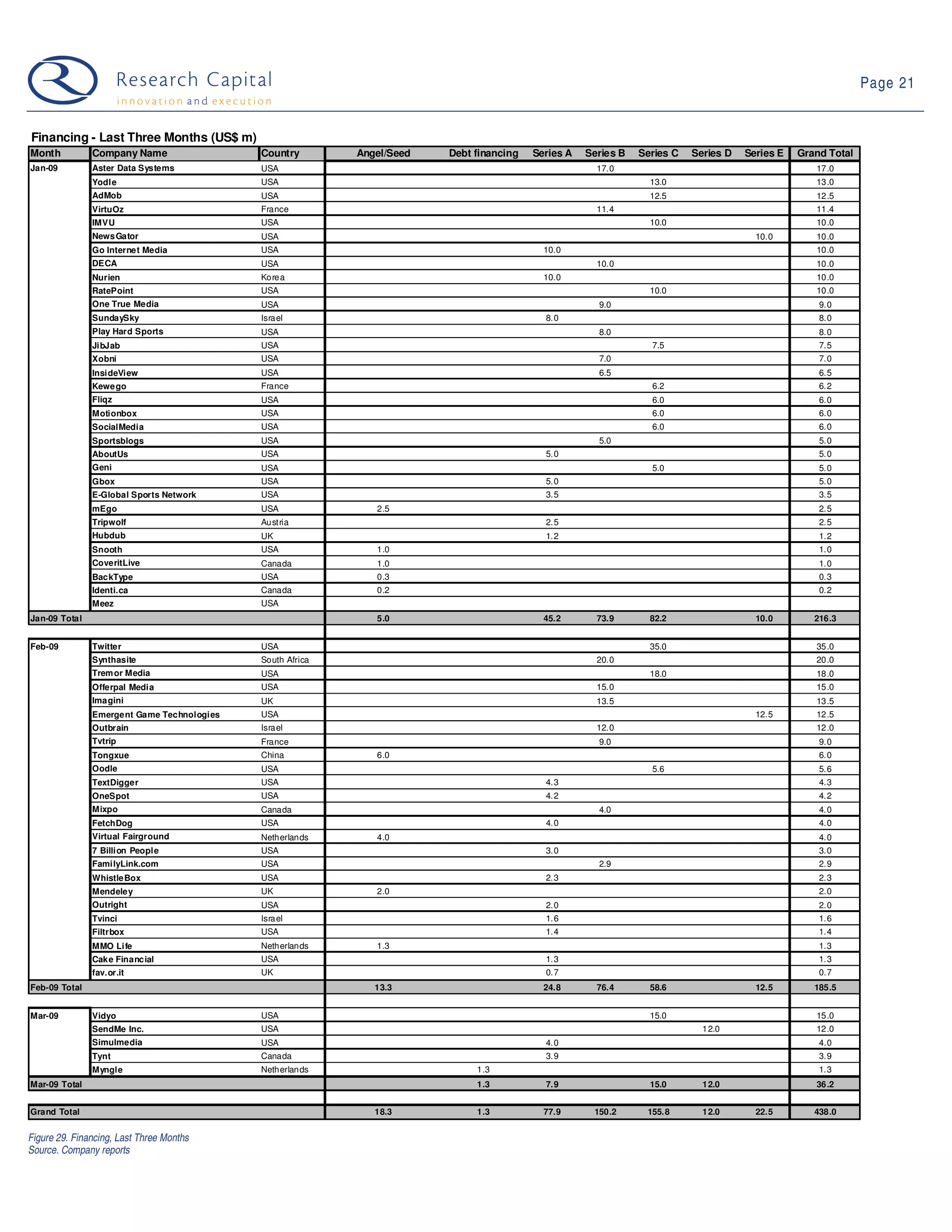

Video companies led financing activity over the last three months, with 13 video companies raising nearly $100 million. Social networking companies were the next most active sector, with nine companies raising $46.7 million. The report identifies 89 public Web 2.0 companies with a combined market cap of $27.8 billion across a variety of sectors including gaming, social networking, media sharing, and social lending.