Q4 2012 Houston Retail Market Research Report

•

1 like•177 views

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Music 4.5 - David Dunn, Managing Partner, Shot Tower

The business model evolution – the interplay between performance and mechanical

A new ecosystem is being shaped by the changes in how music is funded and monetised, the disintermediation between artists and traditional intermediaries, more web generated content, the need for global licenses, and the economics of streaming. How do the changes impact the revenues of artists, record labels, publishers and collection societies?The business model evolution – the interplay between performance and mechanical

The business model evolution – the interplay between performance and mechanical MME 4.5 / Music 4.5 / 2Pears

Find out which jobs you can get with a degree in Non-Destructuve Training and Quality Control. Programs offered at http://www.Spartan.eduSpartan College Non-Destructive Training and Quality Control Program

Spartan College Non-Destructive Training and Quality Control ProgramSpartan College of Aeronautics and Technology

More Related Content

What's hot

Music 4.5 - David Dunn, Managing Partner, Shot Tower

The business model evolution – the interplay between performance and mechanical

A new ecosystem is being shaped by the changes in how music is funded and monetised, the disintermediation between artists and traditional intermediaries, more web generated content, the need for global licenses, and the economics of streaming. How do the changes impact the revenues of artists, record labels, publishers and collection societies?The business model evolution – the interplay between performance and mechanical

The business model evolution – the interplay between performance and mechanical MME 4.5 / Music 4.5 / 2Pears

What's hot (11)

BoyarMiller Forum: Houston Commercial Real Estate Markets 2017 Outlook

BoyarMiller Forum: Houston Commercial Real Estate Markets 2017 Outlook

The business model evolution – the interplay between performance and mechanical

The business model evolution – the interplay between performance and mechanical

SPRING PROPERTY SELLING month-in-review-september-2018-residential

SPRING PROPERTY SELLING month-in-review-september-2018-residential

Viewers also liked

Find out which jobs you can get with a degree in Non-Destructuve Training and Quality Control. Programs offered at http://www.Spartan.eduSpartan College Non-Destructive Training and Quality Control Program

Spartan College Non-Destructive Training and Quality Control ProgramSpartan College of Aeronautics and Technology

Viewers also liked (17)

Q1 2014 Houston Industrial Market Research & Forecast Report

Q1 2014 Houston Industrial Market Research & Forecast Report

Spartan College Non-Destructive Training and Quality Control Program

Spartan College Non-Destructive Training and Quality Control Program

Q4 2012 Houston Medical Office Market Research Report

Q4 2012 Houston Medical Office Market Research Report

VIII FIP de Granada, Nicaragua. Biografía de poetas nicaragüenses

VIII FIP de Granada, Nicaragua. Biografía de poetas nicaragüenses

Similar to Q4 2012 Houston Retail Market Research Report

Similar to Q4 2012 Houston Retail Market Research Report (20)

Q4 2018 | Houston Retail | Research & Forecast Report

Q4 2018 | Houston Retail | Research & Forecast Report

Q3 2017 | Houston Retail | Research & Forecast Report

Q3 2017 | Houston Retail | Research & Forecast Report

Buying Real Estate Notes: The Ultimate Investment Cash Flow

Buying Real Estate Notes: The Ultimate Investment Cash Flow

BoyarMiller Breakfast Forum: The Houston Commercial Real Estate Markets - Wha...

BoyarMiller Breakfast Forum: The Houston Commercial Real Estate Markets - Wha...

More from Colliers International | Houston

The first quarter kicked off what promises to be one of the most transformative years in recent memory for Austin’s industrial real estate market...Q1 2021 | Austin Industrial | Research & Forecast Commericial Real Estate Report

Q1 2021 | Austin Industrial | Research & Forecast Commericial Real Estate ReportColliers International | Houston

More from Colliers International | Houston (20)

Q1 2021 | Austin Industrial | Research & Forecast Commericial Real Estate Report

Q1 2021 | Austin Industrial | Research & Forecast Commericial Real Estate Report

Q4 2020 | Houston Office | Research & Forecast Report

Q4 2020 | Houston Office | Research & Forecast Report

Q3 2020 | Austin Industrial | Research & Forecast Report

Q3 2020 | Austin Industrial | Research & Forecast Report

Q3 2020 | The Woodlands Office | Research Snapshot

Q3 2020 | The Woodlands Office | Research Snapshot

Q3 2020 | Austin Office | Research & Forecast Report

Q3 2020 | Austin Office | Research & Forecast Report

Q3 2020 | Houston Office | Research & Forecast Report

Q3 2020 | Houston Office | Research & Forecast Report

Q2 2020 | The Woodlands Office | Research Snapshot

Q2 2020 | The Woodlands Office | Research Snapshot

Q2 2020 | E Fort Bend Commercial Real Estate Trends

Q2 2020 | E Fort Bend Commercial Real Estate Trends

Mid-Year 2020 | Houston Healthcare | Market Report

Mid-Year 2020 | Houston Healthcare | Market Report

Q2 2020 | Austin Office | Research & Forecast Report

Q2 2020 | Austin Office | Research & Forecast Report

Q1 2020 | Austin Industrial | Research & Forecast Report

Q1 2020 | Austin Industrial | Research & Forecast Report

Recently uploaded

Recently uploaded (20)

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

Call Girls in Anand Vihar Delhi +91 8447779280}Call Girls In Delhi Best in D...

Call Girls in Anand Vihar Delhi +91 8447779280}Call Girls In Delhi Best in D...

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

Call Girls In Seelampur Delhi ↬8447779280}Seelampur Escorts Service In Delhi...

Call Girls In Seelampur Delhi ↬8447779280}Seelampur Escorts Service In Delhi...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 137 Noida (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 137 Noida (Call Girls) Delhi

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

David Litt Foreclosure Specialist - Your Partner in Real Estate Success

David Litt Foreclosure Specialist - Your Partner in Real Estate Success

Retail Center For Sale - 1019 River St., Belleville, WI

Retail Center For Sale - 1019 River St., Belleville, WI

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

Q4 2012 Houston Retail Market Research Report

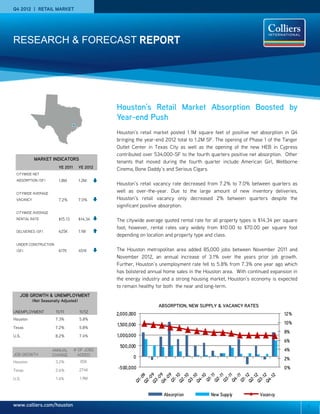

- 1. www.colliers.com/houston Q4 2012 | RETAIL MARKET MARKET INDICATORS YE 2011 YE 2012 CITYWIDE NET ABSORPTION (SF) 1.8M 1.2M CITYWIDE AVERAGE VACANCY 7.2% 7.0% CITYWIDE AVERAGE RENTAL RATE $15.13 $14.34 DELIVERIES (SF) 625K 1.1M UNDER CONSTRUCTION (SF) 617K 451K 1 Houston’s Retail Market Absorption Boosted by Year-end Push Houston’s retail market posted 1.1M square feet of positive net absorption in Q4 bringing the year-end 2012 total to 1.2M SF. The opening of Phase 1 of the Tanger Outlet Center in Texas City as well as the opening of the new HEB in Cypress contributed over 534,000-SF to the fourth quarters positive net absorption. Other tenants that moved during the fourth quarter include American Girl, Wellborne Cinema, Bone Daddy’s and Serious Cigars. Houston’s retail vacancy rate decreased from 7.2% to 7.0% between quarters as well as over-the-year. Due to the large amount of new inventory deliveries, Houston’s retail vacancy only decreased 2% between quarters despite the significant positive absorption. The citywide average quoted rental rate for all property types is $14.34 per square foot; however, rental rates vary widely from $10.00 to $70.00 per square foot depending on location and property type and class. The Houston metropolitan area added 85,000 jobs between November 2011 and November 2012, an annual increase of 3.1% over the years prior job growth. Further, Houston’s unemployment rate fell to 5.8% from 7.3% one year ago which has bolstered annual home sales in the Houston area. With continued expansion in the energy industry and a strong housing market, Houston’s economy is expected to remain healthy for both the near and long-term. ABSORPTION, NEW SUPPLY & VACANCY RATES RESEARCH & FORECAST REPORT 0% 2% 4% 6% 8% 10% 12% -500,000 0 500,000 1,000,000 1,500,000 2,000,000 Absorption New Supply Vacancy JOB GROWTH & UNEMPLOYMENT (Not Seasonally Adjusted) UNEMPLOYMENT 11/11 11/12 Houston 7.3% 5.8% Texas 7.2% 5.8% U.S. 8.2% 7.4% JOB GROWTH ANNUAL CHANGE # OF JOBS ADDED Houston 3.2% 85K Texas 2.6% 274K U.S. 1.4% 1.9M

- 2. RESEARCH & FORECAST REPORT | Q4 2012 | HOUSTON RETAIL MARKET 2 Rental Rates The citywide average quoted rental rate increased from $14.30 to $14.34 per SF NNN between quarters and decreased from $15.13 over the year. Class A in-line retail rental rates vary widely due to location and center type. Recent quoted rates for unanchored strip centers range from $20.00 - $35.00 per SF (Class B and below can rent for $12.00 to $20.00 per SF) while power centers with three or more strong anchors range from $10.00 - $35.00 per SF. Lifestyle centers and newly constructed strip centers in Class A locations such as High Street, Uptown Park and The Vintage range from $40.00 - $70.00 per SF. Vacancy & Availability Houston’s retail vacancy decreased from 7.2% to 7.0% in the fourth quarter. By product type on a quarterly basis, outlet centers posted the largest vacancy rate decrease from 10.1% to 7.8%, 230 basis points. Strip centers, neighborhood centers and theme/ entertainment vacancy rates remained unchanged between quarters. Houston’s retail construction pipeline contains 451,000 SF, of which approximately 31% is pre-leased. Fourth quarter deliveries totaled 756,000 SF. Absorption & Demand Houston’s retail market posted 1.1M SF of positive net absorption in the fourth quarter bringing the year-end total to 1.2M SF. The opening of Phase 1 of the Tanger Outlet Center in Texas City as well as the opening of the new HEB in Cypress contributed over 534,000 SF to the fourth quarters positive net absorption. Other notable tenants that moved into their space during the fourth quarter include: Academy Sports, Kroger, LA Fitness, and Thrift Outlet as seen in the table to the right. HOUSTON RETAIL MARKET STATISTICAL SUMMARY Q4 2012 ABSORPTION Tenant SF Occupied Tanger Outlet Center – Ph1 350,000 HEB 184,083 Academy Sports 72,979 Kroger 48,501 LA Fitness 45,000 Thrift Outlet 26,402 99¢ Store 18,119 American Girl 17,685 Wellborne Cinema 15,180 Ogle School 11,468 JB’s Multi Events 10,300 Velvet Restaurant 8,878 Bone Daddy’s 7,000 Serious Cigars 7,000 Rentable Area Direct Vacant SF Direct Vacancy Rate Sublet Vacant SF Sublet Vacancy Rate Total Vacant SF Total Vacancy Rate Q4 2012 Net Absorption 2012 YTD Net Absorption Class A Rental Rates (in-line)* Strip Centers (unanchored) 31,381,269 3,247,523 10.3% 22,951 0.1% 3,270,474 10.4% 35,161 (89,158) $20.00-$35.00 Neighborhood Centers (one anchor) 68,820,507 7,301,626 10.6% 156,600 0.2% 7,458,226 10.8% 115,789 (335,197) $20.00-$32.00 Community Centers (two anchors) 40,772,147 2,548,743 6.3% 128,071 0.3% 2,676,814 6.6% 125,930 212,540 $15.00-$30.00 Power Centers (3 or more anchors) 20,297,712 874,797 4.3% 71,190 0.4% 945,987 4.7% 93,299 361,102 $10.00-$35.00 Lifestyle Centers 4,618,124 275,217 6.0% - 0.0% 275,217 6.0% 9,509 44,237 $40.00-$70.00 Outlet Centers 1,573,627 122,006 7.8% - 0.0% 122,006 7.8% 351,610 353,673 N/A Theme/Entertainment 653,840 224,804 34.4% - 0.0% 224,804 34.4% - - $25.00-$35.00 Single-Tenant 63,079,142 1,491,177 2.4% 33,660 0.1% 1,524,837 2.4% 364,472 444,792 N/A Malls 29,487,935 1,770,164 6.0% 58,539 0.2% 1,828,703 6.2% 31,304 164,400 N/A Greater Houston 260,684,303 17,856,057 6.8% 471,011 0.2% 18,327,068 7.0% 1,127,074 1,156,389

- 3. RESEARCH & FORECAST REPORT | Q4 2012 | HOUSTON RETAIL MARKET SALES ACTIVITY Houston retail investment sales activity included 72 recorded transactions with a total dollar volume of approximately $115.4M, averaging $116 per SF with an average capitalization rate of 8.7%. Some of the more significant transactions that closed during the fourth quarter include: Becar Venture purchased the 68,780- SF West Loop Plaza from Cathay Bank in December for $9.9M. The neighborhood center located in the Inner Loop River Oaks submarket was 100% leased at the time of sale and was purchased as an investment. Golfsmith and Mattress Giant are the centers anchor tenants. RioCan REIT purchased the 180,000-SF Louetta Central Shopping Center located in the North/Spring Creek submarket from URDANG & RCG Ventures in November for $26M. Major tenants in the center include Michaels, Famous Footwear, and Kohl’s. First Washington Realty purchased the 125,200-SF Woodlands Crossing Shopping Center from Realm Realty in December for $43.2M. The neighborhood center located in The Woodlands and Montgomery County submarket was purchased as an investment. Some of the centers major tenants include Trader Joe’s, Ace Hardware, 24 Hour Fitness, and PETCO. West Houston Retail LLC purchased a 4-property portfolio from Satya, Inc. for approximately $15.8M in November. The portfolio included four strip centers totaling 71,374-SF and were located in Richmond, Cypress and Houston, TX. The portfolio was purchased as an investment. Some of the tenants in the centers include Quick Weight Loss, Subway, New York Pizzeria, and State Farm. LEASING ACTIVITY Houston retail leasing activity for fourth quarter 2012 totaled 841,061-SF in 323 transactions compared to 346 transactions totaling 866,000-SF one year ago. Overall, transactions under 10,000 SF comprised the largest group of retail leases, with the market recording only nine leases over 10,000- SF and two over 20,000-SF in the fourth quarter. 3 RETAIL SALE TRANSACTIONS West Loop Plaza1 3005-3115 West Loop South, Houston, TX Inner Loop River Oaks Ret Submarket RBA: 68,780 SF Built: 2006 Buyer: Becar Venture Seller: Cathay Bank Sale Date: December 5, 2012 Sales Price: $9.9M Sales Price PSF: $144 Woodlands Crossing 10864-10868 Kuykendahl Rd., The Woodlands, TX Montgomery County Ret Submarket RBA: 125,200 SF Built: 2012 Buyer: First Washington Realty Seller: Realm Realty Sale Date: December 19, 2012 Sales Price: $43.2M Sales Price PSF: $345 1Colliers International Transaction Building name/address Submarket Tenant Lease date Point Nasa Shopping Center NASA/Clear Lake 47,900 Conn's Oct-12 Cypress Landing Shopping Center NorthBelt/Greensoint 28,193 Gold's Gym Dec-12 Pasadena Town Plaza Near Southeast 20,558 Goodwill Nov-12 Fondren Southwest Village Southwest 16,579 Palais Royal Oct-12 Westheimer Commons West/Far West 14,500 Shoe Carnival Oct-12 Meadow Park Shopping Center Southeast Outlier 14,000 Family Dollar Oct-12 Cypress Station Square Far North 13,400 Davita Dialysis Nov-12 Pasadena Town Plaza Near Southeast 8,702 Anna's Linens Nov-12 Cypress Station Shopping Center North FM 1960/I-45 7,344 The Pour House Oct-12 Village Green Shopping Center West/Far West 5,900 Snooker 147 Oct-12 908 Congress CBD 5,400 Batanga Restaurant Oct-12 West Loop Market Center Inner Loop/River Oaks 4,700 S Factor Oct-12 River Oaks Shopping Center Inner Loop/River Oaks 4,375 J. Jill Oct-12 SF Q4 2012 Top Retail Leases

- 4. RESEARCH & FORECAST REPORT | Q4 2012 | HOUSTON RETAIL MARKET Accelerating success. COLLIERS INTERNATIONAL | HOUSTON 1300 Post Oak Boulevard Suite 200 Houston, Texas 77056 Main +1 713 222 2111 4COLLIERS INTERNATIONAL | P. LISA R. BRIDGES Director of Market Research Houston Direct +1 713 830 2125 Fax +1 713 830 2118 lisa.bridges@colliers.com