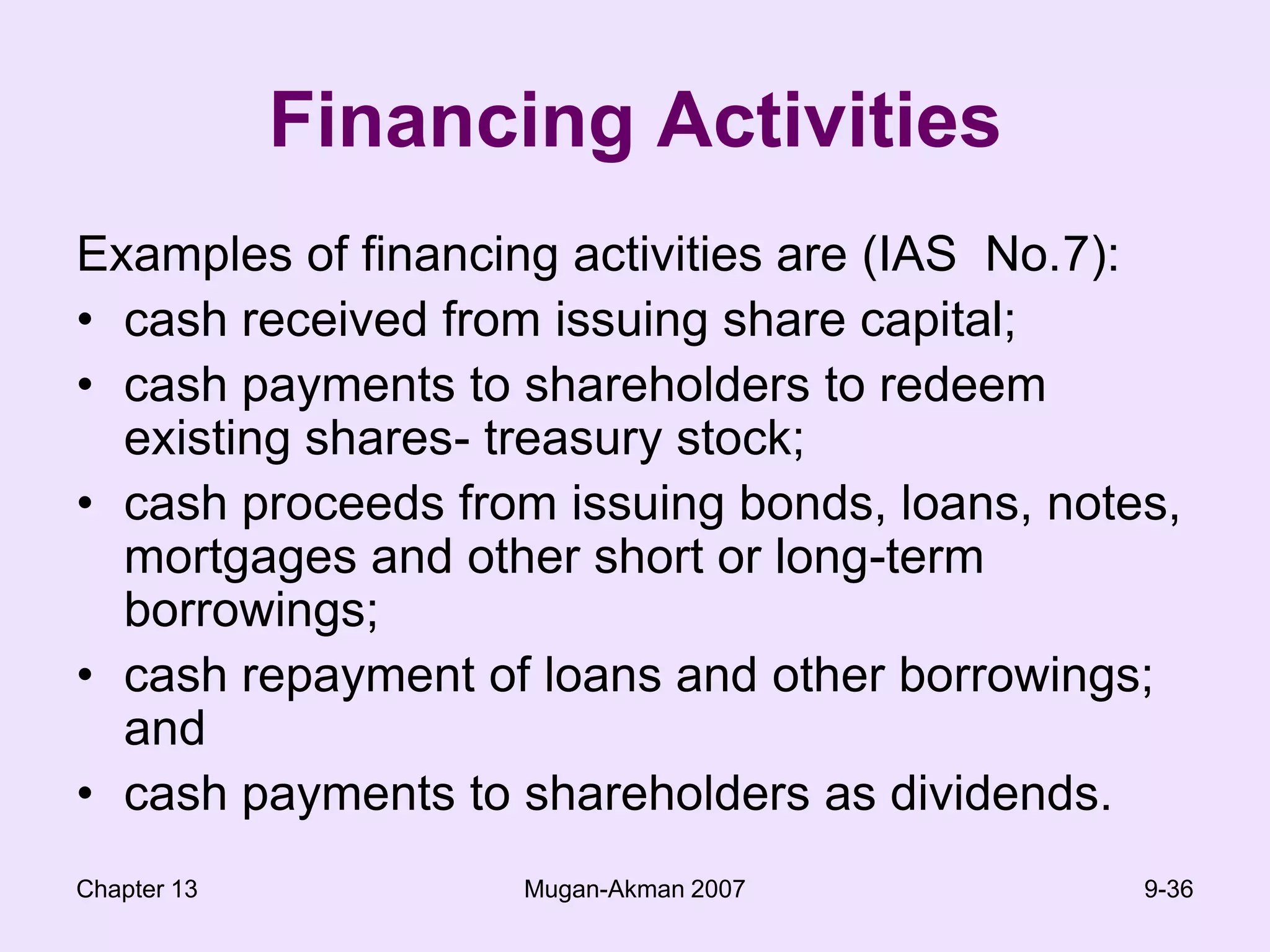

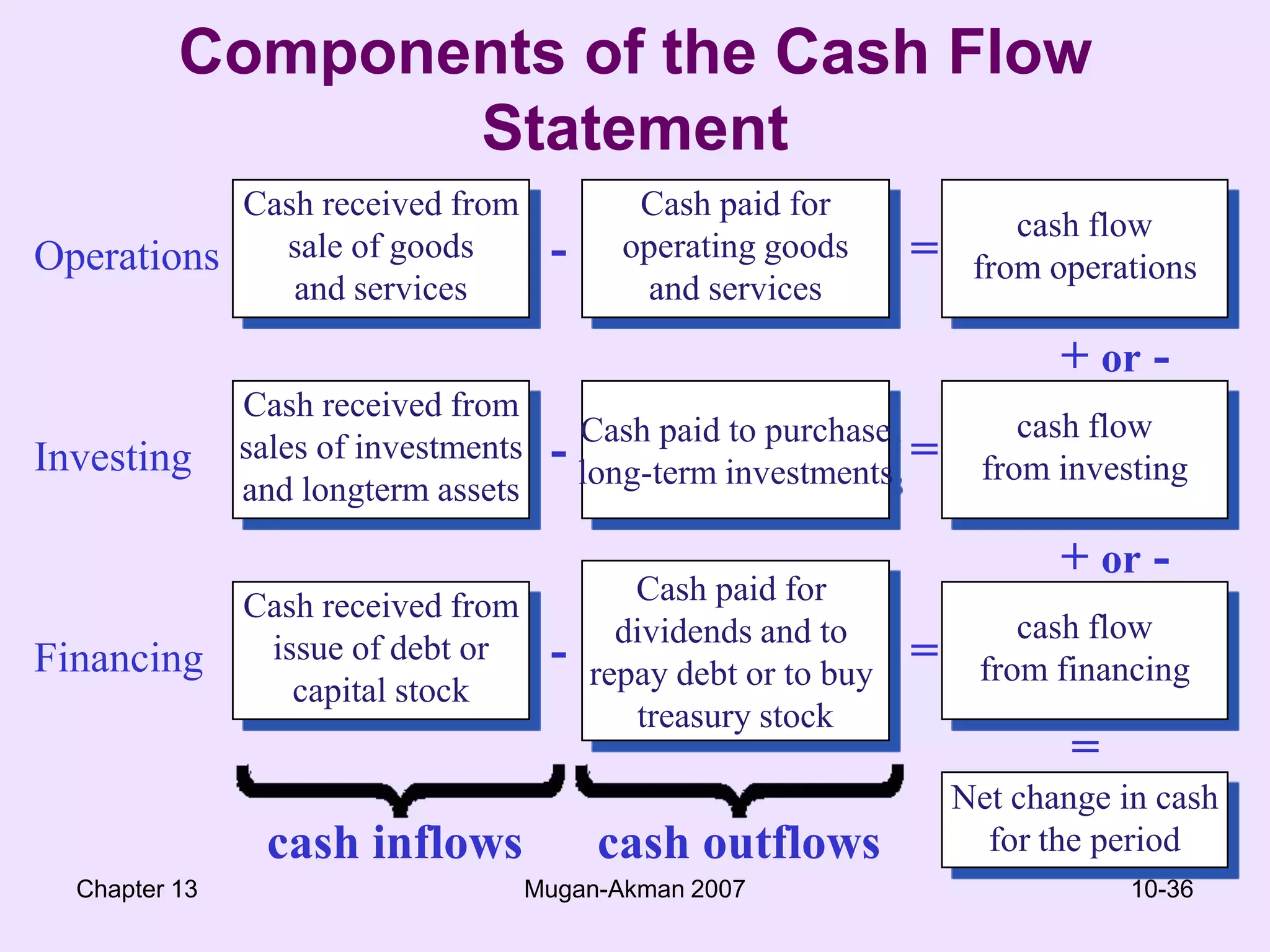

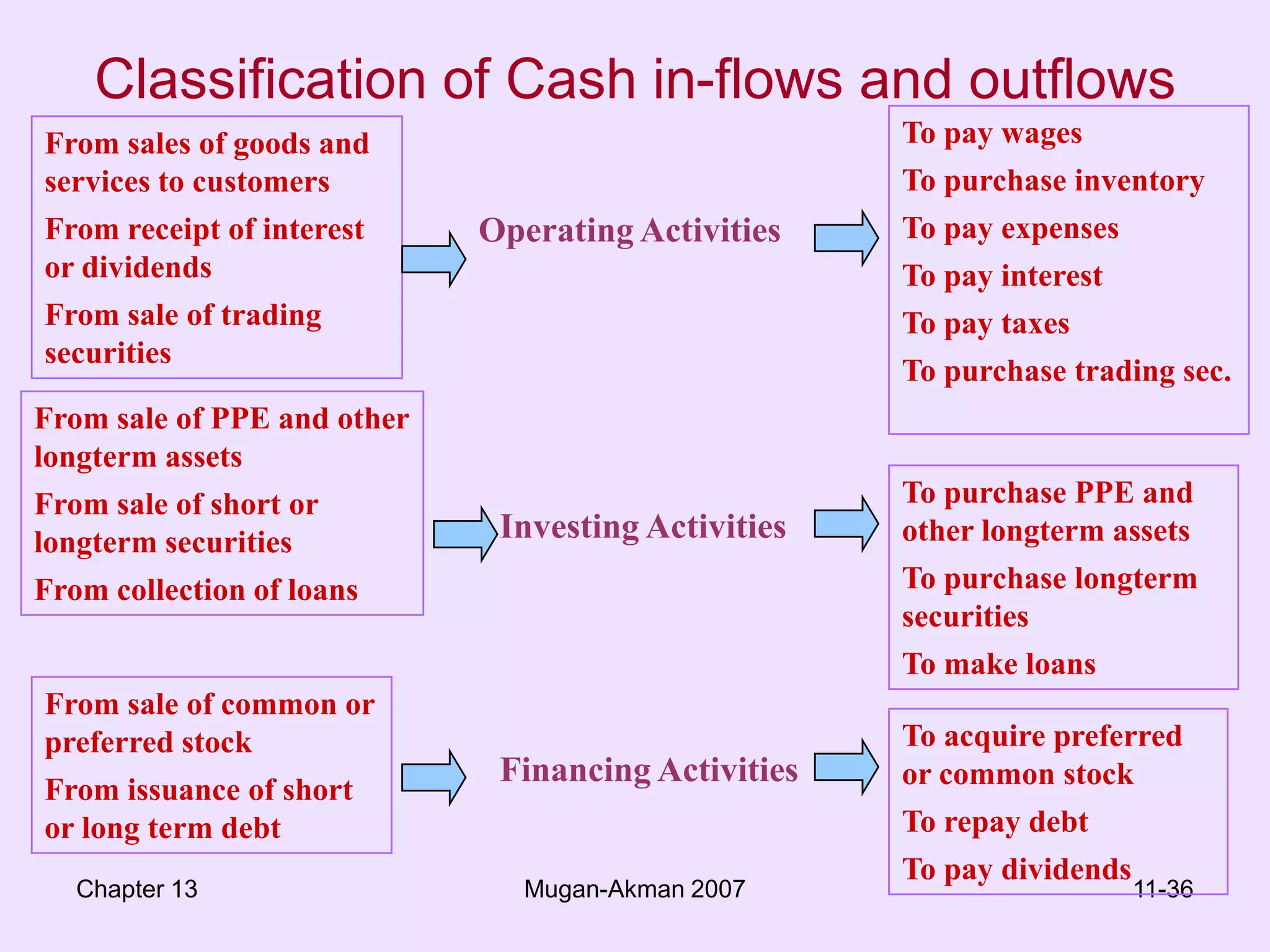

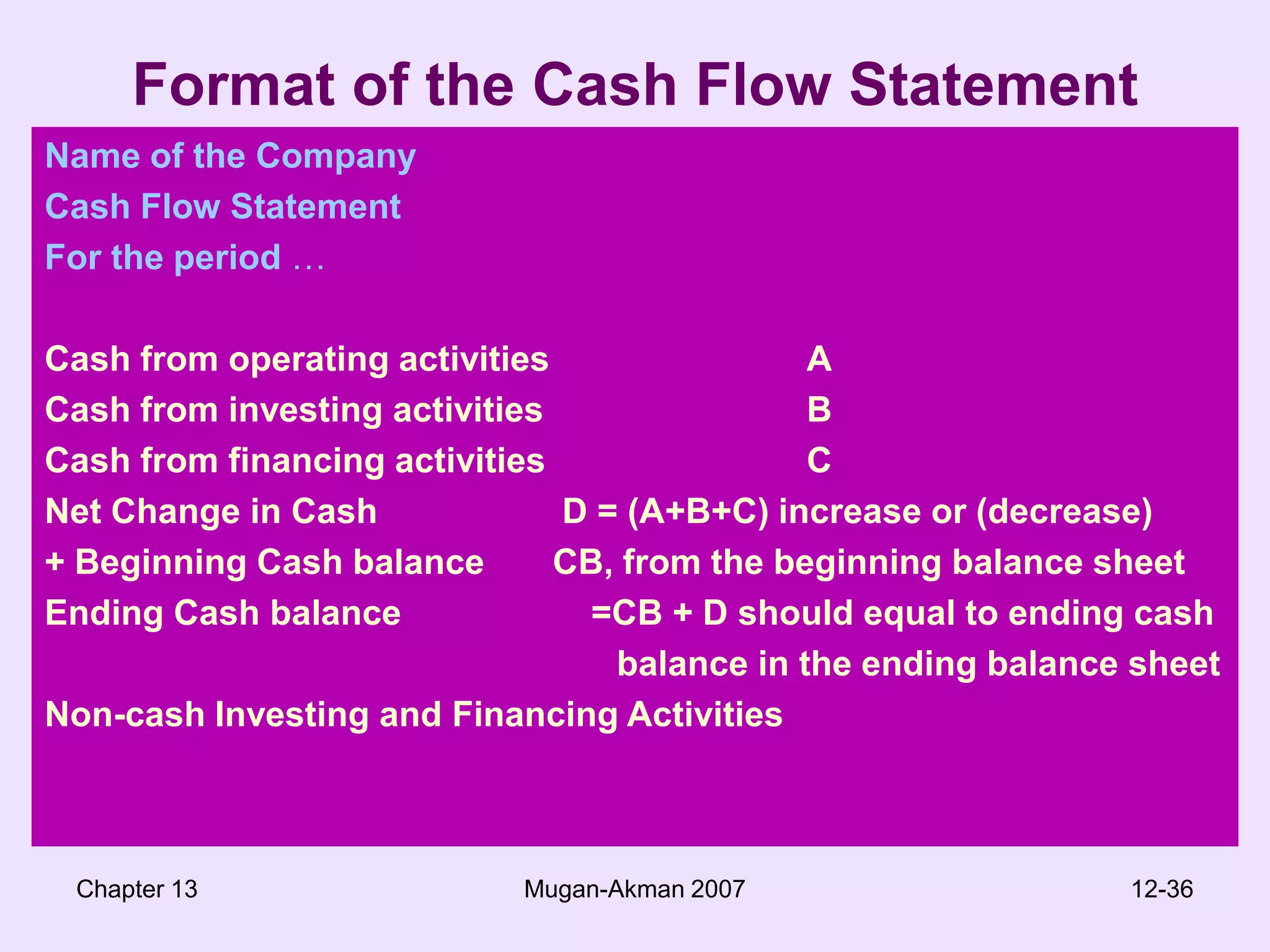

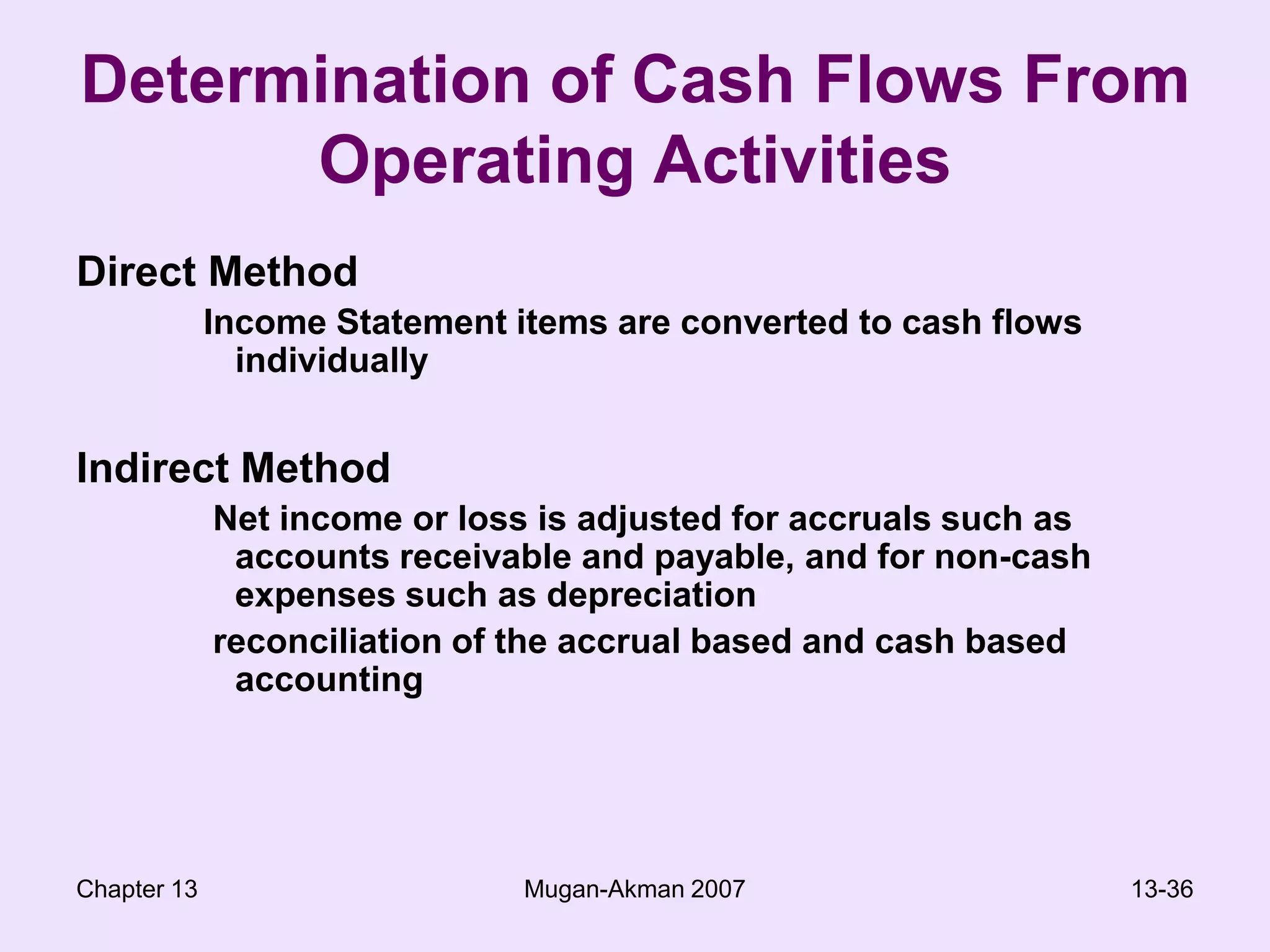

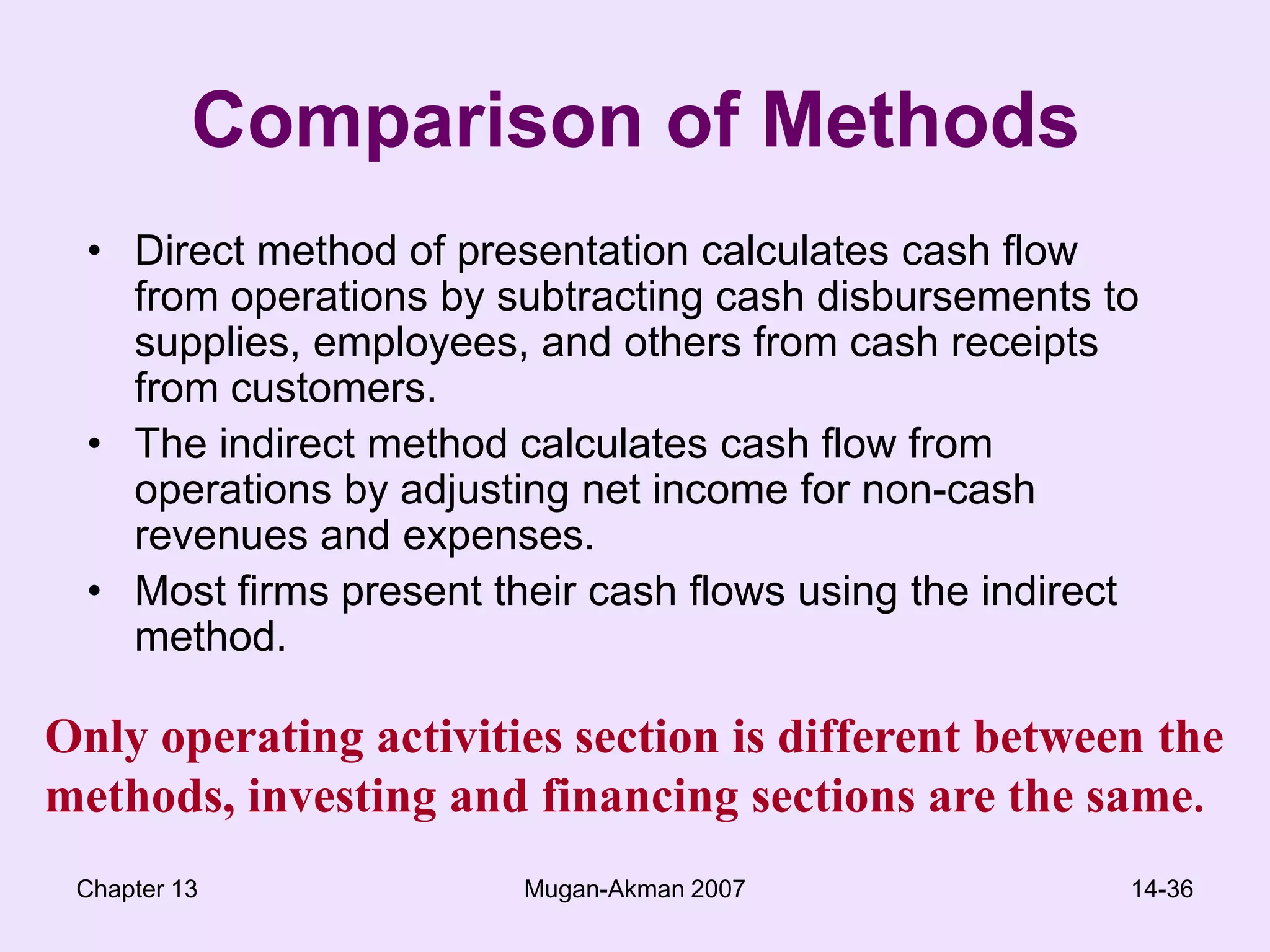

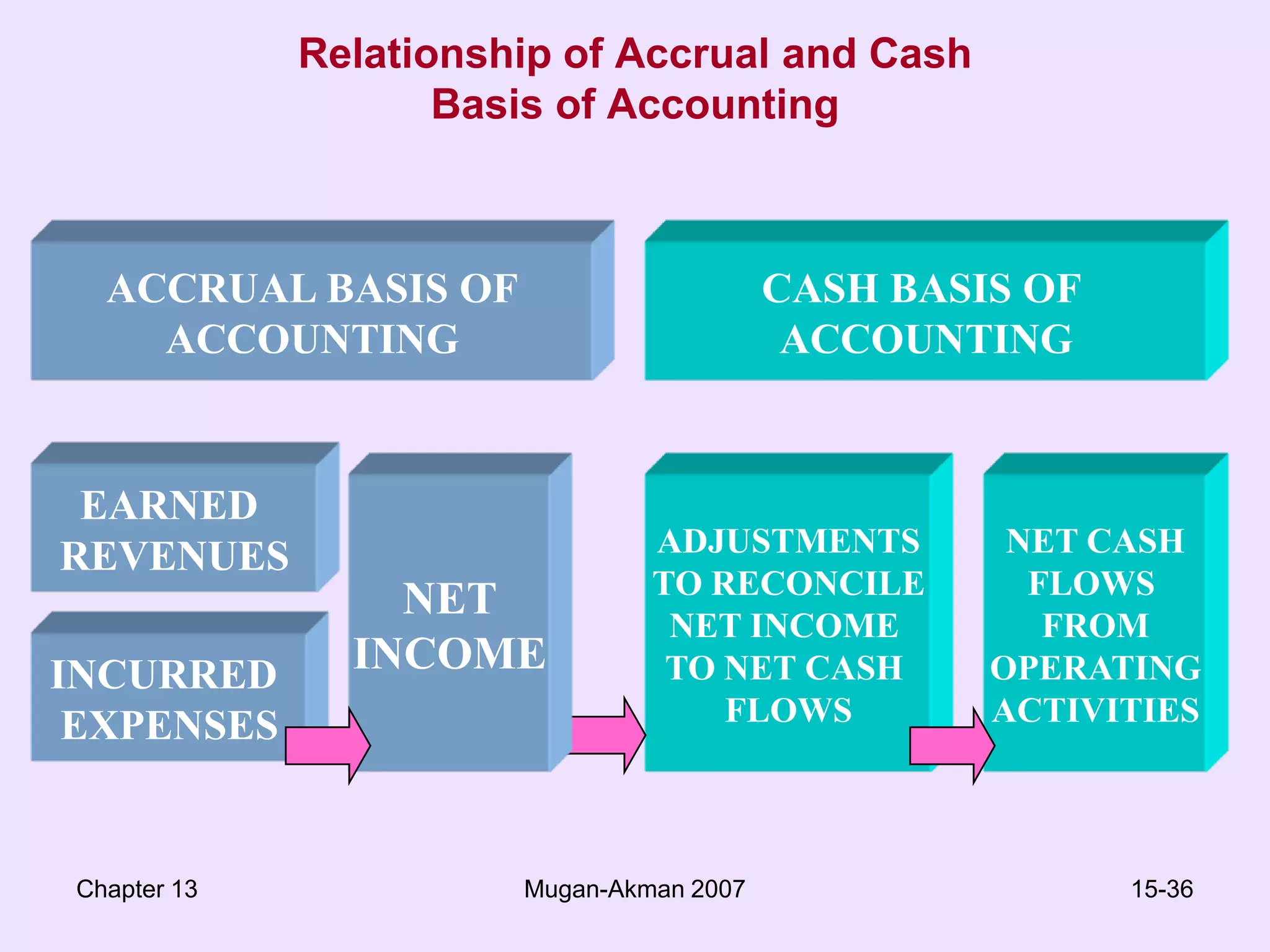

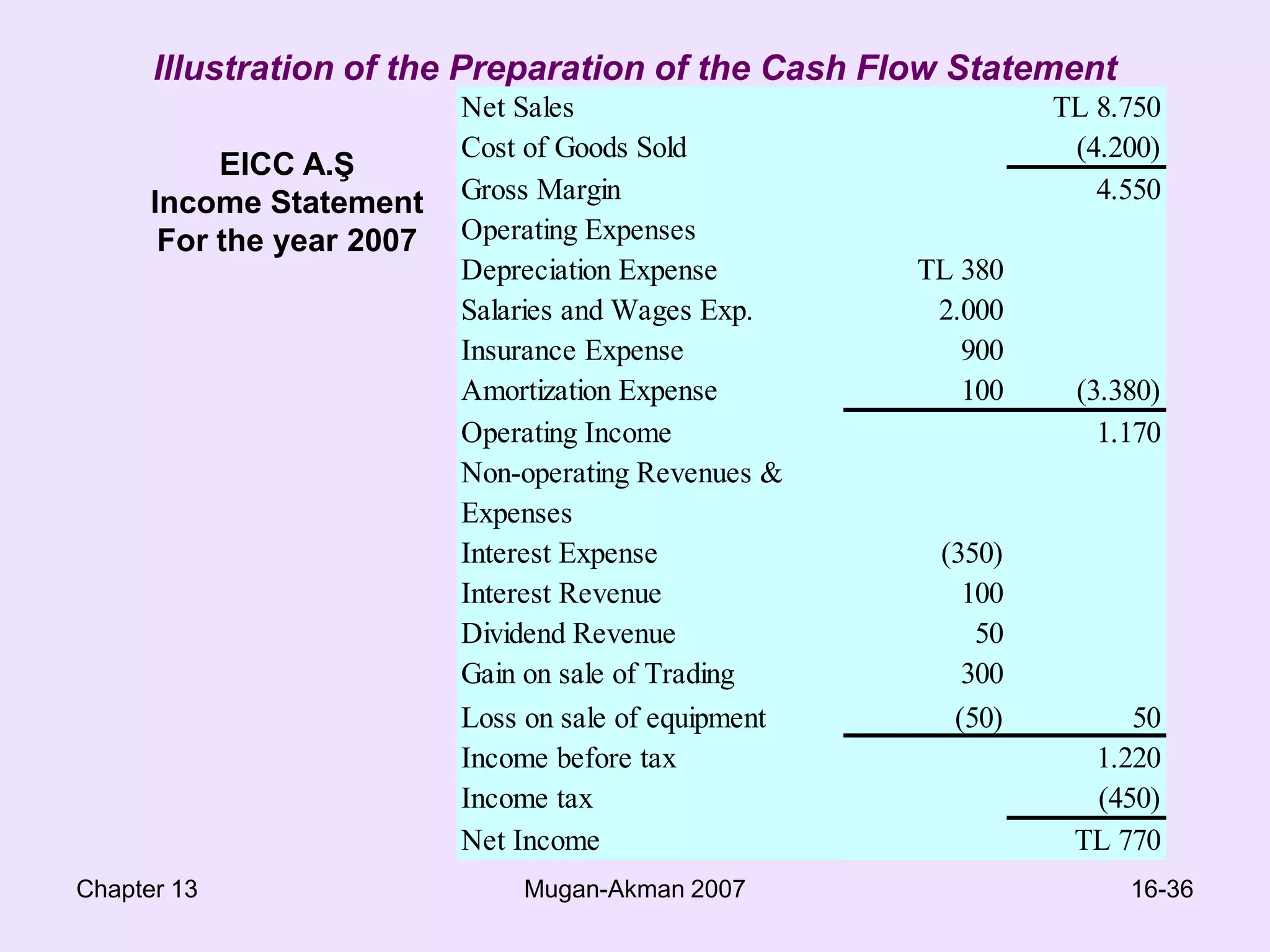

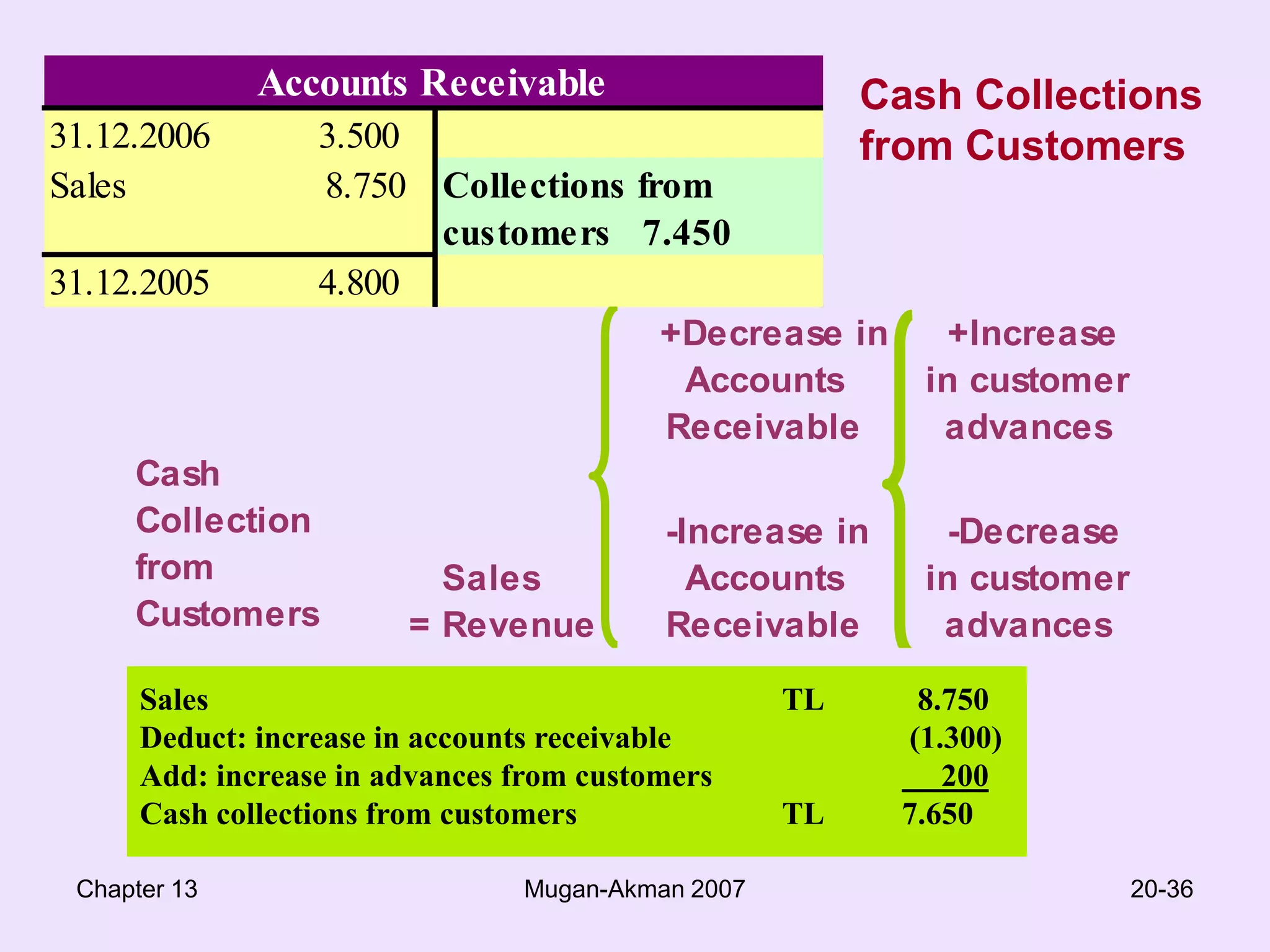

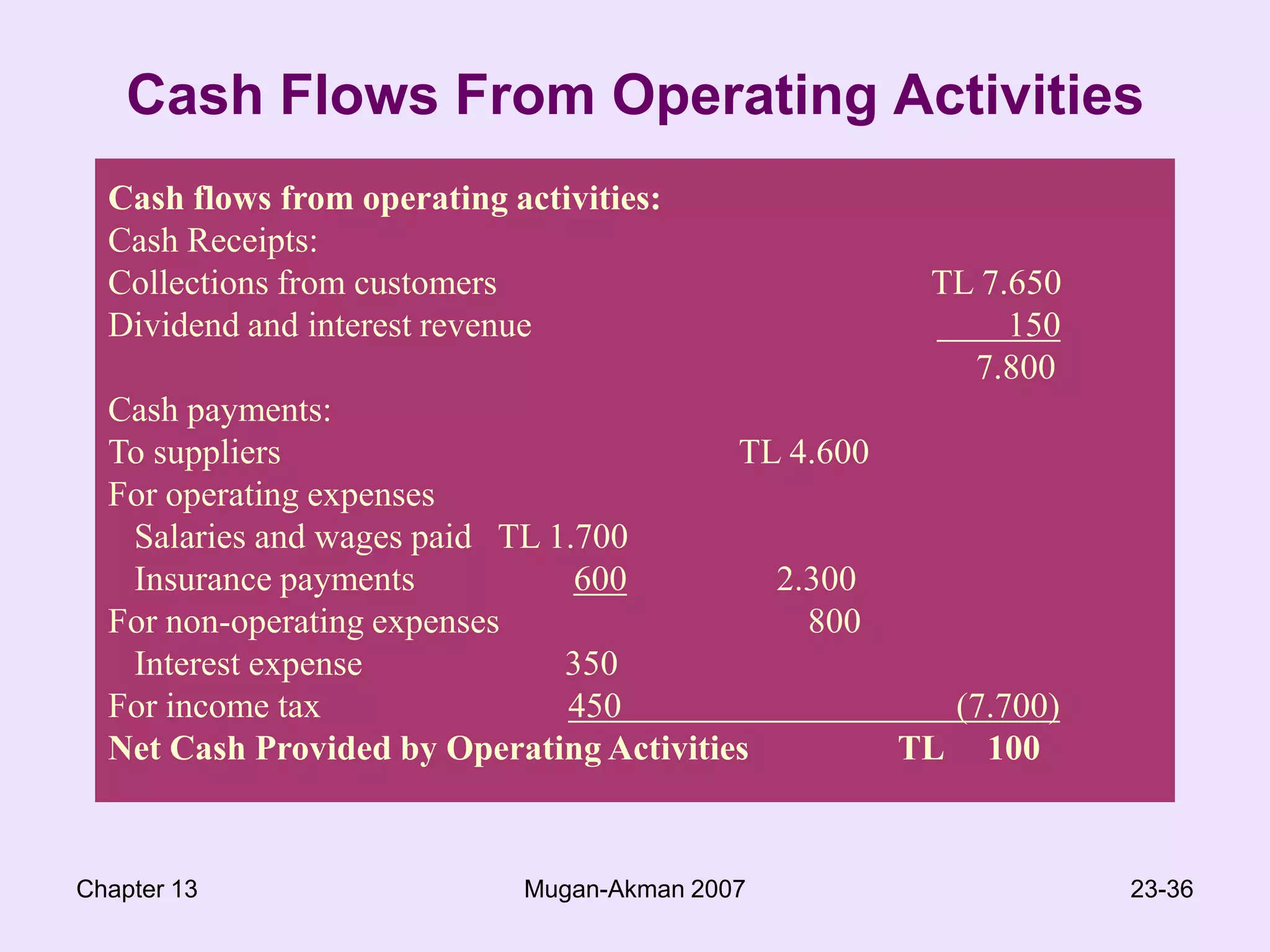

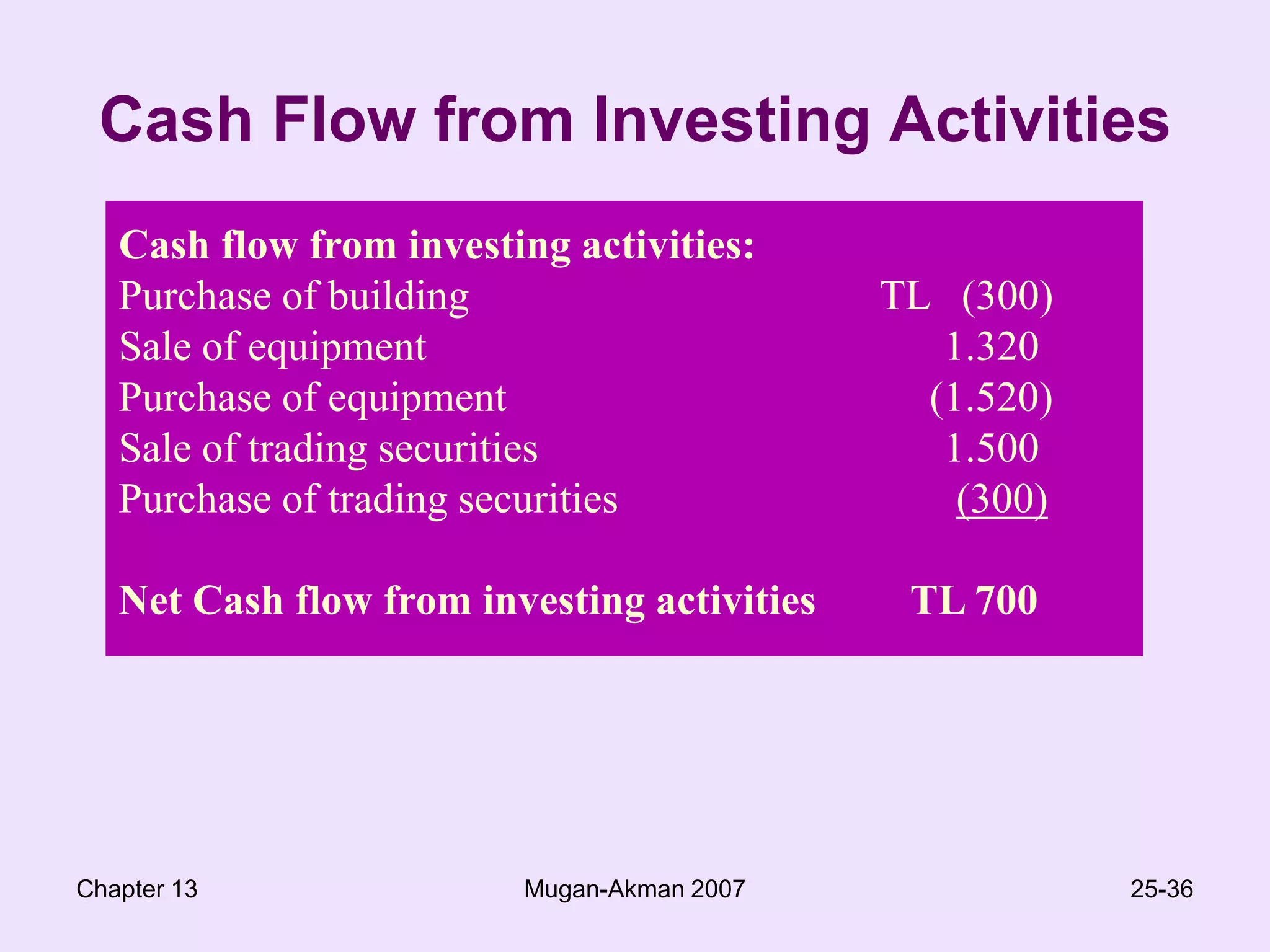

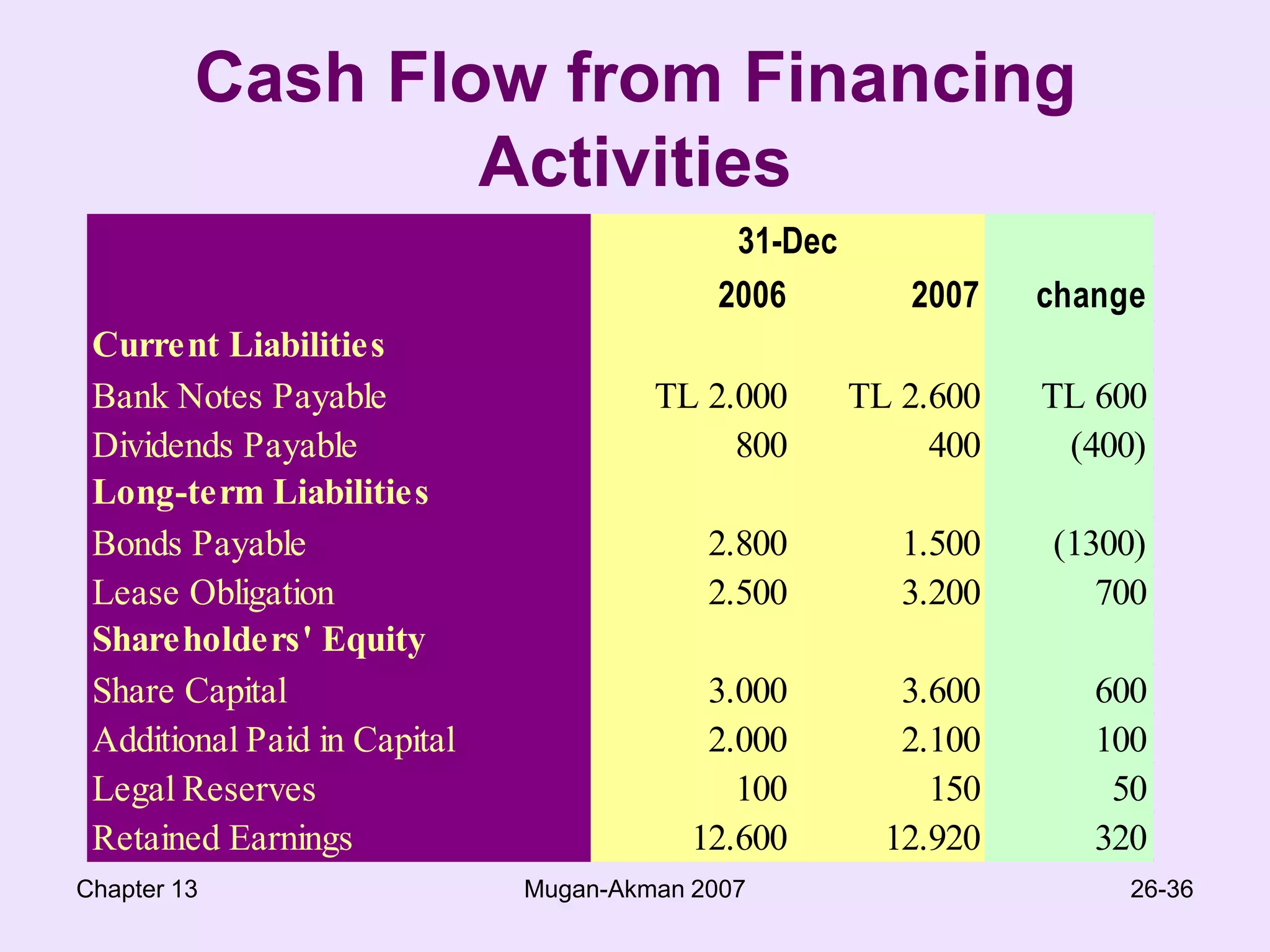

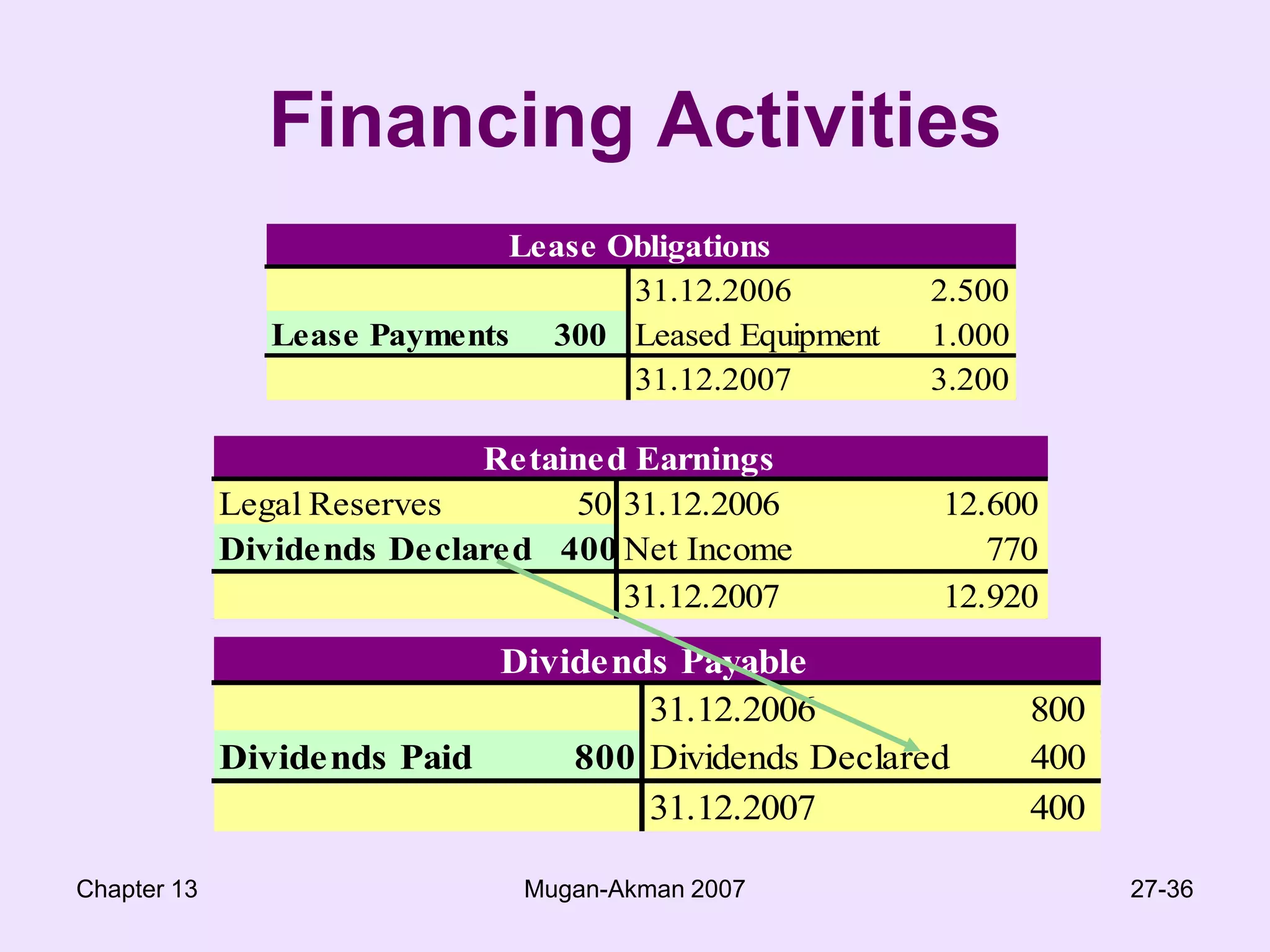

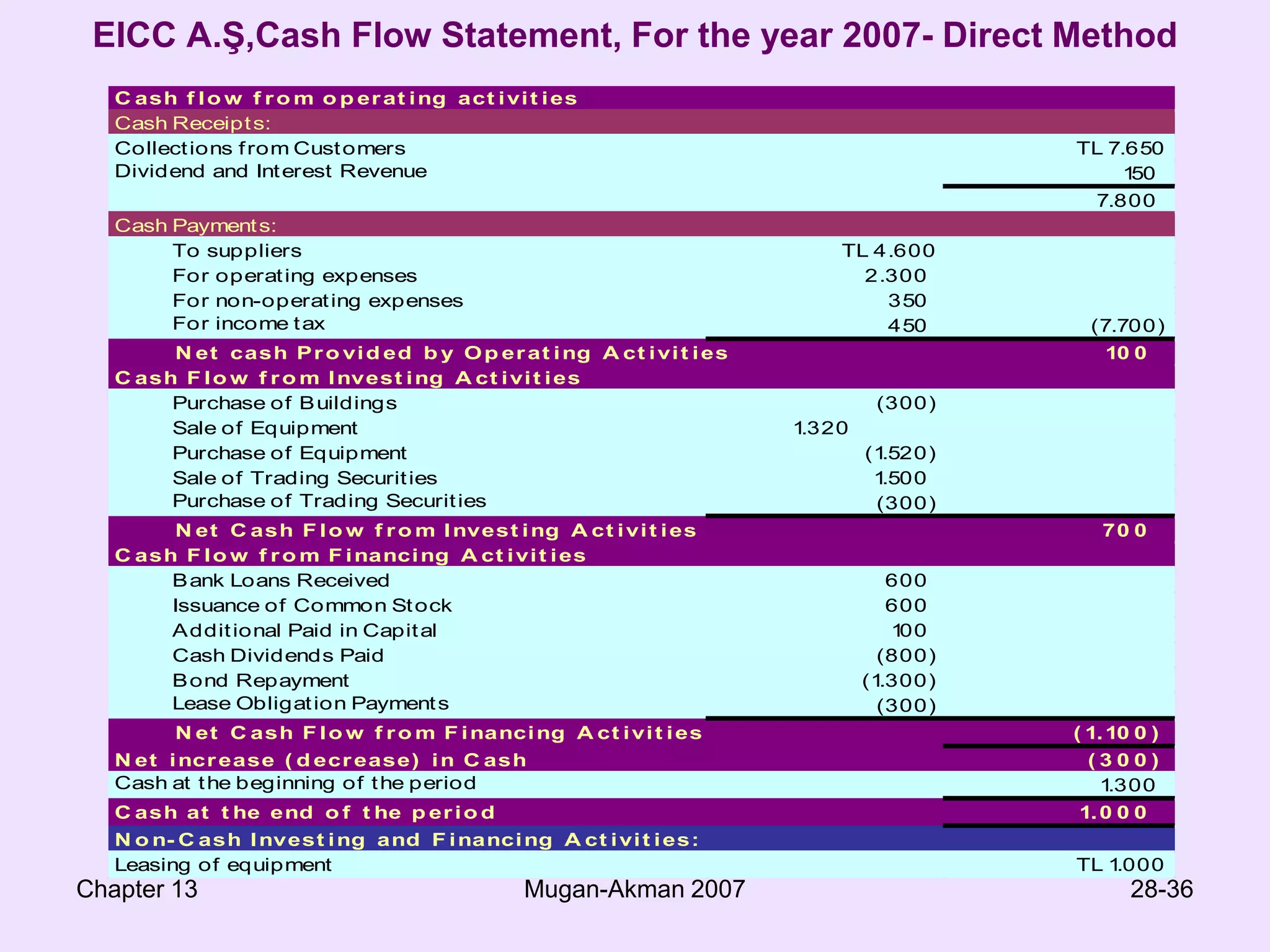

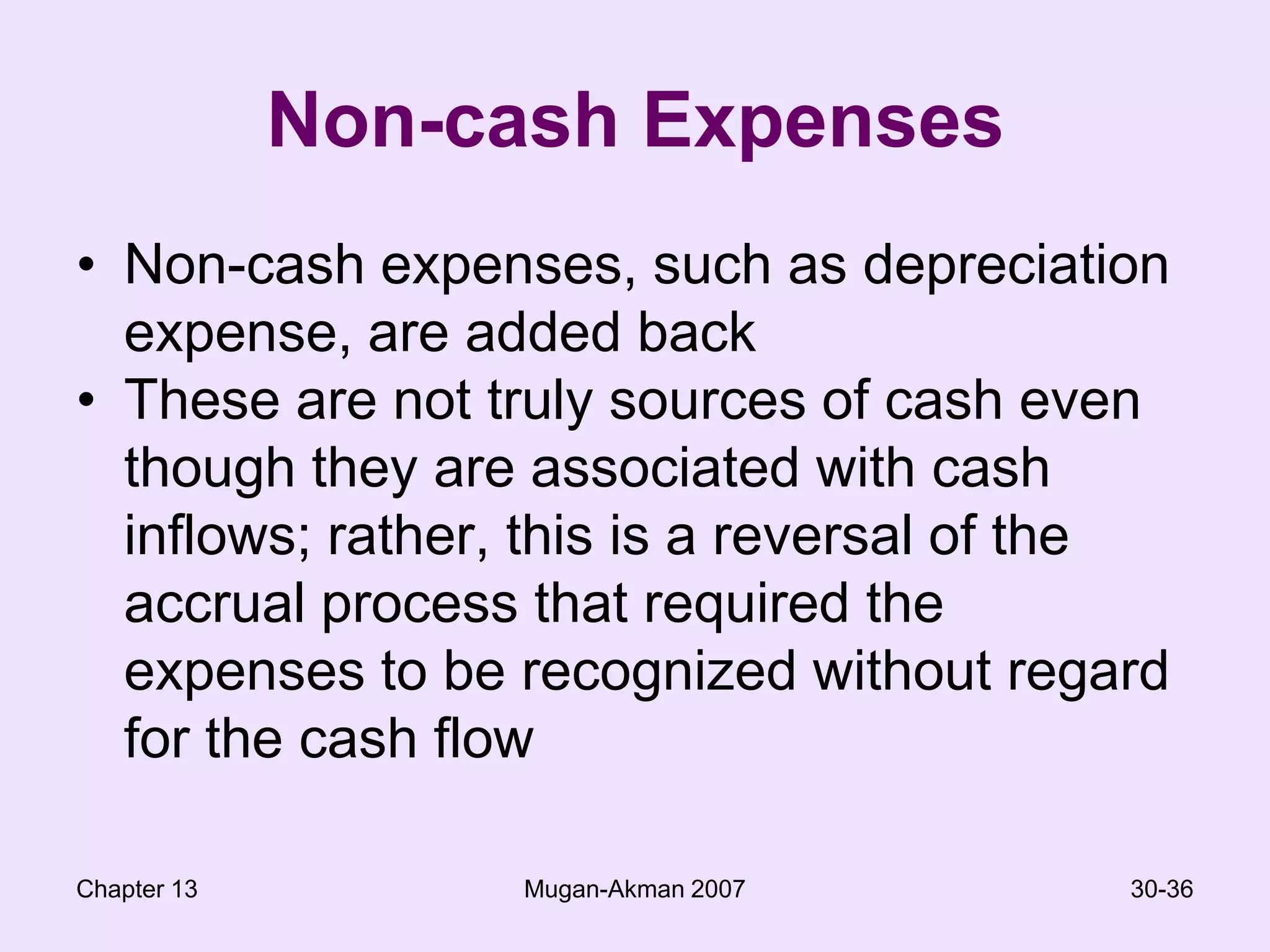

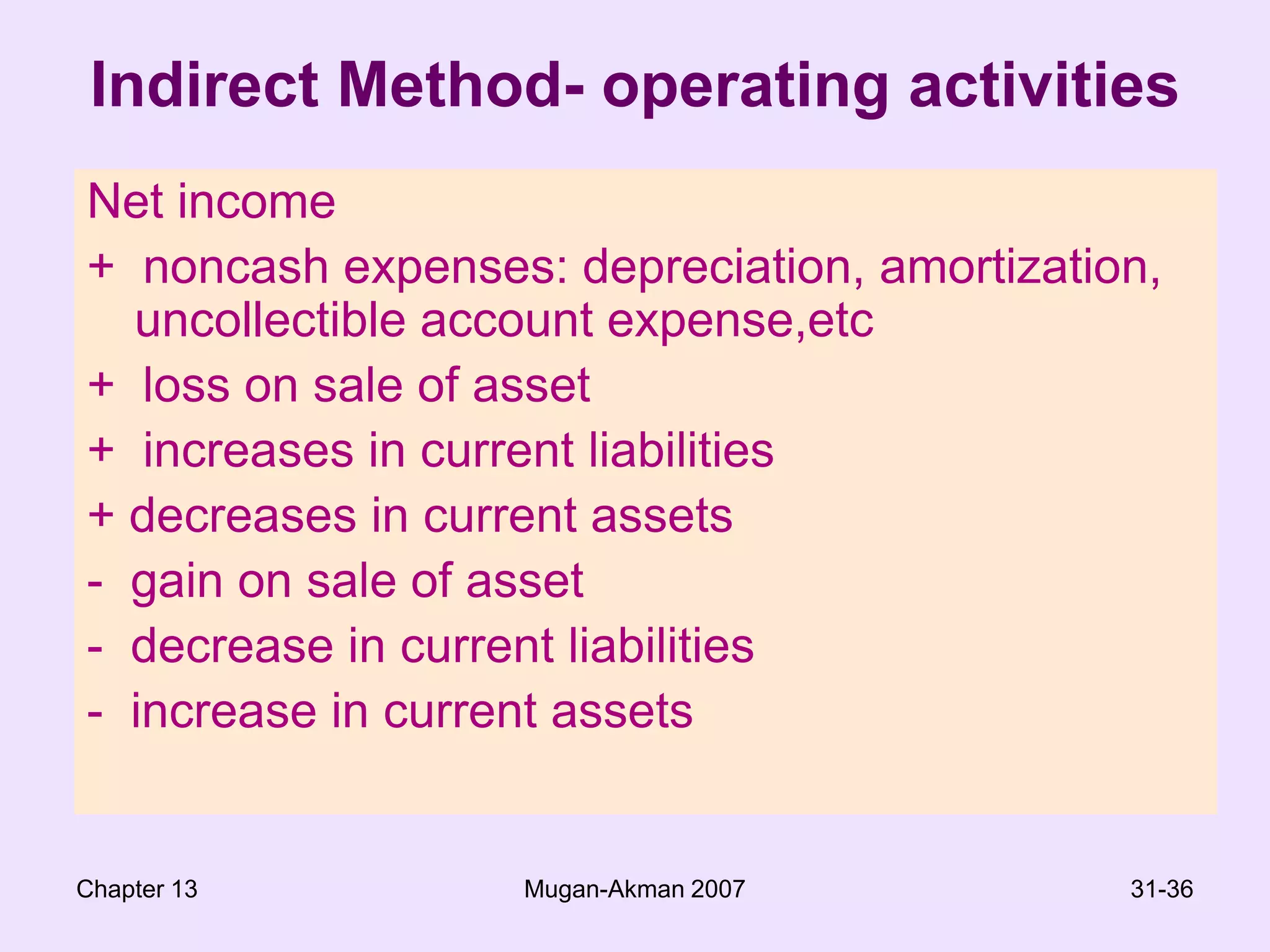

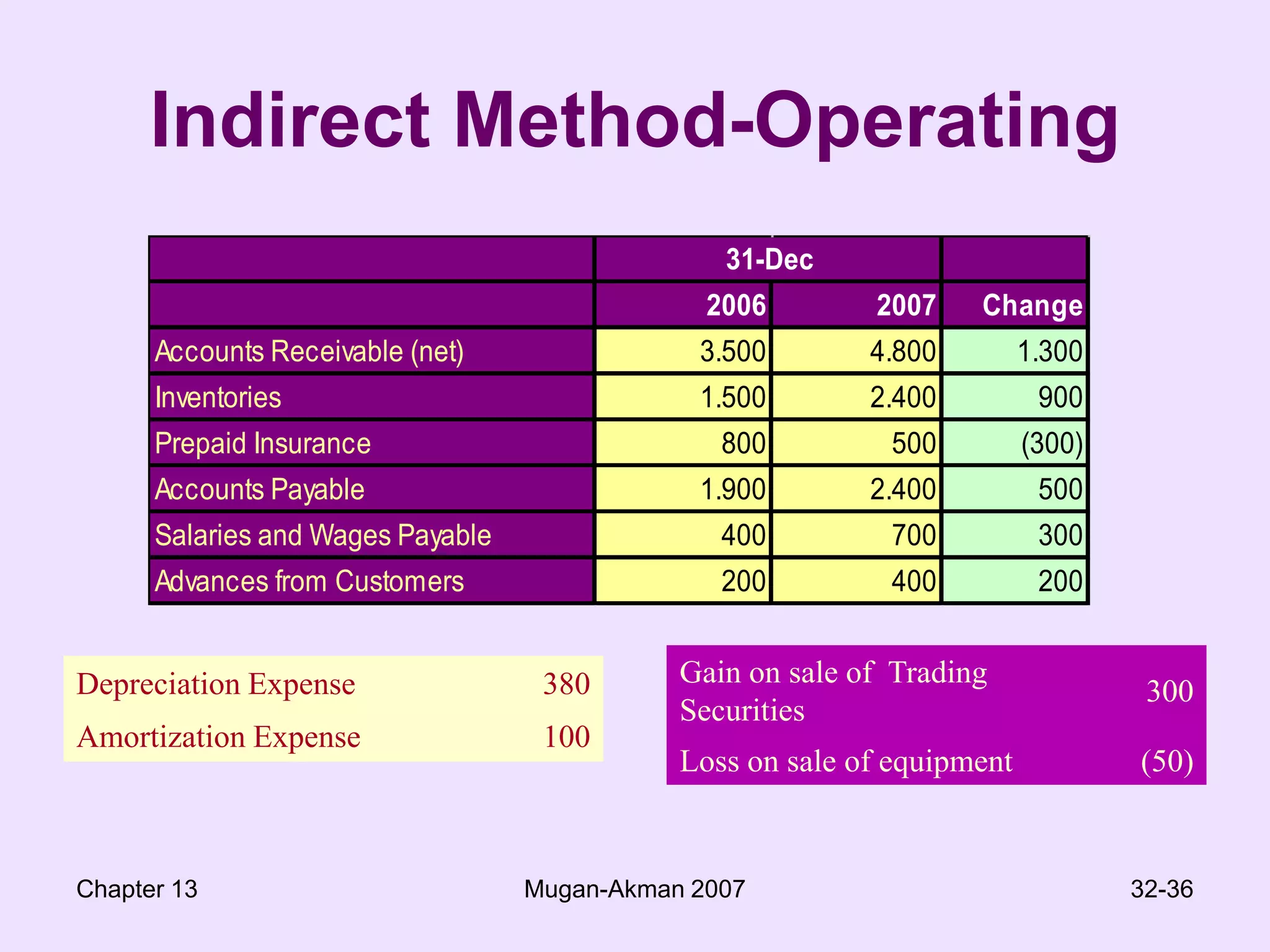

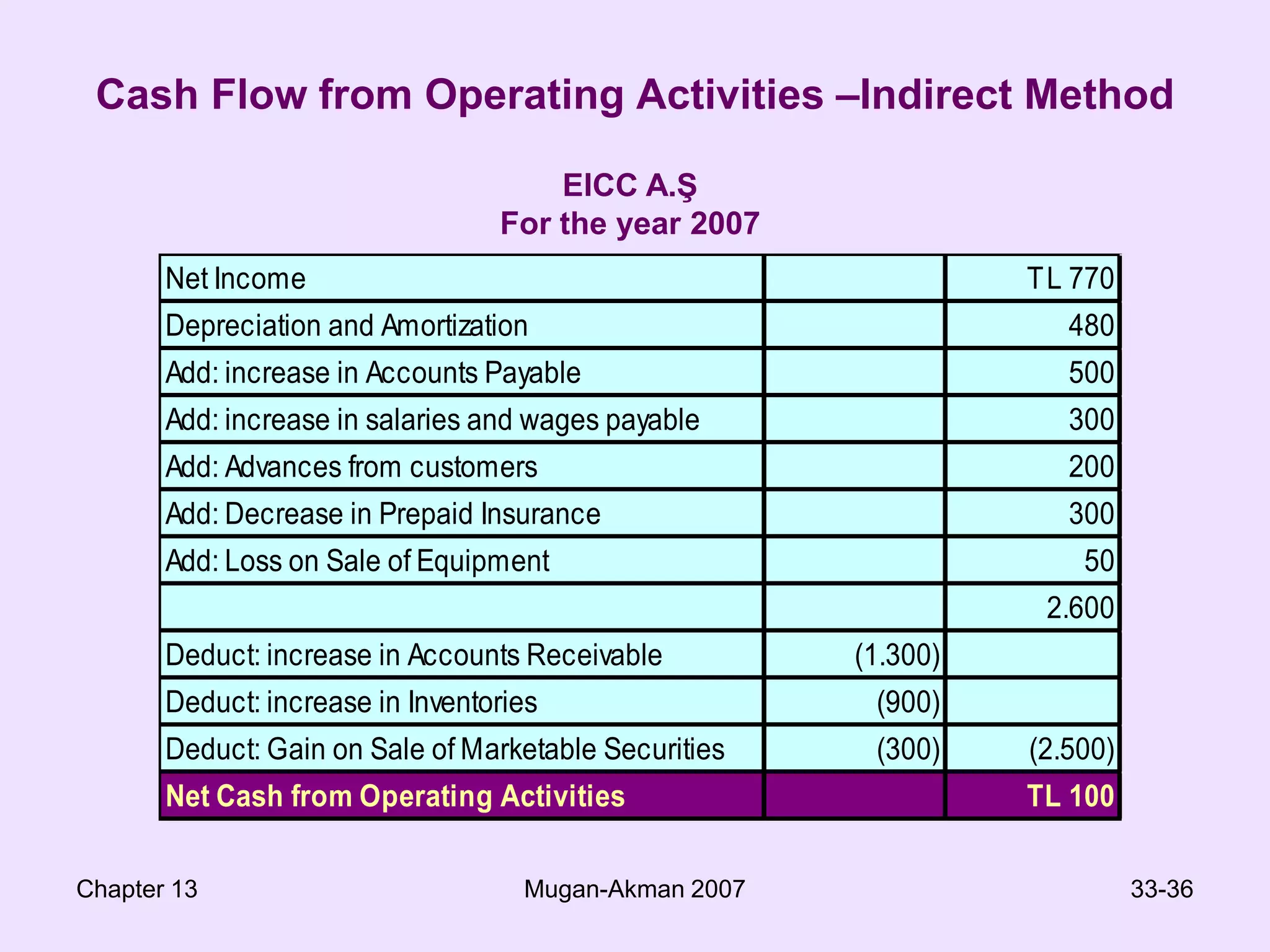

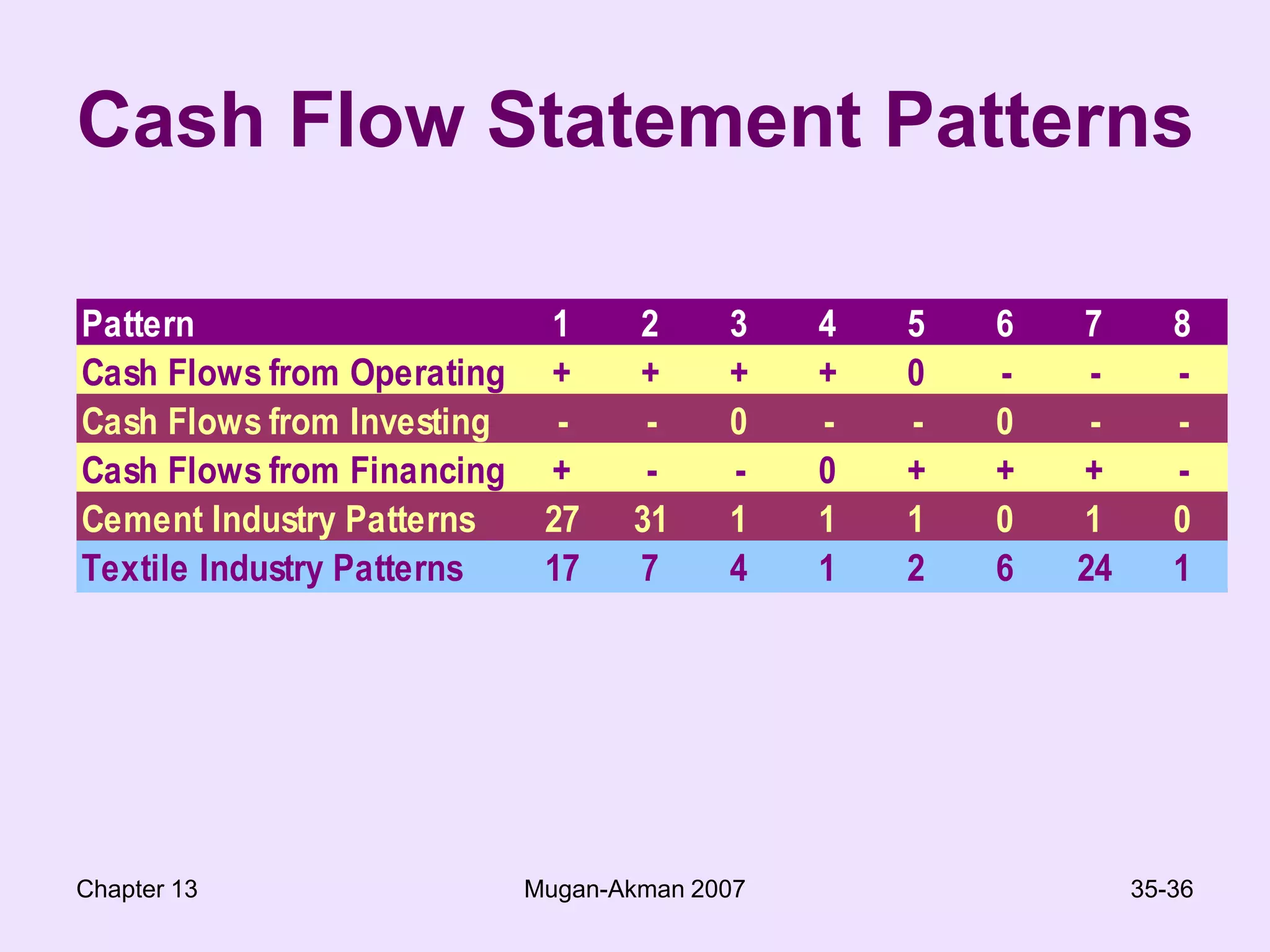

The cash flow statement reports the effects of operating, investing, and financing activities on a company's cash and cash equivalents over a period of time. It reconciles net income to the actual change in cash during the period by adjusting for non-cash revenues and expenses. The cash flow statement classifies cash flows as operating, investing, or financing activities and provides important information about a company's liquidity and ability to generate cash.