Lincoln crowne copper gold report 14102013

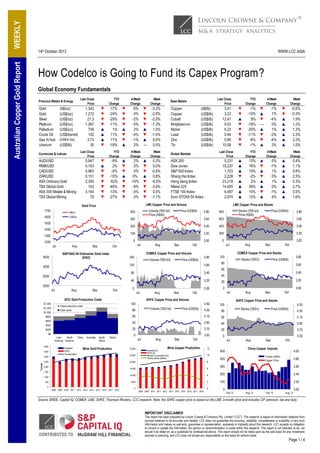

- 1. WWW.LCC.ASIA How Codelco is Going to Fund its Capex Program? Global Economy Fundamentals Last Close Price Precious Metals & Energy Gold Gold Silver Platinum Palladium Crude Oil Gas H.Hub Uranium (A$/oz) (US$/oz) (US$/oz) (US$/oz) (US$/oz) (US$/barrel) 1,343 1,272 21.3 1,367 709 102 3.73 35 (US$/m btu) (US$/lb) YTD Change ▼ ▼ ▼ ▼ ▲ ▲ ▲ ▼ Last Close Price Currencies & Indices AUD/USD RMB/USD CAD/USD ZAR/USD ASX Ordinary Gold TSX Global Gold ASX 300 Metals & Mining TSX Global Mining 0.947 0.163 0.963 0.101 2,350 163 3,164 70 -17% -24% -29% -11% 1% 11% 11% -19% 4-Week Change ▼ ▼ ▼ ▼ ▲ ▼ ▼ ▲ YTD Change ▼ ▲ ▼ ▼ ▼ ▼ ▼ ▼ -9% 2% -4% -15% -52% -46% -13% -27% -5% -3% -2% -5% 2% -4% -1% 2% ▼ ▼ ▼ ▼ ▲ ▼ ▲ — ▲ ▼ ▼ ▲ ▼ ▼ ▼ ▼ 2% 0% 0% 0% -10% -9% -3% -3% -3.2% -2.9% -2.0% -1.3% 1.0% -1.4% 6.5% 0.0% Copper Copper Cobalt Molybdenum Nickel Lead Zinc Tin Week Change ▲ ▼ ▼ ▲ ▼ ▼ ▼ ▼ Last Close Price Base Metals Global Markets 0.3% 0.0% -0.8% 0.8% -6.5% -3.9% 0.0% -1.1% (A$/lb) (US$/lb) (US$/lb) (US$/lb) (US$/lb) (US$/lb) (US$/lb) (US$/lb) US$/oz 5,231 15,237 1,703 2,228 23,218 14,405 6,487 2,974 YTD Change ▲ ▲ ▲ ▼ ▲ ▲ ▲ ▲ 13% 16% 19% -2% 2% 39% 10% 13% -1% 1% -4% 0% 1% -3% -4% 3% ▼ ▼ ▲ ▲ ▲ ▲ ▲ ▲ 4-Week Change ▲ ▼ ▲ ▼ ▲ ▲ ▼ ▲ 0% -1% 1% 0% 1% 0% -1% 4% -0.6% -0.3% 1.9% 1.2% 1.3% 2.3% 2.3% 1.5% Week Change ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ 0.4% 1.1% 0.8% 2.5% 0.3% 2.7% 0.5% 1.6% LME Copper Price and Stocks Price (US$/lb) Stocks ('000 lot) Price (A$/lb) Price (US$/lb) 3.80 800 3.60 600 3.60 3.40 400 3.40 3.20 200 3.20 3.00 0 100 1300 0 1200 Jul Aug Sep Jul Oct S&P/ASX All Ordinaries Gold Index (XGO) 3500 Aug Sep Volume ('000 lot) Price (US$/lb) 120 3.80 3.60 Jul Aug Sep Oct Oct Price (US$/lb) 3.20 0 4.50 100 4.30 3.40 20 3.00 3.80 3.60 60 3.40 80 0 Jul 2012 Gold Production Costs Aug Sep 40 3.20 3.00 Jul Oct SHFE Copper Price and Volume 100 Total production costs Cash costs Sep Stocks ('000 t) 80 40 2000 Aug COMEX Copper Price and Stocks 100 80 2500 3.80 3.00 Jul Oct COMEX Copper Price and Volume 160 3000 $1,000 ▼ ▲ ▼ — ▲ ▼ ▼ ▲ Week Change 200 1400 $1,200 -1% -10% 8% -19% -20% -11% -8% -1% 4-Week Change 300 1500 $1,400 ▼ ▼ ▲ ▼ ▼ ▼ ▼ ▼ Last Close Price ASX 200 Dow Jones S&P 500 Index Shang Hai Index Hang Seng Index Nikkei 225 FTSE 100 Index Euro STOXX 50 Index Volume ('000 lot) Price (A$/lb) 400 YTD Change 3.41 3.23 12.47 9.53 6.23 0.94 0.85 10.58 LME Copper Price and Volume A$/oz 1600 Week Change 4-Week Change Gold Price 1700 Volume ('000 lot) 80 Price (US$/lb) Aug Sep Oct SHFE Copper Price and Stocks 4.50 Stocks ('000 t) Price (US$/lb) 4.30 $800 60 4.10 60 4.10 $600 40 3.90 40 3.90 $200 20 3.70 20 3.70 $0 0 3.50 0 $400 Latin North America America 4,000 3,500 3,000 Tonnes WEEKLY Australian Copper Gold Report 14th October 2013 Australia ROW Consumption Other Australia South Africa World Mine Gold Production 2,500 Jul 30,000 25,000 Aug Sep Oct Mine Copper Production Australia (kt) ROW (kt) Refined Consumption (kt) Closing stocks (weeks) 12 10 8 20,000 2,000 3.50 Jul Aug Sep Oct China Copper Imports 500 4.00 Tonnes ('000t) Copper Price 400 3.80 300 3.60 15,000 6 10,000 4 200 3.40 5,000 2 100 3.20 0 0 0 1,500 1,000 500 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Feb 12 Aug 12 Feb 13 Aug 13 3.00 Source: BREE, Capital IQ, COMEX, LME, SHFE, Thomson Reuters, LCC research. Note: the SHFE copper price is based on the LME 3-month price and includes CIF premium, tax and duty IMPORTANT DISCLAIMER This report has been prepared by Lincoln Crowne & Company Pty. Limited ("LCC"). The research is based on information obtained from sources believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability o f any such information and makes no warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on this basis for actions made . Page 1 / 4

- 2. WEEKLY Australian Copper Gold Report 14th October 2013 WWW.LCC.ASIA Markets & Majors Chile raised its copper output forecast for 2013 and upped its global copper surplus expectations by around 40%, on soaring global production and slower demand growth. The country, the world's largest producer of copper, will produce about 5.7 million tonnes of copper in 2013, (+5% yoy) thanks to better output forecasts. State copper commission Cochilco also raised its copper 2013 surplus expectations to 294,000 tonnes, up from its previous forecast of 209,000, due to higher production in Chile, the US, Zambia and Indonesia and to lower demand for the metals from countries such as India, Taiwan and South Korea. It expects the market surplus to increase in 2014 to 327,000 tonnes as new copper mining projects come on stream, in Chile and abroad. Cochilco kept its 2014 copper price forecast steady at US$3.15/lb. Chile's government is reviewing the way it funds state-owned copper miner Codelco following requests from some members of parliament. The world's top copper miner, which gives all of its profits back to the state, is struggling to finance an ambitious, multi-year investment plan, previously estimated at about US$27 billion. The government has awarded Codelco US$1 billion for 2013, an amount, which the miner deemed insufficient. Codelco, which produces about 11% of the world's copper, has since reduced its planned investment for this year to around US$4 billion from US$4.5 billion. Freeport-McMoRan Copper & Gold (NYSE: FCX) the world's #1 publicly listed copper producer, expects to sell 4.5 billion pounds of copper (2 million tonnes) in 2014 year, but maintained its 5% cut in expected copper sales this year. Chilean miner Antofagasta (LON: ANTO) expects the cost of new projects to fall further following two years of declines, as copper prices weaken into 2014, taking the steam out of rampant inflation that has hampered development. According to ANTO, project costs had already dropped 10 to 15% in the last two years. China’s gold imports through Hong Kong in August reached 110 tonnes (vs. 113 tonnes in July) as the country remains on track to import over 1,000 tonnes of gold this year. A total of 723 tonnes has been imported via Hong Kong for the first eight months. South Australian resource sector jobs are expected to more than triple by 2030 with the tripling of mining and infrastructure projects, according to the Resources and Engineering Skills Alliance. Emerging Copper Companies Code Company Name Open Close Week Week Price Price High Low Weekly Change Market 52 Week Cash EV Cap Project Range (A$m) (A$m) (A$m) AVI Avalon Minerals 0.01 0.01 0.01 0.01 ▲ 33.3% 10 1 9 Viscaria AVB Avanco Resources 0.08 0.08 0.10 0.08 ▲ 2.5% 92 4 89 Antas North AZS Azure Minerals 0.04 0.04 0.05 0.04 ▼ -2.4% 25 2 23 Promontorio BTR Blackthorn Resources 0.27 0.26 0.30 0.25 ▼ -3.7% 43 26 17 Kitumba CDU Cudeco 2.04 1.95 2.06 1.76 ▼ -4.7% 399 48 351 Rocklands FND Finders Resources 0.20 0.20 0.20 0.20 — 0.0% 101 3 107 Wetar (95% ) HAV Havilah Resources 0.26 0.26 0.26 0.25 ▲ 2.0% 31 6 25 Kalkaroo HCH Hot Chili 0.43 0.43 0.43 0.40 — 0.0% 144 23 121 Productora HIG Highlands Pacific 0.06 0.06 0.06 0.06 ▼ -6.7% 44 7 37 Frieda River (18.2% ) IRN Indophil Resources 0.16 0.16 0.17 0.15 ▼ -3.1% 186 224 -37 Tampakan (37.5% ) MMC Marengo Mining 0.02 0.02 0.02 0.02 — 0.0% 26 7 40 Yandera MNC Metminco 0.03 0.04 0.05 0.03 ▲ 33.3% 77 13 64 Los Calatos RXM Rex Minerals 0.52 0.50 0.53 0.49 ▼ -3.8% 94 25 70 Hillside VXR Venturex Resources 0.01 0.01 0.01 0.01 — 0.0% 12 3 9 Pilbara YTC YTC Resources 0.25 0.27 0.27 0.24 ▲ 10.2% 71 16 90 Nymagee (95% ) Source: Capital IQ, ASX announcements, LCC research. C1 costs and capex as estimated and announced by the respective companies. Annual Mineral C1 Production Resource Costs (t) (mt Cu) (US$/lb) 20,000 12,000 4,850 39,000 N/A 28,000 40,000 55,000 246,000 375,000 90,000 100,000 80,000 16,500 N/A 0.610 0.762 0.021 1.000 0.483 0.205 0.623 0.920 13.000 15.000 0.806 6.538 2.000 0.316 0.096 0.49 1.10 1.16 2.04 0.81 1.11 1.20 1.35 0.58 0.46 1.80 1.06 1.20 1.49 N/A Capex (US$m) 180 70 35 358 238 133 360 600 5,300 5,900 1,800 1,320 900 265 N/A IMPORTANT DISCLAIMER This report has been prepared by Lincoln Crowne & Company Pty. Limited ("LCC"). The research is based on information obtained from sources believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability o f any such information and makes no warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on this basis for actions made . Page 2 / 4

- 3. WEEKLY Australian Copper Gold Report 14th October 2013 WWW.LCC.ASIA Copper Producers Ore Quarterly C1 Costs C3 Costs Reserve (mt Production (t) (US$/lb) (US$/lb) Cu) ABY Aditya Birla Minerals 0.36 0.35 0.37 0.34 ▼ -4.2% 108 86 23 0.2x Nifty 9,873 0.473 2.84 N/A AOH Altona Mining 0.15 0.14 0.15 0.13 ▼ -6.9% 72 26 68 4.8x Kylylahti 1,809 0.061 2.23 3.37 DML Discovery Metals 0.07 0.06 0.07 0.05 ▼ -20.5% 32 22 181 NM Boseto 5,034 0.191 3.45 N/A HGO Hillgrove Resources 0.08 0.08 0.08 0.07 ▲ 2.6% 92 17 123 3.5x Kanmantoo 3,590 0.125 2.40 3.19 IVA Inova Resources 0.21 0.21 0.22 0.21 — 0.0% 153 33 120 NM Osborne 5,451 0.069 2.57 3.70 OZL OZ Minerals 4.40 4.40 4.47 4.31 — 0.0% 1,333 433 901 7.1x Prominent Hill 17,379 0.748 1.95 3.56 PEM Perilya 0.32 0.32 0.33 0.32 — 0.0% 246 92 352 5.8x Cerro de Maimón 2,747 0.123 0.92 N/A PNA PanAust 2.07 1.94 2.10 1.87 ▼ -6.5% 1,153 89 1,234 4.0x Phu Kham (90% ) 15,483 1.127 1.45 2.12 SFR Sandfire Resources 6.34 6.30 6.45 6.00 ▼ -0.6% 981 77 1,189 6.0x DeGrussa 14,293 0.438 1.37 2.21 SRQ Straits Resources 0.02 0.02 0.02 0.01 — 0.0% 17 41 99 NM Tritton 6,271 0.178 2.55 3.87 TGS Tiger Resources 0.33 0.33 0.34 0.30 — 0.0% 223 13 210 3.9x Kipoi 1 (60% ) 11,116 0.303 1.06 1.35 Source: Capital IQ, ASX announcements, LCC research. C1 and C3 costs as reported in last quarter, except for TGS, LCC estimate. Code Company Name Open Close Week Week Price Price High Low Weekly Market 52 Week Cash EV EV/ Project Change Cap (A$m) Range (A$m) (A$m) EBITDA ASX-listed Company News Avanco Resources (ASX: AVB) has reached a non-binding agreement on key commercial terms with regard to US$12m of nondilutive royalty based investment with BlackRock. On executing the proposed transaction, Avanco would secure the shortfall funding required to potentially position Antas North as “fully financed into production” for ~12,000tpa of copper and ~7,000ozpa of gold. Capital expenditure at Antas North is estimated at US$70m including contingency and working capital – key terms for a US$58m senior debt facility have already been agreed with Banco Votorantim. Beadell Resources (ASX: BDR) increased gold production to 55,094 ounces (+53% qoq) and increased recovery to 93% at the 100% owned Tucano CIL gold plant in Brazil thanks to the introduction of high grade ore from Duckhead. Head grade increased by 36% to 1.91 g/t gold. During the quarter the CIL plant throughput capacity was solid at 4.0 mtpa (~14% over nameplate capacity of 3.5 mtpa). Guidance for the half year gold production remains unchanged at 120,000 – 130,000 ounces for the six months from 1 July 2013. C1 cash costs (which exclude the 2% royalty) are expected to be within the range of US$435 – $485/oz with no allowance for any iron ore credits. Saracen Mineral Holdings (ASX: SAR) produced 41,241 oz in the September quarter, +13% qoq. SAR recorded gold sales of 43,096 ounces for a revenue of A$66 million at an average gold price received of A$1,531/oz (average of spot and hedge prices). Emerging Gold Producers Code Company Name ABU ALK AZM BAB CVG CAS DRM GCY GRY IGO IDC IAU KGD MSR MLX MDI MYG PAN ABM Resources Alkane Resources Azumah Resources Bullabulling Gold Convergent Minerals Crusader Resources Doray Minerals Gascoyne Resources Gryphon Minerals Independence Group Indochine Mining Intrepid Mines Kula Gold Manas Resources Metals X Middle Island Resources Mutiny Gold Panoramic Resources Open Price Close Price Week High Week Low 0.03 0.40 0.03 0.07 0.02 0.27 0.66 0.20 0.14 3.92 0.07 0.27 0.11 0.05 0.14 0.09 0.04 0.28 0.03 0.40 0.03 0.05 0.01 0.27 0.63 0.19 0.13 3.70 0.06 0.27 0.11 0.05 0.14 0.09 0.03 0.28 0.03 0.42 0.04 0.07 0.02 0.29 0.67 0.21 0.15 3.95 0.07 0.27 0.11 0.05 0.14 0.09 0.04 0.28 0.03 0.35 0.03 0.05 0.01 0.25 0.63 0.19 0.13 3.43 0.05 0.26 0.11 0.05 0.14 0.08 0.03 0.26 Weekly Change 92 149 11 22 4 34 89 30 50 863 55 150 14 14 223 11 17 72 8 64 4 1 1 3 26 3 52 27 2 94 4 6 75 6 2 23 84 85 6 21 2 31 64 27 -2 856 53 56 10 8 149 6 15 49 Annual Reserves C1 Costs Capex Production (oz) (moz) (US$/oz) (US$m) Old Pirate 100,000 Tomingley 55,000 Wa 100,000 Bullabulling 175,500 Blue Vein 40,000 Borborema 131,000 Andy Well 74,000 Glenburgh 73,000 Banfora 151,000 Tropicana (30% ) 470,000 Mt Kare 130,000 Tumpangpitu 143,000 Woodlark 90,000 Shambesai 55,000 CGMP 95,000 Samira Hill N/A Deflector 80,000 Gidgee 87,000 Mt Henry (70% ) 116,000 PIR Papillon Resources 1.04 1.02 1.08 1.02 ▼ -1.9% 345 62 283 Fekola 306,000 PVM PMI Gold 0.32 0.30 0.32 0.30 ▼ -6.3% 122 113 9 Obotan 221,500 PXG Phoenix Gold 0.16 0.16 0.17 0.15 ▼ -3.1% 37 16 21 Castle Hill 100,000 ROL Robust Resources 0.35 0.35 0.38 0.33 — 0.0% 36 19 17 Andash (80% ) 70,000 SIH Sihayo Gold 0.04 0.04 0.04 0.04 — 0.0% 30 3 27 Pungkut 46,000 SUM Sumatra Copper & Gold 0.12 0.12 0.12 0.12 ▲ 4.3% 50 19 31 Tembang 30,000 Source: Capital IQ, LCC research. C1 costs and capex as estimated and announced by the respective companies. Assumption: A$/US$ exchange rate of 0.95 ▼ — — ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▲ — — — — ▼ ▼ -3.4% 0.0% 0.0% -20.0% -13.3% -1.9% -4.5% -2.6% -10.7% -5.6% -12.7% 1.9% 0.0% 0.0% 0.0% 0.0% -15.8% -1.8% Market Cap 52 Week Cash EV Project Name (A$m) Range (A$m) (A$m) 0.3 0.2 0.7 2.4 0.2 1.6 0.3 0.3 1.1 3.9 1.1 1.5 0.8 0.3 1.2 0.3 0.4 0.6 0.9 3.0 2.4 0.7 0.4 0.3 0.4 383 931 700 843 770 558 592 865 774 589 800 376 730 387 930 N/A 606 827 884 580 626 798 27 635 487 27 102 160 387 15 169 53 57 208 793 218 204 160 41 111 1 59 121 185 292 297 124 96 60 40 IMPORTANT DISCLAIMER This report has been prepared by Lincoln Crowne & Company Pty. Limited ("LCC"). The research is based on information obtained from sources believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability o f any such information and makes no warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on this basis for actions made . Page 3 / 4

- 4. WEEKLY Australian Copper Gold Report 14th October 2013 WWW.LCC.ASIA Mergers & Acquisitions Oceana Gold Corporation (ASX: OGC) and Pacific Rim Mining Corp. (TSX: PMU) have entered into a definitive agreement pursuant to which OGC will acquire all the shares of PMU for C$10.2 million. PMU key asset is the El Dorado high grade goldsilver resource with significant exploration upside, in El Salvador. El Dorado has a resource of 1.7 moz AuEq grading 10.4 g/t AuEq. The acquisition transaction multiple amounts to US$6/oz. Capital Mining (ASX: CMY) has signed an agreement with Indochine Mining (ASX: IDC) to acquire up to 85% of IDC gold assets in Cambodia. IDC has agreed to sell an initial 55% interest subject to a number of conditions including the completion of A$3 million capital raising by CMY. IDC has agreed to grant CMY the right to earn up to a further 30% interest as follows: an additional 15% following sole funding a total of A$6 million on exploration expenditure within 3 years of settlement and a further 15% following sole funding of a further A$4 million, for a total expenditure of A$10 million, within 3 years of settlement. IDC has a clawback right should CMY fund less than A$3 million of exploration expenditure within 2 years of settlement. The consideration to acquire the initial 55% is A$20,000 and the issue of CMY shares to IDC representing 40% of CMY’s shares on issue immediately after settlement. Coppermoly (ASX: COY) has amended the terms of the Re-Acquisition Agreement with Barrick in relation to the Simuku, Nakru and Talelumas projects in West New Britain. The first payment has been reduced from A$1.011 million to A$680,000. This has been paid to Barrick, restoring Coppermoly to 51% ownership. The second payment has increased from A$1 million to A$1.331 million, scheduled in August 2012 to increase the ownership by 21% to 72%. Full ownership could be restored for an additional A$3m before August 2018, with the release of a feasibility study on any one or more of the exploration licences. Gold Producers Code Company Name Open Price Close Price Week High Week Low Weekly Change Market Cap (A$m) 52 Week Range Cash Debt (A$m) (A$m) EV EV/ (A$m) EBITDA BDR Beadell Resources 0.86 0.85 0.86 0.81 ▼ -1.2% 668 28 141 781 70.2x BEZ Besra Gold* 0.05 0.05 0.05 0.05 — 0.0% 17 4 43 56 7.6x CTO Citigold Corporation 0.05 0.05 0.05 0.05 ▼ -6.1% 62 1 0 62 NM CRK Crocodile Gold Corp* 0.08 0.11 0.11 0.07 ▲ 31.3% 43 29 45 58 0.6x DRA Dragon Mining 0.24 0.22 0.24 0.22 ▼ -8.5% 19 7 0 12 60.0x EVN Evolution Mining 0.82 0.76 0.83 0.71 ▼ -7.3% 539 14 133 658 3.3x EDV Endeavour Mining Corp* 0.61 0.54 0.65 0.54 ▼ -11.5% 223 82 211 352 5.6x FML Focus Minerals 0.01 0.01 0.01 0.01 ▼ -8.3% 101 114 11 -3 NM GDO Gold One International 0.23 0.21 0.23 0.21 ▼ -10.9% 291 8 226 509 6.6x KCN Kingsgate Consolidated 1.62 1.51 1.62 1.50 ▼ -6.5% 230 42 200 388 3.6x KRM Kingsrose Mining 0.41 0.39 0.41 0.39 ▼ -6.1% 129 1 6 134 NM LSA Lachlan Star 0.16 0.16 0.16 0.16 — 0.0% 18 3 26 41 NM MML Medusa Mining 2.22 2.02 2.25 1.99 ▼ -9.0% 382 8 15 388 5.4x MLX Metals X 0.14 0.14 0.14 0.14 — 0.0% 223 75 0 149 17.7x MOY Millennium Minerals 0.29 0.29 0.30 0.27 ▼ -1.7% 62 5 54 112 3.2x NCM Newcrest Mining 11.15 10.50 11.19 10.45 ▼ -5.8% 8,039 69 4,210 12,180 4.6x NGF Norton Gold Fields 0.14 0.13 0.15 0.13 ▼ -7.1% 121 56 115 180 7.4x NST Northern Star Resources 0.84 0.82 0.85 0.80 ▼ -3.0% 346 61 12 297 4.2x OGC OceanaGold Corporation* 1.46 1.32 1.52 1.28 ▼ -9.6% 388 18 247 616 3.4x PNA PanAust 2.07 1.94 2.10 1.87 ▼ -6.5% 1,153 89 171 1,234 4.0x PGI PanTerra Gold 0.07 0.06 0.07 0.06 ▼ -13.7% 48 4 0 44 NM PRU Perseus Mining 0.52 0.48 0.53 0.48 ▼ -7.7% 220 35 0 185 2.6x RDR Reed Resources 0.02 0.02 0.03 0.02 ▼ -8.7% 11 19 0 -8 NM RED Red 5 - suspended 8 23 16 NM RMS Ramelius Resources 0.15 0.13 0.16 0.13 ▼ -13.3% 47 37 4 13 0.7x RRL Regis Resources 4.05 3.60 4.07 3.56 ▼ -11.1% 1,792 81 0 1,711 7.1x RSG Resolute Mining 0.61 0.56 0.62 0.55 ▼ -8.3% 356 156 91 291 2.0x SAR Saracen Mineral Holdings 0.21 0.22 0.23 0.20 ▲ 2.4% 128 13 22 137 2.3x SBM St Barbara 0.55 0.46 0.55 0.45 ▼ -15.6% 225 129 328 424 NM SLR Silver Lake Resources 0.74 0.67 0.74 0.65 ▼ -8.8% 291 19 33 305 NM TBR Tribune Resources 2.26 2.40 2.48 2.26 ▲ 6.2% 121 9 14 126 1.9x TGZ Teranga Gold Corp* 0.65 0.61 0.67 0.60 ▼ -6.2% 180 54 82 208 0.9x TRY Troy Resources 1.44 1.36 1.45 1.32 ▼ -5.6% 227 41 0 186 3.2x UML Unity Mining 0.07 0.06 0.07 0.06 ▼ -10.1% 44 28 0 16 2.2x Source: Capital IQ, LCC research. Assumption: A$/US$ exchange rate of 0.95. Note: * These stocks are not primarily listed on the ASX. Prices, market cap and multiples are based on their primarily listed market quote. Ore Quarterly C1 Costs C3 Costs Reserve Production (oz) (US$/oz) (US$/oz) (moz) 1.9 0.1 0.3 1.0 0.1 3.1 2.5 0.5 2.7 1.9 N/A 0.4 0.6 2.7 0.7 87.3 1.1 0.3 3.6 1.1 0.6 4.0 0.8 0.7 0.6 3.0 4.4 1.1 5.7 1.7 0.2 1.7 0.4 0.4 36,179 18,500 773 48,261 17,223 112,559 73,700 25,172 68,208 61,793 1,395 16,160 15,642 41,622 16,441 642,032 41,464 25,421 68,353 28,712 6,661 47,565 12,918 3,169 18,988 72,134 102,685 37,259 107,363 55,600 19,133 49,661 27,808 13,212 679 793 559 1,101 928 724 854 1,804 1,071 824 6,445 1,137 355 1,268 685 713 978 722 682 603 991 1,181 1,642 727 1,459 635 799 783 910 681 401 642 813 881 N/A 1,330 N/A N/A N/A 1,298 975 1,863 1,244 1,272 N/A N/A N/A N/A 844 988 1,246 1,043 1,000 757 N/A 1,405 1,700 1,096 N/A N/A 963 1,148 N/A 1,036 N/A 1,063 N/A N/A IMPORTANT DISCLAIMER This report has been prepared by Lincoln Crowne & Company Pty. Limited ("LCC"). The research is based on information obtained from sources believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability o f any such information and makes no warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on this basis for actions made . Page 4 / 4