Oz Metals 20150419

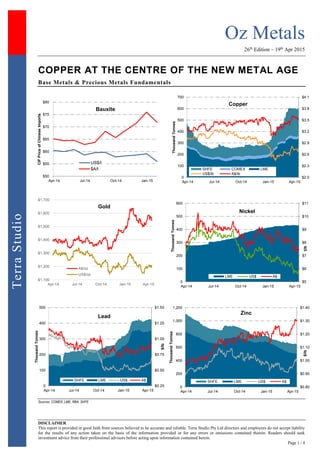

- 1. Oz Metals 26th Edition – 19th Apr 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 4 TerraStudio COPPER AT THE CENTRE OF THE NEW METAL AGE Base Metals & Precious Metals Fundamentals Sources: COMEX, LME, RBA, SHFE $50 $55 $60 $65 $70 $75 $80 Apr-14 Jul-14 Oct-14 Jan-15 CIFPriceofChineseImports Bauxite US$/t $A/t $2.0 $2.3 $2.6 $2.9 $3.2 $3.5 $3.8 $4.1 0 100 200 300 400 500 600 700 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 ThousandTonnes Copper SHFE COMEX LME US$/lb A$/lb $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Gold A$/oz US$/oz $5 $6 $7 $8 $9 $10 $11 0 100 200 300 400 500 600 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Nickel LME US$ A$ $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 0 100 200 300 400 500 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Lead SHFE LME US$ A$ $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 0 200 400 600 800 1,000 1,200 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Zinc SHFE LME US$ A$

- 2. Oz Metals 26th Edition – 19th Apr 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 4 TerraStudio Markets & Majors Reuters - The Singapore trading hubs of the world's largest commodity companies are coming under scrutiny from the governments of some resource-producing countries who say they suspect they are using units in the Southeast Asian financial centre to avoid tax. Some of the world's largest oil, mining and soft commodity companies book billions of dollars of revenue in the tiny island state every year, where tax rates can be very low, which is perfectly legal unless they deliberately under-price group transactions so as to shift profit there from units in other countries. The Australian - A report commissioned by the University of Western Australia claims that the mining slump offers a once-in-a-lifetime chance for the Australian state to exploit its huge recent influx of global professionals by transforming into a regional hub for innovation. SNL - Every A$1 million invested in the Western Australia's Exploration Incentive Scheme stimulates exploration activity which generates A$10.3 million in benefits for the state, according to a study conducted by ACIL Allen Consulting for the Department of Mines and Petroleum. Australian Mining - Mining lobbyist Terry Burgess said South Australia will have the potential to build state mining revenues to A$7 billion per annum, but also believes that the Australian state has its work cut out to prepare for the market upswing. According to The Australian Financial Review, fund managers with large interests in Australian resource companies are not adding more funds to the sector, with Pengana Capital and Fidelity as examples. The two firms are using a "wait-and-see” approach after Australian Treasurer Joe Hockey's comments that iron ore prices could fall as low as US$35/t and a warning from Standard & Poor's Ratings Services. SMM - Will Chinese government introduce more stimulus measures following the better-than-expected economic reports? Will copper prices take impetus to extend rebound? “The PPI, though falling more slowly, remained weak, reflecting the real economy has not yet recovered,” an analyst from Dayou Futures told SMM, ”this means more easing policies are still needed to bring funds into real economy, that plus the growing long positions in copper, may herald further rally in copper prices.” Analyst from Shanghai CIFCO Futures also expected continued rise in copper prices, citing the arrival of peak demand season and disrupted production at large copper mines. But the analyst says the rebound may be limited. Reuters – Nearly a quarter of the world’s major copper mines are running in the red, even after producers including Codelco and BHP Billiton engage in the deepest cost-cutting in years, according to a Reuters analysis. A 17% slump since last July has pushed copper futures on the LME to under $6,000/t ($2.72/lb), the lowest since 2009, is the first major test of producers’ margins, since the global economic crisis, forcing a new reckoning after five years of relatively consistent profitability. Antofagasta CEO Diego Hernandez warned that Chile's copper industry may not remain competitive due to tapped out resources at mining projects and rising labour costs, London's Financial Times reported. Since 2004, Chile's investments in mining were about the same as the preceding decade, yet production has hardly registered any increases. Output between 1990 and 2004 jumped 9.2% annually while productivity nearly doubled. Separately, Hernandez told Metal Bulletin that forecasts of a copper surplus fell significantly in the past few months owing to several issues with existing and upcoming projects. The company initially estimated a copper surplus of 400,000 tonnes for 2015 in November 2014, which was reduced to 200,000 tonnes in February this year. Antofagasta now anticipates an even lower 2015 copper surplus of 100,000 tonnes. The CEO added that opportunities for M&A activity in the copper sector are more limited than other commodities while current prices make greenfield expansions less attractive. According to Metal Bulletin, Hernandez noted that "copper is still the best commodity to be in and the companies that own copper assets don't want to dispose of them." Metal Bulletin - Jean-Sébastien Jacques, CEO of Rio Tinto’s copper division, said the world is on the threshold of a new metal age and copper is at the centre. mining.com - Chilean copper giant Codelco is fine-tuning details of a fresh plan to tackle the almost 12-month-long delay in a project to turn its Chuquicamata open pit mine in the country into an underground operation. Reuters – Codelco expects its annual copper production to reach 2 million tonnes by 2016 at it invests US$25 billion in new mines and expansion projects to boost output. Codelco produced 1.67 million tonnes of copper in 2014 from its 100% owned mines, but its position as the world’s No.1 producer is being threatened by declining ore grades, high energy costs and permitting delays for new projects. Peru's biggest mining union has approved an indefinite work stoppage, commencing May 18, in a bid to demand better working conditions for workers, Reuters reported, citing Ricardo Juarez, president of the national mining workers federation.

- 3. Oz Metals 26th Edition – 19th Apr 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 4 TerraStudio In a bid to prevent looming layoffs and shuttering of operations in the country, Zambia has decided to ditch its initial plans to raise mining royalties by too much, now proposing to set the royalties at 9% for both open-pit and underground mines, Reuters reported, citing "a source in the presidency." The unexpected drop in the price of nickel has prompted Macquarie to lower its price forecasts and downgrade Australian producers, MiningNews reported. "The collapse in nickel prices to six-year lows has taken the market by surprise and certainly was not expected by Macquarie," the report added, citing Macquarie. Reuters – The lead market is on a tear. The least sexy of the industrial metals traded on the LME has surged by over 20% from its March lows to a current $2,049/t ($0.93/lb). It is showing year-to-date gains of almost 10%, making it by some margin the best performance of the core LME metals so far this year. SMM - Zinc prices will have a big chance to rise during the second quarter of the year, Shanghai Metals Market’s interview finds. Production worries from environmental drive and demand expectations following China’s One Belt, One Road policy are a major price driver, Jinyou Futures said to SMM. The ongoing stricter environmental protection inspections across the nation, especially in some regions, will prevent utilisation rate at domestic zinc smelters from rising significantly, and this will serve as a major supporter to zinc price. The US potential hike in its interest rate, however, will be negative to zinc price, but the supply and demand dynamics will remain the leading factor. MiningNews.net reported that MMG is contemplating a revised development plan for its wholly owned Dugald River zinc-lead-silver project in Queensland, with a decision due in the third quarter. Reuters - Members of Indonesia's tin association and PT Timah (Persero) Tbk will not trade the metals at prices below US$17,000/t, Jabin Sufianto — president of the Indonesian Association of Tin Exporters. Tin shipments from Indonesia are forecast to drop by 8% to 14% this year from 75,925 tonnes in 2014. SNL - Cameco Corp. has struck a deal with the Department of Atomic Energy of India to supply 7.1 million pounds of uranium concentrate under a long-term contract through 2020. The Saskatchewan-based uranium giant noted that the contract is its first with India, and that the country is the world's second fastest growing market for nuclear fuel. India is currently operating 21 nuclear reactors to provide 6,000 megawatts of nuclear capacity to meet about 3% of its electricity needs, with 45,000 megawatts of nuclear capacity anticipated by 2032. Australian Mining - Local business lobbyists in Queensland's city of Mt. Isa voiced their support for uranium mining, voting to submit a formal response to the minister for natural resources and mines to say they oppose the re- implementation of the ban on uranium mining. Funding, Mergers & Acquisitions Anglo American is testing market appetite for its copper deposits Mantos Blancos in Antofagasta and Mantoverde in Atacama, two of the assets the miner has earmarked for divestment. Other assets for disposal include the Chagres smelter and the company's 50.1% stake in the El Soldado mine. Reuters - Anglo American is also looking at syndicating its Peru-based Quellaveco copper project and having current partner Mitsubishi Corp. up its current 18.1% interest. Alamos Gold and AuRico Gold are to undertake a US$1.5 billion merger of equals to create an intermediate gold producer with three producing gold mines and strong growth potential, in yet another display of growing investor interest in Canadian and Mexican gold assets. Intermin Resources Ltd entered into a deal with La Mancha Resources Australia Pty Ltd in which the latter could earn up to a 70% interest in the Binduli gold project in Western Australia. Toro Energy is reportedly in discussions with as many as six energy utilities interested in possibly acquiring a stake in the company and funding its A$315 million Wiluna uranium project in Western Australia. Toro is ready to sell even a majority stake in the company under favourable conditions as 22% shareholder OZ Minerals is expected to sell its entire stake in the company. Bauxite Sector Source: Bloomberg, SNL Metals & Mining, Terra Studio Lithium-Tantalum Sector Source: SNL Metals & Mining, Terra Studio Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABX Australian Bauxite 0.35 ▲ 1% 13% 44 5 39 BAU Bauxite Resources 0.080 ▲ 4% (18%) 19 25 (6) CAY Canyon Resources 0.042 ▼ (7%) (16%) 5 1 4 MLM Metallica Minerals 0.066 ▼ (6%) 20% 11 1 10 MMI Metro Mining 0.076 ▼ (5%) 181% 22 8 14 Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) Altura Mining 0.010 ▼ (38%) (85%) 5 3 4 Galaxy Resources 0.030 ▼ (6%) 20% 32 13 125 Neometals 0.080 ▲ 23% 111% 40 7 38 Orocobre 2.15 ▼ (2%) (23%) 326 26 327 Pilbara Minerals 0.038 — 0% (10%) 23 2 20

- 4. Oz Metals 26th Edition – 19th Apr 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 4 TerraStudio Tin Sector Source: SNL Metals & Mining Nickel Sector Source: SNL Metals & Mining Copper Producers Source: SNL Metals & Mining Copper Developers & Explorers Zinc & Poly-metallic Sector Source: SNL Metals & Mining Gold Producers Source: SNL Metals & Mining Gold Developers & Explorers Source: SNL Metals & Mining For further information, please contact: J-François Bertincourt +61 406 998 779 jf@terrastudio.biz Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) Consolidated Tin Mines 0.050 ▲ 19% 22% 14 0 14 Elementos 0.008 ▼ (20%) 0% 6 1 5 Kasbah Resources 0.035 — 0% (35%) 16 4 10 Metals X 1.28 ▼ (2%) 62% 530 57 423 Monto Minerals 0.002 ▲ 100% 0% 3 1 2 Stellar Resources 0.035 — 0% 21% 11 4 8 Venture Minerals 0.025 — 0% (19%) 7 7 3 Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA Independence Group 5.57 ▲ 11% 26% 1,305 57 1,213 NA Mirabella Nickel 0.130 ▲ 30% 348% 121 18 224 0.4x Mincor Resources 0.58 ▼ (8%) (2%) 108 26 90 NA Panoramic Resources 0.43 ▼ (2%) 2% 138 64 79 1.1x Western Areas 3.47 ▲ 13% (7%) 807 231 756 NA Axiom Mining 0.170 ▲ 3% (24%) 41 2 39 NM Cassini Resources 0.08 ▲ 20% (30%) 10 8 7 NA Duketon Mining 0.17 ▼ (3%) (35%) 13 7 6 NA Legend Mining 0.007 ▼ (13%) 0% 14 7 7 NM Matsa Resources 0.165 ▼ (13%) (3%) 24 3 23 NA Metallica Minerals 0.066 ▼ (6%) 20% 11 1 10 NA Pioneer Resources 0.016 ▼ (11%) 23% 11 1 9 NA Poseidon Nickel 0.10 ▼ (8%) (19%) 66 4 83 NA Segue Resources 0.005 — 0% 0% 10 1 9 NA St George Mining 0.065 ▼ (11%) 3% 7 1 6 NA Sirius Resources 2.62 ▲ 5% 2% 895 59 650 NM Talisman Mining 0.17 ▲ 3% 6% 22 16 7 NA Winward Resources 0.24 ▼ (35%) 47% 25 6 22 NA Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA ABY Aditya Birla Minerals 0.19 — 0% (5%) 58 137 (46) NA HGO Hillgrove Resources 0.35 ▼ (1%) (23%) 51 9 61 1.3x KBL KBL Mining 0.025 ▲ 14% (17%) 12 7 35 NA MWE Mawson West 0.055 ▲ 38% 10% 22 21 71 NM OZL OZ Minerals 3.91 ▲ 2% 12% 1,187 219 968 2.8x PNA PanAust 1.74 ▼ (1%) 23% 1,124 74 1,346 NM SFR Sandfire Resources 4.38 ▲ 3% (4%) 683 58 768 NA SRQ Straits Resources 0.004 ▼ (20%) (20%) 5 13 162 NA TGS Tiger Resources 0.053 ▼ (4%) (59%) 61 80 269 5.8x 985 CST Mining 0.065 ▲ 18% 48% 1,761 136 668 1.6x 1208 MMG 3.23 ▲ 5% 35% 17,085 251 88,756 15.3x 3993 China Molybdenum 7.86 ▼ (5%) 75% 76,941 9,326 78,502 20.4x Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AOH Altona Mining 0.105 ▲ 5% (56%) 56 129 (73) ARE Argonaut Resources 0.007 ▼ (22%) (56%) 3 1 2 AVB Avanco Resources 0.083 ▲ 19% 9% 138 20 118 AVI Avalon Minerals 0.025 ▼ (17%) 25% 4 1 3 AZS Azure Minerals 0.014 — 0% (42%) 14 1 0 CDU CuDeco (suspended) 1.41 — 0% (28%) 384 7 439 CVV Caravel Minerals 0.007 — 0% (13%) 5 1 5 ENR Encounter Resources 0.10 ▲ 2% (27%) 13 4 11 ERM Emmerson Resources 0.027 ▲ 8% (13%) 10 2 7 FND Finders Resources 0.15 ▼ (6%) 0% 99 48 99 GCR Golden Cross Resources 0.059 ▼ (2%) (16%) 6 2 5 GPR Geopacific Resources 0.040 ▲ 14% (23%) 15 4 11 HAV Havilah Resources 0.26 ▲ 11% 82% 40 3 37 HCH Hot Chili 0.11 ▼ (4%) (31%) 38 6 44 HMX Hammer Metals 0.083 ▼ (2%) 1% 8 1 8 IAU Intrepid Mines 0.11 ▼ (4%) (19%) 41 74 (33) KDR Kidman Resources 0.046 ▲ 15% (31%) 6 3 5 KGL KGL Resources 0.13 ▼ (11%) (44%) 18 9 9 MEP Minotaur Exploration 0.09 ▼ (1%) (36%) 17 5 11 MNC Metminco 0.005 ▲ 11% (38%) 10 1 9 MTH Mithril Resources 0.006 — 0% (14%) 3 2 1 PEX Peel Mining 0.085 ▲ 16% 23% 11 3 9 RDM Red Metal 0.040 ▼ (2%) (51%) 7 2 3 RER Regal Resources 0.032 ▼ (20%) (30%) 7 2 4 RTG RTG Mining 0.570 ▲ 6% (2%) 77 2 74 RXM Rex Minerals 0.085 ▲ 1% (23%) 19 3 11 SMD Syndicated Metals 0.020 — 0% (38%) 5 2 4 SRI Sipa Resources 0.070 ▼ (7%) 89% 43 4 42 SUH Southern Hemisphere 0.010 — 0% (77%) 2 2 2 THX Thundelarra Resources 0.099 ▲ 11% (10%) 32 7 24 XAM Xanadu Mines 0.093 ▼ (7%) (7%) 35 8 34 Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) Aeon Metals 0.090 ▲ 11% (10%) 27 5 39 DGR Global 0.036 ▼ (10%) 13% 15 0 17 Heron Resources 0.13 ▲ 4% 4% 47 28 22 Ironbark Zinc 0.100 ▲ 6% 25% 44 3 41 Impact Minerals 0.017 ▲ 31% (29%) 10 1 7 Investigator Resources 0.011 — 0% (31%) 5 3 0 MacPhersons Resources 0.120 ▲ 4% (4%) 38 5 33 Phoenix Copper 0.014 ▼ (18%) (53%) 5 3 2 Red Metal 0.040 ▼ (2%) (51%) 7 8 (1) Red River Resources 0.14 ▼ (4%) 23% 24 4 20 Rox Resources 0.030 — 0% 7% 26 3 23 Terramin Australia 0.105 ▼ (9%) (5%) 159 1 158 Variscan Mines 0.011 ▼ (45%) (55%) 3 2 2 Venturex Resources 0.004 — 0% (20%) 6 1 5 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA AGD Austral Gold 0.15 ▲ 85% 15% 72 NA 63 NA ALK Alkane Resources 0.25 ▼ (11%) 14% 104 16 85 NA AMI Aurelia Metals 0.26 ▲ 2% 6% 99 22 200 NA BDR Beadell Resources 0.23 ▲ 7% 0% 180 13 285 4.4x BOK Black Oak Minerals 0.36 ▼ (10%) 33% 16 11 30 NA DRM Doray Minerals 0.44 — 0% (8%) 105 16 104 NA EVN Evolution Mining 0.93 ▲ 5% 44% 667 32 796 3.9x IGO Independence Group 5.57 ▲ 11% 26% 1,305 57 1,213 NA KCN Kingsgate Consolidated 0.69 ▼ (3%) 4% 153 54 236 NA KRM Kingsrose Mining 0.27 ▲ 23% 6% 97 7 107 NA LSA Lachlan Star 0.024 — 0% 20% 4 2 22 NA MIZ Minera Gold 0.002 — 0% (33%) 6 0 11 NA MLX Metals X 1.28 ▼ (2%) 62% 530 57 423 NA MML Medusa Mining 0.90 ▼ (4%) 38% 186 13 179 NA MOY Millennium Minerals 0.028 — 0% (24%) 6 2 42 NM NCM Newcrest Mining 14.18 ▲ 1% 30% 10,869 141 15,286 NA NGF Norton Gold Fields 0.20 ▼ (15%) 56% 182 19 309 4.8x NST Northern Star Resources 2.20 ▼ (4%) 48% 1,304 82 1,276 NA OGC OceanaGold Corp. 2.24 ▼ (12%) 11% 674 NA 756 2.6x PGI PanTerra Gold 0.170 ▲ 13% (6%) 14 3 77 NM PRU Perseus Mining 0.30 ▲ 2% 13% 155 37 121 2.1x RMS Ramelius Resources 0.140 ▼ (3%) 175% 66 12 48 NA RRL Regis Resources 1.29 ▼ (1%) (33%) 642 7 652 NA RSG Resolute Mining 0.26 ▼ (2%) (2%) 167 19 198 NA SAR Saracen Mineral Holdings 0.45 ▲ 5% 76% 357 36 337 NA SBM St Barbara 0.32 — 0% 200% 156 79 479 NA SLR Silver Lake Resources 0.18 ▼ (5%) (10%) 88 24 95 NA TBR Tribune Resources 3.50 ▼ (1%) 32% 175 11 190 11.0x TRY Troy Resources 0.46 ▼ (1%) 0% 90 43 130 NA UML Unity Mining 0.011 ▲ 16% 57% 12 7 0 NA Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AYC A1 Consolidated 0.035 — 0% (13%) 10 0 9 ABU ABM Resources 0.25 ▲ 7% (15%) 84 11 73 AWV Anova Metals 0.046 — 0% 70% 13 1 12 AZM Azumah Resources 0.025 ▼ (7%) 25% 10 4 9 BLK Blackham Resources 0.145 ▼ (6%) 184% 26 3 23 BSR Bassari Resources 0.010 ▼ (9%) (17%) 13 0 13 CHN Chalice Gold Mines 0.12 ▼ (4%) 10% 33 43 (10) CHZ Chesser Resources 0.033 — 0% (8%) 7 1 3 DCN Dacian Gold 0.50 ▲ 6% 79% 48 8 41 EXC Exterra Resources 0.020 ▲ 67% 54% 4 1 3 EXG Excelsior Gold 0.090 ▼ (9%) 48% 42 2 41 FML Focus Minerals 0.007 — 0% (7%) 59 9 50 GCY Gascoyne Resources 0.087 ▼ (4%) 23% 16 1 15 GMR Golden Rim Resources 0.008 ▼ (6%) 60% 12 1 11 GOR Gold Road Resources 0.36 ▲ 3% 47% 214 21 193 GRY Gryphon Minerals 0.060 — 0% (6%) 24 34 0 IDC Indochine Mining 0.006 — 0% (50%) 8 0 10 KGD Kula Gold 0.042 ▼ (2%) (5%) 11 3 8 MSR Manas Resources 0.014 ▼ (13%) 0% 7 0 7 MUX Mungana Goldmines 0.130 — 0% 4% 31 5 36 OGX Orinoco Gold 0.072 ▼ (3%) 24% 11 1 10 PNR Pacific Niugini 0.075 ▼ (6%) 50% 29 1 28 PXG Phoenix Gold 0.072 ▼ (15%) (27%) 31 6 25 RED Red 5 0.115 ▲ 15% 25% 87 38 70 RNI Resource & Investment 0.040 ▼ (20%) (47%) 20 5 37 RNS Renaissance Minerals 0.040 ▼ (2%) (38%) 16 4 12 SAU Southern Gold 0.012 — 0% 50% 6 1 6 SIH Sihayo Gold 0.015 ▲ 25% 88% 17 0 12 TAM Tanami Gold 0.034 ▲ 6% 143% 40 1 50 WAF West African Resources 0.086 ▲ 26% (14%) 23 3 23 WPG WPG Resources 0.035 — 0% (8%) 10 3 6