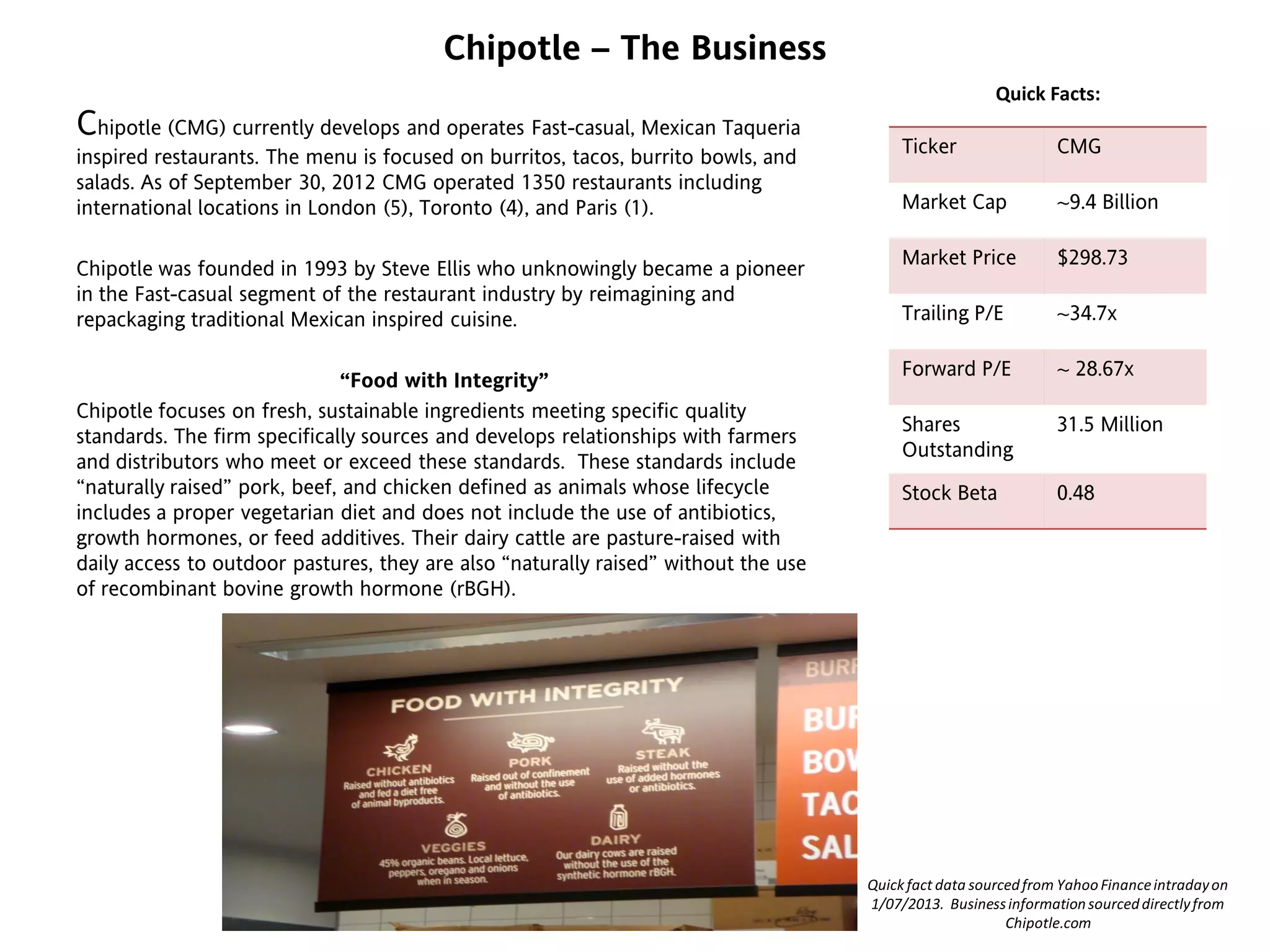

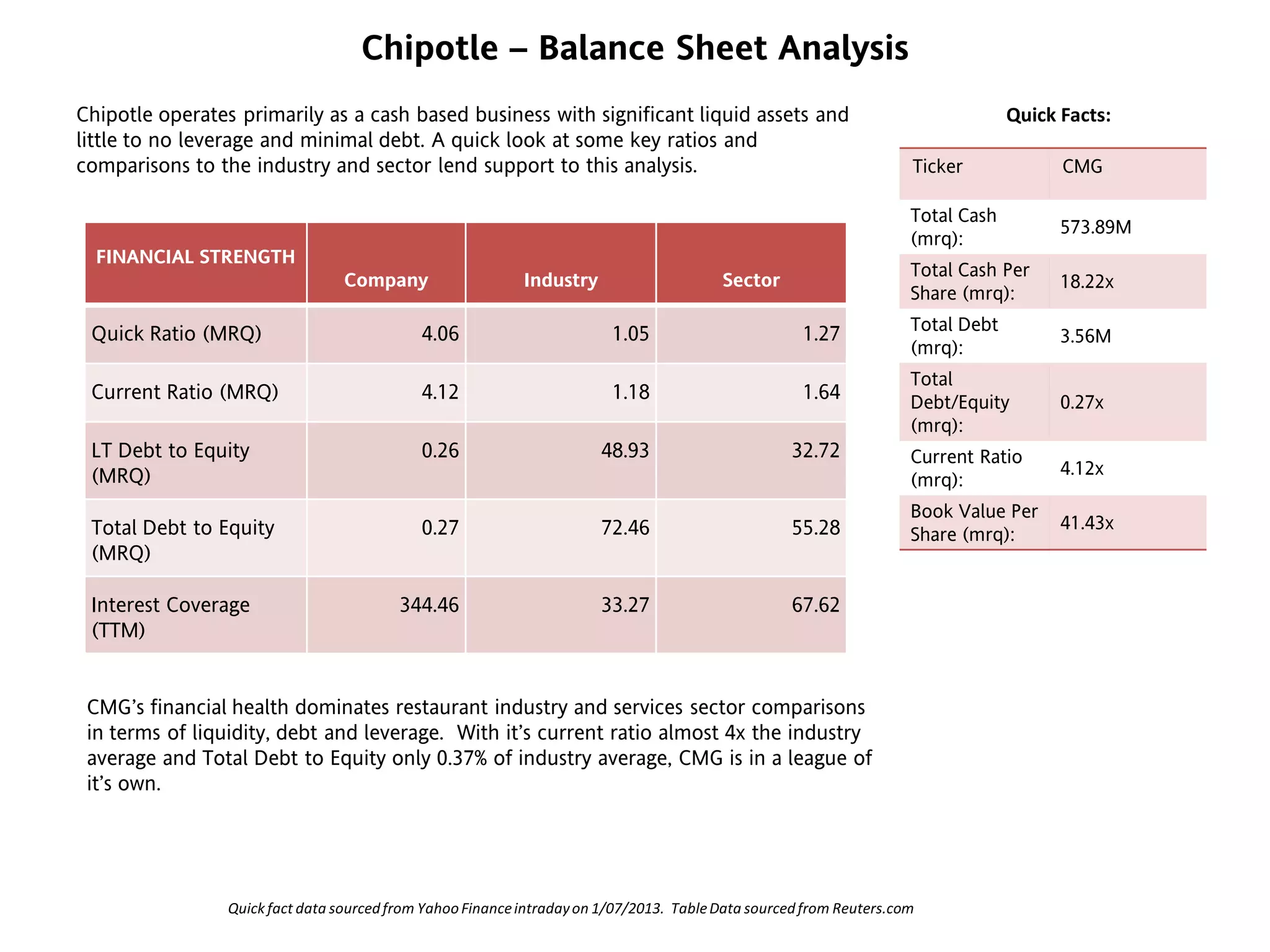

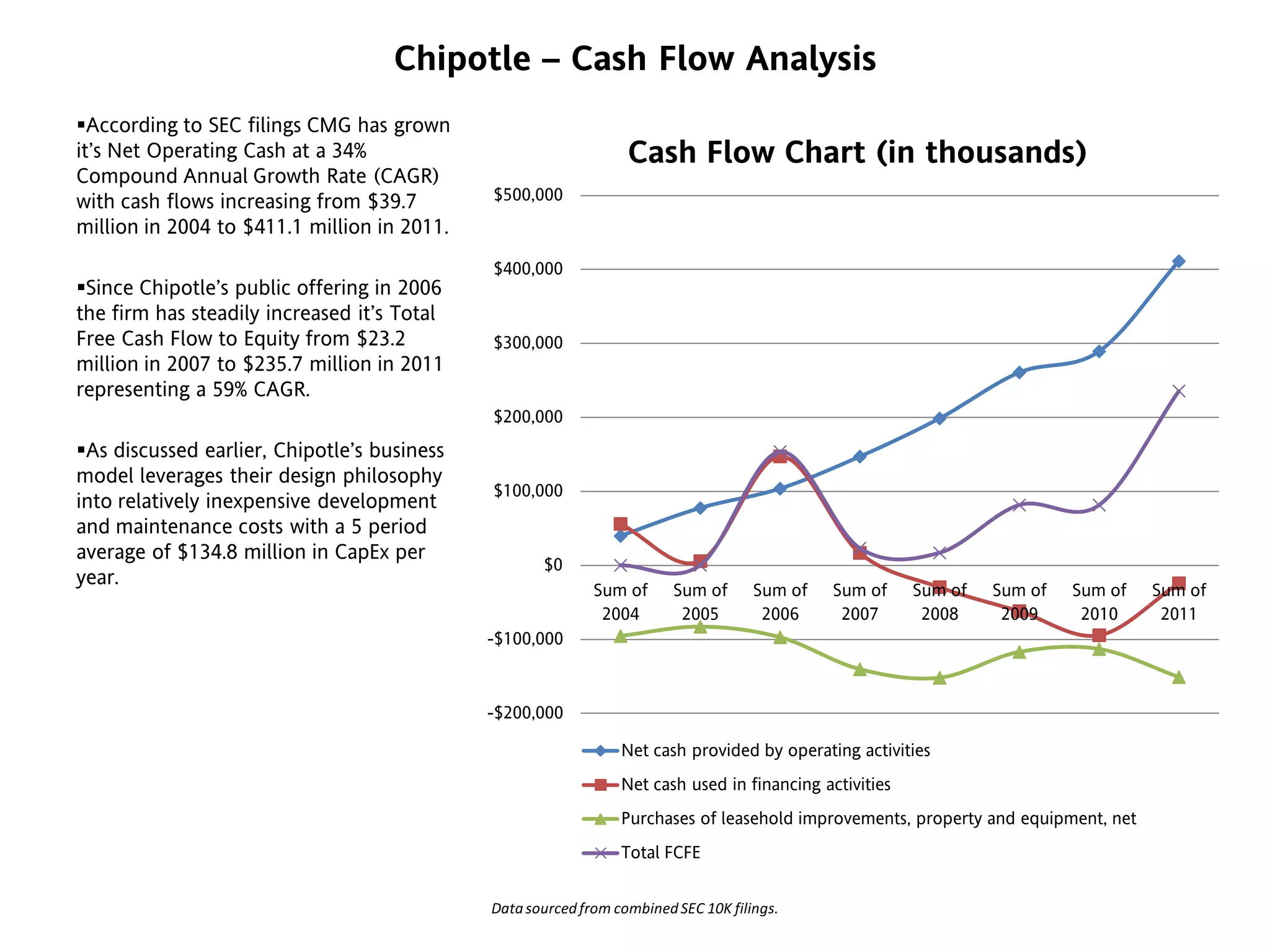

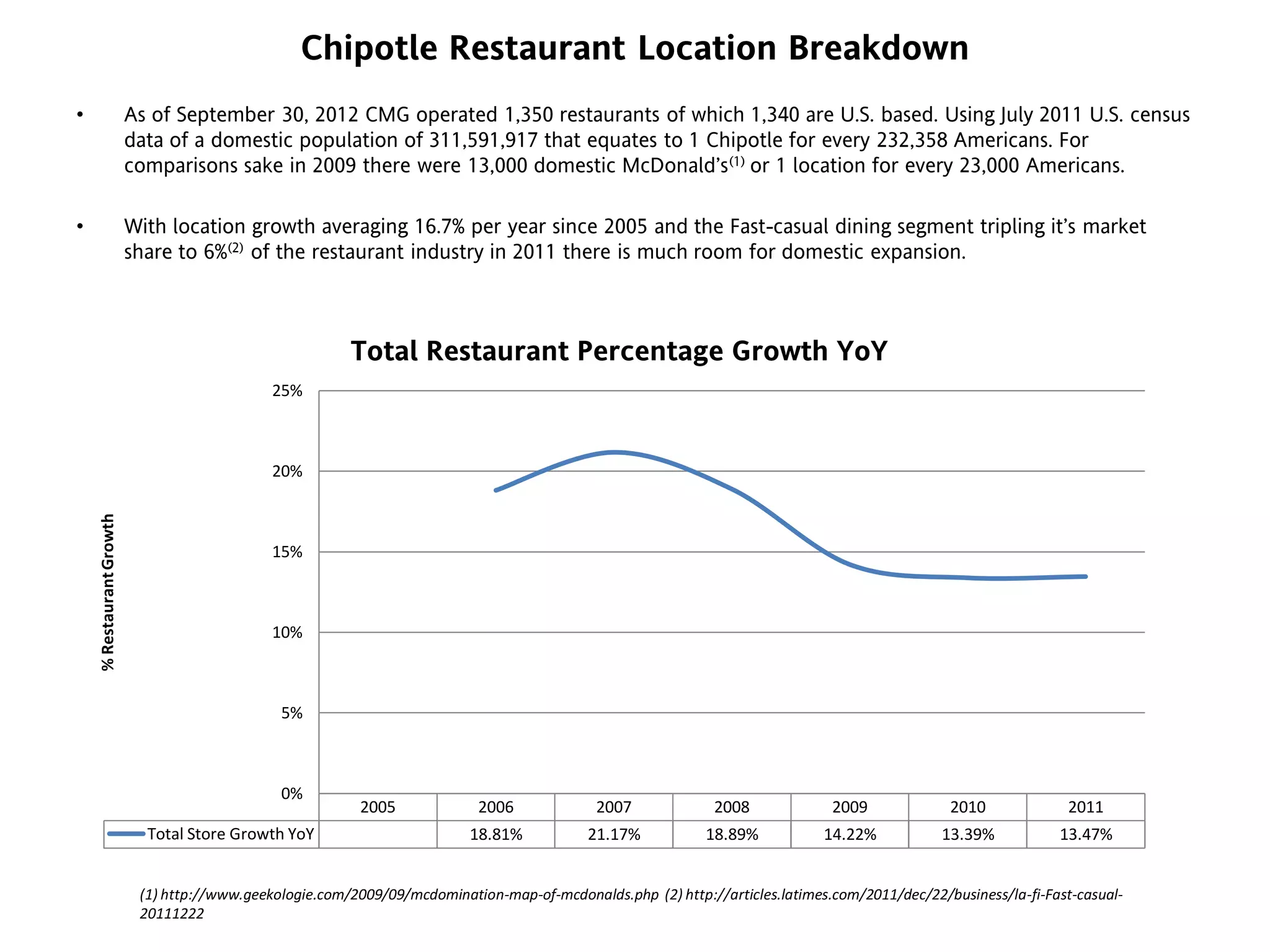

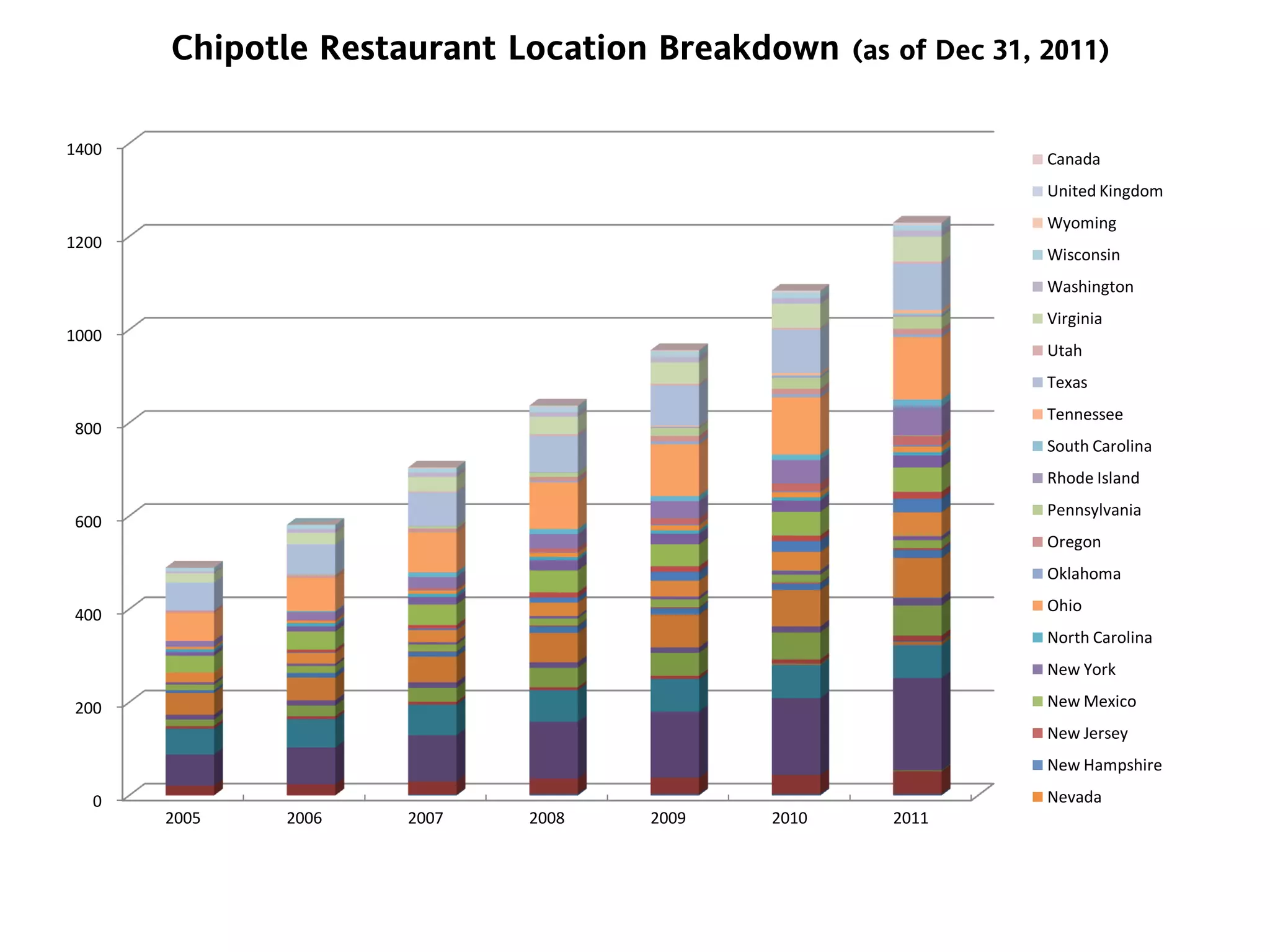

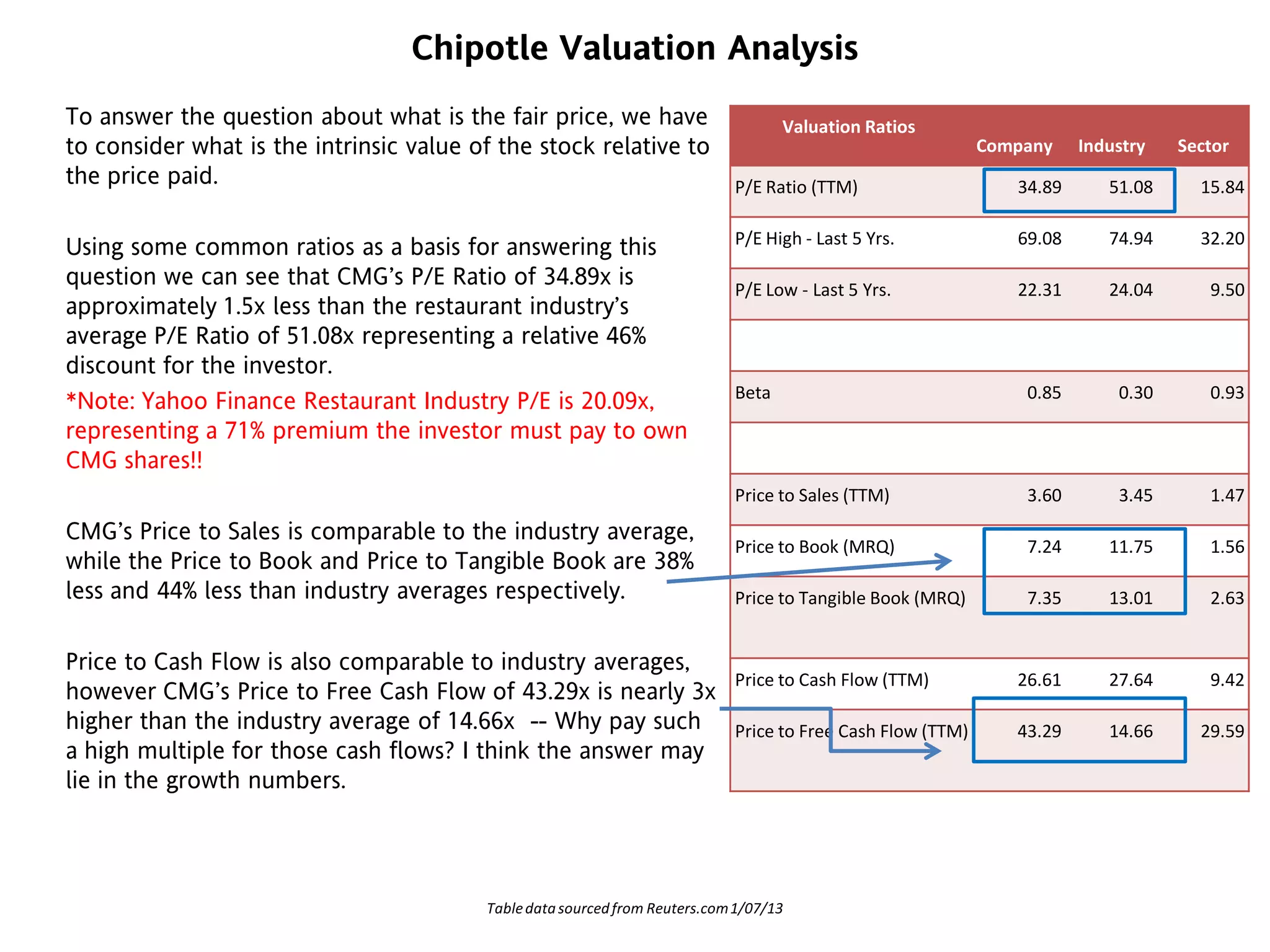

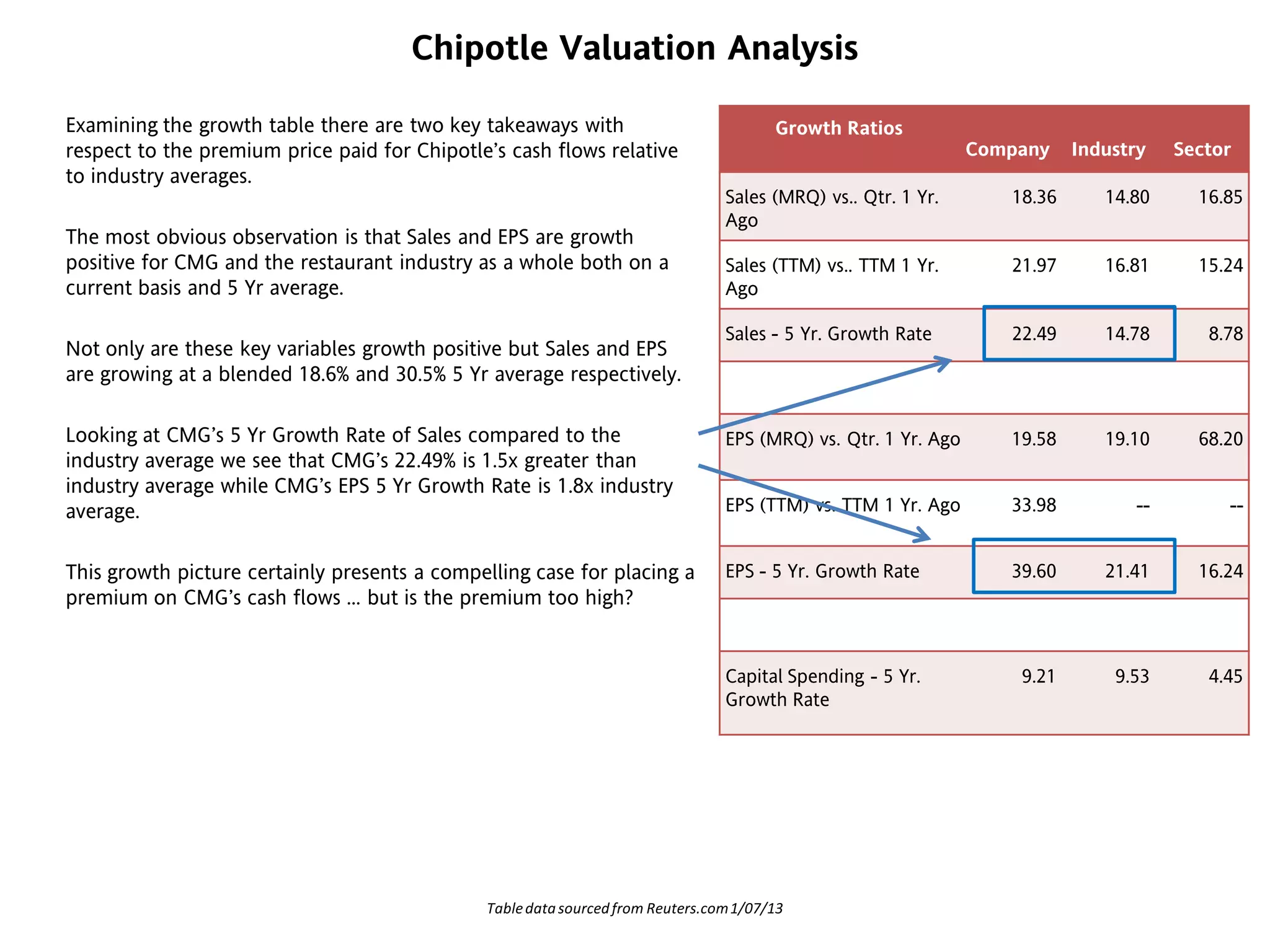

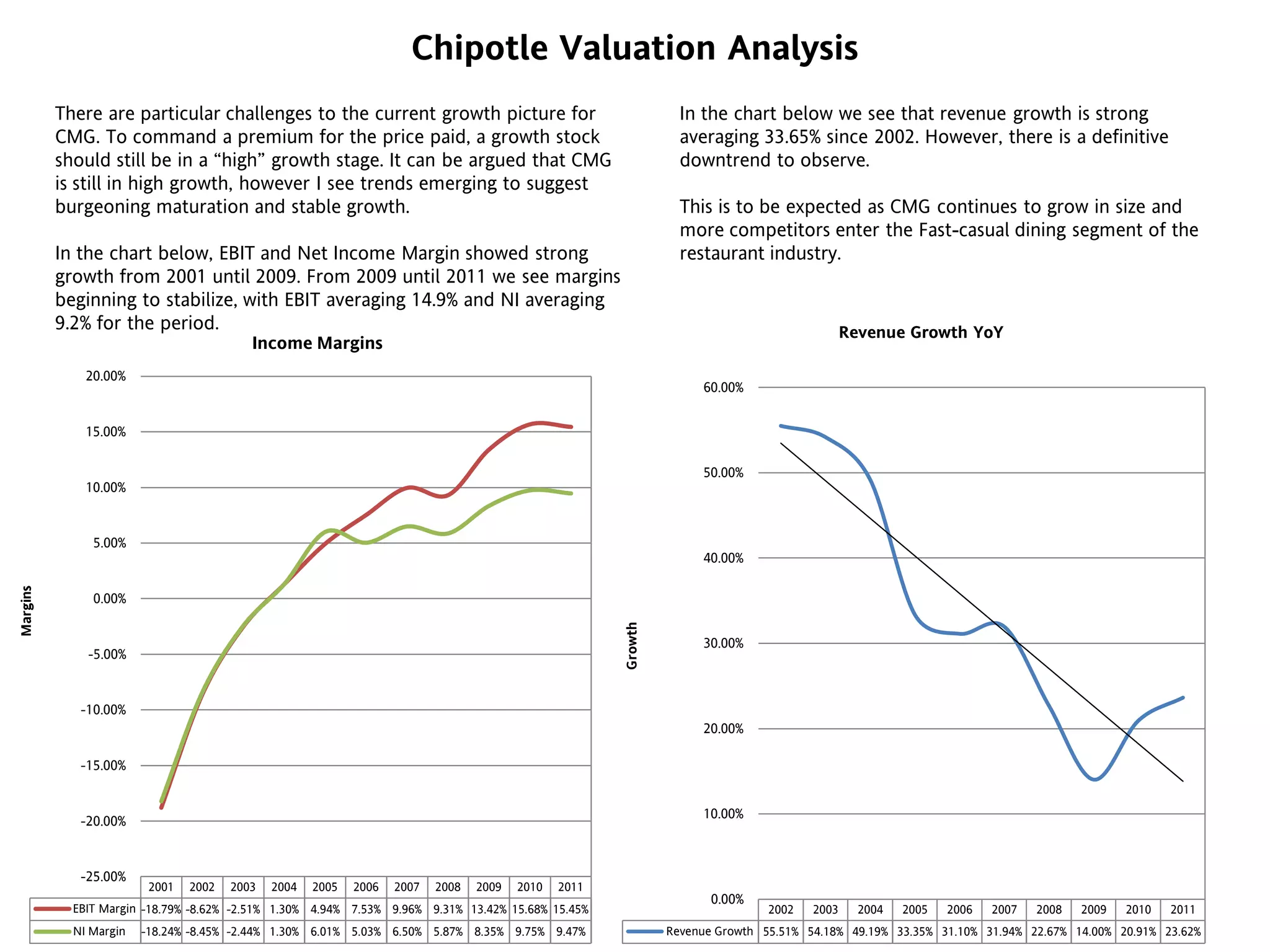

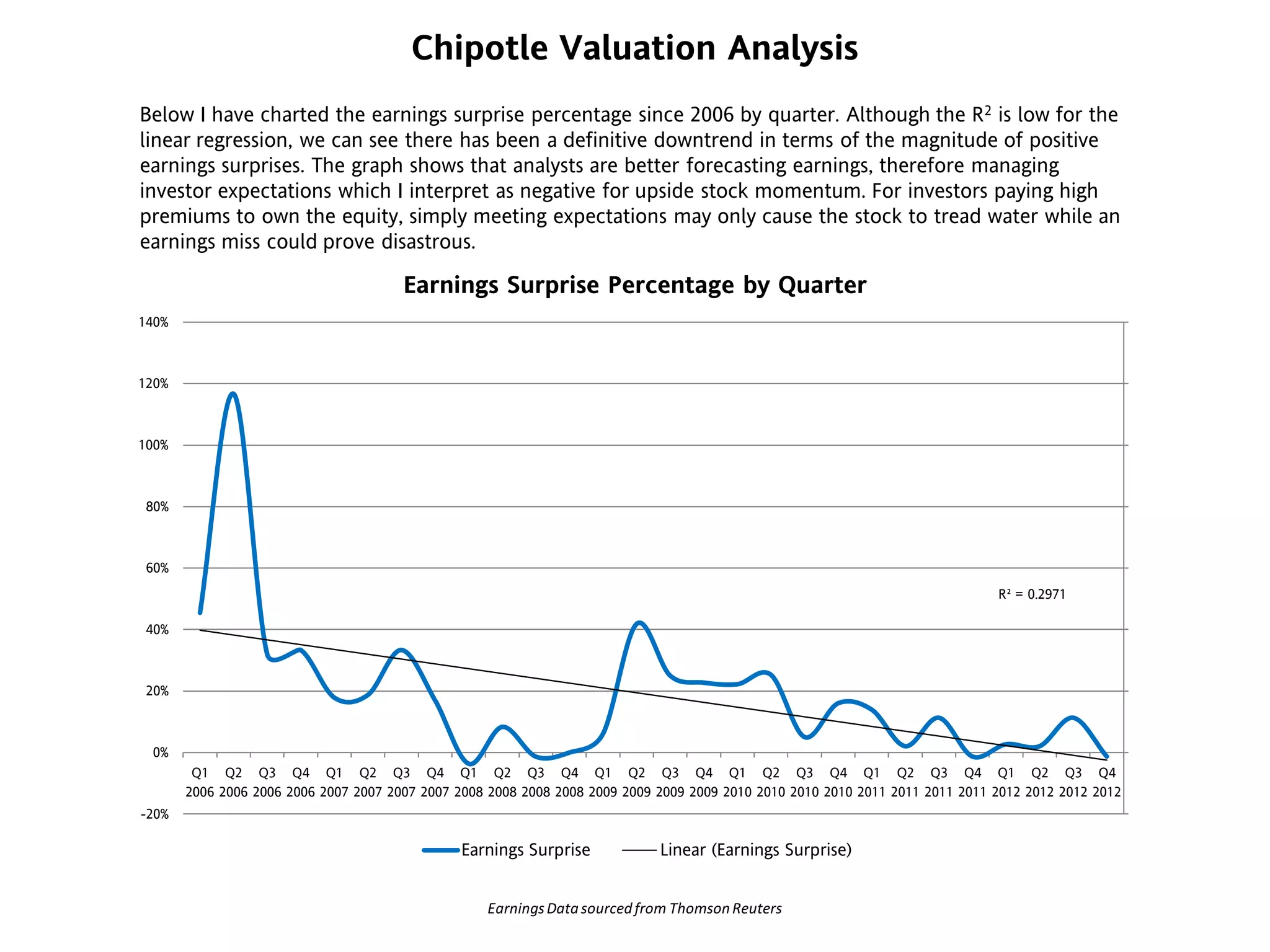

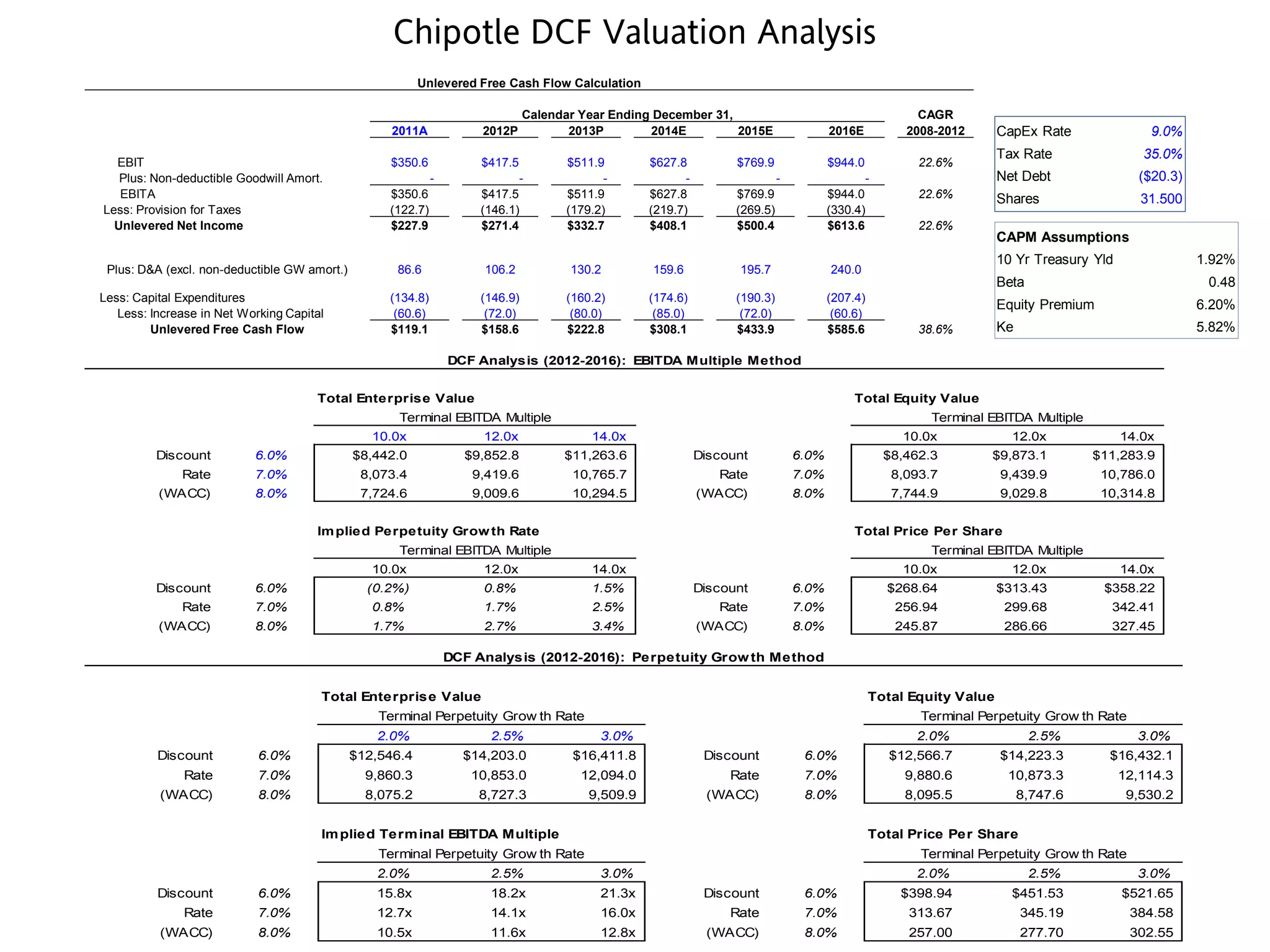

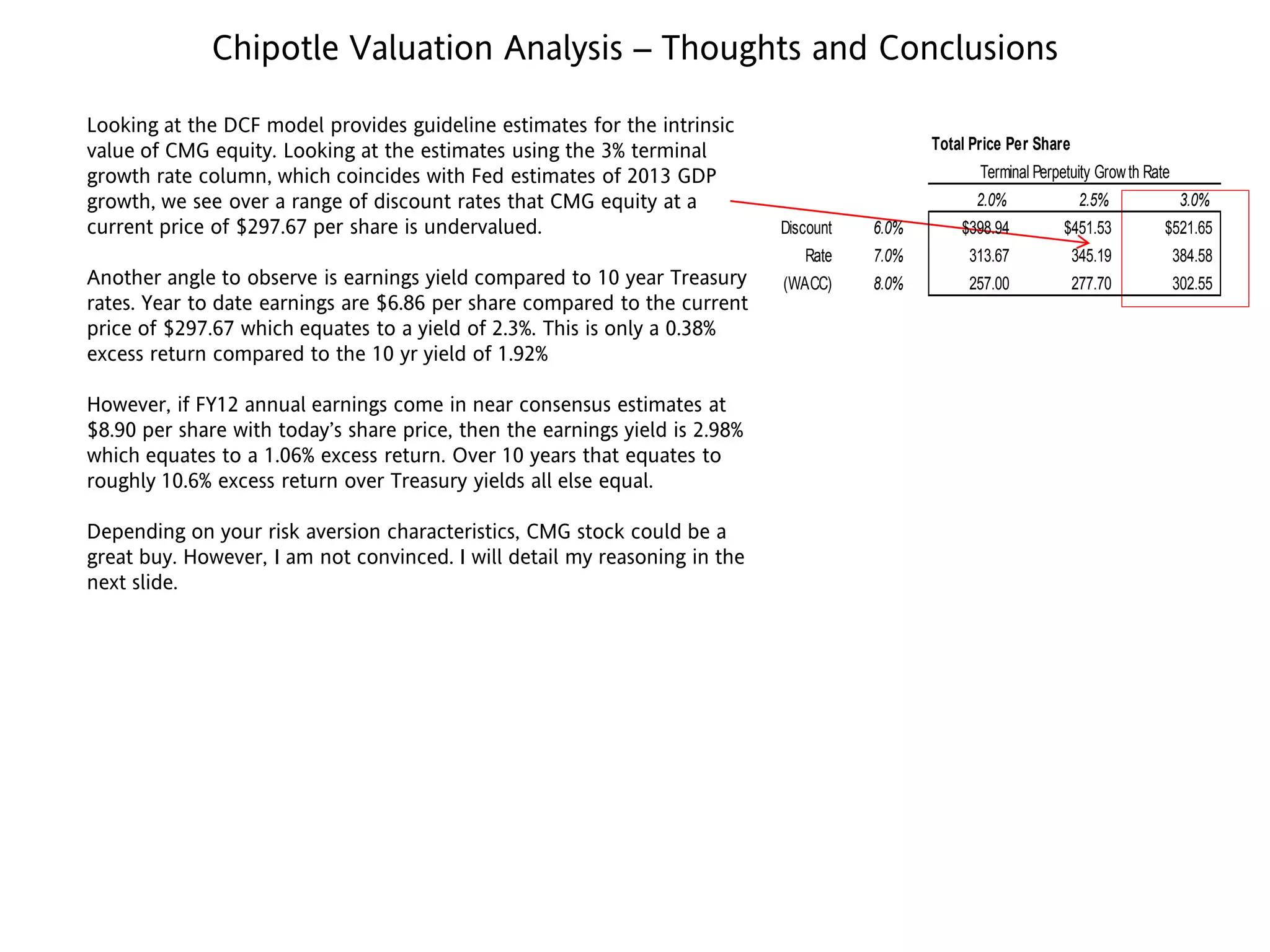

Chipotle operates over 1,350 fast casual Mexican restaurants across the United States and internationally. While the company has experienced strong growth in revenues and earnings, some analysts argue Chipotle may be nearing maturity with margins and revenue growth stabilizing. Using a discounted cash flow model, the fair value of Chipotle's shares depends on future growth assumptions, but some feel the current stock price of $298 reflects a high premium compared to the company's fundamentals and growth outlook.