Chipotle Mexican Grill, Inc. has experienced significant growth over the past three years, achieving high top-line growth rates of up to 28% and strong EBITDA growth, despite facing challenges from recent food safety incidents. The company maintains a unique position between the fast food and casual dining sectors by focusing on quality ingredients and sustainable practices, with plans for continued expansion domestically and modestly internationally. Financially, Chipotle demonstrates resilience with strong profit margins and high inventory turnover, although it has encountered increased operational costs due to rising labor and ingredient expenses.

![Sustainable long term growth rate analysis

...............................................................................................

...................... 10

Underlying assumptions

...............................................................................................

............................................................ 10

Risk and Return Analysis

...............................................................................................

........................................................... 12

Overview Risk/Return Analysis

...............................................................................................

.............................................. 12

Portfolio Simulation

...............................................................................................

..................................................................... 13

Calculation of Beta

...............................................................................................

........................................................................ 14

Required Returns based on Capital Asset Pricing Model

[CAPM] .......................................................................... 15

Preliminary Recommendations

...............................................................................................

.............................................. 15

Corporate Valuation

...............................................................................................

...................................................................... 16

Discounted Cash Flow Model](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-3-320.jpg)

![- 5 -

KEY RATIO ANALYSIS ACROSS INDUSTRY

DuPont Analysis

The DuPont analysis indicates a stable Return on Equity [ROE]

for Chipotle with a slight upwards trend

over the years. However, Chipotle has consistently had lower

ROE than most of its main competitors over

the last five years. This is a trend that continued through

FY2014. However, the main driver for the lower

ROE is debt utilization. They have slightly above average Profit

Margin and Total Asset Turnover, but have

the lowest level of debt to equity and as a result have a low

Leverage.

Figure 3 - DuPont Analysis Split](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-22-320.jpg)

![mARGH

Note: Calculations based on Bloomberg data.

Financial Ratio Analysis

- 8 -

Other Key Ratios

P/E ratio

Chipotle is highly valued based on the P/E Ratio compared to

its peer group. Within the last years,

Chipotle was consistently valued above average. This reflects

its strong growth as well as the stable

business model. The growth and investment strategy of Chipotle

is perceived well by the market

underscored by a share price development of +26.1% over the

last three years (including recent

drawback caused by e-coli incidents).

Cash Conversion

Within the industry a negative Cash Conversion Cycle [CCC] is

quite common. Given the business to

consumer model of the restaurant industry, firms usually collect](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-36-320.jpg)

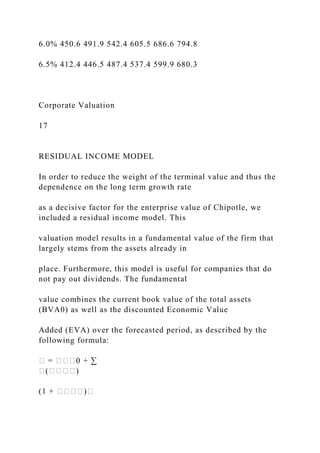

![Risk and Return Analysis

- 12 -

OVERVIEW RISK/RETURN ANALYSIS

In order to analyze the risk and return

of Chipotle [CMG US], we compare its

return distribution to Newmont Mining

Corp [NEM] and the S&P 500 Stock

Index [^GSPC] for 120 data points

comprising monthly prices from

January 2006 up to November 2015

(Resulting in 119 monthly holding

period return observations). Table 4

depicts an expected return of 2.8% for

CMG compared to a negative average

return of -0.3% for NEM and 0.5% for

the GSPC. These returns have to be seen

in relation to each assets’ individual](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-48-320.jpg)

![^GSPC 0.33400 0.12689 1

Var-Covariance Matrix

Correlation Matrix

Risk and Return Analysis

- 14 -

CALCULATION OF BETA

To determine the systematic risk of CMG in

comparison to the market [GSPC], we use the

measurement of beta. In order to compute beta, we

ran a regression with CMG as our dependent variable

and GSPC as our independent variable using monthly

returns. Conducting regression analysis allows us to

determine how the effects of the market impact an

individual security or portfolio. In other words, the regression

tells us how much the variation in the

market affects the individual security, which in this case is

CMG. The assumption we made for using the](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-56-320.jpg)

![S&P 500 Index [^GSPC] as the representation for the market

has to do with the idea of diversification. It

is assumed that we can eliminate firm specific risk through

diversification. Given that the S&P 500 is

composed of the 500 largest companies in the US, we can claim

it has diversified essentially all firm and

industry specific risk and the only risk that needs to be taken

into account is systematic risk. Although

running a regression provides us with the beta measurement, we

also need to determine the statistical

significance of the Beta. The statistical significance will tell us

the probability the relationship in our

regression is accurate. To determine statistically significance

we will look at the t-statistic and the p-value,

which should be larger than 1.96 and smaller than 0.05

respectively. We found that CMG had a beta of

0.84, a t-stat of 3.82 and a p-value of 0.0002. The beta for CMG

is statistically significant and it is less

volatile than the market, which has a beta of 1. Similarly, we

computed the beta of NEM to be 0.31,

however, we found that it was not statistically significant (t-

stat: 1.37, p-value: 0.17). It could be said that

there is a 17% chance that the beta of .31 is an inaccurate

representation of the relation between returns](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-57-320.jpg)

![Risk and Return Analysis

- 15 -

January 2006 through November 2015, giving us 120 data

points. If either Yahoo! Finance or Reuters used

different date ranges then the size of their data will be different

and cause their computation of beta to

differ from ours. Another cause for the differences can be the

frequency of the returns. We used monthly

returns to compute our beta values but if Reuters chose to use

daily or weekly historical prices then this

would also cause their value for beta to differ. Given the

turmoil the CMG stock has been through within

the last months, including or excluding certain trading

days/periods may certainly affect the Beta value,

too.

REQUIRED RETURNS BASED ON THE CAPITAL ASSET

PRICING MODEL [CAPM]

To estimate the required return for CMG and NEM we used the

Capital Asset Pricing Model [CAPM]:

�[������] = �� + �[����� − ��]](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-60-320.jpg)

![- 16 -

DISCOUNTED CASH FLOW MODEL

The first model we used to determine the fundamental value of

Chipotle is a two-step Discounted Cash

Flow Model [DCF]. Table 9 summarizes our forecasts up to

FY2018 using FY2015 as the basis year. This

3-years period is in line with the management forecast period,

which we see as a period of higher growth

rates converging towards our long term growth rate of c. 2.0%.

Table 9 - Free Cash Flow Forecasts

Based on these forecasts, Table 10 provides an overview of the

DCF model. Chipotle has no interest

bearing debt and thus an Equity Ratio of 100%. Hence, the

WACC is purely dependent on the Cost of Equity,

which we calculated with the Capital Asset Pricing Model. The

WACC of 5.6% is used as the discount rate

for the Free Cash Flows resulting in a total present value of

$1,855.0m.

Table 10 - Model Overview](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-62-320.jpg)

![tax operating income/sales10.30%5.31%12.34%11.61%Leverage

MeasuresLong term debt ratioLong term debt/(long term debt +

equity)27.70%26.11%21.86%13.98%Long term debt equity

ratioLong term debt

debt/equity38.32%35.34%27.98%16.26%Total debt ratioTotal

liabilities/total assets61.88%56.46%46.66%42.66%Times

interest earnedEBIT/interest

payments38.4837.9957.91136.42Cash coverage ratio(EBIT +

depreciation)/interest payments44.1744.3866.52156.09Liquidity

MeasuresNet working capital to assetsNet working capital/total

assets52.40%60.09%65.92%64.34%Current ratioCurrent

assets/current liabilities2.12.512.932.8Quick ratio(cash +

marketable securities + receivables)/current liabilitiesCash

ratio(cash + marketable securities)/current liabilitiesDays in

Inventory365/ Inventory Turnover959497101Days in A/R365/

A/R Turnover40353937Days in A/P365/ A/P TurnoverMarket

value of equityStock price x share

outstanding126139.28124026.8490454.3298636.37book value of

equityTotal assets - total liabilities904098121240712258After

tax operating income4029193342403760long-term

debt3464346834711993equity904098121240712258cost of

capitalcapitallong-term debt +

eauity12504132801587814251Inventories at start of

year5261505548384337cost of goods

sold21643204411903817405sales39117363973435032376Total

liabilities1467712724108529121total

assets23717225362325921379EBIT4772444547494502interest1

241178233https://www.marketwatch.com/investing/stock/nke/fi

nancialsdepreciation705747706649https://www.marketwatch.co

m/investing/stock/nke/financialsNet working capitalcurrent

assets - current liabilities86599094105879667Current

assets16525151341606115025current

liabilities7866604054745358cash

4663524561795457receivables4270350036803240marketable

securitiesStock price77.9674.7653.4656.59Share

outstanding1618165916921743Cost of capital[(E/V) * Re] +](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-79-320.jpg)

![[(D/V) * Rd * (1-

Tc)]https://www.thebalancesmb.com/calculate-weighted-

average-cost-of-capital-

393130https://www.macrotrends.net/stocks/charts/NKE/nike/fin

ancial-

ratioshttps://www.marketwatch.com/investing/stock/nke/financi

alshttps://www.marketwatch.com/investing/stock/nke/financials

https://www.thebalancesmb.com/calculate-weighted-average-

cost-of-capital-393130

Under ArmourUnder Armour's Performance

MeasuresPerformance Measures2019201820172016Source

(Link)Market value added ($ millions)Market value of equity –

book value of

equity7656.315863.954344.9910896.35https://www.macrotrends

.net/stocks/charts/UAA/under-armour/financial-ratiosMarket to

book ratioMarket value of equity ÷ book value of

equity4.563.913.156.37https://www.marketwatch.com/investing/

stock/uaa/financialsProfitability MeasuresReturn on assets

(ROA)After tax operating income/total assets2.89%-1.09%-

1.20%7.05%Return on capital (ROC)After tax operating income

/ (long-term debt + equity)4.21%-1.70%-1.73%9.11%Return on

equity (ROE)Net income/equity4.29%-2.30%-2.39%9.75%EVA

($ millions)After tax operating income – cost of capital x

capitalEBITDANet Income + interest + taxes + depreciation +

amortization423.449157.005201.844562.241Efficiency

MeasuresAsset turnoverSales/total assets at start of

year124.08%129.62%136.90%168.65%Receivables

turnoverSales/receivables at start of

year791.28%851.80%801.24%1114.60%Average collection

period (days)Receivables at start of year/daily

sales46.1342.8545.5532.75Inventory turnoverCost of goods

sold/inventory at start of

year274.31%246.23%298.40%330.09%Days in

inventoryInventories at start of year/daily cost of goods

sold133.06148.23122.32110.58Profit marginNet

income/sales1.75%-0.89%-0.97%4.10%Operating profit](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-80-320.jpg)

![tax operating income/sales10.30%5.31%12.34%11.61%Leverage

MeasuresLong term debt ratioLong term debt/(long term debt +

equity)27.70%26.11%21.86%13.98%Long term debt equity

ratioLong term debt

debt/equity38.32%35.34%27.98%16.26%Total debt ratioTotal

liabilities/total assets61.88%56.46%46.66%42.66%Times

interest earnedEBIT/interest

payments38.4837.9957.91136.42Cash coverage ratio(EBIT +

depreciation)/interest payments44.1744.3866.52156.09Liquidity

MeasuresNet working capital to assetsNet working capital/total

assets52.40%60.09%65.92%64.34%Current ratioCurrent

assets/current liabilities2.12.512.932.8Quick ratio(cash +

marketable securities + receivables)/current liabilitiesCash

ratio(cash + marketable securities)/current liabilitiesMarket

value of equityStock price x share

outstanding126139.28124026.8490454.3298636.37book value of

equityTotal assets - total liabilities904098121240712258After

tax operating income4029193342403760long-term

debt3464346834711993equity904098121240712258cost of

capitalcapitallong-term debt +

eauity12504132801587814251Inventories at start of

year5261505548384337cost of goods

sold21643204411903817405sales39117363973435032376Total

liabilities1467712724108529121total

assets23717225362325921379EBIT4772444547494502interest1

241178233https://www.marketwatch.com/investing/stock/nke/fi

nancialsdepreciation705747706649https://www.marketwatch.co

m/investing/stock/nke/financialsNet working capitalcurrent

assets - current liabilities86599094105879667Current

assets16525151341606115025current

liabilities7866604054745358cash

4663524561795457receivables4270350036803240marketable

securitiesStock price77.9674.7653.4656.59Share

outstanding1618165916921743Cost of capital[(E/V) * Re] +

[(D/V) * Rd * (1-

Tc)]https://www.thebalancesmb.com/calculate-weighted-](https://image.slidesharecdn.com/initialvaluationreportchipotlemexicangrillinc-221017180301-6c5d3efd/85/Initial-Valuation-Report-Chipotle-Mexican-Grill-Inc-docx-83-320.jpg)