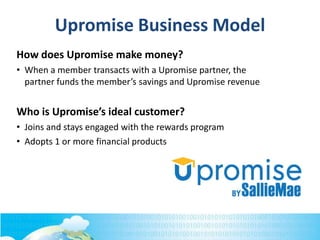

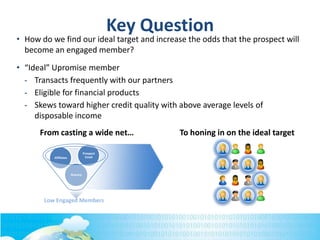

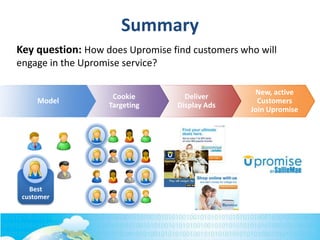

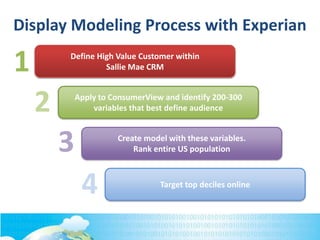

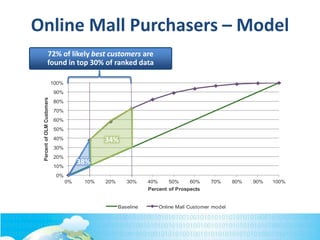

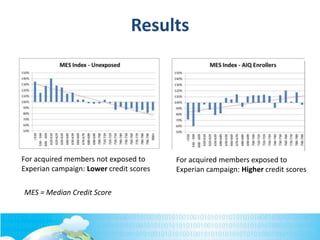

Upromise faced the challenge of finding customers who would regularly engage with their rewards program and adopt financial products. They partnered with Experian to build models that identified the attributes of their most engaged customers and targeted similar prospects online. Experian helped Upromise design and optimize display ad campaigns targeting these high-value audiences. The results included acquiring customers with higher credit scores who spent more per transaction, indicating they were more engaged customers. Upromise plans to further engage customers through preferred channels and optimize across channels.