Embed presentation

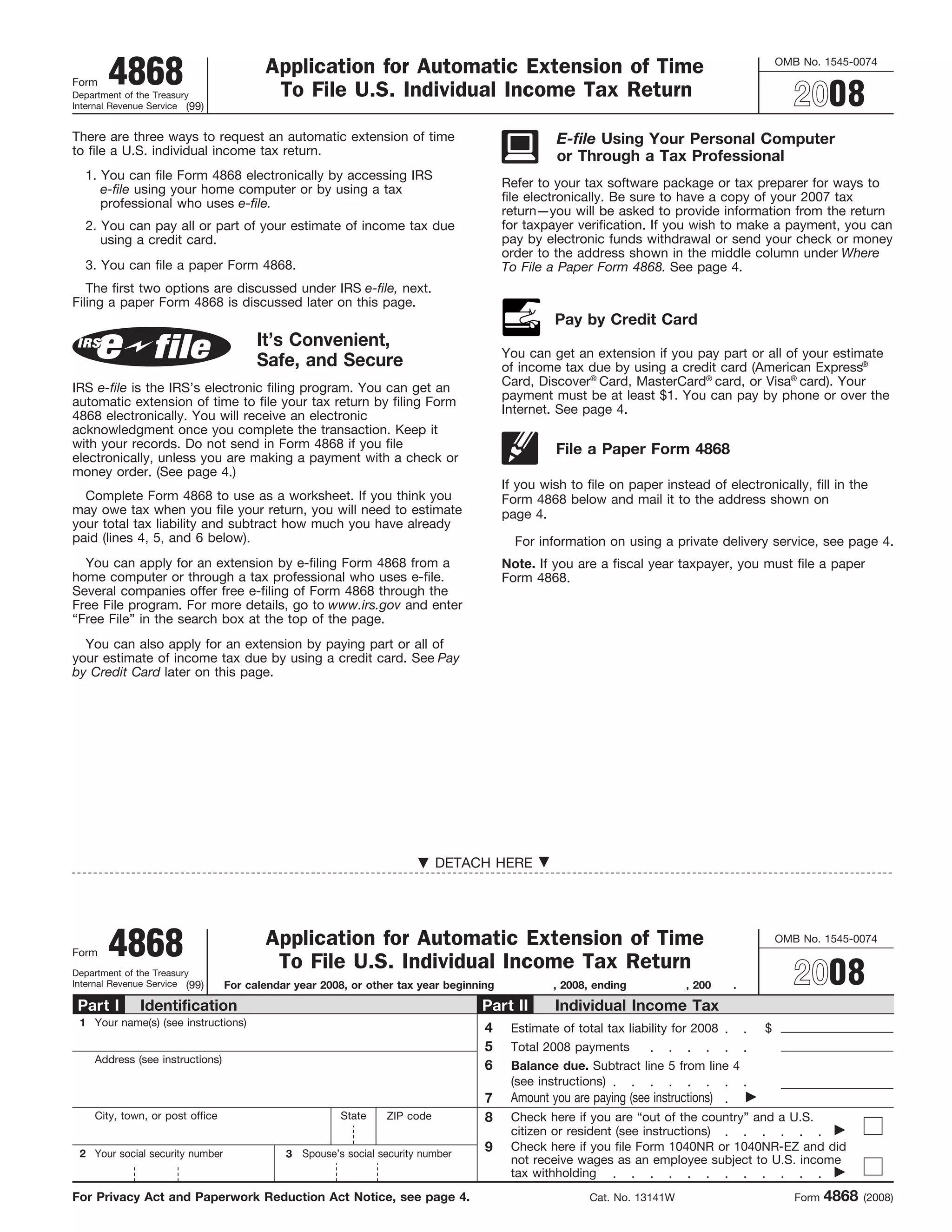

Downloaded 12 times

1) There are three ways to request an automatic extension of time to file a U.S. individual income tax return: electronically through IRS e-file using a home computer or tax professional, by paying all or part of the estimated tax due by credit card, or by filing a paper Form 4868. 2) Filing electronically through IRS e-file is the easiest and most convenient option. It provides an electronic acknowledgment and as long as any payment is not made by check, a paper Form 4868 does not need to be filed. 3) A paper Form 4868 can also be filed and mailed in with an estimated payment to request an extension. Fiscal year taxpayers must file