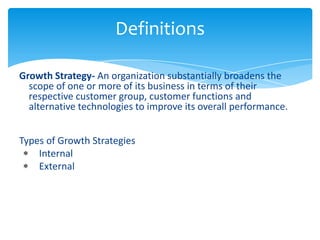

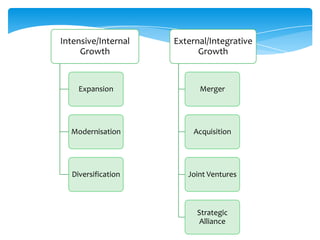

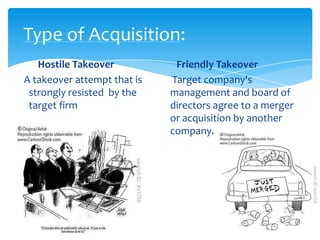

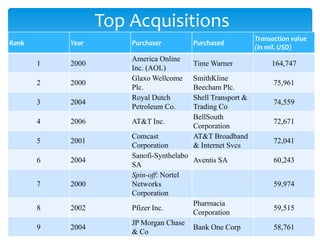

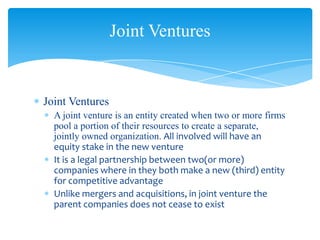

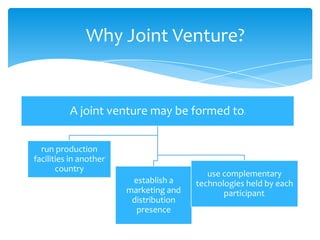

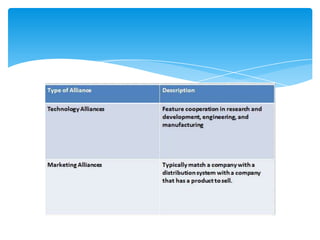

The document discusses various growth strategies that companies can pursue, including internal growth strategies like market penetration, market development, and product development as well as external strategies like mergers & acquisitions, strategic alliances, and joint ventures. It defines key terms, compares different types of mergers and acquisitions, and discusses the benefits and challenges of joint ventures.